GersonH

The euro fell markedly against the US dollar after the publication of the European Commission's report, which is expected to slow the Eurozone economy in 2019. The European Commission lowered the GDP forecast in the Eurozone from 2% to 1.9%.

After the meeting, the US Federal Reserve's Open Market Committee (FOMC) accelerated the pair's descent. As expected, the FOMC decided to leave key interest rates in the country in the range of 2.00%-2.25%. The Committee confirmed its forecast for a gradual increase in interest rates. The statement that risks would remain balanced was present in the September statement, and remains intact. The next meeting is scheduled for December. Another rate hike is expected later this year. See forex economic calendar in https://alpari.com/en/analytics/calendar_fxstreet/

Day's news (GMT+3):

10:45 France: industrial output (Sep).

12:30 UK: GDP (Q3), total business investment (Q3), industrial production (Sep), trade balance (Sep), construction (Sep).

16:00 UK: NIESR GDP estimate (Oct).

16:30 US: PPI (Oct).

18:00 US: Michigan CSI (Nov).

21:00 US: Baker Hughes US oil rig count.

Current situation:

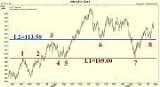

Our forecast for the high and low was accurate. I did not consider the jump from the high (1.1447). I expected a fall to the trend line on Friday, while sellers passed this yesterday. In addition, there was a breakout of the upwards channel and the area around the 112th-135th degree acted as a support.

I did not make a forecast for Friday due to the conflicting situation we have. The price may fall to 1.1313, or via a correctional movement under the trend line. There is no important news scheduled for today for the euro, and should the euro strengthen to 1.1375, that could cancel the bearish scenario.

After the meeting, the US Federal Reserve's Open Market Committee (FOMC) accelerated the pair's descent. As expected, the FOMC decided to leave key interest rates in the country in the range of 2.00%-2.25%. The Committee confirmed its forecast for a gradual increase in interest rates. The statement that risks would remain balanced was present in the September statement, and remains intact. The next meeting is scheduled for December. Another rate hike is expected later this year. See forex economic calendar in https://alpari.com/en/analytics/calendar_fxstreet/

Day's news (GMT+3):

10:45 France: industrial output (Sep).

12:30 UK: GDP (Q3), total business investment (Q3), industrial production (Sep), trade balance (Sep), construction (Sep).

16:00 UK: NIESR GDP estimate (Oct).

16:30 US: PPI (Oct).

18:00 US: Michigan CSI (Nov).

21:00 US: Baker Hughes US oil rig count.

Current situation:

Our forecast for the high and low was accurate. I did not consider the jump from the high (1.1447). I expected a fall to the trend line on Friday, while sellers passed this yesterday. In addition, there was a breakout of the upwards channel and the area around the 112th-135th degree acted as a support.

I did not make a forecast for Friday due to the conflicting situation we have. The price may fall to 1.1313, or via a correctional movement under the trend line. There is no important news scheduled for today for the euro, and should the euro strengthen to 1.1375, that could cancel the bearish scenario.