Carbondale Area School District

Encyclopedia

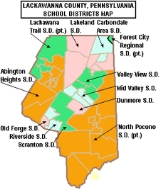

The Carbondale Area School District is a small, suburban school district that provides education services to the children residing in the City of Carbondale

and Fell Township in Lackawanna County, Pennsylvania

. The district encompasses an area of 18.6 square miles. The school district has a population of 11,641, according to the 2000 federal census. In 2009, the district residents' per capita income

was $15,174, while the median family income was $35,833. Per school district administrative officials, during the 2005-06 school year, the district provided basic educational services to 1,458 pupils. The district students are 95% white, 1% asian, 2% black and 3% Hispanic. In 2006, the district employed of 6 administrators, 103 teachers, and 46 full-time and part-time support personnel. Special education is provided by the district and the Northeastern Educational Intermediate Unit #19. Occupational training and adult education in various vocational and technical fields were provided by the district and the Career Technology Center of Lackawanna County.

The district operates Carbondale Area Jr/Sr High School (7th-12th) and Carbondale Area Elementary School (K-6th).

In 2009, the academic achievement of the students of Carbondale Area School District was in the 67th percentile of Pennsylvania's 500 school districts. Scale (0-99; 100 is state best).

In 2008, students in Carbondale Area School District demonstrated the highest achievement on the state's annual math test, among all ten Lackawanna County school districts. Additionally, the Institute for Public Policy and Economic Development found that Carbondale 5th grade writing achievement is low 20% on grade level, which is below the county's average score and has declined from a high f 40% in 2006. The district's 8th has declined in writing achievement from 2007-2009 achieving 65% on grade level in 2009. Eleventh grade students at 09% on grade level, has shown strong writing skills acquisition from 2006-2009.

PSSA Results

11th Grade Reading

11th Grade Math:

11th Grade Science:

College remediation: According to a Pennsylvania Department of Education study released in January 2009, 16% of Carbondale Area High School graduates required remediation in mathematics and or reading before they were prepared to take college level courses in the Pennsylvania State System of Higher Education

or community colleges. Less than 66% of Pennsylvania high school graduates, who enroll in a four-year college in Pennsylvania, will earn a bachelor's degree within six years. Among Pennsylvania high school graduates pursuing an associate degree, only one in three graduate in three years. Per the Pennsylvania Department of Education

, one in three recent high school graduates who attend Pennsylvania's public universities and community colleges takes at least one remedial course in math, reading or English.

For the 2009-10 funding year, the school district received a state grant of $1,005 for the program.

By law, all Pennsylvania secondary school students must complete a project as a part of their eligibility to graduate from high school. The type of project, its rigor and its expectations are set by the individual school district. At Carbondale Area School District the project is a three year process which includes a research paper and oral presentation.

By Pennsylvania School Board regulations, for the graduating class of 2016, students must demonstrate successful completion of secondary level course work in Algebra I, Biology, English Composition, and Literature for which the Keystone Exams serve as the final course exams. Students’ Keystone Exam scores shall count for at least one-third of the final course grade.

8th Grade Math:

8th Grade Science:

7th Grade Reading:

7th Grade Math:

6th Grade Reading:

6th Grade Math:

5th Grade Reading:

5th Grade Math:

4th Grade Reading;

4th Grade Math;

4th Grade Science;

3rd Grade Reading;

3rd Grade Math;

The District engages in identification procedures to ensure that eligible students receive an appropriate educational program consisting of special education and related services, individualized to meet student needs. At no cost to the parents, these services are provided in compliance with state and federal law; and are reasonably calculated to yield meaningful educational benefit and student progress. To identify students who may be eligible for special education, various screening activities are conducted on an ongoing basis. These screening activities include: review of group-based data (cumulative records, enrollment records, health records, report cards, ability and achievement test scores); hearing, vision, motor, and speech/language screening; and review by the Instructional Support Team or Student Assistance Team. When screening results suggest that the student may be eligible, the District seeks parental consent to conduct a multidisciplinary evaluation. Parents who suspect their child is eligible may verbally request a multidisciplinary evaluation from a professional employee of the District or contact the Special Education Department.

In 2010, the state of Pennsylvania provided $1,026,815,000 for Special Education services. The funds were distributed to districts based on a state policy which estimates that 16% of the district's pupils are receiving special education services. This funding is in addition to the state's basic education per pupil funding, as well as, all other state and federal funding.

Carbondale Area School District received a $1,015,364 supplement for special education services in 2010.

The school board prohibits bullying by district students and employees. The Board directs that complaints of bullying shall be investigated promptly, and corrective action shall be taken when allegations are verified. No reprisals or retaliation shall occur as a result of good faith reports of bullying. All Pennsylvania schools are required to have an anti-bullying policy incorporated into their Code of Student Conduct. The policy must identify disciplinary actions for bullying and designate a school staff person to receive complaints of bullying. The policy must be available on the school's website and posted in every classroom. All Pennsylvania public schools must provide a copy of its anti-bullying policy to the Office for Safe Schools every year, and shall review their policy every three years. Additionally, the district must conduct an annual review of that policy with students. District administration are required to annually provide the following information with the district's Safe School Report: the board’s bullying policy, a report of bullying incidents in the school district, and information on the development and implementation of any bullying prevention, intervention or education programs. The Center for Schools and Communities works in partnership with the Pennsylvania Commission on Crime & Delinquency and the Pennsylvania Department of Education to assist schools and communities as they research, select and implement bullying prevention programs and initiatives.

Education standards relating to student safety and antiharassment programs are described in the 10.3. Safety and Injury Prevention in the Pennsylvania Academic Standards for Health, Safety and Physical Education.

As of 2007, Pennsylvania ranked in the top 10 states in average teacher salaries. When adjusted for cost of living Pennsylvania ranked fourth in the nation for teacher compensation.

In 2008, per pupil spending at Carbondale Area School District was $10,837 for each child. This ranked 403rd among Pennsylvania's 500 school districts.

Carbondale Area School District administrative costs per pupil in 2008 was $638.79 per pupil. This is ranked 400th among in the 500 school districts in the Commonwealth of Pennsylvania. The lowest administrative cost per pupil in Pennsylvania was $398 per pupil. In 2011 it was revealed that administrative costs had risen dramatically in recent years. The principal of the elementary school is the highest paid in the region at $155,000 which $12,000 more than the next highest-paid elementary principal in the county. He received a 6 percent raise and a $2,400 annuity in 2011-12. The principal's wife is a member of the Carbondale Area School Board. For the 2011-12 school year, Superintendent received a base salary and annuity of $158,000. He also receives a comprehensive benefits package, which brings his total pay to $189,000. In 2011, the school board notified the superintendent they would not renew his current contract. The Pennsylvania School Board Association tracks salaries for Pennsylvania public school employees. It reports that the average superintendent salary in Pennsylvania was $122,165, in 2008.

For the 2011-12 school year, the board made significant cuts due to a loss of state and federal funding. The final busget was $20,623,457. It eliminated out of state travel, closed the pool and eliminated 2 teaching position, as well as, various staff positions. A $25 yearly fee will be charged to students who plan on driving to school and parking their cars in the student parking lot.

In 2008, the Carbondale Area School District reported an unreserved designated fund balance of zero and a unreserved-undesignated fund balance of $3,119,237.

In January 2009, the Pennsylvania Auditor General conducted a performance audit on the district. Several findings were reported to the school board and administration. The auditors noted that Board members had failed to file Statements of Financial Interests in violation of the Pennsylvania Public Official and Ethics Act.

The district is funded by a combination of: a local tax on income, a property tax, a real estate transfer tax 0.5%, coupled with substantial funding from the Commonwealth of Pennsylvania and the federal government. Grants have provided an opportunity to supplement school funding without raising local taxes. In Pennsylvania, pension income and Social Security income are exempted from state personal income tax and local earned income tax, regardless of the level of wealth.

In 2010, the district reported that 950 pupils received a free or reduced lunch due to the family meeting the federal poverty level

.

For the 2010-11 budget year the Carbondale Area School District received a 6.24% increase in state basic education funding for a total of $8,467,455. The highest increase in state funding, among Lackawanna County school districts, was awarded to unmore School District at 11.88% increase. One hundred fifty school districts in Pennsylvania received the 2% base increase for budget year 2010-11. The highest increase in the state was given to Kennett Consolidated School District

of Chester County

which was awarded a 23.65% increase in state basic education funding.

In the 2009-2010 budget year, the Commonwealth of Pennsylvania provided a 5.13% increase in Basic Education funding for a total of $7,966,172. The highest increase in state funding, to Lackawanna County school districts, was 9.46% increase which was awarded to Scranton School District. In Pennsylvania, 15 school districts received Basic Education Funding increases in excess of 10% in 2009. Muhlenberg School District

in Berks County received the highest with a 22.31% increase in funding. The state's Basic Education Funding to the Carbondale Area School District in 2008-09 was $6,999,344.06. The amount of increase each school district receives is determined by the Governor and the Secretary of Education through the allocation set in the state budget proposal made in February each year.

In 2008, the district reported that 717 pupils received a free or reduced lunch due to their family meeting the federal poverty threshold of $22,050 for a family of four. Many state and federal programs use the threshold to calculate benefits.

for the sixth year. These annual funds are in addition to the state's basic education funding and all federal funding. School Districts apply each year for Accountability Block Grants. In 2009-10, the state provided $271.4 million dollars in Accountability Block grants $199.5 million went to providing all day kindergartens.

- Federal stimulus money to be used in specific programs like special education and meeting the academic needs of low income students.

federal grant which would have brought the district up to million additional federal dollars for improving student academic achievement. Several Lackawanna County school districts applied for funding. Participation required the administration, the school board and the local teachers' union to sign an agreement to prioritize improving student academic success. In Pennsylvania, 120 public school districts and 56 charter schools agreed to participate. Pennsylvania was not approved for the grant. According to then Governor Rendell, failure of districts to agree to participate was cited as one reason that Pennsylvania was not approved.

is not levied on cars, business inventory, or other personal property. Certain types of property are exempt from property taxes including: places of worship, places of burial, private social clubs, charitable and educational institutions and government property. Irregular property reassessments have become a serious issue in the commonwealth as it creates a significant disparity in taxation within a community and across a region. Additionally, service related, disabled US military veterans may seek an exemption from paying property taxes. Pennsylvania school district revenues are dominated by two main sources: 1) Property tax collections, which account for the vast majority (between 75-85%) of local revenues; and 2) Act 511 tax collections, which are around 15% of revenues for school districts. Irregular property reassessments have become a serious issue in the Commonwealth as it creates a significant disparity in taxation within a community and across a region.

in the U.S. Department of Labor, for the previous 12-month period ending June 30. For a school district with a market value/personal income aid ratio (MV/PI AR) greater than 0.4000, its index equals the base index multiplied by the sum of .75 and its MV/PI AR for the current year. With the 2011 state education budget, the General Assembly voted to end most of the Act 1 exceptions leaving only special education costs and pension costs. The cost of construction projects will go to the voters for approval via ballot referendum.

The School District Adjusted Index for the Carbondale Area School District 2006-2007 through 2011-2012.

For the 2011-12 school year, the Carbondale Area School Board did not apply for exceptions to exceed the Act 1 Index. Each year the Carbondale Area School Board has the option of adopting either 1) a resolution in January certifying they will not increase taxes above their index or 2) a preliminary budget in February. A school district adopting the resolution may not apply for referendum exceptions or ask voters for a tax increase above the inflation index. A specific timeline for these decisions is publisher each year by the Pennsylvania Department of Education

.

According to a state report, for the 2011-2012 school year budgets, 247 school districts adopted a resolution certifying that tax rates would not be increased above their index; 250 school districts adopted a preliminary budget. Of the 250 school districts that adopted a preliminary budget, 231 adopted real estate tax rates that exceeded their index. Tax rate increases in the other 19 school districts that adopted a preliminary budget did not exceed the school district’s index. Of the districts who sought exceptions 221 used the pension costs exemption and 171 sought a Special Education costs exemption. Only 1 school district sought an exemption for Nonacademic School Construction Project, while 1 sought an exception for Electoral debt for school construction.

Carbondale Area School Board did not apply for exceptions to exceed the Act 1 index for the budgets in 2009-10 nor in 2010-11. In the Spring of 2010, 135 Pennsylvania school boards asked to exceed their adjusted index. Approval was granted to 133 of them and 128 sought an exception for pension costs increases.

Additionally, the Pennsylvania Property Tax/Rent Rebate program is provided for low income Pennsylvanians aged 65 and older; widows and widowers aged 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 for homeowners. The maximum rebate for both homeowners and renters is $650. Applicants can exclude one-half (1/2) of their Social Security

income, consequently individuals who have income substantially more than $35,000, may still qualify for a rebate. Individuals must apply annually for the rebate. This can be taken in addition to Homestead/Farmstead Property Tax Relief.

Property taxes in Pennsylvania are relatively high on a national scale. According to the Tax Foundation

, Pennsylvania ranked 11th in the U.S. in 2008 in terms of property taxes paid as a percentage of home value (1.34%) and 12th in the country in terms of property taxes as a percentage of income (3.55%).

, there are fewer than 1469 students enrolled in Carbondale Area SD, K-12, in 2010. There were 111 students in the Class of 2010. The district's class of 2009 had 116 students. Enrollment in the Carbondale Area School District is projected, by the Pennsylvania Department of Education, to continue to increase to 1818 pupils K-12 total enrollment, by 2020.

A Standard and Poors study found that an optimal school district size, to conserve administrative costs, was at least 3000 pupils. Consolidation of the administration with an adjacent school district would achieve substantial administrative cost savings for people in both communities. According to a proposal made in 2009, by Governor Edward G. Rendell, the excessive administrative overhead dollars could be redirected to improve lagging academic achievement, to enrich the academic programs or to substantially reduce property taxes. Consolidation of two districts' central administrations into one would not require the closing of any local schools.

In March 2011, the Pennsylvania Institute of Certified Public Accountants Fiscal Responsibility Task Force released a report which found that consolidating school district administrations with one neighboring district, would save the Commonwealth $1.2 billion dollars without forcing the consolidation of any school buildings. The study noted that while the best school districts spent 4% of the annual budget on administration, others spend over 15% on administration.

More than 40 percent of elementary schools and more than 60 percent of secondary schools in western Pennsylvania have been experiencing significant enrollment decreases (15 percent or greater).

Pennsylvania has one of the highest numbers of school districts in the nation. In Pennsylvania, 80% of the school districts serve student populations under 5,000, and 40% serve less than 2,000. This results in excessive school administration bureaucracy and not enough course diversity. In a survey of 88 superintendents of small districts, 42% of the 49 respondents stated that they thought consolidation would save money without closing any schools.

By Pennsylvania law, all K-12 students in the district, including those who attend a private nonpublic school, cyber charter school, charter school and those homeschooled, are eligible to participate in the extracurricular programs including all athletics. They must meet the same eligibility rules as the students enrolled in the district's schools.

Carbondale, Pennsylvania

Carbondale is a city in Lackawanna County, Pennsylvania, United States. Carbondale is located approximately 15 miles due northeast of the city of Scranton in Northeastern Pennsylvania...

and Fell Township in Lackawanna County, Pennsylvania

Lackawanna County, Pennsylvania

As of the census of 2000, there were 213,295 people, 86,218 households, and 55,783 families residing in the county. The population density was 465 people per square mile . There were 95,362 housing units at an average density of 208 per square mile...

. The district encompasses an area of 18.6 square miles. The school district has a population of 11,641, according to the 2000 federal census. In 2009, the district residents' per capita income

Per capita income

Per capita income or income per person is a measure of mean income within an economic aggregate, such as a country or city. It is calculated by taking a measure of all sources of income in the aggregate and dividing it by the total population...

was $15,174, while the median family income was $35,833. Per school district administrative officials, during the 2005-06 school year, the district provided basic educational services to 1,458 pupils. The district students are 95% white, 1% asian, 2% black and 3% Hispanic. In 2006, the district employed of 6 administrators, 103 teachers, and 46 full-time and part-time support personnel. Special education is provided by the district and the Northeastern Educational Intermediate Unit #19. Occupational training and adult education in various vocational and technical fields were provided by the district and the Career Technology Center of Lackawanna County.

The district operates Carbondale Area Jr/Sr High School (7th-12th) and Carbondale Area Elementary School (K-6th).

Academic achievement

Carbondale Area School District was ranked 217th out of 498 Pennsylvania school districts in 2011, by the Pittsburgh Business Times. The ranking was based on five years of student academic performance on the PSSA's for: reading, mathematics and writing, as well as, three years of science.- 2010 - 196th

- 2009 - 234th

- 2008 - 364th

- 2007 - 422nd

In 2009, the academic achievement of the students of Carbondale Area School District was in the 67th percentile of Pennsylvania's 500 school districts. Scale (0-99; 100 is state best).

In 2008, students in Carbondale Area School District demonstrated the highest achievement on the state's annual math test, among all ten Lackawanna County school districts. Additionally, the Institute for Public Policy and Economic Development found that Carbondale 5th grade writing achievement is low 20% on grade level, which is below the county's average score and has declined from a high f 40% in 2006. The district's 8th has declined in writing achievement from 2007-2009 achieving 65% on grade level in 2009. Eleventh grade students at 09% on grade level, has shown strong writing skills acquisition from 2006-2009.

Graduation Rate

In 2010, the Pennsylvania Department of Education issued a new, 4 year cohort graduation rate. Carbondale Area Junior Senior High School's rate was 88% for 2010.- 2010 - 92%

- 2009 - 91%

- 2008 - 93%

- 2007 - 93%

Senior High school

In 2010, the high school is in School Improvement I AYP status. In 2009, the school was in Warning status.PSSA Results

11th Grade Reading

- 2010 - 65% on grade level (24% below basic). In Pennsylvania, 66% of 11th graders on grade level.

- 2009 - 73% (12% below basic), State - 65%

- 2008 - 81% (4% below basic), State - 65%

- 2007 - 77% (10% below basic), State - 65%

11th Grade Math:

- 2010 - 56% on grade level (32% below basic). In Pennsylvania, 59% of 11th graders are on grade level.

- 2009 - 62% (25% below basic), State - 56%

- 2008 - 64% (18% below basic), State - 56%

- 2007 - 51% (18% below basic), State - 53%

11th Grade Science:

- 2010 - 30% on grade level (32% below basic). State - 39% of 11th graders were on grade level.

- 2009 - 36% (26% below basic), State - 40%

- 2008 - 25% (30% below basic), State - 39%

College remediation: According to a Pennsylvania Department of Education study released in January 2009, 16% of Carbondale Area High School graduates required remediation in mathematics and or reading before they were prepared to take college level courses in the Pennsylvania State System of Higher Education

Pennsylvania State System of Higher Education

The Pennsylvania State System of Higher Education is the largest provider of higher education in the Commonwealth of Pennsylvania and a large public university system in the United States. It is the tenth-largest university system in the United States and 43rd largest in the world...

or community colleges. Less than 66% of Pennsylvania high school graduates, who enroll in a four-year college in Pennsylvania, will earn a bachelor's degree within six years. Among Pennsylvania high school graduates pursuing an associate degree, only one in three graduate in three years. Per the Pennsylvania Department of Education

Pennsylvania Department of Education

The Pennsylvania Department of Education is the executive department of the state charged with K-12 and adult educational budgeting, management and guidelines. As the state education agency, its activities are directed by Pennsylvania's Secretary of Education, Gerald L. Zahorchak...

, one in three recent high school graduates who attend Pennsylvania's public universities and community colleges takes at least one remedial course in math, reading or English.

Dual enrollment

The high school offers a Dual Enrollment program. This state program permits high school students to take courses, at local higher education institutions, to earn college credits. Students remain enrolled at their high school. The courses count towards high school graduation requirements and towards earning a college degree. The students continue to have full access to activities and programs at their high school. The college credits are offered at a deeply discounted rate. The state offers a small grant to assist students in costs for tuition, fees and books. Under the Pennsylvania Transfer and Articulation Agreement, many Pennsylvania colleges and universities accept these credits for students who transfer to their institutions.For the 2009-10 funding year, the school district received a state grant of $1,005 for the program.

Graduation requirements

The Carbondale Area school Board has determined that students must earn 23 credits to graduate including: English 4 credits, Social Studies 3 credits, Mathematics 3 credits, Science 3 credits, Physical Education 2 credits, Arts or Humanities 2 credits, Health 0.5 credits, and Electives 5.5 credits.By law, all Pennsylvania secondary school students must complete a project as a part of their eligibility to graduate from high school. The type of project, its rigor and its expectations are set by the individual school district. At Carbondale Area School District the project is a three year process which includes a research paper and oral presentation.

By Pennsylvania School Board regulations, for the graduating class of 2016, students must demonstrate successful completion of secondary level course work in Algebra I, Biology, English Composition, and Literature for which the Keystone Exams serve as the final course exams. Students’ Keystone Exam scores shall count for at least one-third of the final course grade.

Junior High school

8th Grade Reading:- 2010 - 91% on grade level. 82% advanced (3% below basic) State - 81%

- 2009 - 87%, 68% advanced (4% below basic), State - 80%

- 2008 - 94%, 79% advanced (2% below basic), State - 78%

- 2007 - 85%, 53% advanced (6% below basic), State - 75%

8th Grade Math:

- 2010 - 85% on grade level. 71% advanced (8% below basic) State - 75%

- 2009 - 80%, 66% advanced (11% below basic), State - 71%

- 2008 - 88%, 66% advanced (3% below basic), State - 70%

- 2007 - 85%, 65% advanced (4% below basic), State - 67%

8th Grade Science:

- 2010 - 44% on grade level. State - 57%.

- 2009 - 43%, State - 54%

- 2008 - 58%, State - 52%

7th Grade Reading:

- 2010 - 69% on grade level. 31% advanced, (14% below basic) State - 73%

- 2009 - 74%, 46% advanced (8% below basic), State - 71.7%

- 2008 - 75%, 43% advanced (7% below basic), State - 70%

- 2007 - 73%, 40% advanced (8% below basic), State - 66%

7th Grade Math:

- 2010 - 77% on grade level. 47% advanced (8% below basic) State - 77%

- 2009 - 81%, 53% advanced (5% below basic), State - 75%

- 2008 - 82%, 50% advanced (11% below basic), State - 72%

- 2007 - 69%, 44% advanced (12% below basic), State - 67%

Elementary School

Carbondale Elementary School reported a 94% attendance rate in 2010 and 2009. The school achieved AYP in both 2010 and 2009.6th Grade Reading:

- 2010 - 74% on grade level (7% below basic). State - 68%

- 2009 - 69% (11% below basic), State - 67%

- 2008 - 56% (18% below basic), State - 67%

- 2007 - 72% (14% below basic), State - 63%

6th Grade Math:

- 2010 - 86% on grade level (6% below basic). State - 78%

- 2009 - 82% (6% below basic), State - 75%

- 2008 - 84% (5% below basic), State - 72%

- 2007 - 72% (10% below basic), State - 69%

5th Grade Reading:

- 2010 - 63% on grade level (11% below basic). State - 64%

- 2009 - 61% (16% below basic), State - 64%

- 2008 - 51% (25% below basic), State - 62%

- 2007 - 49% (26% below basic), State - 60%

- 2006 - 56% (20% below basic), State - 60%

- 2005 - 60% (25% below basic), State - 64%

5th Grade Math:

- 2010 - 90% on grade level (3% below basic). State - 74%

- 2009 - 75% (3% below basic), State - 73%

- 2008 - 68% (6% below basic), State - 73%

- 2007 - 67% (12% below basic), State - 71%

- 2006 - 63% (15% below basic), State - 66%

- 2005 - 63% (14% below basic), State - 68%

4th Grade Reading;

- 2010 - 96% (2% below basic), State - 73%

- 2009 - 95% (1% below basic), State - 72%

- 2008 - 80% (5% below basic), State - 70%

- 2007 - 54% (17% below basic), State - 60%

4th Grade Math;

- 2010 - 90% (1% below basic), State - 84%

- 2009 - 83% (3% below basic), State - 81%

- 2008 - 88% (7% below basic), State - 80%

- 2007 - 68% (12% below basic), State - 78%

4th Grade Science;

- 2010 - 96%, (1% below basic), State - 81%

- 2009 - 90%, (1% below basic), State - 83%

- 2008 - 83%, (4% below basic), State - 81%

3rd Grade Reading;

- 2010 - 83%, (6% below basic), State - 75%

- 2009 - 81%, (10% below basic), State - 77%

- 2008 - 91%, (4% below basic), State - 70%

- 2007 - 68%, (16% below basic), State - 72%

- 2006 - 50%, (27% below basic), State - 69%

3rd Grade Math;

- 2010 - 89%, (4% below basic), State - 84%

- 2009 - 86%, (2% below basic), State - 81%

- 2008 - 89%, (1% below basic), State - 80%

- 2007 - 69%, (8% below basic), State - 78%

- 2006 - 63%, (15% below basic), State - 82%

Special Education

In December 2009, the district administration reported that 314 pupils or 19.9% of the district's pupils received Special Education services.The District engages in identification procedures to ensure that eligible students receive an appropriate educational program consisting of special education and related services, individualized to meet student needs. At no cost to the parents, these services are provided in compliance with state and federal law; and are reasonably calculated to yield meaningful educational benefit and student progress. To identify students who may be eligible for special education, various screening activities are conducted on an ongoing basis. These screening activities include: review of group-based data (cumulative records, enrollment records, health records, report cards, ability and achievement test scores); hearing, vision, motor, and speech/language screening; and review by the Instructional Support Team or Student Assistance Team. When screening results suggest that the student may be eligible, the District seeks parental consent to conduct a multidisciplinary evaluation. Parents who suspect their child is eligible may verbally request a multidisciplinary evaluation from a professional employee of the District or contact the Special Education Department.

In 2010, the state of Pennsylvania provided $1,026,815,000 for Special Education services. The funds were distributed to districts based on a state policy which estimates that 16% of the district's pupils are receiving special education services. This funding is in addition to the state's basic education per pupil funding, as well as, all other state and federal funding.

Carbondale Area School District received a $1,015,364 supplement for special education services in 2010.

Gifted Education

The District Administration reported that 33 or 2.18% of its students were gifted in 2009. By law, the district must provide mentally gifted programs at all grade levels. The referral process for a gifted evaluation can be initiated by teachers or parents by contacting the student’s building principal and requesting an evaluation. All requests must be made in writing. To be eligible for mentally gifted programs in Pennsylvania, a student must have a cognitive ability of at least 130 as measured on a standardized ability test by a certified school psychologist. Other factors that indicate giftedness will also be considered for eligibility. Through the strategic planning process, the Superintendent must ensure that Carbondale Area School District provides a continuum of program and service options to meet the needs of all mentally gifted students for enrichment, acceleration, or both. The Carbondale Area School District gifted curriculum focuses on complex and in-depth study of major ideas, key concepts and themes that integrate knowledge within and across disciplines.Bullying Policy

The Carbondale Area School Administration reported three incidents of bullying occurring in the schools in 2009.The school board prohibits bullying by district students and employees. The Board directs that complaints of bullying shall be investigated promptly, and corrective action shall be taken when allegations are verified. No reprisals or retaliation shall occur as a result of good faith reports of bullying. All Pennsylvania schools are required to have an anti-bullying policy incorporated into their Code of Student Conduct. The policy must identify disciplinary actions for bullying and designate a school staff person to receive complaints of bullying. The policy must be available on the school's website and posted in every classroom. All Pennsylvania public schools must provide a copy of its anti-bullying policy to the Office for Safe Schools every year, and shall review their policy every three years. Additionally, the district must conduct an annual review of that policy with students. District administration are required to annually provide the following information with the district's Safe School Report: the board’s bullying policy, a report of bullying incidents in the school district, and information on the development and implementation of any bullying prevention, intervention or education programs. The Center for Schools and Communities works in partnership with the Pennsylvania Commission on Crime & Delinquency and the Pennsylvania Department of Education to assist schools and communities as they research, select and implement bullying prevention programs and initiatives.

Education standards relating to student safety and antiharassment programs are described in the 10.3. Safety and Injury Prevention in the Pennsylvania Academic Standards for Health, Safety and Physical Education.

Budget

In 2007, the Carbondale Area School District employed 89 teachers working 180 days of pupil instruction. The average teacher salary in the district was $46,528. District officials reported that Famularo, the superintendent earns $169,000 plus benefits, which makes him the highest-paid school superintendent in the county. By renewing Famularo’s contract as currently written, it would end up costing the district over $1 million.As of 2007, Pennsylvania ranked in the top 10 states in average teacher salaries. When adjusted for cost of living Pennsylvania ranked fourth in the nation for teacher compensation.

In 2008, per pupil spending at Carbondale Area School District was $10,837 for each child. This ranked 403rd among Pennsylvania's 500 school districts.

Carbondale Area School District administrative costs per pupil in 2008 was $638.79 per pupil. This is ranked 400th among in the 500 school districts in the Commonwealth of Pennsylvania. The lowest administrative cost per pupil in Pennsylvania was $398 per pupil. In 2011 it was revealed that administrative costs had risen dramatically in recent years. The principal of the elementary school is the highest paid in the region at $155,000 which $12,000 more than the next highest-paid elementary principal in the county. He received a 6 percent raise and a $2,400 annuity in 2011-12. The principal's wife is a member of the Carbondale Area School Board. For the 2011-12 school year, Superintendent received a base salary and annuity of $158,000. He also receives a comprehensive benefits package, which brings his total pay to $189,000. In 2011, the school board notified the superintendent they would not renew his current contract. The Pennsylvania School Board Association tracks salaries for Pennsylvania public school employees. It reports that the average superintendent salary in Pennsylvania was $122,165, in 2008.

For the 2011-12 school year, the board made significant cuts due to a loss of state and federal funding. The final busget was $20,623,457. It eliminated out of state travel, closed the pool and eliminated 2 teaching position, as well as, various staff positions. A $25 yearly fee will be charged to students who plan on driving to school and parking their cars in the student parking lot.

In 2008, the Carbondale Area School District reported an unreserved designated fund balance of zero and a unreserved-undesignated fund balance of $3,119,237.

In January 2009, the Pennsylvania Auditor General conducted a performance audit on the district. Several findings were reported to the school board and administration. The auditors noted that Board members had failed to file Statements of Financial Interests in violation of the Pennsylvania Public Official and Ethics Act.

The district is funded by a combination of: a local tax on income, a property tax, a real estate transfer tax 0.5%, coupled with substantial funding from the Commonwealth of Pennsylvania and the federal government. Grants have provided an opportunity to supplement school funding without raising local taxes. In Pennsylvania, pension income and Social Security income are exempted from state personal income tax and local earned income tax, regardless of the level of wealth.

State basic education funding

In 2011-12, the district will receive $7,661,220 in state Basic Education Funding. Additionally, the district will receive $115,012 in Accountability Block Grant funding. The enacted Pennsylvania state Education budget includes $5,354,629,000 for the 2011-2012 Basic Education Funding appropriation. This amount is a $233,290,000 increase (4.6%) over the enacted State appropriation for 2010-2011. The highest increase in state basic education funding was awarded to uquesne City School District which got a 49% increase in state funding for 2011-12. Districts experienced a reduction in funding due to the loss of federal stimulus funding which ended in 2011.In 2010, the district reported that 950 pupils received a free or reduced lunch due to the family meeting the federal poverty level

Poverty in the United States

Poverty is defined as the state of one who lacks a usual or socially acceptable amount of money or material possessions. According to the U.S. Census Bureau data released Tuesday September 13th, 2011, the nation's poverty rate rose to 15.1% in 2010, up from 14.3% in 2009 and to its highest level...

.

For the 2010-11 budget year the Carbondale Area School District received a 6.24% increase in state basic education funding for a total of $8,467,455. The highest increase in state funding, among Lackawanna County school districts, was awarded to unmore School District at 11.88% increase. One hundred fifty school districts in Pennsylvania received the 2% base increase for budget year 2010-11. The highest increase in the state was given to Kennett Consolidated School District

Kennett Consolidated School District

The Kennett Consolidated School District,or KCSD for short, is a public school district serving portions of Chester County, Pennsylvania. It is centered on the borough of Kennett Square and also incorporates Kennett Township, New Garden Township, and the southern portion of East Marlborough Twp....

of Chester County

Chester County, Pennsylvania

-State parks:*French Creek State Park*Marsh Creek State Park*White Clay Creek Preserve-Demographics:As of the 2010 census, the county was 85.5% White, 6.1% Black or African American, 0.2% Native American or Alaskan Native, 3.9% Asian, 0.0% Native Hawaiian, 1.8% were two or more races, and 2.4% were...

which was awarded a 23.65% increase in state basic education funding.

In the 2009-2010 budget year, the Commonwealth of Pennsylvania provided a 5.13% increase in Basic Education funding for a total of $7,966,172. The highest increase in state funding, to Lackawanna County school districts, was 9.46% increase which was awarded to Scranton School District. In Pennsylvania, 15 school districts received Basic Education Funding increases in excess of 10% in 2009. Muhlenberg School District

Muhlenberg School District

The Muhlenberg Area School District is a public school district serving parts of Berks County, Pennsylvania, USA. It encompasses the borough of Laureldale and the Muhlenberg Township. The district encompasses approximately 13 square miles. Per the 2000 federal census data it serves a resident...

in Berks County received the highest with a 22.31% increase in funding. The state's Basic Education Funding to the Carbondale Area School District in 2008-09 was $6,999,344.06. The amount of increase each school district receives is determined by the Governor and the Secretary of Education through the allocation set in the state budget proposal made in February each year.

In 2008, the district reported that 717 pupils received a free or reduced lunch due to their family meeting the federal poverty threshold of $22,050 for a family of four. Many state and federal programs use the threshold to calculate benefits.

Accountability Block Grant

The state provides additional education funding to schools in the form of Accountability Block Grants. The use of these funds is strictly focused on specific state approved uses designed to improve student academic achievement. Carbondale Area School District uses its $312,172 to fund all day kindergartenKindergarten

A kindergarten is a preschool educational institution for children. The term was created by Friedrich Fröbel for the play and activity institute that he created in 1837 in Bad Blankenburg as a social experience for children for their transition from home to school...

for the sixth year. These annual funds are in addition to the state's basic education funding and all federal funding. School Districts apply each year for Accountability Block Grants. In 2009-10, the state provided $271.4 million dollars in Accountability Block grants $199.5 million went to providing all day kindergartens.

Classrooms for the Future grant

The Classroom for the Future state program provided districts with hundreds of thousands of extra state funding to buy laptop computers for each core curriculum high school class (English, Science, History, Mathematics) and paid for mandatory teacher training to optimize the computers' use in the classroom for improving instruction. The program was funded from 2006-2009. Carbondale Area School District administration did not apply for the grant in 2006-07. In 2007-08, the district received $162,577 in funding. For the 2008-09, school year the district received a final $45,413 for a total funding of $207,990. Of the 501 public school districts in Pennsylvania, 447 of them received Classrooms for the Future grant awards.Education Assistance Grant

The state's EAP funding provides for the continuing support of tutoring services and other programs to address the academic needs of eligible students. Funds are available to eligible school districts and full-time career and technology centers (CTC) in which one or more schools have failed to meet at least one academic performance target, as provided for in Section 1512-C of the Pennsylvania Public School Code. In 2010-11 the Carbondale Area School District received $36,519.Federal stimulus grant

The Carbondale Area School District received $2.1 million in ARRAArra

Arra is a census town in Puruliya district in the state of West Bengal, India.-Demographics: India census, Arra had a population of 19,911. Males constitute 52% of the population and females 48%. Arra has an average literacy rate of 66%, higher than the national average of 59.5%; with 59% of the...

- Federal stimulus money to be used in specific programs like special education and meeting the academic needs of low income students.

Race to the Top grant

School district officials did not apply for the Race to the TopRace to the Top

Race to the Top, abbreviated R2T, RTTT or RTT, is a $4.35 billion United States Department of Education competition designed to spur innovation and reforms in state and local district K-12 education...

federal grant which would have brought the district up to million additional federal dollars for improving student academic achievement. Several Lackawanna County school districts applied for funding. Participation required the administration, the school board and the local teachers' union to sign an agreement to prioritize improving student academic success. In Pennsylvania, 120 public school districts and 56 charter schools agreed to participate. Pennsylvania was not approved for the grant. According to then Governor Rendell, failure of districts to agree to participate was cited as one reason that Pennsylvania was not approved.

Common Cents state initiative

The Carbondale Area School District School Board chose to not participate in the Pennsylvania Department of Education Common Cents program. The program called for the state to audit the district, at no cost to local taxpayers, to identify ways the district could save tax dollars. After the review of the information, the district was not required to implement the recommended cost savings changes.Real Estate Taxes

In 2011, the Carbondale Area School Board set the property taxes rate at 107.60 mills for the 2011-12 school year. A mill is $1 of tax for every $1,000 of a property's assessed value. Property taxes, in the Commonwealth of Pennsylvania, apply only to real estate - land and buildings. The property taxProperty tax

A property tax is an ad valorem levy on the value of property that the owner is required to pay. The tax is levied by the governing authority of the jurisdiction in which the property is located; it may be paid to a national government, a federated state or a municipality...

is not levied on cars, business inventory, or other personal property. Certain types of property are exempt from property taxes including: places of worship, places of burial, private social clubs, charitable and educational institutions and government property. Irregular property reassessments have become a serious issue in the commonwealth as it creates a significant disparity in taxation within a community and across a region. Additionally, service related, disabled US military veterans may seek an exemption from paying property taxes. Pennsylvania school district revenues are dominated by two main sources: 1) Property tax collections, which account for the vast majority (between 75-85%) of local revenues; and 2) Act 511 tax collections, which are around 15% of revenues for school districts. Irregular property reassessments have become a serious issue in the Commonwealth as it creates a significant disparity in taxation within a community and across a region.

- 2010-11 - 107.60 mills.

- 2009-10 - 107.60 mills.

- 2008-09 - 107.60 mills.

- 2007-08 - 107.60 mills.

Act 1 Adjusted index

The Act 1 of 2006 Index regulates the rates at which each school district can raise property taxes in Pennsylvania. Districts are not permitted to raise taxes above that index, unless they allow voters to vote by referendum, or they seek an exception from the Pennsylvania Department of Education. The base index for the 2011-2012 school year is 1.4 percent, but the Act 1 Index can be adjusted higher, depending on a number of factors, such as property values and the personal income of district residents. Act 1 included 10 exceptions including: increasing pension costs, increases in special education costs, a catastrophe like a fire or flood, increase in health insurance costs for contracts in effect in 2006 or dwindling tax bases. The base index is the average of the percentage increase in the statewide average weekly wage, as determined by the PA Department of Labor and Industry, for the preceding calendar year and the percentage increase in the Employment Cost Index for Elementary and Secondary Schools, as determined by the Bureau of Labor StatisticsBureau of Labor Statistics

The Bureau of Labor Statistics is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics. The BLS is a governmental statistical agency that collects, processes, analyzes, and...

in the U.S. Department of Labor, for the previous 12-month period ending June 30. For a school district with a market value/personal income aid ratio (MV/PI AR) greater than 0.4000, its index equals the base index multiplied by the sum of .75 and its MV/PI AR for the current year. With the 2011 state education budget, the General Assembly voted to end most of the Act 1 exceptions leaving only special education costs and pension costs. The cost of construction projects will go to the voters for approval via ballot referendum.

The School District Adjusted Index for the Carbondale Area School District 2006-2007 through 2011-2012.

- 2006-07 - 5.6%, Base 3.9%

- 2007-08 - 4.9%, Base 3.4%

- 2008-09 - 6.4%, Base 4.4%

- 2009-10 - 6.0%, Base 4.1%

- 2010-11 - 4.3%, Base 2.9%

- 2011-12 - 2.1%, Base 1.4%

For the 2011-12 school year, the Carbondale Area School Board did not apply for exceptions to exceed the Act 1 Index. Each year the Carbondale Area School Board has the option of adopting either 1) a resolution in January certifying they will not increase taxes above their index or 2) a preliminary budget in February. A school district adopting the resolution may not apply for referendum exceptions or ask voters for a tax increase above the inflation index. A specific timeline for these decisions is publisher each year by the Pennsylvania Department of Education

Pennsylvania Department of Education

The Pennsylvania Department of Education is the executive department of the state charged with K-12 and adult educational budgeting, management and guidelines. As the state education agency, its activities are directed by Pennsylvania's Secretary of Education, Gerald L. Zahorchak...

.

According to a state report, for the 2011-2012 school year budgets, 247 school districts adopted a resolution certifying that tax rates would not be increased above their index; 250 school districts adopted a preliminary budget. Of the 250 school districts that adopted a preliminary budget, 231 adopted real estate tax rates that exceeded their index. Tax rate increases in the other 19 school districts that adopted a preliminary budget did not exceed the school district’s index. Of the districts who sought exceptions 221 used the pension costs exemption and 171 sought a Special Education costs exemption. Only 1 school district sought an exemption for Nonacademic School Construction Project, while 1 sought an exception for Electoral debt for school construction.

Carbondale Area School Board did not apply for exceptions to exceed the Act 1 index for the budgets in 2009-10 nor in 2010-11. In the Spring of 2010, 135 Pennsylvania school boards asked to exceed their adjusted index. Approval was granted to 133 of them and 128 sought an exception for pension costs increases.

Property tax relief

In 2011, property tax relief for 2,631 approved residents of Carbondale Area School District was set at $237. In 2009, the Homestead/Farmstead Property Tax Relief from gambling for the Carbondale Area School District was $247 per approved permanent primary residence. In the district, 2,532 property owners applied for the tax relief. The relief was subtracted from the total annual school property tax bill. Property owners apply for the relief through the county Treasurer's office. Farmers can qualify for a farmstead exemption on building used for agricultural purposes. The farm must be at least 10 contiguous acres and must be the primary residence of the owner. Farmers can qualify for both the homestead exemption and the farmstead exemption.Additionally, the Pennsylvania Property Tax/Rent Rebate program is provided for low income Pennsylvanians aged 65 and older; widows and widowers aged 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 for homeowners. The maximum rebate for both homeowners and renters is $650. Applicants can exclude one-half (1/2) of their Social Security

Social Security (United States)

In the United States, Social Security refers to the federal Old-Age, Survivors, and Disability Insurance program.The original Social Security Act and the current version of the Act, as amended encompass several social welfare and social insurance programs...

income, consequently individuals who have income substantially more than $35,000, may still qualify for a rebate. Individuals must apply annually for the rebate. This can be taken in addition to Homestead/Farmstead Property Tax Relief.

Property taxes in Pennsylvania are relatively high on a national scale. According to the Tax Foundation

Tax Foundation

The Tax Foundation is a Washington, D.C.-based think tank founded in 1937 that collects data and publishes research studies on tax policies at the federal and state levels. The organization is broken into three primary areas of research which are the Center for Federal Fiscal Policy, The and the...

, Pennsylvania ranked 11th in the U.S. in 2008 in terms of property taxes paid as a percentage of home value (1.34%) and 12th in the country in terms of property taxes as a percentage of income (3.55%).

Enrollment and Consolidation

According to the Pennsylvania Department of EducationPennsylvania Department of Education

The Pennsylvania Department of Education is the executive department of the state charged with K-12 and adult educational budgeting, management and guidelines. As the state education agency, its activities are directed by Pennsylvania's Secretary of Education, Gerald L. Zahorchak...

, there are fewer than 1469 students enrolled in Carbondale Area SD, K-12, in 2010. There were 111 students in the Class of 2010. The district's class of 2009 had 116 students. Enrollment in the Carbondale Area School District is projected, by the Pennsylvania Department of Education, to continue to increase to 1818 pupils K-12 total enrollment, by 2020.

A Standard and Poors study found that an optimal school district size, to conserve administrative costs, was at least 3000 pupils. Consolidation of the administration with an adjacent school district would achieve substantial administrative cost savings for people in both communities. According to a proposal made in 2009, by Governor Edward G. Rendell, the excessive administrative overhead dollars could be redirected to improve lagging academic achievement, to enrich the academic programs or to substantially reduce property taxes. Consolidation of two districts' central administrations into one would not require the closing of any local schools.

In March 2011, the Pennsylvania Institute of Certified Public Accountants Fiscal Responsibility Task Force released a report which found that consolidating school district administrations with one neighboring district, would save the Commonwealth $1.2 billion dollars without forcing the consolidation of any school buildings. The study noted that while the best school districts spent 4% of the annual budget on administration, others spend over 15% on administration.

More than 40 percent of elementary schools and more than 60 percent of secondary schools in western Pennsylvania have been experiencing significant enrollment decreases (15 percent or greater).

Pennsylvania has one of the highest numbers of school districts in the nation. In Pennsylvania, 80% of the school districts serve student populations under 5,000, and 40% serve less than 2,000. This results in excessive school administration bureaucracy and not enough course diversity. In a survey of 88 superintendents of small districts, 42% of the 49 respondents stated that they thought consolidation would save money without closing any schools.

Fell Charter Elementary School

The charter school provides a free, public education to children in the area since 2002. The school has an enrollment of 157 for the 2011-12 school year. The school offers full-day kindergarten through 8th grade. It employees 24 teachers including: art, music and physical education. Fell Charter Elementary School has a longer school day, class begins at 7:45 am and ends at 3:15 pm. It has moved into a former elementary school in August 2011. Six area school district provide bussing to the school including Carbondale Area School District. The school made AYP in 2009 and 2010. The attendance rate in 2010 was 94%. The U.S. Department of Agriculture approved the charter school's grant and loan application in January 2010. The school will receive a $5 million loan to build a new school facility.Extracurriculars

The district offers a variety of clubs, activities and sports. Eligibility to participate is determined by school board policies.By Pennsylvania law, all K-12 students in the district, including those who attend a private nonpublic school, cyber charter school, charter school and those homeschooled, are eligible to participate in the extracurricular programs including all athletics. They must meet the same eligibility rules as the students enrolled in the district's schools.