Shanghai Stock Exchange

Encyclopedia

The Shanghai Stock Exchange (SSE) , abbreviated as 上证所/上證所 or 上交所, is a stock exchange

that is based in the city of Shanghai

, China

. It is one of the two stock exchanges operating independently in the People's Republic of China, the other is the Shenzhen Stock Exchange

. Shanghai Stock Exchange is the world's 5th largest stock market by market capitalization

at US$2.7 trillion as of Dec 2010. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors due to tight capital account controls exercised by the Chinese mainland

authorities.

The current exchange was re-established on November 26, 1990 and was in operation on December 19 of the same year. It is a non-profit organization directly administered by the China Securities Regulatory Commission

(CSRC).

(foreign concession areas) in Shanghai

was the result of the Treaty of Nanking

of 1842 (which ended the First Opium War

) and subsequent agreements between the Chinese and foreign governments were crucial to the development of foreign trade in China

and of the foreign community in Shanghai. The market for securities trading in Shanghai begins in the late 1860s. The first shares list appeared in June 1866 and by then Shanghai's International Settlement had developed the conditions conducive to the emergence of a share market: several banks, a legal framework for joint-stock companies, and an interest in diversification among the established trading houses (although the trading houses themselves remained partnerships).

In 1891 during the boom in mining shares, foreign businessmen founded the "Shanghai Sharebrokers' Association" headquartered in Shanghai as China's first stock exchange. In 1904 the Association applied for registration in Hong Kong

under the provision of the Companies ordinance and was renamed as the "Shanghai Stock Exchange". The supply of securities came primarily from local companies. In the early days, banks dominated private shares but, by 1880, only the Hong Kong and Shanghai local banks remained.

Later in 1920 and 1921, "Shanghai Securities & Commodities Exchange" and "Shanghai Chinese Merchant Exchange" started operation respectively. An amalgamation eventually took place in 1929, and the combined markets operated thereafter as the "Shanghai Stock Exchange". Shipping, insurance, and docks persisted to 1940 but were overshadowed by industrial shares after the Treaty of Shimonoseki

of 1895, which permitted Japan

, and by extension other nations which had treaties with China, to establish factories in Shanghai and other treaty ports. Rubber plantations became the staple of stock trading beginning in the second decade of the 20th century.

By the 1930s, Shanghai had emerged as the financial center of the Far East

, where both Chinese and foreign investors could trade stocks, debenture

s, government bonds, and futures

. The operation of Shanghai Stock Exchange came to an abrupt halt after Japanese

troops occupied the Shanghai International Settlement on December 8, 1941. In 1946, Shanghai Stock Exchange resumed its operations before closing again 3 years later in 1949, after the Communist revolution

took place.

After the Cultural Revolution

ended and Deng Xiaoping

rose to power, China was re-opened to the outside world in 1978. During the 1980s, China's securities market evolved in tandem with the country's economic reform and opening up and the development of socialist market economy. On 26 November 1990, Shanghai Stock Exchange was re-established and operations began a few weeks later on 19 December.

s, bonds

, and funds

. Bonds traded on SSE include treasury bonds (T-bond), corporate bond

s, and convertible corporate bonds. SSE T-bond market is the most active of its kind in China. There are two types of stocks being issued in the Shanghai Stock Exchange: "A" shares and "B" shares. A shares are priced in the local renminbi

yuan currency, while B shares are quoted in U.S. dollars. Initially, trading in A shares are restricted to domestic investors only while B shares are available to both domestic (since 2001) and foreign investors. However, after reforms were implemented in December 2002, foreign investors are now allowed (with limitations) to trade in A shares under the Qualified Foreign Institutional Investor (QFII) program which was officially launched in 2003. Currently, a total of 98 foreign institutional investors have been approved to buy and sell A shares under the QFII program. Quotas under the QFII program are currently US$30 billion. There has been a plan to eventually merge the two types of shares in the future.

The SSE is open for trading every Monday to Friday. The morning session begins with centralized competitive pricing from 09:15 to 09:25, and continues with consecutive bidding from 09:30 to 11:30. This is followed by the afternoon consecutive bidding session, which starts from 13:00 to 15:00. The market is closed on Saturday and Sunday and other holidays announced by the SSE.

of SSE reached RMB 23,340.9 billion (US$3,241.8 billion; US$1 = RMB 6.82).

Data updated on 18 February 2008 >

Stock listings

Market value

(billion yuan

)

Annual turnover

value

(billion yuan

)

A shares

850

26,849.7

30,196.0

B shares

54

134.2

347.4

Total

904

26,983.9

30,543.4

Other conditions stipulated by the State Council.

The conditions for applications for the listing of shares by limited companies involved in high and new technology are set out separately by the State Council.

Stock exchange

A stock exchange is an entity that provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and...

that is based in the city of Shanghai

Shanghai

Shanghai is the largest city by population in China and the largest city proper in the world. It is one of the four province-level municipalities in the People's Republic of China, with a total population of over 23 million as of 2010...

, China

People's Republic of China

China , officially the People's Republic of China , is the most populous country in the world, with over 1.3 billion citizens. Located in East Asia, the country covers approximately 9.6 million square kilometres...

. It is one of the two stock exchanges operating independently in the People's Republic of China, the other is the Shenzhen Stock Exchange

Shenzhen Stock Exchange

The Shenzhen Stock Exchange is one of the People's Republic of China's two stock exchanges, alongside the Shanghai Stock Exchange. It is based in Shenzhen, China...

. Shanghai Stock Exchange is the world's 5th largest stock market by market capitalization

Market capitalization

Market capitalization is a measurement of the value of the ownership interest that shareholders hold in a business enterprise. It is equal to the share price times the number of shares outstanding of a publicly traded company...

at US$2.7 trillion as of Dec 2010. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors due to tight capital account controls exercised by the Chinese mainland

Mainland China

Mainland China, the Chinese mainland or simply the mainland, is a geopolitical term that refers to the area under the jurisdiction of the People's Republic of China . According to the Taipei-based Mainland Affairs Council, the term excludes the PRC Special Administrative Regions of Hong Kong and...

authorities.

The current exchange was re-established on November 26, 1990 and was in operation on December 19 of the same year. It is a non-profit organization directly administered by the China Securities Regulatory Commission

China Securities Regulatory Commission

The China Securities Regulatory Commission is an institution of the State Council of the People's Republic of China , with ministry-level rank...

(CSRC).

History

The formation of the International SettlementShanghai International Settlement

The Shanghai International Settlement began originally as a purely British settlement. It was one of the original five treaty ports which were established under the terms of the Treaty of Nanking at the end of the first opium war in the year 1842...

(foreign concession areas) in Shanghai

Shanghai

Shanghai is the largest city by population in China and the largest city proper in the world. It is one of the four province-level municipalities in the People's Republic of China, with a total population of over 23 million as of 2010...

was the result of the Treaty of Nanking

Treaty of Nanking

The Treaty of Nanking was signed on 29 August 1842 to mark the end of the First Opium War between the United Kingdom of Great Britain and Ireland and the Qing Dynasty of China...

of 1842 (which ended the First Opium War

First Opium War

The First Anglo-Chinese War , known popularly as the First Opium War or simply the Opium War, was fought between the United Kingdom and the Qing Dynasty of China over their conflicting viewpoints on diplomatic relations, trade, and the administration of justice...

) and subsequent agreements between the Chinese and foreign governments were crucial to the development of foreign trade in China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

and of the foreign community in Shanghai. The market for securities trading in Shanghai begins in the late 1860s. The first shares list appeared in June 1866 and by then Shanghai's International Settlement had developed the conditions conducive to the emergence of a share market: several banks, a legal framework for joint-stock companies, and an interest in diversification among the established trading houses (although the trading houses themselves remained partnerships).

In 1891 during the boom in mining shares, foreign businessmen founded the "Shanghai Sharebrokers' Association" headquartered in Shanghai as China's first stock exchange. In 1904 the Association applied for registration in Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

under the provision of the Companies ordinance and was renamed as the "Shanghai Stock Exchange". The supply of securities came primarily from local companies. In the early days, banks dominated private shares but, by 1880, only the Hong Kong and Shanghai local banks remained.

Later in 1920 and 1921, "Shanghai Securities & Commodities Exchange" and "Shanghai Chinese Merchant Exchange" started operation respectively. An amalgamation eventually took place in 1929, and the combined markets operated thereafter as the "Shanghai Stock Exchange". Shipping, insurance, and docks persisted to 1940 but were overshadowed by industrial shares after the Treaty of Shimonoseki

Treaty of Shimonoseki

The Treaty of Shimonoseki , known as the Treaty of Maguan in China, was signed at the Shunpanrō hall on April 17, 1895, between the Empire of Japan and Qing Empire of China, ending the First Sino-Japanese War. The peace conference took place from March 20 to April 17, 1895...

of 1895, which permitted Japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

, and by extension other nations which had treaties with China, to establish factories in Shanghai and other treaty ports. Rubber plantations became the staple of stock trading beginning in the second decade of the 20th century.

By the 1930s, Shanghai had emerged as the financial center of the Far East

Far East

The Far East is an English term mostly describing East Asia and Southeast Asia, with South Asia sometimes also included for economic and cultural reasons.The term came into use in European geopolitical discourse in the 19th century,...

, where both Chinese and foreign investors could trade stocks, debenture

Debenture

A debenture is a document that either creates a debt or acknowledges it. In corporate finance, the term is used for a medium- to long-term debt instrument used by large companies to borrow money. In some countries the term is used interchangeably with bond, loan stock or note...

s, government bonds, and futures

Futures contract

In finance, a futures contract is a standardized contract between two parties to exchange a specified asset of standardized quantity and quality for a price agreed today with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange...

. The operation of Shanghai Stock Exchange came to an abrupt halt after Japanese

Empire of Japan

The Empire of Japan is the name of the state of Japan that existed from the Meiji Restoration on 3 January 1868 to the enactment of the post-World War II Constitution of...

troops occupied the Shanghai International Settlement on December 8, 1941. In 1946, Shanghai Stock Exchange resumed its operations before closing again 3 years later in 1949, after the Communist revolution

Chinese Civil War

The Chinese Civil War was a civil war fought between the Kuomintang , the governing party of the Republic of China, and the Communist Party of China , for the control of China which eventually led to China's division into two Chinas, Republic of China and People's Republic of...

took place.

After the Cultural Revolution

Cultural Revolution

The Great Proletarian Cultural Revolution, commonly known as the Cultural Revolution , was a socio-political movement that took place in the People's Republic of China from 1966 through 1976...

ended and Deng Xiaoping

Deng Xiaoping

Deng Xiaoping was a Chinese politician, statesman, and diplomat. As leader of the Communist Party of China, Deng was a reformer who led China towards a market economy...

rose to power, China was re-opened to the outside world in 1978. During the 1980s, China's securities market evolved in tandem with the country's economic reform and opening up and the development of socialist market economy. On 26 November 1990, Shanghai Stock Exchange was re-established and operations began a few weeks later on 19 December.

Chronology

- 1866 - The first share list appeared in June.

- 1871 - Speculative bubble burst triggered by monetary panic.

- 1883 - Credit crisis resulted speculation in Chinese companies.

- 1890 - Bank crisis started from Hong Kong.

- 1891 - "Shanghai Sharebrokers Association" established.

- 1895 - Treaty of Shimonoseki opened Chinese market to foreign investors.

- 1904 - Renamed to "Shanghai Stock Exchange".

- 1909-1910 - Rubber boom.

- 1911 - Revolution and the abdication of the Qing DynastyQing DynastyThe Qing Dynasty was the last dynasty of China, ruling from 1644 to 1912 with a brief, abortive restoration in 1917. It was preceded by the Ming Dynasty and followed by the Republic of China....

. Founding of the Republic of ChinaRepublic of ChinaThe Republic of China , commonly known as Taiwan , is a unitary sovereign state located in East Asia. Originally based in mainland China, the Republic of China currently governs the island of Taiwan , which forms over 99% of its current territory, as well as Penghu, Kinmen, Matsu and other minor...

. - 1914 - Market closed for a few months due to the Great War (World War I).

- 1919 - Speculation in cotton shares.

- 1925 - Second rubber boom.

- 1929 - "Shanghai Securities & Commodities Exchange" and "Shanghai Chinese Merchant Exchange" were merged into the existing Shanghai Stock Exchange.

- 1931 - Incursion of Japanese forces into northern China.

- 1930s - The market was dominated by the rubber share price movements.

- 1941 - The market closed on Friday 5 December. Japanese troops occupied Shanghai.

- 1946-1949 - Temporary resumption of the Shanghai Stock Exchange until the communist revolution. Founding of the People's Republic of ChinaPeople's Republic of ChinaChina , officially the People's Republic of China , is the most populous country in the world, with over 1.3 billion citizens. Located in East Asia, the country covers approximately 9.6 million square kilometres...

in 1949. - 1978 - Deng XiaopingDeng XiaopingDeng Xiaoping was a Chinese politician, statesman, and diplomat. As leader of the Communist Party of China, Deng was a reformer who led China towards a market economy...

emerged as the dominant figure in China's leadership, thus beginning a period of 'opening up' to the rest of the worldChinese economic reformThe Chinese economic reform refers to the program of economic reforms called "Socialism with Chinese characteristics" in the People's Republic of China that were started in December 1978 by reformists within the Communist Party of China led by Deng Xiaoping.China had one of the world's largest...

. - 1981 - Trading in treasury bonds were resumed.

- 1984 - Company stocks and corporate bonds emerged in Shanghai and a few other cities.

- 1990 - The present Shanghai Stock Exchange re-opened on November 26 and began operation on December 19.

- 2001-2005 - A four-year market slump which saw Shanghai's market value halved, after reaching a peak in 2001. A ban on new IPOsInitial public offeringAn initial public offering or stock market launch, is the first sale of stock by a private company to the public. It can be used by either small or large companies to raise expansion capital and become publicly traded enterprises...

was put in April 2005 to curb the slump and allow more than US$200 billion of mostly state-owned equity to be converted to tradable shares. - 2006 - The SSE resumed full operation as the yearlong ban on IPOs was lifted in May. The world's second largest (US$21.9 billion) IPO by the Industrial and Commercial Bank of ChinaIndustrial and Commercial Bank of ChinaIndustrial and Commercial Bank of China Ltd. is the largest bank in the world by profit and market capitalization. It is one China's 'Big Four' state-owned commercial banks .It was founded as a limited company on January 1, 1984...

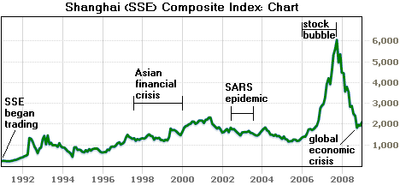

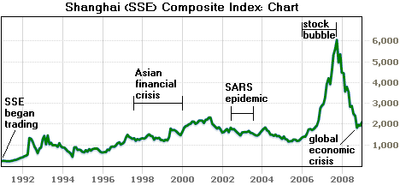

(ICBC) was launched in both Shanghai and Hong Kong stock markets. - 2007-2008 - A "stock market frenzy" as speculative traders rush into the market, making China's stock exchange temporarily the world's second largest in terms of turnoverRevenueIn business, revenue is income that a company receives from its normal business activities, usually from the sale of goods and services to customers. In many countries, such as the United Kingdom, revenue is referred to as turnover....

. After reaching an all-time high of 6,124.044 points on October 16, 2007, the benchmark Shanghai Composite Index ended 2008 down a record 65% mainly due to the impact of the global economic crisisLate 2000s recessionThe late-2000s recession, sometimes referred to as the Great Recession or Lesser Depression or Long Recession, is a severe ongoing global economic problem that began in December 2007 and took a particularly sharp downward turn in September 2008. The Great Recession has affected the entire world...

which started in mid-2008. - 2010 - Agricultural Bank of ChinaAgricultural Bank of ChinaAgricultural Bank of China Limited , also known as AgBank, is one of the "Big Four" banks in the People's Republic of China. It was founded in 1951, and has its headquarters in Beijing...

completed the world's largest IPO to date worth US$22.1 billion.

Structure

The securities listed at the SSE include the three main categories of stockStock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

s, bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

, and funds

Collective investment scheme

A collective investment scheme is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group...

. Bonds traded on SSE include treasury bonds (T-bond), corporate bond

Corporate bond

A corporate bond is a bond issued by a corporation. It is a bond that a corporation issues to raise money in order to expand its business. The term is usually applied to longer-term debt instruments, generally with a maturity date falling at least a year after their issue date...

s, and convertible corporate bonds. SSE T-bond market is the most active of its kind in China. There are two types of stocks being issued in the Shanghai Stock Exchange: "A" shares and "B" shares. A shares are priced in the local renminbi

Renminbi

The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC...

yuan currency, while B shares are quoted in U.S. dollars. Initially, trading in A shares are restricted to domestic investors only while B shares are available to both domestic (since 2001) and foreign investors. However, after reforms were implemented in December 2002, foreign investors are now allowed (with limitations) to trade in A shares under the Qualified Foreign Institutional Investor (QFII) program which was officially launched in 2003. Currently, a total of 98 foreign institutional investors have been approved to buy and sell A shares under the QFII program. Quotas under the QFII program are currently US$30 billion. There has been a plan to eventually merge the two types of shares in the future.

The SSE is open for trading every Monday to Friday. The morning session begins with centralized competitive pricing from 09:15 to 09:25, and continues with consecutive bidding from 09:30 to 11:30. This is followed by the afternoon consecutive bidding session, which starts from 13:00 to 15:00. The market is closed on Saturday and Sunday and other holidays announced by the SSE.

| Holiday Schedule Shanghai Stock Exchange 2010 |

|||

| Holiday | From | To | No. of days (excluding Saturday and Sunday) |

|---|---|---|---|

| New Year | 1 January 2010 (Friday) | 1 January 2010 (Friday) | 1 DAY |

| Chinese New Year | 15 February 2010 (Monday) | 19 February 2010 (Friday) | 5 DAYS |

| Qingming Festival | 5 April 2010 (Monday) | 5 April 2010 (Monday) | 1 DAY |

| Labor Day | 3 May 2010 (Monday) | 3 May 2010 (Monday) | 1 DAY |

| Duanwu Festival | 14 June 2010 (Monday) | 16 June 2010 (Wednesday) | 3 DAYS |

| Mid-Autumn Festival | 22 September 2010 (Wednesday) | 24 September 2010 (Friday) | 3 DAYS |

| National Day | 1 October 2010 (Friday) | 7 October 2010 (Thursday) | 5 DAYS |

| Note: The above dates are inclusive and all Saturdays and Sundays are non-trading days. | |||

Market Performance

As of February 2008, 861 companies were listed on the SSE and the total market capitalizationMarket capitalization

Market capitalization is a measurement of the value of the ownership interest that shareholders hold in a business enterprise. It is equal to the share price times the number of shares outstanding of a publicly traded company...

of SSE reached RMB 23,340.9 billion (US$3,241.8 billion; US$1 = RMB 6.82).

Trading Summary for 2007

(billion yuan

Renminbi

The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC...

)

Revenue

In business, revenue is income that a company receives from its normal business activities, usually from the sale of goods and services to customers. In many countries, such as the United Kingdom, revenue is referred to as turnover....

value

(billion yuan

Renminbi

The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC...

)

Indices

The SSE Composite (also known as Shanghai Composite) Index is the most commonly used indicator to reflect SSE's market performance. Constituents for the SSE Composite Index are all listed stocks (A shares and B shares) at the Shanghai Stock Exchange. The Base Day for the SSE Composite Index is December 19, 1990. The Base Period is the total market capitalization of all stocks of that day. The Base Value is 100. The index was launched on July 15, 1991. At the end of 2006, the index reaches 2,675.47. Other important indexes used in the Shanghai Stock Exchanges include the SSE 50 Index and SSE 180 Index.SSE's Top 10 Largest Stocks

Source: Shanghai Stock Exchange (market values in RMB/Chinese Yuan). Data arranged by market value. Updated on 19 March 2008- PetroChinaPetroChinaPetroChina Company Limited is a Chinese oil company and is the listed arm of state-owned China National Petroleum Corporation , headquartered in Dongcheng District, Beijing. It is China's biggest oil producer, and was the world's most valuable company by market value as of September 28th 2010...

(3,656.20 billion) - Industrial and Commercial Bank of ChinaIndustrial and Commercial Bank of ChinaIndustrial and Commercial Bank of China Ltd. is the largest bank in the world by profit and market capitalization. It is one China's 'Big Four' state-owned commercial banks .It was founded as a limited company on January 1, 1984...

(1,417.93 billion) - SinopecSinopecChina Petroleum & Chemical Corporation Limited , or Sinopec Limited , is a majority owned subsidiary of state owned company Sinopec Group. Sinopec Limited is listed in Hong Kong and also trades in Shanghai and New York ....

(961.42 billion) - Bank of ChinaBank of ChinaBank of China Limited is one of the big four state-owned commercial banks of the People's Republic of China. It was founded in 1912 by the Government of the Republic of China, to replace the Government Bank of Imperial China. It is the oldest bank in China...

(894.42 billion) - China Shenhua Energy CompanyChina Shenhua Energy CompanyChina Shenhua Energy Company is the largest coal mining state-owned enterprise in Mainland China, and the largest coal mining enterprise in the world. It is a subsidiary of Shenhua Group...

(824.22 billion) - China Life (667.39 billion)

- China Merchants BankChina Merchants BankChina Merchants Bank is a bank headquartered in Shenzhen, China. Founded in 1987, it is the first share-holding commercial bank wholly owned by corporate legal entities.CMB has over five hundred branches in mainland China and one in Hong Kong...

(352.74 billion) - Ping An InsurancePing An InsurancePing An , full name Ping An Insurance Company of China, Ltd. is a holding company whose subsidiaries mainly deal with insurance and financial services. The company was founded in 1988 and has its headquarters in Shenzhen.-Business:...

(272.53 billion) - Bank of CommunicationsBank of CommunicationsBank of Communications Limited , founded in 1908, is one of the largest banks in China.-Before 1949:The Bank of Communications was founded in 1908 and emerged as one of the first few major national and note-issuing banks in the early days of the Republic of China...

(269.41 billion) - China Pacific InsuranceChina Pacific InsuranceChina Pacific Insurance Group , or CPIC Group, was established on the basis of the former China Pacific Insurance Company, which was founded in 1991...

(256.64 billion)

Listing Requirements

According to the regulations of Securities Law of the People’s Republic of China and Company Law of the People’s Republic of China, limited companies applying for the listing of shares must meet the following criteria:- The shares must have been publicly issued following approval of the State Council Securities Management Department.

- The company’s total share capital must not be less than RMB 30 million.

- The company must have been in business for more than 3 years and have made profits over the last three consecutive years. This requirement also applies to former state-owned enterprises reincorporating as private or public enterprises. In the case of former state-owned enterprises re-established according to the law or founded after implementation of the law and if their issuers are large and medium state owned enterprises, it can be calculated consecutively. The number of shareholders with holdings of values reaching in excess of RMB 1,000 must not be less than 1,000 persons. Publicly offered shares must be more than 25% of the company’s total share capital. For company whose total share capital exceeds RMB 400 million, the ratio of publicly offered shares must be more than 15%.

- The company must not have committed any major illegal activities or false accounting records in the last three years.

Other conditions stipulated by the State Council.

- China currently has a preference for domestic firms only to list onto their stock exchanges; India has similar rules. However, China is considering opening up their capital markets to foreign firms in 2010.

The conditions for applications for the listing of shares by limited companies involved in high and new technology are set out separately by the State Council.

See also

- China Securities Regulatory CommissionChina Securities Regulatory CommissionThe China Securities Regulatory Commission is an institution of the State Council of the People's Republic of China , with ministry-level rank...

- Economy of the People's Republic of ChinaEconomy of the People's Republic of ChinaThe People's Republic of China ranks since 2010 as the world's second largest economy after the United States. It has been the world's fastest-growing major economy, with consistent growth rates of around 10% over the past 30 years. China is also the largest exporter and second largest importer of...

- Hong Kong Stock ExchangeHong Kong Stock ExchangeThe Hong Kong Stock Exchange is a stock exchange located in Hong Kong. It is Asia's third largest stock exchange in terms of market capitalization behind the Tokyo Stock Exchange and the Shanghai Stock Exchange and fifth largest in the world...

- Shenzhen Stock ExchangeShenzhen Stock ExchangeThe Shenzhen Stock Exchange is one of the People's Republic of China's two stock exchanges, alongside the Shanghai Stock Exchange. It is based in Shenzhen, China...

- Shanghai Metal ExchangeShanghai Metal ExchangeShanghai Metal Exchange , one of the national level futures exchanges of China, was established on 28 May 1992. SHME is a non-profit, self-regulating corporation...

- SSE CompositeSSE CompositeThe SSE Composite Index is an index of all stocks that are traded at the Shanghai Stock Exchange.-Weighting and calculation:...

- Untraded sharesUntraded sharesUntraded shares or refer to the shares of listed companies that are not allowed to be released by some of the investors within the lockup period...

- Leading stockLeading stockLeading stock , which is usually applied to the stock market of Mainland China and Hong Kong, means stock of a certain company which has leading status in their business field, including scope, market share, market capital, turnover and profit. Sometimes, leading stock may lead or influence prices...

Lists

- List of Chinese companies

- List of companies in the People's Republic of China

- List of stock exchanges