Hottinger chronology

Encyclopedia

Zollikon

Zollikon is a municipality in the district of Meilen in the canton of Zürich in Switzerland.-Geography:Zollikon has an area of . Of this area, 21.2% is used for agricultural purposes, while 37.7% is forested. Of the rest of the land, 40.8% is settled and the remainder is non-productive...

, near Zurich, in 1362. The town had recently joined the Swiss Confederation, and was poised to become a thriving center for trade. In 1401, three members of the Hottinger family were named Burghers of the city. Their names Hans, Heinrich and Rudolf – or, in their French variants, Jean, Henri and Rodolphe – have marked the family dynasty for over 500 years. During the 15th and 16th centuries, their descendants oversaw the canton’s progressive transformation from a rural to a financial economy, taking an active role in the region’s political, cultural and religious life all the way into the 18th century.

Five generations of doctors and pastors (1467-1732)

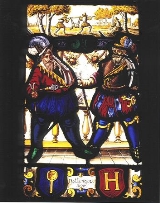

Klaus HottingerKlaus Hottinger

Klaus Hottinger was a shoemaker born in Zollikon in 1467. A disciple of Zwingli, he took part in the famous "Affair of the Sausages" of 1522 which marked the public beginning of the Reformation in Switzerland. In 1523 he overthrew a wooden crucifix at Stadelhofen on the outskirts of Zurich. He was...

(1467-1523), is the first martyr of the Swiss Protestant movement. His grandson Sébastien Hottinger (1538–1600), was a doctor and deputy of the Zurich City Council. Hans-Heinrich Hottinger, Sébastien Hottinger’s brother, produced for his part an illustrious line of mathematicians, physicists, doctors, and theologians, among which Hans-Heinrich Hottinger (1620–1667), better known as Johann Heinrich Hottinger

Johann Heinrich Hottinger

Johann Heinrich Hottinger was a Swiss philologist and theologian.- Life and works :Hottinger studied at Geneva, Groningen and Leiden. After visiting France and England he was appointed professor of church history in his native town of Zürich in 1642...

, a famous orientalist, historian, theologian and Dean of the University of Heidelberg.

Wolfgang Hottinger’s son, Hans-Rudolf (1600–1639) charted a new destiny for the Hottingers as clergymen. His son, Rudolf (1642–1692), and grandson Hans-Rudolf (1673–1732) also became pastors. Zurich rapidly prospered during the second half of the 17th century with the end of the Thirty Year War (1618–1648), the Treaty of Westphalia, and Switzerland's independence from the Holy Roman Empire

Holy Roman Empire

The Holy Roman Empire was a realm that existed from 962 to 1806 in Central Europe.It was ruled by the Holy Roman Emperor. Its character changed during the Middle Ages and the Early Modern period, when the power of the emperor gradually weakened in favour of the princes...

proclaiming the Confederacy’s neutrality. There is little surprise, therefore, that a branch of the Hottinger family would become involved in commerce and trade. It is from this branch that the financial dynasty would emerge.

Businessmen and politicians (1712-1764)

Johannes Hottinger was born in 1712, the sole surviving son among Hans-Rudolf and Verena Hottinger’s five children. The year of Johannes’s birth was marked by the end of the 2nd Battle of VillmergenBattles of Villmergen

The Battles of Villmergen were two battles between Reformed and Catholic Swiss cantons. They occurred on January 24, 1656 and July 24, 1712 at Villmergen, Canton of Aargau, Switzerland ....

, following which Zurich was fully able to capitalize on its position as a major European crossroads and trading center. Johannes's career would be further aided by the fact that his uncle, Christof Hottinger, was Deputy of the City Council for the powerful saffron corporation and Treasurer of the Grossmünster

Grossmünster

The Grossmünster is a Romanesque-style church in Zurich, Switzerland. It is one of the three major churches in the city . The core of the present building near the banks of the Limmat River was constructed on the site of a Carolingian church, which was, according to legend, originally commissioned...

.

In 1734, Johannes married the daughter of Johannès Cramer, a draper and likewise Deputy of the City Council as representative of the saffron corporation. The couple’s three sons – Johann-Heinrich (1734–1808), Johannes (1738–1797) and Johann-Rudolf (1739–1809) would all be raised from an early age with a keen appreciation for trade and business. All three would marry the daughters of well-established merchants, and expanded their business by establishing relations with the Geneva banking house Passavant, de Candolle, Bertrand & Cie.

First steps in finance (1764-1784)

Johann-Konrad (1764–1841), or Jean-Conrad in its French version, was Johann-Rudolf Hottinger’s second son, and the one who would definitively establish the family as a financial dynasty. Like many sons of wealthy Zurich families, he was sent to MulhouseMulhouse

Mulhouse |mill]] hamlet) is a city and commune in eastern France, close to the Swiss and German borders. With a population of 110,514 and 278,206 inhabitants in the metropolitan area in 2006, it is the largest city in the Haut-Rhin département, and the second largest in the Alsace region after...

in 1779 for a traineeship with a cotton factory. But Jean-Conrad was less interested in cotton trading, silk printing or smelting than in impressing the economist M. Wolf, with whom he resided, with his aptitude for drawing and mathematics. As he became more and more interested in finance, Jean-Conrad eventually answered the call of his uncle Johann Heinrich Hottinger to join him in Geneva

Geneva

Geneva In the national languages of Switzerland the city is known as Genf , Ginevra and Genevra is the second-most-populous city in Switzerland and is the most populous city of Romandie, the French-speaking part of Switzerland...

in 1783.

Home to many Protestant banking firms, Geneva was certainly better suited to Jean-Conrad Hottinger’s aspirations. Thanks to his uncle’s connections, Jean-Conrad was able to train as a banker with Passavant, de Candolle, Bertrand & Cie. Over the ensuing years, Jean-Conrad Hottinger would display a thirst for knowledge and a deepening interest in the issue of public debt, notably in France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

and Great Britain

Great Britain

Great Britain or Britain is an island situated to the northwest of Continental Europe. It is the ninth largest island in the world, and the largest European island, as well as the largest of the British Isles...

. Soon he expressed a desire to go to Paris

Paris

Paris is the capital and largest city in France, situated on the river Seine, in northern France, at the heart of the Île-de-France region...

, following in the footsteps of Jacques Necker

Jacques Necker

Jacques Necker was a French statesman of Swiss birth and finance minister of Louis XVI, a post he held in the lead-up to the French Revolution in 1789.-Early life:...

, director-general of the French royal finances.

From Clerk to Banker (1784-1787)

Jean-Conrad Hottinger left for the French capital that same year with a letter of introduction by his former employees. This enabled him to start clerking for Le Couteulx & Cie, a highly reputable business, which had been ennobled in the time of Louis XIV. Back in Zurich, a number of illustrious wealthy businessmen - among whom Jean Conrad and Salomon Escher, Martin Usteri, and Jean Conrad Ott - gathered in early 1786 to discuss how to invest in Paris and which banks to contact. Jean Conrad Escher put forward the name of Hottinger, “the son of Jean Rodophe Hottinger and a young clerk in the service of Le Couteulx.”Arriving in Paris, Jean Conrad and Salomon Escher met with Denis de Rougemont de Chatellois, at the head of an old Parisian banking house, which, at the time, was experiencing credit problems. The Eschers were therefore able to suggest a partnership with the person of their choice. They met with then 23 year-old Jean-Conrad Hottinger, and an immediate bond was forged between the three men. Within the short space of a meeting, Jean-Conrad went from banking clerk to bank owner. In September 1786, the creation of “Rougemont, Hottinger & Cie” was announced. A few months later, in early 1787, the new bank was listed in the Royal Almanac, with offices at Rue Croix des Petits-Champs, Hôtel de Beaupreaux.

The French Revolution (1788-1798)

The bank expanded markedly within months, and already differences appeared between the two associates: “M. Hottinger, highly intelligent and capable, aims to immediately make a fortune; I only wish to preserve mine,” wrote de Rougemont. Soon thereafter, de Rougemont encountered problems that cause the bank's Swiss underwriters, Usteri and Escher, to lose confidence in him. Arriving in Paris amidst social upheaval in 1788, they decide to break ranks with de Rougemont. The following month, however, a number of bankruptcies forced them to reconsider, and matters were further complicated the following year by the French RevolutionFrench Revolution

The French Revolution , sometimes distinguished as the 'Great French Revolution' , was a period of radical social and political upheaval in France and Europe. The absolute monarchy that had ruled France for centuries collapsed in three years...

.

The split then became political, as Jean-Conrad Hottinger pushed to extend the assignats (notes issued as paper currency from 1789 to 1796 by the revolutionary government on the security of confiscated lands) to the financial world. Their partnership was effectively dissolved at end 1790. For his part, Jean-Conrad had already entered an agreement with the former banker of the King of Poland

Poland

Poland , officially the Republic of Poland , is a country in Central Europe bordered by Germany to the west; the Czech Republic and Slovakia to the south; Ukraine, Belarus and Lithuania to the east; and the Baltic Sea and Kaliningrad Oblast, a Russian exclave, to the north...

, Paul Sellouf in July 1790. But ageing and sick, Sellouf retired only a few months later, leaving Jean-Conrad with an extensive and select clientele.

As of October 15, 1790, Jean-Conrad Hottinguer found himself the sole owner of a banking institution that bore his name. The following years were not without turmoil, however, even though Jean-Conrad Hottinguer eventually emerged unscathed. According to The World of Private Banking, he left Paris in 1794 to pursue business opportunities in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. “When he came back to Paris in 1798, he founded “Hottinguer & Co.” and soon thereafter opened branches at Le Havre [1802] and other French ports. He became a financial advisor of Talleyrand and is known as one of the first regents of the Banque de France

Banque de France

The Banque de France is the central bank of France; it is linked to the European Central Bank . Its main charge is to implement the interest rate policy of the European System of Central Banks...

.”

Establishing a financial dynasty (1798-1832)

Jean-Conrad Hottinguer – a ‘u’ had been added to the name to preserve the Germanic pronunciation of the name – continued to profit from his knowledge of the issue of public debt. In particular, he took a strong interest in the new commercial laws promulgated by Napoleon as of 1807. Shortly thereafter, in the throes of several victories, the Emperor decided to bestow titles and honors on affluent members of society. Marshals were named dukes, ministers were named counts, and mayors, bankers and bishops became barons.On 19 September 1810, Jean-Conrad Hottinguer was named Baron of the Empire. He went on to have six daughters and two sons. The eldest, Jean-Henri, inherited the title and the family business. Born in 1803, Jean-Henri Hottinguer took over his father’s position at the head of the bank in January 1833. Jean-Conrad had by now born out Napoleon’s defeat – playing no small role in handling France’s massive war debt – as well as the July Revolution of 1830. The family fortune was made, and Jean-Henri’s focus would be to expand business abroad.

Entering the Industrial Age (1833-1866)

Jean-Henri's life was at least as eventful and adventurous as his father's. He traveled to England when he was only 15 years old. At the age of 23, he sailed to New Orleans to establish new trade business with America, made possible by the bank’s fleet of ships built by his father. He then made his way to Washington D.C. by steamboat, carriage and rail. In 1832, Jean-Henri married Caroline Delessert, the daughter of Baron François Delessert. In 1818, Jules Paul Benjamin DelessertJules Paul Benjamin Delessert

Jules Paul Benjamin Delessert was a French banker and naturalist.He was born at Lyon, the son of Étienne Delessert , the founder of the first fire insurance company and the first discount bank in France...

and Hottinguer created the first savings company and contingency fund in France for modest earners - a precursor to pension funds - called “Caisse d’épargne et de prévoyance

Groupe Caisse d'Epargne

Groupe Caisse d'Epargne is a French semi-cooperative banking group, founded in 1818, with around 4700 branches in the country. The group is active in retail and private banking, as well as holding a significant stake in the publicly traded investment bank Natixis.-Operations:The group's most...

.”

Caroline was the last in the line of the Delessert financial dynasty, and Jean-Henri Hottinguer took over the bank in 1848. His travels did not end after taking over the reins of the family business. He was quick to recognize the potential of the new technologies of his time, notably electricity, and participated in many of the business ventures linked to the economic development of Europe in the mid-19th century. Jean-Henri was notably instrumental in developing the French railway system, as well as, in 1852, contributing in the creation of the French waterworks company, the Compagnie générale des eaux

Compagnie Générale des Eaux

Compagnie Générale des Eaux was a French multinational company which gave birth to three world's leaders in their respective fields: VINCI, Veolia Environnement and Vivendi....

, known today as Veolia Environment. He also invested in Russia and was involved in restructuring Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

’s finances in the early years of the French intervention

French intervention in Mexico

The French intervention in Mexico , also known as The Maximilian Affair, War of the French Intervention, and The Franco-Mexican War, was an invasion of Mexico by an expeditionary force sent by the Second French Empire, supported in the beginning by the United Kingdom and the Kingdom of Spain...

.

Weathering the storms (1867-1950)

Jean-Henri Hottinguer died in 1866, leaving the bank in good hands. Already his son, Rodolphe Hottinguer (1835-1920), had distinguished himself by leading a group of six European financiers in meetings with the Grand VizierGrand Vizier

Grand Vizier, in Turkish Vezir-i Azam or Sadr-ı Azam , deriving from the Arabic word vizier , was the greatest minister of the Sultan, with absolute power of attorney and, in principle, dismissable only by the Sultan himself...

of the Ottoman Empire

Ottoman Empire

The Ottoman EmpireIt was usually referred to as the "Ottoman Empire", the "Turkish Empire", the "Ottoman Caliphate" or more commonly "Turkey" by its contemporaries...

, resulting in the creation, in 1863, of the Ottoman Bank

Ottoman Bank

The Ottoman Bank was founded in 1856 in the Galata business section of İstanbul, the capital of the Ottoman Empire, as a joint venture between British interests, the Banque de Paris et des Pays-Bas of France, and the Ottoman government.The opening capital of the Bank consisted of 135,000 shares,...

(today part of Grindlays Bank

Grindlays Bank

The Grindlays Bank was a major British overseas bank established in 1828.It operated mainly in British colonies, especially British India. After decolonization, it was a major foreign bank in India, Pakistan and other West Asian countries. As ANZ Grindlays Bank, it was for a while the largest...

). In France, the Franco-Prussian War

Franco-Prussian War

The Franco-Prussian War or Franco-German War, often referred to in France as the 1870 War was a conflict between the Second French Empire and the Kingdom of Prussia. Prussia was aided by the North German Confederation, of which it was a member, and the South German states of Baden, Württemberg and...

of 1870-71 and the advent of the Third Republic

French Third Republic

The French Third Republic was the republican government of France from 1870, when the Second French Empire collapsed due to the French defeat in the Franco-Prussian War, to 1940, when France was overrun by Nazi Germany during World War II, resulting in the German and Italian occupations of France...

had little impact on the country’s financial institutions. A series of economic setbacks coupled with overexpansion in the US and Europe, however, led to severe deflation and a world-wide depression in 1873, which lasted in France until 1896.

Hottinguer & Cie. survived and even thrived thanks to its continued involvement in the major financial events of the time, as well as Rodolphe Hottinguer’s inherited interest and knowledge of the issue of public debt. In 1890, the bank fittingly celebrated its centennial, as Rodolphe Hottinger continued to pursue his father’s preoccupation with the development of France’s industrial infrastructure. He notably occupied the position of Vice President of the Paris-Lyon-Méditérannée (PLM) railway. But barely two decades after the end of the economic depression, Rodolphe Hottinguer would face more tumultuous times with the advent of World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

.

By this time, Rodolphe could rely on the help of his son Henri Hottinguer (1868-1943)

Baron Henri Hottinguer (1868-1943)

Baron Henri Hottinguer, was born at castle Piple on September 15, 1868, the first born son of Baron Rodolphe Hottinguer. He had a long and prosperous life, and during his era the bank, Hottinger & Cie, accomplished many achievements...

, who was present in 1919 at the signing of the Armistice with Germany, and on whose shoulders would fall the arduous task of coping with the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

. In turn, Henri would be able to rely on the intelligence and diligence of his own son, Rodolphe Hottinguer (1902-1985)

Baron Rodolphe Hottinguer (1902-1985)

Rodolphe Hottinguer was the fifth baron Hottinguer.-Early life and education:Born on October 16, 1902, he was the elder son of Baron Henri Hottinguer and Marian Munroe. He earned a Diploma from École supérieure des sciences économiques et commerciales in Paris, then entered the Artillery School...

, during World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

. As he worked hard to keep the business afloat and preserve the family domain of Castle Piple, Rodolphe consigned his memories of the war to a black notebook. These memories include retrieving a list of Hottinguer employees from a German employment office at Chateaudun, or racing down a deserted Rue Royale in Paris, in August 1944, chased by a truck full of German soldiers.

The modern era (1950-2011)

With Baron Rodolphe Hottinguer (1902-1985)Baron Rodolphe Hottinguer (1902-1985)

Rodolphe Hottinguer was the fifth baron Hottinguer.-Early life and education:Born on October 16, 1902, he was the elder son of Baron Henri Hottinguer and Marian Munroe. He earned a Diploma from École supérieure des sciences économiques et commerciales in Paris, then entered the Artillery School...

, the bank truly entered the 20th century to embrace a modern approach to banking. He led the financial dynasty through rapidly changing times, managing to preserve the tradition of private banking and the qualities of a family-oriented, human size institution in an era of enticing opportunities offered by the inexorable trend towards globalization. In 1945, Hottinguer & Cie. in Paris joined in creating the Drouot insurance company, which would be one of AXA's roots.

During his long life, Rodolphe Hottinguer pursued the family tradition of being actively involved in the economic development of France and Europe. He would occupy such important posts as Vice-Chairman of the Paris Chamber of Commerce and Industry, Chairman of the International Chamber of Commerce

International Chamber of Commerce

The International Chamber of Commerce is the largest, most representative business organization in the world. Its hundreds of thousands of member companies in over 130 countries have interests spanning every sector of private enterprise....

, Chairman of the European Banking Federation

European Banking Federation

The European Banking Federation is an organization of the European banking sector, representing interest of over 5000 European banks in 31 countries with combined assets of over 30,000 billion Euro and around 2.4 million employees...

and, for more than 35 years,

Chairman of the French Banking Association now called Fédération Bancaire Française

Fédération Bancaire Française

The Fédération Bancaire Française is the professional body representing over 500 commercial, cooperative, and mutual banks operating in France and includes both French and foreign-based organisations....

. Rodolphe Hottinguer died in 1985 leaving his son, Henri, a banking legacy in solid shape and sound condition. The Banque Hottinguer in Paris was sold to the Credit Suisse in 1997.

In 1968, Henri Hottinguer, Rodolphe's son, returned to Zurich and founded Hottinger & Cie, Zurich, and with the help of his sons, Rodolphe and Frederic, they started the Swiss and the international development of the Hottinger Banking Group. They founded Hottinger Capital Corp in New-York, opened a Geneva branch in 1987, and managed Hottinger Capital SA in Geneva as of 1998. A year later, they initiated a proactive international policy, based on a system of strategic partnerships, or “affiliated companies,” to expand the bank’s reach without unduly expanding its size. The Hottinger Group is now active in Basel, Brig, Brussels, Geneva, London, Luxembourg, Nassau, New-York, Paris, Sion, Toronto, Vienna, Zurich and Zug. Since its inception in 1968, 9 members of the Hottinguer Family where partners of the Bank in Switzerland: Baron Rodolphe Hottinguer, Pierre Hottinguer, Baron Henri Hottinguer, Jean Philippe Hottinguer, Paul Hottinguer, Francois Hottinguer, Emmanuel Hottinguer, Rodolphe Hottinger

Rodolphe Hottinger

Rodolphe Hottinger is a Swiss banker, who represents a financial dynasty stretching back to seven generations. His ancestor, Jean-Conrad Hottinguer, created the Bank Rougemont, Hottinguer & Cie. in 1786...

and Frederic Hottinguer.

In 2007, as Paul Hottinguer retired, two first cousins of the Hottinguer family became partners of the Bank: Paul de Pourtales became Managing Partner, and Jonathan Bowdler-Raynar as Limited Partner. In December 2009 Rodolphe Hottinger

Rodolphe Hottinger

Rodolphe Hottinger is a Swiss banker, who represents a financial dynasty stretching back to seven generations. His ancestor, Jean-Conrad Hottinguer, created the Bank Rougemont, Hottinguer & Cie. in 1786...

left the Hottinger Group. In May 2010, to prepare the future challenges of the new financial environment, the bank became Hottinger & Cie

Hottinger & Cie

Hottinger & Cie, founded in 1968 in Zurich, is the principal company of the Hottinger Group, it is one of the successor of the private banking firm established in Paris by Hans-Konrad Hottinger . Since its foundation in 1786 it was very active in European economic life...

SA with the arrival of new partners.

The family-office style of business is a tradition, to which the family is particularly beholden. As Rodolphe Hottinger

Rodolphe Hottinger

Rodolphe Hottinger is a Swiss banker, who represents a financial dynasty stretching back to seven generations. His ancestor, Jean-Conrad Hottinguer, created the Bank Rougemont, Hottinguer & Cie. in 1786...

once explained: “We are not a private bank but a house of private bankers. The distinction is important. (...) We take care of our clients as family doctors used to do. We’ve known some families for generations.”

Sources

- http://www.gameo.org/encyclopedia/contents/hottinger_klaus_d._1524

- http://www.genea-bdf.org/BasesDonnees/genealogies/hottinger.htm

- Max Gerard, Messieurs Hottinger banquiers A Paris, Paris 1968 (Tome Premier)