Endaka

Encyclopedia

Japanese yen

The is the official currency of Japan. It is the third most traded currency in the foreign exchange market after the United States dollar and the euro. It is also widely used as a reserve currency after the U.S. dollar, the euro and the pound sterling...

is high compared to other currencies. Since the Economy of Japan

Economy of Japan

The economy of Japan, a free market economy, is the third largest in the world after the United States and the People's Republic of China, and ahead of Germany at 4th...

is highly dependent on exports, this can cause Japan to fall into an economic recession

Recession

In economics, a recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way...

.

The opposite of endaka is en'yasu , where the yen is low relative to other currencies.

History

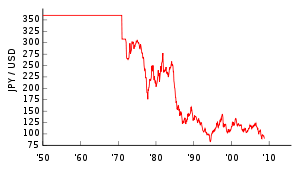

The origins of endaka began in 1971 with the Smithsonian AgreementSmithsonian Agreement

The Smithsonian Agreement was a December 1971 agreement that ended the fixed exchange rates established at the Bretton Woods Conference of 1944.-History:...

. The term was coined with the first usage in 1985 during the Plaza Accord

Plaza Accord

The Plaza Accord or Plaza Agreement was an agreement between the governments of France, West Germany, Japan, the United States, and the United Kingdom, to depreciate the U.S. dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets...

, in which the yen was revalued sharply overnight. However, its use in the context of recession was first used in 1992, when Japan's economy slowed down, and again in 1995, when the yen hit its then an all time peak of 79 to the dollar.

Japan has struggled to keep its yen low to aid exporters, resulting in a huge rise in foreign exchange reserves

Foreign exchange reserves

Foreign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

. China, Singapore and Hong Kong typically have a target exchange rate, and they buy foreign currencies to maintain that target rate. Since 2004, Japan has fostered the massive carry trade (via yen-denominated bank loans to overseas investors) to weaken its currency over state intervention.

Endaka occurred in 2008. The yen moved from the floating near 120 to floating near 90. This is thought to be the first time endaka contributed to a worldwide recession, instead of just a Japanese recession. While the proximate cause of the recession is widely thought to be an increase in credit defaults (largely outside Japan) causing a loss in confidence in the credit markets (a credit crisis), the yen was funding these investments through the carry trade over a period of years, where loans were made at low interest rates in yen to finance the purchase of non-yen debts which had higher interest rates. As the value of the yen increased, the trillions of dollars worth of carry trade buildup over years swiftly reversed in a matter of days, and there was pressure to sell these assets to cover the more expensive yen loans, thus decreasing the available credit and accelerating the crisis. By 2010, the yen had touched 81.1129 per USD.

Japan saw renewed endaka after the massive 2011 Tohoku earthquake and tsunami

2011 Tōhoku earthquake and tsunami

The 2011 earthquake off the Pacific coast of Tohoku, also known as the 2011 Tohoku earthquake, or the Great East Japan Earthquake, was a magnitude 9.0 undersea megathrust earthquake off the coast of Japan that occurred at 14:46 JST on Friday, 11 March 2011, with the epicenter approximately east...

, briefly hitting 76 to the dollar. Again, after the 2011 U.S. debt ceiling crisis of 2011, the yen slowly but surely climbed its way back to after tsunami highs.

Timeline

- 1971: Smithsonian AgreementSmithsonian AgreementThe Smithsonian Agreement was a December 1971 agreement that ended the fixed exchange rates established at the Bretton Woods Conference of 1944.-History:...

, yen revalued from 360 to 308 per dollar. - 1973–1: energy crisisEnergy crisisAn energy crisis is any great bottleneck in the supply of energy resources to an economy. In popular literature though, it often refers to one of the energy sources used at a certain time and place, particularly those that supply national electricity grids or serve as fuel for vehicles...

, yen weakened. - 1978: yen strengthened to 180 per dollar, first endaka.

- 1979–1984: yen remained between 200–250 per dollar.

- 1985: Plaza AccordPlaza AccordThe Plaza Accord or Plaza Agreement was an agreement between the governments of France, West Germany, Japan, the United States, and the United Kingdom, to depreciate the U.S. dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets...

, revalued yen from 250 to 160 per dollar. - 1986–1988: yen further strengthened to 120 per dollar, second endaka.

- 1989–1995: yen fluctuated between 100 to 160 per dollar.

- 1995: yen surged to all time peak of 79 per dollar, endaka fukyo.

- 1997: Asian Financial Crisis, yen fell to 147 per dollar.

- 1997–2004: Bank of JapanBank of Japanis the central bank of Japan. The Bank is often called for short. It has its headquarters in Chuo, Tokyo.-History:Like most modern Japanese institutions, the Bank of Japan was founded after the Meiji Restoration...

(BOJ) fights yen appreciation, surging foreign exchange reserves, ballooning national debt, endaka fukyo. - 2004: (BOJ) abandons active intervention, promotes yen carry trades.

- August 2008: Yen strengthens on oil collapse. This sets off a carry trade reversal which cut $5.9 trillion of yen carry and $1.2 trillion of yen loans (7.1 trillion USD), adding to a severe international credit crunchCredit crunchA credit crunch is a reduction in the general availability of loans or a sudden tightening of the conditions required to obtain a loan from the banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates...

which set off a global financial crisis. - 2010: 2010 European sovereign debt crisis2010 European sovereign debt crisisFrom late 2009, fears of a sovereign debt crisis developed among investors concerning some European states, intensifying in early 2010 and thereafter.....

causes the yen to rise to a nine-year high against the euro, rising up to 107 per euro.