Fractional-reserve banking

Encyclopedia

Fractional-reserve banking is a form of banking where banks maintain reserves

(of cash and coin or deposits at the central bank

) that are only a fraction of the customer's deposits

. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction (called the reserve ratio

) of the quantity of deposits as reserves. Some of the funds lent out are subsequently deposited with another bank, increasing deposits at that second bank and allowing further lending. As most bank deposits are treated as money

in their own right, fractional reserve banking increases the money supply

, and banks are said to create money

. Due to the prevalence of fractional reserve banking, the broad money supply of most countries is a multiple larger than the amount of base money

created by the country's central bank

. That multiple (called the money multiplier

) is determined by the reserve requirement

or other financial ratio

requirements imposed by financial regulators, and by the excess reserves

kept by commercial banks.

Central bank

s generally mandate reserve requirement

s that require banks to keep a minimum fraction of their demand deposits as cash reserves. This both limits the amount of money creation

that occurs in the commercial banking system, and ensures that banks have enough ready cash to meet normal demand for withdrawals. Problems can arise, however, when depositors seek withdrawal of a large proportion of deposits at the same time; this can cause a bank run

or, when problems are extreme and widespread, a systemic crisis

. To mitigate this risk, the governments of most countries (usually acting through the central bank

) regulate and oversee

commercial banks, provide deposit insurance

and act as lender of last resort

to commercial banks.

Fractional-reserve banking is the most common form of banking and is practiced in almost all countries. Although Islamic banking

prohibits the making of profit from interest on debt, a form of fractional-reserve banking is still evident in most Islamic countries.

s and silver coin

s at goldsmith

s, receiving in turn a note

for their deposit

(see Bank of Amsterdam). Once these notes became a trusted medium of exchange

an early form of paper money

was born, in the form of the goldsmiths' notes.

As the notes were used directly in trade

, the goldsmiths observed that people would not usually redeem all their notes at the same time, and they saw the opportunity to invest their coin reserves in interest-bearing loans and bills. This generated income

for the goldsmiths but left them with more notes on issue than reserves with which to pay them. A process was started that altered the role of the goldsmiths from passive guardians of bullion, charging fees for safe storage, to interest-paying and interest-earning banks. Thus fractional-reserve banking was born.

However, if creditor

s (note holders of gold originally deposited) lost faith in the ability of a bank to redeem (pay) their notes, many would try to redeem their notes at the same time. If in response a bank could not raise enough funds by calling in loans or selling bills, it either went into insolvency

or defaulted on its notes. Such a situation is called a bank run

and caused the demise of many early banks.

Repeated bank failures and financial crises led to the creation of central banks – public institutions that have the authority to regulate commercial banks, impose reserve requirements, and act as lender-of-last-resort

if a bank runs low on liquidity. The emergence of central banks mitigated the dangers associated with fractional reserve banking.

From about 1991 a consensus had emerged within developed economies about the optimum design of monetary policy methods. In essence central bankers gave up attempts to directly control the amount of money in the economy and instead moved to indirect methods by targeting interest rates. This consensus is criticized by some economists.

According to mainstream economic theory, regulated fractional-reserve banking also benefits the economy by providing regulators with powerful tools for manipulating the money supply

and interest rates, which many see as essential to a healthy economy.

) repayable on demand, that the bank can use to finance its investments in loans and interest bearing securities. Banks make a profit based on the difference between the interest they charge on the loans they make, and the interest they pay to their depositors (aggregately called the net interest margin

(NIM)). Since a bank lends out most of the money deposited, keeping only a fraction of the total as reserves, it necessarily has less money than the account balances of its depositors.

The main reason customers deposit funds at a bank is to store savings in the form of a demand claim on the bank. Depositors still have a claim to full repayment of their funds on demand even though most of the funds have already been invested by the bank in interest bearing loans and securities. Holders of demand deposits can withdraw all of their deposits at any time. If all the depositors of a bank did so at the same time a bank run

would occur, and the bank would likely collapse. Due to the practice of central banking, this is a rare event today, as central banks usually guarantee the deposits at commercial banks, and act as lender of last resort

when there is a run on a bank. However, there have been some recent bank runs: the Northern Rock crisis of 2007 in the United Kingdom is an example. The collapse of Washington Mutual

bank in September 2008, the largest bank failure in history, was preceded by a "silent run" on the bank, where depositors removed vast sums of money from the bank through electronic transfer. However, in these cases, the banks proved to have been insolvent at the time of the run. Thus, these bank runs merely precipitated failures that were inevitable in any case.

In the absence of crises that trigger bank run

s, fractional-reserve banking usually functions smoothly because at any one time relatively few depositors will make cash withdrawals simultaneously compared to the total amount on deposit, and a cash reserve can be maintained as a buffer to deal with the normal cash demands from depositors seeking withdrawals. In addition, in a normal economic environment, cash is steadily being introduced into the economy by the central bank

, and new funds are steadily being deposited into the commercial banks.

However, if a bank is experiencing a financial crisis, and net redemption demands are unusually large over a period of time, the bank will run low on cash reserves and will be forced to raise additional funds to avoid running out of reserves and defaulting on its obligations. A bank can raise funds from additional borrowings (e.g., by borrowing from the money market

or using lines of credit

held with other banks), or by selling assets, or by calling in short-term loans. If creditors are afraid that the bank is running out of cash or is insolvent, they have an incentive to redeem their deposits as soon as possible before other depositors access the remaining cash reserves before they do, triggering a cascading crisis that can result in a full-scale bank run

.

There are two types of money in a fractional-reserve banking system operating with a central bank:

When a deposit of central bank money is made at a commercial bank, the central bank money is removed from circulation and added to the commercial banks' reserves (it is no longer counted as part of M1 money supply). Simultaneously, an equal amount of new commercial bank money is created in the form of bank deposits. When a loan is made by the commercial bank (which keeps only a fraction of the central bank money as reserves), using the central bank money from the commercial bank's reserves, the m1 money supply expands by the size of the loan. This process is called deposit multiplication.

relending model of how loans are funded and how the money supply is affected. It also shows how central bank money is used to create commercial bank money from an initial deposit of $100 of central bank money. In the example, the initial deposit is lent out 10 times with a fractional-reserve rate of 20% to ultimately create $500 of commercial bank money. Each successive bank involved in this process creates new commercial bank money on a diminishing portion of the original deposit of central bank money. This is because banks only lend out a portion of the central bank money deposited, in order to fulfill reserve requirements and to ensure that they always have enough reserves on hand to meet normal transaction demands.

The relending model begins when an initial $100 deposit of central bank money is made into Bank A. Bank A takes 20 percent of it, or $20, and sets it aside as reserves, and then loans out the remaining 80 percent, or $80. At this point, the money supply actually totals $180, not $100, because the bank has loaned out $80 of the central bank money, kept $20 of central bank money in reserve (not part of the money supply), and substituted a newly created $100 IOU claim for the depositor that acts equivalently to and can be implicitly redeemed for central bank money (the depositor can transfer it to another account, write a check on it, demand his cash back, etc.). These claims by depositors on banks are termed demand deposits or commercial bank money and are simply recorded in a bank's accounts as a liability (specifically, an IOU to the depositor). From a depositor's perspective, commercial bank money is equivalent to central bank money – it is impossible to tell the two forms of money apart unless a bank run occurs (at which time everyone wants central bank money).

At this point in the relending model, Bank A now only has $20 of central bank money on its books. The loan recipient is holding $80 in central bank money, but he soon spends the $80. The receiver of that $80 then deposits it into Bank B. Bank B is now in the same situation as Bank A started with, except it has a deposit of $80 of central bank money instead of $100. Similar to Bank A, Bank B sets aside 20 percent of that $80, or $16, as reserves and lends out the remaining $64, increasing money supply by $64. As the process continues, more commercial bank money is created. To simplify the table, a different bank is used for each deposit. In the real world, the money a bank lends may end up in the same bank so that it then has more money to lend out.

Although no new money was physically created in addition to the initial $100 deposit, new commercial bank money is created through loans. The 2 boxes marked in red show the location of the original $100 deposit throughout the entire process. The total reserves plus the last deposit (or last loan, whichever is last) will always equal the original amount, which in this case is $100. As this process continues, more commercial bank money is created. The amounts in each step decrease towards a limit. If a graph is made showing the accumulation of deposits, one can see that the graph is curved and approaches a limit. This limit is the maximum amount of money that can be created with a given reserve rate. When the reserve rate is 20%, as in the example above, the maximum amount of total deposits that can be created is $500 and the maximum increase in the money supply is $400.

Although no new money was physically created in addition to the initial $100 deposit, new commercial bank money is created through loans. The 2 boxes marked in red show the location of the original $100 deposit throughout the entire process. The total reserves plus the last deposit (or last loan, whichever is last) will always equal the original amount, which in this case is $100. As this process continues, more commercial bank money is created. The amounts in each step decrease towards a limit. If a graph is made showing the accumulation of deposits, one can see that the graph is curved and approaches a limit. This limit is the maximum amount of money that can be created with a given reserve rate. When the reserve rate is 20%, as in the example above, the maximum amount of total deposits that can be created is $500 and the maximum increase in the money supply is $400.

For an individual bank, the deposit is considered a liability whereas the loan it gives out and the reserves are considered assets. Deposits will always be equal to loans plus a bank's reserves, since loans and reserves are created from deposits. This is the basis for a bank's balance sheet

.

Fractional reserve banking allows the money supply to expand or contract. Generally the expansion or contraction of the money supply is dictated by the balance between the rate of new loans being created and the rate of existing loans being repaid or defaulted on. The balance between these two rates can be influenced to some degree by actions of the central bank.

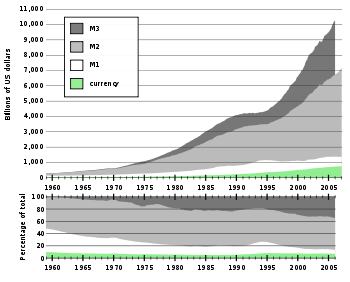

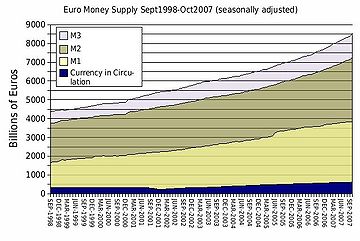

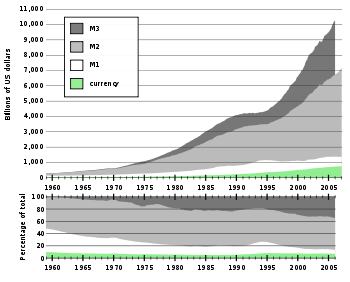

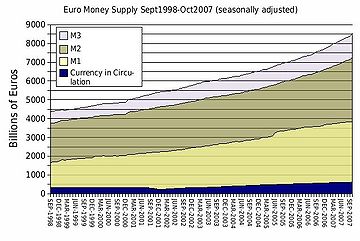

This table gives an outline of the makeup of money supplies

worldwide. Most of the money in any given money supply consists of commercial bank money. The value of commercial bank money is based on the fact that it can be exchanged freely at a bank for central bank money.

The actual increase in the money supply through this process may be lower, as (at each step) banks may choose to hold reserves in excess

of the statutory minimum, borrowers may let some funds sit idle, and some members of the public may choose to hold cash, and there also may be delays or frictions in the lending process. Government regulations may also be used to limit the money creation process by preventing banks from giving out loans even though the reserve requirements have been fulfilled.

The most common mechanism used to measure this increase in the money supply is typically called the money multiplier. It calculates the maximum amount of money that an initial deposit can be expanded to with a given reserve ratio.

The most common mechanism used to measure this increase in the money supply is typically called the money multiplier. It calculates the maximum amount of money that an initial deposit can be expanded to with a given reserve ratio.

Example

For example, with the reserve ratio of 20 percent, this reserve ratio, R, can also be expressed as a fraction:

So then the money multiplier, m, will be calculated as:

This number is multiplied by the initial deposit to show the maximum amount of money it can be expanded to.

The money creation process is also affected by the currency drain ratio (the propensity of the public to hold banknotes rather than deposit them with a commercial bank), and the safety reserve ratio (excess reserves

beyond the legal requirement that commercial banks voluntarily hold—usually a small amount). Data for "excess" reserves and vault cash are published regularly by the Federal Reserve in the United States. In practice, the actual money multiplier varies over time, and may be substantially lower than the theoretical maximum.

Confusingly there are many different "money multipliers", some referring to ratios of rates of change of different money measures and others referring to ratios of absolute values of money measures.

s is that they are intended to prevent banks from:

In practice, some central banks do not require reserves to be held, and in some countries that do, such as the USA and the EU they are not required to be held during the day when the banks are lending, and banks can borrow from other banks at near the central bank policy rate to ensure they have the necessary amount of required reserves by the close of business. Required reserves are therefore considered by some central bankers, monetary economists and text books to only play a very small role in limiting money creation in these countries. Most commentators agree however, that they help the banks have sufficient supplies of highly liquid assets, so that the system operates in an orderly fashion and maintains public confidence. The UK for example, which does not have required reserves, does have requirements that the banks keep a certain amount of cash, and in Australia while there are no reserve requirements, there are a variety of requirements to ensure the banks have a stabilising ratio of liquid assets, such as deposits held with local banks.

In addition to reserve requirements, there are other required financial ratio

s that affect the amount of loans that a bank can fund. The capital requirement ratio

is perhaps the most important of these other required ratios. When there are no mandatory reserve requirements, which are considered by some mainstream economists to restrict lending, the capital requirement ratio acts to prevent an infinite amount of bank lending.

date to the 19th century, and were described by Joseph Schumpeter

, and later the post-Keynesians. Endogenous money theory states that the supply of money is credit-driven and determined endogenously by the demand for bank loans, rather than exogenously by monetary authorities.

Charles Goodhart

worked for many years to encourage a different approach to money supply analysis and said the base money multiplier model was "such an incomplete way of describing the process of the determination of the stock of money that it amounts to misinstruction" Ten years later he said: "Almost all those who have worked in a [central bank] believe that this view is totally mistaken; in particular, it ignores the implications of several of the crucial institutional features of a modern commercial banking system...". Goodhart has characterized the money stock as a dependent endogenous variable. In 1994, Mervyn King

said that the causation between money and demand is a contentious issue, because although textbooks assume that money is exogenous, in the United Kingdom

money is endogenous, as the Bank of England

provides base money on demand and broad money is created by the banking system.

Seth B. Carpenter and Selva Demiralp concluded the simple textbook base money multiplier is implausible in the United States.

Fractional-reserve banking determines the relationship between the amount of central bank money (currency) in the official money supply statistics and the total money supply. Most of the money in these systems is commercial bank money. Fractional reserve banking involves the issuance and creation of commercial bank money, which increases the money supply through the deposit creation multiplier. The issue of money through the banking system is a mechanism of monetary transmission, which a central bank

can influence indirectly by raising or lowering interest rate

s (although banking regulations may also be adjusted to influence the money supply, depending on the circumstances).

s, central bank

s have been created throughout the world to address these problems.

s related to fractional-reserve banking have generally been used to impose restrictive requirements on note issue and deposit taking on the one hand, and to provide relief from bankruptcy and creditor claims, and/or protect creditors with government funds, when banks defaulted on the other hand. Such measures have included:

Because different funding options have different costs, and differ in reliability, banks maintain a stock of low cost and reliable sources of liquidity such as:

As with reserves, other sources of liquidity are managed with targets.

The ability of the bank to borrow money reliably and economically is crucial, which is why confidence in the bank's creditworthiness is important to its liquidity. This means that the bank needs to maintain adequate capitalisation and to effectively control its exposures to risk in order to continue its operations. If creditors doubt the bank's assets are worth more than its liabilities, all demand creditors have an incentive to demand payment immediately, a situation known as a run on the bank.

Contemporary bank management methods for liquidity are based on maturity analysis of all the bank's assets and liabilities (off balance sheet exposures may also be included). Assets and liabilities are put into residual contractual maturity buckets such as 'on demand', 'less than 1 month', '2–3 months' etc. These residual contractual maturities may be adjusted to account for expected counter party behaviour such as early loan repayments due to borrowers refinancing and expected renewals of term deposits to give forecast cash flows. This analysis highlights any large future net outflows of cash and enables the bank to respond before they occur. Scenario analysis may also be conducted, depicting scenarios including stress scenarios such as a bank-specific crisis.

, the demand depositors and note holders would attempt to withdraw more money than the bank has in reserves, causing the bank to suffer a liquidity crisis and, ultimately, to perhaps default. In the event of a default, the bank would need to liquidate assets and the creditors of the bank would suffer a loss if the proceeds were insufficient to pay its liabilities. Since public deposits are payable on demand, liquidation may require selling assets quickly and potentially in large enough quantities to affect the price of those assets. An otherwise solvent bank (whose assets are worth more than its liabilities) may be made insolvent by a bank run. This problem potentially exists for any corporation with debt or liabilities, but is more critical for banks as they rely upon public deposits (which may be redeemable upon demand).

Although an initial analysis of a bank run and default points to the bank's inability to liquidate or sell assets (i.e. because the fraction of assets not held in the form of liquid reserves are held in less liquid investments such as loans), a more full analysis indicates that depositors will cause a bank run only when they have a genuine fear of loss of capital, and that banks with a strong risk adjusted capital ratio should be able to liquidate assets and obtain other sources of finance to avoid default. For this reason, fractional-reserve banks have every reason to maintain their liquidity, even at the cost of selling assets at heavy discounts and obtaining finance at high cost, during a bank run (to avoid a total loss for the contributors of the bank's capital, the shareholders).

Many governments have enforced or established deposit insurance

systems in order to protect depositors from the event of bank defaults and to help maintain public confidence in the fractional-reserve system.

Responses to the problem of financial risk described above include:

In this example the cash reserves held by the bank is $3010m ($201m currency + $2809m held at central bank) and the demand liabilities of the bank are $25482m, for a cash reserve ratio of 11.81%.

used to analyze fractional-reserve banks is the cash reserve ratio, which is the ratio of cash reserves to demand deposits. However, other important financial ratios are also used to analyze the bank's liquidity, financial strength, profitability etc.

For example the ANZ National Bank Limited balance sheet above gives the following financial ratios:

It is very important how the term 'reserves' is defined for calculating the reserve ratio, as different definitions give different results. Other important financial ratios may require analysis of disclosures in other parts of the bank's financial statements. In particular, for liquidity risk

, disclosures are incorporated into a note to the financial statements that provides maturity analysis of the bank's assets and liabilities and an explanation of how the bank manages its liquidity.

.

Bank reserves

Bank reserves are banks' holdings of deposits in accounts with their central bank , plus currency that is physically held in the bank's vault . The central banks of some nations set minimum reserve requirements...

(of cash and coin or deposits at the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

) that are only a fraction of the customer's deposits

Deposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction (called the reserve ratio

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

) of the quantity of deposits as reserves. Some of the funds lent out are subsequently deposited with another bank, increasing deposits at that second bank and allowing further lending. As most bank deposits are treated as money

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

in their own right, fractional reserve banking increases the money supply

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

, and banks are said to create money

Money creation

In economics, money creation is the process by which the money supply of a country or a monetary region is increased due to some reason. There are two principal stages of money creation. First, the central bank introduces new money into the economy by purchasing financial assets or lending money...

. Due to the prevalence of fractional reserve banking, the broad money supply of most countries is a multiple larger than the amount of base money

Monetary base

In economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

created by the country's central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

. That multiple (called the money multiplier

Money multiplier

In monetary economics, a money multiplier is one of various closely related ratios of commercial bank money to central bank money under a fractional-reserve banking system. Most often, it measures the maximum amount of commercial bank money that can be created by a given unit of central bank money...

) is determined by the reserve requirement

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

or other financial ratio

Financial ratio

A financial ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization...

requirements imposed by financial regulators, and by the excess reserves

Excess reserves

In banking, excess reserves are bank reserves in excess of the reserve requirement set by a central bank. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount...

kept by commercial banks.

Central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

s generally mandate reserve requirement

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

s that require banks to keep a minimum fraction of their demand deposits as cash reserves. This both limits the amount of money creation

Money creation

In economics, money creation is the process by which the money supply of a country or a monetary region is increased due to some reason. There are two principal stages of money creation. First, the central bank introduces new money into the economy by purchasing financial assets or lending money...

that occurs in the commercial banking system, and ensures that banks have enough ready cash to meet normal demand for withdrawals. Problems can arise, however, when depositors seek withdrawal of a large proportion of deposits at the same time; this can cause a bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

or, when problems are extreme and widespread, a systemic crisis

Systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to risk associated with any one individual entity, group or component of a system. It can be defined as "financial system instability, potentially catastrophic, caused or exacerbated by...

. To mitigate this risk, the governments of most countries (usually acting through the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

) regulate and oversee

Bank regulation

Bank regulations are a form of government regulation which subject banks to certain requirements, restrictions and guidelines. This regulatory structure creates transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things...

commercial banks, provide deposit insurance

Deposit insurance

Explicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due...

and act as lender of last resort

Lender of last resort

A lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

to commercial banks.

Fractional-reserve banking is the most common form of banking and is practiced in almost all countries. Although Islamic banking

Islamic banking

Islamic banking is banking or banking activity that is consistent with the principles of Islamic law and its practical application through the development of Islamic economics. Sharia prohibits the fixed or floating payment or acceptance of specific interest or fees for loans of money...

prohibits the making of profit from interest on debt, a form of fractional-reserve banking is still evident in most Islamic countries.

History

Savers looking to keep their valuables in safekeeping depositories deposited gold coinGold coin

A gold coin is a coin made mostly or entirely of gold. Gold has been used for coins practically since the invention of coinage, originally because of gold's intrinsic value...

s and silver coin

Silver coin

Silver coins are possibly the oldest mass produced form of coinage. Silver has been used as a coinage metal since the times of the Greeks. Their silver drachmas were popular trade coins....

s at goldsmith

Goldsmith

A goldsmith is a metalworker who specializes in working with gold and other precious metals. Since ancient times the techniques of a goldsmith have evolved very little in order to produce items of jewelry of quality standards. In modern times actual goldsmiths are rare...

s, receiving in turn a note

Promissory note

A promissory note is a negotiable instrument, wherein one party makes an unconditional promise in writing to pay a determinate sum of money to the other , either at a fixed or determinable future time or on demand of the payee, under specific terms.Referred to as a note payable in accounting, or...

for their deposit

Deposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

(see Bank of Amsterdam). Once these notes became a trusted medium of exchange

Medium of exchange

A medium of exchange is an intermediary used in trade to avoid the inconveniences of a pure barter system.By contrast, as William Stanley Jevons argued, in a barter system there must be a coincidence of wants before two people can trade – one must want exactly what the other has to offer, when and...

an early form of paper money

Paper Money

Paper Money is the second album by the band Montrose. It was released in 1974 and was the band's last album to feature Sammy Hagar as lead vocalist.-History:...

was born, in the form of the goldsmiths' notes.

As the notes were used directly in trade

Trade

Trade is the transfer of ownership of goods and services from one person or entity to another. Trade is sometimes loosely called commerce or financial transaction or barter. A network that allows trade is called a market. The original form of trade was barter, the direct exchange of goods and...

, the goldsmiths observed that people would not usually redeem all their notes at the same time, and they saw the opportunity to invest their coin reserves in interest-bearing loans and bills. This generated income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

for the goldsmiths but left them with more notes on issue than reserves with which to pay them. A process was started that altered the role of the goldsmiths from passive guardians of bullion, charging fees for safe storage, to interest-paying and interest-earning banks. Thus fractional-reserve banking was born.

However, if creditor

Creditor

A creditor is a party that has a claim to the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption that the second party will return an equivalent property or...

s (note holders of gold originally deposited) lost faith in the ability of a bank to redeem (pay) their notes, many would try to redeem their notes at the same time. If in response a bank could not raise enough funds by calling in loans or selling bills, it either went into insolvency

Insolvency

Insolvency means the inability to pay one's debts as they fall due. Usually used to refer to a business, insolvency refers to the inability of a company to pay off its debts.Business insolvency is defined in two different ways:...

or defaulted on its notes. Such a situation is called a bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

and caused the demise of many early banks.

Repeated bank failures and financial crises led to the creation of central banks – public institutions that have the authority to regulate commercial banks, impose reserve requirements, and act as lender-of-last-resort

Lender of last resort

A lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

if a bank runs low on liquidity. The emergence of central banks mitigated the dangers associated with fractional reserve banking.

From about 1991 a consensus had emerged within developed economies about the optimum design of monetary policy methods. In essence central bankers gave up attempts to directly control the amount of money in the economy and instead moved to indirect methods by targeting interest rates. This consensus is criticized by some economists.

Reason for existence

Fractional reserve banking allows people to invest their money, without losing the ability to use it on demand. Since most people do not need to use all their money all the time, banks lend out that money, to generate profit for themselves. Thus, banks can act as financial intermediaries — facilitating the investment of savers' funds. Full reserve banking, on the other hand, does not allow any money in such demand deposits to be invested (since all of the money would be locked up in reserves) and less liquid investments (such as stocks, bonds and time deposits) lock up a lender's money for a time, making it unavailable for the lender to use.According to mainstream economic theory, regulated fractional-reserve banking also benefits the economy by providing regulators with powerful tools for manipulating the money supply

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

and interest rates, which many see as essential to a healthy economy.

How it works

The nature of modern banking is such that the cash reserves at the bank available to repay demand deposits need only be a fraction of the demand deposits owed to depositors. In most legal systems, a demand deposit at a bank (e.g., a checking or savings account) is considered a loan to the bank (instead of a bailmentBailment

Bailment describes a legal relationship in common law where physical possession of personal property, or chattel, is transferred from one person to another person who subsequently has possession of the property...

) repayable on demand, that the bank can use to finance its investments in loans and interest bearing securities. Banks make a profit based on the difference between the interest they charge on the loans they make, and the interest they pay to their depositors (aggregately called the net interest margin

Net interest margin

Net interest margin is a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders, relative to the amount of their assets...

(NIM)). Since a bank lends out most of the money deposited, keeping only a fraction of the total as reserves, it necessarily has less money than the account balances of its depositors.

The main reason customers deposit funds at a bank is to store savings in the form of a demand claim on the bank. Depositors still have a claim to full repayment of their funds on demand even though most of the funds have already been invested by the bank in interest bearing loans and securities. Holders of demand deposits can withdraw all of their deposits at any time. If all the depositors of a bank did so at the same time a bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

would occur, and the bank would likely collapse. Due to the practice of central banking, this is a rare event today, as central banks usually guarantee the deposits at commercial banks, and act as lender of last resort

Lender of last resort

A lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

when there is a run on a bank. However, there have been some recent bank runs: the Northern Rock crisis of 2007 in the United Kingdom is an example. The collapse of Washington Mutual

Washington Mutual

Washington Mutual, Inc. , abbreviated to WaMu, was a savings bank holding company and the former owner of Washington Mutual Bank, which was the United States' largest savings and loan association until its collapse in 2008....

bank in September 2008, the largest bank failure in history, was preceded by a "silent run" on the bank, where depositors removed vast sums of money from the bank through electronic transfer. However, in these cases, the banks proved to have been insolvent at the time of the run. Thus, these bank runs merely precipitated failures that were inevitable in any case.

In the absence of crises that trigger bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

s, fractional-reserve banking usually functions smoothly because at any one time relatively few depositors will make cash withdrawals simultaneously compared to the total amount on deposit, and a cash reserve can be maintained as a buffer to deal with the normal cash demands from depositors seeking withdrawals. In addition, in a normal economic environment, cash is steadily being introduced into the economy by the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

, and new funds are steadily being deposited into the commercial banks.

However, if a bank is experiencing a financial crisis, and net redemption demands are unusually large over a period of time, the bank will run low on cash reserves and will be forced to raise additional funds to avoid running out of reserves and defaulting on its obligations. A bank can raise funds from additional borrowings (e.g., by borrowing from the money market

Money market

The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

or using lines of credit

Line of credit

A line of credit is any credit source extended to a government, business or individual by a bank or other financial institution. A line of credit may take several forms, such as overdraft protection, demand loan, special purpose, export packing credit, term loan, discounting, purchase of...

held with other banks), or by selling assets, or by calling in short-term loans. If creditors are afraid that the bank is running out of cash or is insolvent, they have an incentive to redeem their deposits as soon as possible before other depositors access the remaining cash reserves before they do, triggering a cascading crisis that can result in a full-scale bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

.

Money creation

Modern central banking allows banks to practice fractional reserve banking with inter-bank business transactions with a reduced risk of bankruptcy. The process of fractional-reserve banking expands the money supply of the economy but also increases the risk that a bank cannot meet its depositor withdrawals. Though not a mainstream economic belief, a number of central bankers, monetary economists, and text books, have said that banks create money by 'extending credit', where banks obligate themselves to borrowers, and then later manage whatever liabilities this creates for them, where if the central bank targets interest rates, it must supply base money on demand to meet the banks reserve requirements, after the banks have begun the lending process and that rather than deposits leading to loans, causality is reversed, and loans lead to deposits.There are two types of money in a fractional-reserve banking system operating with a central bank:

- Central bank money: money created or adopted by the central bank regardless of its form –- precious metals, commodity certificates, banknotes, coins, electronic money loaned to commercial banks, or anything else the central bank chooses as its form of money

- Commercial bank money: demand deposits in the commercial banking system; sometimes referred to as chequebook money

When a deposit of central bank money is made at a commercial bank, the central bank money is removed from circulation and added to the commercial banks' reserves (it is no longer counted as part of M1 money supply). Simultaneously, an equal amount of new commercial bank money is created in the form of bank deposits. When a loan is made by the commercial bank (which keeps only a fraction of the central bank money as reserves), using the central bank money from the commercial bank's reserves, the m1 money supply expands by the size of the loan. This process is called deposit multiplication.

Example of deposit multiplication

The table below displays the mainstream economicsMainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

relending model of how loans are funded and how the money supply is affected. It also shows how central bank money is used to create commercial bank money from an initial deposit of $100 of central bank money. In the example, the initial deposit is lent out 10 times with a fractional-reserve rate of 20% to ultimately create $500 of commercial bank money. Each successive bank involved in this process creates new commercial bank money on a diminishing portion of the original deposit of central bank money. This is because banks only lend out a portion of the central bank money deposited, in order to fulfill reserve requirements and to ensure that they always have enough reserves on hand to meet normal transaction demands.

The relending model begins when an initial $100 deposit of central bank money is made into Bank A. Bank A takes 20 percent of it, or $20, and sets it aside as reserves, and then loans out the remaining 80 percent, or $80. At this point, the money supply actually totals $180, not $100, because the bank has loaned out $80 of the central bank money, kept $20 of central bank money in reserve (not part of the money supply), and substituted a newly created $100 IOU claim for the depositor that acts equivalently to and can be implicitly redeemed for central bank money (the depositor can transfer it to another account, write a check on it, demand his cash back, etc.). These claims by depositors on banks are termed demand deposits or commercial bank money and are simply recorded in a bank's accounts as a liability (specifically, an IOU to the depositor). From a depositor's perspective, commercial bank money is equivalent to central bank money – it is impossible to tell the two forms of money apart unless a bank run occurs (at which time everyone wants central bank money).

At this point in the relending model, Bank A now only has $20 of central bank money on its books. The loan recipient is holding $80 in central bank money, but he soon spends the $80. The receiver of that $80 then deposits it into Bank B. Bank B is now in the same situation as Bank A started with, except it has a deposit of $80 of central bank money instead of $100. Similar to Bank A, Bank B sets aside 20 percent of that $80, or $16, as reserves and lends out the remaining $64, increasing money supply by $64. As the process continues, more commercial bank money is created. To simplify the table, a different bank is used for each deposit. In the real world, the money a bank lends may end up in the same bank so that it then has more money to lend out.

| Individual Bank | Amount Deposited | Lent Out | Reserves |

|---|---|---|---|

| A | 100 | 80 | 20 |

| B | 80 | 64 | 16 |

| C | 64 | 51.20 | 12.80 |

| D | 51.20 | 40.96 | 10.24 |

| E | 40.96 | 32.77 | 8.19 |

| F | 32.77 | 26.21 | 6.55 |

| G | 26.21 | 20.97 | 5.24 |

| H | 20.97 | 16.78 | 4.19 |

| I | 16.78 | 13.42 | 3.36 |

| J | 13.42 | 10.74 | 2.68 |

| K | 10.74 | |

|

| |

|

|

Total Reserves: |

| |

|

|

89.26 |

| |

Total Amount of Deposits: | Total Amount Lent Out: | Total Reserves + Last Amount Deposited: |

| |

457.05 | 357.05 | 100 |

For an individual bank, the deposit is considered a liability whereas the loan it gives out and the reserves are considered assets. Deposits will always be equal to loans plus a bank's reserves, since loans and reserves are created from deposits. This is the basis for a bank's balance sheet

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A...

.

Fractional reserve banking allows the money supply to expand or contract. Generally the expansion or contraction of the money supply is dictated by the balance between the rate of new loans being created and the rate of existing loans being repaid or defaulted on. The balance between these two rates can be influenced to some degree by actions of the central bank.

This table gives an outline of the makeup of money supplies

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

worldwide. Most of the money in any given money supply consists of commercial bank money. The value of commercial bank money is based on the fact that it can be exchanged freely at a bank for central bank money.

The actual increase in the money supply through this process may be lower, as (at each step) banks may choose to hold reserves in excess

Excess reserves

In banking, excess reserves are bank reserves in excess of the reserve requirement set by a central bank. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount...

of the statutory minimum, borrowers may let some funds sit idle, and some members of the public may choose to hold cash, and there also may be delays or frictions in the lending process. Government regulations may also be used to limit the money creation process by preventing banks from giving out loans even though the reserve requirements have been fulfilled.

Money multiplier

Formula

The money multiplier, m, is the inverse of the reserve requirement, R:

Example

For example, with the reserve ratio of 20 percent, this reserve ratio, R, can also be expressed as a fraction:

So then the money multiplier, m, will be calculated as:

This number is multiplied by the initial deposit to show the maximum amount of money it can be expanded to.

The money creation process is also affected by the currency drain ratio (the propensity of the public to hold banknotes rather than deposit them with a commercial bank), and the safety reserve ratio (excess reserves

Excess reserves

In banking, excess reserves are bank reserves in excess of the reserve requirement set by a central bank. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount...

beyond the legal requirement that commercial banks voluntarily hold—usually a small amount). Data for "excess" reserves and vault cash are published regularly by the Federal Reserve in the United States. In practice, the actual money multiplier varies over time, and may be substantially lower than the theoretical maximum.

Confusingly there are many different "money multipliers", some referring to ratios of rates of change of different money measures and others referring to ratios of absolute values of money measures.

Reserve requirements

The modern mainstream view of reserve requirementReserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

s is that they are intended to prevent banks from:

- generating too much money by making too many loans against the narrow money deposit base;

- having a shortage of cash when large deposits are withdrawn (although the reserve is thought to be a legal minimum, it is understood that in a crisis or bank runBank runA bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

, reserves may be made available on a temporary basis).

In practice, some central banks do not require reserves to be held, and in some countries that do, such as the USA and the EU they are not required to be held during the day when the banks are lending, and banks can borrow from other banks at near the central bank policy rate to ensure they have the necessary amount of required reserves by the close of business. Required reserves are therefore considered by some central bankers, monetary economists and text books to only play a very small role in limiting money creation in these countries. Most commentators agree however, that they help the banks have sufficient supplies of highly liquid assets, so that the system operates in an orderly fashion and maintains public confidence. The UK for example, which does not have required reserves, does have requirements that the banks keep a certain amount of cash, and in Australia while there are no reserve requirements, there are a variety of requirements to ensure the banks have a stabilising ratio of liquid assets, such as deposits held with local banks.

In addition to reserve requirements, there are other required financial ratio

Financial ratio

A financial ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization...

s that affect the amount of loans that a bank can fund. The capital requirement ratio

Capital requirement

Capital requirement refers to -The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through regulatory agencies such as the Bank for International Settlements, Federal Deposit...

is perhaps the most important of these other required ratios. When there are no mandatory reserve requirements, which are considered by some mainstream economists to restrict lending, the capital requirement ratio acts to prevent an infinite amount of bank lending.

Alternative views

Theories of endogenous moneyEndogenous money

In economics, endogenous money refers to the theory that money comes into existence driven by the requirements of the real economy and that banking system reserves expand or contract as needed to accommodate loan demand at prevailing interest rates. It forms part of Post-Keynesian economics...

date to the 19th century, and were described by Joseph Schumpeter

Joseph Schumpeter

Joseph Alois Schumpeter was an Austrian-Hungarian-American economist and political scientist. He popularized the term "creative destruction" in economics.-Life:...

, and later the post-Keynesians. Endogenous money theory states that the supply of money is credit-driven and determined endogenously by the demand for bank loans, rather than exogenously by monetary authorities.

Charles Goodhart

Charles Goodhart

Charles Albert Eric Goodhart, CBE, FBA is an economist. He was a member of the Bank of England's Monetary Policy Committee from June 1997-May 2000 and a professor at the London School of Economics . He is the developer of Goodhart's law, an economic law named after him...

worked for many years to encourage a different approach to money supply analysis and said the base money multiplier model was "such an incomplete way of describing the process of the determination of the stock of money that it amounts to misinstruction" Ten years later he said: "Almost all those who have worked in a [central bank] believe that this view is totally mistaken; in particular, it ignores the implications of several of the crucial institutional features of a modern commercial banking system...". Goodhart has characterized the money stock as a dependent endogenous variable. In 1994, Mervyn King

Mervyn King (economist)

An ex-officio member of the Bank's interest-rate setting Monetary Policy Committee since its inception in 1997, Sir Mervyn is the only person to have taken part in every one of its monthly meetings to date. His voting style is often seen as "hawkish", a perspective that emphasises the dangers of...

said that the causation between money and demand is a contentious issue, because although textbooks assume that money is exogenous, in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

money is endogenous, as the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

provides base money on demand and broad money is created by the banking system.

Seth B. Carpenter and Selva Demiralp concluded the simple textbook base money multiplier is implausible in the United States.

Money supplies around the world

Fractional-reserve banking determines the relationship between the amount of central bank money (currency) in the official money supply statistics and the total money supply. Most of the money in these systems is commercial bank money. Fractional reserve banking involves the issuance and creation of commercial bank money, which increases the money supply through the deposit creation multiplier. The issue of money through the banking system is a mechanism of monetary transmission, which a central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

can influence indirectly by raising or lowering interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s (although banking regulations may also be adjusted to influence the money supply, depending on the circumstances).

Regulation

Because the nature of fractional-reserve banking involves the possibility of bank runBank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

s, central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

s have been created throughout the world to address these problems.

Central banks

Government controls and bank regulationBank regulation

Bank regulations are a form of government regulation which subject banks to certain requirements, restrictions and guidelines. This regulatory structure creates transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things...

s related to fractional-reserve banking have generally been used to impose restrictive requirements on note issue and deposit taking on the one hand, and to provide relief from bankruptcy and creditor claims, and/or protect creditors with government funds, when banks defaulted on the other hand. Such measures have included:

- Minimum required reserve ratioReserve requirementThe reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

s (RRRs) - Minimum capital ratios

- Government bond deposit requirements for note issue

- 100% Marginal Reserve requirements for note issue, such as the Bank Charter Act 1844Bank Charter Act 1844The Bank Charter Act 1844 was an Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which restricted the powers of British banks and gave exclusive note-issuing powers to the central Bank of England....

(UK) - Sanction on bank defaults and protection from creditors for many months or even years, and

- Central bank support for distressed banks, and government guarantee funds for notes and deposits, both to counteract bank runs and to protect bank creditors.

Liquidity and capital management for a bank

To avoid defaulting on its obligations, the bank must maintain a minimal reserve ratio that it fixes in accordance with, notably, regulations and its liabilities. In practice this means that the bank sets a reserve ratio target and responds when the actual ratio falls below the target. Such response can be, for instance:- Selling or redeeming other assets, or securitizationSecuritizationSecuritization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

of illiquid assets, - Restricting investment in new loans,

- Borrowing funds (whether repayable on demand or at a fixed maturity),

- Issuing additional capital instruments, or

- Reducing dividends.

Because different funding options have different costs, and differ in reliability, banks maintain a stock of low cost and reliable sources of liquidity such as:

- Demand deposits with other banks

- High quality marketable debt securities

- Committed lines of credit with other banks

As with reserves, other sources of liquidity are managed with targets.

The ability of the bank to borrow money reliably and economically is crucial, which is why confidence in the bank's creditworthiness is important to its liquidity. This means that the bank needs to maintain adequate capitalisation and to effectively control its exposures to risk in order to continue its operations. If creditors doubt the bank's assets are worth more than its liabilities, all demand creditors have an incentive to demand payment immediately, a situation known as a run on the bank.

Contemporary bank management methods for liquidity are based on maturity analysis of all the bank's assets and liabilities (off balance sheet exposures may also be included). Assets and liabilities are put into residual contractual maturity buckets such as 'on demand', 'less than 1 month', '2–3 months' etc. These residual contractual maturities may be adjusted to account for expected counter party behaviour such as early loan repayments due to borrowers refinancing and expected renewals of term deposits to give forecast cash flows. This analysis highlights any large future net outflows of cash and enables the bank to respond before they occur. Scenario analysis may also be conducted, depicting scenarios including stress scenarios such as a bank-specific crisis.

Risk and prudential regulation

In a fractional-reserve banking system, in the event of a bank runBank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

, the demand depositors and note holders would attempt to withdraw more money than the bank has in reserves, causing the bank to suffer a liquidity crisis and, ultimately, to perhaps default. In the event of a default, the bank would need to liquidate assets and the creditors of the bank would suffer a loss if the proceeds were insufficient to pay its liabilities. Since public deposits are payable on demand, liquidation may require selling assets quickly and potentially in large enough quantities to affect the price of those assets. An otherwise solvent bank (whose assets are worth more than its liabilities) may be made insolvent by a bank run. This problem potentially exists for any corporation with debt or liabilities, but is more critical for banks as they rely upon public deposits (which may be redeemable upon demand).

Although an initial analysis of a bank run and default points to the bank's inability to liquidate or sell assets (i.e. because the fraction of assets not held in the form of liquid reserves are held in less liquid investments such as loans), a more full analysis indicates that depositors will cause a bank run only when they have a genuine fear of loss of capital, and that banks with a strong risk adjusted capital ratio should be able to liquidate assets and obtain other sources of finance to avoid default. For this reason, fractional-reserve banks have every reason to maintain their liquidity, even at the cost of selling assets at heavy discounts and obtaining finance at high cost, during a bank run (to avoid a total loss for the contributors of the bank's capital, the shareholders).

Many governments have enforced or established deposit insurance

Deposit insurance

Explicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due...

systems in order to protect depositors from the event of bank defaults and to help maintain public confidence in the fractional-reserve system.

Responses to the problem of financial risk described above include:

- Proponents of prudential regulation, such as minimum capital ratios, minimum reserve ratios, central bank or other regulatory supervision, and compulsory note and deposit insurance, (see Controls on Fractional-Reserve Banking below);

- Proponents of free banking, who believe that banking should be open to free entryFree entryFree entry is a term used by economists to describe a condition in which firms can freely enter the market for an economic good by establishing production and beginning to sell the product....

and competition, and that the self-interest of debtors, creditors and shareholders should result in effective risk management; and, - Withdrawal restrictions: some bank accounts may place a limit on daily cash withdrawals and may require a notice period for very large withdrawals. Banking laws in some countries may allow restrictions to be placed on withdrawals under certain circumstances, although these restrictions may rarely, if ever, be used;

- Opponents of fractional reserve banking who insist that notes and demand deposits be 100% reserved.

Example of a bank balance sheet and financial ratios

An example of fractional reserve banking, and the calculation of the reserve ratio is shown in the balance sheet below:| Example 2: ANZ National Bank Limited Balance Sheet as at 30 September 2007 | |||

|---|---|---|---|

| ASSETS | NZ$m | LIABILITIES | NZ$m |

| Cash | 201 | Demand Deposits | 25482 |

| Balance with Central Bank | 2809 | Term Deposits and other borrowings | 35231 |

| Other Liquid Assets | 1797 | Due to Other Financial Institutions | 3170 |

| Due from other Financial Institutions | 3563 | Derivative financial instruments | 4924 |

| Trading Securities | 1887 | Payables and other liabilities | 1351 |

| Derivative financial instruments | 4771 | Provisions | 165 |

| Available for sale assets | 48 | Bonds and Notes | 14607 |

| Net loans and advances | 87878 | Related Party Funding | 2775 |

| Shares in controlled entities | 206 | [subordinated] Loan Capital | 2062 |

| Current Tax Assets | 112 | Total Liabilities | 99084 |

| Other assets | 1045 | Share Capital | 5943 |

| Deferred Tax Assets | 11 | [revaluation] Reserves | 83 |

| Premises and Equipment | 232 | Retained profits | 2667 |

| Goodwill and other intangibles | 3297 | Total Equity | 8703 |

| Total Assets | 107787 | Total Liabilities plus Net Worth | 107787 |

In this example the cash reserves held by the bank is $3010m ($201m currency + $2809m held at central bank) and the demand liabilities of the bank are $25482m, for a cash reserve ratio of 11.81%.

Other financial ratios

The key financial ratioFinancial ratio

A financial ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization...

used to analyze fractional-reserve banks is the cash reserve ratio, which is the ratio of cash reserves to demand deposits. However, other important financial ratios are also used to analyze the bank's liquidity, financial strength, profitability etc.

For example the ANZ National Bank Limited balance sheet above gives the following financial ratios:

- The cash reserve ratio is $3010m/$25482m, i.e. 11.81%.

- The liquid assets reserve ratio is ($201m+$2809m+$1797m)/$25482m, i.e. 18.86%.

- The equity capital ratio is $8703m/107787m, i.e. 8.07%.

- The tangible equity ratio is ($8703m-$3297m)/107787m, i.e. 5.02%

- The total capital ratio is ($8703m+$2062m)/$107787m, i.e. 9.99%.

It is very important how the term 'reserves' is defined for calculating the reserve ratio, as different definitions give different results. Other important financial ratios may require analysis of disclosures in other parts of the bank's financial statements. In particular, for liquidity risk

Liquidity risk

In finance, liquidity risk is the risk that a given security or asset cannot be traded quickly enough in the market to prevent a loss .-Types of Liquidity Risk:...

, disclosures are incorporated into a note to the financial statements that provides maturity analysis of the bank's assets and liabilities and an explanation of how the bank manages its liquidity.

How the example bank manages its liquidity

The ANZ National Bank Limited explains its methods as:| Example 2: ANZ National Bank Limited Maturity Analysis of Assets and Liabilities as at 30 September 2007 | ||||||

|---|---|---|---|---|---|---|

| Total carrying value | Less than 3 months | 3–12 months | 1–5 years | Beyond 5 years | No Specified Maturity | |

| Assets | ||||||

| Liquid Assets | 4807 | 4807 | ||||

| Due from other financial institutions | 3563 | 2650 | 440 | 187 | 286 | |

| Derivative Financial Instruments | 4711 | 4711 | ||||

| Assets available for sale | 48 | 33 | 1 | 13 | 1 | |

| Net loans and advances | 87878 | 9276 | 9906 | 24142 | 44905 | |

| Other Assets | 4903 | 970 | 179 | 3754 | ||

| Total Assets | 107787 | 18394 | 10922 | 25013 | 45343 | 8115 |

| Liabilities | ||||||

| Due to other financial institutions | 3170 | 2356 | 405 | 32 | 377 | |

| Deposits and other borrowings | 70030 | 53059 | 14726 | 2245 | ||

| Derivative financial instruments | 4932 | 4932 | ||||

| Other liabilities | 1516 | 1315 | 96 | 32 | 60 | 13 |

| Bonds and notes | 14607 | 672 | 4341 | 9594 | ||

| Related party funding | 2275 | 2275 | ||||

| Loan capital | 2062 | 100 | 1653 | 309 | ||

| Total liabilities | 99084 | 60177 | 19668 | 13556 | 746 | 4937 |

| Net liquidity gap | 8703 | (41783) | (8746) | 11457 | 44597 | 3178 |

| Net liquidity gap - cumulative | 8703 | (41783) | (50529) | (39072) | 5525 | 8703 |

Criticisms

Critics of fractional reserve banking have argued one or more of the following: that it is unstable, that it exacerbates business cycles, that it causes inflation, or that it leads to environmental degradationEnvironmental degradation

Environmental degradation is the deterioration of the environment through depletion of resources such as air, water and soil; the destruction of ecosystems and the extinction of wildlife...

.

See also

- Islamic bankingIslamic bankingIslamic banking is banking or banking activity that is consistent with the principles of Islamic law and its practical application through the development of Islamic economics. Sharia prohibits the fixed or floating payment or acceptance of specific interest or fees for loans of money...

- Narrow bankingNarrow bankingNarrow banking is a proposed type of bank called a narrow bank also called a safe bank. Ultimately, if adopted widely, this could lead to an entirely new banking system. Narrow banks can, by risk reduction measures designed into the narrow bank, significantly reduce potential bank runs and the need...

- Open Market Operations

- Seignorage

- UsuryUsuryUsury Originally, when the charging of interest was still banned by Christian churches, usury simply meant the charging of interest at any rate . In countries where the charging of interest became acceptable, the term came to be used for interest above the rate allowed by law...

Further reading

- Crick, W.F. (1927), The genesis of bank deposits, Economica, vol 7, 1927, pp 191–202.

- Friedman, MiltonMilton FriedmanMilton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

(1960), A Program for Monetary Stability, New York, Fordham University Press. - Meigs, A.J. (1962), Free reserves and the money supply, Chicago, University of Chicago, 1962.

- Philips, C.A. (1921), Bank Credit, New York, Macmillan, chapters 1-4, 1921,

- Thomson, P. (1956), Variations on a theme by Philips, American Economic Review vol 46, December 1956, pp. 965–970.

- Federalreserveeducation.org - The Principle of Multiple Deposit Creation

- Reserve Requirements - Fedpoints - Federal Reserve Bank of New York

- Bank for International Settlements - The Role of Central Bank Money in Payment Systems

External links

- Modern Money Mechanics Federal Reserve educational material explaining how money is created.

- Interactive Fractional Reserve Calculator Calculator that details deposit multiplication for any reserve requirement.