Tax wedge

Encyclopedia

Following from the Law of Supply and Demand

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

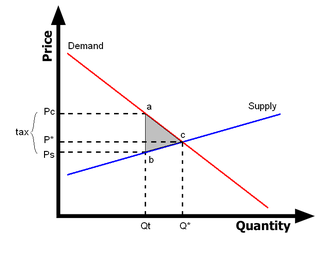

, as the price to consumers increases, and the price suppliers receive decreases, the quantity each wishes to trade will decrease. After a tax is introduced, a new equilibrium is reached where consumers pay more (P* → Pc), suppliers receive less (P* → Ps), and the quantity exchanged falls (Q* → Qt). The difference between

and

and  will be equivalent to the value of the tax.

will be equivalent to the value of the tax.While both consumers and suppliers pay some portion of the tax, the distribution depends on the structure of the demand and supply curves, respectively. As long-run supply curves tend to flatten over time, consumers tend to pay an increasingly larger portion of the tax.

Europe’s generally high tax burden and its extensive welfare systems have created big marginal effects and tax wedges. For example a 2007 report calculated the amount going to the service worker's wallet is approximately 10% in Belgium, 15% in Sweden, 30% in Ireland and the UK, compared to 50% in United States.