Credit card

Encyclopedia

Plastic

A plastic material is any of a wide range of synthetic or semi-synthetic organic solids used in the manufacture of industrial products. Plastics are typically polymers of high molecular mass, and may contain other substances to improve performance and/or reduce production costs...

card issued to users as a system of payment

Payment

A payment is the transfer of wealth from one party to another. A payment is usually made in exchange for the provision of goods, services or both, or to fulfill a legal obligation....

. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card creates a revolving account

Revolving account

A revolving account is an account created by a lender to represent debts where the outstanding balance does not have to be paid in full every month by the borrower to the lender. The borrower may be required to make a minimum payment, based on the balance amount. The most common example of a...

and grants a line of credit

Line of credit

A line of credit is any credit source extended to a government, business or individual by a bank or other financial institution. A line of credit may take several forms, such as overdraft protection, demand loan, special purpose, export packing credit, term loan, discounting, purchase of...

to the consumer

Consumer

Consumer is a broad label for any individuals or households that use goods generated within the economy. The concept of a consumer occurs in different contexts, so that the usage and significance of the term may vary.-Economics and marketing:...

(or the user) from which the user can borrow money for payment to a merchant

Merchant

A merchant is a businessperson who trades in commodities that were produced by others, in order to earn a profit.Merchants can be one of two types:# A wholesale merchant operates in the chain between producer and retail merchant...

or as a cash advance

Cash advance

A cash advance is a service provided by most credit card and charge card issuers. The service allows cardholders to withdraw cash, either through an ATM or over the counter at a bank or other financial agency, up to a certain limit...

to the user.

A credit card is different from a charge card

Charge card

A charge card is a card that provides an alternative payment to cash when making purchases in which the issuer and the cardholder enter into an agreement that the debt incurred on the charge account will be paid in full and by due date or be subject to severe late fees and restrictions on card...

: a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest

Credit card interest

Credit card interest is the principal way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously...

being charged. A credit card also differs from a cash card, which can be used like currency by the owner of the card. Most credit cards are issued by bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s or credit union

Credit union

A credit union is a cooperative financial institution that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members...

s, and are the shape and size specified by the ISO/IEC 7810 standard as ID-1. This is defined as 85.6 × (33/8 × 21/8 in) in size.

History

The concept of using a card for purchases was described in 1887 by Edward BellamyEdward Bellamy

Edward Bellamy was an American author and socialist, most famous for his utopian novel, Looking Backward, set in the year 2000. He was a very influential writer during the Gilded Age of United States history.-Early life:...

in his utopian novel Looking Backward

Looking Backward

Looking Backward: 2000-1887 is a utopian science fiction novel by Edward Bellamy, a lawyer and writer from western Massachusetts; it was first published in 1887...

. Bellamy used the term credit card eleven times in this novel.

The modern credit card was the successor of a variety of merchant credit schemes. It was first used in the 1920s, in the United States, specifically to sell fuel

Fuel

Fuel is any material that stores energy that can later be extracted to perform mechanical work in a controlled manner. Most fuels used by humans undergo combustion, a redox reaction in which a combustible substance releases energy after it ignites and reacts with the oxygen in the air...

to a growing number of automobile

Automobile

An automobile, autocar, motor car or car is a wheeled motor vehicle used for transporting passengers, which also carries its own engine or motor...

owners. In 1938 several companies started to accept each other's cards. Western Union

Western Union

The Western Union Company is a financial services and communications company based in the United States. Its North American headquarters is in Englewood, Colorado. Up until 2006, Western Union was the best-known U.S...

had begun issuing charge cards to its frequent customers in 1921. Some charge cards were printed on paper card stock, but were easily counterfeited.

The Charga-Plate, developed in 1928, was an early predecessor to the credit card and used in the U.S. from the 1930s to the late 1950s. It was a 2½" × 1¼" rectangle of sheet metal related to Addressograph

Addressograph

An addressograph is an address labeler and labeling system.In 1896, the first U.S. patent for an addressing machine, the Addressograph was issued to Joseph Smith Duncan of Sioux City, Iowa. It was a development of the invention he had made in 1892. His earlier model consisted of a hexagonal wood...

and military dog tag

Dog tag (identifier)

A dog tag is the informal name for the identification tags worn by military personnel, named such as it bears resemblance to actual dog tags. The tag is primarily used for the identification of dead and wounded and essential basic medical information for the treatment of the latter, such as blood...

systems. It was embossed with the customer's name, city and state. It held a small paper card for a signature. In recording a purchase, the plate was laid into a recess in the imprinter, with a paper "charge slip" positioned on top of it. The record of the transaction included an impression of the embossed information, made by the imprinter pressing an inked ribbon

Typewriter ribbon

A typewriter ribbon is an expendable module serving the function of transferring pigment to paper in various devices for impact printing. Such ribbons were part of standard designs for hand- or motor-driven typewriters, teleprinters, stenotype machines, computer-driven printers and many mechanical...

against the charge slip. Charga-Plate was a trademark of Farrington Manufacturing Co. Charga-Plates were issued by large-scale merchants to their regular customers, much like department store credit cards of today. In some cases, the plates were kept in the issuing store rather than held by customers. When an authorized user made a purchase, a clerk retrieved the plate from the store's files and then processed the purchase. Charga-Plates speeded back-office bookkeeping that was done manually in paper ledgers in each store, before computers.

In 1934, American Airlines and the Air Transport Association simplified the process even more with the advent of the Air Travel Card. They created a numbering scheme that identified the Issuer of card as well as the Customer account. This is the reason the modern UATP cards still start with the number 1. With an Air Travel Card passengers could “buy now, and pay later” for a ticket against their credit and receive a fifteen percent discount at any of the accepting airlines. By the 1940s, all of the major domestic airlines offered Air Travel Cards that could be used on 17 different airlines. By 1941 about half of the Airlines Revenues came through the Air Travel Card agreement. The Airlines had also started offering installment plans to lure new travelers into the air. In October 1948 the Air Travel Card become the first inter-nationally valid Charge Card within all members of the International Air Transport Association.

The concept of customers paying different merchants using the same card was expanded in 1950 by Ralph Schneider and Frank McNamara, founders of Diners Club

Diners Club

Diners Club International, founded as Diners Club, is a charge card company formed in 1950 by Frank X. McNamara, Ralph Schneider and Matty Simmons...

, to consolidate multiple cards. The Diners Club, which was created partially through a merger with Dine and Sign, produced the first "general purpose" charge card

Charge card

A charge card is a card that provides an alternative payment to cash when making purchases in which the issuer and the cardholder enter into an agreement that the debt incurred on the charge account will be paid in full and by due date or be subject to severe late fees and restrictions on card...

, and required the entire bill to be paid with each statement. That was followed by Carte Blanche and in 1958 by American Express

American Express

American Express Company or AmEx, is an American multinational financial services corporation headquartered in Three World Financial Center, Manhattan, New York City, New York, United States. Founded in 1850, it is one of the 30 components of the Dow Jones Industrial Average. The company is best...

which created a worldwide credit card network (although these were initially charge cards that acquired credit card features after BankAmericard demonstrated the feasibility of the concept).

However, until 1958, no one had been able to create a working revolving credit financial instrument issued by a third-party bank that was generally accepted by a large number of merchants (as opposed to merchant-issued revolving cards accepted by only a few merchants). A dozen experiments by small American banks had been attempted (and had failed). In September 1958, Bank of America

Bank of America

Bank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

launched the BankAmericard in Fresno, California

Fresno, California

Fresno is a city in central California, United States, the county seat of Fresno County. As of the 2010 census, the city's population was 510,365, making it the fifth largest city in California, the largest inland city in California, and the 34th largest in the nation...

. BankAmericard became the first successful recognizably modern credit card (although it underwent a troubled gestation during which its creator resigned), and with its overseas affiliates, eventually evolved into the Visa

VISA (credit card)

Visa Inc. is an American multinational financial services corporation headquartered on 595 Market Street, Financial District in San Francisco, California, United States, although much of the company's staff is based in Foster City, California. It facilitates electronic funds transfers throughout...

system. In 1966, the ancestor of MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

was born when a group of banks established Master Charge to compete with BankAmericard; it received a significant boost when Citibank

Citibank

Citibank, a major international bank, is the consumer banking arm of financial services giant Citigroup. Citibank was founded in 1812 as the City Bank of New York, later First National City Bank of New York...

merged its proprietary Everything Card (launched in 1967) into Master Charge in 1969.

Early credit cards in the U.S., of which BankAmericard was the most prominent example, were mass produced and mass mailed unsolicited to bank customers who were thought to be good credit risks. But, “They have been mailed off to unemployables, drunks, narcotics addicts and to compulsive debtors, a process President Johnson’s Special Assistant Betty Furness found very like ‘giving sugar to diabetics’.” These mass mailings were known as "drops" in banking terminology, and were outlawed in 1970 due to the financial chaos they caused, but not before 100 million credit cards had been dropped into the U.S. population. After 1970, only credit card applications could be sent unsolicited in mass mailings.

The fractured nature of the U.S. banking system under the Glass–Steagall Act meant that credit cards became an effective way for those who were traveling around the country to move their credit to places where they could not directly use their banking facilities. In 1966 Barclaycard

Barclaycard

Barclaycard, part of Barclays Retail and Business Banking, is a global payment business. The Barclaycard was the first credit card introduced in the UK, coming into service in 1966. It enjoyed a monopoly until the introduction of the Access card in 1972....

in the UK launched the first credit card outside of the U.S.

There are now countless variations on the basic concept of revolving credit for individuals (as issued by banks and honored by a network of financial institutions), including organization-branded credit cards, corporate-user credit cards, store cards and so on.

Although credit cards reached very high adoption levels in the US, Canada and the UK in the mid twentieth century, many cultures were more cash-oriented, or developed alternative forms of cash-less payments, such as Carte bleue

Carte Bleue

Carte Bleue is a major debit card payment system operating in France. Unlike Visa Electron or Maestro debit cards, Carte Bleue allows transactions without requiring authorization from the cardholder's bank. In many situations, the card works like a credit card but without fees for the cardholder...

or the Eurocard

EUROCARD (payment card)

Eurocard was a credit card, introduced in 1964 by a Swedish banker in the Wallenberg family as an alternative to American Express.-History:In 1965, Eurocard International N.V. was established, based in Brussels, as a not-for-profit membership association of European banks. Its operational entity...

(Germany, France, Switzerland, and others). In these places, adoption of credit cards was initially much slower. It took until the 1990s to reach anything like the percentage market-penetration levels achieved in the US, Canada, or UK. In some countries, acceptance still remains poor as the use of a credit card system depends on the banking system being perceived as reliable. Japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

remains a very cash oriented society, with credit card adoption being limited to only the largest of merchants, although an alternative system based on RFIDs inside cellphones has seen some acceptance. Because of strict regulations regarding banking system overdrafts, some countries, France in particular, were much faster to develop and adopt chip-based credit cards which are now seen as major anti-fraud credit devices. Debit card

Debit card

A debit card is a plastic card that provides the cardholder electronic access to his or her bank account/s at a financial institution...

s and online banking

Online banking

Online banking allows customers to conduct financial transactions on a secure website operated by their retail or virtual bank, credit union or building society.-Features:...

are used more widely than credit cards in some countries.

The design of the credit card itself has become a major selling point in recent years. The value of the card to the issuer is often related to the customer's usage of the card, or to the customer's financial worth. This has led to the rise of Co-Brand and Affinity

Affinity credit card scheme

An affinity credit card program allows an organization to offer its members and supporters—those who have an "affinity" for that organization—a credit card that promotes the organization's brand and imagery each time a cardholder uses the card...

cards - where the card design is related to the "affinity" (a university or professional society, for example) leading to higher card usage. In most cases a percentage of the value of the card is returned to the affinity group.

Collectible credit cards

A growing field of numismaticsNumismatics

Numismatics is the study or collection of currency, including coins, tokens, paper money, and related objects. While numismatists are often characterized as students or collectors of coins, the discipline also includes the broader study of money and other payment media used to resolve debts and the...

(study of money), or more specifically exonumia

Exonumia

Exonumia are numismatic items other than coins and paper money. This includes "Good For" tokens, badges, counterstamped coins, elongated coins, encased coins, souvenir medallions, tags, wooden nickels and other similar items...

(study of money-like objects), credit card collectors seek to collect various embodiments of credit from the now familiar plastic cards to older paper merchant cards, and even metal

Metal

A metal , is an element, compound, or alloy that is a good conductor of both electricity and heat. Metals are usually malleable and shiny, that is they reflect most of incident light...

tokens that were accepted as merchant credit cards. Early credit cards were made of celluloid

Celluloid

Celluloid is the name of a class of compounds created from nitrocellulose and camphor, plus dyes and other agents. Generally regarded to be the first thermoplastic, it was first created as Parkesine in 1862 and as Xylonite in 1869, before being registered as Celluloid in 1870. Celluloid is...

plastic, then metal and fiber

Fiber

Fiber is a class of materials that are continuous filaments or are in discrete elongated pieces, similar to lengths of thread.They are very important in the biology of both plants and animals, for holding tissues together....

, then paper, and are now mostly plastic.

How credit cards work

Credit cards are issued by a credit card issuer, such as a bank or credit union, after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchantMerchant

A merchant is a businessperson who trades in commodities that were produced by others, in order to earn a profit.Merchants can be one of two types:# A wholesale merchant operates in the chain between producer and retail merchant...

s accepting that card. Merchants often advertise which cards they accept by displaying acceptance mark

Acceptance mark

An acceptance mark, in the world of credit cards, is a logo or design that indicates that a merchant accepts one or more credit card types. Common uses include decals and signs at merchant locations or in merchant advertisements. The purpose of the mark is to provide the card holder with...

s – generally derived from logos – or may communicate this orally, as in "We take (brands X, Y, and Z)" or "We don't take credit cards".

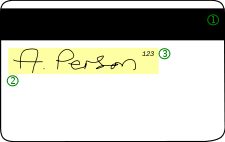

When a purchase is made, the credit card user agrees to pay the card issuer. The cardholder indicates consent to pay by signing a receipt

Receipt

A receipt is a written acknowledgment that a specified article or sum of money has been received as an exchange for goods or services. The receipt is evidence of purchase of the property or service obtained in the exchange.-Printed:...

with a record of the card details and indicating the amount to be paid or by entering a personal identification number

Personal identification number

A personal identification number is a secret numeric password shared between a user and a system that can be used to authenticate the user to the system. Typically, the user is required to provide a non-confidential user identifier or token and a confidential PIN to gain access to the system...

(PIN). Also, many merchants now accept verbal authorizations via telephone and electronic authorization using the Internet, known as a card not present transaction

Card not present transaction

A card not present transaction is a credit card purchase made over the telephone or over the Internet where the physical card has not been swiped into a reader. It is a major route for credit card fraud. If a fraudulent transaction is reported, the bank that hosted the merchant account that...

(CNP).

Electronic

Electronics

Electronics is the branch of science, engineering and technology that deals with electrical circuits involving active electrical components such as vacuum tubes, transistors, diodes and integrated circuits, and associated passive interconnection technologies...

verification systems allow merchants to verify in a few seconds that the card is valid and the credit card customer has sufficient credit to cover the purchase, allowing the verification to happen at time of purchase. The verification is performed using a credit card payment terminal

Credit card terminal

A Credit card terminal is a device that can do transactions with a debit card or a credit card.Several types of credit card terminals are available to merchants. Most have the same basic purpose and functions. They allow a merchant to swipe or key in required credit card information and transmit...

or point-of-sale

Point of sale

Point of sale or checkout is the location where a transaction occurs...

(POS) system with a communications link to the merchant's acquiring bank. Data from the card is obtained from a magnetic stripe

Magnetic stripe card

A magnetic stripe card is a type of card capable of storing data by modifying the magnetism of tiny iron-based magnetic particles on a band of magnetic material on the card...

or chip

Smart card

A smart card, chip card, or integrated circuit card , is any pocket-sized card with embedded integrated circuits. A smart card or microprocessor cards contain volatile memory and microprocessor components. The card is made of plastic, generally polyvinyl chloride, but sometimes acrylonitrile...

on the card; the latter system is called Chip and PIN

Chip and PIN

Chip and PIN is the brandname adopted by the banking industries in the United Kingdom and Ireland for the rollout of the EMV smartcard payment system for credit, debit and ATM cards.- History :...

in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

and Ireland

Ireland

Ireland is an island to the northwest of continental Europe. It is the third-largest island in Europe and the twentieth-largest island on Earth...

, and is implemented as an EMV

EMV

EMV stands for Europay, MasterCard and VISA, a global standard for inter-operation of integrated circuit cards and IC card capable point of sale terminals and automated teller machines , for authenticating credit and debit card transactions.It is a joint effort between Europay, MasterCard and...

card.

For card not present transaction

Card not present transaction

A card not present transaction is a credit card purchase made over the telephone or over the Internet where the physical card has not been swiped into a reader. It is a major route for credit card fraud. If a fraudulent transaction is reported, the bank that hosted the merchant account that...

s where the card is not shown (e.g., e-commerce

Electronic commerce

Electronic commerce, commonly known as e-commerce, eCommerce or e-comm, refers to the buying and selling of products or services over electronic systems such as the Internet and other computer networks. However, the term may refer to more than just buying and selling products online...

, mail order

Mail order

Mail order is a term which describes the buying of goods or services by mail delivery. The buyer places an order for the desired products with the merchant through some remote method such as through a telephone call or web site. Then, the products are delivered to the customer...

, and telephone sales), merchants additionally verify that the customer is in physical possession of the card and is the authorized user by asking for additional information such as the security code

Card security code

The card security code , sometimes called Card Verification Data , Card Verification Value , Card Verification Value Code , Card Verification Code , Verification Code , or Card Code Verification are different terms for security features for credit or debit card...

printed on the back of the card, date of expiry, and billing address.

Each month, the credit card user is sent a statement indicating the purchases undertaken with the card, any outstanding fees, and the total amount owed. After receiving the statement, the cardholder may dispute any charges that he or she thinks are incorrect (see , which limits cardholder liability for unauthorized use of a credit card to $50, and the Fair Credit Billing Act

Fair Credit Billing Act

The Fair Credit Billing Act is a United States federal law enacted in 1975 as an amendment to the Truth in Lending Act...

for details of the US regulations). Otherwise, the cardholder must pay a defined minimum proportion of the bill by a due date, or may choose to pay a higher amount up to the entire amount owed. The credit issuer charges interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

on the amount owed if the balance is not paid in full (typically at a much higher rate than most other forms of debt). In addition, if the credit card user fails to make at least the minimum payment by the due date, the issuer may impose a "late fee

Late fee

A late fee, also known as a late fine or a past due fee, is a charge levied against a client by a company or organization for not paying a bill or returning a rented or borrowed item by its due date. Its use is most commonly associated with businesses like creditors, video rental outlets and...

" and/or other penalties on the user. To help mitigate this, some financial institutions can arrange for automatic payments to be deducted from the user's bank accounts, thus avoiding such penalties altogether as long as the cardholder has sufficient funds.

Advertising, solicitation, application and approval

Credit card advertising regulations include the Schumer box disclosure requirements. A large fraction of junk mail consists of credit card offers created from lists provided by the major credit reporting agencies. In the United States, the three major US credit bureaus (Equifax, TransUnion and Experian) allow consumers to opt out from related credit card solicitation offers via its Opt Out Pre ScreenOptoutprescreen.com

Optoutprescreen.com is a joint venture among Equifax, Experian, Innovis, and TransUnion, allowing customers to opt out of receiving credit card solicitations by mail....

program.

Interest charges

Credit card issuers usually waive interest charges if the balance is paid in full each month, but typically will charge full interest on the entire outstanding balance from the date of each purchase if the total balance is not paid.For example, if a user had a $1,000 transaction and repaid it in full within this grace period, there would be no interest charged. If, however, even $1.00 of the total amount remained unpaid, interest would be charged on the $1,000 from the date of purchase until the payment is received. The precise manner in which interest is charged is usually detailed in a cardholder agreement which may be summarized on the back of the monthly statement. The general calculation formula most financial institutions use to determine the amount of interest to be charged is APR/100 x ADB/365 x number of days revolved. Take the annual percentage rate

Annual percentage rate

The term annual percentage rate , also called nominal APR, and the term effective APR, also called EAR, describe the interest rate for a whole year , rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate...

(APR) and divide by 100 then multiply to the amount of the average daily balance (ADB) divided by 365 and then take this total and multiply by the total number of days the amount revolved before payment was made on the account. Financial institutions refer to interest charged back to the original time of the transaction and up to the time a payment was made, if not in full, as RRFC or residual retail finance charge. Thus after an amount has revolved and a payment has been made, the user of the card will still receive interest charges on their statement after paying the next statement in full (in fact the statement may only have a charge for interest that collected up until the date the full balance was paid, i.e. when the balance stopped revolving).

The credit card may simply serve as a form of revolving credit

Revolving credit

Revolving credit is a type of credit that does not have a fixed number of payments, in contrast to installment credit. Examples of revolving credits used by consumers include credit cards. Corporate revolving credit facilities are typically used to provide liquidity for a company's day-to-day...

, or it may become a complicated financial instrument with multiple balance segments each at a different interest rate, possibly with a single umbrella credit limit, or with separate credit limits applicable to the various balance segments. Usually this compartmentalization is the result of special incentive offers from the issuing bank, to encourage balance transfer

Balance transfer

A balance transfer is the transfer of the balance in an account to another account, often held at another institution.-Types of balance transfers:...

s from cards of other issuers. In the event that several interest rates apply to various balance segments, payment allocation is generally at the discretion of the issuing bank, and payments will therefore usually be allocated towards the lowest rate balances until paid in full before any money is paid towards higher rate balances. Interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s can vary considerably from card to card, and the interest rate on a particular card may jump dramatically if the card user is late with a payment on that card or any other credit instrument, or even if the issuing bank decides to raise its revenue.

Benefits to customers

The main benefit to each customer is convenience. Compared to debit cards and cheques, a credit card allows small short-term loans to be quickly made to a customer who need not calculate a balance remaining before every transaction, provided the total charges do not exceed the maximum credit line for the card. Credit cards also provide more fraud protection than debit cards. In the UK for example, the bank is jointly liable with the merchant for purchases of defective products over £100.Many credit cards offer rewards and benefits packages, such as offering enhanced product warranties at no cost, free loss/damage coverage on new purchases, and points which may be redeemed for cash, products, or airline tickets.

High interest and bankruptcy

Low introductory credit card rates are limited to a fixed term, usually between 6 and 12 months, after which a higher rate is charged. As all credit cards charge fees and interest, some customers become so indebted to their credit card provider that they are driven to bankruptcyBankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

. Some credit cards often levy a rate of 20 to 30 percent after a payment is missed.http://www.creditcards.com/credit-card-news/default-penalty-rates-what-they-are-how-to-avoid-1276.php In other cases a fixed charge is levied without change to the interest rate. In some cases universal default

Universal default

Universal default is the term for a practice in the financial services industry in the United States for a particular lender to change the terms of a loan from the normal terms to the default terms Universal default is the term for a practice in the financial services industry in the United States...

may apply: the high default rate is applied to a card in good standing by missing a payment on an unrelated account from the same provider. This can lead to a snowball effect in which the consumer is drowned by unexpectedly high interest rates.

Further, most card holder agreements enable the issuer to arbitrarily raise the interest rate for any reason they see fit.

First Premier Bank

First Premier Bank

First Premier Bank, headquartered in Sioux Falls, South Dakota, is the 10th largest issuer of Visa and MasterCard brand credit cards in the United States...

at one point offered a credit card with a 79.9% interest rate, however they pulled the plug on this card in February of 2011 because of persistant defaults.

Complex fee structures in the credit card industry limit customers' ability to comparison shop, help ensure that the industry is not price-competitive and help maximize industry profits.

Inflated pricing for all consumers

Merchants that accept credit cards must pay interchange feeInterchange fee

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card based transactions. Usually it is a fee that a merchant's bank pays a customer's bank however there are instances where the interchange fee is paid from the issuer to...

s and discount fees on all credit-card transactions. In some cases merchants are barred by their credit agreements from passing these fees directly to credit card customers, or from setting a minimum transaction amount (no longer prohibited in the United States). The result is that merchants may charge all customers (including those who do not use credit cards) higher prices to cover the fees on credit card transactions. In the United States in 2008 credit card companies collected a total of $48 billion in interchange fees, or an average of $427 per family, with an average fee rate of about 2% per transaction.

Weakens self regulation

Several studies have shown that consumers are likely to spend more money when they pay by credit card. Researchers suggest that when people pay using credit cards, they do not experience the abstract pain of payment. Furthermore, researchers have found that using credit cards can increase consumption of unhealthy food.Grace period

A credit card's grace period is the time the customer has to pay the balance before interest is assessed on the outstanding balance. Grace periods may vary, but usually range from 20 to 50 days depending on the type of credit card and the issuing bank. Some policies allow for reinstatement after certain conditions are met.Usually, if a customer is late paying the balance, finance charges will be calculated and the grace period does not apply. Finance charges incurred depend on the grace period and balance; with most credit cards there is no grace period if there is any outstanding balance from the previous billing cycle or statement (i.e. interest is applied on both the previous balance and new transactions). However, there are some credit cards that will only apply finance charge on the previous or old balance, excluding new transactions.

Benefits to merchants

Cheque

A cheque is a document/instrument See the negotiable cow—itself a fictional story—for discussions of cheques written on unusual surfaces. that orders a payment of money from a bank account...

s, because the issuing bank commits to pay the merchant the moment the transaction is authorized, regardless of whether the consumer defaults on the credit card payment (except for legitimate disputes, which are discussed below, and can result in charges back to the merchant). In most cases, cards are even more secure than cash, because they discourage theft by the merchant's employees and reduce the amount of cash on the premises.

Prior to credit cards, each merchant had to evaluate each customer's credit history

Credit history

Credit history or credit report is, in many countries, a record of an individual's or company's past borrowing and repaying, including information about late payments and bankruptcy...

before extending credit. That task is now performed by the banks which assume the credit risk

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

. Credit cards can also aid in securing a sale, especially if the customer does not have enough cash on his or her person or checking account. Extra turnover is generated by the fact that the customer can purchase goods and/or services immediately and is less inhibited by the amount of cash in his or her pocket and the immediate state of his or her bank balance. Much of merchants' marketing is based on this immediacy.

For each purchase, the bank charges the merchant a commission (discount fee) for this service and there may be a certain delay before the agreed payment is received by the merchant. The commission is often a percentage of the transaction amount, plus a fixed fee (interchange rate). In addition, a merchant may be penalized or have their ability to receive payment using that credit card restricted if there are too many cancellations or reversals of charges as a result of disputes. Some small merchants require credit purchases to have a minimum amount to compensate for the transaction costs.

In some countries, for example the Nordic countries

Nordic countries

The Nordic countries make up a region in Northern Europe and the North Atlantic which consists of Denmark, Finland, Iceland, Norway and Sweden and their associated territories, the Faroe Islands, Greenland and Åland...

, banks guarantee payment on stolen cards only if an ID card is checked and the ID card number/civic registration number is written down on the receipt together with the signature. In these countries merchants therefore usually ask for ID. Non-Nordic citizens, who are unlikely to possess a Nordic ID card or driving license, will instead have to show their passport, and the passport number will be written down on the receipt, sometimes together with other information. Some shops use the card's PIN for identification, and in that case showing an ID card is not necessary.

Costs to merchants

Merchants are charged several fees for accepting credit cards. The merchant is usually charged a commissionCommission (remuneration)

The payment of commission as remuneration for services rendered or products sold is a common way to reward sales people. Payments often will be calculated on the basis of a percentage of the goods sold...

of around 1 to 3 percent of the value of each transaction paid for by credit card. The merchant may also pay a variable charge, called an interchange rate, for each transaction. In some instances of very low-value transactions, use of credit cards will significantly reduce the profit margin

Profit margin

Profit margin, net margin, net profit margin or net profit ratio all refer to a measure of profitability. It is calculated by finding the net profit as a percentage of the revenue.Net profit Margin = x100...

or cause the merchant to lose money on the transaction. Merchants with very low average transaction prices or very high average transaction prices are more averse to accepting credit cards. In some cases merchants may charge users a "credit card supplement", either a fixed amount or a percentage, for payment by credit card. This practice is prohibited by the credit card contracts in the United States, although the contracts allow the merchants to give discounts for cash payment.

Parties involved

- Cardholder: The holder of the card used to make a purchase; the consumerConsumerConsumer is a broad label for any individuals or households that use goods generated within the economy. The concept of a consumer occurs in different contexts, so that the usage and significance of the term may vary.-Economics and marketing:...

. - Card-issuing bank: The financial institution or other organization that issued the credit card to the cardholder. This bank bills the consumer for repayment and bears the risk that the card is used fraudulently. American Express and Discover were previously the only card-issuing banks for their respective brands, but as of 2007, this is no longer the case. Cards issued by banks to cardholders in a different country are known as offshore credit cardOffshore credit cardOffshore credit cards are credit cards issued by an offshore bank in a jurisdiction that is different to that of the cardholder. Real 'unsecured' offshore credit cards with credit lines are very difficult for the average person to obtain because banks refuse to issue them. Most banks will need...

s. - Merchant: The individual or business accepting credit card payments for products or services sold to the cardholder.

- Acquiring bankAcquiring bankAn acquiring bank is the bank or financial institution that processes credit and or debit card payments for products or services for a merchant. The term acquirer indicates that the bank accepts or acquires credit card transactions from the card-issuing banks within an association...

: The financial institution accepting payment for the products or services on behalf of the merchant. - Independent sales organization: Resellers (to merchants) of the services of the acquiring bank.

- Merchant accountMerchant accountA merchant account is a type of bank account that allows businesses to accept payments by debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of credit card and/or debit card transactions...

: This could refer to the acquiring bank or the independent sales organization, but in general is the organization that the merchant deals with. - Credit Card association: An association of card-issuing banks such as DiscoverDiscover CardThe Discover Card is a major credit card, issued primarily in the United States. It was originally introduced by Sears in 1985, and was part of Dean Witter, and then Morgan Stanley, until 2007, when Discover Financial Services became an independent company. Novus, a major processing center, used to...

, Visa, MasterCardMasterCardMastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

, American ExpressAmerican ExpressAmerican Express Company or AmEx, is an American multinational financial services corporation headquartered in Three World Financial Center, Manhattan, New York City, New York, United States. Founded in 1850, it is one of the 30 components of the Dow Jones Industrial Average. The company is best...

, etc. that set transaction terms for merchants, card-issuing banks, and acquiring banks. - Transaction network: The system that implements the mechanics of the electronic transactions. May be operated by an independent company, and one company may operate multiple networks.

- Affinity partner: Some institutions lend their names to an issuer to attract customers that have a strong relationship with that institution, and get paid a fee or a percentage of the balance for each card issued using their name. Examples of typical affinity partners are sports teams, universities, charities, professional organizations, and major retailers.

The flow of information and money between these parties — always through the card associations — is known as the interchange, and it consists of a few steps.

Transaction steps

- AuthorizationAuthorization holdAuthorization hold is the practice within the banking industry of authorizing electronic transactions done with a debit card or credit card and holding this balance as unavailable either until the merchant clears the transaction , or the hold "falls off." In the case of debit cards,...

: The cardholder presents the card as payment to the merchant and the merchant submits the transaction to the acquirer (acquiring bank). The acquirer verifies the credit card number, the transaction type and the amount with the issuer (Card-issuing bank) and reserves that amount of the cardholder's credit limit for the merchant. An authorization will generate an approval code, which the merchant stores with the transaction.

- Batching: Authorized transactions are stored in "batches", which are sent to the acquirer. Batches are typically submitted once per day at the end of the business day. If a transaction is not submitted in the batch, the authorization will stay valid for a period determined by the issuer, after which the held amount will be returned to the cardholder's available credit (see authorization holdAuthorization holdAuthorization hold is the practice within the banking industry of authorizing electronic transactions done with a debit card or credit card and holding this balance as unavailable either until the merchant clears the transaction , or the hold "falls off." In the case of debit cards,...

). Some transactions may be submitted in the batch without prior authorizations; these are either transactions falling under the merchant's floor limitFloor limitA floor limit is the amount of money above which Visa transactions must be authorised. The limit can vary from store to store.Floor limits do not apply to certain types of debit card , as these cards require authorisation for every transaction to prevent the cardholder becoming overdrawn.The term...

or ones where the authorization was unsuccessful but the merchant still attempts to force the transaction through. (Such may be the case when the cardholder is not present but owes the merchant additional money, such as extending a hotel stay or car rental.)

- Clearing and Settlement: The acquirer sends the batch transactions through the credit card association, which debits the issuers for payment and credits the acquirer. Essentially, the issuer pays the acquirer for the transaction.

- Funding: Once the acquirer has been paid, the acquirer pays the merchant. The merchant receives the amount totaling the funds in the batch minus either the "discount rate," "mid-qualified rate", or "non-qualified rate" which are tiers of fees the merchant pays the acquirer for processing the transactions.

- Chargebacks: A chargeback is an event in which money in a merchant account is held due to a dispute relating to the transaction. Chargebacks are typically initiated by the cardholder. In the event of a chargebackChargebackA chargeback is the return of funds to a consumer, forcibly initiated by the consumer's issuing bank. Specifically, it is the reversal of a prior outbound transfer of funds from a consumer's bank account, line of credit, or credit card....

, the issuer returns the transaction to the acquirer for resolution. The acquirer then forwards the chargeback to the merchant, who must either accept the chargeback or contest it.

Secured credit cards

A secured credit card is a type of credit card secured by a deposit accountDeposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

owned by the cardholder. Typically, the cardholder must deposit between 100% and 200% of the total amount of credit desired. Thus if the cardholder puts down $1000, they will be given credit in the range of $500–$1000. In some cases, credit card issuers will offer incentives even on their secured card portfolios. In these cases, the deposit required may be significantly less than the required credit limit, and can be as low as 10% of the desired credit limit. This deposit is held in a special savings account. Credit card issuers offer this because they have noticed that delinquencies were notably reduced when the customer perceives something to lose if the balance is not repaid.

The cardholder of a secured credit card is still expected to make regular payments, as with a regular credit card, but should they default on a payment, the card issuer has the option of recovering the cost of the purchases paid to the merchants out of the deposit. The advantage of the secured card for an individual with negative or no credit history is that most companies report regularly to the major credit bureaus. This allows for building of positive credit history.

Although the deposit is in the hands of the credit card issuer as security in the event of default by the consumer, the deposit will not be debited simply for missing one or two payments. Usually the deposit is only used as an offset when the account is closed, either at the request of the customer or due to severe delinquency (150 to 180 days). This means that an account which is less than 150 days delinquent will continue to accrue interest and fees, and could result in a balance which is much higher than the actual credit limit on the card. In these cases the total debt may far exceed the original deposit and the cardholder not only forfeits their deposit but is left with an additional debt.

Most of these conditions are usually described in a cardholder agreement which the cardholder signs when their account is opened.

Secured credit cards are an option to allow a person with a poor credit history

Credit history

Credit history or credit report is, in many countries, a record of an individual's or company's past borrowing and repaying, including information about late payments and bankruptcy...

or no credit history to have a credit card which might not otherwise be available. They are often offered as a means of rebuilding one's credit. Fees and service charges for secured credit cards often exceed those charged for ordinary non-secured credit cards, however, for people in certain situations, (for example, after charging off on other credit cards, or people with a long history of delinquency on various forms of debt), secured cards are almost always more expensive then unsecured credit cards.

Sometimes a credit card will be secured by the equity in the borrower's home

Home equity

Home equity is the market value of a homeowner's unencumbered interest in their real property—that is, the difference between the home's fair market value and the outstanding balance of all liens on the property. The property's equity increases as the debtor makes payments against the...

.

Prepaid "credit" cards

A prepaid credit card is not a true credit card, since no credit is offered by the card issuer: the card-holder spends money which has been "stored" via a prior deposit by the card-holder or someone else, such as a parent or employer. However, it carries a credit-card brand (such as DiscoverDiscover Card

The Discover Card is a major credit card, issued primarily in the United States. It was originally introduced by Sears in 1985, and was part of Dean Witter, and then Morgan Stanley, until 2007, when Discover Financial Services became an independent company. Novus, a major processing center, used to...

, Visa, MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

, American Express

American Express

American Express Company or AmEx, is an American multinational financial services corporation headquartered in Three World Financial Center, Manhattan, New York City, New York, United States. Founded in 1850, it is one of the 30 components of the Dow Jones Industrial Average. The company is best...

, or JCB

Japan Credit Bureau

Japan Credit Bureau is a credit card company based in Tokyo, Japan. Its English name is .Founded in 1961, JCB established dominance over the Japanese credit card market when it purchased Osaka Credit Bureau in 1968, and its cards are now issued in 20 different countries...

etc.) and can be used in similar ways just as though it were a regular credit card. Unlike debit cards, prepaid credit cards generally do not require a PIN. An exception are prepaid credit cards with an EMV

EMV

EMV stands for Europay, MasterCard and VISA, a global standard for inter-operation of integrated circuit cards and IC card capable point of sale terminals and automated teller machines , for authenticating credit and debit card transactions.It is a joint effort between Europay, MasterCard and...

chip. These cards do require a PIN if the payment is processed via Chip and PIN

Chip and PIN

Chip and PIN is the brandname adopted by the banking industries in the United Kingdom and Ireland for the rollout of the EMV smartcard payment system for credit, debit and ATM cards.- History :...

technology.

After purchasing the card, the cardholder loads the account with any amount of money, up to the predetermined card limit and then uses the card to make purchases the same way as a typical credit card. Prepaid cards can be issued to minors (above 13) since there is no credit line involved. The main advantage over secured credit cards (see above section) is that you are not required to come up with $500 or more to open an account. With prepaid credit cards purchasers are not charged any interest but are often charged a purchasing fee plus monthly fees after an arbitrary time period. Many other fees also usually apply to a prepaid card.

Prepaid credit cards are sometimes marketed to teenagers for shopping online without having their parents complete the transaction.

Because of the many fees that apply to obtaining and using credit-card-branded prepaid cards, the Financial Consumer Agency of Canada

Financial Consumer Agency of Canada

The Financial Consumer Agency of Canada is an independent government agency of the Government of Canada. FCAC provides consumer information and oversees financial institutions to ensure that they comply with federal consumer protection measures. Created in 2001, the Agency investigates cases of...

describes them as "an expensive way to spend your own money". The agency publishes a booklet entitled Pre-paid Cards which explains the advantages and disadvantages of this type of prepaid card.

Features

As well as convenient, accessible credit, credit cards offer consumers an easy way to track expenseExpense

In common usage, an expense or expenditure is an outflow of money to another person or group to pay for an item or service, or for a category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture or an automobile is often...

s, which is necessary for both monitoring personal expenditures and the tracking of work-related expenses for tax

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

ation and reimbursement

Reimbursement

Reimbursement is the act of compensating someone for an expense . Often, a person is reimbursed for out-of-pocket expenses when the person incurs those expenses through employment or in an account of carrying out the duties for another party or member....

purposes. Credit cards are accepted worldwide, and are available with a large variety of credit limits, repayment arrangement, and other perks (such as rewards schemes

Loyalty program

Loyalty programs are structured marketing efforts that reward, and therefore encourage, loyal buying behavior — behavior which is potentially beneficial to the firm....

in which points earned by purchasing goods with the card can be redeemed for further goods and services or credit card cashback

Credit card cashback

When accepting payment by credit card, merchants typically pay a percentage of the transaction amount in commission to their bank or merchant services provider. Many credit card issuers, particularly those in the United Kingdom and United States, share the commission with the card holder by giving...

).

Some countries, such as the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, and France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, limit the amount for which a consumer can be held liable

Legal liability

Legal liability is the legal bound obligation to pay debts.* In law a person is said to be legally liable when they are financially and legally responsible for something. Legal liability concerns both civil law and criminal law. See Strict liability. Under English law, with the passing of the Theft...

due to fraudulent transactions as a result of a consumer's credit card being lost or stolen.

Security problems and solutions

Credit card security relies on the physical security of the plastic card as well as the privacy of the credit card number. Therefore, whenever a person other than the card owner has access to the card or its number, security is potentially compromised. Once, merchants would often accept credit card numbers without additional verification for mail order purchases. It's now common practice to only ship to confirmed addresses as a security measure to minimise fraudulent purchases. Some merchants will accept a credit card number for in-store purchases, whereupon access to the number allows easy fraud, but many require the card itself to be present, and require a signature. A lost or stolen card can be cancelled, and if this is done quickly, will greatly limit the fraud that can take place in this way. European banks can require a cardholder's security PIN be entered for in-person purchases with the card.The PCI DSS is the security standard issued by The PCI SSC (Payment Card Industry Security Standards Council). This data security standard is used by acquiring banks to impose cardholder data security measures upon their merchants.

Internet fraud

Internet fraud

Internet fraud refers to the use of Internet services to present fraudulent solicitations to prospective victims, to conduct fraudulent transactions, or to transmit the proceeds of fraud to financial institutions or to others connected with the scheme....

may be by claiming a chargeback

Chargeback

A chargeback is the return of funds to a consumer, forcibly initiated by the consumer's issuing bank. Specifically, it is the reversal of a prior outbound transfer of funds from a consumer's bank account, line of credit, or credit card....

which is not justified ("friendly fraud

Friendly Fraud

Friendly fraud, also known as friendly fraud chargeback, is a credit card industry term used to describe a consumer who makes an Internet purchase with his/her own credit card and then issues a chargeback through his/her card provider after receiving the goods or services...

"), or carried out by the use of credit card information which can be stolen in many ways, the simplest being copying information from retailers, either online

ONLINE

ONLINE is a magazine for information systems first published in 1977. The publisher Online, Inc. was founded the year before. In May 2002, Information Today, Inc. acquired the assets of Online Inc....

or offline

Off-line

The terms "online" and "offline" have specific meanings in regard to computer technology and telecommunications. In general, "online" indicates a state of connectivity, while "offline" indicates a disconnected state...

. Despite efforts to improve security for remote purchases using credit cards, security breaches are usually the result of poor practice by merchants. For example, a website that safely uses SSL

Transport Layer Security

Transport Layer Security and its predecessor, Secure Sockets Layer , are cryptographic protocols that provide communication security over the Internet...

to encrypt card data from a client may then email the data, unencrypted, from the webserver to the merchant; or the merchant may store unencrypted details in a way that allows them to be accessed over the Internet or by a rogue employee; unencrypted card details are always a security risk. Even encryption data may be cracked.

Controlled Payment Number

Controlled Payment Number

A controlled payment number is an alias for one's credit card number...

s which are used by various banks such as Citibank (Virtual Account Numbers), Discover (Secure Online Account Numbers, Bank of America (Shop Safe), 5 banks using eCarte Bleue and CMB's Virtualis in France, and Swedbank of Sweden's eKort product are another option for protecting against credit card fraud. These are generally one-time use numbers that front one's actual account (debit/credit) number, and are generated as one shops on-line. They can be valid for a relatively short time, for the actual amount of the purchase, or for a price limit set by the user. Their use can be limited to one merchant. If the number given to the merchant is compromised, it will be rejected if an attempt is made to use it again.

A similar system of controls can be used on physical cards. Technology provides the option for banks to support many other controls too that can be turned on and off and varied by the credit card owner in real time as circumstances change (i.e., they can change temporal, numerical, geographical and many other parameters on their primary and subsidiary cards). Apart from the obvious benefits of such controls: from a security perspective this means that a customer can have a Chip and PIN card secured for the real world, and limited for use in the home country. In this eventuality a thief stealing the details will be prevented from using these overseas in non chip and pin (EMV) countries. Similarly the real card can be restricted from use on-line so that stolen details will be declined if this tried. Then when card users shop online they can use virtual account numbers. In both circumstances an alert system can be built in notifying a user that a fraudulent attempt has been made which breaches their parameters, and can provide data on this in real time. This is the optimal method of security for credit cards, as it provides very high levels of security, control and awareness in the real and virtual world.

Additionally, there are security features present on the physical card itself in order to prevent counterfeiting. For example, most modern credit cards have a watermark

Watermark

A watermark is a recognizable image or pattern in paper that appears as various shades of lightness/darkness when viewed by transmitted light , caused by thickness or density variations in the paper...

that will fluoresce under ultraviolet light. A Visa card has a letter V superimposed over the regular Visa logo and a Mastercard has the letters MC across the front of the card. Older Visa cards have a bald eagle or dove across the front. In the aforementioned cases, the security features are only visible under ultraviolet light and are invisible in normal light.

The Federal Bureau of Investigation

Federal Bureau of Investigation

The Federal Bureau of Investigation is an agency of the United States Department of Justice that serves as both a federal criminal investigative body and an internal intelligence agency . The FBI has investigative jurisdiction over violations of more than 200 categories of federal crime...

and U.S. Postal Inspection Service are responsible for prosecuting criminals who engage in credit card fraud

Credit card fraud

Credit card fraud is a wide-ranging term for theft and fraud committed using a credit card or any similar payment mechanism as a fraudulent source of funds in a transaction. The purpose may be to obtain goods without paying, or to obtain unauthorized funds from an account. Credit card fraud is also...

in the United States, but they do not have the resources to pursue all criminals. In general, federal officials only prosecute cases exceeding US$5,000. Three improvements to card security have been introduced to the more common credit card networks but none has proven to help reduce credit card fraud so far. First, the on-line verification system used by merchants is being enhanced to require a 4 digit Personal Identification Number

Personal identification number

A personal identification number is a secret numeric password shared between a user and a system that can be used to authenticate the user to the system. Typically, the user is required to provide a non-confidential user identifier or token and a confidential PIN to gain access to the system...

(PIN) known only to the card holder. Second, the cards themselves are being replaced with similar-looking tamper-resistant smart card

Smart card

A smart card, chip card, or integrated circuit card , is any pocket-sized card with embedded integrated circuits. A smart card or microprocessor cards contain volatile memory and microprocessor components. The card is made of plastic, generally polyvinyl chloride, but sometimes acrylonitrile...

s which are intended to make forgery

Forgery

Forgery is the process of making, adapting, or imitating objects, statistics, or documents with the intent to deceive. Copies, studio replicas, and reproductions are not considered forgeries, though they may later become forgeries through knowing and willful misrepresentations. Forging money or...

more difficult. The majority of smart card (IC card) based credit cards comply with the EMV

EMV

EMV stands for Europay, MasterCard and VISA, a global standard for inter-operation of integrated circuit cards and IC card capable point of sale terminals and automated teller machines , for authenticating credit and debit card transactions.It is a joint effort between Europay, MasterCard and...

(Europay MasterCard Visa) standard. Third, an additional 3 or 4 digit Card Security Code

Card security code

The card security code , sometimes called Card Verification Data , Card Verification Value , Card Verification Value Code , Card Verification Code , Verification Code , or Card Code Verification are different terms for security features for credit or debit card...

(CSC) is now present on the back of most cards, for use in card not present transaction

Card not present transaction

A card not present transaction is a credit card purchase made over the telephone or over the Internet where the physical card has not been swiped into a reader. It is a major route for credit card fraud. If a fraudulent transaction is reported, the bank that hosted the merchant account that...

s. Stakeholders at all levels in electronic payment have recognized the need to develop consistent global standards for security that account for and integrate both current and emerging security technologies. They have begun to address these needs through organizations such as PCI DSS

PCI DSS

The Payment Card Industry Data Security Standard is an information security standard for organizations that handle cardholder information for the major debit, credit, prepaid, e-purse, ATM, and POS cards....

and the Secure POS Vendor Alliance.

Code 10

Code 10 calls are made when merchants are suspicious about accepting a credit card.The operator then asks the merchant a series of YES or NO questions to find out whether the merchant is suspicious of the card or the cardholder. The merchant may be asked to retain the card if it is safe to do so.

Credit history

The way credit card owners pay off their balances has a tremendous effect on their credit historyCredit history

Credit history or credit report is, in many countries, a record of an individual's or company's past borrowing and repaying, including information about late payments and bankruptcy...

. Two of the most important factors reported to a credit bureau are the timeliness of the debt payments and the amount of debt to credit limit. Lenders want to see payments made as agreed, usually on a monthly basis, and a credit balance of around one-third the credit limit. The credit information stays on the credit report generally for 7 years. However, there are a few jurisdictions and situations where the timeframe might differ.

Profits and losses

In recent times, credit card portfolios have been very profitable for banks, largely due to the booming economy of the late nineties. However, in the case of credit cards, such high returns go hand in hand with risk, since the business is essentially one of making unsecured (uncollateralized) loans, and thus dependent on borrowers not to default in large numbers.Interest expenses

Banks generally borrow the money they then lend to their customers. As they receive very low-interest loans from other firms, they may borrow as much as their customers require, while lending their capital to other borrowers at higher rates. If the card issuer charges 15% on money lent to users, and it costs 5% to borrow the money to lend, and the balance sits with the cardholder for a year, the issuer earns 10% on the loan. This 10% difference is the "net interest spread" and the 5% is the "interest expense".Operating costs

This is the cost of runningOperating cost

Operating costs can be described as the expenses which are related to the operation of a business, or to the operation of a device, component, piece of equipment or facility.-Business operating costs:...

the credit card portfolio, including everything from paying the executives who run the company to printing the plastics, to mailing the statements, to running the computers that keep track of every cardholder's balance, to taking the many phone calls which cardholders place to their issuer, to protecting the customers from fraud rings. Depending on the issuer, marketing programs are also a significant portion of expenses.

Charge offs

When a consumer becomes severely delinquent on a debt (often at the point of six months without payment), the creditor may declare the debt to be a charge-offCharge-off

A charge-off or chargeoff is the declaration by a creditor that an amount of debt is unlikely to be collected. This occurs when a consumer becomes severely delinquent on a debt. Traditionally, creditors will make this declaration at the point of six months without payment...

. It will then be listed as such on the debtor's credit bureau reports (Equifax

Equifax

Equifax Inc. is a consumer credit reporting agency in the United States, considered one of the three largest American credit agencies along with Experian and TransUnion. Founded in 1899, Equifax is the oldest of the three agencies and gathers and maintains information on over 400 million credit...

, for instance, lists "R9" in the "status" column to denote a charge-off.)

A charge-off is considered to be "written off as uncollectable." To banks, bad debts and even fraud are simply part of the cost of doing business.

However, the debt is still legally valid, and the creditor can attempt to collect the full amount for the time periods permitted under state law, which is usually 3 to 7 years. This includes contacts from internal collections staff, or more likely, an outside collection agency

Collection agency

A collection agency is a business that pursues payments of debts owed by individuals or businesses. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed....

. If the amount is large (generally over $1500–$2000), there is the possibility of a lawsuit or arbitration

Arbitration

Arbitration, a form of alternative dispute resolution , is a legal technique for the resolution of disputes outside the courts, where the parties to a dispute refer it to one or more persons , by whose decision they agree to be bound...

.

Rewards

Many credit card customers receive rewards, such as frequent flyer points, gift certificates, or cash backCredit card cashback

When accepting payment by credit card, merchants typically pay a percentage of the transaction amount in commission to their bank or merchant services provider. Many credit card issuers, particularly those in the United Kingdom and United States, share the commission with the card holder by giving...

as an incentive to use the card. Rewards are generally tied to purchasing an item or service on the card, which may or may not include balance transfer

Balance transfer

A balance transfer is the transfer of the balance in an account to another account, often held at another institution.-Types of balance transfers:...

s, cash advances

Payday loan

A payday loan is a small, short-term loan that is intended to cover a borrower's expenses until his or her next payday. The loans are also sometimes referred to as cash advances, though that term can also refer to cash provided against a prearranged line of credit such as a credit card...

, or other special uses. Depending on the type of card, rewards will generally cost the issuer between 0.25% and 2.0% of the spread. Networks such as Visa or MasterCard have increased their fees to allow issuers to fund their rewards system. Some issuers discourage redemption by forcing the cardholder to call customer service for rewards. On their servicing website, redeeming awards is usually a feature that is very well hidden by the issuers. With a fractured and competitive environment, rewards points cut dramatically into an issuer's bottom line, and rewards points and related incentives must be carefully managed to ensure a profitable portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

. Unlike unused gift cards, in whose case the breakage

Breakage (Accounting)

Breakage is a term used in accounting to indicate gift cards that have been sold but never redeemed. Revenue from breakage is almost entirely profit, since companies need not provide any goods or services for unredeemed gift cards....

in certain US states goes to the state's treasury, unredeemed credit card points are retained by the issuer.

Fraud

In relative numbers the values lost in bank card fraud are minor, calculated in 2006 at 7 cents per 100 dollars worth of transactions (7 basis pointBasis point

A basis point is a unit equal to 1/100 of a percentage point or one part per ten thousand...

s). In 2004, in the UK, the cost of fraud was over £500 million.

When a card is stolen, or an unauthorized duplicate made, most card issuers will refund some or all of the charges that the customer has received for things they did not buy. These refunds will, in some cases, be at the expense of the merchant, especially in mail order cases where the merchant cannot claim sight of the card. In several countries, merchants will lose the money if no ID card was asked for, therefore merchants usually require ID card in these countries. Credit card companies generally guarantee the merchant will be paid on legitimate transactions regardless of whether the consumer pays their credit card bill.