Killington, Vermont secession movement

Encyclopedia

Skiing

Skiing is a recreational activity using skis as equipment for traveling over snow. Skis are used in conjunction with boots that connect to the ski with use of a binding....

resort community of Killington, Vermont

Killington, Vermont

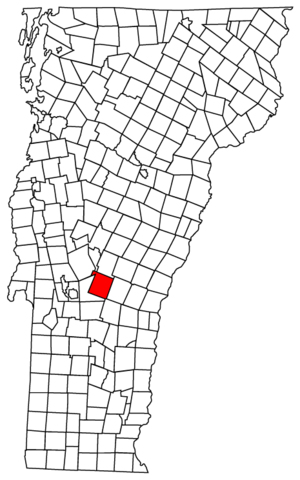

Killington is a town in Rutland County, Vermont, United States. The population was 811 at the 2010 census. Killington Ski Resort is located here....

voted in favor of pursuing secession

Secession

Secession is the act of withdrawing from an organization, union, or especially a political entity. Threats of secession also can be a strategy for achieving more limited goals.-Secession theory:...

from Vermont and admission into the state of New Hampshire

New Hampshire

New Hampshire is a state in the New England region of the northeastern United States of America. The state was named after the southern English county of Hampshire. It is bordered by Massachusetts to the south, Vermont to the west, Maine and the Atlantic Ocean to the east, and the Canadian...

, which lies 25 miles to the east.

Adherents' claims

Supporters claim that the townspeople pay the state $10 million per year in property taxProperty tax

A property tax is an ad valorem levy on the value of property that the owner is required to pay. The tax is levied by the governing authority of the jurisdiction in which the property is located; it may be paid to a national government, a federated state or a municipality...

es and $10 million a year in sales tax

Sales tax

A sales tax is a tax, usually paid by the consumer at the point of purchase, itemized separately from the base price, for certain goods and services. The tax amount is usually calculated by applying a percentage rate to the taxable price of a sale....

es (as well as income

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

and other taxes), but receive only $1 million a year to help fund their school system. In the words of Town Selectman

Board of selectmen

The board of selectmen is commonly the executive arm of the government of New England towns in the United States. The board typically consists of three or five members, with or without staggered terms.-History:...

Butch Findeisen, "There is a point where sharing turns to looting."

An economic study commissioned by the town determined Killington would save a minimum of $7 million per year, excluding individual state income tax savings. Copies of this study were distributed at the 2004 Town Meeting

Town meeting

A town meeting is a form of direct democratic rule, used primarily in portions of the United States since the 17th century, in which most or all the members of a community come together to legislate policy and budgets for local government....

and are available from the town clerk's office.

The town also claims to have suffered long term problems with restrained development under the state's Act 250 environmental law, which, in an attempt to control unrestrained growth and to balance the interests of developers and their neighbors, set up a system of environmental review boards, in which those affected by the planned development can challenge a proposed development plan. Supporters claim the expense of dealing with this has led Killington Ski Resort to have the highest lift ticket

Lift ticket

A Lift ticket is an identifier usually attached to a skier's outerwear that indicates they have paid and can ride on the ski lift up a mountain to ski....

prices in the country. (Luckily, thanks to the fact that the ski area is close to New York City

New York City

New York is the most populous city in the United States and the center of the New York Metropolitan Area, one of the most populous metropolitan areas in the world. New York exerts a significant impact upon global commerce, finance, media, art, fashion, research, technology, education, and...

and Boston

Boston

Boston is the capital of and largest city in Massachusetts, and is one of the oldest cities in the United States. The largest city in New England, Boston is regarded as the unofficial "Capital of New England" for its economic and cultural impact on the entire New England region. The city proper had...

, the operators have thus far been able to get customers to pay those prices.) Supporters further claim that the state of Vermont has steadfastly refused to redress the grievances of the town and its people, and that their own state legislator, who represents Killington and Mendon, Vermont

Mendon, Vermont

Mendon is a town in Rutland County, Vermont, United States. The population was 1,059 at the 2010 census. The town was originally chartered under the name Medway, changed its name to Parkerstown, and became Mendon in 1827....

refuses to stand up for the town's interests.

On March 2, 2004 200–300 residents voted, by voice vote, for the secession

Secession

Secession is the act of withdrawing from an organization, union, or especially a political entity. Threats of secession also can be a strategy for achieving more limited goals.-Secession theory:...

proposal, passing it by a wide margin. On March 1, 2005, the measure was passed again, this time by ballot, with nearly 2/3 voting in favor.

Arguments in opposition to secession

Others dispute many of the town's claims:- The town manager would love to tell you how many millions of dollars Killington sent to the state. Well many of those millions of dollars are sales and rooms and meals taxes. Those weren’t sent from Killington to the state. They were sent from tourists and others that were in Killington and were required to pay taxes levied by the state of Vermont. —Rep. Mark Young (R-OrwellOrwell, VermontOrwell is a town in Addison County, Vermont, United States. The population was 1,185 at the 2000 census. Mount Independence was the largest fortification constructed by the American colonial forces...

)

New Hampshire lacks a general sales tax, but it does have a rooms and meals tax. The Granite State also has what amounts to a statewide property tax, like Vermont's. Like all other states, both Vermont and New Hampshire levy high taxes on gasoline

Gasoline

Gasoline , or petrol , is a toxic, translucent, petroleum-derived liquid that is primarily used as a fuel in internal combustion engines. It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. Some gasolines also contain...

and tobacco

Tobacco

Tobacco is an agricultural product processed from the leaves of plants in the genus Nicotiana. It can be consumed, used as a pesticide and, in the form of nicotine tartrate, used in some medicines...

. Like Vermont (but unlike some other states), New Hampshire does not guarantee that a given municipality will get any minimum percentage of tax revenues back as state aid. State aid in both states is allocated according to population and other factors not directly related to tax revenues.

Support of education

School funding has long been a matter of contention in Vermont, primarily centering around the substantial disparity in ability to fund schools through property taxes, between towns with large grand lists and those with small ones. In 1997, the Vermont Supreme CourtVermont Supreme Court

The Vermont Supreme Court is the highest judicial authority of the U.S. state of Vermont and is one of seven state courts of Vermont.The Court consists of a chief justice and four associate justices; the Court mostly hears appeals of cases that have been decided by other courts...

, in the case of Brigham v. State, decided that the disparity was such as to unconstitutionally deprive children in poorer towns of equal opportunity to an education. The court left it to the legislature to come up with a remedy. The legislature responded by passing a highly controversial law known as Act 60

Act 60 (Vermont law)

In June 1997, the Vermont legislature passed Act 60, known as The Equal Educational Opportunity Act.It was drafted in response to a Vermont Supreme Court decision, in the Brigham vs...

. This law provided for a state-wide school property tax, per-pupil block grant

Block grant

In a fiscal federal form of government, a block grant is a large sum of money granted by the national government to a regional government with only general provisions as to the way it is to be spent...

s, and sharing of tax revenue from property wealthy towns to property poor towns. Act 60 was revised in 2003 by Act 68, but retains the state-wide property tax. It is as a result of these pieces of legislation that Killington pays more property tax to the state than it receives in the form of block grants. The extent to which a town such as Killington may receive benefits in addition to the block grant, such as possibly lower social welfare costs and higher worker productivity as a result of a better educated population in the state, as well as from general state services (such as highway maintenance, tourism promotion, etc.), is less easily quantified.

Disposition of the secession request

The legal decision will be made by the states of Vermont and New Hampshire and the United States CongressUnited States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

. Article IV of the U.S. Constitution requires that when the boundaries of existing states are altered, the action needs the consent of the legislatures of all states involved, as well as of Congress. The New Hampshire state legislature

New Hampshire General Court

The General Court of New Hampshire is the bicameral state legislature of the U.S. state of New Hampshire. The lower house is the New Hampshire House of Representatives with 400 members. The upper house is the New Hampshire Senate with 24 members...

passed a law in 2005 authorizing a commission which would negotiate with the State of Vermont, if Vermont ever chooses to establish a corresponding commission. The Vermont legislature is generally expected to reject the idea of ceding Killington to New Hampshire. Even if Vermont votes in favor of Killington's secession, the New Hampshire bill does not obligate the Granite State to accept Killington: the bill merely authorizes the beginnings of negotiations. If no deal can be reached, Killington would remain part of Vermont.

Supporters have threatened a federal court battle, but the legal grounds for such a lawsuit remain unclear, since the US Constitution explicitly prohibits Killington's unilateral secession from Vermont.

In 2005, Vermont state Reps. Mark Young (R-Orwell

Orwell, Vermont

Orwell is a town in Addison County, Vermont, United States. The population was 1,185 at the 2000 census. Mount Independence was the largest fortification constructed by the American colonial forces...

), Richard Marron (R-Stowe

Stowe, Vermont

Stowe is a town in Lamoille County, Vermont, United States. The population was 4,339 at the 2000 census. Tourism is a significant industry.-Geography:...

) and Kathleen Keenan (D-St. Albans City) introduced House Bill 426 that would have required Killington to pay "exit fees" to reimburse the state for "stranded assets of the state, including those relating to education, transportation, and public service". The legislation would also have stripped Killington residents of all benefits of Vermont resident status, including instate tuition and tuition assistance. The bill was not acted upon by the House, and effectively died with the adjournment of the 2005-2006 Legislative session on June 1, 2006.