Credit derivative

Encyclopedia

In finance

, a credit derivative is a securitized

derivative

whose value is derived from the credit risk

on an underlying bond, loan or any other financial asset. In this way, the credit risk is on an entity other than the counterparties to the transaction itself. This entity is known as the reference entity and may be a corporate, a sovereign or any other form of legal entity which has incurred debt. Credit derivatives are bilateral contracts between a buyer and seller under which the seller sells protection against the credit risk of the reference entity.

The parties will select which credit events apply to a transaction and these usually consist of one or more of the following:

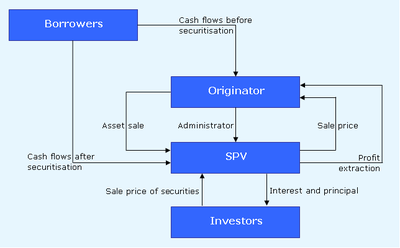

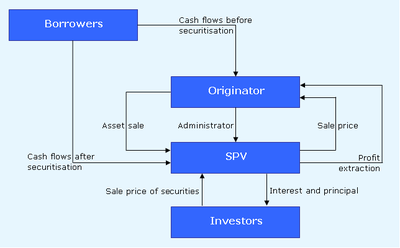

Where credit protection is bought and sold between bilateral counterparties, this is known as an unfunded credit derivative. If the credit derivative is entered into by a financial institution or a special purpose vehicle (SPV) and payments under the credit derivative are funded using securitization

techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations, this is known as a funded credit derivative.

This synthetic securitization process has become increasingly popular over the last decade, with the simple versions of these structures being known as synthetic CDO

s; credit linked notes; single tranche CDOs, to name a few. In funded credit derivatives, transactions are often rated by rating agencies, which allows investors to take different slices of credit risk according to their risk appetite.

s and funded products such as collateralized debt obligations (see further discussion below).

The ISDA reported in April 2007 that total notional amount on outstanding credit derivatives was $35.1 trillion with a gross market value

of $948 billion (ISDA's Website). As reported in The Times

on September 15, 2008, the "Worldwide credit derivatives market is valued at $62 trillion".

Although the credit derivatives market

is a global one, London has a market share of about 40%, with the rest of Europe having about 10%.

The main market participants are banks, hedge funds, insurance companies, pension funds, and other corporates.

In 2011, The Depository Trust & Clearing Corporation estimated that the size of the global credit derivatives market in 2010 was $1.66 quadrillion USD

Unfunded credit derivative products include the following products:

Funded credit derivative products include the following products:

A credit default swap, in its simplest form (the unfunded single name credit default swap) is a bilateral contract between a protection buyer and a protection seller. The credit default swap will reference the creditworthiness of a third party called a reference entity: this will usually be a corporate or sovereign. The credit default swap will relate to the specified debt obligations of the reference entity: perhaps its bonds and loans, which fulfill certain pre-agreed characteristics. The protection buyer will pay a periodic fee to the protection seller in return for a contingent payment by the seller upon a credit event affecting the obligations of the reference entity specified in the transaction.

The relevant credit events specified in a transaction will usually be selected from amongst the following:

If any of these events occur and the protection buyer serves a credit event notice on the protection seller detailing the credit event as well as (usually) providing some publicly available information validating this claim, then the transaction will settle.

This means that, in the case of a physically settled transaction, the protection buyer can deliver an amount of the reference entity's defaulted obligations to the protection seller, in return for their full face value (notwithstanding that they are now worth far less). In the case of a cash settled transaction, a relevant obligation of the reference entity will be valued and the protection seller will pay the protection buyer the full face value of the reference obligation less its current value (i.e. compensating the protection buyer for the decline in the obligation's creditworthiness).

Credit default swaps have unique characteristics that distinguish them from insurance products and financial guaranties. The protection buyer does not need to own an underlying obligation of the reference entity. The protection buyer does not need to suffer a loss.

Since the reference entity is not a party to agreement between the protection buyer and seller, the seller of protection has no inherent recourse to the reference entity in the event of default and no right to sue the reference entity for recovery. However, if the transaction were to be physically settled the seller of protection could derive a right to take action against the reference entity on the basis of the loan or securities acquired during the settlement process.

The product has many variations, including where there is a basket or portfolio of reference entities, although fundamentally, the principles remain the same. A powerful recent variation has been gathering market share of late: credit default swaps which relate to asset-backed securities.

. The payments are based upon the same notional amount

. The reference asset may be any asset, index or basket of assets.

The TRS is simply a mechanism that allows one party to derive the economic benefit of owning an asset without use of the balance sheet

, and which allows the other to effectively "buy protection" against loss in value due to ownership of a credit asset.

The essential difference between a total return swap and a credit default swap is that the credit default swap provides protection against specific credit event

s. The total return swap protects against the loss of value irrespective of cause, whether default, widening of credit spreads

or anything else i.e. it isolates both credit risk and market risk.

A credit linked note is a note whose cash flow depends upon an event, which may be a default, change in credit spread, or rating change. The definition of the relevant credit events must be negotiated by the parties to the note.

A credit linked note is a note whose cash flow depends upon an event, which may be a default, change in credit spread, or rating change. The definition of the relevant credit events must be negotiated by the parties to the note.

A CLN in effect combines a credit-default swap with a regular note (with coupon, maturity, redemption). Given its note like features, a CLN is an on-balance-sheet asset, in contrast to a CDS.

Typically, an investment fund manager will purchase such a note to hedge against possible down grades, or loan defaults.

Numerous different types of credit linked notes (CLNs) have been structured and placed in the past few years. Here we are going to provide an overview rather than a detailed account of these instruments.

The most basic CLN consists of a bond, issued by a well-rated borrower, packaged with a credit default swap on a less creditworthy risk.

For example, a bank may sell some of its exposure to a particular emerging country by issuing a bond linked to that country's default or convertibility risk. From the bank's point of view, this achieves the purpose of reducing its exposure to that risk, as it will not need to reimburse all or part of the note if a credit event occurs. However, from the point of view of investors, the risk profile is different from that of the bonds issued by the country. If the bank runs into difficulty, their investments will suffer even if the country is still performing well.

The credit rating is improved by using a proportion of government bonds, which means the CLN investor receives an enhanced coupon.

Through the use of a credit default swap, the bank receives some recompense if the reference credit defaults.

There are several different types of securitized product, which have a credit dimension. CLN is a generic name related to any bond whose value is linked to the performance of a reference asset, or assets. This link may be through the use of a credit derivative, but does not have to be.

CDO refers either to the pool of assets used to support the CLNs or, confusingly, to the CLNs themselves.

Other more complicated CDOs have been developed where each underlying credit risk is itself a CDO tranche

. These CDOs are commonly known as CDOs-squared.

these and other derivatives is that the people who know most about them also typically have a vested incentive

in encouraging their growth and lack of regulation. incentive may be indirect, e.g., academics have not only consulting incentives, but also incentives in keeping open doors for research.)

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, a credit derivative is a securitized

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

derivative

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

whose value is derived from the credit risk

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

on an underlying bond, loan or any other financial asset. In this way, the credit risk is on an entity other than the counterparties to the transaction itself. This entity is known as the reference entity and may be a corporate, a sovereign or any other form of legal entity which has incurred debt. Credit derivatives are bilateral contracts between a buyer and seller under which the seller sells protection against the credit risk of the reference entity.

The parties will select which credit events apply to a transaction and these usually consist of one or more of the following:

- bankruptcyBankruptcyBankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

(the risk that the reference entity will become bankrupt) - failure to pay (the risk that the reference entity will default on one of its obligations such as a bond or loan)

- obligation defaultDefault (finance)In finance, default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant of the debt contract. A default is the failure to pay back a loan. Default may occur if the debtor is either...

(the risk that the reference entity will default on any of its obligations) - obligation acceleration (the risk that an obligation of the reference entity will be accelerated e.g. a bond will be declared immediately due and payable following a default)

- repudiation/moratoriumDebt moratoriumA debt moratorium is a delay in the payment of debts or obligations. The term is generally used to refer to acts by national governments. A moratory law is usually passed in some special period of political or commercial stress; for instance, on several occasions during the Franco-Prussian War,...

(the risk that the reference entity or a government will declare a moratorium over the reference entity's obligations) - restructuringRestructuringRestructuring is the corporate management term for the act of reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs...

(the risk that obligations of the reference entity will be restructured)...

Where credit protection is bought and sold between bilateral counterparties, this is known as an unfunded credit derivative. If the credit derivative is entered into by a financial institution or a special purpose vehicle (SPV) and payments under the credit derivative are funded using securitization

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations, this is known as a funded credit derivative.

This synthetic securitization process has become increasingly popular over the last decade, with the simple versions of these structures being known as synthetic CDO

Collateralized debt obligation

Collateralized debt obligations are a type of structured asset-backed security with multiple "tranches" that are issued by special purpose entities and collateralized by debt obligations including bonds and loans. Each tranche offers a varying degree of risk and return so as to meet investor demand...

s; credit linked notes; single tranche CDOs, to name a few. In funded credit derivatives, transactions are often rated by rating agencies, which allows investors to take different slices of credit risk according to their risk appetite.

Market size and participants

Credit default products are the most commonly traded credit derivative product and include unfunded products such as credit default swapCredit default swap

A credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default...

s and funded products such as collateralized debt obligations (see further discussion below).

The ISDA reported in April 2007 that total notional amount on outstanding credit derivatives was $35.1 trillion with a gross market value

Market value

Market value is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with open market value, fair value or fair market value, although these terms have distinct definitions in different standards, and may differ in some...

of $948 billion (ISDA's Website). As reported in The Times

The Times

The Times is a British daily national newspaper, first published in London in 1785 under the title The Daily Universal Register . The Times and its sister paper The Sunday Times are published by Times Newspapers Limited, a subsidiary since 1981 of News International...

on September 15, 2008, the "Worldwide credit derivatives market is valued at $62 trillion".

Although the credit derivatives market

Derivatives market

The derivatives market is the financial market for derivatives, financial instruments like futures contracts or options, which are derived from other forms of assets....

is a global one, London has a market share of about 40%, with the rest of Europe having about 10%.

The main market participants are banks, hedge funds, insurance companies, pension funds, and other corporates.

In 2011, The Depository Trust & Clearing Corporation estimated that the size of the global credit derivatives market in 2010 was $1.66 quadrillion USD

Types

Credit derivatives are fundamentally divided into two categories: funded credit derivatives and unfunded credit derivatives. An unfunded credit derivative is a bilateral contract between two counterparties, where each party is responsible for making its payments under the contract (i.e. payments of premiums and any cash or physical settlement amount) itself without recourse to other assets. A funded credit derivative involves the protection seller (the party that assumes the credit risk) making an initial payment that is used to settle any potential credit events. However, the protection buyer is exposed to the credit risk of the protection seller, in which case the protection seller fails to pay the protection buyer under the event of the protection seller's default. It is also known as counterparty risk.Unfunded credit derivative products include the following products:

- Credit default swapCredit default swapA credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default...

(CDS) - Total return swapTotal return swapTotal return swap, or TRS , or total rate of return swap, or TRORS, is a financial contract that transfers both the credit risk and market risk of an underlying asset.- Contract definition :...

- Constant maturity credit default swapConstant Maturity Credit Default SwapA constant maturity credit default swap is a type of credit derivative product, similar to a standard Credit Default Swap . Addressing CMCDS typically requires prior understanding of credit default swaps....

(CMCDS) - First to Default Credit Default Swap

- Portfolio Credit Default Swap

- Secured Loan Credit Default Swap

- Credit Default Swap on Asset Backed Securities

- Credit default swaptionSwaptionA swaption is an option granting its owner the right but not the obligation to enter into an underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps....

- Recovery lock transaction

- Credit Spread Option

- CDS index products

Funded credit derivative products include the following products:

- Credit linked note (CLN)

- Synthetic Collateralised Debt Obligation (CDO)

- Constant Proportion Debt Obligation (CPDO)

- Synthetic Constant Proportion Portfolio Insurance (Synthetic CPPI)

Credit default swap

The credit default swap or CDS has become the cornerstone product of the credit derivatives market. This product represents over thirty percent of the credit derivatives market.A credit default swap, in its simplest form (the unfunded single name credit default swap) is a bilateral contract between a protection buyer and a protection seller. The credit default swap will reference the creditworthiness of a third party called a reference entity: this will usually be a corporate or sovereign. The credit default swap will relate to the specified debt obligations of the reference entity: perhaps its bonds and loans, which fulfill certain pre-agreed characteristics. The protection buyer will pay a periodic fee to the protection seller in return for a contingent payment by the seller upon a credit event affecting the obligations of the reference entity specified in the transaction.

The relevant credit events specified in a transaction will usually be selected from amongst the following:

- The bankruptcy of the reference entity;

- Its failure to pay in relation to a covered obligation;

- It defaulting on an obligation or that obligation being accelerated;

- It agreeing to restructure a covered obligation or a repudiation or moratorium being declared over any covered obligation.

If any of these events occur and the protection buyer serves a credit event notice on the protection seller detailing the credit event as well as (usually) providing some publicly available information validating this claim, then the transaction will settle.

This means that, in the case of a physically settled transaction, the protection buyer can deliver an amount of the reference entity's defaulted obligations to the protection seller, in return for their full face value (notwithstanding that they are now worth far less). In the case of a cash settled transaction, a relevant obligation of the reference entity will be valued and the protection seller will pay the protection buyer the full face value of the reference obligation less its current value (i.e. compensating the protection buyer for the decline in the obligation's creditworthiness).

Credit default swaps have unique characteristics that distinguish them from insurance products and financial guaranties. The protection buyer does not need to own an underlying obligation of the reference entity. The protection buyer does not need to suffer a loss.

Since the reference entity is not a party to agreement between the protection buyer and seller, the seller of protection has no inherent recourse to the reference entity in the event of default and no right to sue the reference entity for recovery. However, if the transaction were to be physically settled the seller of protection could derive a right to take action against the reference entity on the basis of the loan or securities acquired during the settlement process.

The product has many variations, including where there is a basket or portfolio of reference entities, although fundamentally, the principles remain the same. A powerful recent variation has been gathering market share of late: credit default swaps which relate to asset-backed securities.

Total return swap

A total return swap (also known as Total Rate of Return Swap) is a contract between two counterparties whereby they swap periodic payments for the period of the contract. Typically, one party receives the total return (interest payments plus any capital gains or losses for the payment period) from a specified reference asset, while the other receives a specified fixed or floating cash flow that is not related to the creditworthiness of the reference asset, as with a vanilla Interest rate swapInterest rate swap

An interest rate swap is a popular and highly liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate or from one floating rate to another...

. The payments are based upon the same notional amount

Notional amount

The notional amount on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument...

. The reference asset may be any asset, index or basket of assets.

The TRS is simply a mechanism that allows one party to derive the economic benefit of owning an asset without use of the balance sheet

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A...

, and which allows the other to effectively "buy protection" against loss in value due to ownership of a credit asset.

The essential difference between a total return swap and a credit default swap is that the credit default swap provides protection against specific credit event

Credit event

A credit event is the financial term used to describe either:* A general default event related to a legal entity's previously agreed financial obligation. In this case, a legal entity fails to meet its obligation on any significant financial transaction...

s. The total return swap protects against the loss of value irrespective of cause, whether default, widening of credit spreads

Credit spread (bond)

The financial term, credit spread is the yield spread, or difference in yield between different securities, due to different credit quality. The credit spread reflects the additional net yield an investor can earn from a security with more credit risk relative to one with less credit risk...

or anything else i.e. it isolates both credit risk and market risk.

Credit linked notes

A CLN in effect combines a credit-default swap with a regular note (with coupon, maturity, redemption). Given its note like features, a CLN is an on-balance-sheet asset, in contrast to a CDS.

Typically, an investment fund manager will purchase such a note to hedge against possible down grades, or loan defaults.

Numerous different types of credit linked notes (CLNs) have been structured and placed in the past few years. Here we are going to provide an overview rather than a detailed account of these instruments.

The most basic CLN consists of a bond, issued by a well-rated borrower, packaged with a credit default swap on a less creditworthy risk.

For example, a bank may sell some of its exposure to a particular emerging country by issuing a bond linked to that country's default or convertibility risk. From the bank's point of view, this achieves the purpose of reducing its exposure to that risk, as it will not need to reimburse all or part of the note if a credit event occurs. However, from the point of view of investors, the risk profile is different from that of the bonds issued by the country. If the bank runs into difficulty, their investments will suffer even if the country is still performing well.

The credit rating is improved by using a proportion of government bonds, which means the CLN investor receives an enhanced coupon.

Through the use of a credit default swap, the bank receives some recompense if the reference credit defaults.

There are several different types of securitized product, which have a credit dimension. CLN is a generic name related to any bond whose value is linked to the performance of a reference asset, or assets. This link may be through the use of a credit derivative, but does not have to be.

- Credit-linked noteCredit-linked noteA credit linked note is a form of funded credit derivative. It is structured as a security with an embedded credit default swap allowing the issuer to transfer a specific credit risk to credit investors. The issuer is not obligated to repay the debt if a specified event occurs...

s CLN: Credit-linked note is a generic name related to any bond whose value is linked to the performance of a reference asset, or assets. This link may be through the use of a credit derivative, but does not have to be. - Collateralized debt obligationCollateralized debt obligationCollateralized debt obligations are a type of structured asset-backed security with multiple "tranches" that are issued by special purpose entities and collateralized by debt obligations including bonds and loans. Each tranche offers a varying degree of risk and return so as to meet investor demand...

CDO: Generic term for a bond issued against a mixed pool of assets - There also exists CDO-squared (CDO^2) where the underlying assets are CDO tranches. - Collateralized bond obligations CBO: Bond issued against a pool of bond assets or other securities. It is referred to in a generic sense as a CDO

- Collateralized loan obligationCollateralized loan obligationCollateralized loan obligations are a form of securitization where payments from multiple middle sized and large business loans are pooled together and passed on to different classes of owners in various tranches...

s CLO: Bond issued against a pool of bank loan. It is referred to in a generic sense as a CDO

CDO refers either to the pool of assets used to support the CLNs or, confusingly, to the CLNs themselves.

Collateralized debt obligations (CDO)

Contrary to popular belief, not all collateralized debt obligations (CDOs) are credit derivatives. For example a CDO made up of leveraged loans is merely a securitizing of loans that is then tranched based on its credit rating. This particular securitization is known as a collateralized loan obligation (CLO) and the investor receives the cash flow that accompanies the paying of the debtor to the creditor. Essentially, a CDO is held up by a pool of assets that generate cash. A CDO only becomes a derivative when it is used in conjunction with credit default swaps (CDS), in which case it becomes a Synthetic CDO. The main difference between CDO's and derivatives is that a derivative is essentially a bilateral agreement in which the payout occurs during a specific event which is tied to the underlying asset.Other more complicated CDOs have been developed where each underlying credit risk is itself a CDO tranche

Tranche

In structured finance, a tranche is one of a number of related securities offered as part of the same transaction. The word tranche is French for slice, section, series, or portion, and is cognate to English trench . In the financial sense of the word, each bond is a different slice of the deal's...

. These CDOs are commonly known as CDOs-squared.

Pricing

Pricing of credit derivative is not an easy process. This is because:- The complexity in monitoring the market price of the underlying credit obligation.

- Understanding the creditworthiness of a debtor is often a cumbersome task as it is not easily quantifiable.

- The incidence of default is not a frequent phenomenon and makes it difficult for the investors to find the empirical data of a solvent company with respect to default.

- Even though one can take help of different ratings published by ranking agencies but often these ratings will be different.

Risks

Risks involving credit derivatives are a concern among regulators of financial markets. The US Federal Reserve issued several statements in the Fall of 2005 about these risks, and highlighted the growing backlog of confirmations for credit derivatives trades. These backlogs pose risks to the market (both in theory and in all likelihood), and they exacerbate other risks in the financial system. One challenge in regulatingRegulation

Regulation is administrative legislation that constitutes or constrains rights and allocates responsibilities. It can be distinguished from primary legislation on the one hand and judge-made law on the other...

these and other derivatives is that the people who know most about them also typically have a vested incentive

Incentive

In economics and sociology, an incentive is any factor that enables or motivates a particular course of action, or counts as a reason for preferring one choice to the alternatives. It is an expectation that encourages people to behave in a certain way...

in encouraging their growth and lack of regulation. incentive may be indirect, e.g., academics have not only consulting incentives, but also incentives in keeping open doors for research.)

External links

- A Credit Derivatives Risk Primer - Simplified explanation for lay persons.

- The Lehman Brothers Guide to Exotic Credit Derivatives

- The J.P. Morgan Guide to Credit Derivatives

- History of Credit Derivatives, Financial-edu.com

- A Beginner's Guide to Credit Derivatives - Noel Vaillant, Nomura International

- Documenting credit default swaps on asset backed securities, Edmund Parker and Jamila Piracci, Mayer Brown, Euromoney Handbooks.