Butterfly (options)

Encyclopedia

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability

Probability

Probability is ordinarily used to describe an attitude of mind towards some proposition of whose truth we arenot certain. The proposition of interest is usually of the form "Will a specific event occur?" The attitude of mind is of the form "How certain are we that the event will occur?" The...

of earning a small limited profit when the future volatility

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

of the underlying

Underlying

In finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

is expected to be different from the implied volatility

Implied volatility

In financial mathematics, the implied volatility of an option contract is the volatility of the price of the underlying security that is implied by the market price of the option based on an option pricing model. In other words, it is the volatility that, when used in a particular pricing model,...

.

Long butterfly

A longLong (finance)

In finance, a long position in a security, such as a stock or a bond, or equivalently to be long in a security, means the holder of the position owns the security and will profit if the price of the security goes up. Going long is the more conventional practice of investing and is contrasted with...

butterfly position will make profit if the future volatility is lower than the implied volatility.

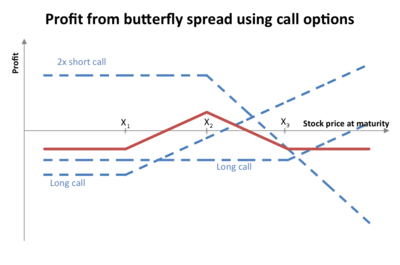

A long butterfly options strategy consists of the following options

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

:

- Long 1 callCall optionA call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller...

with a strike priceStrike priceIn options, the strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the spot price of the underlying instrument at that time.Formally, the strike...

of (X − a) - Short 2 calls with a strike price of X

- Long 1 call with a strike price of (X + a)

where X = the spot price (i.e. current market price of underlying) and a > 0.

Using put–call parity

Put–call parity

In financial mathematics, put–call parity defines a relationship between the price of a European call option and European put option in a frictionless market —both with the identical strike price and expiry, and the underlying being a liquid asset. In the absence of liquidity, the existence of a...

a long butterfly can also be created as follows:

- Long 1 put with a strike price of (X + a)

- Short 2 puts with a strike price of X

- Long 1 put with a strike price of (X − a)

where X = the spot price and a > 0.

All the options have the same expiration

Expiration (options)

For an option contract, expiration is the date on which the contract expires. The option holder must elect to exercise the option or allow it to expire worthless.Typically, option contracts expire according to a pre-determined calendar. For instance, for U.S...

date.

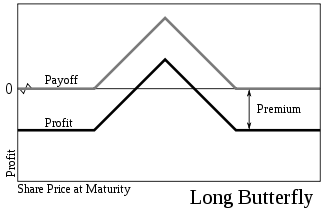

At expiration the value (but not the profit) of the butterfly will be:

- zero if the price of the underlying is below (X − a) or above (X + a)

- positive if the price of the underlying is between (X - a) and (X + a)

The maximum value occurs at X (see diagram).

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long.

Variations of the butterfly

The double option position in the middle is called the body, while the two other positions are called the wings.The option strategy where the middle two positions have different strike price is known as an Iron condor

Iron condor

The iron condor is an advanced option trading strategy utilising two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. If the outer strikes are bought and the inner strikes sold a long iron condor is produced. The converse produces a short iron...

.

In an unbalanced butterfly the variable "a" has two different values.

External links

- Butterfly Screener

- Long and Short Butterflies graphically illustrates component options in long and short butterflies.

- Butterfly Spreads - Spread Your Wings & Profit things you should know about Butterfly Spreads

- - Know More about Butterfly Option Trading Strategy via real trade example