TED spread

Encyclopedia

Acronym and initialism

Acronyms and initialisms are abbreviations formed from the initial components in a phrase or a word. These components may be individual letters or parts of words . There is no universal agreement on the precise definition of the various terms , nor on written usage...

formed from T-Bill and ED, the ticker symbol for the Eurodollar

Eurodollar

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar deposits within the U.S., allowing for higher margins. The term...

futures contract.

Initially, the TED spread was the difference between the interest rates for three-month U.S. Treasuries

Treasury security

A United States Treasury security is government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt. Treasury securities are the debt financing instruments of the United States federal government, and they are often referred to simply as Treasuries...

contracts and the three-month Eurodollars contract as represented by the London Interbank Offered Rate

London Interbank Offered Rate

The LIBOR rate is the average interest rate that leading banks in London charge when lending to other banks. It is an acronym for London Interbank Offered Rate Banks borrow money for one day, one month, two months, six months, one year etc. and they pay interest to their lenders based on...

(LIBOR). However, since the Chicago Mercantile Exchange

Chicago Mercantile Exchange

The Chicago Mercantile Exchange is an American financial and commodity derivative exchange based in Chicago. The CME was founded in 1898 as the Chicago Butter and Egg Board. Originally, the exchange was a non-profit organization...

dropped T-bill futures

Futures contract

In finance, a futures contract is a standardized contract between two parties to exchange a specified asset of standardized quantity and quality for a price agreed today with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange...

, the TED spread is now calculated as the difference between the three-month T-bill interest rate and three-month LIBOR.

The size of the spread is usually denominated in basis point

Basis point

A basis point is a unit equal to 1/100 of a percentage point or one part per ten thousand...

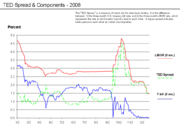

s (bps). For example, if the T-bill rate is 5.10% and ED trades at 5.50%, the TED spread is 40 bps. The TED spread fluctuates over time but generally has remained within the range of 10 and 50 bps (0.1% and 0.5%) except in times of financial crisis. A rising TED spread often presages a downturn in the U.S. stock market, as it indicates that liquidity is being withdrawn.

Indicator

The TED spread is an indicator of perceived credit riskCredit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

in the general economy. This is because T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks. When the TED spread increases, that is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. Interbank lenders therefore demand a higher rate of interest, or accept lower returns on safe investments such as T-bills. When the risk of bank defaults is considered to be decreasing, the TED spread decreases.

Historical levels

The long term average of the TED has been 30 basis points with a maximum of 50 bps.During 2007, the subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

ballooned the TED spread to a region of 150-200 bps. On September 17, 2008, the TED spread exceeded 300 bps, breaking the previous record set after the Black Monday

Black Monday (1987)

In finance, Black Monday refers to Monday October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin...

crash of 1987. Some higher readings for the spread were due to inability to obtain accurate LIBOR rates in the absence of a liquid unsecured lending market. On October 10, 2008, the TED spread reached another new high of 457 basis points.

See also

- LIBOR-OIS spreadLIBOR-OIS spreadThe LIBOR–OIS is the difference between LIBOR and the overnight indexed swap rates. The spread between the two rates is considered to be a measure of health of the banking system.-Risk barometer:...

- Overnight indexed swapOvernight indexed swapAn overnight indexed swap is an interest rate swap where the periodic floating rate of the swap is equal to the geometric average of an overnight index over every day of the payment period...

- Treasury Bill

- Treasury securityTreasury securityA United States Treasury security is government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt. Treasury securities are the debt financing instruments of the United States federal government, and they are often referred to simply as Treasuries...

External links

- Current TED Spread Quote from Bloomberg

- Betting the Bank

- Understanding the TED spread from the Econbrowser blog