Sixteenth Amendment to the United States Constitution

Encyclopedia

The Sixteenth Amendment (Amendment XVI) to the United States Constitution

United States Constitution

The Constitution of the United States is the supreme law of the United States of America. It is the framework for the organization of the United States government and for the relationship of the federal government with the states, citizens, and all people within the United States.The first three...

allows the Congress to levy an income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

without apportioning it among the states

U.S. state

A U.S. state is any one of the 50 federated states of the United States of America that share sovereignty with the federal government. Because of this shared sovereignty, an American is a citizen both of the federal entity and of his or her state of domicile. Four states use the official title of...

or basing it on Census

United States Census

The United States Census is a decennial census mandated by the United States Constitution. The population is enumerated every 10 years and the results are used to allocate Congressional seats , electoral votes, and government program funding. The United States Census Bureau The United States Census...

results. This amendment exempted income taxes from the constitutional requirements regarding direct taxes, after income taxes on rents, dividends, and interest were ruled to be direct taxes in Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Company, , aff'd on reh'g, , with a ruling of 5–4, was a landmark case in which the Supreme Court of the United States ruled that the unapportioned income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and...

(1895). It was ratified on February 3, 1913.

Text

Other Constitutional provisions regarding taxes

Article IArticle One of the United States Constitution

Article One of the United States Constitution describes the powers of Congress, the legislative branch of the federal government. The Article establishes the powers of and limitations on the Congress, consisting of a House of Representatives composed of Representatives, with each state gaining or...

, Section 2, Clause 3:

Article I, Section 8, Clause 1:

Article I, Section 9, Clause 4:

This clause basically refers to a tax on property, such as a tax based on the value of land, as well as a capitation.

Income taxes pre-Pollock

To raise revenue to fund the Civil WarAmerican Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

, Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

introduced the income tax through the Revenue Act of 1861

Revenue Act of 1861

The Revenue Act of 1861, formally cited as , included the first U.S. Federal income tax statute . The Act, motivated by the need to fund the Civil War , imposed an income tax to be "levied, collected, and paid, upon the annual income of every person residing in the United States, whether such...

. It levied a flat tax

Flat tax

A flat tax is a tax system with a constant marginal tax rate. Typically the term flat tax is applied in the context of an individual or corporate income that will be taxed at one marginal rate...

of 3% on annual income above $800, which was equivalent to $ in today's money. This act was replaced the following year with the Revenue Act of 1862

Revenue Act of 1862

The Revenue Act of 1862 , was passed by the United States Congress to help fund the American Civil War. The Act was signed into law by President Abraham Lincoln, introducing the first progressive rate income tax to the country....

, which levied a graduated tax

Progressive tax

A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate...

of 3–5% on income above $600 (worth $ today) and specified a termination of income taxation in 1866.

The Socialist Labor Party

Socialist Labor Party of America

The Socialist Labor Party of America , established in 1876 as the Workingmen's Party, is the oldest socialist political party in the United States and the second oldest socialist party in the world. Originally known as the Workingmen's Party of America, the party changed its name in 1877 and has...

advocated a graduated income tax in 1887. The Populist Party

Populist Party (United States)

The People's Party, also known as the "Populists", was a short-lived political party in the United States established in 1891. It was most important in 1892-96, then rapidly faded away...

"demand[ed] a graduated income tax" in its 1892 platform. The Democratic Party, led by William Jennings Bryan

William Jennings Bryan

William Jennings Bryan was an American politician in the late-19th and early-20th centuries. He was a dominant force in the liberal wing of the Democratic Party, standing three times as its candidate for President of the United States...

, advocated the income tax law passed in 1894, and proposed an income tax in its 1908 platform.

Prior to the Supreme Court's

Supreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

decision in Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Company, , aff'd on reh'g, , with a ruling of 5–4, was a landmark case in which the Supreme Court of the United States ruled that the unapportioned income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and...

, all income taxes had been considered indirect taxes imposed without respect to geography, unlike direct taxes, that must be apportioned among the states according to population.

The Wilson–Gorman Tariff Act of 1894 attempted to impose a federal tax of 2% on incomes over $4,000 (worth $ today). Derided as "un-Democratic, inquisitorial, and wrong in principle," it was challenged in federal court

United States federal courts

The United States federal courts make up the judiciary branch of federal government of the United States organized under the United States Constitution and laws of the federal government.-Categories:...

.

The Pollock case

In Pollock v. Farmers' Loan & Trust Co.Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Company, , aff'd on reh'g, , with a ruling of 5–4, was a landmark case in which the Supreme Court of the United States ruled that the unapportioned income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and...

the Supreme Court

Supreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

declared certain taxes on incomes — such as those from property under the 1894 Act — to be unconstitutionally

Constitutionality

Constitutionality is the condition of acting in accordance with an applicable constitution. Acts that are not in accordance with the rules laid down in the constitution are deemed to be ultra vires.-See also:*ultra vires*Company law*Constitutional law...

unapportioned direct tax

Direct tax

The term direct tax generally means a tax paid directly to the government by the persons on whom it is imposed.-General meaning:In the general sense, a direct tax is one paid directly to the government by the persons on whom it is imposed...

es. The Court reasoned that a tax on income from property should be treated as a tax on "property by reason of its ownership" and so should be required to be apportioned. The reasoning was that taxes on the rents from land, the dividends from stocks and so forth burdened the property generating the income in the same way that a tax on "property by reason of its ownership" burdened that property.

After Pollock, while income taxes on wages (as indirect taxes) were still not required to be apportioned by population, taxes on interest, dividends and rent income were required to be apportioned by population. The Pollock ruling made the source of the income (e.g., property versus labor, etc.) relevant in determining whether the tax imposed on that income was deemed to be "direct" (and thus required to be apportioned among the states according to population) or, alternatively, "indirect" (and thus required only to be imposed with geographical uniformity).

In his dissent to the Pollock decision, Justice John Marshall Harlan

John Marshall Harlan

John Marshall Harlan was a Kentucky lawyer and politician who served as an associate justice on the Supreme Court. He is most notable as the lone dissenter in the Civil Rights Cases , and Plessy v...

stated:

In responding to the decision, members of Congress reflected widespread concern that many of the wealthiest Americans had consolidated too much economic power.

Adoption

On June 16, 1909, President William Howard TaftWilliam Howard Taft

William Howard Taft was the 27th President of the United States and later the tenth Chief Justice of the United States...

, in an address to Congress, proposed a 2% federal income tax on corporation

Corporation

A corporation is created under the laws of a state as a separate legal entity that has privileges and liabilities that are distinct from those of its members. There are many different forms of corporations, most of which are used to conduct business. Early corporations were established by charter...

s by way of an excise tax and a constitutional amendment to allow the previously enacted income tax.

An income tax amendment to the Constitution was first proposed by Senator Norris Brown

Norris Brown

Norris Brown was a Senator from Nebraska.Brown was born in Maquoketa, Iowa. The son of William Henry Harrison and Eliza Ann Phelps Brown, he attended Jefferson Iowa Academy and graduated with a law degree from the University of Iowa College of Law in Iowa City, Iowa, in 1883. He was admitted to...

of Nebraska. He submitted two proposals, Senate Resolutions Nos. 25 and 39. The amendment proposal finally accepted was Senate Joint Resolution No. 40, introduced by Senator Nelson W. Aldrich

Nelson W. Aldrich

Nelson Wilmarth Aldrich was a prominent American politician and a leader of the Republican Party in the Senate, where he served from 1881 to 1911....

of Rhode Island, the Senate majority leader and Finance Committee

United States Senate Committee on Finance

The U.S. Senate Committee on Finance is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection...

Chairman.

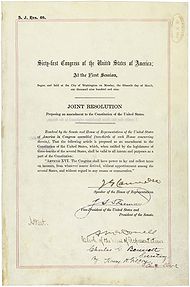

On July 12, 1909, the resolution proposing the Sixteenth Amendment was passed by the Sixty-first Congress

61st United States Congress

The Sixty-first United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, DC from March 4, 1909 to March 4, 1911, during the first two years of...

and submitted to the state legislatures. Support for the income tax was strongest in the western states and opposition was strongest in the northeastern states. In 1910, New York Governor Charles Evans Hughes

Charles Evans Hughes

Charles Evans Hughes, Sr. was an American statesman, lawyer and Republican politician from New York. He served as the 36th Governor of New York , Associate Justice of the Supreme Court of the United States , United States Secretary of State , a judge on the Court of International Justice , and...

, shortly before becoming a Supreme Court justice, spoke out against the income tax amendment. While he supported the idea of a federal income tax, Hughes believed the words "from whatever source derived" in the proposed amendment implied that the federal government would have the power to tax state and municipal bonds. He believed this would excessively centralize governmental power and "would make it impossible for the state to keep any property".

The presidential election of 1912

United States presidential election, 1912

The United States presidential election of 1912 was a rare four-way contest. Incumbent President William Howard Taft was renominated by the Republican Party with the support of its conservative wing. After former President Theodore Roosevelt failed to receive the Republican nomination, he called...

was contested between three advocates of an income tax. On February 25, 1913, Secretary of State

United States Secretary of State

The United States Secretary of State is the head of the United States Department of State, concerned with foreign affairs. The Secretary is a member of the Cabinet and the highest-ranking cabinet secretary both in line of succession and order of precedence...

Philander Knox proclaimed that the amendment had been ratified by the necessary three-fourths of the states; thus, it had become part of the Constitution. The Revenue Act of 1913

Revenue Act of 1913

The United States Revenue Act of 1913 also known as the Tariff Act, Underwood Tariff, Underwood Tariff Act, or Underwood-Simmons Act , re-imposed the federal income tax following the ratification of the Sixteenth Amendment and lowered basic tariff rates from 40% to 25%, well below the Payne-Aldrich...

was enacted shortly thereafter.

According to the United States Government Printing Office

United States Government Printing Office

The United States Government Printing Office is an agency of the legislative branch of the United States federal government. The office prints documents produced by and for the federal government, including the Supreme Court, the Congress, the Executive Office of the President, executive...

, the following states ratified the amendment:

- AlabamaAlabamaAlabama is a state located in the southeastern region of the United States. It is bordered by Tennessee to the north, Georgia to the east, Florida and the Gulf of Mexico to the south, and Mississippi to the west. Alabama ranks 30th in total land area and ranks second in the size of its inland...

(August 10, 1909) - KentuckyKentuckyThe Commonwealth of Kentucky is a state located in the East Central United States of America. As classified by the United States Census Bureau, Kentucky is a Southern state, more specifically in the East South Central region. Kentucky is one of four U.S. states constituted as a commonwealth...

(February 8, 1910) - South CarolinaSouth CarolinaSouth Carolina is a state in the Deep South of the United States that borders Georgia to the south, North Carolina to the north, and the Atlantic Ocean to the east. Originally part of the Province of Carolina, the Province of South Carolina was one of the 13 colonies that declared independence...

(February 19, 1910) - IllinoisIllinoisIllinois is the fifth-most populous state of the United States of America, and is often noted for being a microcosm of the entire country. With Chicago in the northeast, small industrial cities and great agricultural productivity in central and northern Illinois, and natural resources like coal,...

(March 1, 1910) - MississippiMississippiMississippi is a U.S. state located in the Southern United States. Jackson is the state capital and largest city. The name of the state derives from the Mississippi River, which flows along its western boundary, whose name comes from the Ojibwe word misi-ziibi...

(March 7, 1910) - OklahomaOklahomaOklahoma is a state located in the South Central region of the United States of America. With an estimated 3,751,351 residents as of the 2010 census and a land area of 68,667 square miles , Oklahoma is the 28th most populous and 20th-largest state...

(March 10, 1910) - MarylandMarylandMaryland is a U.S. state located in the Mid Atlantic region of the United States, bordering Virginia, West Virginia, and the District of Columbia to its south and west; Pennsylvania to its north; and Delaware to its east...

(April 8, 1910) - GeorgiaGeorgia (U.S. state)Georgia is a state located in the southeastern United States. It was established in 1732, the last of the original Thirteen Colonies. The state is named after King George II of Great Britain. Georgia was the fourth state to ratify the United States Constitution, on January 2, 1788...

(August 3, 1910) - TexasTexasTexas is the second largest U.S. state by both area and population, and the largest state by area in the contiguous United States.The name, based on the Caddo word "Tejas" meaning "friends" or "allies", was applied by the Spanish to the Caddo themselves and to the region of their settlement in...

(August 16, 1910) - OhioOhioOhio is a Midwestern state in the United States. The 34th largest state by area in the U.S.,it is the 7th‑most populous with over 11.5 million residents, containing several major American cities and seven metropolitan areas with populations of 500,000 or more.The state's capital is Columbus...

(January 19, 1911) - IdahoIdahoIdaho is a state in the Rocky Mountain area of the United States. The state's largest city and capital is Boise. Residents are called "Idahoans". Idaho was admitted to the Union on July 3, 1890, as the 43rd state....

(January 20, 1911) - OregonOregonOregon is a state in the Pacific Northwest region of the United States. It is located on the Pacific coast, with Washington to the north, California to the south, Nevada on the southeast and Idaho to the east. The Columbia and Snake rivers delineate much of Oregon's northern and eastern...

(January 23, 1911) - Washington (January 26, 1911)

- MontanaMontanaMontana is a state in the Western United States. The western third of Montana contains numerous mountain ranges. Smaller, "island ranges" are found in the central third of the state, for a total of 77 named ranges of the Rocky Mountains. This geographical fact is reflected in the state's name,...

(January 27, 1911) - IndianaIndianaIndiana is a US state, admitted to the United States as the 19th on December 11, 1816. It is located in the Midwestern United States and Great Lakes Region. With 6,483,802 residents, the state is ranked 15th in population and 16th in population density. Indiana is ranked 38th in land area and is...

(January 30, 1911) - CaliforniaCaliforniaCalifornia is a state located on the West Coast of the United States. It is by far the most populous U.S. state, and the third-largest by land area...

(January 31, 1911) - NevadaNevadaNevada is a state in the western, mountain west, and southwestern regions of the United States. With an area of and a population of about 2.7 million, it is the 7th-largest and 35th-most populous state. Over two-thirds of Nevada's people live in the Las Vegas metropolitan area, which contains its...

(January 31, 1911) - South DakotaSouth DakotaSouth Dakota is a state located in the Midwestern region of the United States. It is named after the Lakota and Dakota Sioux American Indian tribes. Once a part of Dakota Territory, South Dakota became a state on November 2, 1889. The state has an area of and an estimated population of just over...

(February 1, 1911) - NebraskaNebraskaNebraska is a state on the Great Plains of the Midwestern United States. The state's capital is Lincoln and its largest city is Omaha, on the Missouri River....

(February 9, 1911) - North CarolinaNorth CarolinaNorth Carolina is a state located in the southeastern United States. The state borders South Carolina and Georgia to the south, Tennessee to the west and Virginia to the north. North Carolina contains 100 counties. Its capital is Raleigh, and its largest city is Charlotte...

(February 11, 1911) - ColoradoColoradoColorado is a U.S. state that encompasses much of the Rocky Mountains as well as the northeastern portion of the Colorado Plateau and the western edge of the Great Plains...

(February 15, 1911) - North DakotaNorth DakotaNorth Dakota is a state located in the Midwestern region of the United States of America, along the Canadian border. The state is bordered by Canada to the north, Minnesota to the east, South Dakota to the south and Montana to the west. North Dakota is the 19th-largest state by area in the U.S....

(February 17, 1911) - MichiganMichiganMichigan is a U.S. state located in the Great Lakes Region of the United States of America. The name Michigan is the French form of the Ojibwa word mishigamaa, meaning "large water" or "large lake"....

(February 23, 1911) - IowaIowaIowa is a state located in the Midwestern United States, an area often referred to as the "American Heartland". It derives its name from the Ioway people, one of the many American Indian tribes that occupied the state at the time of European exploration. Iowa was a part of the French colony of New...

(February 24, 1911) - KansasKansasKansas is a US state located in the Midwestern United States. It is named after the Kansas River which flows through it, which in turn was named after the Kansa Native American tribe, which inhabited the area. The tribe's name is often said to mean "people of the wind" or "people of the south...

(March 2, 1911) - MissouriMissouriMissouri is a US state located in the Midwestern United States, bordered by Iowa, Illinois, Kentucky, Tennessee, Arkansas, Oklahoma, Kansas and Nebraska. With a 2010 population of 5,988,927, Missouri is the 18th most populous state in the nation and the fifth most populous in the Midwest. It...

(March 16, 1911) - MaineMaineMaine is a state in the New England region of the northeastern United States, bordered by the Atlantic Ocean to the east and south, New Hampshire to the west, and the Canadian provinces of Quebec to the northwest and New Brunswick to the northeast. Maine is both the northernmost and easternmost...

(March 31, 1911) - TennesseeTennesseeTennessee is a U.S. state located in the Southeastern United States. It has a population of 6,346,105, making it the nation's 17th-largest state by population, and covers , making it the 36th-largest by total land area...

(April 7, 1911) - ArkansasArkansasArkansas is a state located in the southern region of the United States. Its name is an Algonquian name of the Quapaw Indians. Arkansas shares borders with six states , and its eastern border is largely defined by the Mississippi River...

(April 22, 1911), after having previously rejected the amendment - WisconsinWisconsinWisconsin is a U.S. state located in the north-central United States and is part of the Midwest. It is bordered by Minnesota to the west, Iowa to the southwest, Illinois to the south, Lake Michigan to the east, Michigan to the northeast, and Lake Superior to the north. Wisconsin's capital is...

(May 16, 1911) - New YorkNew YorkNew York is a state in the Northeastern region of the United States. It is the nation's third most populous state. New York is bordered by New Jersey and Pennsylvania to the south, and by Connecticut, Massachusetts and Vermont to the east...

(July 12, 1911) - ArizonaArizonaArizona ; is a state located in the southwestern region of the United States. It is also part of the western United States and the mountain west. The capital and largest city is Phoenix...

(April 3, 1912) - MinnesotaMinnesotaMinnesota is a U.S. state located in the Midwestern United States. The twelfth largest state of the U.S., it is the twenty-first most populous, with 5.3 million residents. Minnesota was carved out of the eastern half of the Minnesota Territory and admitted to the Union as the thirty-second state...

(June 11, 1912) - LouisianaLouisianaLouisiana is a state located in the southern region of the United States of America. Its capital is Baton Rouge and largest city is New Orleans. Louisiana is the only state in the U.S. with political subdivisions termed parishes, which are local governments equivalent to counties...

(June 28, 1912) - West VirginiaWest VirginiaWest Virginia is a state in the Appalachian and Southeastern regions of the United States, bordered by Virginia to the southeast, Kentucky to the southwest, Ohio to the northwest, Pennsylvania to the northeast and Maryland to the east...

(January 31, 1913) - DelawareDelawareDelaware is a U.S. state located on the Atlantic Coast in the Mid-Atlantic region of the United States. It is bordered to the south and west by Maryland, and to the north by Pennsylvania...

(February 3, 1913)

Ratification (by the requisite 36 states) was completed on February 3, 1913 with the ratification by Delaware

Delaware

Delaware is a U.S. state located on the Atlantic Coast in the Mid-Atlantic region of the United States. It is bordered to the south and west by Maryland, and to the north by Pennsylvania...

. The amendment was subsequently ratified by the following states, bringing the total number of ratifying states to forty-two of the forty-eight then existing:

- 37. New MexicoNew MexicoNew Mexico is a state located in the southwest and western regions of the United States. New Mexico is also usually considered one of the Mountain States. With a population density of 16 per square mile, New Mexico is the sixth-most sparsely inhabited U.S...

(February 3, 1913) - 38. WyomingWyomingWyoming is a state in the mountain region of the Western United States. The western two thirds of the state is covered mostly with the mountain ranges and rangelands in the foothills of the Eastern Rocky Mountains, while the eastern third of the state is high elevation prairie known as the High...

(February 3, 1913) - 39. New JerseyNew JerseyNew Jersey is a state in the Northeastern and Middle Atlantic regions of the United States. , its population was 8,791,894. It is bordered on the north and east by the state of New York, on the southeast and south by the Atlantic Ocean, on the west by Pennsylvania and on the southwest by Delaware...

(February 4, 1913) - 40. VermontVermontVermont is a state in the New England region of the northeastern United States of America. The state ranks 43rd in land area, , and 45th in total area. Its population according to the 2010 census, 630,337, is the second smallest in the country, larger only than Wyoming. It is the only New England...

(February 19, 1913) - 41. MassachusettsMassachusettsThe Commonwealth of Massachusetts is a state in the New England region of the northeastern United States of America. It is bordered by Rhode Island and Connecticut to the south, New York to the west, and Vermont and New Hampshire to the north; at its east lies the Atlantic Ocean. As of the 2010...

(March 4, 1913) - 42. New HampshireNew HampshireNew Hampshire is a state in the New England region of the northeastern United States of America. The state was named after the southern English county of Hampshire. It is bordered by Massachusetts to the south, Vermont to the west, Maine and the Atlantic Ocean to the east, and the Canadian...

(March 7, 1913), after rejecting the amendment on March 2, 1911

The legislatures of the following states rejected the amendment without ever subsequently ratifying it:

- ConnecticutConnecticutConnecticut is a state in the New England region of the northeastern United States. It is bordered by Rhode Island to the east, Massachusetts to the north, and the state of New York to the west and the south .Connecticut is named for the Connecticut River, the major U.S. river that approximately...

- Rhode IslandRhode IslandThe state of Rhode Island and Providence Plantations, more commonly referred to as Rhode Island , is a state in the New England region of the United States. It is the smallest U.S. state by area...

- UtahUtahUtah is a state in the Western United States. It was the 45th state to join the Union, on January 4, 1896. Approximately 80% of Utah's 2,763,885 people live along the Wasatch Front, centering on Salt Lake City. This leaves vast expanses of the state nearly uninhabited, making the population the...

- VirginiaVirginiaThe Commonwealth of Virginia , is a U.S. state on the Atlantic Coast of the Southern United States. Virginia is nicknamed the "Old Dominion" and sometimes the "Mother of Presidents" after the eight U.S. presidents born there...

The legislatures of the following states never considered the proposed amendment:

- FloridaFloridaFlorida is a state in the southeastern United States, located on the nation's Atlantic and Gulf coasts. It is bordered to the west by the Gulf of Mexico, to the north by Alabama and Georgia and to the east by the Atlantic Ocean. With a population of 18,801,310 as measured by the 2010 census, it...

- PennsylvaniaPennsylvaniaThe Commonwealth of Pennsylvania is a U.S. state that is located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware and Maryland to the south, West Virginia to the southwest, Ohio to the west, New York and Ontario, Canada, to the north, and New Jersey to...

Pollock nullified

The Sixteenth Amendment nullified the effect of Pollock. That means the Congress may impose taxes on income from any source without having to apportion the total dollar amount of tax collected from each state according to each state's population in relation to the total national population. In Abrams v. Commissioner, the United States Tax CourtUnited States Tax Court

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court"...

stated:

Case law

The federal courts' interpretations of the Sixteenth Amendment have changed considerably over time and there have been many disputes about the applicability of the amendment.The Brushaber case

In Brushaber v. Union Pacific RailroadBrushaber v. Union Pacific Railroad

Brushaber v. Union Pacific Railroad, 240 U.S. 1 , was a landmark United States Supreme Court case in which the Court upheld the validity of a tax statute called the Revenue Act of 1913, also known as the Tariff Act, Ch. 16, 38 Stat. 166 Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916), was a...

, , the Supreme Court ruled that (1) the Sixteenth Amendment removes the Pollock requirement that certain income taxes (such as taxes on income "derived from real property" that were the subject of the Pollock decision), be apportioned among the states according to population; (2) the federal income tax statute does not violate the Fifth Amendment's prohibition against the government taking property without due process of law; (3) the federal income tax statute does not violate the Article I, Section 8's uniformity clause (relating to the requirement that excises, also known as indirect taxes, be imposed with geographical uniformity).

The Kerbaugh-Empire Co. case

In Bowers v. Kerbaugh-Empire Co.Bowers v. Kerbaugh-Empire Co.

Bowers v. Kerbaugh-Empire Co., 271 U.S. 170 , was a case in which the United States Supreme Court held that no taxable income arose from the repayment in German marks of loans that had originally been made in U.S...

, , the Supreme Court, through Justice Pierce Butler

Pierce Butler (justice)

Pierce Butler was an American jurist who served as an Associate Justice of the Supreme Court of the United States from 1923 until his death in 1939...

, stated:

The Glenshaw Glass case

In Commissioner v. Glenshaw Glass Co.Commissioner v. Glenshaw Glass Co.

Commissioner v. Glenshaw Glass Co., , was an important income tax case before the United States Supreme Court. The Court held as follows:...

, , the Supreme Court laid out what has become the modern understanding of what constitutes 'gross income' to which the Sixteenth Amendment applies, declaring that income taxes could be levied on "accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Under this definition, any increase in wealth — whether through wage

Wage

A wage is a compensation, usually financial, received by workers in exchange for their labor.Compensation in terms of wages is given to workers and compensation in terms of salary is given to employees...

s, benefits, bonuses, sale of stock or other property at a profit, bets won, lucky finds, awards of punitive damages

Punitive damages

Punitive damages or exemplary damages are damages intended to reform or deter the defendant and others from engaging in conduct similar to that which formed the basis of the lawsuit...

in a lawsuit, qui tam

Qui tam

In common law, a writ of qui tam is a writ whereby a private individual who assists a prosecution can receive all or part of any penalty imposed...

actions — are all within the definition of income, unless the Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

makes a specific exemption, as it has for items such as life insurance

Life insurance

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness may also trigger...

proceeds received by reason of the death of the insured party, gift

Gift

A gift or a present is the transfer of something without the expectation of receiving something in return. Although gift-giving might involve an expectation of reciprocity, a gift is meant to be free. In many human societies, the act of mutually exchanging money, goods, etc. may contribute to...

s, bequest

Bequest

A bequest is the act of giving property by will. Strictly, "bequest" is used of personal property, and "devise" of real property. In legal terminology, "bequeath" is a verb form meaning "to make a bequest."...

s, devises and inheritances, and certain scholarship

Scholarship

A scholarship is an award of financial aid for a student to further education. Scholarships are awarded on various criteria usually reflecting the values and purposes of the donor or founder of the award.-Types:...

s.

Income taxation of wages, etc.

The courts have ruled that the Sixteenth Amendment allows a direct tax on "wages, salaries, commissions, etc. without apportionment."The Penn Mutual case

Although the Sixteenth Amendment is often cited as the "source" of the Congressional power to tax incomes, at least one court has reiterated the point made in Brushaber and other cases that the Sixteenth Amendment itself did not grant the Congress the power to tax incomes (a power the Congress has had since 1789), but only removed the requirement, if any, that any income tax be apportioned among the states according to their respective populations. In the Penn Mutual Indemnity case, the United States Tax Court stated:In that same Penn Mutual Indemnity case, on appeal, the United States Court of Appeals for the Third Circuit

United States Court of Appeals for the Third Circuit

The United States Court of Appeals for the Third Circuit is a federal court with appellate jurisdiction over the district courts for the following districts:* District of Delaware* District of New Jersey...

agreed, stating:

The Murphy case

On December 22, 2006, a three-judge panel of the United States Court of Appeals for the District of Columbia CircuitUnited States Court of Appeals for the District of Columbia Circuit

The United States Court of Appeals for the District of Columbia Circuit known informally as the D.C. Circuit, is the federal appellate court for the U.S. District Court for the District of Columbia. Appeals from the D.C. Circuit, as with all the U.S. Courts of Appeals, are heard on a...

vacated

Vacated judgment

A vacated judgment makes a previous legal judgment legally void. A vacated judgment is usually the result of the judgment of an appellate court which overturns, reverses, or sets aside the judgment of a lower court....

its unanimous August 2006 opinion in Murphy v. Internal Revenue Service and United States

Murphy v. IRS

Marrita Murphy and Daniel J. Leveille, Appellants v. Internal Revenue Service and United States of America, Appellees , is a controversial tax case in which the United States Court of Appeals for the District of Columbia Circuit originally held that the taxation of emotional distress awards by the...

. In an unrelated matter, the court had also granted the government's motion to dismiss Murphy's suit against the "Internal Revenue Service." Under federal sovereign immunity, a taxpayer may sue the federal government, but not a government agency, officer, or employee (with few exceptions). The court stated:

An exception to federal sovereign immunity is in the United States Tax Court

United States Tax Court

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court"...

, where a taxpayer may sue the Commissioner of Internal Revenue

Commissioner of Internal Revenue

The Commissioner of Internal Revenue is the head of the Internal Revenue Service , a bureau within the United States Department of the Treasury.The office of Commissioner was created by Congress by the Revenue Act of 1862...

. The original three-judge panel then agreed to rehear the case itself. In its original decision, the Court had ruled that was unconstitutional under the Sixteenth Amendment to the extent that the statute purported to tax, as income, a recovery for a non-physical personal injury for mental distress and loss of reputation not received in lieu of taxable income such as lost wages or earnings.

Because the August 2006 opinion was vacated, the full court did not hear the case en banc

En banc

En banc, in banc, in banco or in bank is a French term used to refer to the hearing of a legal case where all judges of a court will hear the case , rather than a panel of them. It is often used for unusually complex cases or cases considered to be of greater importance...

.

On July 3, 2007, the Court (through the original three-judge panel) ruled (1) that the taxpayer's compensation was received on account of a non-physical injury or sickness; (2) that gross income under section 61 of the Internal Revenue Code does include compensatory damages for non-physical injuries, even if the award is not an "accession to wealth," (3) that the income tax imposed on an award for non-physical injuries is an indirect tax, regardless of whether the recovery is restoration of "human capital," and therefore the tax does not violate the constitutional requirement of Article I, Section 9, Clause 4, that capitations

Poll tax

A poll tax is a tax of a portioned, fixed amount per individual in accordance with the census . When a corvée is commuted for cash payment, in effect it becomes a poll tax...

or other direct tax

Direct tax

The term direct tax generally means a tax paid directly to the government by the persons on whom it is imposed.-General meaning:In the general sense, a direct tax is one paid directly to the government by the persons on whom it is imposed...

es must be laid among the states only in proportion to the population; (4) that the income tax imposed on an award for non-physical injuries does not violate the constitutional requirement of Article I, Section 8, Clause 1

Taxing and Spending Clause

Article I, Section 8, Clause 1 of the United States Constitution, is known as the Taxing and Spending Clause. It is the clause that gives the federal government of the United States its power of taxation...

, that all duties

Duty

Duty is a term that conveys a sense of moral commitment to someone or something. The moral commitment is the sort that results in action and it is not a matter of passive feeling or mere recognition...

, imposts and excise

Excise

Excise tax in the United States is a indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are far from uniform throughout the United States...

s be uniform throughout the United States; (5) that under the doctrine of sovereign immunity, the Internal Revenue Service may not be sued in its own name.

The Court stated that "[a]lthough the 'Congress cannot make a thing income which is not so in fact,' [ . . . ] it can label a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9." The court ruled that Ms. Murphy was not entitled to the tax refund she claimed, and that the personal injury award she received was "within the reach of the congressional power to tax under Article I, Section 8 of the Constitution" -- even if the award was "not income within the meaning of the Sixteenth Amendment". See also the Penn Mutual case cited above.

On April 21, 2008, the Supreme Court declined to review the Court of Appeals decision.

External links

- National Archives: Sixteenth Amendment

- Sixteenth Amendment and 1913 tax return form Images of original documents

- CRS Annotated Constitution: Sixteenth Amendment

- Pollock Decision The decision nullified by the Sixteenth Amendment

- Brushaber Decision Supreme Court opinion on the apportionment clause of the Constitution.

- Stanton Decision - no new power of taxation (affirming constitutionality of income tax after Sixteenth Amendment)

- History of the U.S. Tax System - Almanac of Policy Issues; annotated as "US Department of the Treasury Undated.".