Robert Shiller

Encyclopedia

Robert James "Bob" Shiller (born Detroit, Michigan

, March 29, 1946) is an American

economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University

and is a Fellow at the Yale International Center for Finance, Yale School of Management

. Shiller has been a research

associate of the National Bureau of Economic Research

(NBER) since 1980, was Vice President of the American Economic Association

in 2005, and President of the Eastern Economic Association for 2006-2007. He is also the co-founder and chief economist of the investment management firm MacroMarkets LLC.

Shiller is ranked among the 100 most influential economists of the world.

from the University of Michigan

in 1967, S.M.

from MIT in 1968, and his Ph.D.

from MIT in 1972. He has taught at Yale since 1982 and previously held faculty positions at the Wharton School of the University of Pennsylvania

and the University of Minnesota

, also giving frequent lectures at the London School of Economics

. He has written on economic topics that range from behavioral finance

to real estate

to risk management

, and has been co-organizer of NBER workshops on behavioral finance with Richard Thaler

since 1991. His book Macro Markets

won TIAA-CREF

's first annual Paul A. Samuelson

Award. He currently publishes a syndicated column.

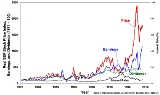

In 1981 Shiller published an article in the American Economic Review

titled "Do stock prices move too much to be justified by subsequent changes in dividends?" He challenged the efficient markets

model, which at that time was the dominant view in the economics profession. Shiller argued that in a rational stock market, investors would base stock prices on the expected receipt of future dividends, discounted to a present value. He examined the performance of the U.S. stock market since the 1920s, and considered the kinds of expectations of future dividends and discount rates that could justify the wide range of variation experienced in the stock market. Shiller concluded that the volatility of the stock market was greater than could plausibly be explained by any rational view of the future.

The behavioral finance school gained new credibility following the October 1987 stock market crash

. Shiller's work included survey research that asked investors and stock traders what motivated them to make trades; the results further bolstered his hypothesis that these decisions are often driven by emotion instead of rational calculation. Much of this survey data has been gathered continuously since 1989, and is available at Yale's Investor Behavior Project.

In 1991, he formed Case Shiller Weiss with economists Karl Case

and Allan Weiss

. The company produced a repeat-sales index using home sales prices data from across the nation, studying home pricing trends. The index was developed by Shiller and Case when Case was studying unsustainable house pricing booms in Boston and Shiller was studying the behavioral aspects of economic bubble

s. The repeat-sales index developed by Case and Shiller was later acquired and further developed by Fiserv

and Standard & Poor, creating the Case-Shiller index

.

His book Irrational Exuberance

(2000) – a New York Times bestseller – warned that the stock market had become a bubble

in March 2000 (the very height of the market top) which could lead to a sharp decline.

On CNBC

's "How to Profit from the Real Estate Boom" in 2005, he noted that housing price rises could not outstrip inflation in the long term because, except for land restricted sites, house prices would tend toward building costs plus normal economic profit. Co-panelist David Lereah

disagreed. In February, Lereah had put out his book Are You Missing the Real Estate Boom? signaling the market top for housing prices. While Shiller repeated his precise timing again for another market bubble, because the general level of nationwide residential real estate prices do not reveal themselves until after a lag of about one year, people did not believe Shiller had called another top until late 2006 and early 2007.

In the first decade of the 21st century Shiller co-authored a 2003 Brookings paper, "Is There a Bubble in the Housing Market?". Shiller subsequently refined his position in the 2nd edition of Irrational Exuberance

(2005), acknowledging that “ further rises in the [stock and housing] markets could lead, eventually, to even more significant declines… A long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession. This extreme outcome … is not inevitable, but it is a much more serious risk than is widely acknowledged.” Writing in the Wall Street Journal in August 2006, Shiller again warned that "there is significant risk of a very bad period, with slow sales, slim commissions, falling prices, rising default and foreclosures, serious trouble in financial markets, and a possible recession sooner than most of us expected.”

Robert Shiller was awarded the Deutsche Bank Prize in Financial Economics in 2009 for his pioneering research in the field of financial economics, relating to the dynamics of asset prices, such as fixed income, equities, and real estate, and their metrics. His work has been influential in the development of the theory as well as its implications for practice and policy-making. His contributions on risk sharing, financial market volatility, bubbles and crises, have received widespread attention among academics, practitioners and policy makers alike. In 2010, he was named by Foreign Policy magazine to its list of top global thinkers.

Other

Michigan

Michigan is a U.S. state located in the Great Lakes Region of the United States of America. The name Michigan is the French form of the Ojibwa word mishigamaa, meaning "large water" or "large lake"....

, March 29, 1946) is an American

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University

Yale University

Yale University is a private, Ivy League university located in New Haven, Connecticut, United States. Founded in 1701 in the Colony of Connecticut, the university is the third-oldest institution of higher education in the United States...

and is a Fellow at the Yale International Center for Finance, Yale School of Management

Yale School of Management

The Yale School of Management is the graduate business school of Yale University and is located on Hillhouse Avenue in New Haven, Connecticut, United States. The School offers Master of Business Administration and Ph.D. degree programs. As of January 2011, 454 students were enrolled in its MBA...

. Shiller has been a research

Research

Research can be defined as the scientific search for knowledge, or as any systematic investigation, to establish novel facts, solve new or existing problems, prove new ideas, or develop new theories, usually using a scientific method...

associate of the National Bureau of Economic Research

National Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end...

(NBER) since 1980, was Vice President of the American Economic Association

American Economic Association

The American Economic Association, or AEA, is a learned society in the field of economics, headquartered in Nashville, Tennessee. It publishes one of the most prestigious academic journals in economics: the American Economic Review...

in 2005, and President of the Eastern Economic Association for 2006-2007. He is also the co-founder and chief economist of the investment management firm MacroMarkets LLC.

Shiller is ranked among the 100 most influential economists of the world.

Career

Shiller received his B.A.Bachelor of Arts

A Bachelor of Arts , from the Latin artium baccalaureus, is a bachelor's degree awarded for an undergraduate course or program in either the liberal arts, the sciences, or both...

from the University of Michigan

University of Michigan

The University of Michigan is a public research university located in Ann Arbor, Michigan in the United States. It is the state's oldest university and the flagship campus of the University of Michigan...

in 1967, S.M.

Master of Science

A Master of Science is a postgraduate academic master's degree awarded by universities in many countries. The degree is typically studied for in the sciences including the social sciences.-Brazil, Argentina and Uruguay:...

from MIT in 1968, and his Ph.D.

Ph.D.

A Ph.D. is a Doctor of Philosophy, an academic degree.Ph.D. may also refer to:* Ph.D. , a 1980s British group*Piled Higher and Deeper, a web comic strip*PhD: Phantasy Degree, a Korean comic series* PhD Docbook renderer, an XML renderer...

from MIT in 1972. He has taught at Yale since 1982 and previously held faculty positions at the Wharton School of the University of Pennsylvania

University of Pennsylvania

The University of Pennsylvania is a private, Ivy League university located in Philadelphia, Pennsylvania, United States. Penn is the fourth-oldest institution of higher education in the United States,Penn is the fourth-oldest using the founding dates claimed by each institution...

and the University of Minnesota

University of Minnesota

The University of Minnesota, Twin Cities is a public research university located in Minneapolis and St. Paul, Minnesota, United States. It is the oldest and largest part of the University of Minnesota system and has the fourth-largest main campus student body in the United States, with 52,557...

, also giving frequent lectures at the London School of Economics

London School of Economics

The London School of Economics and Political Science is a public research university specialised in the social sciences located in London, United Kingdom, and a constituent college of the federal University of London...

. He has written on economic topics that range from behavioral finance

Behavioral finance

Behavioral economics and its related area of study, behavioral finance, use social, cognitive and emotional factors in understanding the economic decisions of individuals and institutions performing economic functions, including consumers, borrowers and investors, and their effects on market...

to real estate

Real estate

In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or...

to risk management

Risk management

Risk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities...

, and has been co-organizer of NBER workshops on behavioral finance with Richard Thaler

Richard Thaler

Richard H. Thaler is an American economist and the Ralph and Dorothy Keller Distinguished Service Professor of Behavioral Science and Economics at the University of Chicago Booth School of Business...

since 1991. His book Macro Markets

Macro Markets

Macro Markets is a book by Robert Shiller. It was published in 1993 by the Clarendon Press imprint of the Oxford University Press. It suggests that humans cannot fully diversify away their risk as portfolio theory would like us to. This is because there are missing markets, such as the general...

won TIAA-CREF

TIAA-CREF

Teachers Insurance and Annuity Association – College Retirement Equities Fund is a Fortune 100 financial services organization that is the leading retirement provider for people who work in the academic, research, medical and cultural fields...

's first annual Paul A. Samuelson

Paul Samuelson

Paul Anthony Samuelson was an American economist, and the first American to win the Nobel Memorial Prize in Economic Sciences. The Swedish Royal Academies stated, when awarding the prize, that he "has done more than any other contemporary economist to raise the level of scientific analysis in...

Award. He currently publishes a syndicated column.

In 1981 Shiller published an article in the American Economic Review

American Economic Review

The American Economic Review is a peer-reviewed academic journal of economics publishing seven issues annually by the American Economic Association. First published in 1911, it is considered one of the most prestigious journals in the field. The current editor-in-chief is Penny Goldberg . The...

titled "Do stock prices move too much to be justified by subsequent changes in dividends?" He challenged the efficient markets

Efficient market hypothesis

In finance, the efficient-market hypothesis asserts that financial markets are "informationally efficient". That is, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information available at the time the investment is made.There are...

model, which at that time was the dominant view in the economics profession. Shiller argued that in a rational stock market, investors would base stock prices on the expected receipt of future dividends, discounted to a present value. He examined the performance of the U.S. stock market since the 1920s, and considered the kinds of expectations of future dividends and discount rates that could justify the wide range of variation experienced in the stock market. Shiller concluded that the volatility of the stock market was greater than could plausibly be explained by any rational view of the future.

The behavioral finance school gained new credibility following the October 1987 stock market crash

Black Monday (1987)

In finance, Black Monday refers to Monday October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin...

. Shiller's work included survey research that asked investors and stock traders what motivated them to make trades; the results further bolstered his hypothesis that these decisions are often driven by emotion instead of rational calculation. Much of this survey data has been gathered continuously since 1989, and is available at Yale's Investor Behavior Project.

In 1991, he formed Case Shiller Weiss with economists Karl Case

Karl E. Case

Karl Case is Professor of Economics Emeritus at Wellesley College where he held the Coman and Hepburn Chair in Economics and taught for 34 years. He is a currently a Senior Fellow at the Joint Center for Housing Studies at Harvard University and was recently elected President of the Boston...

and Allan Weiss

Allan Weiss

Allan Neil Weiss has spent his career as an innovator in the areas of asset pricing, asset allocation and risk management. In 1991 he co-founded Case Shiller Weiss, Inc. and served as its CEO from inception to its sale to Fiserv in 2002. CSW is the creator of the Standard & Poor Case-Shiller...

. The company produced a repeat-sales index using home sales prices data from across the nation, studying home pricing trends. The index was developed by Shiller and Case when Case was studying unsustainable house pricing booms in Boston and Shiller was studying the behavioral aspects of economic bubble

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

s. The repeat-sales index developed by Case and Shiller was later acquired and further developed by Fiserv

Fiserv

Fiserv, Inc. provides information management systems and services to the financial and insurance industries. Leading services include transaction processing, outsourcing, business process outsourcing , software and systems solutions. The company serves more than 16,000 clients worldwide...

and Standard & Poor, creating the Case-Shiller index

Case-Shiller index

The Standard & Poor's Case–Shiller Home Price Indices are constant-quality house price indices for the United States. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area...

.

His book Irrational Exuberance

Irrational Exuberance (book)

Irrational Exuberance is a March 2000 book written by Yale University professor Robert Shiller, named after Alan Greenspan's "irrational exuberance" quote. Published at the height of the dot-com boom, it put forth several arguments demonstrating how the stock markets were overvalued at the time...

(2000) – a New York Times bestseller – warned that the stock market had become a bubble

Stock market bubble

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation....

in March 2000 (the very height of the market top) which could lead to a sharp decline.

On CNBC

CNBC

CNBC is a satellite and cable television business news channel in the U.S., owned and operated by NBCUniversal. The network and its international spinoffs cover business headlines and provide live coverage of financial markets. The combined reach of CNBC and its siblings is 390 million viewers...

's "How to Profit from the Real Estate Boom" in 2005, he noted that housing price rises could not outstrip inflation in the long term because, except for land restricted sites, house prices would tend toward building costs plus normal economic profit. Co-panelist David Lereah

David Lereah

David Lereah is the President of , a real estate advisory and information company located in the Washington, DC area. Reecon Advisors is the owner and publisher of , one of the industry's leading Web sites providing intelligence and information on the residential real estate market. The Web site...

disagreed. In February, Lereah had put out his book Are You Missing the Real Estate Boom? signaling the market top for housing prices. While Shiller repeated his precise timing again for another market bubble, because the general level of nationwide residential real estate prices do not reveal themselves until after a lag of about one year, people did not believe Shiller had called another top until late 2006 and early 2007.

In the first decade of the 21st century Shiller co-authored a 2003 Brookings paper, "Is There a Bubble in the Housing Market?". Shiller subsequently refined his position in the 2nd edition of Irrational Exuberance

Irrational Exuberance (book)

Irrational Exuberance is a March 2000 book written by Yale University professor Robert Shiller, named after Alan Greenspan's "irrational exuberance" quote. Published at the height of the dot-com boom, it put forth several arguments demonstrating how the stock markets were overvalued at the time...

(2005), acknowledging that “ further rises in the [stock and housing] markets could lead, eventually, to even more significant declines… A long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession. This extreme outcome … is not inevitable, but it is a much more serious risk than is widely acknowledged.” Writing in the Wall Street Journal in August 2006, Shiller again warned that "there is significant risk of a very bad period, with slow sales, slim commissions, falling prices, rising default and foreclosures, serious trouble in financial markets, and a possible recession sooner than most of us expected.”

Robert Shiller was awarded the Deutsche Bank Prize in Financial Economics in 2009 for his pioneering research in the field of financial economics, relating to the dynamics of asset prices, such as fixed income, equities, and real estate, and their metrics. His work has been influential in the development of the theory as well as its implications for practice and policy-making. His contributions on risk sharing, financial market volatility, bubbles and crises, have received widespread attention among academics, practitioners and policy makers alike. In 2010, he was named by Foreign Policy magazine to its list of top global thinkers.

|

.png) |

- In 2011, he made the Bloomberg 50 most influential people in global finance.

Books

- Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global CapitalismAnimal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global CapitalismAnimal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism is a book written to promote the understanding of the role played by emotions in influencing economic decision making...

by George A. Akerlof and Robert J. Shiller, Princeton University Press (2009), ISBN 978-0-691-14233-6. - The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do about It by Robert J. Shiller, Princeton University Press (2008), ISBN 0691139296.

- The New Financial Order: Risk in the 21st Century, by Robert J. Shiller, Princeton University Press (2003), ISBN 0691091722.

- Irrational ExuberanceIrrational Exuberance (book)Irrational Exuberance is a March 2000 book written by Yale University professor Robert Shiller, named after Alan Greenspan's "irrational exuberance" quote. Published at the height of the dot-com boom, it put forth several arguments demonstrating how the stock markets were overvalued at the time...

, by Robert J Shiller, Princeton University Press (2000), ISBN 0691050627. - Macro Markets: Creating Institutions for Managing Society's largest Economic Risks by Robert J. Shiller, Clarendon Press, New York: Oxford University Press (1993), ISBN 0198287828.

- Market Volatility, by Robert J. Shiller, MIT Press (1990), ISBN 026219290X.

See also

- Behavioral economics

- Journal of Behavioral FinanceJournal of Behavioral FinanceThe Journal of Behavioral Finance is a peer-reviewed journal that publishes research related to the field of behavioral finance. It formerly published as The Journal of Psychology and Financial Markets....

- House price indexHouse price index-FHFA/OFHEO:The US Federal Housing Finance Agency publishes the HPI inx, a quarterly broad measure of the movement of single-family house prices....

- Herd behaviorHerd behaviorHerd behavior describes how individuals in a group can act together without planned direction. The term pertains to the behavior of animals in herds, flocks and schools, and to human conduct during activities such as stock market bubbles and crashes, street demonstrations, sporting events,...

- Case-Shiller indexCase-Shiller indexThe Standard & Poor's Case–Shiller Home Price Indices are constant-quality house price indices for the United States. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area...

- 2008–2009 Keynesian resurgence2008–2009 Keynesian resurgenceIn 2008 and 2009, there was a resurgence of interest in Keynesian economics among policy makers in the world's industrialized economies. This has included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great...

External links

- Homepage of Robert J. Shiller

- Faculty profile at Yale School of ManagementYale School of ManagementThe Yale School of Management is the graduate business school of Yale University and is located on Hillhouse Avenue in New Haven, Connecticut, United States. The School offers Master of Business Administration and Ph.D. degree programs. As of January 2011, 454 students were enrolled in its MBA...

- Financial Markets with Professor Robert Shiller, Open Yale CoursesOpen Yale CoursesOpen Yale Courses is a project of Yale University to share full video and course materials from its undergraduate courses.Open Yale Courses provides free access to a selection of introductory courses....

- Financial Markets with Professor Robert Shiller, Open Yale Courses

- Robert J. Shiller, 2009 winner of the Deutsche Bank Prize in Financial Economics

- Column archive at Project SyndicateProject SyndicateProject Syndicate is an international not-for-profit newspaper syndicate and association of newspapers. It distributes commentaries and analysis by experts, activists, Nobel laureates, statesmen, economists, political thinkers, business leaders and academics to its member publications, and...

Other

- Stocks Revisited: Siegel and Shiller Debate

- Robert Shiller's Workshop in Behavioral Finance

- Robert Shiller research, Yale Economic ReviewYale Economic ReviewThe Yale Economic Review , established in 2005, is a non-profit, bi-annual journal of popular economics which reports on developments in economics to a broad audience. YER is not a peer-reviewed academic journal; rather, it aims to fill the gap between the technical content in traditional academic...

, Fall 2005 - The compelling Real DJIA, 1924–now

- Article on Robert J. Shiller (German language)

- Robert Shiller's interview on the housing crisis with The Politic

- Video conversation on the economy with Shiller and Robert WrightRobert Wright (journalist)Robert Wright is an American journalist, scholar, and prize-winning author of best-selling books about science, evolutionary psychology, history, religion, and game theory, including The Evolution of God, Nonzero: The Logic of Human Destiny, The Moral Animal, and Three Scientists and Their Gods:...

on Bloggingheads.tvBloggingheads.tvBloggingheads.tv is a political, world events, philosophy, and science video blog discussion site in which the participants take part in an active back and forth conversation via webcam which is then broadcast online to viewers...

. - Link to podcast lecture at London School of Economics on Sub Prime Crisis

- RSA Vision webcasts - Robert Shiller in conversation with Daniel Finkelstein on "How Human Psychology Drives the Economy"

- Interview with italian magazine House living and business

- Economic ratios maintained by Robert Shiller - P/E, Interest Rates, Divided Yields, Inflation, etc.