Cumulative prospect theory

Encyclopedia

Amos Tversky

Amos Nathan Tversky, was a cognitive and mathematical psychologist, a pioneer of cognitive science, a longtime collaborator of Daniel Kahneman, and a key figure in the discovery of systematic human cognitive bias and handling of risk. Much of his early work concerned the foundations of measurement...

and Daniel Kahneman

Daniel Kahneman

Daniel Kahneman is an Israeli-American psychologist and Nobel laureate. He is notable for his work on the psychology of judgment and decision-making, behavioral economics and hedonic psychology....

in 1992 (Tversky, Kahneman, 1992). It is a further development and variant of prospect theory

Prospect theory

Prospect theory is a theory that describes decisions between alternatives that involve risk i.e. where the probabilities of outcomes are known. The model is descriptive: it tries to model real-life choices, rather than optimal decisions.-Model:...

. The difference between this version and the original version of prospect theory

Prospect theory

Prospect theory is a theory that describes decisions between alternatives that involve risk i.e. where the probabilities of outcomes are known. The model is descriptive: it tries to model real-life choices, rather than optimal decisions.-Model:...

is that weighting is applied to the cumulative probability distribution function, as in rank-dependent expected utility

Rank-dependent expected utility

The rank-dependent expected utility model is a generalized expected utility model of choice under uncertainty, designed to explain the behaviour observed in the Allais paradox, as well as for the observation that many people both purchase lottery tickets and insure against losses .A...

theory but not applied to the probabilities of individual outcomes. In 2002, Daniel Kahneman received the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel for his contributions to behavioral economics, in particular the development of Cumulative Prospect Theory (CPT).

Outline of the model

Framing (social sciences)

A frame in social theory consists of a schema of interpretation — that is, a collection of anecdotes and stereotypes—that individuals rely on to understand and respond to events. In simpler terms, people build a series of mental filters through biological and cultural influences. They use these...

. Moreover, they have different risk attitudes towards gains (i.e. outcomes above the reference point) and losses (i.e. outcomes below the reference point) and care generally more about potential losses than potential gains (loss aversion

Loss aversion

In economics and decision theory, loss aversion refers to people's tendency to strongly prefer avoiding losses to acquiring gains. Some studies suggest that losses are twice as powerful, psychologically, as gains....

). Finally, people tend to overweight extreme, but unlikely events, but underweight "average" events. The last point is in contrast to Prospect Theory which assumes that people overweight unlikely events, independently of their relative outcomes.

CPT incorporates these observations in a modification of Expected Utility Theory

Expected utility hypothesis

In economics, game theory, and decision theory the expected utility hypothesis is a theory of utility in which "betting preferences" of people with regard to uncertain outcomes are represented by a function of the payouts , the probabilities of occurrence, risk aversion, and the different utility...

by replacing final wealth with payoffs relative to the reference point, replacing the utility function with a value function that depends on relative payoff, and replacing cumulative probabilities with weighted cumulative probabilities.

In the general case, this leads to the following formula for subjective utility of a risky outcome described by probability measure p:

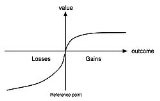

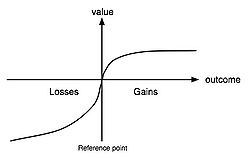

where v is the value function (typical form shown in Figure 1),

w is the weighting function (as sketched in Figure 2)

and

, i.e. the integral of the probability measure over all values up to

, i.e. the integral of the probability measure over all values up to  , is the cumulative probability. This generalizes the original formulation by Tversky and Kahneman from finitely many distinct outcomes to infinite (i.e., continuous) outcomes.

, is the cumulative probability. This generalizes the original formulation by Tversky and Kahneman from finitely many distinct outcomes to infinite (i.e., continuous) outcomes.Differences to Prospect Theory

The main modification to Prospect Theory is that, as in rank-dependent expected utilityRank-dependent expected utility

The rank-dependent expected utility model is a generalized expected utility model of choice under uncertainty, designed to explain the behaviour observed in the Allais paradox, as well as for the observation that many people both purchase lottery tickets and insure against losses .A...

theory, cumulative probabilities are transformed, rather than the probabilities itself. This leads to the aforementioned overweighting of extreme events which occur with small probability, rather than to an overweighting of all small probability events. The modification helps to avoid a violation of first order stochastic dominance

Stochastic dominance

Stochastic dominance is a form of stochastic ordering. The term is used in decision theory and decision analysis to refer to situations where one gamble can be ranked as superior to another gamble. It is based on preferences regarding outcomes...

and makes the generalization to arbitrary outcome distributions easier. CPT is therefore on theoretical grounds an improvement over Prospect Theory.

Applications

Cumulative prospect theory has been applied to a diverse range of situations which appear inconsistent with standard economic rationality, in particular the equity premium puzzleEquity premium puzzle

The equity premium puzzle is a term coined in 1985 by economists Rajnish Mehra and Edward C. Prescott. It is based on the observation that in order to reconcile the much higher returns of stocks compared to government bonds in the United States, individuals must have implausibly high risk aversion...

, the asset allocation puzzle, the status quo bias

Status quo bias

The status quo bias is a cognitive bias for the status quo; in other words, people tend not to change an established behavior unless the incentive to change is compelling...

, various gambling and betting puzzles, intertemporal consumption and the endowment effect

Endowment effect

In behavioral economics, the endowment effect is a hypothesis that people value a good or service more once their property right to it has been established. In other words, people place a higher value on objects they own than objects that they do not...

.