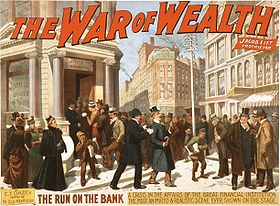

Bank run

Encyclopedia

A bank run occurs when a large number of bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

customers withdraw their deposits

Deposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

because they believe the bank is, or might become, insolvent

Insolvency

Insolvency means the inability to pay one's debts as they fall due. Usually used to refer to a business, insolvency refers to the inability of a company to pay off its debts.Business insolvency is defined in two different ways:...

. As a bank run progresses, it generates its own momentum, in a kind of self-fulfilling prophecy

Self-fulfilling prophecy

A self-fulfilling prophecy is a prediction that directly or indirectly causes itself to become true, by the very terms of the prophecy itself, due to positive feedback between belief and behavior. Although examples of such prophecies can be found in literature as far back as ancient Greece and...

(or positive feedback

Positive feedback

Positive feedback is a process in which the effects of a small disturbance on a system include an increase in the magnitude of the perturbation. That is, A produces more of B which in turn produces more of A. In contrast, a system that responds to a perturbation in a way that reduces its effect is...

): as more people withdraw their deposits, the likelihood of default increases, and this encourages further withdrawals. This can destabilize the bank to the point where it faces bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

.

A banking panic or bank panic is a financial crisis

Financial crisis

The term financial crisis is applied broadly to a variety of situations in which some financial institutions or assets suddenly lose a large part of their value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these...

that occurs when many banks suffer runs at the same time. A systemic banking crisis is one where all or almost all of the banking capital in a country is wiped out. The resulting chain of bankruptcies can cause a long economic recession. Much of the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

's economic damage was caused directly by bank runs. The cost of cleaning up a systemic banking crisis can be huge, with fiscal costs averaging 13% of GDP and economic output losses averaging 20% of GDP for important crises from 1970 to 2007.

Several techniques can help to prevent bank runs. They include temporary suspension of withdrawals, the organization of central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

s that act as a lender of last resort

Lender of last resort

A lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

, the protection of deposit insurance

Deposit insurance

Explicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due...

systems such as the U.S. Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

, and governmental bank regulation

Bank regulation

Bank regulations are a form of government regulation which subject banks to certain requirements, restrictions and guidelines. This regulatory structure creates transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things...

. These techniques do not always work: for example, even with deposit insurance, depositors may still be motivated by beliefs they may lack immediate access to deposits during a bank reorganization.

Theory

Under fractional-reserve bankingFractional-reserve banking

Fractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

, the type of banking currently used in most developed countries

Developed country

A developed country is a country that has a high level of development according to some criteria. Which criteria, and which countries are classified as being developed, is a contentious issue...

, banks retain only a fraction of their demand deposit

Demand deposit

Demand deposits, bank money or scriptural money are funds held in demand deposit accounts in commercial banks. These account balances are usually considered money and form the greater part of the money supply of a country.-History:...

s as cash. The remainder is invested in securities and loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

s, whose terms are typically longer than the demand deposits, resulting in an asset liability mismatch

Asset liability mismatch

In finance, an asset–liability mismatch occurs when the financial terms of an institution's assets and liabilities do not correspond. Several types of mismatches are possible....

. No bank has enough reserves

Bank reserves

Bank reserves are banks' holdings of deposits in accounts with their central bank , plus currency that is physically held in the bank's vault . The central banks of some nations set minimum reserve requirements...

on hand to cope with all deposits being taken out at once.

Diamond and Dybvig developed an influential model to explain why bank runs occur and why banks issue deposits that are more liquid

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

than their assets. According to the model, the bank acts as an intermediary between borrowers who prefer long-maturity loans and depositors who prefer liquid accounts.

In the model, business investment requires expenditures in the present to obtain returns that take time in coming, for example, spending on machines and buildings now for production in future years. A business or entrepreneur that needs to borrow to finance investment will want to give their investments a long time to generate returns before full repayment, and will prefer long maturity

Maturity (finance)

In finance, maturity or maturity date refers to the final payment date of a loan or other financial instrument, at which point the principal is due to be paid....

loans, which offer little liquidity to the lender. The same principle applies to individuals and households seeking financing to purchase large-ticket items such as housing

House

A house is a building or structure that has the ability to be occupied for dwelling by human beings or other creatures. The term house includes many kinds of different dwellings ranging from rudimentary huts of nomadic tribes to free standing individual structures...

or automobile

Automobile

An automobile, autocar, motor car or car is a wheeled motor vehicle used for transporting passengers, which also carries its own engine or motor...

s.

The households and firms who have the money to lend to these businesses may have sudden, unpredictable needs for cash, so they are often willing to lend only on the condition of being guaranteed immediate access to their money in the form of liquid demand deposit accounts, that is, accounts with shortest possible maturity. Since borrowers need money and depositors fear to make these loans individually, banks provide a valuable service by aggregating funds from many individual deposits, portioning them into loans for borrowers, and spreading the risks both of default and sudden demands for cash. Banks can charge much higher interest on their long-term loans than they pay out on demand deposits, allowing them to earn a profit.

If only a few depositors withdraw at any given time, this arrangement works well. Barring some major emergency on a scale matching or exceeding the bank's geographical area of operation, depositors' unpredictable needs for cash are unlikely to occur at the same time; that is, by the law of large numbers

Law of large numbers

In probability theory, the law of large numbers is a theorem that describes the result of performing the same experiment a large number of times...

, banks can expect only a small percentage of accounts withdrawn on any one day because individual expenditure needs are largely uncorrelated

Correlation

In statistics, dependence refers to any statistical relationship between two random variables or two sets of data. Correlation refers to any of a broad class of statistical relationships involving dependence....

. A bank can make loans over a long horizon, while keeping only relatively small amounts of cash on hand to pay any depositors who may demand withdrawals.

However, if many depositors withdraw all at once, the bank itself (as opposed to individual investors) may run short of liquidity, and depositors will rush to withdraw their money, forcing the bank to liquidate many of its assets at a loss, and eventually to fail. If such a bank were to attempt to call in its loans early, businesses might be forced to disrupt their production while individuals might need to sell their homes and/or vehicles, causing further losses to the larger economy. Even so, many if not most debtors would be unable to pay the bank in full on demand and would be forced to declare bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

, possibly affecting other creditors in the process.

A bank run can occur even when started by a false story. Even depositors who know the story is false will have an incentive to withdraw, if they suspect other depositors will believe the story. The story becomes a self-fulfilling prophecy

Self-fulfilling prophecy

A self-fulfilling prophecy is a prediction that directly or indirectly causes itself to become true, by the very terms of the prophecy itself, due to positive feedback between belief and behavior. Although examples of such prophecies can be found in literature as far back as ancient Greece and...

. Indeed, Robert K. Merton

Robert K. Merton

Robert King Merton was a distinguished American sociologist. He spent most of his career teaching at Columbia University, where he attained the rank of University Professor...

, who coined the term self-fulfilling prophecy, mentioned bank runs as a prime example of the concept in his book Social Theory and Social Structure

Social Theory and Social Structure

Social Theory and Social Structure was a landmark publication in sociology by Robert K. Merton. It has been translated into close to 20 languages and is one of the most frequently cited texts in social sciences...

.

The Diamond-Dybvig model provides an example of an economic game

Game theory

Game theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

with more than one Nash equilibrium

Nash equilibrium

In game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

, where it is logical for individual depositors to engage in a bank run once they suspect one might start, even though that run will cause the bank to collapse.

Systemic banking crises

A bank run is the sudden withdrawal of deposits of just one bank. A banking panic or bank panic is a financial crisisFinancial crisis

The term financial crisis is applied broadly to a variety of situations in which some financial institutions or assets suddenly lose a large part of their value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these...

that occurs when many banks suffer runs at the same time, as a cascading failure

Cascading failure

A cascading failure is a failure in a system of interconnected parts in which the failure of a part can trigger the failure of successive parts.- Cascading failure in power transmission :...

. In a systemic banking crisis, all or almost all of the banking capital in a country is wiped out; this can result when regulators ignore systemic risk

Systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to risk associated with any one individual entity, group or component of a system. It can be defined as "financial system instability, potentially catastrophic, caused or exacerbated by...

s and spillover effect

Spillover effect

Spillover effects are externalities of economic activity or processes that affect those who are not directly involved. Odours from a rendering plant are negative spillover effects upon its neighbours; the beauty of a homeowner's flower garden is a positive spillover effect upon neighbours.In the...

s.

Systemic banking crises are associated with substantial fiscal costs and large output losses. Frequently, emergency liquidity support and blanket guarantees have been used to contain these crises, not always successfully. Although fiscal tightening may help contain market pressures if a crisis is triggered by unsustainable fiscal policies, expansionary fiscal policies are typically used. In crises of liquidity and solvency, central banks can provide liquidity to support illiquid banks. Depositor protection can help restore confidence, although it tends to be costly and does not necessarily speed up economic recovery. Intervention is often delayed in the hope that recovery will occur, and this delay increases the stress on the economy.

Some measures are more effective than others in containing economic fallout and restoring the banking system after a systemic crisis. These include establishing the scale of the problem, targeted debt relief programs to distressed borrowers, corporate restructuring programs, recognizing bank losses, and adequately capitalizing banks. Speed of intervention appears to be crucial; intervention is often delayed in the hope that insolvent banks will recover if given liquidity support and relaxation of regulations, and in the end this delay increases stress on the economy. Programs that are targeted, that specify clear quantifiable rules that limit access to preferred assistance, and that contain meaningful standards for capital regulation, appear to be more successful. According to IMF, government-owned asset management companies (bad bank

Bad bank

Bad bank is a term for a financial institution created to hold nonperforming assets owned by a state guaranteed bank. Such institutions have been created to address challenges arising during an economic credit crunch wherein private banks are allowed to take problem assets off their books...

s) are largely ineffective due to political constraints.

A silent run occurs when the implicit fiscal deficit from a government's unbooked loss exposure to zombie bank

Zombie bank

A zombie bank is a financial institution that has an economic net worth less than zero but continues to operate because its ability to repay its debts is shored up by implicit or explicit government credit support...

s is large enough to deter depositors of those banks. As more depositors and investors begin to doubt whether a government can support a country's banking system, the silent run on the system can gather steam, causing the zombie banks' funding costs to increase. If a zombie bank sells some assets at market value, its remaining assets contain a larger fraction of unbooked losses; if it rolls over its liabilities at increased interest rates, it squeezes its profits along with the profits of healthier competitors. The longer the silent run goes on, the more benefits are transferred from healthy banks and taxpayers to the zombie banks. The term is also used when a large number of depositors in countries with deposit insurance draw down their balances below the limit for deposit insurance.

The cost of cleaning up after a crisis can be huge. In systemically important banking crises in the world from 1970 to 2007, the average net recapitalization cost to the government was 6% of GDP, fiscal costs associated with crisis management averaged 13% of GDP (16% of GDP if expense recoveries are ignored), and economic output losses averaged about 20% of GDP during the first four years of the crisis.

Individual banks

Some prevention techniques apply to individual banks, independently of the rest of the economy.- A bank may try to hide information that might spark a run. For example, in the days before deposit insurance, it made sense for a bank to have a large lobby and fast service, to prevent the formation of a line of depositors extending out into the street which might cause passers-by to infer a bank run.

- Banks can encourage customers to make term deposits that cannot be withdrawn on demand. If term deposits form a high enough percentage of a bank's liabilities its vulnerability to bank runs will be reduced considerably. The drawback is that banks have to pay a higher interest rate on term deposits.

- A bank can temporarily suspend withdrawals to stop a run; this is called suspension of convertibility. In many cases the threat of suspension prevents the run, which means the threat need not be carried out.

- To clean up after a bank failure, the government may set up a 'bad bankBad bankBad bank is a term for a financial institution created to hold nonperforming assets owned by a state guaranteed bank. Such institutions have been created to address challenges arising during an economic credit crunch wherein private banks are allowed to take problem assets off their books...

', which is a new government-run asset management corporation that buys individual nonperforming assets from one or more private banks, reducing the proportion of junk bonds in their asset pools, and then acts as the creditor in the insolvency cases that follow. This, however, creates a moral hazard problem, essentially subsidizing bankruptcy: temporarily underperforming debtors can be forced to file for bankruptcy in order to make them eligible to be sold to the bad bank.

Collective prevention

Some prevention techniques apply across the whole economy, though they may still allow individual institutions to fail.- Full-reserve bankingFull-reserve bankingFull-reserve banking, also known as 100% reserve banking, is a banking practice in which the full amount of each depositor's funds are kept in reserve, as cash or other highly liquid assets...

is the hypothetical case where the reserve ratio is set to 100%. Under this approach, the risk of bank runs would be eliminated, and banks would match maturities of deposits and loans to avoid vulnerability to runs.

- A less severe alternative to full-reserve banking is a reserve ratio requirement, which limits the proportion of deposits which a bank can lend out, making it less likely for a bank run to start, as more reserves will be available to satisfy the demands of depositors. This practice sets a limit on the fraction in fractional-reserve bankingFractional-reserve bankingFractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

.

- TransparencyTransparency (market)In economics, a market is transparent if much is known by many about:* What products, services or capital assets are available.* What price.* Where....

may help prevent crises spreading through the banking system. In the context of the recent crisis, the extreme complexity of certain types of assets made it difficult for market participants to assess which financial institutions would survive, which amplified the crisis by making most institutions very reluctant to lend to one another.

- Central banks act as a lender of last resortLender of last resortA lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

. To prevent a bank run, the central bank guarantees that it will make short-term loans to banks, to ensure that, if they remain economically viable, they will always have enough liquidity to honor their deposits. Walter BagehotWalter BagehotWalter Bagehot was an English businessman, essayist, and journalist who wrote extensively about literature, government, and economic affairs.-Early years:...

's book Lombard Street provides influential early analysis of the role of the lender of last resortLender of last resortA lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

.

- Deposit insuranceDeposit insuranceExplicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due...

systems insure each depositor up to a certain amount, so that depositors' savings are protected even if the bank fails. This removes the incentive to withdraw one's deposits simply because others are withdrawing theirs. However, depositors may still be motivated by fears they may lack immediate access to deposits during a bank reorganization.

The role of the lender of last resort, and the existence of deposit insurance, both create moral hazard

Moral hazard

In economic theory, moral hazard refers to a situation in which a party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party insulated from risk behaves differently from how it would if it were fully exposed to the risk.Moral hazard...

, since they reduce banks' incentive to avoid making risky loans. They are nonetheless standard practice, as the benefits of collective prevention are thought to outweigh the costs of excessive risk-taking.

History

Credit cycle

The credit cycle is the expansion and contraction of access to credit over the course of the business cycle. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and some members of the Austrian school, regard credit cycles as the fundamental process...

and its subsequent contraction. In the 16th century onwards, English goldsmiths issuing promissory notes suffered severe failures due to bad harvests, plummeting parts of the country into famine and unrest. Other examples are the Dutch Tulip mania

Tulip mania

Tulip mania or tulipomania was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then suddenly collapsed...

s (1634–1637), the British South Sea Bubble (1717–1719), the French Mississippi Company

Mississippi Company

The "Mississippi Company" became the "Company of the West" and expanded as the "Company of the Indies" .-The Banque Royale:...

(1717–1720), the post-Napoleonic depression (1815–1830) and the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

(1929–1939).

Bank runs have also been used to blackmail individuals or governments. In 1832, for example, the British government under the Duke of Wellington

Arthur Wellesley, 1st Duke of Wellington

Field Marshal Arthur Wellesley, 1st Duke of Wellington, KG, GCB, GCH, PC, FRS , was an Irish-born British soldier and statesman, and one of the leading military and political figures of the 19th century...

overturned a majority government on the orders of the king, George IV

George IV of the United Kingdom

George IV was the King of the United Kingdom of Great Britain and Ireland and also of Hanover from the death of his father, George III, on 29 January 1820 until his own death ten years later...

, to prevent reform (the later 1832 Reform Act). Wellesley's actions angered reformers, and they threatened a run on the banks under the rallying cry "Stop the Duke, go for gold!".

Many of the recessions in the United States were caused by banking panics. The Great Depression contained several banking crises consisting of runs on multiple banks from 1929 to 1933; some of these were specific to regions of the U.S. Banking panics began in October 1930, one year after the stock market crash, triggered by the collapse of correspondent networks; the bank runs became worse after financial conglomerates in New York and Los Angeles failed in prominently-covered scandals. Much of the Depression's economic damage was caused directly by bank runs, and institutions put into place after the Depression have prevented runs on U.S. commercial banks since the 1930s, even under conditions such as the U.S. savings and loan crisis of the 1980s and 1990s

Savings and Loan crisis

The savings and loan crisis of the 1980s and 1990s was the failure of about 747 out of the 3,234 savings and loan associations in the United States...

. The Depression's bank runs left a lasting mark on the American psyche, exhibited in sometimes disturbing images such as the bleak scenes in the movie It's a Wonderful Life

It's a Wonderful Life

It's a Wonderful Life is a 1946 American Christmas drama film produced and directed by Frank Capra and based on the short story "The Greatest Gift" written by Philip Van Doren Stern....

, where the fictional hero George Bailey

George Bailey (fictional character)

George Bailey is a fictional character and the main protagonist in Frank Capra's 1946 film It's a Wonderful Life. He is played by James Stewart. He is loosely based on George Pratt, a character in Philip Van Doren Stern's The Greatest Gift....

struggles to keep his Building & Loan open with a crowd of customers demanding their deposits.

The global financial crisis that began in 2007 was centered around market-liquidity failures that were comparable to a bank run. The crisis contained a wave of bank nationalizations, including those associated with Northern Rock

Northern Rock

Northern Rock plc is a British bank, best known for becoming the first bank in 150 years to suffer a bank run after having had to approach the Bank of England for a loan facility, to replace money market funding, during the credit crisis in 2007. Having failed to find a commercial buyer for...

of the UK and IndyMac of the U.S. This crisis was caused by low real interest rates stimulating an asset price bubble fuelled by new financial products that were not stress tested and that failed in the downturn.

In addition to the plot of It's a Wonderful Life

It's a Wonderful Life

It's a Wonderful Life is a 1946 American Christmas drama film produced and directed by Frank Capra and based on the short story "The Greatest Gift" written by Philip Van Doren Stern....

(1946), notable fictional depictions of bank runs include those in American Madness

American Madness

American Madness is a 1932 American film directed by Frank Capra and starring Walter Huston as a New York banker embroiled in scandal. The story thematically anticipates Capra's 1946 classic It's a Wonderful Life, in which Capra repeats the "run on the bank" scene...

(1932) and Mary Poppins

Mary Poppins (film)

Mary Poppins is a 1964 musical film starring Julie Andrews and Dick Van Dyke, produced by Walt Disney, and based on the Mary Poppins books series by P. L. Travers with illustrations by Mary Shepard. The film was directed by Robert Stevenson and written by Bill Walsh and Don DaGradi, with songs by...

(1964).