Brady Bonds

Encyclopedia

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

-denominated bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

, issued mostly by Latin America

Latin America

Latin America is a region of the Americas where Romance languages – particularly Spanish and Portuguese, and variably French – are primarily spoken. Latin America has an area of approximately 21,069,500 km² , almost 3.9% of the Earth's surface or 14.1% of its land surface area...

n countries in the 1980s, named after U.S. Treasury

United States Department of the Treasury

The Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

Secretary Nicholas Brady

Nicholas F. Brady

Nicholas Frederick Brady was United States Secretary of the Treasury under Presidents Ronald Reagan and George H. W. Bush, and is also known for articulating the Brady Plan in March 1989.-Early life:...

.

History

Brady bonds were created in March 1989 in order to convert bank loans to mostly Latin AmericaLatin America

Latin America is a region of the Americas where Romance languages – particularly Spanish and Portuguese, and variably French – are primarily spoken. Latin America has an area of approximately 21,069,500 km² , almost 3.9% of the Earth's surface or 14.1% of its land surface area...

n countries into a variety or "menu" of new bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

after many of those countries defaulted

Default (finance)

In finance, default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant of the debt contract. A default is the failure to pay back a loan. Default may occur if the debtor is either...

on their debt in the 1980s. At that time, the market for Emerging Markets' sovereign debt was small and illiquid

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

, and the standardization of emerging-market

Emerging markets

Emerging markets are nations with social or business activity in the process of rapid growth and industrialization. Based on data from 2006, there are around 28 emerging markets in the world . The economies of China and India are considered to be the largest...

debt facilitated risk-spreading and trading. In exchange for commercial bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

loans, the countries issued new bonds for the principal sum and, in some cases, unpaid interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

. Because they were tradable and came with some guarantees, in some cases they were more valuable to the creditors than the original bonds.

The key innovation behind the introduction of Brady Bonds was to allow the commercial banks to exchange their claims on developing countries into tradable instruments, allowing them to get the debt off their balance sheet

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A...

s. This reduced the concentration risk

Concentration risk

Concentration risk is a banking term denoting the overall spread of a bank's outstanding accounts over the number or variety of debtors to whom the bank has lent money. This risk is calculated using a "concentration ratio" which explains what percentage of the outstanding accounts each bank loan...

to these banks.

The plan included two rounds. In the first round, creditors bargained with debtors over the terms of these new claims. Loosely interpreted, the options contained different mixes of "exit" and "new money" options. The exit options were designed for creditors who wanted to reduce their exposure to a debtor country. These options allowed creditors to reduce their exposure to debtor nations, albeit at a discount. The new money options reflected the belief that those creditors who chose not to exit would experience a capital gain from the transaction, since the nominal outstanding debt obligation of the debtor would be reduced, and with it, the probability of future default. These options allowed creditors to retain their exposure, but required additional credit extension designed to "tax" the expected capital gains. The principal of many instruments was collateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

ized, as were "rolling interest guarantees," which guaranteed payment for fixed short periods. The first round negotiations thus involved the determination of the effective magnitude of discount on the exit options together with the amount of new lending called for under the new money options.

In the second round, creditors converted their existing claims into their choice among the "menu" of options agreed upon in the first round. The penalties for creditors failing to comply with the terms of the deal were never made explicit. Nevertheless, compliance was not an important problem under the Brady Plan. Banks wishing to cease their foreign lending activities tended to choose the exit option under the auspices of the deal.

By offering a "menu" of options, the Brady Plan permitted credit restructurings to be tailored to the heterogeneous preferences of creditors. The terms achieved under these deals indicate that debtors used the menu approach to reduce the cost of debt reduction. Furthermore, it reduced the holdout problem

Holdout problem

In finance, a holdout problem occurs when a bond issuer is in default or nears default, and launches an exchange offer in an attempt to restructure debt held by existing bond holders...

where certain shareholders have an incentive to not participate in the restructuring in hopes of getting a better deal.

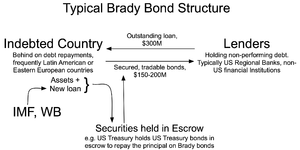

The principal amount was usually, but not always, collateralized by specially issued U.S. Treasury 30-year zero-coupon bonds

Treasury security

A United States Treasury security is government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt. Treasury securities are the debt financing instruments of the United States federal government, and they are often referred to simply as Treasuries...

purchased by the debtor country using a combination of International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

, World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

, and the country's own foreign currency reserves. Interest payments on Brady bonds, in some cases, are guaranteed by securities of at least double-A-rated credit quality held with the Federal Reserve Bank of New York

Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,...

.

Countries that participated in the initial round of Brady bond issuance were Argentina

Argentina

Argentina , officially the Argentine Republic , is the second largest country in South America by land area, after Brazil. It is constituted as a federation of 23 provinces and an autonomous city, Buenos Aires...

, Brazil

Brazil

Brazil , officially the Federative Republic of Brazil , is the largest country in South America. It is the world's fifth largest country, both by geographical area and by population with over 192 million people...

, Bulgaria

Bulgaria

Bulgaria , officially the Republic of Bulgaria , is a parliamentary democracy within a unitary constitutional republic in Southeast Europe. The country borders Romania to the north, Serbia and Macedonia to the west, Greece and Turkey to the south, as well as the Black Sea to the east...

, Costa Rica

Costa Rica

Costa Rica , officially the Republic of Costa Rica is a multilingual, multiethnic and multicultural country in Central America, bordered by Nicaragua to the north, Panama to the southeast, the Pacific Ocean to the west and the Caribbean Sea to the east....

, Dominican Republic

Dominican Republic

The Dominican Republic is a nation on the island of La Hispaniola, part of the Greater Antilles archipelago in the Caribbean region. The western third of the island is occupied by the nation of Haiti, making Hispaniola one of two Caribbean islands that are shared by two countries...

, Ecuador

Ecuador

Ecuador , officially the Republic of Ecuador is a representative democratic republic in South America, bordered by Colombia on the north, Peru on the east and south, and by the Pacific Ocean to the west. It is one of only two countries in South America, along with Chile, that do not have a border...

, Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

, Morocco

Morocco

Morocco , officially the Kingdom of Morocco , is a country located in North Africa. It has a population of more than 32 million and an area of 710,850 km², and also primarily administers the disputed region of the Western Sahara...

, Nigeria

Nigeria

Nigeria , officially the Federal Republic of Nigeria, is a federal constitutional republic comprising 36 states and its Federal Capital Territory, Abuja. The country is located in West Africa and shares land borders with the Republic of Benin in the west, Chad and Cameroon in the east, and Niger in...

, Philippines

Philippines

The Philippines , officially known as the Republic of the Philippines , is a country in Southeast Asia in the western Pacific Ocean. To its north across the Luzon Strait lies Taiwan. West across the South China Sea sits Vietnam...

, Poland

Poland

Poland , officially the Republic of Poland , is a country in Central Europe bordered by Germany to the west; the Czech Republic and Slovakia to the south; Ukraine, Belarus and Lithuania to the east; and the Baltic Sea and Kaliningrad Oblast, a Russian exclave, to the north...

, Uruguay

Uruguay

Uruguay ,officially the Oriental Republic of Uruguay,sometimes the Eastern Republic of Uruguay; ) is a country in the southeastern part of South America. It is home to some 3.5 million people, of whom 1.8 million live in the capital Montevideo and its metropolitan area...

and Venezuela

Venezuela

Venezuela , officially called the Bolivarian Republic of Venezuela , is a tropical country on the northern coast of South America. It borders Colombia to the west, Guyana to the east, and Brazil to the south...

.

Types

There were two main types of Brady bonds:- Par bonds were issued to the same value as the original loan, but the coupon on the bonds is below market rate, principal and interest payments are usually guaranteed.

- Discount bonds were issued at a discount to the original value of the loan, but the coupon is at market rate, principal and interest payments are usually guaranteed.

Other, less common, types include front-loaded interest-reduction bonds (FLIRB), new-money bonds, debt-conversion bonds (DCB), and past-due interest bonds (PDI). Brady Bond negotiations generally involved some form of "haircut

Haircut (finance)

In finance, a haircut is a percentage that is subtracted from the market value of an asset that is being used as collateral. The size of the haircut reflects the perceived risk associated with holding the asset...

" – meaning that the value of the bonds resulting from the restructurings was less than the face value

Face value

The Face value is the value of a coin, stamp or paper money, as printed on the coin, stamp or bill itself by the minting authority. While the face value usually refers to the true value of the coin, stamp or bill in question it can sometimes be largely symbolic, as is often the case with bullion...

of the claims before the restructurings.

Guarantees attached to Brady bonds included collateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

to guarantee the principal, rolling interest guarantees, and value recovery rights. Not all Brady bonds would necessarily have all of these forms of guarantee and the specifics would vary from issuance to issuance.

Current status

Although the Brady Bond process ended during the 1990s, many of the innovations introduced in these restructurings (call optionCall option

A call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller...

s embedded in the bonds, "stepped" coupons, Pars and Discounts) were retained in the later sovereign restructurings in, for example, Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

and Ecuador

Ecuador

Ecuador , officially the Republic of Ecuador is a representative democratic republic in South America, bordered by Colombia on the north, Peru on the east and south, and by the Pacific Ocean to the west. It is one of only two countries in South America, along with Chile, that do not have a border...

. Ecuador

Ecuador

Ecuador , officially the Republic of Ecuador is a representative democratic republic in South America, bordered by Colombia on the north, Peru on the east and south, and by the Pacific Ocean to the west. It is one of only two countries in South America, along with Chile, that do not have a border...

, in 1999, became the first country to default on its Brady bonds. In 2003, Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

became the first country to retire its Brady debt. The Philippines bought back all of its Brady bonds in May 2007, joining Colombia

Colombia

Colombia, officially the Republic of Colombia , is a unitary constitutional republic comprising thirty-two departments. The country is located in northwestern South America, bordered to the east by Venezuela and Brazil; to the south by Ecuador and Peru; to the north by the Caribbean Sea; to the...

, Brazil

Brazil

Brazil , officially the Federative Republic of Brazil , is the largest country in South America. It is the world's fifth largest country, both by geographical area and by population with over 192 million people...

, Venezuela

Venezuela

Venezuela , officially called the Bolivarian Republic of Venezuela , is a tropical country on the northern coast of South America. It borders Colombia to the west, Guyana to the east, and Brazil to the south...

, and Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

as countries that have retired the bonds.

External links

- History of Brady bonds, written by EMTA, a financial community trade association formed "in response to ... new trading opportunities ... under the Brady Plan."

- Treasury press release on Mexico retiring its Brady bonds

- IMF press release on Mexico retiring its Brady bonds

- BBC story on Ecuadorean default

- Collective Action Difficulties in Foreign Lending: Banks and Bonds (FRBSF)