Transaction cost

Encyclopedia

In economics

and related disciplines, a transaction cost is a cost

incurred in making an economic exchange (restated: the cost of participating in a market). For example, most people, when buying or selling a stock

, must pay a commission to their broker

; that commission is a transaction cost of doing the stock deal. Or consider buying a spatula from a store; to purchase the spatula, your costs will be not only the price of the spatula itself, but also the energy and effort it requires to find out which of the various spatula products you prefer, where to get them and at what price, the cost of traveling from your house to the store and back, the time waiting in line, and the effort of the paying itself; the costs above and beyond the cost of the spatula are the transaction costs. When rationally evaluating a potential transaction, it is important to consider transaction costs that might prove significant.

A number of kinds of transaction cost have come to be known by particular names:

The idea that transactions form the basis of an economic thinking was introduced by the institutional economist

The idea that transactions form the basis of an economic thinking was introduced by the institutional economist

John R. Commons

(1931). He says that,

The term "transaction cost" is frequently thought to have been coined by Ronald Coase

, who used it to develop a theoretical framework for predicting when certain economic tasks would be performed by firms, and when they would be performed on the market

. However, the term is actually absent from his early work up to the 1970s. While he did not coin the specific term, Coase indeed discussed "costs of using the price mechanism" in his 1937 paper The Nature of the Firm, where he first discusses the concept of transaction costs, and refers to the "Costs of Market Transactions" in his seminal work, The Problem of Social Cost (1960). The term "Transaction Costs" itself can instead be traced back to the monetary economics literature of the 1950s, and does not appear to have been consciously 'coined' by any particular individual.

Arguably, transaction cost reasoning became most widely known through Oliver E. Williamson

's Transaction Cost Economics. Today, transaction cost economics is used to explain a number of different behaviours. Often this involves considering as "transactions" not only the obvious cases of buying and selling

, but also day-to-day emotional interactions, informal gift

exchanges, etc. Oliver E. Williamson was awarded the 2009 Nobel Prize in Economics

According to Williamson, the determinants of transaction costs are frequency, specificity

, uncertainty, limited rationality, and opportunistic behavior.

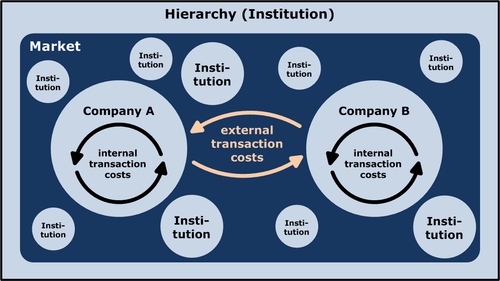

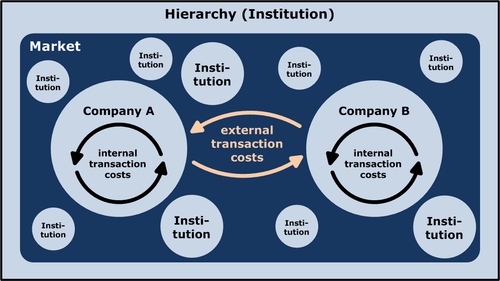

At least two definitions of the phrase "transaction cost" are commonly used in literature. Transaction costs have been broadly defined by Steven N. S. Cheung

as any costs that are not conceivable in a "Robinson Crusoe

economy"—in other words, any costs that arise due to the existence of institution

s. To Cheung, "transaction costs", if the term is not so popular in economics literatures, should be called "institutional costs". But many economists seem to restrict the definition to exclude costs internal to an organization. The latter definition parallels Coase's early analysis of "costs of the price mechanism" and the origins of the term as a market trading fee.

Starting with the broad definition, many economists then ask what kind of institutions (firms, markets, franchise

s, etc.) minimize the transaction costs of producing and distributing a particular good or service. Often these relationships are categorized by the kind of contract

involved. This approach sometimes goes under the rubric of New Institutional Economics

.

/monopsony

relationship, known as a bilateral monopoly

. This means that the customer has greater leverage over the supplier such as when price cuts occur. To avoid these potential costs, "hostages" may be swapped to avoid this event. These hostages could include partial ownership in the widget factory; revenue sharing might be another way.

Car companies and their suppliers often fit into this category, with the car companies forcing price cuts on their suppliers. Defense suppliers and the military appear to have the opposite problem, with cost overruns occurring quite often. Technologies like enterprise resource planning (ERP)

can provide technical support for these strategies.

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

and related disciplines, a transaction cost is a cost

Cost

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this...

incurred in making an economic exchange (restated: the cost of participating in a market). For example, most people, when buying or selling a stock

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

, must pay a commission to their broker

Stock broker

A stock broker or stockbroker is a regulated professional broker who buys and sells shares and other securities through market makers or Agency Only Firms on behalf of investors...

; that commission is a transaction cost of doing the stock deal. Or consider buying a spatula from a store; to purchase the spatula, your costs will be not only the price of the spatula itself, but also the energy and effort it requires to find out which of the various spatula products you prefer, where to get them and at what price, the cost of traveling from your house to the store and back, the time waiting in line, and the effort of the paying itself; the costs above and beyond the cost of the spatula are the transaction costs. When rationally evaluating a potential transaction, it is important to consider transaction costs that might prove significant.

A number of kinds of transaction cost have come to be known by particular names:

- Search and information costsSearch costSearch costs are one facet of transaction costs or switching costs. Rational consumers will continue to search for a better product or service until the marginal cost of searching exceeds the marginal benefit. Search theory is a branch of microeconomics that studies decisions of this type.The costs...

are costs such as those incurred in determining that the required good is available on the market, which has the lowest price, etc. - Bargaining costs are the costs required to come to an acceptable agreement with the other party to the transaction, drawing up an appropriate contractContractA contract is an agreement entered into by two parties or more with the intention of creating a legal obligation, which may have elements in writing. Contracts can be made orally. The remedy for breach of contract can be "damages" or compensation of money. In equity, the remedy can be specific...

and so on. In game theoryGame theoryGame theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

this is analyzed for instance in the game of chicken. On asset markets and in market microstructure, the transaction cost is some function of the distance between the bid and askBid and askPrice mechanism is an economic term that refers to the buyers and sellers who negotiate prices of goods or services depending on demand and supply. A price mechanism or market-based mechanism refers to a wide variety of ways to match up buyers and sellers through price rationing.An example of a...

. - Policing and enforcement costs are the costs of making sure the other party sticks to the terms of the contract, and taking appropriate action (often through the legal system) if this turns out not to be the case.

History of development

Institutional economics

Institutional economics focuses on understanding the role of the evolutionary process and the role of institutions in shaping economic behaviour. Its original focus lay in Thorstein Veblen's instinct-oriented dichotomy between technology on the one side and the "ceremonial" sphere of society on the...

John R. Commons

John R. Commons

John Rogers Commons was an American institutional economist and labor historian at the University of Wisconsin–Madison.-Biography:Born in Hollansburg, Ohio, John R. Commons had a religious upbringing which led him to be an advocate for social justice early in life...

(1931). He says that,

The term "transaction cost" is frequently thought to have been coined by Ronald Coase

Ronald Coase

Ronald Harry Coase is a British-born, American-based economist and the Clifton R. Musser Professor Emeritus of Economics at the University of Chicago Law School. After studying with the University of London External Programme in 1927–29, Coase entered the London School of Economics, where he took...

, who used it to develop a theoretical framework for predicting when certain economic tasks would be performed by firms, and when they would be performed on the market

Market

A market is one of many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers...

. However, the term is actually absent from his early work up to the 1970s. While he did not coin the specific term, Coase indeed discussed "costs of using the price mechanism" in his 1937 paper The Nature of the Firm, where he first discusses the concept of transaction costs, and refers to the "Costs of Market Transactions" in his seminal work, The Problem of Social Cost (1960). The term "Transaction Costs" itself can instead be traced back to the monetary economics literature of the 1950s, and does not appear to have been consciously 'coined' by any particular individual.

Arguably, transaction cost reasoning became most widely known through Oliver E. Williamson

Oliver E. Williamson

Oliver Eaton Williamson is an American economist, professor at the University of California, Berkeley and recipient of the Nobel Memorial Prize in Economic Sciences....

's Transaction Cost Economics. Today, transaction cost economics is used to explain a number of different behaviours. Often this involves considering as "transactions" not only the obvious cases of buying and selling

Selling

Selling is offering to exchange something of value for something else. The something of value being offered may be tangible or intangible. The something else, usually money, is most often seen by the seller as being of equal or greater value than that being offered for sale.Another person or...

, but also day-to-day emotional interactions, informal gift

Gift

A gift or a present is the transfer of something without the expectation of receiving something in return. Although gift-giving might involve an expectation of reciprocity, a gift is meant to be free. In many human societies, the act of mutually exchanging money, goods, etc. may contribute to...

exchanges, etc. Oliver E. Williamson was awarded the 2009 Nobel Prize in Economics

According to Williamson, the determinants of transaction costs are frequency, specificity

Asset specificity

Asset specificity is a term related to the inter-party relationships of a transaction. It is usually defined as the extent to which the investments made to support a particular transaction have a higher value to that transaction than they would have if they were redeployed for any other purpose...

, uncertainty, limited rationality, and opportunistic behavior.

At least two definitions of the phrase "transaction cost" are commonly used in literature. Transaction costs have been broadly defined by Steven N. S. Cheung

Steven N. S. Cheung

Steven Ng-Sheong Cheung , a Hong Kong born economist, specializes in the fields of transaction costs and property rights. Known for his work on private property rights and transaction costs, he achieved his fame with an economic analysis on China open-door policy after 1980s...

as any costs that are not conceivable in a "Robinson Crusoe

Robinson Crusoe

Robinson Crusoe is a novel by Daniel Defoe that was first published in 1719. Epistolary, confessional, and didactic in form, the book is a fictional autobiography of the title character—a castaway who spends 28 years on a remote tropical island near Trinidad, encountering cannibals, captives, and...

economy"—in other words, any costs that arise due to the existence of institution

Institution

An institution is any structure or mechanism of social order and cooperation governing the behavior of a set of individuals within a given human community...

s. To Cheung, "transaction costs", if the term is not so popular in economics literatures, should be called "institutional costs". But many economists seem to restrict the definition to exclude costs internal to an organization. The latter definition parallels Coase's early analysis of "costs of the price mechanism" and the origins of the term as a market trading fee.

Starting with the broad definition, many economists then ask what kind of institutions (firms, markets, franchise

Franchising

Franchising is the practice of using another firm's successful business model. The word 'franchise' is of anglo-French derivation - from franc- meaning free, and is used both as a noun and as a verb....

s, etc.) minimize the transaction costs of producing and distributing a particular good or service. Often these relationships are categorized by the kind of contract

Contract

A contract is an agreement entered into by two parties or more with the intention of creating a legal obligation, which may have elements in writing. Contracts can be made orally. The remedy for breach of contract can be "damages" or compensation of money. In equity, the remedy can be specific...

involved. This approach sometimes goes under the rubric of New Institutional Economics

New institutional economics

New institutional economics is an economic perspective that attempts to extend economics by focusing on the social and legal norms and rules that underlie economic activity.-Overview:...

.

Examples

A supplier may bid in a competitive environment with a customer to build a widget. However, to make the widget, the supplier will be required to build specialized machinery which cannot be easily redeployed to make other products. Once the contract is awarded to the supplier, the relationship between customer and supplier changes from a competitive environment to a monopolyMonopoly

A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

/monopsony

Monopsony

In economics, a monopsony is a market form in which only one buyer faces many sellers. It is an example of imperfect competition, similar to a monopoly, in which only one seller faces many buyers...

relationship, known as a bilateral monopoly

Bilateral monopoly

In a bilateral monopoly there is both a monopoly and monopsony in the same market.In such, market price and output will be determined by forces like bargaining power of both buyer and seller...

. This means that the customer has greater leverage over the supplier such as when price cuts occur. To avoid these potential costs, "hostages" may be swapped to avoid this event. These hostages could include partial ownership in the widget factory; revenue sharing might be another way.

Car companies and their suppliers often fit into this category, with the car companies forcing price cuts on their suppliers. Defense suppliers and the military appear to have the opposite problem, with cost overruns occurring quite often. Technologies like enterprise resource planning (ERP)

Enterprise resource planning

Enterprise resource planning systems integrate internal and external management information across an entire organization, embracing finance/accounting, manufacturing, sales and service, customer relationship management, etc. ERP systems automate this activity with an integrated software application...

can provide technical support for these strategies.

Differences to Neoclassical Microeconomics

Williamson argues in The Mechanisms of Governance (1996) that Transaction Cost Economics (TCE) differs from neoclassical microeconomics in the following six points:- Behavioral assumptions: whereas neoclassical theory assumes hyperrationality and ignores most of the hazards related to opportunism, TCE assumes bounded rationalityBounded rationalityBounded rationality is the idea that in decision making, rationality of individuals is limited by the information they have, the cognitive limitations of their minds, and the finite amount of time they have to make a decision...

. - Unit of analysis: whereas neoclassical theory is concerned with composite goods and services, TCE analyzes the transactionFinancial transactionA financial transaction is an event or condition under the contract between a buyer and a seller to exchange an asset for payment. It involves a change in the status of the finances of two or more businesses or individuals.-History:...

itself. - Governance structure: whereas neoclassical theory describes the firm as a production functionProduction functionIn microeconomics and macroeconomics, a production function is a function that specifies the output of a firm, an industry, or an entire economy for all combinations of inputs...

(a technological construction), TCE describes it as a governance structure (an organizational construction). - Problematic property rights and contracts: whereas neoclassical theory often assumes that property rights are clearly defined and the cost of enforcing those rights by the mean of courts is negligible, TCE treats property rights and contracts as problematic.

- Discrete structural analysis: whereas neoclassical theory uses continuous marginal modes of analysis in order to achieve second-order economizing (adjusting margins), TCE analyzes the basic structures of the firm and its governance in order to achieve first-order economizing (improving the basic governance structure).

- Remediableness: whereas neoclassical theory recognizes profit maximizationProfit maximizationIn economics, profit maximization is the process by which a firm determines the price and output level that returns the greatest profit. There are several approaches to this problem...

or cost minimizationCost-minimization analysisCost-minimization is a tool used in pharmacoeconomics and is applied when comparing multiple drugs of equal efficacy and equal tolerabilityTherapeutic equivalence must be referenced by the author conducting the study and should have been done prior to the cost-minimization work...

as criteria of efficiency, TCE insists that there is no optimal solution and that all alternatives are flawed, thus bounding "optimal" efficiencyEfficiencyEfficiency in general describes the extent to which time or effort is well used for the intended task or purpose. It is often used with the specific purpose of relaying the capability of a specific application of effort to produce a specific outcome effectively with a minimum amount or quantity of...

to the solution with no superior alternative and whose implementation produces net gains.

See also

- Bounded RationalityBounded rationalityBounded rationality is the idea that in decision making, rationality of individuals is limited by the information they have, the cognitive limitations of their minds, and the finite amount of time they have to make a decision...

- Ronald CoaseRonald CoaseRonald Harry Coase is a British-born, American-based economist and the Clifton R. Musser Professor Emeritus of Economics at the University of Chicago Law School. After studying with the University of London External Programme in 1927–29, Coase entered the London School of Economics, where he took...

- Diseconomy of scale

- Economic anthropologyEconomic anthropologyEconomic anthropology is a scholarly field that attempts to explain human economic behavior using the tools of both economics and anthropology. It is practiced by anthropologists and has a complex relationship with economics...

- New Institutional EconomicsNew institutional economicsNew institutional economics is an economic perspective that attempts to extend economics by focusing on the social and legal norms and rules that underlie economic activity.-Overview:...

- Nobel Prize in Economics

- Property rights (economics)Property rights (economics)A property right is the exclusive authority to determine how a resource is used, whether that resource is owned by government or by individuals. All economic goods have a property rights attribute...

- Herbert SimonHerbert SimonHerbert Alexander Simon was an American political scientist, economist, sociologist, and psychologist, and professor—most notably at Carnegie Mellon University—whose research ranged across the fields of cognitive psychology, cognitive science, computer science, public administration, economics,...

- Switching costs

- Theory of the firmTheory of the firmThe theory of the firm consists of a number of economic theories that describe the nature of the firm, company, or corporation, including its existence, behavior, structure, and relationship to the market.-Overview:...

- Transaction cost theory

- Oliver E. WilliamsonOliver E. WilliamsonOliver Eaton Williamson is an American economist, professor at the University of California, Berkeley and recipient of the Nobel Memorial Prize in Economic Sciences....

- Market makerMarket makerA market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...