Purchase price allocation

Encyclopedia

Purchase price allocation, or PPA, is an application of goodwill accounting

whereby one company (the acquirer), when purchasing a second company (the target), allocates the purchase price into various assets and liabilities acquired from the transaction.

In the United States, the process of conducting a PPA is typically conducted in accordance with the Financial Accounting Standards Board

's ("FASB") Statement of Financial Accounting Standards No. 141 (revised 2007) “Business Combinations” (“SFAS 141r”) and SFAS 142 “Goodwill and Other Intangible Assets” (“SFAS 142”) . Effective for financial statements issued for interim and annual periods ending after September 15, 2009, the FASB "Accounting Standards Codification" ("ASC") reorganizes the FASB statements and represents a single authoritative source of U.S. accounting and reporting standards for nongovernmental entities. The set of guidelines prescribed by SFAS 141r are generally found in ASC Topic 805. Outside the United States, the International Accounting Standards Board

governs the process through the issuance of IFRS 3.

Purchase price allocations are performed in conformity with the purchase method of merger and acquisition

accounting. In the United States, a second method (known as the pooling or pooling-of-interests method) was discontinued after the issuance of the Statement of Financial Accounting Standards No. 141 “Business Combinations” (“SFAS 141”) and SFAS 142.

Before the target company can complete the acquisition, the target must appraise the assets and liabilities being acquired to determine their Fair Market Value

("FMV") -- the price a willing buyer would pay, and a willing seller would receive, through an arm's length transaction

in a market with perfect information

. The acquirer hires an appraisal firm (typically an external accounting firm or a valuation advisor) who reports that the FMV of the net assets is $24B.

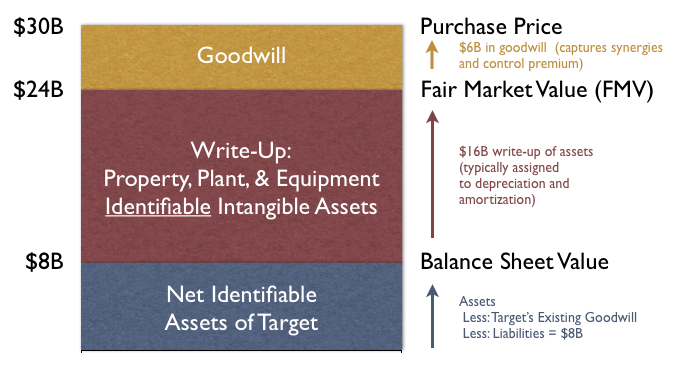

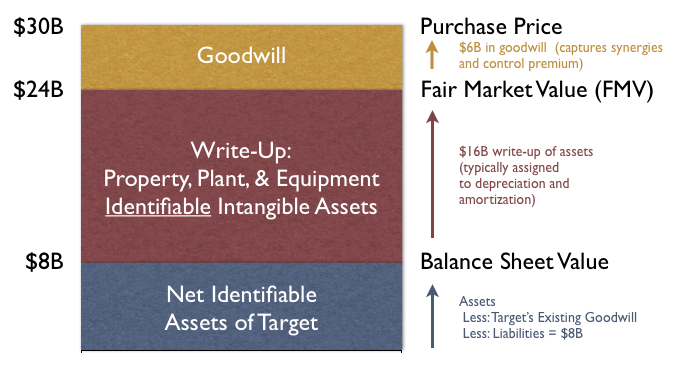

The figure below walks through the difference between the three values ($8B, $24B, and $30B).

The difference between the $8 and $24 is $16B in write-up -- the values of the net identifiable assets are in effect increased to 3 times the value reported on the original balance sheet. The difference between the $24B and $30B is $6B in goodwill acquired through the transaction—the excess of the purchase price paid over the FMV of the net identifiable assets acquired.

Finally, the acquirer adds both the value of the written-up assets ($24B) as well as the goodwill ($6B) onto the balance sheet, for a total of $30B in new net assets on the acquirer's balance sheet.

Collectively, the process of conducting the appraisal, reporting the FMV of the assets and liabilities, the allocation of the net identifiable assets from the old balance sheet price to the FMV, and the determination of the goodwill in the transaction, is referred to as the PPA process. Note that a purchase price may be less than the target's balance sheet value for a variety of reasons, which can lend itself to a write-down

of net assets.

The process of valuing goodwill, while a component of the PPA process, is governed through goodwill accounting

.

Goodwill (accounting)

Goodwill is an accounting concept meaning the value of an entity over and above the value of its assets. The term was originally used in accounting to express the intangible but quantifiable "prudent value" of an ongoing business beyond its assets, resulting perhaps because the reputation the firm...

whereby one company (the acquirer), when purchasing a second company (the target), allocates the purchase price into various assets and liabilities acquired from the transaction.

In the United States, the process of conducting a PPA is typically conducted in accordance with the Financial Accounting Standards Board

Financial Accounting Standards Board

The Financial Accounting Standards Board is a private, not-for-profit organization whose primary purpose is to develop generally accepted accounting principles within the United States in the public's interest...

's ("FASB") Statement of Financial Accounting Standards No. 141 (revised 2007) “Business Combinations” (“SFAS 141r”) and SFAS 142 “Goodwill and Other Intangible Assets” (“SFAS 142”) . Effective for financial statements issued for interim and annual periods ending after September 15, 2009, the FASB "Accounting Standards Codification" ("ASC") reorganizes the FASB statements and represents a single authoritative source of U.S. accounting and reporting standards for nongovernmental entities. The set of guidelines prescribed by SFAS 141r are generally found in ASC Topic 805. Outside the United States, the International Accounting Standards Board

International Accounting Standards Board

The International Accounting Standards Board is an independent, privately funded accounting standard-setter based in London, England.The IASB was founded on April 1, 2001 as the successor to the International Accounting Standards Committee...

governs the process through the issuance of IFRS 3.

Purchase price allocations are performed in conformity with the purchase method of merger and acquisition

Mergers and acquisitions

Mergers and acquisitions refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling, dividing and combining of different companies and similar entities that can help an enterprise grow rapidly in its sector or location of origin, or a new field or...

accounting. In the United States, a second method (known as the pooling or pooling-of-interests method) was discontinued after the issuance of the Statement of Financial Accounting Standards No. 141 “Business Combinations” (“SFAS 141”) and SFAS 142.

Example

A company wishes to acquire a particular target company for a variety of reasons. After much negotiation, a purchase price of $30B is agreed upon by both sides. As of the acquisition date, the target company reported net identifiable assets of $8B on its own balance sheet.Before the target company can complete the acquisition, the target must appraise the assets and liabilities being acquired to determine their Fair Market Value

Fair market value

Fair market value is an estimate of the market value of a property, based on what a knowledgeable, willing, and unpressured buyer would probably pay to a knowledgeable, willing, and unpressured seller in the market. An estimate of fair market value may be founded either on precedent or...

("FMV") -- the price a willing buyer would pay, and a willing seller would receive, through an arm's length transaction

Arm's length principle

The arm's length principle is the condition or the fact that the parties to a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction"...

in a market with perfect information

Perfect information

In game theory, perfect information describes the situation when a player has available the same information to determine all of the possible games as would be available at the end of the game....

. The acquirer hires an appraisal firm (typically an external accounting firm or a valuation advisor) who reports that the FMV of the net assets is $24B.

The figure below walks through the difference between the three values ($8B, $24B, and $30B).

The difference between the $8 and $24 is $16B in write-up -- the values of the net identifiable assets are in effect increased to 3 times the value reported on the original balance sheet. The difference between the $24B and $30B is $6B in goodwill acquired through the transaction—the excess of the purchase price paid over the FMV of the net identifiable assets acquired.

Finally, the acquirer adds both the value of the written-up assets ($24B) as well as the goodwill ($6B) onto the balance sheet, for a total of $30B in new net assets on the acquirer's balance sheet.

Collectively, the process of conducting the appraisal, reporting the FMV of the assets and liabilities, the allocation of the net identifiable assets from the old balance sheet price to the FMV, and the determination of the goodwill in the transaction, is referred to as the PPA process. Note that a purchase price may be less than the target's balance sheet value for a variety of reasons, which can lend itself to a write-down

Write-off

The term write-off describes a reduction in recognized value. In accounting terminology, it refers to recognition of the reduced or zero value of an asset. In income tax statements, it refers to a reduction of taxable income as recognition of certain expenses required to produce the income...

of net assets.

The process of valuing goodwill, while a component of the PPA process, is governed through goodwill accounting

Goodwill (accounting)

Goodwill is an accounting concept meaning the value of an entity over and above the value of its assets. The term was originally used in accounting to express the intangible but quantifiable "prudent value" of an ongoing business beyond its assets, resulting perhaps because the reputation the firm...

.