Bryan v. Itasca County

Encyclopedia

Bryan v. Itasca County, 426 U.S. 373

(1976), was a case in which the Supreme Court of the United States

held that a state did not have the right to assess a tax on the property of a Native American (Indian) living on tribal land absent a specific Congressional grant of authority to do so.

A county in Minnesota

taxed an Indian's mobile home that was located on the reservation, and the court ruled that they did not have the authority to do so, nor to regulate behavior on the reservation. This case has become a landmark case that set the stage for Indian gaming on reservations and altered the economic status of almost every Indian tribe. The case has also called into question the ability of the states to impose any sort of regulations on tribal reservations, such as labor standards and certain traffic regulations.

. This is based primarily on the Commerce Clause

of the Constitution

, which states that "The Congress shall have Power ... To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes." This doctrine is based on Worcester v. Georgia

, which stated Indian tribes are considered to be dependent sovereign nations that deal directly with the federal government, and that states have no authority to regulate or control the tribes. Congress can authorize the states to have some control, and Minnesota is a Public Law 280

state, where Congress has granted the state has criminal and some civil jurisdiction on tribal land and reservations.

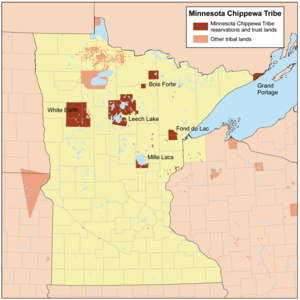

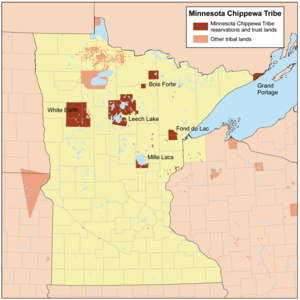

, which is a component band of the Minnesota Chippewa Tribe

. He married Helen Charwood in 1957. Helen was an enrolled member of the Leech Lake Band of Ojibwe

which was also a part of the Minnesota Chippewa Tribe. They raised their children on reservation land and lived in a mobile home

that that they purchased in 1971. The mobile home was located on the Greater Leech Lake Indian Reservation

near Squaw Lake

in Minnesota

within Itasca County

. Bryan's mobile home, had it not been on the reservation, would have been subject to taxes from Itasca County. In June 1972, Itasca County notified Bryan that the mobile home was subject to US$147.95 in taxes. The Bryans could not afford to pay the tax, and contacted the Leech Lake Reservation Legal Services Project (Legal Services) for help, noting that the mobile home was on Indian land.

seeking declaratory relief

and an injunction

that would prevent the state and county from collecting taxes from Indians on tribal land. This was filed as a class action suit

. There was no dispute as to the facts of the case, so the matter was submitted as a question of law to Judge James F. Murphy. In 1973, the district court held that the state and county were authorized to collect such taxes under Public Law 280. Murphy noted that while the Chippewa had at one time been a sovereign Indian nation, their members were now citizens of Minnesota and received benefits from the state such as county services, the court system, and other like services.

At about the same time as the district court made its decision, Legal Services hired a new director, Gerald "Jerry" Seck. Seck did not know much about Indian law, so he contacted the Native American Rights Fund

(NARF). With their help, Bryan appealed to the Minnesota Supreme Court

. The Minnesota Chippewa tribe and the United States both filed amicus curae briefs with the court that supported Bryan's position, and NARF attorneys appeared on his behalf. In March 1975, that court affirmed the decision of the trial court by a unanimous decision, holding that Public Law 280 showed Congressional intent to allow such taxation. The Minnesota Supreme Court based its decision primarily on Omaha Tribe of Indians v. Peters, 382 F.Supp. 421 (D. Neb. 1974) Bryan appealed this decision, and the United States Supreme Court granted certiorari

.

to prepare the brief with Dan Israel of NARF and Bernie Becker, the tribe's attorney who would argue the case before the Supreme Court. At oral arguments on April 20, 1976, Becker pointed out that Public Law 280 gave the state jurisdiction over criminal matters and civil "causes of actions" - a legal term for lawsuits. Since Congress had also passed other Indian laws at the same time, such as the various Indian Termination Acts

which specifically authorized states to collect taxes from Indians, its silence in this area meant that they did not intend to do so with Public Law 280. Becker brought up the leading article on Public Law 280 by UCLA

law professor Carole Goldberg, who had argued that the law was established to address the problem of crime on reservations. He also noted that tribes which had adequate law and order processes, such as the Red Lake Band of Chippewa

were excluded from state jurisdiction in Minnesota. Arguing for the State of Minnesota was C. H. Luther of the State Attorney General's office. Luther conceded that if the trailer was a fixed house or real property, that it would be exempt from taxation. Luther also stated that other taxes, such as gasoline, sales, income and other taxes of general applicability would apply to Indians.

delivered the unanimous opinion of the court on June 14, 1976. Brennan stated that Public Law 280 was not designed to eliminate all restrictions on the states as they dealt with Indian tribes. Brennan noted that under the courts' prior decisions of Mescalero Apache Tribe v. Jones

, and McClanahan v. Arizona State Tax Comm'n

, that states had no authority to tax Indians "absent Congressional consent." Since Itasca County was claiming that Public Law 280 granted that consent, Brennan evaluated that statute in regards to taxation of Indians.

Brennan noted that the Minnesota Supreme Court had found that the statute did grant the right to tax that personal property as an inherent power, even though the law did not specifically mention the power to tax. Brennan rejected this argument, noting that the primary purpose of the law was to provide for "state criminal jurisdiction over offenses committed by or against Indians on the reservations." Nothing in the legislative history of the law provided support for Itasca County's interpretation. Brennan also noted that several tribal termination acts were considered at the same time, and those acts specifically discussed the taxation of Indians, while Public Law 280 was silent.

Brennan then noted that the principles of statutory construction as regards to Indians were very specific. Any differences in possible interpretation must be resolved in favor of the tribe or the Indian. Since Minnesota's interpretation did not meet any of these tests regarding either the consent of Congress to tax or of statutory construction, Brennan stated that the court would not follow their reasoning, and reversed their decision.

When the decision was announced, it was reported as a substantial victory for Indians by both the local and national press. Bryan is a landmark case on the taxation of Indians and tribal sovereignty, having been cited over 380 times as of July 2010. The case has had a significant impact on Indian gaming with its broad holding that Public Law 280 did not confer "general state civil regulatory control over Indian reservations." This ruling in a challenge to a tax bill of $147.95 had the effect of enabling Indian tribes to earn over $200 billion in gaming revenue. The first such cases involved bingo, which many states allowed, but regulated. The cases that were decided all cited Bryan in holding that the various states had no legal grounds to regulate the games on tribal land. Many analysts point to the Bryan case as being the grounds upon which California v. Cabazon Band of Mission Indians, was decided, since the Supreme Court noted that California

When the decision was announced, it was reported as a substantial victory for Indians by both the local and national press. Bryan is a landmark case on the taxation of Indians and tribal sovereignty, having been cited over 380 times as of July 2010. The case has had a significant impact on Indian gaming with its broad holding that Public Law 280 did not confer "general state civil regulatory control over Indian reservations." This ruling in a challenge to a tax bill of $147.95 had the effect of enabling Indian tribes to earn over $200 billion in gaming revenue. The first such cases involved bingo, which many states allowed, but regulated. The cases that were decided all cited Bryan in holding that the various states had no legal grounds to regulate the games on tribal land. Many analysts point to the Bryan case as being the grounds upon which California v. Cabazon Band of Mission Indians, was decided, since the Supreme Court noted that California

was not able to impose civil regulations against an Indian tribe on tribal land. In that case, the court noted that California not only allowed gaming, but promoted their own state lottery, therefore the prohibition against gaming were regulatory in nature, not criminal, and notwithstanding the fact that the games were open to non-Indians as well as Indians. After that decision, Congress passed the Indian Gaming Regulatory Act

to provide for a system of regulation of the Indian gaming industry, a direct result but unintended consequence of the Bryan decision.

The case is often cited to support the concept that first "coalesced" in the 1968 case, Menominee Tribe of Indians v. United States, , that tribal rights would not be abrogated without an explicit intent of Congress to do so. It has been opined by a number of legal scholars that tribes would not be subject to state labor laws. In some instances, Bryan and Cabazon have been viewed to not allow the state jurisdiction over traffic violations of non-member Indians on another tribes' reservation. Finally, Bryan is extensively discussed in both major legal textbooks on Native American law, along with numerous other high school and college texts.

Case citation

Case citation is the system used in many countries to identify the decisions in past court cases, either in special series of books called reporters or law reports, or in a 'neutral' form which will identify a decision wherever it was reported...

(1976), was a case in which the Supreme Court of the United States

Supreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

held that a state did not have the right to assess a tax on the property of a Native American (Indian) living on tribal land absent a specific Congressional grant of authority to do so.

A county in Minnesota

Minnesota

Minnesota is a U.S. state located in the Midwestern United States. The twelfth largest state of the U.S., it is the twenty-first most populous, with 5.3 million residents. Minnesota was carved out of the eastern half of the Minnesota Territory and admitted to the Union as the thirty-second state...

taxed an Indian's mobile home that was located on the reservation, and the court ruled that they did not have the authority to do so, nor to regulate behavior on the reservation. This case has become a landmark case that set the stage for Indian gaming on reservations and altered the economic status of almost every Indian tribe. The case has also called into question the ability of the states to impose any sort of regulations on tribal reservations, such as labor standards and certain traffic regulations.

Background

Background information

Generally, no state has the authority to tax an Indian tribe or an individual Indian living on a reservation without authorization from CongressUnited States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

. This is based primarily on the Commerce Clause

Commerce Clause

The Commerce Clause is an enumerated power listed in the United States Constitution . The clause states that the United States Congress shall have power "To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes." Courts and commentators have tended to...

of the Constitution

United States Constitution

The Constitution of the United States is the supreme law of the United States of America. It is the framework for the organization of the United States government and for the relationship of the federal government with the states, citizens, and all people within the United States.The first three...

, which states that "The Congress shall have Power ... To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes." This doctrine is based on Worcester v. Georgia

Worcester v. Georgia

Worcester v. Georgia, 31 U.S. 515 , was a case in which the United States Supreme Court vacated the conviction of Samuel Worcester and held that the Georgia criminal statute that prohibited non-Indians from being present on Indian lands without a license from the state was unconstitutional.The...

, which stated Indian tribes are considered to be dependent sovereign nations that deal directly with the federal government, and that states have no authority to regulate or control the tribes. Congress can authorize the states to have some control, and Minnesota is a Public Law 280

Public Law 280

Public Law 280 is a federal law of the United States establishing "a method whereby States may assume jurisdiction over reservation Indians," as stated by Arizona Supreme Court Justice Stanley G. Feldman. Public Law 280 is a federal law of the United States establishing "a method whereby States...

state, where Congress has granted the state has criminal and some civil jurisdiction on tribal land and reservations.

History

Russell Bryan was an enrolled member of the White Earth Band of OjibweWhite Earth Band of Ojibwe

The White Earth Band of Ojibwe, or Gaa-waabaabiganikaag Anishinaabeg, is a Native American tribe located in northwestern Minnesota. The tribe's land-based home is the White Earth Indian Reservation...

, which is a component band of the Minnesota Chippewa Tribe

Minnesota Chippewa Tribe

The Minnesota Chippewa Tribe is a centralized government for six Chippewa bands in the U.S. state of Minnesota. It was created on June 18, 1934, and the organization and its constitution were recognized by the Secretary of the Interior two years later on July 24, 1936...

. He married Helen Charwood in 1957. Helen was an enrolled member of the Leech Lake Band of Ojibwe

Leech Lake Band of Ojibwe

The Leech Lake Band of Ojibwe, also known as the Leech Lake Band of Chippewa Indians or the Leech Lake Band of Minnesota Chippewa Tribe, and as Gaa-zagaskwaajimekaag Ojibweg in the Ojibwe language, is an Ojibwa tribe located in Minnesota. The tribe boasts 8,861 tribal members as of July, 2007...

which was also a part of the Minnesota Chippewa Tribe. They raised their children on reservation land and lived in a mobile home

Mobile home

Mobile homes or static caravans are prefabricated homes built in factories, rather than on site, and then taken to the place where they will be occupied...

that that they purchased in 1971. The mobile home was located on the Greater Leech Lake Indian Reservation

Leech Lake Indian Reservation

The Leech Lake Indian Reservation or Gaa-zagaskwaajimekaag in the Ojibwe language, is an Native American reservation located in the north-central Minnesota counties of Cass, Itasca, Beltrami, and Hubbard. It is the land-base for the Leech Lake Band of Ojibwe...

near Squaw Lake

Squaw Lake, Minnesota

Squaw Lake is a city in Itasca County, Minnesota, United States. The population was 107 at the 2010 census.The town center is located along Minnesota State Highway 46.-Geography:...

in Minnesota

Minnesota

Minnesota is a U.S. state located in the Midwestern United States. The twelfth largest state of the U.S., it is the twenty-first most populous, with 5.3 million residents. Minnesota was carved out of the eastern half of the Minnesota Territory and admitted to the Union as the thirty-second state...

within Itasca County

Itasca County, Minnesota

Itasca County is a county located in the U.S. state of Minnesota. It is named after Lake Itasca, which is in turn a shortened version the Latin words veritas caput, meaning 'truth' and 'head', a reference to the source of the Mississippi River. As of 2010, the population was 45,058. Its county seat...

. Bryan's mobile home, had it not been on the reservation, would have been subject to taxes from Itasca County. In June 1972, Itasca County notified Bryan that the mobile home was subject to US$147.95 in taxes. The Bryans could not afford to pay the tax, and contacted the Leech Lake Reservation Legal Services Project (Legal Services) for help, noting that the mobile home was on Indian land.

Lower courts

On behalf of Bryan, Legal Services attorney Patrick Moriarty then sued the state and Itasca County in the District Court of Itasca CountyMinnesota District Courts

The Minnesota District Courts are the state trial courts of general jurisdiction in the U.S. state of Minnesota.The Minnesota Constitution provides that the district court has original jurisdiction in civil and criminal cases and such appellate jurisdiction as may be prescribed by law.Each district...

seeking declaratory relief

Declaratory relief

Declaratory relief is a judge's determination of the parties' rights under a contract or a statute, often requested in a lawsuit over a contract. In theory, an early resolution of legal rights will resolve some or all of the other issues in the matter....

and an injunction

Injunction

An injunction is an equitable remedy in the form of a court order that requires a party to do or refrain from doing certain acts. A party that fails to comply with an injunction faces criminal or civil penalties and may have to pay damages or accept sanctions...

that would prevent the state and county from collecting taxes from Indians on tribal land. This was filed as a class action suit

Class action

In law, a class action, a class suit, or a representative action is a form of lawsuit in which a large group of people collectively bring a claim to court and/or in which a class of defendants is being sued...

. There was no dispute as to the facts of the case, so the matter was submitted as a question of law to Judge James F. Murphy. In 1973, the district court held that the state and county were authorized to collect such taxes under Public Law 280. Murphy noted that while the Chippewa had at one time been a sovereign Indian nation, their members were now citizens of Minnesota and received benefits from the state such as county services, the court system, and other like services.

At about the same time as the district court made its decision, Legal Services hired a new director, Gerald "Jerry" Seck. Seck did not know much about Indian law, so he contacted the Native American Rights Fund

Native American Rights Fund

The Native American Rights Fund, also known as NARF, is a non-profit organization that uses existing laws and treaties to ensure that state governments and the national government live up to their legal obligations...

(NARF). With their help, Bryan appealed to the Minnesota Supreme Court

Minnesota Supreme Court

The Minnesota Supreme Court is the highest court in the U.S. state of Minnesota and consists of seven members. The court was first assembled as a three-judge panel in 1849 when Minnesota was still a territory. The first members were lawyers from outside of the region who were appointed by...

. The Minnesota Chippewa tribe and the United States both filed amicus curae briefs with the court that supported Bryan's position, and NARF attorneys appeared on his behalf. In March 1975, that court affirmed the decision of the trial court by a unanimous decision, holding that Public Law 280 showed Congressional intent to allow such taxation. The Minnesota Supreme Court based its decision primarily on Omaha Tribe of Indians v. Peters, 382 F.Supp. 421 (D. Neb. 1974) Bryan appealed this decision, and the United States Supreme Court granted certiorari

Certiorari

Certiorari is a type of writ seeking judicial review, recognized in U.S., Roman, English, Philippine, and other law. Certiorari is the present passive infinitive of the Latin certiorare...

.

Opinion of the Court

Arguments

By the time that the appeal was prepared, Seck had left Legal Services but was still the attorney of record. The tribe paid to fly him to Washington, D.C.Washington, D.C.

Washington, D.C., formally the District of Columbia and commonly referred to as Washington, "the District", or simply D.C., is the capital of the United States. On July 16, 1790, the United States Congress approved the creation of a permanent national capital as permitted by the U.S. Constitution....

to prepare the brief with Dan Israel of NARF and Bernie Becker, the tribe's attorney who would argue the case before the Supreme Court. At oral arguments on April 20, 1976, Becker pointed out that Public Law 280 gave the state jurisdiction over criminal matters and civil "causes of actions" - a legal term for lawsuits. Since Congress had also passed other Indian laws at the same time, such as the various Indian Termination Acts

Indian termination policy

Indian termination was the policy of the United States from the mid-1940s to the mid-1960s. The belief was that Native Americans would be better off if assimilated as individuals into mainstream American society. To that end, Congress proposed to end the special relationship between tribes and the...

which specifically authorized states to collect taxes from Indians, its silence in this area meant that they did not intend to do so with Public Law 280. Becker brought up the leading article on Public Law 280 by UCLA

University of California, Los Angeles

The University of California, Los Angeles is a public research university located in the Westwood neighborhood of Los Angeles, California, USA. It was founded in 1919 as the "Southern Branch" of the University of California and is the second oldest of the ten campuses...

law professor Carole Goldberg, who had argued that the law was established to address the problem of crime on reservations. He also noted that tribes which had adequate law and order processes, such as the Red Lake Band of Chippewa

Red Lake Indian Reservation

The Red Lake Indian Reservation covers 1,258.62 sq mi in parts of nine counties in northern Minnesota, United States. It is divided into many pieces, although the largest piece is centered about Red Lake, in north-central Minnesota, the largest lake entirely within that state. This section lies...

were excluded from state jurisdiction in Minnesota. Arguing for the State of Minnesota was C. H. Luther of the State Attorney General's office. Luther conceded that if the trailer was a fixed house or real property, that it would be exempt from taxation. Luther also stated that other taxes, such as gasoline, sales, income and other taxes of general applicability would apply to Indians.

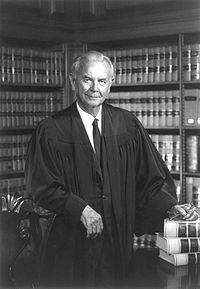

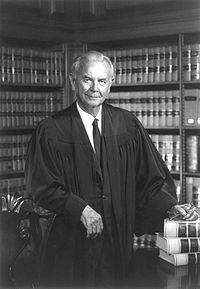

Unanimous opinion

Justice William J. Brennan, Jr.William J. Brennan, Jr.

William Joseph Brennan, Jr. was an American jurist who served as an Associate Justice of the United States Supreme Court from 1956 to 1990...

delivered the unanimous opinion of the court on June 14, 1976. Brennan stated that Public Law 280 was not designed to eliminate all restrictions on the states as they dealt with Indian tribes. Brennan noted that under the courts' prior decisions of Mescalero Apache Tribe v. Jones

Mescalero Apache Tribe v. Jones

Mescalero Apache Tribe v. Jones, 411 U.S. 145 , was a case in which the Supreme Court of the United States held that a state could tax tribal, off-reservation business activities but could not impose a tax on tribal land, which was exempt from all forms of property taxes.-Background:The Mescalero...

, and McClanahan v. Arizona State Tax Comm'n

McClanahan v. Arizona State Tax Comm'n

McClanahan v. Arizona State Tax Comm'n, 411 U.S. 164 , was a case in which the Supreme Court of the United States holding that Arizona has no jurisdiction to impose a tax on the income of Navajo Indians residing on the Navajo Reservation and whose income is wholly derived from reservation...

, that states had no authority to tax Indians "absent Congressional consent." Since Itasca County was claiming that Public Law 280 granted that consent, Brennan evaluated that statute in regards to taxation of Indians.

Brennan noted that the Minnesota Supreme Court had found that the statute did grant the right to tax that personal property as an inherent power, even though the law did not specifically mention the power to tax. Brennan rejected this argument, noting that the primary purpose of the law was to provide for "state criminal jurisdiction over offenses committed by or against Indians on the reservations." Nothing in the legislative history of the law provided support for Itasca County's interpretation. Brennan also noted that several tribal termination acts were considered at the same time, and those acts specifically discussed the taxation of Indians, while Public Law 280 was silent.

Brennan then noted that the principles of statutory construction as regards to Indians were very specific. Any differences in possible interpretation must be resolved in favor of the tribe or the Indian. Since Minnesota's interpretation did not meet any of these tests regarding either the consent of Congress to tax or of statutory construction, Brennan stated that the court would not follow their reasoning, and reversed their decision.

Subsequent developments

California

California is a state located on the West Coast of the United States. It is by far the most populous U.S. state, and the third-largest by land area...

was not able to impose civil regulations against an Indian tribe on tribal land. In that case, the court noted that California not only allowed gaming, but promoted their own state lottery, therefore the prohibition against gaming were regulatory in nature, not criminal, and notwithstanding the fact that the games were open to non-Indians as well as Indians. After that decision, Congress passed the Indian Gaming Regulatory Act

Indian Gaming Regulatory Act

The Indian Gaming Regulatory Act is a 1988 United States federal law that establishes the jurisdictional framework that governs Indian gaming. There was no federal gaming structure before this act...

to provide for a system of regulation of the Indian gaming industry, a direct result but unintended consequence of the Bryan decision.

The case is often cited to support the concept that first "coalesced" in the 1968 case, Menominee Tribe of Indians v. United States, , that tribal rights would not be abrogated without an explicit intent of Congress to do so. It has been opined by a number of legal scholars that tribes would not be subject to state labor laws. In some instances, Bryan and Cabazon have been viewed to not allow the state jurisdiction over traffic violations of non-member Indians on another tribes' reservation. Finally, Bryan is extensively discussed in both major legal textbooks on Native American law, along with numerous other high school and college texts.

External links

- Bryan v. Itasca County, , full text of the opinion courtesy of Findlaw.com