Metro Rail Transit Corporation

Encyclopedia

Consortium

A consortium is an association of two or more individuals, companies, organizations or governments with the objective of participating in a common activity or pooling their resources for achieving a common goal....

responsible for the maintenance of the Manila Metro Rail Transit System

Manila Metro Rail Transit System

The Metro Rail Transit is Metro Manila's third rapid transit line. It forms part of the Strong Republic Transit System, which includes the Manila Light Rail Transit System. The line operates under the name Metrostar Express and is colored blue on rail maps.The line is located along the Epifanio de...

. It is also the original contractor for the MRT project. It runs the MRT in coordination with the Department of Transportation and Communications

Department of Transportation and Communications (Philippines)

The Department of Transportation and Communications is the executive department of the Philippine government responsible for the maintenance and expansion of viable, efficient, and dependable transportation and communications systems as effective instruments for national recovery and economic...

.

Formation and Purpose of Metro Rail Transit Corporation

The contract for building and leasing for the EDSA Rail Transit III, Phase I Project was first awarded in 1992 to a consortium of international sponsors headed by Mr Eli Levin, who was involved in installing the first light rail transit system in Manila in the mid-1980s. Mr. Levin incorporated EDSA LRT Corporation Ltd. ("ELCL") in Hong Kong as the initial contractual counterparty to the DOTC. Legal and other problems beset the project through the first quarter of 1995, which were all subsequently resolved with a Supreme Court decision that asserted the validity of the Project.In June 1995, a newly formed consortium of reputable Philippine companies purchased a majority stake in ELCL through EDSA LRT Holdings, Inc. ("ELHI"), a Philippine-registered company. It was also approximately at this same period that the consortium engaged JP Morgan to help organize the financial structure of the Project and its highly complex financing plan.

The Philippine owners obtained control of roughly 85% of ELCL's voting stock. ELHI also formed and owns in its entirety a development company ("MRT DevCo") that acquired the development and commercial rights to develop the 16-hectare depot site and in the 13 stations, as well as the right to develop the air space above the 13 stations. In December 1995, ELCL's name was changed to Metro Rail Transit Corporation Ltd. ("Metro Rail") and ELHI was correspondingly renamed MRT Holdings, Inc.

A Philippines subsidiary of Metro Rail, Metro Rail Transit Corporation ("MRTC"), was later formed for the purpose of designing, constructing, testing, commissioning, and maintaining the EDSA Rail Transit III, Phase-1 system. An Accession Undertaking and an Assignment and Assumption Agreement was executed which gave MRTC all rights and obligations to the Project agreements during the debt repayment period and establish MRTC as the Project borrowing entity.

The BLT Agreement

The BLT Agreement was signed by DOTC and Metro Rail on August 8, 1997 and amended on October 16, 1997. It constitutes a restatement of similar agreements dating back to the first such contract, which was signed on November 7, 1991. That agreement was restated on April 22, 1992, and the restated agreement was supplemented on May 6, 1993, and amended on July 28, 1994 and May 1996. Another restatement was signed on October 3, 1996. All the terms in those prior agreements were superseded by the provisions of the BLT Agreement.The BLT Agreement governs the relationship between Metro Rail and DOTC during the Project’s two major phases, construction and revenue service. During the construction phase, Metro Rail was obliged to construct the Project (Phase 1) and to complete that construction by a certain date (the “Date Certain”). The construction was to be accomplished in accordance with the specifications and drawings approved by the DOTC and the completed system capable of achieving certain capacity requirements. Metro Rail was also obligated to provide all equipment that was to be used in the system, including the rail vehicles.

The DOTC’s obligations during the construction phase included granting Metro Rail access to the Project site (including relocating squatters and other persons from the Depot area) and ensuring that certain work to be performed by the Department of Public Works and Highways (“DPWH”) was completed properly and on time. In addition, the DOTC accepted the responsibility for certain events that could delay completion of the system. Should such events occur, DOTC would be responsible for paying the costs of the event and the delay it causes, and the date by which Metro Rail is obliged to complete construction would be adjusted.

After completion, Metro Rail was obligated to lease the system to DOTC, who would operate the system, with Metro Rail providing the maintenance. DOTC was required to make payments of Rental Fees to Metro Rail, and these were broken down into several different portions. One significant part was intended to repay the loans taken out to finance the Project (“Debt Rental Fees”).

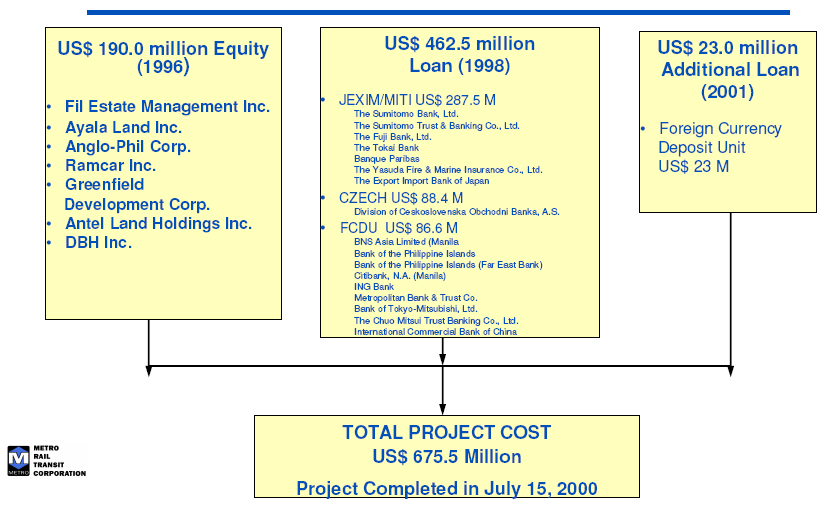

Project Funding Components

A breakdown of the key funders and trancheTranche

In structured finance, a tranche is one of a number of related securities offered as part of the same transaction. The word tranche is French for slice, section, series, or portion, and is cognate to English trench . In the financial sense of the word, each bond is a different slice of the deal's...

funding components of the MRT-3 Phase-1 Project were as follows:

The Key Management Team Members: Construction, Operations and Financial Management

From September 1995 to March 2002, Metro Rail oversaw the construction, financing and operational management of the Project. On December 15, 1999 Metro Rail commenced operations (soft opening) of the MRT-3 Phase-1 System operating 10-stations from Buendia to North Avenue. The Project was formally inaugurated on July 15, 2000 (all 13 stations) as scheduled and within the DOTC-approved budget.Robert John Sobrepena, was Metro Rail's Chairman and CEO, overseeing all aspects of the Project from Financing to Construction and turn over. Laurence Weldon, President and Chief Operating Officer, oversaw all aspects of construction of the Project. Mr. Weldon was previously connected as project manager of the Los Angeles “Blue Line” Rapid Transit Project before July 1995. In Manila he was supported by Carlos 'Karl' Quirino, Chief Financial Officer, Robert Ball, Vice-President of Technical Services, William Lathrop & Walter Mergelsberg of the Project Management Team and Harry Redstone and their teams for the engineering aspects of the Project.

JP Morgan and the management team of MRTC negotiated with the support of a team of technical experts and other advisors in arranging project financing totaling US$ 675.5-million from the Japan Bank for International Cooperation

Japan Bank for International Cooperation

The , also known by its acronym, JBIC, is a Japanese public financial institution and export credit agency, and was created on October 1, 1999, through the merging of the Japan Export-Import Bank and the Overseas Economic Cooperation Fund ....

(formerly Japan Export-Import Bank

Japan Bank for International Cooperation

The , also known by its acronym, JBIC, is a Japanese public financial institution and export credit agency, and was created on October 1, 1999, through the merging of the Japan Export-Import Bank and the Overseas Economic Cooperation Fund ....

or JEXIM), Investicni a Postovni Bank of the Czech Republic, a consortium of Foreign Currency Deposit Unit (“FCDU”) banks led by Citibank, Bank of the Philippine Islands, Far East Bank, ING Bank, Metrobank and the Philippine Government under a Sovereign Credit basis whose blended all-in financing cost amounted to only 4.72% p.a. over the entire life of the loan facilities.