Income tax in the United States

Encyclopedia

In the United States

, a tax is imposed on income by the Federal, most states, and many local governments. The income tax

is determined by applying a tax rate, which may increase as income increases

, to taxable income

as defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the Federal and some state levels.

Taxable income is total income less allowable deductions

. Income is broadly defined. Most business expenses are deductible. Individuals may also deduct a personal allowance (exemption) and certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains

are fully taxable, and capital losses reduce taxable income only to the extent of gains. Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

Taxpayers generally must self assess income tax by filing tax returns. Advance payments of tax are required in the form of withholding tax or estimated tax payments. Taxes are determined separately by each jurisdiction imposing tax. Due dates and other administrative procedures vary by jurisdiction. April 15 following the tax year is the due date for individual returns for Federal and many state and local returns. Tax as determined by the taxpayer may be adjusted by the taxing jurisdiction.

in the United States by the Federal, most state, and some local governments. Income tax is imposed on individuals, corporations, estates, and trusts. The definition of net taxable income for most sub-federal jurisdictions mostly follows the Federal definition.

The rate of tax at the federal level is graduated; that is, the tax rates of higher amounts of income are higher than on lower amounts. The lower rate on lower income was phased out at higher incomes prior to 2010. Some states and localities impose an income tax at a graduated rate, and some at a flat rate on all taxable income. Federal tax rates in 2009 varied from 10% to 35%. From 2003 through 2010, individuals were eligible for a reduced rate of Federal income tax on capital gains and qualifying dividends. The tax rate and some deductions are different for individuals depending on filing status. Married individuals may compute tax as a couple or separately. Single individuals may be eligible for reduced tax rates if they are head of a household in which they live with a dependent.

Federal taxable income is defined in a comprehensive manner in the Internal Revenue Code

and regulations issued by the Department of Treasury and the Internal Revenue Service. Taxable income is gross income

as adjusted less tax deduction

s. Most states and localities follow this definition at least in part, though some make adjustments to determine income taxed in that jurisdiction. Taxable income for a company or business may not be the same as its book income.

Gross income includes all income earned or received from whatever source. This includes salaries and wages, tips, pensions, fees earned for services, price of goods sold, other business income, gains on sale of other property, rents received, interest and dividend

s received, alimony received, proceeds from selling crops, and many other types of income. Some income, however, is exempt from income tax. This includes interest on municipal bonds.

Adjustments (usually reductions) to gross income of individuals are made for alimony paid, contributions to many types of retirement or health savings plans, certain student loan interest, half of self employment tax, and a few other items. The cost of goods sold

in a business is a direct reduction of gross income.

Taxable income of all taxpayers is reduced by tax deductions for expenses related to their business. These include salaries, rent, and other business expenses paid or accrued, as well as allowances for depreciation

. The deduction of expenses may result in a loss. Generally, such loss can reduce other taxable income, subject to some limits.

Individuals are allowed several nonbusiness deductions. A flat amount per person is allowed as a deduction for personal exemptions. For 2009 this amount was $3,650. Each taxpayer is allowed one such deduction for themselves and one for each person they support.

In addition, individuals get a deduction from taxable income for certain personal expenses. Alternatively, the individual may claim a standard deduction

. For 2011, the standard deduction is $5,800 for single individuals, $11,600 for a married couple, and $8,500 for a head of household. Those who choose to claim actual itemized deductions may deduct the following, subject to many conditions and limitations:

Capital gains

and qualified dividend

s may be taxed as part of taxable income. However, the tax is limited to a lower tax rate. Capital gains include gains on selling stocks and bonds, real estate, and other capital assets. The gain is the excess of the proceeds over the adjusted basis (cost less depreciation deductions allowed) of the property. This limit on tax also applies to dividends from U.S. corporations and many foreign corporations. There are limits on how much net capital loss may reduce other taxable income.

All taxpayers are allowed a tax credit

for foreign taxes and for a percentage of certain types of business expenses. Individuals are also allowed credits related to education expenses, retirement savings, child care expenses, and a credit for each child. Each of the credits is subject to specific rules and limitations. Some credits are treated as refundable payments.

All taxpayers are also subject to the Alternative Minimum Tax

if their income exceeds certain exclusion amounts. This tax applies only if it exceeds regular income tax, and is reduced by some credits.

Individuals must file income tax returns in each year their income exceeds the standard deduction plus one personal exemption, or if any tax is due. Other taxpayers must file income tax returns each year. These returns may be filed electronically. Generally, an individual's tax return covers the calendar year. Corporations may elect a different tax year. Most states and localities follow the Federal tax year, and require separate returns.

Taxpayers must pay income tax due without waiting for an assessment. Many taxpayers are subject to withholding tax

es when they receive income. To the extent withholding taxes do not cover all taxes due, all taxpayers must make estimated tax payments.

Failing to make payments on time, or failing to file returns, can result in substantial penalties

. Certain intentional failures may result in jail time.

Tax returns may be examined and adjusted by tax authorities. Taxpayers have rights to appeal any change to tax, and these rights vary by jurisdiction. Taxpayers may also go to court to contest tax changes. Tax authorities may not make changes after a certain period of time (generally 3 years).

".

An individual's marginal income tax bracket

depends upon his or her income and tax-filing classification. As of 2008, there are six tax brackets for ordinary income (ranging from 10% to 35%) and four classifications: single, married filing jointly (or qualified widow or widower), married filing separately, and head of household.

An individual pays tax at a given bracket only for each dollar within that bracket's range. For example, a single taxpayer who earned $10,000 in 2009 would be taxed 10% of each dollar earned from the 1st dollar to the 8,350th dollar (10% × $8,350 = $835.00), then 15% of each dollar earned from the 8,351st dollar to the 10,000th dollar (15% × $1,650 = $247.50), for a total of $1,082.50. Notice this amount ($1,082.50) is lower than if the individual had been taxed at 15% on the full $10,000 (for a tax of $1,500). This is because the individual's marginal rate (the percentage tax on the last dollar earned, here 15%) has no effect on the income taxed at a lower bracket (here the first $8,350 of income taxed at 10%). This ensures that every rise in a person's pre-tax salary results in an increase of their after-tax salary.

Single taxpayer, no children, under 65 and not blind, taking standard deduction;

Note that in addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax

(FICA) (and an equal amount of FICA tax must be paid by the employer):

less allowable tax deductions. Taxable income as determined for Federal tax purposes may be modified for state tax purposes.

states that "gross income means all income from whatever source derived," and gives specific examples. Gross income is not limited to cash received. "It includes income realized in any form, whether money, property, or services." Gross income includes wages and tips, fees for performing services, gain from sale of inventory or other property, interest, dividends, rents, royalties, pensions, alimony, and many other types of income. Items must be included in income when received or accrued. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned, cost of goods sold

, or tax basis

of property sold.

Certain types of income are subject to tax exemption

. Among the more common types of exempt income are interest on municipal bonds, a portion of Social Security benefits, life insurance proceeds, gifts or inheritances, and the value of many employee benefits.

Gross income is reduced by adjustments and tax deductions. Among the more common adjustments are reductions for alimony paid and IRA

and certain other retirement plan contributions. Adjusted gross income is used in calculations relating to various deductions, credits, phase outs, and penalties.

rules. Deductions for meals and entertainment are limited to 50% of the amount incurred.

Certain deductions must be capitalized or deferred. These include:

Business losses may reduce nonbusiness income for individuals and corporations. However, losses from passive activities may reduce only income from other passive activities. Passive activities include most rental activities (except for real estate professionals) and business activities in which the taxpayer does not materially participate. In addition, losses may not, in most cases, be deducted in excess of the taxpayer's amount at risk (generally tax basis in the entity plus share of debt).

Overall net operating loss

es (business deductions in excess of gross income) may be deducted in other years by carryover or carryback of the loss.

Citizens and individuals who have U.S. tax residence

may deduct a flat amount as a standard deduction

. Alternatively, they may claim an itemized deduction

for actual amounts incurred for specific categories of nonbusiness expenses. Home owners may deduct the amount of interest and property taxes paid on their principal and second homes. Local and state income taxes are deductible, or the individual may elect to deduct state and local sales tax

. Contributions to charitable organizations are deductible by individuals and corporations, but the deduction is limited to 50% and 10% of gross income respectively. Medical expenses in excess of 7.5% of adjusted gross income

are deductible, as are uninsured casualty losses. Other income producing expenses in excess of 2% of adjusted gross income are also deductible. For years before 2010, the allowance of itemized deductions was phased out at higher incomes. The phase out expired for 2010.

(cost) of capital assets, such as corporate stock, land, buildings, etc. Capital losses (where basis is more than sales price) are deductible, but deduction for long term capital losses is limited to capital gains. An individual may exclude $250,000 ($500,000 for a married couple filing jointly) of capital gains on the sale of the individual's primary residence, subject to certain conditions and limitations.

In determining gain, it is necessary to determine which property is sold and the basis of that property. This may require identification conventions, such as first-in-first-out, for identical properties like shares of stock. Further, tax basis must be allocated among properties purchased together unless they are sold together. Original basis, usually cost paid for the asset, is reduced by deductions for depreciation

or loss.

Certain capital gains are deferred, that is, taxed at a time later than disposition. Gains on property sold for installment payments may be recognized as those payments are received. Gains on property exchanged for like kind property are not recognized, and the tax basis of the new property is based on the tax basis of the old property.

Before 1986 and from 2004 onward, individuals have been subject to a reduced rate of Federal tax on long term capital gains. This reduced rate (limited to 15%) applies for regular tax and the Alternative Minimum Tax.

). Corporate income tax is based on taxable income

, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on dividend

distributions from the corporation. They are also subject to tax on capital gains upon sale or exchange of their shares for money or property. However, certain exchanges, such as in reorganizations, are not taxable.

Multiple corporations may file a consolidated return

at the Federal and some state levels with their common parent.

Some deductions of corporations are limited at Federal or state levels. Limitations apply to items due to related parties, including interest and royalty expenses.

, and for the employer to get a deduction, the plan must meet minimum participation, vesting, funding, and operational standards.

Examples of qualified plans include:

Employees or former employees are generally taxed on distributions from retirement or stock plans. Employees are not taxed on distributions from health insurance plans to pay for medical expenses. Cafeteria plans allow employees to choose among benefits (like choosing food in a cafeteria), and distributions to pay those expenses are not taxable.

In addition, individuals may make contributions to Individual Retirement Account

s (IRAs). Those not currently covered by other retirement plans may claim a deduction for contributions to certain types of IRAs. Income earned within an IRA is not taxed until the individual withdraws it.

Businesses are also eligible for several credits. These credits are available to individuals and corporations, and can be taken by partners in business partnerships. Among the Federal credits included in a "general business credit" are:

In addition, a Federal foreign tax credit

is allowed for foreign income taxes paid. This credit is limited to the portion of Federal income tax arising due to foreign source income. The credit is available to all taxpayers.

Business credits and the foreign tax credit may be offset taxes in other years.

States and some localities offer a variety of credits that vary by jurisdiction. States typically grant a credit to resident individuals for income taxes paid to other states, generally limited in proportion to income taxed in the other state(s).

(AMT). Taxpayers who have paid AMT in prior years may claim a credit against regular tax for the prior AMT. The credit is limited so that regular tax is not reduced below current year AMT.

AMT is imposed at a nearly flat rate (20% for corporations, 26% or 28% for individuals, estates, and trusts) on taxable income as modified for AMT. Key differences between regular taxable income and AMT taxable income include:

Taxpayers must determine their taxable income based on their method of accounting

for the particular activity. Most individuals use the cash method for all activities. Under this method, income is recognized when received and deductions taken when paid. Taxpayers may choose or be required to use the accrual method for some activities. Under this method, income is recognized when the right to receive it arises, and deductions are taken when the liability to pay arises and the amount can be reasonably determined. Taxpayers recognizing cost of goods sold

on inventory must use the accrual method with respect to sales and costs of the inventory.

Methods of accounting may differ for financial reporting and tax purposes. Specific methods are specified for certain types of income or expenses. Gain on sale of property other than inventory may be recognized at the time of sale or over the period in which installment sale

payments are received. Income from long term contracts must be recognized ratably over the term of the contract, not just at completion. Other special rules also apply.

. Exempt organizations are still taxed on any business income. An organization which participates in lobbying, political campaigning, or certain other activities may lose its exempt status. Special taxes apply to prohibited transactions and activities of tax exempt entities.

Special rules apply to some or all items in the following industries:

In addition, mutual funds (regulated investment companies) are subject to special rules allowing them to be taxed only at the owner level. The company must report to each owner his/her share of ordinary income, capital gains, and creditable foreign taxes. The owners then include these items in their own tax calculation. The fund itself is not taxed, and distributions are treated as a return of capital

to the owners. Similar rules apply to real estate investment trusts and real estate mortgage investment conduits.

is limited to that part of current year tax caused by foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. States tax resident individuals and corporations on their worldwide income, but few allow a credit for foreign taxes.

Federal and state income taxes are imposed on foreign persons on their income within the jurisdiction. Federal rules tax interest, dividends, royalties, and certain other income of foreign persons at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income from a U.S. business similarly to U.S. persons. Foreign persons are not subject to U.S. tax on capital gains and certain other income. The states tax non-resident individuals only on income earned within the state (wages, etc.) and tax individuals and corporations on business income apportioned to the state. Most of the states otherwise do not impose income tax on persons not resident in the state.

The United States has income tax treaties with over 65 countries. These treaties reduce the chance of double taxation by allowing each country to fully tax its citizens and residents and reducing the amount the other country can tax them. Generally the treaties provide for reduced rates of tax on investment income and limits as to which business income can be taxed. The treaties each define which taxpayers can benefit from the treaty.

. Additional backup withholding provisions apply to some payments of interest or dividends to U.S. persons. The amount of income tax withheld is treated as a payment of tax by the person receiving the payment on which tax was withheld.

, with Federal and appropriate state tax authorities. These returns vary greatly in complexity level depending on the type of filer and complexity of their affairs. On the return, the taxpayer reports income and deductions, calculates the amount of tax owed, reports payments and credits, and calculates the balance due.

Federal individual, estate, and trust income tax returns are due by April 15 for most taxpayers. Corporate returns are due two and one half months following the corporation's year end. Partnership returns are due three and one half months following the partnership's year end. Tax exempt entity returns are due four and one half months following the entity's year end. All Federal returns may be extended, with most extensions available upon merely filing a single page form. Due dates and extension provisions for state and local income tax returns vary.

Income tax returns generally consist of the basic form with attached forms and schedules. Several forms are available for individuals and corporations, depending on complexity and nature of the taxpayer's affairs. Many individuals are able to use the one page Form 1040-EZ, which requires no attachments except wage statements from employers (Forms W-2). Individuals claiming itemized deductions must complete Schedule A. Similar schedules apply for interest (B), dividends (B), business income (C), capital gains (D), farm income (F), and self employment tax (SE). All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them.

Electronic filing of tax returns may be done for taxpayers by registered tax preparers.

If a taxpayer discovers an error on a return, or determines that tax for a year should be different, the taxpayer should file an amended return. These returns constitute claims for refund if taxes are determined to have been overpaid.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued as proposed adjustments. The taxpayer may agree to the proposal, or may advise the IRS why it disagrees. Proposed adjustments are often resolved by the IRS and taxpayer agreeing to what the adjustment should be. For those adjustments to which agreement is not reached, the IRS issues a 30-day letter advising of the adjustment. The taxpayer may appeal this preliminary assessment within 30 days within the IRS. The Appeals Division reviews the IRS field team determination and taxpayer arguments, and often proposes a solution that the IRS team and the taxpayer find acceptable. Where agreement is still not reached, the IRS issues an assessment as a notice of deficiency or 90-day letter. The taxpayer then has three choices: file suit in United States Tax Court

without paying the tax, pay the tax and sue for refund in regular court, or pay the tax and be done. Recourse to court can be costly and time consuming, but is often successful.

IRS computers routinely make adjustments to correct mechanical errors in returns. In addition, the IRS conducts an extensive document matching computer program that compares taxpayer amounts of wages, interest, dividends, and other items to amounts reported by taxpayers. These programs automatically issue 30-day letters advising of proposed changes. Only a very small percentage of tax returns are actually examined. These are selected by a combination of computer analysis of return information and random sampling. The IRS has long maintained a program to identify patterns on returns most likely to require adjustment.

Procedures for examination by state and local authorities vary by jurisdiction.

Intentional failures, including tax fraud, may result in criminal penalties. These penalties may include jail time or forfeiture of property. Criminal penalties are assessed in coordination with the United States Department of Justice

.

"), specifies Congress

's power to impose "Taxes, Duties, Imposts and Excises," but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."

The Constitution specifically limited Congress' ability to impose direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property tax

es (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the Federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

Taxation was also the subject of Federalist No. 33

penned secretly by the Federalist Alexander Hamilton

under the pseudonym

Publius. In it, he explains that the wording of the "Necessary and Proper" clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property. All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se. What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

In order to help pay for its war effort in the American Civil War

, Congress imposed its first personal income tax in 1861. It was part of the Revenue Act of 1861

(3% of all incomes over US $800). This tax was repealed and replaced by another income tax in 1862.

In 1894, Democrat

s in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay any. The purpose of the income tax was to make up for revenue that would be lost by tariff reductions. Also, the Panic of 1893

is said to have something to do with the passage of Wilson-Gorman.

In 1895 the United States Supreme Court, in its ruling in Pollock v. Farmers' Loan & Trust Co.

, held a tax based on receipts from the use of property to be unconstitutional. The Court held that taxes on rent

s from real estate, on interest

income from personal property and other income from personal property (which includes dividend

income) were treated as direct taxes on property, and therefore had to be apportioned. Since apportionment of income taxes is impractical, this had the effect of prohibiting a federal tax on income from property. However, the Court affirmed that the Constitution did not deny Congress the power to impose a tax on real and personal property, and it affirmed that such would be a direct tax. Due to the political difficulties of taxing individual wages without taxing income from property, a federal income tax was impractical from the time of the Pollock decision until the time of ratification of the Sixteenth Amendment (below).

(ratified by the requisite number of states in 1913), which states:

The Supreme Court

in Brushaber v. Union Pacific Railroad

, , indicated that the amendment did not expand the Federal government's existing power to tax income (meaning profit or gain from any source) but rather removed the possibility of classifying an income tax as a direct tax on the basis of the source of the income. The Amendment removed the need for the income tax to be apportioned among the states on the basis of population. Income taxes are required, however, to abide by the law of geographical uniformity.

Some tax protester

s and others opposed to income taxes cite what they contend is evidence that the Sixteenth Amendment was never properly ratified

, based in large part on materials sold by William J. Benson. In December 2007, Benson's "Defense Reliance Package

" containing his non-ratification argument which he offered for sale on the Internet, was ruled by a Federal court to be a "fraud perpetrated by Benson" that had "caused needless confusion and a waste of the customers' and the IRS' time and resources." The court stated: "Benson has failed to point to evidence that would create a genuinely disputed fact regarding whether the Sixteenth Amendment was properly ratified or whether United States Citizens are legally obligated to pay Federal taxes." See also Tax protester Sixteenth Amendment arguments

.

. In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income

, under the Internal Revenue Code of 1939

, to include:

(Note: The Glenshaw Glass case was an interpretation of the definition of "gross income" in section 22 of the Internal Revenue Code of 1939. The successor to section 22 of the 1939 Code is section 61 of the current Internal Revenue Code of 1986, as amended.)

The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted."

The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant in that case suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (see Codification).

In Central Illinois Public Service Co. v. United States, , the U.S. Supreme Court confirmed that wages and income are not identical as far as taxes on income are concerned, because income not only includes wages, but any other gains as well. The Court in that case noted that in enacting taxation legislation, Congress "chose not to return to the inclusive language of the Tariff Act of 1913, but, specifically, 'in the interest of simplicity and ease of administration,' confined the obligation to withhold [income taxes] to 'salaries, wages, and other forms of compensation for personal services'" and that "committee reports ... stated consistently that 'wages' meant remuneration 'if paid for services performed by an employee for his employer'".

Other courts have noted this distinction in upholding the taxation not only of wages, but also of personal gain derived from other sources, recognizing some limitation to the reach of income taxation. For example, in Conner v. United States, 303 F. Supp. 1187 (S.D. Tex. 1969), aff’d in part and rev’d in part, 439 F.2d 974 (5th Cir. 1971), a couple had lost their home to a fire, and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The court acknowledged the authority of the IRS to assess taxes on all forms of payment, but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the Court noted, "Congress has taxed income, not compensation".

By contrast, other courts have interpreted the Constitution as providing even broader taxation powers for Congress. In Murphy v. IRS

, the United States Court of Appeals for the District of Columbia Circuit upheld the Federal income tax imposed on a monetary settlement recovery that the same court had previously indicated was not income, stating: "[a]lthough the 'Congress cannot make a thing income which is not so in fact,' [ . . . ] it can label a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9."

Similarly, in Penn Mutual Indemnity Co. v. Commissioner, the United States Court of Appeals for the Third Circuit indicated that Congress could properly impose the Federal income tax on a receipt of money, regardless of what that receipt of money is called:

! colspan=8 |>

Year

$10,001

$20,001

$60,001

$100,001

$250,001

1913

1%

2%

3%

5%

6%

1914

1%

2%

3%

5%

6%

1916

2%

3%

5%

7%

10%

1918

16%

21%

41%

64%

72%

1920

12%

17%

37%

60%

68%

1922

10%

16%

36%

56%

58%

1924

7%

11%

27%

43%

44%

1926

6%

10%

21%

25%

25%

1928

6%

10%

21%

25%

25%

1930

6%

10%

21%

25%

25%

1932

10%

16%

36%

56%

58%

1934

11%

19%

37%

56%

58%

1936

11%

19%

39%

62%

68%

1938

11%

19%

39%

62%

68%

1940

14%

28%

51%

62%

68%

1942

38%

55%

75%

85%

88%

1944

41%

59%

81%

92%

94%

1946

38%

56%

78%

89%

91%

1948

38%

56%

78%

89%

91%

1950

38%

56%

78%

89%

91%

1952

42%

62%

80%

90%

92%

1954

38%

56%

78%

89%

91%

1956

26%

38%

62%

75%

89%

1958

26%

38%

62%

75%

89%

1960

26%

38%

62%

75%

89%

1962

26%

38%

62%

75%

89%

1964

23%

34%

56%

66%

76%

1966 - 1976

22%

32%

53%

62%

70%

1980

18%

24%

54%

59%

70%

1982

16%

22%

49%

50%

50%

1984

14%

18%

42%

45%

50%

1986

14%

18%

38%

45%

50%

1988

15%

15%

28%

28%

28%

1990

15%

15%

28%

28%

28%

1992

15%

15%

28%

28%

31%

1994

15%

15%

28%

31%

39.6%

1996

15%

15%

28%

31%

36%

1998

15%

15%

28%

28%

36%

2000

15%

15%

28%

28%

36%

2002

10%

15%

27%

27%

35%

2004

10%

15%

25%

25%

33%

2006

10%

15%

15%

25%

33%

2008

10%

15%

15%

25%

33%

2010

10%

15%

15%

25%

33%

is a theory by one economist that postulates that in the United States, federal tax revenues will always be equal to approximately 19.5% of gross domestic product

(GDP), regardless of what the top marginal tax rate is. From fiscal year 1946 to fiscal year 2007, federal tax receipts as a percentage of GDP averaged 17.9%, with a range of 14.4% to 20.9%. During the years referred to by Hauser (FY 46 to FY 93), the actual average was 17.7%.

Where conflicts exist between various sources of tax authority, an authority in Tier 1 outweighs an authority in Tier 2 or 3. Similarly, an authority in Tier 2 outweighs an authority in Tier 3. Where conflicts exist between two authorities in the same tier, the "last-in-time rule" is applied. As the name implies, the "last-in-time rule" states that the authority that was issued later in time is controlling.

Regulations and case law serve to interpret the statutes. Additionally, various sources of law attempt to do the same thing. Revenue Rulings, for example, serves as an interpretation of how the statutes apply to a very specific set of facts. Treaties serve in an international realm.

have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, Thomas Walter Swan, 57 Yale Law Journal

No. 2, 167, 169 (December 1947), Judge Hand wrote:

Complexity is a separate issue from flatness of rate structures. Also, in the United States, income tax laws are often used by legislatures as policy instruments for encouraging numerous undertakings deemed socially useful — including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, development of alternative energy sources and increased investment in conventional energy. Special tax provisions granted for any purpose increase complexity, irrespective of the system's flatness or lack thereof.

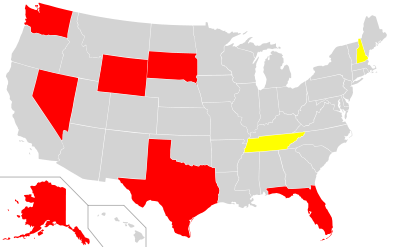

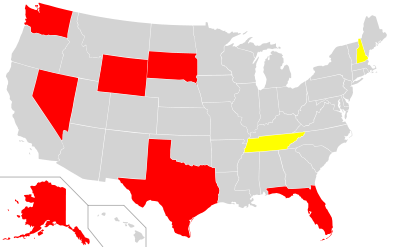

Income tax is also be levied by most U.S. state

Income tax is also be levied by most U.S. state

s and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to Federal income tax and are deductible for Federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income. Some state and local income tax rates are flat (single rate) and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the Federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from Federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax

on payment of wages.

Puerto Rico

imposes a separate income tax in lieu of Federal income tax. The unincorporated territories Guam

, American Samoa

, and the Virgin Islands also impose income tax separately, under a "mirror" tax law based on Federal income tax law.

criticized the tax system as being extremely complex, requiring detailed record-keeping, lengthy instructions, and complicated schedules, worksheets, and forms. They stated that it penalizes work, discourages saving and investment

, and hinders the competitiveness of American business. "The tax code is commonly riddled with provisions that treat similarly situated taxpayers differently and create perceptions of unfairness." The panel's major reform push was for the removal of the Alternative Minimum Tax

, which is not indexed for inflation.

Several organizations and individuals are working for tax reform in the United States

including Americans for Tax Reform

, Citizens for an Alternative Tax System

, Americans For Fair Taxation

, and FreedomWorks

. Various proposals have been put forth for tax simplification in Congress including the Fair Tax Act and various Flat tax

plans.

argue that the income tax system creates perverse incentive

s by encouraging taxpayers to spend rather than save: a taxpayer is only taxed once on income spent immediately, while any interest earned on saved income is itself taxed. To the extent that this is considered unjust, it may be remedied in a variety of ways, e.g. excluding investment income from taxable income, making investments deductible and therefore only taxing them when gains are realized, or replacing the income tax by other forms of tax, such as a sales tax.

believe in a natural right

to property (money being a representation of a person's property), and that no individual, including institutions composed of individuals, can take another individual's property without their permission. Some holders of this view say that the only way government can enforce its power is through coercion; thus, such individuals may view taxation as equivalent to theft. Some believe income taxation offers the federal government a technique to diminish the power of the states, because the federal government is then able to distribute funding to states with conditions attached, often giving the states no choice but to submit to federal demands. Although many libertarians view all taxes as undesirable, the question of whether or not taxation is nevertheless necessary is up for debate among libertarians. However, in general the libertarian philosophy prefers local government over less-local government; thus a federal tax is by some viewed as the worst kind of tax.

have been raised asserting that the federal income tax is unconstitutional, including discredited claims that the Sixteenth Amendment was not properly ratified. All such claims have been repeatedly rejected by the federal courts as frivolous

.

is employed which equates to higher income earners paying a larger percentage of their income in taxes. According to the IRS, the top 1% of income earners for 2008 paid 38% of income tax revenue, while earning 20% of the income reported. The top 5% of income earners paid 59% of the total income tax revenue, while earning 35% of the income reported. The top 10% paid 70%, earning 46% and the top 25% paid 86%, earning 67%. The top 50% paid 97%, earning 87% and leaving the bottom 50% paying 3% of the taxes collected and earning 13% of the income reported.

A 2008 OECD

study ranked 24 OECD nations by progressiveness of taxes and separately by progressiveness of cash transfers, which include pensions, unemployment and other benefits. The United States had the highest concentration coefficient in income tax, a measure of progressiveness, before adjusting for income inequality. The United States was not at the top of either measure for cash transfers. Adjusting for income inequality, Ireland had the highest concentration coefficient for income taxes. Overall income tax rates for the US are below the OECD average.

IRS videos on tax topics

Law & regulations:

Standard texts (updated annually):

Reference works (annual):

Popular publications (annual):

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, a tax is imposed on income by the Federal, most states, and many local governments. The income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

is determined by applying a tax rate, which may increase as income increases

Progressive tax

A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate...

, to taxable income

Taxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

as defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the Federal and some state levels.

Taxable income is total income less allowable deductions

Tax deduction

Income tax systems generally allow a tax deduction, i.e., a reduction of the income subject to tax, for various items, especially expenses incurred to produce income. Often these deductions are subject to limitations or conditions...

. Income is broadly defined. Most business expenses are deductible. Individuals may also deduct a personal allowance (exemption) and certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains

Capital gains tax in the United States

In the United States, individuals and corporations pay income tax on the net total of all their capital gains just as they do on other sorts of income. Capital gains are generally taxed at a preferential rate in comparison to ordinary income...

are fully taxable, and capital losses reduce taxable income only to the extent of gains. Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

Taxpayers generally must self assess income tax by filing tax returns. Advance payments of tax are required in the form of withholding tax or estimated tax payments. Taxes are determined separately by each jurisdiction imposing tax. Due dates and other administrative procedures vary by jurisdiction. April 15 following the tax year is the due date for individual returns for Federal and many state and local returns. Tax as determined by the taxpayer may be adjusted by the taxing jurisdiction.

Basics

A tax is imposed on net taxable incomeTaxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

in the United States by the Federal, most state, and some local governments. Income tax is imposed on individuals, corporations, estates, and trusts. The definition of net taxable income for most sub-federal jurisdictions mostly follows the Federal definition.

The rate of tax at the federal level is graduated; that is, the tax rates of higher amounts of income are higher than on lower amounts. The lower rate on lower income was phased out at higher incomes prior to 2010. Some states and localities impose an income tax at a graduated rate, and some at a flat rate on all taxable income. Federal tax rates in 2009 varied from 10% to 35%. From 2003 through 2010, individuals were eligible for a reduced rate of Federal income tax on capital gains and qualifying dividends. The tax rate and some deductions are different for individuals depending on filing status. Married individuals may compute tax as a couple or separately. Single individuals may be eligible for reduced tax rates if they are head of a household in which they live with a dependent.

Federal taxable income is defined in a comprehensive manner in the Internal Revenue Code

Internal Revenue Code

The Internal Revenue Code is the domestic portion of Federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code...

and regulations issued by the Department of Treasury and the Internal Revenue Service. Taxable income is gross income

Gross income

Gross income in United States tax law is receipts and gains from all sources less cost of goods sold. Gross income is the starting point for determining Federal and state income tax of individuals, corporations, estates and trusts, whether resident or nonresident."Except as otherwise provided" by...

as adjusted less tax deduction

Tax deduction

Income tax systems generally allow a tax deduction, i.e., a reduction of the income subject to tax, for various items, especially expenses incurred to produce income. Often these deductions are subject to limitations or conditions...

s. Most states and localities follow this definition at least in part, though some make adjustments to determine income taxed in that jurisdiction. Taxable income for a company or business may not be the same as its book income.

Gross income includes all income earned or received from whatever source. This includes salaries and wages, tips, pensions, fees earned for services, price of goods sold, other business income, gains on sale of other property, rents received, interest and dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

s received, alimony received, proceeds from selling crops, and many other types of income. Some income, however, is exempt from income tax. This includes interest on municipal bonds.

Adjustments (usually reductions) to gross income of individuals are made for alimony paid, contributions to many types of retirement or health savings plans, certain student loan interest, half of self employment tax, and a few other items. The cost of goods sold

Cost of goods sold

Cost of goods sold refers to the inventory costs of those goods a business has sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out , or average cost...

in a business is a direct reduction of gross income.

Taxable income of all taxpayers is reduced by tax deductions for expenses related to their business. These include salaries, rent, and other business expenses paid or accrued, as well as allowances for depreciation

MACRS

The Modified Accelerated Cost Recovery System is the current tax depreciation system in the United States. Under this system, the capitalized cost of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal...

. The deduction of expenses may result in a loss. Generally, such loss can reduce other taxable income, subject to some limits.

Individuals are allowed several nonbusiness deductions. A flat amount per person is allowed as a deduction for personal exemptions. For 2009 this amount was $3,650. Each taxpayer is allowed one such deduction for themselves and one for each person they support.

In addition, individuals get a deduction from taxable income for certain personal expenses. Alternatively, the individual may claim a standard deduction

Standard deduction

The standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens who are individuals, married persons, and heads of household and increases every...

. For 2011, the standard deduction is $5,800 for single individuals, $11,600 for a married couple, and $8,500 for a head of household. Those who choose to claim actual itemized deductions may deduct the following, subject to many conditions and limitations:

- Medical expenses in excess of 7.5% of adjusted gross income,

- State, local, and foreign taxes,

- Home mortgage interest,

- Contributions to charities,

- Losses on nonbusiness property due to casualty, and

- Deductions for expenses incurred in the production of income in excess of 2% of adjusted gross income.

Capital gains

Capital gains tax in the United States

In the United States, individuals and corporations pay income tax on the net total of all their capital gains just as they do on other sorts of income. Capital gains are generally taxed at a preferential rate in comparison to ordinary income...

and qualified dividend

Qualified dividend

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income...

s may be taxed as part of taxable income. However, the tax is limited to a lower tax rate. Capital gains include gains on selling stocks and bonds, real estate, and other capital assets. The gain is the excess of the proceeds over the adjusted basis (cost less depreciation deductions allowed) of the property. This limit on tax also applies to dividends from U.S. corporations and many foreign corporations. There are limits on how much net capital loss may reduce other taxable income.

All taxpayers are allowed a tax credit

Tax credit

A tax credit is a sum deducted from the total amount a taxpayer owes to the state. A tax credit may be granted for various types of taxes, such as an income tax, property tax, or VAT. It may be granted in recognition of taxes already paid, as a subsidy, or to encourage investment or other behaviors...

for foreign taxes and for a percentage of certain types of business expenses. Individuals are also allowed credits related to education expenses, retirement savings, child care expenses, and a credit for each child. Each of the credits is subject to specific rules and limitations. Some credits are treated as refundable payments.

All taxpayers are also subject to the Alternative Minimum Tax

Alternative Minimum Tax

The Alternative Minimum Tax is an income tax imposed by the United States federal government on individuals, corporations, estates, and trusts. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold . This exemption is substantially higher than the...

if their income exceeds certain exclusion amounts. This tax applies only if it exceeds regular income tax, and is reduced by some credits.

Individuals must file income tax returns in each year their income exceeds the standard deduction plus one personal exemption, or if any tax is due. Other taxpayers must file income tax returns each year. These returns may be filed electronically. Generally, an individual's tax return covers the calendar year. Corporations may elect a different tax year. Most states and localities follow the Federal tax year, and require separate returns.

Taxpayers must pay income tax due without waiting for an assessment. Many taxpayers are subject to withholding tax

Withholding tax

Withholding tax, also called retention tax, is a government requirement for the payer of an item of income to withhold or deduct tax from the payment, and pay that tax to the government. In most jurisdictions, withholding tax applies to employment income. Many jurisdictions also require...

es when they receive income. To the extent withholding taxes do not cover all taxes due, all taxpayers must make estimated tax payments.

Failing to make payments on time, or failing to file returns, can result in substantial penalties

IRS penalties

Taxpayers in the United States may face various penalties for failures related to Federal, state, and local tax matters. The Internal Revenue Service is primarily responsible for initiating these penalties at the Federal level. The IRS can impose only those penalties specified in Federal tax law...

. Certain intentional failures may result in jail time.

Tax returns may be examined and adjusted by tax authorities. Taxpayers have rights to appeal any change to tax, and these rights vary by jurisdiction. Taxpayers may also go to court to contest tax changes. Tax authorities may not make changes after a certain period of time (generally 3 years).

Federal income tax rates

Recent Federal income brackets and tax rates are published annually by the IRS as "Tax Rate SchedulesRate schedule (federal income tax)

A rate schedule is a chart that helps United States taxpayers determine their federal income tax burden for a particular year. Another name for “rate schedule” is “rate table.”- Origin :...

".

Marginal rate vs. income

Year 2009 income brackets and tax rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,350 | $0 – $16,700 | $0 – $8,350 | $0 – $11,950 |

| 15% | $8,351 – $33,950 | $16,701 – $67,900 | $8,351 – $33,950 | $11,951 – $45,500 |

| 25% | $33,951 – $82,250 | $67,901 – $137,050 | $33,951 – $68,525 | $45,501 – $117,450 |

| 28% | $82,251 – $171,550 | $137,051 – $208,850 | $68,526 – $104,425 | $117,451 – $190,200 |

| 33% | $171,551 – $372,950 | $208,851 – $372,950 | $104,426 – $186,475 | $190,201 – $372,950 |

| 35% | $372,951+ | $372,951+ | $186,476+ | $372,951+ |

Year 2010 income brackets and tax rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,375 | $0 – $16,750 | $0 – $8,375 | $0 – $11,950 |

| 15% | $8,376 – $34,000 | $16,751 – $68,000 | $8,376 – $34,000 | $11,951 – $45,550 |

| 25% | $34,001 – $82,400 | $68,001 – $137,300 | $34,001 – $68,650 | $45,551 – $117,650 |

| 28% | $82,401 – $171,850 | $137,301 – $209,250 | $68,651 – $104,625 | $117,651 – $190,550 |

| 33% | $171,851 – $373,650 | $209,251 – $373,650 | $104,626 – $186,825 | $190,551 – $373,650 |

| 35% | $373,651+ | $373,651+ | $186,826+ | $373,651+ |

Year 2011 income brackets and tax rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,500 | $0 – $17,000 | $0 – $8,500 | $0 – $12,150 |

| 15% | $8,501 – $34,500 | $17,001 – $69,000 | $8,501 – $34,500 | $12,150 – $46,250 |

| 25% | $34,501 – $83,600 | $69,001 – $139,350 | $34,501 – $69,675 | $46,251 – $119,400 |

| 28% | $83,601 – $174,400 | $139,351 – $212,300 | $69,676 – $106,150 | $119,401 – $193,350 |

| 33% | $174,401 – $379,150 | $212,301 – $379,150 | $106,151 – $189,575 | $193,351 – $379,150 |

| 35% | $379,151+ | $379,151+ | $189,576+ | $379,151+ |

An individual's marginal income tax bracket

Tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system . Essentially, they are the cutoff values for taxable income — income past a certain point will be taxed at a higher rate.-Example:Imagine that there are three tax brackets: 10%, 20%, and 30%...

depends upon his or her income and tax-filing classification. As of 2008, there are six tax brackets for ordinary income (ranging from 10% to 35%) and four classifications: single, married filing jointly (or qualified widow or widower), married filing separately, and head of household.

An individual pays tax at a given bracket only for each dollar within that bracket's range. For example, a single taxpayer who earned $10,000 in 2009 would be taxed 10% of each dollar earned from the 1st dollar to the 8,350th dollar (10% × $8,350 = $835.00), then 15% of each dollar earned from the 8,351st dollar to the 10,000th dollar (15% × $1,650 = $247.50), for a total of $1,082.50. Notice this amount ($1,082.50) is lower than if the individual had been taxed at 15% on the full $10,000 (for a tax of $1,500). This is because the individual's marginal rate (the percentage tax on the last dollar earned, here 15%) has no effect on the income taxed at a lower bracket (here the first $8,350 of income taxed at 10%). This ensures that every rise in a person's pre-tax salary results in an increase of their after-tax salary.

Example of a tax computation

Income tax for year 2011:Single taxpayer, no children, under 65 and not blind, taking standard deduction;

- $40,000 gross income – $5,800 standard deductionStandard deductionThe standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens who are individuals, married persons, and heads of household and increases every...

– $3,700 personal exemption = $30,500 taxable income- $8,500 × 10% = $850.00 (taxation of the first income bracket)

- $30,500 – $8,500 = $22,000.00 (amount in the second income bracket)

- $22,000.00 × 15% = $3,300.00 (taxation of the amount in the second income bracket)

- Total income tax is $850.00 + $3,300.00 = $4,150.00 (10.375% effective tax)

Note that in addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax

Federal Insurance Contributions Act tax

Federal Insurance Contributions Act tax is a United States payroll tax imposed by the federal government on both employees and employers to fund Social Security and Medicare —federal programs that provide benefits for retirees, the disabled, and children of deceased workers...

(FICA) (and an equal amount of FICA tax must be paid by the employer):

- $40,000 (adjusted gross income)

- $40,000 × 4.2% = $1,680 (Social Security portion)

- $40,000 × 1.45% = $580 (Medicare portion)

- Total FICA tax = $2,260 (5.65% of income)

- Total Federal tax of individual = $6,410.00 (16.025% of income)

Taxable income

Income tax is imposed as a tax rate times taxable income, less applicable tax credits. Taxable income is gross incomeGross income

Gross income in United States tax law is receipts and gains from all sources less cost of goods sold. Gross income is the starting point for determining Federal and state income tax of individuals, corporations, estates and trusts, whether resident or nonresident."Except as otherwise provided" by...

less allowable tax deductions. Taxable income as determined for Federal tax purposes may be modified for state tax purposes.

Gross income

The Internal Revenue CodeInternal Revenue Code

The Internal Revenue Code is the domestic portion of Federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code...

states that "gross income means all income from whatever source derived," and gives specific examples. Gross income is not limited to cash received. "It includes income realized in any form, whether money, property, or services." Gross income includes wages and tips, fees for performing services, gain from sale of inventory or other property, interest, dividends, rents, royalties, pensions, alimony, and many other types of income. Items must be included in income when received or accrued. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned, cost of goods sold

Cost of goods sold

Cost of goods sold refers to the inventory costs of those goods a business has sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out , or average cost...

, or tax basis

Tax basis

The tax basis of an asset is generally its cost. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced basis is referred to as the adjusted tax basis. Adjusted tax basis is used in...

of property sold.

Certain types of income are subject to tax exemption

Tax exemption

Various tax systems grant a tax exemption to certain organizations, persons, income, property or other items taxable under the system. Tax exemption may also refer to a personal allowance or specific monetary exemption which may be claimed by an individual to reduce taxable income under some...

. Among the more common types of exempt income are interest on municipal bonds, a portion of Social Security benefits, life insurance proceeds, gifts or inheritances, and the value of many employee benefits.

Gross income is reduced by adjustments and tax deductions. Among the more common adjustments are reductions for alimony paid and IRA

Individual Retirement Account

An individual retirement arrangement is the blanket term for a form of retirement plan that provides tax advantages for retirement savings in the United States...

and certain other retirement plan contributions. Adjusted gross income is used in calculations relating to various deductions, credits, phase outs, and penalties.

Business deductions

Deductions are permitted for most business expenses of entities and individuals. There are limits on some types of these deductions. The deduction for depreciation expense must be computed under MACRSMACRS

The Modified Accelerated Cost Recovery System is the current tax depreciation system in the United States. Under this system, the capitalized cost of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal...

rules. Deductions for meals and entertainment are limited to 50% of the amount incurred.

Certain deductions must be capitalized or deferred. These include:

- Cost of goods soldCost of goods soldCost of goods sold refers to the inventory costs of those goods a business has sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out , or average cost...

, including costs required to be capitalized under tax rules that differ from financial accounting rules, - Personal, living, and family expenses,

- Items producing future benefits,

- Political contributions,

- Expenses not properly documented under tax rules, and

- Other items.

Business losses may reduce nonbusiness income for individuals and corporations. However, losses from passive activities may reduce only income from other passive activities. Passive activities include most rental activities (except for real estate professionals) and business activities in which the taxpayer does not materially participate. In addition, losses may not, in most cases, be deducted in excess of the taxpayer's amount at risk (generally tax basis in the entity plus share of debt).

Overall net operating loss

Net operating loss

Under U.S. Federal income tax law, a net operating loss occurs when certain tax-deductible expenses exceed taxable revenues for a taxable year. If a taxpayer is taxed during profitable periods without receiving any tax relief during periods of NOLs, an unbalanced tax burden results...

es (business deductions in excess of gross income) may be deducted in other years by carryover or carryback of the loss.

Personal deductions

Individuals are allowed a special deduction called a personal exemption for dependents. This is a fixed amount allowed each taxpayer, plus an additional fixed amount for each child or other dependent the taxpayer supports. The amount of this deduction for 2009 and 2010 is $3,650. The amount is indexed annually for inflation. The amount of exemption is phased out at higher incomes through 2009; the phase out expired for 2010.Citizens and individuals who have U.S. tax residence

Tax residence

Definitions of residence for tax purposes vary considerably from state to state. For individuals, physical presence in a state is an important factor. Some states also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability...

may deduct a flat amount as a standard deduction

Standard deduction

The standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens who are individuals, married persons, and heads of household and increases every...

. Alternatively, they may claim an itemized deduction

Itemized deduction

An itemized deduction is an eligible expense that individual taxpayers in the United States can report on their federal income tax returns in order to decrease their taxable income....

for actual amounts incurred for specific categories of nonbusiness expenses. Home owners may deduct the amount of interest and property taxes paid on their principal and second homes. Local and state income taxes are deductible, or the individual may elect to deduct state and local sales tax

Sales tax

A sales tax is a tax, usually paid by the consumer at the point of purchase, itemized separately from the base price, for certain goods and services. The tax amount is usually calculated by applying a percentage rate to the taxable price of a sale....

. Contributions to charitable organizations are deductible by individuals and corporations, but the deduction is limited to 50% and 10% of gross income respectively. Medical expenses in excess of 7.5% of adjusted gross income

Adjusted Gross Income

For United States individual income tax, taxable income is adjusted gross income less allowances for personal exemptions and itemized deductions. Adjusted gross income is total gross income minus specific items laid out in the tax code...

are deductible, as are uninsured casualty losses. Other income producing expenses in excess of 2% of adjusted gross income are also deductible. For years before 2010, the allowance of itemized deductions was phased out at higher incomes. The phase out expired for 2010.

Capital gains

Taxable income includes capital gains. These are the excess of the sales price over tax basisTax basis

The tax basis of an asset is generally its cost. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced basis is referred to as the adjusted tax basis. Adjusted tax basis is used in...

(cost) of capital assets, such as corporate stock, land, buildings, etc. Capital losses (where basis is more than sales price) are deductible, but deduction for long term capital losses is limited to capital gains. An individual may exclude $250,000 ($500,000 for a married couple filing jointly) of capital gains on the sale of the individual's primary residence, subject to certain conditions and limitations.

In determining gain, it is necessary to determine which property is sold and the basis of that property. This may require identification conventions, such as first-in-first-out, for identical properties like shares of stock. Further, tax basis must be allocated among properties purchased together unless they are sold together. Original basis, usually cost paid for the asset, is reduced by deductions for depreciation

Depreciation

Depreciation refers to two very different but related concepts:# the decrease in value of assets , and# the allocation of the cost of assets to periods in which the assets are used ....

or loss.

Certain capital gains are deferred, that is, taxed at a time later than disposition. Gains on property sold for installment payments may be recognized as those payments are received. Gains on property exchanged for like kind property are not recognized, and the tax basis of the new property is based on the tax basis of the old property.

Before 1986 and from 2004 onward, individuals have been subject to a reduced rate of Federal tax on long term capital gains. This reduced rate (limited to 15%) applies for regular tax and the Alternative Minimum Tax.

| Ordinary Income Rate | Long-term Capital Gain Rate | Short-term Capital Gain Rate | Long-term Gain on Real Estate* | Long-term Gain on Collectibles | Long-term Gain on Certain Small Business Stock |

|---|---|---|---|---|---|

| 10% | 0% | 10% | 10% | 10% | 10% |

| 15% | 0% | 15% | 15% | 15% | 15% |

| 25% | 15% | 25% | 25% | 25% | 25% |

| 28% | 15% | 28% | 25% | 28% | 28% |

| 33% | 15% | 33% | 25% | 28% | 28% |

| 35% | 15% | 35% | 25% | 28% | 28% |

* Capital gains up to $250,000 ($500,000 if filed jointly) on real estate used as primary residence are exempt.

Partnerships and LLCs

Business entities treated as partnerships are not subject to income tax at the entity level. Instead, their members include their shares of income, deductions, and credits in computing their own tax. The character of the partner's share of income (such as capital gains) is determined at the partnership level. Many types of business entities, including limited liability companies (LLCs), may elect to be treated as a corporation or as a partnership. Distributions from partnerships are not taxed as dividends.Corporate tax

Corporate tax is imposed in the United States at the Federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Shareholders of a corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships (see S CorporationS Corporation

An S corporation, for United States federal income tax purposes, is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code....

). Corporate income tax is based on taxable income

Taxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

distributions from the corporation. They are also subject to tax on capital gains upon sale or exchange of their shares for money or property. However, certain exchanges, such as in reorganizations, are not taxable.

Multiple corporations may file a consolidated return

Combined Reporting

Some jurisdictions permit or require combined reporting or combined or consolidated filing of income tax returns. Such returns include income, deductions, and other items of multiple related corporations, and may compute tax as if such multiple entities were a single taxpayer. Most rules require...

at the Federal and some state levels with their common parent.

Corporate tax rates

Federal corporate income tax is imposed at graduated rates from 15% to 35%. The lower rate brackets are phased out at higher rates of income, with all income subject to tax at 34% to 35% where taxable income exceeds $335,000. All income is taxed at the same rate. Additional tax rates imposed below the federal level vary widely by jurisdiction, from under 1% to over 16%. State and local income taxes are allowed as tax deductions in computing Federal taxable income.Deductions for corporations

Corporations are not allowed the personal deductions allowed to individuals, such as deductions for exemptions and the standard deduction. However, most other deductions are allowed. In addition, corporations are allowed certain deductions unique to corporate status. These include a partial deduction for dividends received from other corporations, deductions related to organization costs, and certain other items.Some deductions of corporations are limited at Federal or state levels. Limitations apply to items due to related parties, including interest and royalty expenses.

Estates and trusts

Estates and trusts may be subject to income tax at the estate or trust level, or the beneficiaries may be subject to income tax on their share of income. Where the all income must be distributed, the beneficiaries are taxed similarly to partners in a partnership. Where income may be retained, the estate or trust is taxed. It may get a deduction for later distributions of income. Estates and trusts are allowed only those deductions related to producing income, plus $1,000. They are taxed at graduated rates that increase rapidly to the maximum rate for individuals. The tax rate for trust and estate income in excess of $11,500 was 35% for 2009. Estates and trusts are eligible for the reduced rate of tax on dividends and capital gains through 2010.Retirement savings and fringe benefit plans

Employers get a deduction for amounts contributed to a qualified employee retirement plan or benefit plan. The employee does not recognize income with respect to the plan until he or she receives a distribution from the plan. The plan itself is organized as a trust and is considered a separate entity. For the plan to qualify for tax exemptionTax exemption

Various tax systems grant a tax exemption to certain organizations, persons, income, property or other items taxable under the system. Tax exemption may also refer to a personal allowance or specific monetary exemption which may be claimed by an individual to reduce taxable income under some...

, and for the employer to get a deduction, the plan must meet minimum participation, vesting, funding, and operational standards.