Economic history of the Russian Federation

Encyclopedia

Historical background

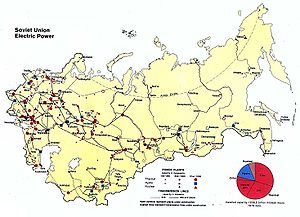

For about 60 years, the Russian economy and that of the rest of the Soviet UnionSoviet Union

The Soviet Union , officially the Union of Soviet Socialist Republics , was a constitutionally socialist state that existed in Eurasia between 1922 and 1991....

operated on the basis of a centrally planned economy, with a state control over virtually all means of production and over investment, production, and consumption decisions throughout the economy. Economic policy

Economic policy

Economic policy refers to the actions that governments take in the economic field. It covers the systems for setting interest rates and government budget as well as the labor market, national ownership, and many other areas of government interventions into the economy.Such policies are often...

was made according to directives from the Communist Party

Communist Party of the Soviet Union

The Communist Party of the Soviet Union was the only legal, ruling political party in the Soviet Union and one of the largest communist organizations in the world...

, which controlled all aspects of economic activity. Since the collapse of Communism in the early 1990s, Russia has experienced difficulties in making the transition from a centrally planned economy to a market based economy.

Much of the structure of the Soviet economy that operated until 1987 originated under the leadership of Joseph Stalin

Joseph Stalin

Joseph Vissarionovich Stalin was the Premier of the Soviet Union from 6 May 1941 to 5 March 1953. He was among the Bolshevik revolutionaries who brought about the October Revolution and had held the position of first General Secretary of the Communist Party of the Soviet Union's Central Committee...

, with only incidental modifications made between 1953 and 1987. Five-year plan and annual plans were the chief mechanisms the Soviet government used to translate economic policies into programs. According to those policies, the State Planning Committee (Gosudarstvennyy planovyy komitet—Gosplan

Gosplan

Gosplan or State Planning Committee was the committee responsible for economic planning in the Soviet Union. The word "Gosplan" is an abbreviation for Gosudarstvenniy Komitet po Planirovaniyu...

) formulated countrywide output targets for stipulated planning periods. Regional planning

Regional planning

Regional planning deals with the efficient placement of land use activities, infrastructure, and settlement growth across a larger area of land than an individual city or town. The related field of urban planning deals with the specific issues of city planning...

bodies then refined these targets for economic units such as state industrial enterprises and state farms (sovkhozy; sing., sovkhoz

Sovkhoz

A sovkhoz , typically translated as state farm, is a state-owned farm. The term originated in the Soviet Union, hence the name. The term is still in use in some post-Soviet states, e.g., Russia and Belarus. It is usually contrasted with kolkhoz, which is a collective-owned farm...

) and collective farms (kolkhozy; sing., kolkhoz

Kolkhoz

A kolkhoz , plural kolkhozy, was a form of collective farming in the Soviet Union that existed along with state farms . The word is a contraction of коллекти́вное хозя́йство, or "collective farm", while sovkhoz is a contraction of советское хозяйство...

), each of which had its own specific output plan. Central planning operated on the assumption that if each unit met or exceeded its plan, then demand and supply would balance.

The government's role was to ensure that the plans were fulfilled. Responsibility for production flowed from the top down. At the national level, some seventy government ministries and state committees, each responsible for a production sector or subsector, supervised the economic production activities of units within their areas of responsibility. Regional ministerial bodies reported to the national-level ministries and controlled economic units in their respective geographical areas.

The central planning system allowed Soviet leaders to marshal resources quickly in times of crisis, such as the Nazi invasion, and to reindustrialize the country during the postwar period. The rapid development of its defence and industrial base after the war permitted the Soviet Union to become a superpower.

The attempts and failures of reformers during the era of perestroika

Perestroika

Perestroika was a political movement within the Communist Party of the Soviet Union during 1980s, widely associated with the Soviet leader Mikhail Gorbachev...

(restructuring) in the regime of Mikhail Gorbachev

Mikhail Gorbachev

Mikhail Sergeyevich Gorbachev is a former Soviet statesman, having served as General Secretary of the Communist Party of the Soviet Union from 1985 until 1991, and as the last head of state of the USSR, having served from 1988 until its dissolution in 1991...

(1985–91) attested to the complexity of the challenge.

Transition to Market Economy

After 1991, under the leadership of Boris YeltsinBoris Yeltsin

Boris Nikolayevich Yeltsin was the first President of the Russian Federation, serving from 1991 to 1999.Originally a supporter of Mikhail Gorbachev, Yeltsin emerged under the perestroika reforms as one of Gorbachev's most powerful political opponents. On 29 May 1990 he was elected the chairman of...

, the country made a significant turn toward developing a market economy by implanting basic tenets such as market-determined prices. Two fundamental and interdependent goals — macroeconomic stabilization and economic restructuring — the transition from central planning to a market-based economy. The former entailed implementing fiscal and monetary policies that promote economic growth in an environment of stable prices and exchange rates. The latter required establishing the commercial, and institutional entities — banks, private property, and commercial legal codes— that permit the economy to operate efficiently. Opening domestic markets to foreign trade

International trade

International trade is the exchange of capital, goods, and services across international borders or territories. In most countries, such trade represents a significant share of gross domestic product...

and investment, thus linking the economy with the rest of the world, was an important aid in reaching these goals. The Gorbachev regime failed to address these fundamental goals. At the time of the Soviet Union's demise, the Yeltsin government of the Russian Republic had begun to attack the problems of macroeconomic stabilization and economic restructuring. By mid-1996, the results were mixed.

Since collapse of the Soviet Union in 1991, Russia has tried to develop a market economy

Market economy

A market economy is an economy in which the prices of goods and services are determined in a free price system. This is often contrasted with a state-directed or planned economy. Market economies can range from hypothetically pure laissez-faire variants to an assortment of real-world mixed...

and achieve consistent economic growth. In October 1991, Yeltsin announced that Russia would proceed with radical, market-oriented reform along the lines of "shock therapy

Shock therapy (economics)

In economics, shock therapy refers to the sudden release of price and currency controls, withdrawal of state subsidies, and immediate trade liberalization within a country, usually also including large scale privatization of previously public owned assets....

", as recommended by the United States and IMF. However, this policy resulted in economic collapse, with millions being plunged into poverty and corruption and crime spreading rapidly. Hyperinflation

Hyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

resulted from the removal of Soviet price controls and again following the 1998 Russian financial crisis. Assuming the role as the continuing legal personality of the Soviet Union, Russia took up the responsibility for settling the USSR's external debt

External debt

External debt is that part of the total debt in a country that is owed to creditors outside the country. The debtors can be the government, corporations or private households. The debt includes money owed to private commercial banks, other governments, or international financial institutions such...

s, even though its population made up just half of the population of the USSR at the time of its dissolution.

The Russian GDP contracted an estimated 40% between 1991 and 1998, despite the country's wealth of natural resources, its well-educated population, and its diverse - although increasingly dilapidated - industrial base. Such a figure may be misleading, however, since much of the Soviet Union's GDP was military spending and the production of goods for which there was little demand. The discontinuation of much of that wasteful spending created the false impression of larger than actual economic contraction.

Critical elements such as privatization of state enterprises

Government-owned corporation

A government-owned corporation, state-owned company, state-owned entity, state enterprise, publicly owned corporation, government business enterprise, or parastatal is a legal entity created by a government to undertake commercial activities on behalf of an owner government...

and extensive foreign investment were rushed into place in the first few years of the post-Soviet period. But other fundamental parts of the economic infrastructure, such as commercial bank

Commercial bank

After the implementation of the Glass–Steagall Act, the U.S. Congress required that banks engage only in banking activities, whereas investment banks were limited to capital market activities. As the two no longer have to be under separate ownership under U.S...

ing and authoritative, comprehensive commercial laws, were absent or only partly in place by 1996. Although by the mid-1990s a return to Soviet-era central planning seemed unlikely, the configuration of the post-transition economy remained unpredictable.

Monetary and fiscal policies

In January 1992, the government clamped down on money and credit creation at the same time that it lifted price controls. However, beginning in February, the Central Bank, headed by Viktor Gerashchenko, loosened the reins on the money supply. In the second and third quarters of 1992, the money supply had increased at especially sharp rates of 34% and 30%, respectively. By the end of 1992, the Russian money supply had increased by eighteen times. This led directly to high inflation and to a deterioration in the exchange rate of the ruble.The sharp increase in the money supply was influenced by large foreign currency deposits that state-run enterprises and individuals had built up, and by the depreciation of the ruble. Enterprises drew on these deposits to pay wages and other expenses after the Government had tightened restrictions on monetary emissions. Commercial banks monetized enterprise debts by drawing down accounts in foreign banks and drawing on privileged access to accounts in the Central Bank.

Inflation

In 1992, the first year of economic reform, retail prices in Russia increased by 2,520%. A major cause of the increase was the deregulation of most of the prices in January 1992, a step that prompted an average price increase of 245% in that month alone. By 1993 the annual rate had declined to 240%, still a very high figure. In 1994 the inflation rate had improved to 224%.Trends in annual inflation rates mask variations in monthly rates, however. In 1994, for example, the government managed to reduce monthly rates from 21% in January to 4% in August, but rates climbed once again, to 16.4% by December and 18% by January 1995. Instability in Russian monetary policy caused the variations. After tightening the flow of money early in 1994, the Government loosened its restrictions in response to demands for credits by agriculture, industries in the Far North, and some favored large enterprises. In 1995 the pattern was avoided more successfully by maintaining the tight monetary policy adopted early in the year and by passing a relatively stringent budget. Thus, the monthly inflation rate held virtually steady below 5% in the last quarter of the year. For the first half of 1996, the inflation rate was 16.5%. However, experts noted that control of inflation was aided substantially by the failure to pay wages to workers in state enterprises, a policy that kept prices low by depressing demand.

Exchange rates

An important symptom of Russian macroeconomic instability has been severe fluctuations in the exchange rate of the ruble. From July 1992, when the ruble first could be legally exchanged for United States dollars, to October 1995, the rate of exchange between the ruble and the dollar declined from 144 rubles per US$1 to around 5,000 per US$1. Prior to July 1992, the ruble's rate was set artificially at a highly overvalued level. But rapid changes in the nominal rate (the rate that does not account for inflation) reflected the overall macroeconomic instability. The most drastic example of such fluctuation was the Black Tuesday (1994) 27% reduction in the ruble's value.In July 1995, the Central Bank announced its intention to maintain the ruble within a band of 4,300 to 4,900 per US$1 through October 1995, but it later extended the period to June 1996. The announcement reflected strengthened fiscal and monetary policies and the buildup of reserves with which the government could defend the ruble. By the end of October 1995, the ruble had stabilized and actually appreciated in inflation-adjusted terms. It remained stable during the first half of 1996. In May 1996, a "crawling band" exchange rate was introduced to allow the ruble to depreciate gradually through the end of 1996, beginning between 5,000 and 5,600 per US $1 and ending between 5,500 and 6,100.

Another sign of currency stabilization was the announcement that effective June 1996, the ruble would become fully convertible on a current-account basis. This meant that Russian citizens and foreigners would be able to convert rubles to other currencies for trade transactions.

Privatization

When once all enterprises belonged to the state and were supposed to be equally owned amongst all citizens, they fell into the hands of a few, who became immensely rich. Stocks of the state-owned enterprises were issued, and these new publicly traded companies were quickly handed to the members of NomenklaturaNomenklatura

The nomenklatura were a category of people within the Soviet Union and other Eastern Bloc countries who held various key administrative positions in all spheres of those countries' activity: government, industry, agriculture, education, etc., whose positions were granted only with approval by the...

or known criminal bosses. For example, the director of a factory during the Soviet regime would often become the owner of the same enterprise. During the same period, violent criminal groups often took over state enterprises, clearing the way by assassinations or extortion. Corruption

Political corruption

Political corruption is the use of legislated powers by government officials for illegitimate private gain. Misuse of government power for other purposes, such as repression of political opponents and general police brutality, is not considered political corruption. Neither are illegal acts by...

of government officials became an everyday rule of life. Under the government's cover, outrageous financial manipulations were performed that enriched the narrow group of individuals at key positions of the business and government mafia

Russian Mafia

The Russian Mafia is a name applied to organized crime syndicates in Russia and Ukraine. The mafia in various countries take the name of the country, as for example the Ukrainian mafia....

. Many took billions in cash and assets outside of the country in an enormous capital flight

Capital flight

Capital flight, in economics, occurs when assets and/or money rapidly flow out of a country, due to an economic event and that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic...

.

The largest state enterprises were controversially privatized by President Boris Yeltsin to insiders for far less than they were worth. Many Russians consider these infamous "oligarchs

Business oligarch

Business oligarch is a near-synonym of the term "business magnate", borrowed by the English speaking and western media from post-Soviet parlance to describe the huge, fast-acquired wealth of some businessmen of the former Soviet republics during the privatization in Russia and other post-Soviet...

" to be thieves. Through their immense wealth, the oligarchs wielded significant political influence.

1991-1992

Government efforts to take over the credit expansion also proved ephemeral in the early years of the transition. Domestic credit increased about nine times between the end of 1991 and 1992. The credit expansion was caused in part by the buildup of interenterprise arrears and the RCB's subsequent financing of those arrears. The Government restricted financing to state enterprises after it lifted controls on prices in January 1992, but enterprises faced cash shortages because the decontrol of prices cut demand for their products. Instead of curtailing production, most firms chose to build up inventories. To support continued production under these circumstances, enterprises relied on loans from other enterprises. By mid-1992, when the amount of unpaid interenterprise loans had reached 3.2 trillion rubles (about US$20 billion), the government froze interenterprise debts. Shortly thereafter, the government provided 181 billion rubles (about US$1.1 billion) in credits to enterprises that were still holding debt.The government also failed to constrain its own expenditures in this period, partially under the influence of the post-Soviet Supreme Soviet of Russia

Supreme Soviet of Russia

The Supreme Soviet of the Russian SFSR , later Supreme Soviet of the Russian Federation was the supreme government institution of the Russian SFSR in 1938–1990; in 1990–1993 it was a permanent parliament, elected by the Congress of People's Deputies of the Russian Federation.The Supreme Soviet of...

, which encouraged the Soviet-style financing of favored industries. By the end of 1992, the Russian budget

Budget

A budget is a financial plan and a list of all planned expenses and revenues. It is a plan for saving, borrowing and spending. A budget is an important concept in microeconomics, which uses a budget line to illustrate the trade-offs between two or more goods...

deficit was 20% of GDP, much higher than the 5% projected under the economic program and stipulated under the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF) conditions for international funding. This budget deficit was financed largely by expanding the money supply. These monetary and fiscal policies were a factor along with price liberalization in an inflation rate of over 2,000% in 1992.

In late 1992, deteriorating economic conditions and a sharp conflict with the parliament led Yeltsin to dismiss neoliberal

Neoliberalism

Neoliberalism is a market-driven approach to economic and social policy based on neoclassical theories of economics that emphasizes the efficiency of private enterprise, liberalized trade and relatively open markets, and therefore seeks to maximize the role of the private sector in determining the...

reform advocate Yegor Gaidar

Yegor Gaidar

Yegor Timurovich Gaidar was a Soviet and Russian economist, politician and author, and was the Acting Prime Minister of Russia from 15 June 1992 to 14 December 1992....

as prime minister. Gaidar's successor was Viktor Chernomyrdin

Viktor Chernomyrdin

Viktor Stepanovich Chernomyrdin was the founder and the first chairman of the Gazprom energy company, the longest serving Prime Minister of Russia and Acting President of Russia for a day in 1996. He was a key figure in Russian politics in the 1990s, and a great contributor to the Russian...

, a former head of the State Natural Gas Company (Gazprom

Gazprom

Open Joint Stock Company Gazprom is the largest extractor of natural gas in the world and the largest Russian company. Its headquarters are in Cheryomushki District, South-Western Administrative Okrug, Moscow...

), who was considered less favorable to neoliberal reform.

1993

Chernomyrdin formed a new government with Boris Fedorov, an economic reformer, as deputy prime minister and finance minister. Fedorov considered macroeconomic stabilization a primary goal of Russian economic policy. In January 1993, Fedorov announced a so-called anticrisis program to control inflation through tight monetary and fiscal policies. Under the program, the government would control money and credit emissions by requiring the RCB to increase interest rates on credits by issuing government bonds, by partially financing budget deficits, and by starting to close inefficient state enterprises. Budget deficits were to be brought under control by limiting wage increases for state enterprises, by establishing quarterly budget deficit targets, and by providing a more efficient social safety net for the unemployed and pensioners.The printing of money

Russian ruble

The ruble or rouble is the currency of the Russian Federation and the two partially recognized republics of Abkhazia and South Ossetia. Formerly, the ruble was also the currency of the Russian Empire and the Soviet Union prior to their breakups. Belarus and Transnistria also use currencies with...

and domestic credit expansion moderated somewhat in 1993. In a public confrontation with the parliament, Yeltsin won a referendum on his economic reform policies that may have given the reformers some political clout to curb state expenditures. In May 1993, the Ministry of Finance and the Central Bank agreed to macroeconomic measures, such as reducing subsidies and increasing revenues, to stabilize the economy. The Central Bank was to raise the discount lending rate to reflect inflation. Based on positive early results from this policy, the IMF extended the first payment of US$1.5 billion to Russia from a special Systemic Transformation Facility (STF) the following July.

Fedorov's anticrisis program and the Government's accord with the Central Bank had some effect. In the first three quarters of 1993, the Central Bank held money expansion to a monthly rate of 19%. It also substantially moderated the expansion of credits during that period. The 1993 annual inflation rate was around 1,000%, a sharp improvement over 1992, but still very high. The improvement figures were exaggerated, however, because state expenditures had been delayed from the last quarter of 1993 to the first quarter of 1994. State enterprise arrears, for example, had built up in 1993 to about 15 trillion rubles (about US$13 billion, according to the mid-1993 exchange rate).

1994

In June 1994, Chernomyrdin presented a set of moderate reforms calculated to accommodate the more conservative elements of the Government and parliament while placating reformers and Western creditors. The prime minister pledged to move ahead with restructuring the economy and pursuing fiscal and monetary policies conducive to macroeconomic stabilization. But stabilization was undermined by the Central Bank, which issued credits to enterprises at subsidized rates, and by strong pressure from industrial and agricultural lobbies seeking additional credits.By October 1994, inflation, which had been reduced by tighter fiscal and monetary policies early in 1994, began to soar once again to dangerous levels. On 11 October, a day that became known as Black Tuesday, the value of the ruble on interbank exchange markets plunged by 27%. Although experts presented a number of theories to explain the drop, including the existence of a conspiracy

Conspiracy theory

A conspiracy theory explains an event as being the result of an alleged plot by a covert group or organization or, more broadly, the idea that important political, social or economic events are the products of secret plots that are largely unknown to the general public.-Usage:The term "conspiracy...

, the loosening of credit and monetary controls clearly was a significant cause of declining confidence in the Russian economy and its currency.

In late 1994, Yeltsin reasserted his commitment to macroeconomic stabilization by firing Viktor Gerashchenko

Viktor Gerashchenko

Viktor Vladimirovich Gerashchenko , byname Gerakl , was the Chairman of the Soviet and then Russian Central Bank during much of the Perestroika and post-Perestroika periods....

, head of the Central Bank, and nominating Tatyana Paramonova as his replacement. Although reformers in the Russian government and the IMF and other Western supporters greeted the appointment with skepticism, Paramonova was able to implement a tight monetary policy that ended cheap credits and restrained interest rates (although the money supply fluctuated in 1995). Furthermore, the parliament passed restrictions on the use of monetary policy to finance the state debt, and the Ministry of Finance began to issue government bonds at market rates to finance the deficits.

The government also began to address the interenterprise debt that had been feeding inflation. The 1995 budget draft, which was proposed in September 1994, included a commitment to reducing inflation and the budget deficit to levels acceptable to the IMF, with the aim of qualifying for additional international funding. In this budget proposal, the Chernomyrdin government sent a signal that it no longer would tolerate soft credits and loose budget constraints, and that stabilization must be a top government priority.

According to official Russian data, in 1994 the national gross domestic product (GDP) was 604 trillion rubles (about US$207 billion according to the 1994 exchange rate), or about 4% of the United States GDP for that year. But this figure underestimates the size of the Russian economy. Adjusted by a purchasing-power parity formula to account for the lower cost of living in Russia, the 1994 Russian GDP was about US$678 billion, making the Russian economy approximately 10% of the United States economy. In 1994 the adjusted Russian GDP was US$4,573 per capita, approximately 19% of that of the United States.

1995

During most of 1995, the government maintained its commitment to tight fiscal constraints, and budget deficits remained within prescribed parameters. However, in 1995 pressures mounted to increase government spending to alleviate wage arrearages, which were becoming a chronic problem within state enterprises, and to improve the increasingly tattered social safety net. In fact, in 1995 and 1996 the state's failure to pay many such obligations (as well as the wages of most state workers) was a major factor in keeping Russia's budget deficit at a moderate level. Conditions changed by the second half of 1995. The members of the State DumaState Duma

The State Duma , common abbreviation: Госду́ма ) in the Russian Federation is the lower house of the Federal Assembly of Russia , the upper house being the Federation Council of Russia. The Duma headquarters is located in central Moscow, a few steps from Manege Square. Its members are referred to...

(beginning in 1994, the lower house of the Federal Assembly, Russia's parliament) faced elections in December, and Yeltsin faced dim prospects in his 1996 presidential reelection bid. Therefore, political conditions caused both Duma deputies and the president to make promises to increase spending.

In addition, late in 1995 Yeltsin dismissed Anatoly Chubais

Anatoly Chubais

Anatoly Borisovich Chubais is a Russian politician and business manager who was responsible for privatization in Russia as an influential member of Boris Yeltsin's administration. From 1998 to 2008 he was the head of the state owned electrical power monopoly RAO UES. The 2004 survey by...

, one of the last economic reform advocates remaining in a top Government position, as deputy prime minister in charge of economic policy. In place of Chubais, Yeltsin named Vladimir Kadannikov, a former automobile plant manager whose views were antireform. This move raised concerns in Russia and the West about Yeltsin's commitment to economic reform. Another casualty of the political atmosphere was RCB chairman Paramonova, whose nomination had remained a source of controversy between the State Duma and the Government. In November 1995, Yeltsin was forced to replace her with Sergey Dubinin, a Chernomyrdin protégé who continued the tight-money policy that Paramonova had established.

1996

As of mid-1996, four and one-half years after the launching of Russia's post-Soviet economic reform, experts found the results promising but mixed. The Russian economy has passed through a long and wrenching depression. Official Russian economic statistics indicate that from 1990 to the end of 1995, Russian GDP declined by roughly 50%, far greater than the decline that the United States experienced during the Great DepressionGreat Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

. (However, alternative estimates by Western neoliberal pro-disregulation analysts described a much less severe decline, taking into account the upward bias of Soviet-era economic data and the downward bias of post-Soviet data. E.g. IMF estimates: http://www.imf.org/external/pubs/ft/weo/2006/01/data/dbcoutm.cfm?SD=1992&ED=1999&R1=1&R2=1&CS=3&SS=2&OS=C&DD=0&OUT=1&C=922&S=NGDPRPC-NGDPPC-NGDPDPC-PPPPC&CMP=0&x=41&y=9) Much of the decline in production has occurred in the military-industrial complex and other heavy industries that benefited most from the economic priorities of Soviet planners but have much less robust demand in a free market.

But other major sectors such as agriculture, energy, and light industry also suffered from the transition. To enable these sectors to function in a market system, inefficient enterprises had to be closed and workers laid off, with resulting declines in output and consumption. Analysts had expected that Russia's GDP would begin to rise in 1996, but data for the first six months of the year showed a continuing decline, and some Russian experts predicted a new phase of economic crisis in the second half of the year.

The pain of the restructuring has been assuaged somewhat by the emergence of a new private sector. Western experts believe that Russian data overstate the dimensions of Russia's economic collapse by failing to reflect a large portion of the country's private-sector activity. The Russian services sector, especially retail sales, is playing an increasingly vital role in the economy, accounting for nearly half of GDP in 1995. The services sector's activities have not been adequately measured. Data on sector performance are skewed by the underreporting or nonreporting of output that Russia's tax laws encourage. According to Western analysts, by the end of 1995 more than half of GDP and more than 60% of the labor force were based in the private sector.

An important but unconventional service in Russia's economy is "shuttle trading" — the transport and sale of consumer goods by individual entrepreneurs, of whom 5 to 10 million were estimated to be active in 1996. Traders buy goods in foreign countries such as China, Turkey, and the United Arab Emirates and in Russian cities, then sell them on the domestic market where demand is highest. Yevgeniy Yasin, minister of economics, estimated that in 1995 some US$11 billion worth of goods entered Russia in this way. Shuttle traders have been vital in maintaining the standard of living of Russians who cannot afford consumer goods on the conventional market. However, domestic industries such as textiles suffer from this infusion of competing merchandise, whose movement is unmonitored, untaxed, and often mafia-controlled.

The geographical distribution of Russia's wealth has been skewed at least as severely as it was in Soviet times. By the mid-1990s, economic power was being concentrated in Moscow at an even faster rate than the federal government was losing political power in the rest of the country. In Moscow an economic oligarchy, composed of politicians, banks, businesspeople, security forces, and city agencies, controlled a huge percentage of Russia's financial assets under the rule of Moscow's energetic and popular mayor, Yuriy Luzhkov

Yuriy Luzhkov

Yury Mikhaylovich Luzhkov is a Russian politician who was the Mayor of Moscow from 1992 to 2010. He was also vice-chairman and one of the founders of the ruling United Russia party....

. Unfortunately, organized crime also has played a strong role in the growth of the city. Opposed by a weak police force, Moscow's rate of protection rackets, contract murders, kickbacks, and bribes — all intimately connected with the economic infrastructure — has remained among the highest in Russia. Most businesses have not been able to function without paying for some form of mafia protection, informally called a krysha (the Russian word for roof).

Luzhkov, who has close ties to all legitimate power centers in the city, has overseen the construction of sports stadiums, shopping malls, monuments to Moscow's history, and the ornate Christ the Savior Cathedral. In 1994 Yeltsin gave Luzhkov full control over all state property in Moscow. In the first half of 1996, the city privatized state enterprises at the rate of US$1 billion per year, a faster rate than the entire national privatization process in the same period. Under Luzhkov's leadership, the city government also acquired full or major interests in a wide variety of enterprises — from banking, hotels, and construction to bakeries and beauty salons. Such ownership has allowed Luzhkov's planners to manipulate resources efficiently and with little or no competition. Meanwhile, Moscow also became the center of foreign investment in Russia, often to the exclusion of other regions. For example, the McDonald's fast-food chain, which began operations in Moscow in 1990, enjoyed immediate success but expanded only in Moscow. The concentration of Russia's banking industry in Moscow gave the city a huge advantage in competing for foreign commercial activity.

In mid-1996 the national government appeared to have achieved some degree of macroeconomic stability. However, longer-term stability depends on the ability of policy makers to withstand the inflationary pressures of demands for state subsidies and easier credits for failing enterprises and other special interests. (Chubais estimated that spending promises made during Yeltsin's campaign amounted to US$250 per voter, which if actually spent would approximately double the national budget deficit; most of Yeltsin's pledges seemingly were forgotten shortly after his reelection.)

By 1996 the structure of Russian economic output had shifted far enough that it more closely resembled that of a developed market economy than the distorted Soviet central-planning model. With the decline in demand for defense industry goods, overall production has shifted from heavy industry to consumer production. However, in the mid-1990s the low quality of most domestically produced consumer goods continued to limit enterprises' profits and therefore their ability to modernize production operations. On the other side of the "vicious circle," reliance on an outmoded production system guaranteed that product quality would remain low and uncompetitive.

Most prices were left to the market, although local and regional governments control the prices of some staples. Energy prices remain controlled, but the Government has been shifting these prices upward to close the gap with world market prices.

A 1996 government report quantified so-called "shadow economy" which yields no taxes or government statistics as accounting for about 51% of the economy and 40% of its cash turnover.

1997-1998

By the end of 1997, Russia had achieved some progress. Inflation had been brought under control, the ruble was stabilized, and an ambitious privatization program had transferred thousands of enterprises to private ownership. Some important market-oriented laws had also been passed, including a commercial code governing business relations and the establishment of an arbitration court for resolving economic disputes.But in 1998 difficulties in implementing fiscal reforms aimed at raising government revenues and a dependence on short-term borrowing to finance budget deficits led to a serious financial crisis in 1998, contributing to a sharp decline in Russia's earnings from oil exports and resulting in an exodus of foreign investors. The government allowed the ruble to fall precipitously and stopped payment on $40 billion in ruble bonds.

1999

In 1999, output increased for only the second time since 1991, by an officially estimated 6.4%, regaining 4.6% drop of 1998. This increase was achieved despite a year of potential turmoil that included the tenure of three premiers and culminated in the New Year's Eve resignation of President Boris Yeltsin. Of great help was the tripling of international oil prices in the second half of 1999, raising the export surplus to $29 billion.On the negative side, inflation rose to an average 85% in 1998, compared with a 11% average in 1997 and a hoped-for 36% average in 1999. Ordinary persons found their wages falling by roughly 30% and their pensions by 45%. The Vladimir Putin

Vladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

government has given high priority to supplementing low incomes by paying down wage and pension arrears.

2000-2007

Russia posted gross domestic product growth of 6.4% in 1999, 10% in 2000, 5.1% in 2001, 4.7% in 2002, 7.3% in 2003, 7.2% in 2004, 6.4% in 2005, 8.2% in 2006 and 8.5% in 2007 with industrial sector posting high growth figures as well.

Under the presidency of Vladimir Putin

Vladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

Russia's economy saw the nominal Gross Domestic Product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

(GDP) double, climbing from 22nd to 11th largest in the world. The economy made real gains of an average 7% per year (2000: 10%, 2001: 5.1%, 2002: 4.7%, 2003: 7.3%, 2004: 7.2%, 2005: 6.4%, 2006: 8.2%, 2007: 8.5%, 2008: 5.6%), making it the 6th largest economy in the world in GDP(PPP). In 2007, Russia's GDP exceeded that of 1990, meaning it has overcome the devastating consequences of the Soviet era, 1998 financial crisis, and preceding recession in the 1990s. On a per capita basis, Russian GDP was US$11,339 per individual in 2008, making Russians 57th richest on both a purchasing power and nominal basis.

During Putin's eight years in office, industry grew by 75%, investments increased by 125%, and agricultural production and construction increased as well. Real incomes more than doubled and the average salary increased eightfold from $80 to $640. The volume of consumer credit between 2000–2006 increased 45 times, and during that same time period, the middle class grew from 8 million to 55 million, an increase of 7 times. The number of people living below the poverty line also decreased from 30% in 2000 to 14% in 2008.

Inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

remained a problem however, as the government failed to contain the growth of prices. Between 1999–2007 inflation was kept at the forecast ceiling only twice, and in 2007 the inflation exceeded that of 2006, continuing an upward trend at the beginning of 2008.

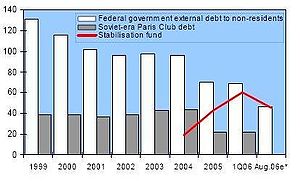

In the June 2002 G8 Summit, leaders of the eight nations signed a statement agreeing to explore cancellation of some of Russia's old Soviet debt to use the savings for safeguarding materials in Russia that could be used by terrorists. Under the proposed deal, $10 billion would come from the United States and $10 billion from other G-8 countries over 10 years.

In 2003, the debt has risen to $19 billion due to higher Ministry of Finance and Eurobond payments. However, $1 billion of this has been prepaid, and some of the private sector debt may already have been repurchased. Russia continued to explore debt swap/exchange opportunities.

On January 1, 2004, the Stabilization fund of the Russian Federation

Stabilization Fund of the Russian Federation

The Stabilization fund of the Russian Federation wasestablished by resolution of the Government of Russia on January 1, 2004, as a part of the federal budget to balance the...

was established by the Government of Russia

Government of Russia

The Government of the Russian Federation exercises executive power in the Russian Federation. The members of the government are the prime minister , the deputy prime ministers, and the federal ministers...

as a part of the federal budget to balance it if oil price falls. Now the Stabilization fund of the Russian Federation]] is being modernized. The Stabilization Fund was be divided into two parts on February 1, 2008. The first part is a reserve fund equal to 10 percent of GDP (10% of GDP equals to about $200 billion now), and is invested in a similar way as the Stabilization Fund. The second part is turned into the National Prosperity Fund of Russian Federation. The National Prosperity Fund is to be invested into more risky instruments, including the shares of foreign companies.

The Russian economy remained commodity-driven despite its growth. Payments from the fuel and energy sector in the form of customs duties and taxes accounted for nearly half of the federal budget's revenues. The large majority of Russia's exports was made up by raw materials and fertilizers, although exports as a whole accounted for only 8.7% of the GDP in 2007, compared to 20% in 2000.

There was also a growing gap between rich and poor in Russia. Between 2000–2007 the incomes of the rich grew from approximately 14 times to 17 times larger than the incomes of the poor. The income differentiation ratio shows that the 10% of Russia's rich live increasingly better than the 10% of the poor, amongst whom are mostly pensioners and unskilled workers in depressive regions. (See: Gini Coefficient

Gini coefficient

The Gini coefficient is a measure of statistical dispersion developed by the Italian statistician and sociologist Corrado Gini and published in his 1912 paper "Variability and Mutability" ....

)

Russia has been experiencing a boom in capital investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

since the beginning of 2007. Capital investment showed record growth in June, rising 27.2 percent over June of last year in real terms (adjusted for price changes), to 579.8 billion rubles, with construction industry leading the way. That is a rise of 58 percent in nominal terms and a better showing than in China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

. Modern Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

has never before seen such a growth rate. The rate of investment in Russia rose 22.3 percent in the first half of 2007 compared to the same period the year before. The increase during that period in 2005 was only 11 percent. The statistics significantly exceed both the conservative prognoses of the Ministry of Economic Development and Trade and less conservative independent analyses. According to Interfax, the consensus among analysts at the end of last month 15.3-percent growth compared to last year.

As of 2007 real GDP increased by the highest percentage since the fall of the Soviet Union at 8.1%, the ruble remains stable, inflation has been moderate, and investment began to increase again. In 2007 the World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

declared that the Russian economy had achieved "unprecedented macroeconomic stability". Russia is making progress in meeting its foreign debts obligations. During 2000-01, Russia not only met its external debt services but also made large advance repayments of principal on IMF

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

loans but also built up Central Bank reserves with government budget

Government budget

A government budget is a legal document that is often passed by the legislature, and approved by the chief executive-or president. For example, only certain types of revenue may be imposed and collected...

, trade, and current account surpluses. The FY 2002 Russian Government budget assumes payment of roughly $14 billion in official debt service payments falling due. Large current account surpluses have brought a rapid appreciation of the ruble over the past several years. This has meant that Russia has given back much of the terms-of-trade advantage that it gained when the ruble fell by 60% during the debt crisis. Oil and gas dominate Russian exports, so Russia remains highly dependent upon the price of energy. Loan and deposit rates at or below the inflation rate inhibit the growth of the banking system and make the allocation of capital and risk much less efficient than it would be otherwise.

By the end of first decade of 21st century, the ECB

European Central Bank

The European Central Bank is the institution of the European Union that administers the monetary policy of the 17 EU Eurozone member states. It is thus one of the world's most important central banks. The bank was established by the Treaty of Amsterdam in 1998, and is headquartered in Frankfurt,...

reported that the country has caught a new strain of Dutch disease

Dutch disease

In economics, the Dutch disease is a concept that purportedly explains the apparent relationship between the increase in exploitation of natural resources and a decline in the manufacturing sector...

.

2008-present

Arms sales have increased to the point where Russia is second (with 0.6 the amount of US arms sale) in the world in sale of weapons, the IT industry has recorded a record year of growth concentrating on high end niches like algorithm designAlgorithm design

Algorithm design is a specific method to create a mathematical process in solving problems. Applied algorithm design is algorithm engineering....

and microelectronics

Microelectronics

Microelectronics is a subfield of electronics. As the name suggests, microelectronics relates to the study and manufacture of very small electronic components. Usually, but not always, this means micrometre-scale or smaller,. These devices are made from semiconductors...

, while leaving the lesser end work to India

India

India , officially the Republic of India , is a country in South Asia. It is the seventh-largest country by geographical area, the second-most populous country with over 1.2 billion people, and the most populous democracy in the world...

and China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

; Russia is now the world's third biggest destination for outsourcing software behind India and China. The space launch industry is now the world's second largest behind the European Ariane 5

Ariane 5

Ariane 5 is, as a part of Ariane rocket family, an expendable launch system used to deliver payloads into geostationary transfer orbit or low Earth orbit . Ariane 5 rockets are manufactured under the authority of the European Space Agency and the Centre National d'Etudes Spatiales...

and nuclear power plant companies are going from strength to strength, selling plants to China and India, and recently signed a joint venture with Toshiba to develop cutting edge power plants.

The civilian aerospace industry has developed the Sukhoi Superjet, as well as the upcoming MS 21 project to compete with Boeing and Airbus.

The recent global economic downturn has resulted in three major shocks to Russia's long-term economic growth, though. Oil

Oil

An oil is any substance that is liquid at ambient temperatures and does not mix with water but may mix with other oils and organic solvents. This general definition includes vegetable oils, volatile essential oils, petrochemical oils, and synthetic oils....

prices dropped from $140 per barrel to $40 per barrel, a decrease in access to financing with an increase in sovereign and corporate bond spreads, and the reversal of capital flows from $80 billion of in-flows to $130 billion of out-flows have all served to crush fledging Russian economic growth. In January 2009, industrial production was down almost 16% year to year, fixed capital investment was down 15.5% year to year, and GDP had shrunk 9% year to year. However, in the second quarter the GDP rose by 7.5 percent on a quarterly basis indicating the beginning of economic recovery.