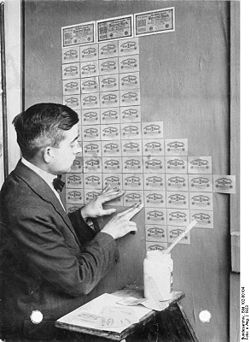

Inflation in the Weimar Republic

Encyclopedia

Hyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

in Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

(the Weimar Republic

Weimar Republic

The Weimar Republic is the name given by historians to the parliamentary republic established in 1919 in Germany to replace the imperial form of government...

) between June 1921 and July 1924.

Analysis

The hyperinflation episode in the Weimar RepublicWeimar Republic

The Weimar Republic is the name given by historians to the parliamentary republic established in 1919 in Germany to replace the imperial form of government...

in the 1920s was not the first hyperinflation, nor was it the only one in early 1920s Europe or even the most extreme inflation in history (the Hungarian pengő

Hungarian pengo

The pengő was the currency of Hungary between 1 January 1927, when it replaced the korona, and 31 July 1946, when it was replaced by the forint. The pengő was subdivided into 100 fillér...

and Zimbabwean dollar

Zimbabwean dollar

The Zimbabwean dollar was the official currency of Zimbabwe from 1980 to 12 April 2009....

have both been more inflated). However, as the most prominent case following the emergence of economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

as a science, it drew interest in a way that previous instances had not. Many of the dramatic and unusual economic behaviors now associated with hyperinflation were first documented systematically in Germany: order-of-magnitude increases in prices and interest rates, redenomination of the currency, consumer flight from cash to hard assets, and the rapid expansion of industries that produced those assets. German monetary economics was then highly influenced by Chartalism

Chartalism

Chartalism is a descriptive economic theory that details the procedures and consequences of using government-issued tokens as the unit of money. The name derives from the Latin charta, in the sense of a token or ticket...

and the German Historical School

German Historical School

The German Historical School of Law is a 19th century intellectual movement in the study of German law. With Romanticism as its background, it emphasized the historical limitations of the law...

, and this conditioned the way the hyperinflation was then usually analyzed.

John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

described the situation in The Economic Consequences of the Peace

The Economic Consequences of the Peace

The Economic Consequences of the Peace is a book written and published by John Maynard Keynes. Keynes attended the Versailles Conference as a delegate of the British Treasury and argued for a much more generous peace. It was a bestseller throughout the world and was critical in establishing a...

: "The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance."

It was during this period of hyperinflation that French and British economic experts began to claim that Germany destroyed its economy with the purpose of avoiding reparations, but both governments had conflicting views on how to handle the situation. The French declared that Germany should keep paying reparations while Britain sought to grant the Germany a moratorium

Moratorium

Moratorium may refer to:*Moratorium *Moratorium *Moratorium to End the War in Vietnam*UN moratorium on the death penalty*2010 U.S. Deepwater Drilling Moratorium...

that would allow for its financial reconstruction.

Although reparation

Reparation

Reparation may refer to:*Reparation, the legal philosophy*Reparations , measures taken by the state to redress gross and systematic violations of human rights law or humanitarian law...

s accounted for about one third of the German deficit from 1920 to 1923, the government found reparations a convenient scapegoat

Scapegoat

Scapegoating is the practice of singling out any party for unmerited negative treatment or blame. Scapegoating may be conducted by individuals against individuals , individuals against groups , groups against individuals , and groups against groups Scapegoating is the practice of singling out any...

. Other scapegoats included bankers and speculators (particularly foreign). The inflation reached its peak by November 1923 but ended when a new currency (the Rentenmark

German rentenmark

The Rentenmark was a currency issued on 15 November 1923 to stop the hyperinflation of 1922 and 1923 in Germany. It was subdivided into 100 Rentenpfennig.-History:...

) was introduced. In order to make way for the new currency, banks "turned the marks over to junk dealers by the ton

Ton

The ton is a unit of measure. It has a long history and has acquired a number of meanings and uses over the years. It is used principally as a unit of weight, and as a unit of volume. It can also be used as a measure of energy, for truck classification, or as a colloquial term.It is derived from...

" to be recycled as paper.

Outcome

Although the inflation ended with the introduction of the Rentenmark and the Weimar Republic continued for a decade afterwards, hyperinflation is widely believed to have contributed to the NaziNazism

Nazism, the common short form name of National Socialism was the ideology and practice of the Nazi Party and of Nazi Germany...

takeover of Germany and Adolf Hitler's rise to power. Adolf Hitler

Adolf Hitler

Adolf Hitler was an Austrian-born German politician and the leader of the National Socialist German Workers Party , commonly referred to as the Nazi Party). He was Chancellor of Germany from 1933 to 1945, and head of state from 1934 to 1945...

himself in his book, Mein Kampf

Mein Kampf

Mein Kampf is a book written by Nazi leader Adolf Hitler. It combines elements of autobiography with an exposition of Hitler's political ideology. Volume 1 of Mein Kampf was published in 1925 and Volume 2 in 1926...

, makes many references to the German debt and the negative consequences that brought about the inevitability of "National Socialism". The inflation also raised doubts about the competence of liberal

Liberalism

Liberalism is the belief in the importance of liberty and equal rights. Liberals espouse a wide array of views depending on their understanding of these principles, but generally, liberals support ideas such as constitutionalism, liberal democracy, free and fair elections, human rights,...

institutions, especially amongst a middle class who had held cash savings and bonds. It also produced resentment of bankers and speculators, whom the government and press blamed for the inflation. Many of them were Jews

Judaism

Judaism ) is the "religion, philosophy, and way of life" of the Jewish people...

, and some Germans called the hyperinflated Weimar banknotes Jew Confetti.

Later German monetary policy showed far greater concern for maintaining a sound currency, a concern that even affects Germany's present attitude in eurozone

Eurozone

The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender...

debates concerning bailouts of failing national economies today.

The hyperinflated, worthless Marks became widely collected abroad. The Los Angeles Times

Los Angeles Times

The Los Angeles Times is a daily newspaper published in Los Angeles, California, since 1881. It was the second-largest metropolitan newspaper in circulation in the United States in 2008 and the fourth most widely distributed newspaper in the country....

estimated in 1924 that more of the decommissioned notes were spread about the United States than existed in Germany.

History

In order to pay the large costs of World War IWorld War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, Germany suspended the convertibility of its currency into gold

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

when that war broke out. Unlike France, which imposed its first income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

to pay for the war, the German Kaiser and Parliament decided without opposition to fund the war entirely by borrowing a decision criticised by financial experts like Hjalmar Schacht

Hjalmar Schacht

Dr. Hjalmar Horace Greeley Schacht was a German economist, banker, liberal politician, and co-founder of the German Democratic Party. He served as the Currency Commissioner and President of the Reichsbank under the Weimar Republic...

even before hyperinflation broke out. The result was that the exchange rate of the Mark against the US dollar

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

fell steadily throughout the war to 8.91 Marks per dollar. The Treaty of Versailles

Treaty of Versailles

The Treaty of Versailles was one of the peace treaties at the end of World War I. It ended the state of war between Germany and the Allied Powers. It was signed on 28 June 1919, exactly five years after the assassination of Archduke Franz Ferdinand. The other Central Powers on the German side of...

, however, accelerated the decline in the value of the Mark, so that by the end of 1919 more than 47 paper Marks were required to buy one US dollar. It is sometimes argued that Germany had to inflate its currency to pay the war reparations required under the Treaty of Versailles, but this is misleading, because the Reparations Commission required payment to be in gold marks or in foreign currency, not in the rapidly depreciating paper mark

German papiermark

The name Papiermark is applied to the German currency from the 4th August 1914 when the link between the Mark and gold was abandoned, due to the outbreak of World War I...

.

The German currency was relatively stable at about 60 Marks per US Dollar during the first half of 1921. Because the Western theatre of World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

was mostly in France and Belgium, Germany had come out of the war with most of its industrial power intact, a healthy economy, and arguably in a better position to once again become a dominant force in the European continent than its neighbours. But the "London ultimatum" in May 1921 demanded reparations in gold or foreign currency to be paid in annual installments of 2,000,000,000 (2 billion) goldmarks plus 26 percent of the value of Germany's exports.

The first payment was paid when due in June 1921. That was the beginning of an increasingly rapid devaluation

Devaluation

Devaluation is a reduction in the value of a currency with respect to those goods, services or other monetary units with which that currency can be exchanged....

of the Mark which fell to less than one third of a cent by November 1921 (approx. 330 Marks per US Dollar). The total reparations demanded was 132,000,000,000 (132 billion) goldmarks which was far more than the total German gold and foreign exchange.

Beginning in August 1921, Germany began to buy foreign currency with Marks at any price, but that only increased the speed of breakdown in the value of the Mark. The lower the mark sank in international markets, the greater the amount of marks were required to buy the foreign currency demanded by the Reparations Commission.

J. P. Morgan, Jr.

John Pierpont "Jack" Morgan, Jr. was an American banker and philanthropist.-Biography:He was born on September 7, 1867 in Irvington, New York to John Pierpont Morgan, Sr. and Frances Louisa Tracy. He graduated from Harvard in 1886, where he was a member of the Delphic Club, formerly known as the...

When these meetings produced no workable solution, the inflation changed to hyperinflation and the Mark fell to 8000 Marks per Dollar by December 1922. The cost of living index was 41 in June 1922 and 685 in December, an increase of more than 16 times.

In January 1923 French and Belgian troops occupied the Ruhr

Occupation of the Ruhr

The Occupation of the Ruhr between 1923 and 1925, by troops from France and Belgium, was a response to the failure of the German Weimar Republic under Chancellor Cuno to pay reparations in the aftermath of World War I.-Background:...

, the industrial region of Germany in the Ruhr valley

Ruhr Area

The Ruhr, by German-speaking geographers and historians more accurately called Ruhr district or Ruhr region , is an urban area in North Rhine-Westphalia, Germany. With 4435 km² and a population of some 5.2 million , it is the largest urban agglomeration in Germany...

to ensure that the reparations were paid in goods, such as coal

Coal

Coal is a combustible black or brownish-black sedimentary rock usually occurring in rock strata in layers or veins called coal beds or coal seams. The harder forms, such as anthracite coal, can be regarded as metamorphic rock because of later exposure to elevated temperature and pressure...

from the Ruhr

Ruhr

The Ruhr is a medium-size river in western Germany , a right tributary of the Rhine.-Description:The source of the Ruhr is near the town of Winterberg in the mountainous Sauerland region, at an elevation of approximately 2,200 feet...

and other industrial zones of Germany, because the Mark was practically worthless. Inflation was exacerbated when workers in the Ruhr went on a general strike

General strike

A general strike is a strike action by a critical mass of the labour force in a city, region, or country. While a general strike can be for political goals, economic goals, or both, it tends to gain its momentum from the ideological or class sympathies of the participants...

, and the German government printed more money in order to continue paying them for "passively resisting."

Stabilization

When the new currency, the RentenmarkGerman rentenmark

The Rentenmark was a currency issued on 15 November 1923 to stop the hyperinflation of 1922 and 1923 in Germany. It was subdivided into 100 Rentenpfennig.-History:...

, replaced the worthless Reichsbank marks on November 16, 1923 and 12 zeros were cut from prices, prices in the new currency remained stable. The German people regarded this stable currency as a miracle because they had heard such claims of stability before with the Notgeld

Notgeld

Notgeld is the name of money issued by an institution not authorized for money emission. This occurs usually when money is not available from the central bank. The most well know emergency money emissions occurred in Germany and Austria-Hungary around the end of the first World War, that's why the...

(emergency money) that rapidly devalued as an additional source of inflation. The usual explanation was that the Rentenmarks were issued in a fixed amount and were backed by hard assets such as agricultural land and industrial assets, but what happened was more complex than that, as summarized in the following description.

In August 1923, Karl Helfferich

Karl Helfferich

Karl Theodor Helfferich was a German politician, economist, and financier from Neustadt an der Weinstraße in the Palatinate.-Biography:...

proposed a plan to issue a new currency (roggenmark) backed by mortgage bond

Mortgage bond

A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of specific assets are called mortgage bonds. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods....

s indexed

Index (economics)

In economics and finance, an index is a statistical measure of changes in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from...

to market price

Market price

In economics, market price is the economic price for which a good or service is offered in the marketplace. It is of interest mainly in the study of microeconomics...

s (in paper Marks) of rye grain. His plan was rejected because of the greatly fluctuating price of rye in paper Marks. The Agriculture Minister Hans Luther

Hans Luther

Hans Luther was a German politician and Chancellor of Germany.-Biography:Born in Berlin, Luther started in politics in 1907 by becoming the town councillor in Magdeburg. He continued on becoming secretary of the German Städtetag in 1913 and then mayor of Essen in 1918...

proposed a different plan which substituted gold for rye and a new currency, the Rentenmark, backed by bonds indexed to market prices (in paper Marks) of gold.

The gold bond

Gold bond

Gold bond may refer to* Bond, that can be redeemed for gold such as a United States gold certificate* Gold Bond Trading Company, later Carlson Companies, a company that dealt in trading stamps* Gold Bond medicated powder, an over-the-counter skin treatment...

s were defined at the rate of 2,790 gold Marks per kilogram of gold, which was the same definition as the pre-war goldmark

German gold mark

The Goldmark was the currency used in the German Empire from 1873 to 1914.-History:Before unification, the different German states issued a variety of different currencies, though most were linked to the Vereinsthaler, a silver coin containing 16⅔ grams of pure silver...

s. The rentenmarks were not redeemable in gold, but were only indexed to the gold bonds. This rentenmark plan was adopted in monetary reform

Monetary reform

Monetary reform describes any movement or theory that proposes a different system of supplying money and financing the economy from the current system.Monetary reformers may advocate any of the following, among other proposals:...

decrees on October 13–15, 1923 that set up a new bank, the Rentenbank controlled by Hans Luther who had become the new Finance Minister.

After November 12, 1923, when Hjalmar Schacht

Hjalmar Schacht

Dr. Hjalmar Horace Greeley Schacht was a German economist, banker, liberal politician, and co-founder of the German Democratic Party. He served as the Currency Commissioner and President of the Reichsbank under the Weimar Republic...

became currency commissioner, the Reichsbank

Reichsbank

The Reichsbank was the central bank of Germany from 1876 until 1945. It was founded on 1 January 1876 . The Reichsbank was a privately owned central bank of Prussia, under close control by the Reich government. Its first president was Hermann von Dechend...

, the old central bank, was not allowed to discount any further government Treasury bills, which meant the corresponding issue of paper marks also ceased. Discounting of commercial trade bills was allowed and the amount of Rentenmarks expanded, but the issue was strictly controlled to conform to current commercial and government transactions. The new Rentenbank refused credit to the government and to speculators who were not able to borrow Rentenmarks, because Rentenmarks were not legal tender. When Reichsbank president Rudolf Havenstein died on November 20, 1923, Schacht was appointed president of the Reichsbank.

By November 30, 1923, there were 500 million Rentenmarks in circulation, which increased to 1000 million by January 1, 1924, and again to 1,800 million Rentenmarks by July 1924. Meanwhile, the old paper Marks continued in circulation. The total paper Marks increased to 1,211 quintillion in July 1924 and continued to fall in value to one third of their conversion value in Rentenmarks.

The monetary law of August 30, 1924 permitted exchange of each old paper 1,000,000,000,000 Mark note for one new Reichsmark, equivalent in value to one Rentenmark.

Eventually, some debts were reinstated to partially compensate those who had been creditors. A decree of 1925 reinstated some mortgages at 25% of face value in the new Reichsmark (effectively 25,000,000,000 times their value in old marks) if they had been held 5 years or more. Similarly some government bonds were reinstated at 2-1/2% of face - to be paid after reparations were paid. Mortgage debt was reinstated at much higher percentages than government bonds. Reinstatement of some debts, combined with a resumption of effective taxation in a still-devastated economy, triggered a wave of corporate bankruptcies.

See also

- German gold markGerman gold markThe Goldmark was the currency used in the German Empire from 1873 to 1914.-History:Before unification, the different German states issued a variety of different currencies, though most were linked to the Vereinsthaler, a silver coin containing 16⅔ grams of pure silver...

- Rudolf Havenstein

- Andreas HermesAndreas HermesAndreas Hermes was a German Christian Democratic Union politician, agricultural scientist, Finance Minister of the Weimar Republic, and a member of the resistance to Nazism.- Life :...

- Karl HelfferichKarl HelfferichKarl Theodor Helfferich was a German politician, economist, and financier from Neustadt an der Weinstraße in the Palatinate.-Biography:...

- Zero strokeZero strokeZero stroke or cipher stroke was a term used to describe a mental disorder reportedly diagnosed by physicians in Germany under the Weimar Republic and which was caused by hyperinflation that occurred in the early 1920s...