Proven reserves

Encyclopedia

Fossil fuel

Fossil fuels are fuels formed by natural processes such as anaerobic decomposition of buried dead organisms. The age of the organisms and their resulting fossil fuels is typically millions of years, and sometimes exceeds 650 million years...

reserves such as oil reserves

Oil reserves

The total estimated amount of oil in an oil reservoir, including both producible and non-producible oil, is called oil in place. However, because of reservoir characteristics and limitations in petroleum extraction technologies, only a fraction of this oil can be brought to the surface, and it is...

(see main article

Oil reserves

The total estimated amount of oil in an oil reservoir, including both producible and non-producible oil, is called oil in place. However, because of reservoir characteristics and limitations in petroleum extraction technologies, only a fraction of this oil can be brought to the surface, and it is...

), natural gas

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

reserves, or coal

Coal

Coal is a combustible black or brownish-black sedimentary rock usually occurring in rock strata in layers or veins called coal beds or coal seams. The harder forms, such as anthracite coal, can be regarded as metamorphic rock because of later exposure to elevated temperature and pressure...

reserves.

Operating conditions includes operational break-even price, regulatory and contractual approvals, of which without these items cannot be classified as proven and are usually classified into probable. Price changes therefore can have a large impact on classification of proven reserves. Regulatory and contractual conditions may change, and also affect proven reserves amount.

Numbered terms

The engineering term P90 refers to 90 percent engineering probability, is a commonly accepted specific definition by Society of Petroleum EngineersSociety of Petroleum Engineers

The Society of Petroleum Engineers is a not-for-profit professional organization whose mission is to collect, disseminate, and exchange technical knowledge concerning the exploration, development and production of oil and gas resources and related technologies for the public benefit and to provide...

, it does not take into account anything except technical concerns. Therefore, it is different from the business term which does take into account current break-even profitability, and regulatory and contractual approval, but is considered a very rough equivalent. The definition is certainly not universal. Energy Watch Group uses a different definition, P95.

More terms

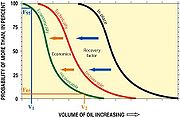

Disregarding economics, the proper engineering term for the total technologically extractable amount is the Producible fractionProducible fraction

Producible fraction sometimes producible reserves of a fossil fuel is an engineering term that relates to the amount of a fossil fuel which can be ultimately produced with current technologies. As an engineering term, it does not take into account any business or political issues such as...

, which is easily confused with the business/political term proven reserves. However, the purely engineering term is also misleading in that squeezing the last bits of fossil fuel out follows the diminishing returns and at some point is so costly that it becomes highly impractical, as seen on a bell curve

Bell curve

Bell curve can refer to:* A Gaussian function, a specific kind of function whose graph is a bell-shaped curve* Normal distribution, whose density function is a Gaussian function...

, which is why measures like P90 and P95 were created. The term proven reserves is further subdivided into proved developed reserves and proved undeveloped reserves. Note that it DOES NOT include Unproven reserves, which is broken down into probable reserves as well as possible reserves - which are those reserves that only have a 10% likelihood of being recoverable.

These reserve categories are totalled up by the measures 1P, 2P, and 3P, which are inclusive, so include the previous safer measures as:

- "1P reserves" = proven reserves (both proved developed reserves + proved undeveloped reserves).

- "2P reserves" = 1P (proven reserves) + probable reserves, hence "proved AND probable."

- "3P reserves" = the sum of 2P (proven reserves + probable reserves) + possible reserves, all 3Ps "proven AND probable AND possible."

Reserves growth may also occur due to technological changes, economic changes, and even geological changes and the passage of time (decades) as settling occurs.

Reserve evaluations, valuations and certifications

Oil companies employ specialist reserve valuation consultants - such as DeGolyer and MacNaughtonDeGolyer and MacNaughton

DeGolyer and MacNaughton is a petroleum consulting company based in Dallas, Texas, with offices in Houston, Moscow, and Calgary.DeGolyer and MacNaughton was founded in 1936 by Everette Lee DeGolyer and Lewis MacNaughton. In 2004, it acquired Calgary-based Outtrim Szabo Associates forming its...

, Ryder Scott

Ryder Scott

Ryder Scott is a Houston-based oil industry consultant, which like similar companies such as DeGolyer and MacNaughton, provides independent oil and gas reserves evaluation to oil majors and nation states...

, Netherland, Sewell and others - to provide third party reports as part of Securities and Exchange Commission (SEC) SEC filings. On December 30 2009, recognising advances in exploration and valuation technology, the SEC allowed 2P probable and 3P possible reserves to be reported, along with 1P proved reserves, though oil companies also have to verify the independence of third party consultants. Since investors view 1P reserves with much greater importance than 2P or 3P reserves, oil companies seek to convert 2P and 3P reserves into 1P reserves.