Inflationism

Encyclopedia

In economics

, an inflationist or inflationary economic

, fiscal

, or monetary policy

, is one that is predicted to lead to a substantial level of inflation

. Similarly, an inflationist economist is one that advocates an inflationist policy. "Inflationism" is generally a term of abuse or a current in heterodox economics

, as inflation is largely considered an evil within mainstream economics

.

Mainstream economics holds that inflation is a necessary evil

, and advocates a low, stable level of inflation, and thus is largely opposed to inflationist policies – some inflation is necessary, but inflation beyond a low level is not desirable. However, deflation is often seen as a worse danger, particularly within Keynesian economics

and in the theory of debt deflation

, and thus the policies advocated by Keynesian economists such as Paul Krugman

to prevent deflation in cases of economic crisis are labeled as inflationist policies by others.

of currency (reducing the precious metal content) is unambiguously inflationary, as it reduces the value of currency relative to the precious metal.

Fiat money

is widely argued to be inflationary, with 20th inflation being attributed to the use of fiat money and the ending of the gold standard

.

or monetary policy

, to achieve full employment

. Such schools often have heterodox

views on monetary economics

The early 19th century Birmingham School

of economics, which advocated expansionary monetary policy

to achieve full employment, was attacked as "crude inflationists".

The contemporary Post-Keynesian monetary economic school of Neo-Chartalism, which advocates government deficit spending

to yield full employment, is attacked as inflationist, with critics arguing that such deficit spending inevitably leads to hyperinflation

. Neo-Chartalists reject this charge, such as in the title of the Neo-Chartalist organization the Center for Full Employment and Price Stability.

Neoclassical economics

has often argued a deflationist policy; during the Great Depression

, many mainstream economists argued that nominal wages should fall, as they had in 19th century economic crises, thus returning prices and employment to equilibrium. This was opposed by Keynesian economics, which argued that a general cut in wages reduced demand, worsening the crisis, without improving employment.

In political debate, inflationism is opposed to hard currency

In political debate, inflationism is opposed to hard currency

, which believes that the real value of currency should be maintained.

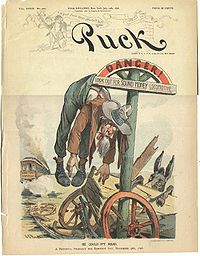

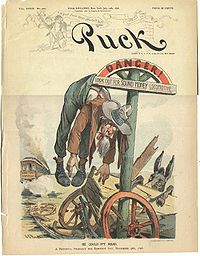

In late 19th century United States, the Free Silver

movement advocated the inflationary policy of free coinage of silver. This was a contentious political issue in the 40-year period 1873–1913, consistently defeated. Later, economist John Maynard Keynes

described the effects of inflationism:

Three contemporary arguments for higher inflation, the first two from the mainstream school of Keynesian economics

and advocated by prominent economists, the latter from the heterodox

school of Post-Keynesian economics

, are:

Added flexibility in monetary policy:

A high inflation rate with a low nominal interest rate result in a negative real interest rate; for example, a nominal interest rate of 1% and an inflation rate of 4% yields a real interest rate of (approximately)Properly, the real interest rate in this case is but the linear approximation

but the linear approximation

is widely used; see Fisher equation

is widely used; see Fisher equation

for details. −3%. As lower (real) interest rates are associated with stimulating the economy under monetary policy

, the higher inflation is, the more flexibility a central bank has in setting (nominal) interest rates while still keeping them nonnegative; negative (nominal) interest rates are considered unconventional monetary policy and have very rarely been practiced.

Olivier Blanchard

, chief economist of the International Monetary Fund

, argues that the inflation rates during The Great Moderation

were too low, causing constraints in the late-2000s recession, and that central banks should consider a target inflation rate of 4% instead of 2%.

Wage stickiness:

Inflation decreases the real value of wages, in the absence of corresponding wage rises. In the theory of wage stickiness, a cause of unemployment in recessions and depressions is the failure of workers to take pay cuts, to decrease real labor costs. It is observed that wages are nominally sticky downwards, even in the long term (it is difficult to cut real wages), and thus that inflation provides useful erosion of real costs wages without requiring nominal wage cuts.

In this context it is worth noting that collective bargaining

in the Netherlands

and Japan

has at times yielded nominal wage cuts, though this has not generally occurred in the United States, and that this argument ascribes high real labor costs as a cause of unemployment, and argues that labor should have a lower share of national income – workers should be paid less.

Decreasing real burden of debt:

In the theory of debt-deflation, a key cause of economic crises is a high level of debt, and a key cause of recovery from crises is when this debt level has decreased. Other than repayment (paying down debt) and default (not paying it), a key mechanism of debt reduction is inflation – because debts are general in nominal terms, inflation reduces the real level of debt. This effect is more pronounced the higher the level of debt, in proportion to the level of debt. For example, if the debt to GDP ratio

of a country is 300% and it experiences one year of 10% inflation, the debt level will be reduced by approximately to 270%. By contrast, if the debt to GDP ratio is 20%, then one year of 10% inflation will reduce the debt level by 2%, to 18%. Thus several years of sustained high inflation significantly reduce a high level of initial debt. This is argued by Steve Keen

to 270%. By contrast, if the debt to GDP ratio is 20%, then one year of 10% inflation will reduce the debt level by 2%, to 18%. Thus several years of sustained high inflation significantly reduce a high level of initial debt. This is argued by Steve Keen

, among others.

In this context, the direct result of inflation is a transfer of wealth from creditors to debtors – the creditors receive less in real terms than they would have before, while the debtors pay less, assuming that the debts would in fact have been repaid, and not defaulted on. Formally, this is a de facto debt restructuring

, with reduction of the real value of principle, and may benefit creditors if it results in the debts being serviced (paid in part), rather than defaulted on.

A related argument is by Chartalists, who argue that nations who issue debt denominated in their own fiat currency need never default, because they can print money to pay off the debt. Chartalists note, however, that printing money without matching it with taxation (to recover money and prevent the money supply from growing) can result in inflation if pursued beyond the point of full employment, and Chartalists generally do not argue for inflation.

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, an inflationist or inflationary economic

Economic policy

Economic policy refers to the actions that governments take in the economic field. It covers the systems for setting interest rates and government budget as well as the labor market, national ownership, and many other areas of government interventions into the economy.Such policies are often...

, fiscal

Fiscal policy

In economics and political science, fiscal policy is the use of government expenditure and revenue collection to influence the economy....

, or monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

, is one that is predicted to lead to a substantial level of inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

. Similarly, an inflationist economist is one that advocates an inflationist policy. "Inflationism" is generally a term of abuse or a current in heterodox economics

Heterodox economics

"Heterodox economics" refers to approaches or to schools of economic thought that are considered outside of "mainstream economics". Mainstream economists sometimes assert that it has little or no influence on the vast majority of academic economists in the English speaking world. "Mainstream...

, as inflation is largely considered an evil within mainstream economics

Mainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

.

Mainstream economics holds that inflation is a necessary evil

Necessary Evil

Necessary Evil sometimes referred to as Plane # 91 was the name of a B-29 Superfortress participating in the atomic bomb attack on Hiroshima on August 6, 1945....

, and advocates a low, stable level of inflation, and thus is largely opposed to inflationist policies – some inflation is necessary, but inflation beyond a low level is not desirable. However, deflation is often seen as a worse danger, particularly within Keynesian economics

Keynesian economics

Keynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

and in the theory of debt deflation

Debt deflation

Debt deflation is a theory of economic cycles, which holds that recessions and depressions are due to the overall level of debt shrinking : the credit cycle is the cause of the economic cycle....

, and thus the policies advocated by Keynesian economists such as Paul Krugman

Paul Krugman

Paul Robin Krugman is an American economist, professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor at the London School of Economics, and an op-ed columnist for The New York Times...

to prevent deflation in cases of economic crisis are labeled as inflationist policies by others.

Policies

While the causes of inflation are debated within economics, certain policies are widely considered inflationary. Of these, debasementDebasement

Debasement is the practice of lowering the value of currency. It is particularly used in connection with commodity money such as gold or silver coins...

of currency (reducing the precious metal content) is unambiguously inflationary, as it reduces the value of currency relative to the precious metal.

Fiat money

Fiat money

Fiat money is money that has value only because of government regulation or law. The term derives from the Latin fiat, meaning "let it be done", as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used.Fiat money originated in 11th...

is widely argued to be inflationary, with 20th inflation being attributed to the use of fiat money and the ending of the gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

.

Schools of economic thought

Inflationism is most associated with, and a charge most leveled against, schools of economic thought which advocate government action, either fiscal policyFiscal policy

In economics and political science, fiscal policy is the use of government expenditure and revenue collection to influence the economy....

or monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

, to achieve full employment

Full employment

In macroeconomics, full employment is a condition of the national economy, where all or nearly all persons willing and able to work at the prevailing wages and working conditions are able to do so....

. Such schools often have heterodox

Heterodox economics

"Heterodox economics" refers to approaches or to schools of economic thought that are considered outside of "mainstream economics". Mainstream economists sometimes assert that it has little or no influence on the vast majority of academic economists in the English speaking world. "Mainstream...

views on monetary economics

The early 19th century Birmingham School

Birmingham School (economics)

The Birmingham School was a school of economic thought that emerged in Birmingham, England during the Post-Napoleonic depression that affected England following the end of the Napoleonic wars in 1815....

of economics, which advocated expansionary monetary policy

Expansionary monetary policy

In economics, expansionary policies are fiscal policies, like higher spending and tax cuts, that encourage economic growth. In turn, an expansionary monetary policy is monetary policy that seeks to increase the size of the money supply...

to achieve full employment, was attacked as "crude inflationists".

The contemporary Post-Keynesian monetary economic school of Neo-Chartalism, which advocates government deficit spending

Deficit spending

Deficit spending is the amount by which a government, private company, or individual's spending exceeds income over a particular period of time, also called simply "deficit," or "budget deficit," the opposite of budget surplus....

to yield full employment, is attacked as inflationist, with critics arguing that such deficit spending inevitably leads to hyperinflation

Hyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

. Neo-Chartalists reject this charge, such as in the title of the Neo-Chartalist organization the Center for Full Employment and Price Stability.

Neoclassical economics

Neoclassical economics

Neoclassical economics is a term variously used for approaches to economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand, often mediated through a hypothesized maximization of utility by income-constrained individuals and of profits...

has often argued a deflationist policy; during the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

, many mainstream economists argued that nominal wages should fall, as they had in 19th century economic crises, thus returning prices and employment to equilibrium. This was opposed by Keynesian economics, which argued that a general cut in wages reduced demand, worsening the crisis, without improving employment.

Political debate

Hard currency

Hard currency , in economics, refers to a globally traded currency that is expected to serve as a reliable and stable store of value...

, which believes that the real value of currency should be maintained.

In late 19th century United States, the Free Silver

Free Silver

Free Silver was an important United States political policy issue in the late 19th century and early 20th century. Its advocates were in favor of an inflationary monetary policy using the "free coinage of silver" as opposed to the less inflationary Gold Standard; its supporters were called...

movement advocated the inflationary policy of free coinage of silver. This was a contentious political issue in the 40-year period 1873–1913, consistently defeated. Later, economist John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

described the effects of inflationism:

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationismInflationismIn economics, an inflationist or inflationary economic, fiscal, or monetary policy, is one that is predicted to lead to a substantial level of inflation. Similarly, an inflationist economist is one that advocates an inflationist policy...

has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Contemporary advocacy

While few, if any, economists argue that inflation is a good thing in itself, some argue for a generally higher level of inflation, either in general or in the context of economic crises, and deflation is widely agreed to be very harmful.Three contemporary arguments for higher inflation, the first two from the mainstream school of Keynesian economics

Keynesian economics

Keynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

and advocated by prominent economists, the latter from the heterodox

Heterodox economics

"Heterodox economics" refers to approaches or to schools of economic thought that are considered outside of "mainstream economics". Mainstream economists sometimes assert that it has little or no influence on the vast majority of academic economists in the English speaking world. "Mainstream...

school of Post-Keynesian economics

Post-Keynesian economics

Post Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, although its subsequent development was influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor and Paul Davidson...

, are:

- added flexibility in monetary policyPolicyA policy is typically described as a principle or rule to guide decisions and achieve rational outcome. The term is not normally used to denote what is actually done, this is normally referred to as either procedure or protocol...

; - wage stickiness; and

- decreasing real burden of debt.

Added flexibility in monetary policy:

A high inflation rate with a low nominal interest rate result in a negative real interest rate; for example, a nominal interest rate of 1% and an inflation rate of 4% yields a real interest rate of (approximately)Properly, the real interest rate in this case is

but the linear approximation

but the linear approximationLinear approximation

In mathematics, a linear approximation is an approximation of a general function using a linear function . They are widely used in the method of finite differences to produce first order methods for solving or approximating solutions to equations.-Definition:Given a twice continuously...

is widely used; see Fisher equation

is widely used; see Fisher equationFisher equation

The Fisher equation in financial mathematics and economics estimates the relationship between nominal and real interest rates under inflation....

for details. −3%. As lower (real) interest rates are associated with stimulating the economy under monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

, the higher inflation is, the more flexibility a central bank has in setting (nominal) interest rates while still keeping them nonnegative; negative (nominal) interest rates are considered unconventional monetary policy and have very rarely been practiced.

Olivier Blanchard

Olivier Blanchard

Olivier Jean Blanchard is currently the chief economist at the International Monetary Fund, a post he has held since September 1, 2008. He is also the Class of 1941 Professor of Economics at MIT, though he is currently on leave. Blanchard is one of the most cited economists in the world, according...

, chief economist of the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

, argues that the inflation rates during The Great Moderation

The Great Moderation

In economics, the Great Moderation refers to a reduction in the volatility of business cycle fluctuations starting in the mid-1980s, believed to have been caused by institutional and structural changes in developed nations in the later part of the twentieth century...

were too low, causing constraints in the late-2000s recession, and that central banks should consider a target inflation rate of 4% instead of 2%.

Wage stickiness:

Inflation decreases the real value of wages, in the absence of corresponding wage rises. In the theory of wage stickiness, a cause of unemployment in recessions and depressions is the failure of workers to take pay cuts, to decrease real labor costs. It is observed that wages are nominally sticky downwards, even in the long term (it is difficult to cut real wages), and thus that inflation provides useful erosion of real costs wages without requiring nominal wage cuts.

In this context it is worth noting that collective bargaining

Collective bargaining

Collective bargaining is a process of negotiations between employers and the representatives of a unit of employees aimed at reaching agreements that regulate working conditions...

in the Netherlands

Netherlands

The Netherlands is a constituent country of the Kingdom of the Netherlands, located mainly in North-West Europe and with several islands in the Caribbean. Mainland Netherlands borders the North Sea to the north and west, Belgium to the south, and Germany to the east, and shares maritime borders...

and Japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

has at times yielded nominal wage cuts, though this has not generally occurred in the United States, and that this argument ascribes high real labor costs as a cause of unemployment, and argues that labor should have a lower share of national income – workers should be paid less.

Decreasing real burden of debt:

In the theory of debt-deflation, a key cause of economic crises is a high level of debt, and a key cause of recovery from crises is when this debt level has decreased. Other than repayment (paying down debt) and default (not paying it), a key mechanism of debt reduction is inflation – because debts are general in nominal terms, inflation reduces the real level of debt. This effect is more pronounced the higher the level of debt, in proportion to the level of debt. For example, if the debt to GDP ratio

Debt to GDP ratio

In economics, the debt-to-GDP ratio is one of the indicators of the health of an economy.It is the amount of national debt of a country as a percentage of its Gross Domestic Product ....

of a country is 300% and it experiences one year of 10% inflation, the debt level will be reduced by approximately

to 270%. By contrast, if the debt to GDP ratio is 20%, then one year of 10% inflation will reduce the debt level by 2%, to 18%. Thus several years of sustained high inflation significantly reduce a high level of initial debt. This is argued by Steve Keen

to 270%. By contrast, if the debt to GDP ratio is 20%, then one year of 10% inflation will reduce the debt level by 2%, to 18%. Thus several years of sustained high inflation significantly reduce a high level of initial debt. This is argued by Steve KeenSteve Keen

Steve Keen is a Professor in economics and finance at the University of Western Sydney. He classes himself as a post-Keynesian, criticizing both modern neoclassical economics and Marxian economics as inconsistent, unscientific and empirically unsupported...

, among others.

In this context, the direct result of inflation is a transfer of wealth from creditors to debtors – the creditors receive less in real terms than they would have before, while the debtors pay less, assuming that the debts would in fact have been repaid, and not defaulted on. Formally, this is a de facto debt restructuring

Debt restructuring

Debt restructuring is a process that allows a private or public company – or a sovereign entity – facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity and rehabilitate so that it can continue its...

, with reduction of the real value of principle, and may benefit creditors if it results in the debts being serviced (paid in part), rather than defaulted on.

A related argument is by Chartalists, who argue that nations who issue debt denominated in their own fiat currency need never default, because they can print money to pay off the debt. Chartalists note, however, that printing money without matching it with taxation (to recover money and prevent the money supply from growing) can result in inflation if pursued beyond the point of full employment, and Chartalists generally do not argue for inflation.

See also

- Asset price inflationAsset price inflationAsset price inflation is an economic phenomenon denoting a rise in price of assets, as opposed to ordinary goods and services. Typical assets are financial instruments such as bonds, shares, and their derivatives, as well as real estate and other capital goods.-Price inflation and assets...

- Chronic inflationChronic inflationChronic inflation occurs when a country experiences high inflation for a prolonged period of time due to undue expansion or increase of the money supply...

- Monetary inflationMonetary inflationMonetary inflation is a sustained increase in the money supply of a country. It usually results in price inflation, which is a rise in the general level of prices of goods and services . Originally the term "inflation" was used to refer only to monetary inflation, whereas in present usage it...

- Debt monetization or Deficit financing

- StatismStatismStatism is a term usually describing a political philosophy, whether of the right or the left, that emphasises the role of the state in politics or supports the use of the state to achieve economic, military or social goals...

External links

- Inflation, explained by Pete SmithPete Smith (film producer)Pete Smith was a film producer and narrator of "short subject" films from 1931 to 1955....

, directed by Zion Myers (1933), pro-inflation movie (IMDb)