.gif)

Argentine economic crisis (1999-2002)

Encyclopedia

The Argentine economic crisis was a financial situation, tied to poilitical unrest, that affected Argentina's economy

during the late 1990s

and early 2000s

. In macroeconomic

al terms, the critical period started with the decrease of real Gross Domestic Product

(GDP) in 1999 and ended in 2002 with the return to GDP growth, but the origins of the collapse of Argentina's economy, and also the effects on the country's population, can be traced back to both economical and political incorrect decisions.

(alternating with weak, short-lived democratic

governments) for many years, that resulted in a number of significant economic problems. During the National Reorganization Process

(1976–1983) huge debt was acquired for money that was later lost in unfinished projects, the Falklands War

, and the state's takeover of private debts; in this period, a neoliberal

economic platform was introduced. By the end of the military government the country's industries were severely affected and unemployment, calculated at 18% (though official figures claimed 5%), was at its highest point since the Great Depression

.

In 1983, democracy

in the country was restored with the election of president Raúl Alfonsín

. The new government's plans included stabilizing Argentina's economy

including the creation of a new currency (the austral

, first of its kind not to carry the word peso as part of its name), for which new loans were required. The state eventually became unable to pay the interest of this debt and confidence in the austral collapsed. Inflation

, which had been held to 10 to 20% a month, spiraled out of control. In July 1989, Argentina's inflation reached 200% that month alone, topping 5,000% for the year. During the Alfonsin years unemployment did not substantially increase but real wages fell by almost half (to the lowest level in fifty years). Amid riots

President Alfonsín resigned five months before ending his term and Carlos Menem

, who was already President-elect, took office.

, in late 1990 Domingo Cavallo

was appointed Minister of the Economy. In 1991 he took executive measures that fixed the value of Argentine currency at ₳

10,000 per US$

. Furthermore any citizen could go to a bank and convert any amount of domestic currency to dollars. To secure this "convertibility

" the Central Bank of Argentina had to keep its U.S. dollar foreign exchange reserves

at the same level as the cash in circulation

. The initial aim of such measures was to ensure the acceptance of domestic currency since during 1989 and 1990 hyperinflation

peaks people had started to reject it as payment demanding U.S. dollars instead. This regime was later fixated by a law (Ley de Convertibilidad) which restored the peso

as the Argentine currency with a monetary value fixed

by law to the value of the U.S. dollar.

As a result of the convertibility law inflation dropped sharply, price stability was assured and the value of the currency was preserved. This raised the quality of life

for many citizens who could now afford to travel abroad, buy imported goods or ask for credit in dollars at very low interest

rates.

Argentina still had external debts to pay and it needed to keep borrowing money. The fixed exchange rate made imports cheap, producing a constant flight of dollars away from the country and a progressive loss of Argentina's industrial infrastructure

which led to an increase in unemployment

.

In the meantime, government spending continued to be high and corruption

was rampant. Argentina's public debt grew enormously during the 1990s and the country showed no true signs of being able to pay it. The IMF, however, kept lending money to Argentina and postponing its payment schedules. Massive tax evasion

and money laundering

explained a large part of the evaporation of funds toward offshore banks. A congressional committee started investigations in 2001 over accusations that the Central Bank of Argentina's governor, Pedro Pou, as well as part of the board of directors, had failed to investigate cases of alleged money laundering through Argentina's financial system. Clearstream

was also accused of being instrumental in this global financial process.

Other countries, such as Mexico and Brazil (both of which also happen to be important trade partners for Argentina), faced economic crises of their own leading other countries to mistrust Latin American countries moneywise and affecting the overall economy of the region. The influx of foreign currency provided by the privatisation

of state companies had dried up. After 1999 Argentine exports were harmed by the devaluation

of the Brazilian real

and a considerable international revaluation

of the dollar effectively revaluing the peso against its major trading partners, Brazil (30% of total trade flows) and the euro area

(23% of total trade flows).

By 1999, newly elected President Fernando de la Rúa

faced a country where unemployment had risen to a critical point and the undesirable effects of the fixed exchange rate were showing forcefully. In 1999 Argentina's gross domestic product

(GDP) dropped 4% and the country entered a recession

which lasted three years ending in a collapse. Economic stability

became economic stagnation

(even deflation at times) and the economic measures taken did nothing to avert it. In fact the government continued the contractive economic policies of its predecessor. The possible solution (abandonment of the exchange peg, with a voluntary devaluation of the peso) was considered political suicide and a recipe for economic disaster. By the end of the century, a spectrum of complementary currencies

had emerged.

While the provinces

had always issued complementary currency in the form of bonds

and drafts to brave shortages of cash, the maintenance of the convertibility regime led to this being done in an unprecedented scale. This led to their being called "quasi-currencies

", the strongest of them being Buenos Aires province's Patacón

. The national state also issued its own quasi-currency—the LECOP

.

(IMF), with the organism providing the country with a reliable access to credit and guiding its economic reforms. When its economy entered in recession the federal government deficit widened to 2.5% of GDP in 1999 and its external debt surpassed 50% of GDP. Seeing these levels as excessive, the IMF advised the government that it needed to address the issue of investor confidence, and that the government had to balance its budget by implementing austerity measures to do so. Complying with IMF's requests, De la Rua administration committed to a sustained effort of fiscal consolidation and implemented billion in cuts in its first weeks in office in late 1999. In June 2000, with unemployment at 14% and projections of 3.5% GDP growth for the year, that move was furthered by a package of million in spending cuts and billion in tax increases. Following De la Rúa's vice president Carlos Álvarez

resignment in over bribery suspicions in the Upper House, the crisis accelerated.

GDP growth projections proved to be overly optimistic (instead of growing, real GDP shrank 0.8%), and lagging tax receipts prompted the government to freeze spending and cut retirement benefits again in . In early November, Standard & Poor's

placed Argentina on a credit watch, and a treasury bill auction resulted in yields reaching 16% (up from 9% in July); this was the second highest rate of any country in South America at the time. Rising bond yields left Argentina with no choice but to borrow from major international lenders, such as the IMF, World Bank

, and the U.S. Treasury, which would lend to the government at below-market rates, and to comply with their conditions. Several more rounds of belt-tightening followed. José Luis Machinea

resigned as the Minister of Economy in February 2001. He was replaced with Ricardo López Murphy

, who lasted 8 days in the office before being replaced with Domingo Cavallo

. In July 2001, Standard and Poor's cut the credit rating of the country to B–. In July 2001 the government instituted an unpopular across-the-board pay cut of up to 13% to all civil servants and an equivalent cut to government pension benefits - seventh austerity plan implemented since President Fernando de la Rua

took office in 1999, triggering nationwide strikes, and, starting in August, it was forced to pay salaries of highest-paid employees in I.O.U.s

instead of money. This further depressed the economy, which was already weak after a three-year recession. The unemployment rate rose to 16.4% in August 2001 up from a 14.7% a month earlier, and it stood at 20% by December.

In , public discontent with the economic conditions was expressed in the nationwide election

. President Fernando de la Rua

's alliance lost seats in both chambers of Argentina's congress

, leaving it in the minority. Over 20% of all voters chose to enter so-called "anger votes", returning blank or defaced ballots rather than indicate support of any candidate.

The crisis intensified when, on , the IMF refused to release a billion tranche of its loan, citing the failure of the Argentinean government to reach previously agreed-upon budget deficit targets, and demanded further budget cuts, amounting 10% of the federal budget. On 4 December, Argentinean bond yields stood at 34% over U.S. treasury bonds, and, by , the spread jumped to 42%.

By the end of , people fearing the worst began withdrawing large sums of money from their bank account

s, turning pesos into dollars and sending them abroad, causing a run on the banks

. On the government enacted a set of measures, informally known as the corralito

, that effectively froze all bank accounts for twelve months, allowing for only minor sums of cash to be withdrawn, initially announced to be of just $

250 a week.

. They engaged in a form of popular protest that became known as cacerolazo

(banging pots and pans). These protests occurred especially in 2001 and 2002. At first the cacerolazos were simply noisy demonstrations

, but soon they included property destruction, often directed at banks, foreign privatized companies, and especially big American and European companies. Many businesses installed metal barriers because windows and glass facades were being broken, and even fires being ignited at their doors. Billboards

of such companies as Coca Cola and others were brought down by the masses of demonstrators.

Confrontations between the police and citizens became a common sight, and fires were also set on Buenos Aires avenues. Fernando de la Rúa declared a state of emergency

Confrontations between the police and citizens became a common sight, and fires were also set on Buenos Aires avenues. Fernando de la Rúa declared a state of emergency

, only to get the situation worsened, precipitating the violent protests of 20 and 21 December 2001

in Plaza de Mayo

, where clashes between demonstrators and the police ended up with several people dead, and precipitated the fall of the government. De la Rúa eventually fled the Casa Rosada

in a helicopter on 21 December. Following presidential succession procedures established in the Constitution

, the Senate chairman is the one in the line of succession in the absence of both president and vice-president in office. Therefore, Ramón Puerta

took office as caretaker's head of state

, and the Legislative Assembly

(a body formed by merging both chambers of the Congress) was convened. By law, the candidates were the members of the Senate plus the Governors of the Provinces; Adolfo Rodríguez Saá

, then governor of San Luis

, was eventually appointed as the new interim president. During the last week of 2001, the interim government led by Rodríguez Saá, facing the impossibility of meeting debt payments, default

ed on the larger part of the public debt, totalling no less than billion, what approximately represented the seventh portion of all the money borrowed by the Third World

.

Politically, the most heated debate involved the time for the following elections—the spectrum ranged from March 2002 to October 2003 (the original date for the ending of De la Rúa's office).

Rodríguez Saá's economy team came up with a project designed to preserve the convertibility regime, dubbed the "Third Currency" Plan. It consisted of creating a new, non-convertible currency called Argentino coexisting with convertible pesos and U.S. dollars. It would only circulate as cash (checks, promissory notes or other instruments could be nominated in pesos or dollars but not in Argentinos) and would be partially guaranteed with federally managed land—such features were expected to counterbalance inflationary tendencies.

Argentinos having legal currency status would be used to redeem all complementary currency

already in circulation—the acceptance of which as a means of payment was quite uneven. It was hoped that preservation of convertibility would restore public confidence, while the non-convertible nature of this currency would allow for a measure of fiscal flexibility (unthinkable with pesos) that could ameliorate the crippling recession of economy. Critics called this plan merely a "controlled devaluation"; its advocates countered that since controlling a devaluation is perhaps its thorniest issue, this criticism was a praise in disguise. The "Third Currency" plan had enthusiastic supporters among mainstream economists (the most notorious being perhaps Martín Redrado

, a former president of the central bank

) citing sound technical arguments. However, it could never be implemented because the Rodríguez Saá government lacked the political support required.

Rodríguez Saá, utterly incapable of dealing with the crisis and unsupported by his own party

, resigned before the end of the year. The Legislative Assembly convened again, appointing Peronist Eduardo Duhalde

—then a Senator for the Buenos Aires province—to take his place.

After much deliberation, Duhalde abandoned in January 2002 the fixed 1-to-1 peso–dollar parity that had been in place for ten years. In a matter of days, the peso lost a large part of its value in the unregulated market. A provisional "official" exchange rate was set at 1.4 pesos per dollar.

After much deliberation, Duhalde abandoned in January 2002 the fixed 1-to-1 peso–dollar parity that had been in place for ten years. In a matter of days, the peso lost a large part of its value in the unregulated market. A provisional "official" exchange rate was set at 1.4 pesos per dollar.

In addition to the corralito, the Ministry of Economy dictated the pesificación ("peso-ification"), by which all bank accounts denominated in dollars would be converted to pesos at official rate. This measure angered most savings holders and appeals were made by many citizens to declare it unconstitutional.

After a few months, the exchange rate was left to float more or less freely. The peso suffered a huge depreciation, which in turn prompted inflation (since Argentina depended heavily on imports, and had no means to replace them locally at the time).

The economic situation became steadily worse with regards to inflation and unemployment during 2002. By that time the original 1-to-1 rate had increased to nearly 4 pesos per dollar, while the accumulated inflation since the devaluation was about 80%; these figures were considerably lower than those foretold by most orthodox economists at the time. The quality of life of the average Argentine was lowered proportionally; many businesses closed or went bankrupt, many imported products became virtually inaccessible, and salaries were left as they were before the crisis.

Since the volume of pesos did not fit the demand for cash (even after the devaluation) huge quantities of a wide spectrum of complementary currency

kept circulating alongside them. Fears of hyperinflation as a consequence of devaluation quickly eroded the attractiveness of their associated revenue, originally stated in convertible pesos. Their acceptability now ultimately depended on the State's willingness to take them as payment of taxes and other charges, consequently becoming very irregular. Very often they were taken at less than their nominal value—while the Patacón was frequently accepted at the same value as peso, Entre Ríos

's Federal was among the worst-faring, at an average 30% as the provincial government that had issued them was reluctant to take them back. There were also frequent rumors that the Government would simply banish complementary currency overnight (instead of redeeming them, even at disadvantageous rates), leaving their holders with useless printed paper.

Many private companies were affected by the crisis: Aerolíneas Argentinas

Many private companies were affected by the crisis: Aerolíneas Argentinas

, for example, was one of the most affected Argentine companies, having to stop all international flights for various days in 2002. The airline came close to bankruptcy

, but survived.

Most barter

networks, viable as devices to ameliorate the shortage of cash during the recession, collapsed as large numbers of people turned to them, desperate to save as many pesos as they could for exchange for hard currency as a palliative for uncertainty.

Several thousand newly homeless and jobless Argentines found work as cartoneros, or cardboard collectors. The 2003 estimation of 30,000 to 40,000 people scavenged the streets for cardboard to eke out a living by selling it to recycling plants. This method accounts for only one of many ways of coping in a country that at the time suffered from an unemployment rate soaring at nearly 25%.

Agriculture was also affected: Argentine products were rejected in some international markets, for fear they might arrive damaged from the poor conditions they grew in, and the USDA

put restrictions on Argentine food and drugs arriving at the United States.

Producers of television channels were forced to produce more reality shows than any other type of shows, because these were generally cheap to produce as compared to other programmes. Virtually all education-related TV programmes were canceled.

Eduardo Duhalde finally managed to stabilise the situation to a certain extent, and called for elections. On Néstor Kirchner

Eduardo Duhalde finally managed to stabilise the situation to a certain extent, and called for elections. On Néstor Kirchner

took office as the new president. Kirchner kept Duhalde's Minister of Economy, Roberto Lavagna

, in his post. Lavagna, a respected economist with centrist views, showed a considerable aptitude at managing the crisis, with the help of heterodox

measures.

The economic outlook was completely different from that of the 1990s; the devalued peso made Argentine exports cheap and competitive abroad, while discouraging imports. In addition, the high price of soy

in the international market produced an injection of massive amounts of foreign currency (with China becoming a major buyer of Argentina's soy products).

The government encouraged import substitution

and accessible credit for businesses, staged an aggressive plan to improve tax collection, and set aside large amounts of money for social welfare, while controlling expenditure in other fields.

As a result of the administration's productive model and controlling measures (selling reserve dollars in the public market), the peso slowly revalued, reaching a 3-to-1 rate to the dollar. Agricultural exports grew and tourism returned.

The huge trade surplus ultimately caused such an inflow of dollars that the government was forced to begin intervening to keep the peso from revaluing further, which would ruin the tax collection scheme (largely based on import taxes and royalties) and discourage further reindustrialisation. The central bank started buying dollars in the local market and stocking them as reserves. By December 2005, foreign currency reserves had reached billion (they were greatly reduced by the anticipated payment of the full debt to the IMF in ). The downside of this reserve accumulation strategy is that the dollars have to be bought with freshly issued pesos, which may induce inflation. The central bank neutralises a part of this monetary emission by selling Treasury

letters. In this way the exchange rate has been stabilised near a reference value of 3 pesos to the dollar.

The currency exchange issue is complicated by two mutually opposing factors: a sharp increase in imports since 2004

The currency exchange issue is complicated by two mutually opposing factors: a sharp increase in imports since 2004

(which raises the demand of dollars), and the return of foreign investment (which brings fresh currency from abroad) after the successful restructuring of about three quarters of the external debt. The government has set up controls and restrictions aimed at keeping short-term speculative investment from destabilising the financial market.

Argentina's recovery suffered a minor setback in 2004 when rising industrial demand caused a short-lived energy crisis

. The prospect of future energy shortages are not discounted.

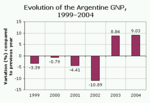

Argentina has managed to return to growth

with surprising strength; the GDP jumped 8.8% in 2003, 9.0% in 2004, 9.2% in 2005, 8.5% in 2006 and 8.7% in 2007. Though average wages have increased 17% annually since 2002 (jumping 25% in the year to May 2008), consumer prices have partly accompanied this surge; though not comparable to the levels of former crises, the inflation rate was 12.5% in 2005, 10% in 2006 and is believed by private economists to have approached 15% in 2007 and to exceed 20% during 2008(even if the Ministry of Economy refuses to acknowledge inflation greater than 10%). This has prompted the government to increase tariffs for exporters and to pressure retailers into one price truce after another in a bid to stabilize prices, so far with little effect.

While unemployment has been considerably reduced (it has been hovering around 8.5% since 2006), Argentina has so far failed to reach an equitable distribution of income

(the wealthiest 10% of the population receives 31 times more income than the poorest 10%). This disparity, nevertheless, compares quite favorably to levels seen in most of Latin America.

s.

Worker managed cooperative

businesses range from ceramics factory Zanon (FaSinPat

), to the four-star Hotel Bauen

, to suit factory Brukman

, to printing press Chilavert, and many others. In some cases, former owners sent police to remove workers out of these workplaces; this was sometimes successful but in other cases workers defended occupied workplaces against the state, the police, and the bosses.

A survey by an Argentina newspaper in the capital found that around 1/3 of the population had participated in general assemblies. The assemblies used to take place in street corners and public spaces, and generally gathered to discuss ways of helping each other in the face of eviction, or organizing around issues like health care, collective food buying, or conducting free food distribution programs. Some assemblies started to create new structures of health care and schooling, to replace the old ones that were not working. Neighborhood assemblies met once a week in a large assembly to discuss issues affecting the larger community. In 2004, Avi Lewis

and Naomi Klein

(author of No Logo

) released the documentary The Take, about these events.

Some businesses have now been legally purchased by the workers for nominal fees, others remain 'occupied' by workers who have no legal standing with the state (and in some cases reject negotiation with the state on the grounds that working productively is its own justification). The Argentine government is considering a Law of Expropriation

that would transfer some occupied businesses to their worker-managers.

, the Gini coefficient

and the wealth gap between the 10% poorest and the 10% richest among the population, grew continuously since 2001, and decreased for the first time in March 2005.

Similar statistics are available from the World Bank

The Argentine government kept a firm stance, and finally got a deal in 2005 by which 76% of the defaulted bonds were exchanged by others, of a much lower nominal value (25–35% of the original) and at longer terms. In 2008, President Cristina Fernández de Kirchner announced she was studying a reopening of the 2005 swap to gain adhesion from the remaining 24% of the so-called "holdouts", and thereby fully exit the default with private investors.

suffered no discounts in its part of the Argentine debt. Some payments were refinanced or postponed on agreement. However, the authorities of the IMF at times expressed harsh criticism of the discounts and actively lobbied for the private creditors.

In a speech before the United Nations

General Assembly

on September 21, 2004, President Kirchner said that "An urgent, tough, and structural redesign of the International Monetary Fund is needed, to prevent crises and help in [providing] solutions". Implicitly referencing the fact that the intent of the original Bretton Woods system

was to encourage economic development, Kirchner warned that the IMF today must "change that direction, which took it from being a lender for development to a creditor demanding privileges".

During the weekend of October 1–2, 2004, at the annual meeting of the IMF/World Bank

, leaders of the IMF, the European Union

, the Group of Seven industrialised nations, and the Institute of International Finance

(IIF), warned President Kirchner that Argentina had to come to an immediate debt-restructuring agreement with the speculative "vulture fund

s", increase its primary budget surplus to pay more debt, and impose "structural reforms" to prove to the world financial community that it deserved loans and investment.

In 2005, as a large and consistently growing fiscal surplus made it possible, Argentina shifted to a policy of "disindebtment" towards the IMF: paying the IMF in schedule, with no negotiation whenever possible, with the intention of gaining independence from it. On December 15, 2005, following a similar action by Brazil, President Kirchner suddenly announced that Argentina would pay the whole debt to the IMF. The debt payments, totaling 9.810 billion USD, were previously scheduled as installments until 2008. Argentina paid it with the central bank's foreign currency reserves.

In a June 2006 report, a group of independent experts hired by the IMF to revise the work of its Independent Evaluation Office (IEO) stated that the assessment of the Argentine case suffered from informative manipulation and lack of collaboration on the part of the IMF; the IEO is claimed to have unduly softened its conclusions to avoid criticizing the IMF's board of directors.

Economy of Argentina

This article provides an overview of the Economic history of Argentina.-Emergence into the world economy:Prior to the 1880s, Argentina was a relatively isolated backwater, dependent on the wool, leather and hide industry for both the greater part of its foreign exchange and the generation of...

during the late 1990s

1990s

File:1990s decade montage.png|From left, clockwise: The Hubble Space Telescope floats in space after it was taken up in 1990; American F-16s and F-15s fly over burning oil fields and the USA Lexie in Operation Desert Storm, also known as the 1991 Gulf War; The signing of the Oslo Accords on...

and early 2000s

2000s

File:2000s decade montage3.png|From left, clockwise: The World Trade Center towers, in the wake of the September 11 attacks; the Euro enters into European currency in 2002; a statue of Saddam Hussein being toppled during the Iraq War; U.S. troops heading toward an army helicopter during the War in...

. In macroeconomic

Macroeconomics

Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of the whole economy. This includes a national, regional, or global economy...

al terms, the critical period started with the decrease of real Gross Domestic Product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

(GDP) in 1999 and ended in 2002 with the return to GDP growth, but the origins of the collapse of Argentina's economy, and also the effects on the country's population, can be traced back to both economical and political incorrect decisions.

Origins

Argentina was subject to military dictatorshipMilitary dictatorship

A military dictatorship is a form of government where in the political power resides with the military. It is similar but not identical to a stratocracy, a state ruled directly by the military....

(alternating with weak, short-lived democratic

Democracy

Democracy is generally defined as a form of government in which all adult citizens have an equal say in the decisions that affect their lives. Ideally, this includes equal participation in the proposal, development and passage of legislation into law...

governments) for many years, that resulted in a number of significant economic problems. During the National Reorganization Process

National Reorganization Process

The National Reorganization Process was the name used by its leaders for the military government that ruled Argentina from 1976 to 1983. In Argentina it is often known simply as la última junta militar or la última dictadura , because several of them existed throughout its history.The Argentine...

(1976–1983) huge debt was acquired for money that was later lost in unfinished projects, the Falklands War

Falklands War

The Falklands War , also called the Falklands Conflict or Falklands Crisis, was fought in 1982 between Argentina and the United Kingdom over the disputed Falkland Islands and South Georgia and the South Sandwich Islands...

, and the state's takeover of private debts; in this period, a neoliberal

Neoliberalism

Neoliberalism is a market-driven approach to economic and social policy based on neoclassical theories of economics that emphasizes the efficiency of private enterprise, liberalized trade and relatively open markets, and therefore seeks to maximize the role of the private sector in determining the...

economic platform was introduced. By the end of the military government the country's industries were severely affected and unemployment, calculated at 18% (though official figures claimed 5%), was at its highest point since the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

.

In 1983, democracy

Democracy

Democracy is generally defined as a form of government in which all adult citizens have an equal say in the decisions that affect their lives. Ideally, this includes equal participation in the proposal, development and passage of legislation into law...

in the country was restored with the election of president Raúl Alfonsín

Raúl Alfonsín

Raúl Ricardo Alfonsín was an Argentine lawyer, politician and statesman, who served as the President of Argentina from December 10, 1983, to July 8, 1989. Alfonsín was the first democratically-elected president of Argentina following the military government known as the National Reorganization...

. The new government's plans included stabilizing Argentina's economy

Economy of Argentina

This article provides an overview of the Economic history of Argentina.-Emergence into the world economy:Prior to the 1880s, Argentina was a relatively isolated backwater, dependent on the wool, leather and hide industry for both the greater part of its foreign exchange and the generation of...

including the creation of a new currency (the austral

Argentine austral

The austral was the currency of Argentina between June 15, 1985 and December 31, 1991. It was subdivided into 100 centavos. The symbol was an uppercase A with an extra horizontal line . This symbol appeared on all coins issued in this currency , to distinguish them from earlier currencies...

, first of its kind not to carry the word peso as part of its name), for which new loans were required. The state eventually became unable to pay the interest of this debt and confidence in the austral collapsed. Inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

, which had been held to 10 to 20% a month, spiraled out of control. In July 1989, Argentina's inflation reached 200% that month alone, topping 5,000% for the year. During the Alfonsin years unemployment did not substantially increase but real wages fell by almost half (to the lowest level in fifty years). Amid riots

1989 riots in Argentina

The 1989 food riots were a series of riots and related episodes of looting in stores and supermarkets in Argentina, during the last part of the presidency of Raúl Alfonsín, between May and June 1989...

President Alfonsín resigned five months before ending his term and Carlos Menem

Carlos Menem

Carlos Saúl Menem is an Argentine politician who was President of Argentina from 1989 to 1999. He is currently an Argentine National Senator for La Rioja Province.-Early life:...

, who was already President-elect, took office.

1990s

Following a second bout of hyperinflationHyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

, in late 1990 Domingo Cavallo

Domingo Cavallo

Domingo Felipe "Mingo" Cavallo is an Argentine economist and politician. He has a long history of public service and is known for implementing the Convertibilidad plan, which fixed the dollar-peso exchange rate at 1:1 between 1991 and 2001, which brought the Argentine inflation rate down from over...

was appointed Minister of the Economy. In 1991 he took executive measures that fixed the value of Argentine currency at ₳

Argentine austral

The austral was the currency of Argentina between June 15, 1985 and December 31, 1991. It was subdivided into 100 centavos. The symbol was an uppercase A with an extra horizontal line . This symbol appeared on all coins issued in this currency , to distinguish them from earlier currencies...

10,000 per US$

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

. Furthermore any citizen could go to a bank and convert any amount of domestic currency to dollars. To secure this "convertibility

Convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged....

" the Central Bank of Argentina had to keep its U.S. dollar foreign exchange reserves

Foreign exchange reserves

Foreign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

at the same level as the cash in circulation

Monetary base

In economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

. The initial aim of such measures was to ensure the acceptance of domestic currency since during 1989 and 1990 hyperinflation

Hyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

peaks people had started to reject it as payment demanding U.S. dollars instead. This regime was later fixated by a law (Ley de Convertibilidad) which restored the peso

Peso

The word peso was the name of a coin that originated in Spain and became of immense importance internationally...

as the Argentine currency with a monetary value fixed

Fixed exchange rate

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime wherein a currency's value is matched to the value of another single currency or to a basket of other currencies, or to another measure of value, such as gold.A fixed exchange rate is usually used to...

by law to the value of the U.S. dollar.

As a result of the convertibility law inflation dropped sharply, price stability was assured and the value of the currency was preserved. This raised the quality of life

Quality of life

The term quality of life is used to evaluate the general well-being of individuals and societies. The term is used in a wide range of contexts, including the fields of international development, healthcare, and politics. Quality of life should not be confused with the concept of standard of...

for many citizens who could now afford to travel abroad, buy imported goods or ask for credit in dollars at very low interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

rates.

Argentina still had external debts to pay and it needed to keep borrowing money. The fixed exchange rate made imports cheap, producing a constant flight of dollars away from the country and a progressive loss of Argentina's industrial infrastructure

Industry

Industry refers to the production of an economic good or service within an economy.-Industrial sectors:There are four key industrial economic sectors: the primary sector, largely raw material extraction industries such as mining and farming; the secondary sector, involving refining, construction,...

which led to an increase in unemployment

Unemployment

Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks...

.

In the meantime, government spending continued to be high and corruption

Political corruption

Political corruption is the use of legislated powers by government officials for illegitimate private gain. Misuse of government power for other purposes, such as repression of political opponents and general police brutality, is not considered political corruption. Neither are illegal acts by...

was rampant. Argentina's public debt grew enormously during the 1990s and the country showed no true signs of being able to pay it. The IMF, however, kept lending money to Argentina and postponing its payment schedules. Massive tax evasion

Tax evasion

Tax evasion is the general term for efforts by individuals, corporations, trusts and other entities to evade taxes by illegal means. Tax evasion usually entails taxpayers deliberately misrepresenting or concealing the true state of their affairs to the tax authorities to reduce their tax liability,...

and money laundering

Money laundering

Money laundering is the process of disguising illegal sources of money so that it looks like it came from legal sources. The methods by which money may be laundered are varied and can range in sophistication. Many regulatory and governmental authorities quote estimates each year for the amount...

explained a large part of the evaporation of funds toward offshore banks. A congressional committee started investigations in 2001 over accusations that the Central Bank of Argentina's governor, Pedro Pou, as well as part of the board of directors, had failed to investigate cases of alleged money laundering through Argentina's financial system. Clearstream

Clearstream

Clearstream Banking S.A. is the clearing and settlement division of Deutsche Börse, based in Luxembourg and Frankfurt. Clearstream was created in January 2000 through the merger of Cedel International and Deutsche Börse Clearing...

was also accused of being instrumental in this global financial process.

Other countries, such as Mexico and Brazil (both of which also happen to be important trade partners for Argentina), faced economic crises of their own leading other countries to mistrust Latin American countries moneywise and affecting the overall economy of the region. The influx of foreign currency provided by the privatisation

Privatization

Privatization is the incidence or process of transferring ownership of a business, enterprise, agency or public service from the public sector to the private sector or to private non-profit organizations...

of state companies had dried up. After 1999 Argentine exports were harmed by the devaluation

Devaluation

Devaluation is a reduction in the value of a currency with respect to those goods, services or other monetary units with which that currency can be exchanged....

of the Brazilian real

Brazilian real

The real is the present-day currency of Brazil. Its sign is R$ and its ISO code is BRL. It is subdivided into 100 centavos ....

and a considerable international revaluation

Revaluation

Revaluation means a rise of a price of goods or products. This term is specially used as revaluation of a currency, where it means a rise of currency to the relation with a foreign currency in a fixed exchange rate. In floating exchange rate correct term would be appreciation. The antonym of...

of the dollar effectively revaluing the peso against its major trading partners, Brazil (30% of total trade flows) and the euro area

Eurozone

The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender...

(23% of total trade flows).

By 1999, newly elected President Fernando de la Rúa

Fernando de la Rúa

Fernando de la Rúa is an Argentine politician. He was president of the country from December 10, 1999 to December 21, 2001 for the Alliance for Work, Justice and Education ....

faced a country where unemployment had risen to a critical point and the undesirable effects of the fixed exchange rate were showing forcefully. In 1999 Argentina's gross domestic product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

(GDP) dropped 4% and the country entered a recession

Recession

In economics, a recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way...

which lasted three years ending in a collapse. Economic stability

Economic stability

Economic stability refers to an absence of excessive fluctuations in the macroeconomy. An economy with fairly constant output growth and low and stable inflation would be considered economically stable. An economy with frequent large recessions, a pronounced business cycle, very high or variable...

became economic stagnation

Economic stagnation

Economic stagnation or economic immobilism, often called simply stagnation or immobilism, is a prolonged period of slow economic growth , usually accompanied by high unemployment. Under some definitions, "slow" means significantly slower than potential growth as estimated by experts in macroeconomics...

(even deflation at times) and the economic measures taken did nothing to avert it. In fact the government continued the contractive economic policies of its predecessor. The possible solution (abandonment of the exchange peg, with a voluntary devaluation of the peso) was considered political suicide and a recipe for economic disaster. By the end of the century, a spectrum of complementary currencies

Complementary currency

Complementary currency is a currency meant to be used as a complement to another currency, typically a national currency. Complementary currency is sometimes referred to as complementary community currency or as community currency...

had emerged.

While the provinces

Provinces of Argentina

Argentina is subdivided into twenty-three provinces and one autonomous city...

had always issued complementary currency in the form of bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

and drafts to brave shortages of cash, the maintenance of the convertibility regime led to this being done in an unprecedented scale. This led to their being called "quasi-currencies

Complementary currency

Complementary currency is a currency meant to be used as a complement to another currency, typically a national currency. Complementary currency is sometimes referred to as complementary community currency or as community currency...

", the strongest of them being Buenos Aires province's Patacón

Patacón (bond)

The Patacón was a bond issued by the government of the province of Buenos Aires, Argentina, during 2001...

. The national state also issued its own quasi-currency—the LECOP

LECOP

The LECOP was a bond issued by Argentine national government. LECOP , stands for Letra de Cancelación de Obligaciones Provinciales ....

.

Event

Since the early 1990s, Argentina had been closely engaged with the International Monetary FundInternational Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF), with the organism providing the country with a reliable access to credit and guiding its economic reforms. When its economy entered in recession the federal government deficit widened to 2.5% of GDP in 1999 and its external debt surpassed 50% of GDP. Seeing these levels as excessive, the IMF advised the government that it needed to address the issue of investor confidence, and that the government had to balance its budget by implementing austerity measures to do so. Complying with IMF's requests, De la Rua administration committed to a sustained effort of fiscal consolidation and implemented billion in cuts in its first weeks in office in late 1999. In June 2000, with unemployment at 14% and projections of 3.5% GDP growth for the year, that move was furthered by a package of million in spending cuts and billion in tax increases. Following De la Rúa's vice president Carlos Álvarez

Carlos Álvarez (vice-president)

Carlos Alberto "Chacho" Álvarez is an Argentine politician; he was Vice-President of Argentina during part of President Fernando de la Rúa's mandate, and currently heads the Aladi Secretariat....

resignment in over bribery suspicions in the Upper House, the crisis accelerated.

GDP growth projections proved to be overly optimistic (instead of growing, real GDP shrank 0.8%), and lagging tax receipts prompted the government to freeze spending and cut retirement benefits again in . In early November, Standard & Poor's

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

placed Argentina on a credit watch, and a treasury bill auction resulted in yields reaching 16% (up from 9% in July); this was the second highest rate of any country in South America at the time. Rising bond yields left Argentina with no choice but to borrow from major international lenders, such as the IMF, World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

, and the U.S. Treasury, which would lend to the government at below-market rates, and to comply with their conditions. Several more rounds of belt-tightening followed. José Luis Machinea

José Luis Machinea

José Luis Machinea is an Argentine economist and United Nations official.-Career:Machinea was born in Buenos Aires, and earned a degree in Economics from the Universidad Católica Argentina in 1968. He first entered public service in 1974, as a member of the Central Bank's Center for Montary and...

resigned as the Minister of Economy in February 2001. He was replaced with Ricardo López Murphy

Ricardo López Murphy

Ricardo Hipólito López Murphy is an Argentine economist and politician.-Career:López Murphy was born in Adrogué, Buenos Aires Province. He attended the National University of La Plata, where he was awarded the title of "Licenciado en Economía" in 1975...

, who lasted 8 days in the office before being replaced with Domingo Cavallo

Domingo Cavallo

Domingo Felipe "Mingo" Cavallo is an Argentine economist and politician. He has a long history of public service and is known for implementing the Convertibilidad plan, which fixed the dollar-peso exchange rate at 1:1 between 1991 and 2001, which brought the Argentine inflation rate down from over...

. In July 2001, Standard and Poor's cut the credit rating of the country to B–. In July 2001 the government instituted an unpopular across-the-board pay cut of up to 13% to all civil servants and an equivalent cut to government pension benefits - seventh austerity plan implemented since President Fernando de la Rua

Fernando de la Rúa

Fernando de la Rúa is an Argentine politician. He was president of the country from December 10, 1999 to December 21, 2001 for the Alliance for Work, Justice and Education ....

took office in 1999, triggering nationwide strikes, and, starting in August, it was forced to pay salaries of highest-paid employees in I.O.U.s

Patacón (bond)

The Patacón was a bond issued by the government of the province of Buenos Aires, Argentina, during 2001...

instead of money. This further depressed the economy, which was already weak after a three-year recession. The unemployment rate rose to 16.4% in August 2001 up from a 14.7% a month earlier, and it stood at 20% by December.

In , public discontent with the economic conditions was expressed in the nationwide election

Argentine legislative election, 2001

Argentina held national parliamentary elections on Sunday, 14 October 2001. Turnout was 75.6% and the results were as follows:-Chamber of Deputies:-Senate:-Background:...

. President Fernando de la Rua

Fernando de la Rúa

Fernando de la Rúa is an Argentine politician. He was president of the country from December 10, 1999 to December 21, 2001 for the Alliance for Work, Justice and Education ....

's alliance lost seats in both chambers of Argentina's congress

Argentine National Congress

The Congress of the Argentine Nation is the legislative branch of the government of Argentina. Its composition is bicameral, constituted by a 72-seat Senate and a 257-seat Chamber of Deputies....

, leaving it in the minority. Over 20% of all voters chose to enter so-called "anger votes", returning blank or defaced ballots rather than indicate support of any candidate.

The crisis intensified when, on , the IMF refused to release a billion tranche of its loan, citing the failure of the Argentinean government to reach previously agreed-upon budget deficit targets, and demanded further budget cuts, amounting 10% of the federal budget. On 4 December, Argentinean bond yields stood at 34% over U.S. treasury bonds, and, by , the spread jumped to 42%.

By the end of , people fearing the worst began withdrawing large sums of money from their bank account

Bank account

A Bank account is a financial account recording the financial transactions between the customer and the bank and the resulting financial position of the customer with the bank .-Account types:...

s, turning pesos into dollars and sending them abroad, causing a run on the banks

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

. On the government enacted a set of measures, informally known as the corralito

Corralito

Corralito was the informal name for the economic measures taken in Argentina at the end of 2001 by Minister of Economy Domingo Cavallo in order to stop a bank run, and which were fully in force for one year. The corralito almost completely froze bank accounts and forbade withdrawals from U.S...

, that effectively froze all bank accounts for twelve months, allowing for only minor sums of cash to be withdrawn, initially announced to be of just $

Argentine peso

The peso is the currency of Argentina, identified by the symbol $ preceding the amount in the same way as many countries using dollar currencies. It is subdivided into 100 centavos. Its ISO 4217 code is ARS...

250 a week.

December 2001 riots and political turmoil

Because of this allowance limit and the serious problems it caused in certain cases, many Argentines became enraged and took to the streets of important cities, especially Buenos AiresBuenos Aires

Buenos Aires is the capital and largest city of Argentina, and the second-largest metropolitan area in South America, after São Paulo. It is located on the western shore of the estuary of the Río de la Plata, on the southeastern coast of the South American continent...

. They engaged in a form of popular protest that became known as cacerolazo

Cacerolazo

A cacerolazo or cacerolada is a form of popular protest practised in certain Spanish-speaking countries – in particular Argentina and Chile – which consists in a group of people creating noise by banging pots, pans, and other utensils in order to call for attention...

(banging pots and pans). These protests occurred especially in 2001 and 2002. At first the cacerolazos were simply noisy demonstrations

Demonstration (people)

A demonstration or street protest is action by a mass group or collection of groups of people in favor of a political or other cause; it normally consists of walking in a mass march formation and either beginning with or meeting at a designated endpoint, or rally, to hear speakers.Actions such as...

, but soon they included property destruction, often directed at banks, foreign privatized companies, and especially big American and European companies. Many businesses installed metal barriers because windows and glass facades were being broken, and even fires being ignited at their doors. Billboards

Billboard (advertising)

A billboard is a large outdoor advertising structure , typically found in high traffic areas such as alongside busy roads. Billboards present large advertisements to passing pedestrians and drivers...

of such companies as Coca Cola and others were brought down by the masses of demonstrators.

State of emergency

A state of emergency is a governmental declaration that may suspend some normal functions of the executive, legislative and judicial powers, alert citizens to change their normal behaviours, or order government agencies to implement emergency preparedness plans. It can also be used as a rationale...

, only to get the situation worsened, precipitating the violent protests of 20 and 21 December 2001

December 2001 riots (Argentina)

The December 2001 uprising was a period of civil unrest and rioting in Argentina, which took place during December 2001, with the most violent incidents taking place on December 19 and December 20 in the capital, Buenos Aires, Rosario and other large cities around the country.- Background :The...

in Plaza de Mayo

Plaza de Mayo

The Plaza de Mayo is the main square in downtown Buenos Aires, Argentina. It is flanked by Hipólito Yrigoyen, Balcarce, Rivadavia and Bolívar streets....

, where clashes between demonstrators and the police ended up with several people dead, and precipitated the fall of the government. De la Rúa eventually fled the Casa Rosada

Casa Rosada

La Casa Rosada is the official seat of the executive branch of the government of Argentina, and of the offices of the President. The President normally lives at the Quinta de Olivos, a compound in Olivos, Buenos Aires Province. Its characteristic color is pink, and is considered one of the most...

in a helicopter on 21 December. Following presidential succession procedures established in the Constitution

Constitution of Argentina

The constitution of Argentina is one of the primary sources of existing law in Argentina. Its first version was written in 1853 by a Constitutional Assembly gathered in Santa Fe, and the doctrinal basis was taken in part from the United States Constitution...

, the Senate chairman is the one in the line of succession in the absence of both president and vice-president in office. Therefore, Ramón Puerta

Ramón Puerta

Federico Ramón Puerta is an Argentine Peronist politician who has served as a governor, senator and national deputy and effectively acted as President of Argentina during 2001.-Biography:...

took office as caretaker's head of state

President of Argentina

The President of the Argentine Nation , usually known as the President of Argentina, is the head of state of Argentina. Under the national Constitution, the President is also the chief executive of the federal government and Commander-in-Chief of the armed forces.Through Argentine history, the...

, and the Legislative Assembly

Legislative Assembly

Legislative Assembly is the name given in some countries to either a legislature, or to one of its branch.The name is used by a number of member-states of the Commonwealth of Nations, as well as a number of Latin American countries....

(a body formed by merging both chambers of the Congress) was convened. By law, the candidates were the members of the Senate plus the Governors of the Provinces; Adolfo Rodríguez Saá

Adolfo Rodríguez Saá

Adolfo Rodríguez Saá Páez Montero is an Argentine Peronist politician. He was the governor of the province of San Luis during several terms, and briefly served as President of Argentina.-Biography:...

, then governor of San Luis

San Luis Province

San Luis is a province of Argentina located near the geographical center of the country . Neighboring provinces are, from the north clockwise, La Rioja, Córdoba, La Pampa, Mendoza and San Juan.-History:...

, was eventually appointed as the new interim president. During the last week of 2001, the interim government led by Rodríguez Saá, facing the impossibility of meeting debt payments, default

Default (finance)

In finance, default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant of the debt contract. A default is the failure to pay back a loan. Default may occur if the debtor is either...

ed on the larger part of the public debt, totalling no less than billion, what approximately represented the seventh portion of all the money borrowed by the Third World

Third World

The term Third World arose during the Cold War to define countries that remained non-aligned with either capitalism and NATO , or communism and the Soviet Union...

.

Politically, the most heated debate involved the time for the following elections—the spectrum ranged from March 2002 to October 2003 (the original date for the ending of De la Rúa's office).

Rodríguez Saá's economy team came up with a project designed to preserve the convertibility regime, dubbed the "Third Currency" Plan. It consisted of creating a new, non-convertible currency called Argentino coexisting with convertible pesos and U.S. dollars. It would only circulate as cash (checks, promissory notes or other instruments could be nominated in pesos or dollars but not in Argentinos) and would be partially guaranteed with federally managed land—such features were expected to counterbalance inflationary tendencies.

Argentinos having legal currency status would be used to redeem all complementary currency

Complementary currency

Complementary currency is a currency meant to be used as a complement to another currency, typically a national currency. Complementary currency is sometimes referred to as complementary community currency or as community currency...

already in circulation—the acceptance of which as a means of payment was quite uneven. It was hoped that preservation of convertibility would restore public confidence, while the non-convertible nature of this currency would allow for a measure of fiscal flexibility (unthinkable with pesos) that could ameliorate the crippling recession of economy. Critics called this plan merely a "controlled devaluation"; its advocates countered that since controlling a devaluation is perhaps its thorniest issue, this criticism was a praise in disguise. The "Third Currency" plan had enthusiastic supporters among mainstream economists (the most notorious being perhaps Martín Redrado

Martín Redrado

Hernán Martín Pérez Redrado is an Argentine economist and policy-maker. He served as President of the Central Bank of Argentina between September 2004 and January 2010.-Early life and career:...

, a former president of the central bank

Banco Central de la República Argentina

-Overview:Established by six Acts of Congress enacted on May 28, 1935, the bank replaced Argentina's Currency board, which had been in operation since 1890...

) citing sound technical arguments. However, it could never be implemented because the Rodríguez Saá government lacked the political support required.

Rodríguez Saá, utterly incapable of dealing with the crisis and unsupported by his own party

Justicialist Party

The Justicialist Party , or PJ, is a Peronist political party in Argentina, and the largest component of the Peronist movement.The party was led by Néstor Kirchner, President of Argentina from 2003 to 2007, until his death on October 27, 2010. The current Argentine president, Cristina Fernández de...

, resigned before the end of the year. The Legislative Assembly convened again, appointing Peronist Eduardo Duhalde

Eduardo Duhalde

-External links:...

—then a Senator for the Buenos Aires province—to take his place.

End of convertibility

In addition to the corralito, the Ministry of Economy dictated the pesificación ("peso-ification"), by which all bank accounts denominated in dollars would be converted to pesos at official rate. This measure angered most savings holders and appeals were made by many citizens to declare it unconstitutional.

After a few months, the exchange rate was left to float more or less freely. The peso suffered a huge depreciation, which in turn prompted inflation (since Argentina depended heavily on imports, and had no means to replace them locally at the time).

The economic situation became steadily worse with regards to inflation and unemployment during 2002. By that time the original 1-to-1 rate had increased to nearly 4 pesos per dollar, while the accumulated inflation since the devaluation was about 80%; these figures were considerably lower than those foretold by most orthodox economists at the time. The quality of life of the average Argentine was lowered proportionally; many businesses closed or went bankrupt, many imported products became virtually inaccessible, and salaries were left as they were before the crisis.

Since the volume of pesos did not fit the demand for cash (even after the devaluation) huge quantities of a wide spectrum of complementary currency

Complementary currency

Complementary currency is a currency meant to be used as a complement to another currency, typically a national currency. Complementary currency is sometimes referred to as complementary community currency or as community currency...

kept circulating alongside them. Fears of hyperinflation as a consequence of devaluation quickly eroded the attractiveness of their associated revenue, originally stated in convertible pesos. Their acceptability now ultimately depended on the State's willingness to take them as payment of taxes and other charges, consequently becoming very irregular. Very often they were taken at less than their nominal value—while the Patacón was frequently accepted at the same value as peso, Entre Ríos

Entre Ríos Province

Entre Ríos is a northeastern province of Argentina, located in the Mesopotamia region. It borders the provinces of Buenos Aires , Corrientes and Santa Fe , and Uruguay in the east....

's Federal was among the worst-faring, at an average 30% as the provincial government that had issued them was reluctant to take them back. There were also frequent rumors that the Government would simply banish complementary currency overnight (instead of redeeming them, even at disadvantageous rates), leaving their holders with useless printed paper.

Immediate effects

Aerolíneas Argentinas

Aerolíneas Argentinas , formally Aerolíneas Argentinas S.A., is Argentina's largest airline and serves as the country's flag carrier. Owned in its majority by the Argentine Government, the airline is headquartered in the Torre Bouchard, located in San Nicolás, Buenos Aires...

, for example, was one of the most affected Argentine companies, having to stop all international flights for various days in 2002. The airline came close to bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

, but survived.

Most barter

Barter

Barter is a method of exchange by which goods or services are directly exchanged for other goods or services without using a medium of exchange, such as money. It is usually bilateral, but may be multilateral, and usually exists parallel to monetary systems in most developed countries, though to a...

networks, viable as devices to ameliorate the shortage of cash during the recession, collapsed as large numbers of people turned to them, desperate to save as many pesos as they could for exchange for hard currency as a palliative for uncertainty.

Several thousand newly homeless and jobless Argentines found work as cartoneros, or cardboard collectors. The 2003 estimation of 30,000 to 40,000 people scavenged the streets for cardboard to eke out a living by selling it to recycling plants. This method accounts for only one of many ways of coping in a country that at the time suffered from an unemployment rate soaring at nearly 25%.

Agriculture was also affected: Argentine products were rejected in some international markets, for fear they might arrive damaged from the poor conditions they grew in, and the USDA

United States Department of Agriculture

The United States Department of Agriculture is the United States federal executive department responsible for developing and executing U.S. federal government policy on farming, agriculture, and food...

put restrictions on Argentine food and drugs arriving at the United States.

Producers of television channels were forced to produce more reality shows than any other type of shows, because these were generally cheap to produce as compared to other programmes. Virtually all education-related TV programmes were canceled.

Recovery

Néstor Kirchner

Néstor Carlos Kirchner was an Argentine politician who served as the 54th President of Argentina from 25 May 2003 until 10 December 2007. Previously, he was Governor of Santa Cruz Province since 10 December 1991. He briefly served as Secretary General of the Union of South American Nations ...

took office as the new president. Kirchner kept Duhalde's Minister of Economy, Roberto Lavagna

Roberto Lavagna

Roberto Lavagna is an Argentine economist and politician, and was the former Minister of Economy and Production of Argentina from April 27, 2002, to November 28, 2005.-Career:...

, in his post. Lavagna, a respected economist with centrist views, showed a considerable aptitude at managing the crisis, with the help of heterodox

Heterodoxy

Heterodoxy is generally defined as "any opinions or doctrines at variance with an official or orthodox position". As an adjective, heterodox is commonly used to describe a subject as "characterized by departure from accepted beliefs or standards"...

measures.

The economic outlook was completely different from that of the 1990s; the devalued peso made Argentine exports cheap and competitive abroad, while discouraging imports. In addition, the high price of soy

Soybean

The soybean or soya bean is a species of legume native to East Asia, widely grown for its edible bean which has numerous uses...

in the international market produced an injection of massive amounts of foreign currency (with China becoming a major buyer of Argentina's soy products).

The government encouraged import substitution

Import substitution

Import substitution industrialization or "Import-substituting Industrialization" is a trade and economic policy that advocates replacing imports with domestic production. It is based on the premise that a country should attempt to reduce its foreign dependency through the local production of...

and accessible credit for businesses, staged an aggressive plan to improve tax collection, and set aside large amounts of money for social welfare, while controlling expenditure in other fields.

As a result of the administration's productive model and controlling measures (selling reserve dollars in the public market), the peso slowly revalued, reaching a 3-to-1 rate to the dollar. Agricultural exports grew and tourism returned.

The huge trade surplus ultimately caused such an inflow of dollars that the government was forced to begin intervening to keep the peso from revaluing further, which would ruin the tax collection scheme (largely based on import taxes and royalties) and discourage further reindustrialisation. The central bank started buying dollars in the local market and stocking them as reserves. By December 2005, foreign currency reserves had reached billion (they were greatly reduced by the anticipated payment of the full debt to the IMF in ). The downside of this reserve accumulation strategy is that the dollars have to be bought with freshly issued pesos, which may induce inflation. The central bank neutralises a part of this monetary emission by selling Treasury

Treasury

A treasury is either*A government department related to finance and taxation.*A place where currency or precious items is/are kept....

letters. In this way the exchange rate has been stabilised near a reference value of 3 pesos to the dollar.

2004 in Argentina

-January:* 7 January: Roger Noriega, U.S. Sub-Secretary for the Western Hemisphere, criticizes Argentina's position on Cuba, and Minister of Foreign Affairs Rafael Bielsa says he feels affected and offended, starting a minor diplomatic crisis....

(which raises the demand of dollars), and the return of foreign investment (which brings fresh currency from abroad) after the successful restructuring of about three quarters of the external debt. The government has set up controls and restrictions aimed at keeping short-term speculative investment from destabilising the financial market.

Argentina's recovery suffered a minor setback in 2004 when rising industrial demand caused a short-lived energy crisis

Argentine energy crisis (2004)

The Argentine energy crisis was a natural gas supply shortage experienced by Argentina in 2004. After the recession triggered by the economic crisis and ending in 2002, Argentina's energy demands grew quickly as industry recovered, but extraction and transportation of natural gas, a cheap and...

. The prospect of future energy shortages are not discounted.

Argentina has managed to return to growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

with surprising strength; the GDP jumped 8.8% in 2003, 9.0% in 2004, 9.2% in 2005, 8.5% in 2006 and 8.7% in 2007. Though average wages have increased 17% annually since 2002 (jumping 25% in the year to May 2008), consumer prices have partly accompanied this surge; though not comparable to the levels of former crises, the inflation rate was 12.5% in 2005, 10% in 2006 and is believed by private economists to have approached 15% in 2007 and to exceed 20% during 2008(even if the Ministry of Economy refuses to acknowledge inflation greater than 10%). This has prompted the government to increase tariffs for exporters and to pressure retailers into one price truce after another in a bid to stabilize prices, so far with little effect.

While unemployment has been considerably reduced (it has been hovering around 8.5% since 2006), Argentina has so far failed to reach an equitable distribution of income

Lorenz curve

In economics, the Lorenz curve is a graphical representation of the cumulative distribution function of the empirical probability distribution of wealth; it is a graph showing the proportion of the distribution assumed by the bottom y% of the values...

(the wealthiest 10% of the population receives 31 times more income than the poorest 10%). This disparity, nevertheless, compares quite favorably to levels seen in most of Latin America.

Worker-owned cooperatives and self-management

During the economic collapse, many business owners and foreign investors drew all of their money out of the Argentine economy and sent it overseas. As a result, many small and medium enterprises closed due to lack of capital, thereby exacerbating unemployment. Many workers at these enterprises, faced with a sudden loss of employment and no source of income, decided to reopen businesses on their own, without the presence of the owners and their capital, as self-managed cooperativeCooperative

A cooperative is a business organization owned and operated by a group of individuals for their mutual benefit...

s.

Worker managed cooperative

Worker cooperative

A worker cooperative is a cooperative owned and democratically managed by its worker-owners. This control may be exercised in a number of ways. A cooperative enterprise may mean a firm where every worker-owner participates in decision making in a democratic fashion, or it may refer to one in which...

businesses range from ceramics factory Zanon (FaSinPat

FaSinPat

FaSinPat, formerly known as Zanon, is a worker-controlled ceramic tile factory in the southern Argentine province of Neuquén, and one of the most prominent in the recovered factory movement of Argentina...

), to the four-star Hotel Bauen

Hotel Bauen

The Hotel Bauen is a recuperated business located at 360 Callao Avenue in Buenos Aires run collectively by its workers, serving both as a hotel and as a free meeting place for Argentine leftist and workers' groups...

, to suit factory Brukman

Brukman factory

Brukman is a textile factory in Balvanera, Buenos Aires, Argentina . Currently under the control of a worker cooperative called "18 de Diciembre", it is among the most famous of the country's "recovered factories".-Background:...

, to printing press Chilavert, and many others. In some cases, former owners sent police to remove workers out of these workplaces; this was sometimes successful but in other cases workers defended occupied workplaces against the state, the police, and the bosses.