London Gold Pool

Encyclopedia

The London Gold Pool was the pooling of gold reserves by a group of eight central bank

s in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System

of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce

by interventions in the London gold market

.

The central banks coordinated concerted methods of gold sales to balance spikes in the market price of gold as determined by the London morning gold fixing

while buying gold on price weaknesses. The United States provided 50% of the required gold supply for sale. The price controls were successful for six years when the system became no longer workable because the pegged price of gold was too low, runs on gold

, the British pound, and the US dollar occurred, and France decided to withdraw from the pool. The pool collapsed in March 1968.

The London Gold Pool controls were followed with an effort to suppress the gold price with a two-tier system of official exchange and open market transactions, but this gold window collapsed in 1971 with the Nixon Shock

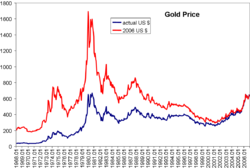

, and resulted in the onset of the gold bull market which saw the price of gold appreciate rapidly to US$850 in 1980.

, delegates from the 44 allied nations

nations gathered in Bretton Woods, New Hampshire

, to reestablish and regulate the international financial systems. The meeting resulted in the founding of the International Monetary Fund

(IMF) and the International Bank for Reconstruction and Development

(IBRD), and was followed by other post-war reconstruction efforts, such as establishing the General Agreement on Tariffs and Trade

(GATT). The IMF was charged with the maintenance of a system of international currency exchange rates which became known as the Bretton Woods system

.

Foreign exchange market

rates were fixed, but were allowed adjustments when necessary and currencies were required to be convertible

. For this purpose, all currencies had to be backed by either physical gold reserves, or a currency convertible into gold and the United States dollar was recognized as the world's reserve currency

, as an anchor currency of the system. The price of one troy ounce

of gold was pegged to US$35.

This agreement did not affect the independent global or regional markets in which gold was traded as a precious metal

commodity

. There was still an open gold market. For the Bretton Woods system to remain effective, the fix of the dollar to gold would have to be adjustable, or the free market price of gold would have to be maintained near the $35 official foreign exchange price. The larger the gap, known as the gold window, between free market gold price and the foreign exchange rate, the more tempting it was for nations to deal with internal economic crises by buying gold at the Bretton Woods price and selling it in the gold markets.

The Bretton Woods system was challenged by several crises. As the economic post-war upswing proceeded, international trade and foreign exchange reserves rose, while the gold supply increased only marginally. In the recessions of the 1950s, the US had to convert vast amounts of gold, and the Bretton Woods system suffered increasing break downs due to US payment imbalances.

After oil import quotas and restrictions on trade outflows were insufficient, by 1960, targeted efforts began to maintain the Bretton Woods system and to enforce the US$35 per ounce gold valuation. Late in 1960, amidst of US election debates, panic buying of gold led to a surge in price to over US$40 per oz, causing agreements between the US Federal Reserve

and the Bank of England

to stabilize the price by allocating for sale substantial gold supplies held by the Bank of England. The United States sought means of ending the drain on its gold reserves.

In November 1961, eight nations agreed on a system of regulating the price of gold and defending the $35/oz price through measures of targeted selling and buying of gold on the world markets. For this purpose each nation provided a contribution of the precious metal into the London Gold Pool, led by the United States pledging to match all other contributions on a one-to-one basis, and thus contributing 50% of the pool.

By 1965 the pool was increasingly unable to balance the outflow of gold reserves with buyback

s. Excessive inflation of the US money supply, in part to fund the Vietnam War, led to the US no longer being able to redeem foreign-held dollars into gold, as the world's gold reserves had not grown in relation, and the payment deficit had grown to US$3 billion. Thus, the London Gold Pool came under increased pressures of failure, causing France to announced in June 1967 a withdrawal from the agreements and moving large amounts of gold from New York to Paris. The 1967 devaluation of the British currency, followed by another run on gold and an attack on the pound sterling

, was one of the final triggers for the collapse of the pooling arrangements. By spring 1968, "the international financial system was moving toward a crisis more dangerous than any since 1931."

The collapse of the gold pool forced an official policy of maintaining a two-tiered market system of stipulating an official exchange standard of US$35, while also allowing open market transactions for the metal.The two-tiered market system from 1968 to 1971 is described by Although the gold pool members refused to trade gold with private persons, and the United States pledged to suspend gold sales to governments that trade in the private markets, this created an open opportunity for some market participants to exploit the gold window by converting currency reserves into gold and selling the metal in the gold markets at higher rates. This unsustainable situation collapsed in 1971, when West Germany

The collapse of the gold pool forced an official policy of maintaining a two-tiered market system of stipulating an official exchange standard of US$35, while also allowing open market transactions for the metal.The two-tiered market system from 1968 to 1971 is described by Although the gold pool members refused to trade gold with private persons, and the United States pledged to suspend gold sales to governments that trade in the private markets, this created an open opportunity for some market participants to exploit the gold window by converting currency reserves into gold and selling the metal in the gold markets at higher rates. This unsustainable situation collapsed in 1971, when West Germany

was the first to officially abandon the Bretton Woods accords, resulting in a sudden decline of the dollar. The United States, under President Richard Nixon, unilaterally without consultation with international leaders abolished the direct convertibility of the United States dollar into gold resulting in the Nixon Shock

. The events of 1971 ignited the onset of a gold bull market culminating in a price peak of US$850 in January 1980.

the pound on 18 November 1967 by 14.3%. Further protective

measures in the US tried to avert a continued run on gold and attacks on the US dollar. On 14 March 1968, a Thursday evening, the United States requested of the British government that the London gold markets

be closed the following day to combat the heavy demand for gold. The ad-hoc declaration of the same Friday (March 15) as a bank holiday in England by the Queen upon petition of the House of Commons, and a conference scheduled for the weekend in Washington, served the consideration of the international monetary situation and to reach a decision with regards to future gold policy. The events of the weekend led the Congress of the United States to repeal the requirement for a gold reserve to back the US currency as of Monday, March 18, 1968. The London gold market stayed closed for two weeks, while markets in other countries continued trading with increasing gold prices. The events ended the London Gold Pool.

As a reaction to the temporary closure of the London gold market in March 1968 and the resulting instability of the gold markets and the financial systems in general, Swiss banks acted immediately to minimize effects on the Swiss banking system and its currency by establishing a gold trading organization, the Zürich Gold Pool, which helped in establishing Zürich as a major trading location for gold.

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

s in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce

Troy ounce

The troy ounce is a unit of imperial measure. In the present day it is most commonly used to gauge the weight of precious metals. One troy ounce is nowadays defined as exactly 0.0311034768 kg = 31.1034768 g. There are approximately 32.1507466 troy oz in 1 kg...

by interventions in the London gold market

London bullion market

The London bullion market is a wholesale over-the-counter market for the trading of gold and silver. Trading is conducted amongst members of the London Bullion Market Association , loosely overseen by the Bank of England...

.

The central banks coordinated concerted methods of gold sales to balance spikes in the market price of gold as determined by the London morning gold fixing

Gold Fixing

The London gold fixing or gold fix is the procedure by which the price of gold is determined twice each business day on the London market by the five members of The London Gold Market Fixing Ltd, on the premises of N M Rothschild & Sons...

while buying gold on price weaknesses. The United States provided 50% of the required gold supply for sale. The price controls were successful for six years when the system became no longer workable because the pegged price of gold was too low, runs on gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

, the British pound, and the US dollar occurred, and France decided to withdraw from the pool. The pool collapsed in March 1968.

The London Gold Pool controls were followed with an effort to suppress the gold price with a two-tier system of official exchange and open market transactions, but this gold window collapsed in 1971 with the Nixon Shock

Nixon Shock

The Nixon Shock was a series of economic measures taken by U.S. President Richard Nixon in 1971 including unilaterally cancelling the direct convertibility of the United States dollar to gold that essentially ended the existing Bretton Woods system of international financial exchange.-Background:By...

, and resulted in the onset of the gold bull market which saw the price of gold appreciate rapidly to US$850 in 1980.

Gold price regulation

In 1944, before the conclusion of World War IIWorld War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

, delegates from the 44 allied nations

Allies of World War II

The Allies of World War II were the countries that opposed the Axis powers during the Second World War . Former Axis states contributing to the Allied victory are not considered Allied states...

nations gathered in Bretton Woods, New Hampshire

Bretton Woods, New Hampshire

Bretton Woods is an area within the town of Carroll, New Hampshire, USA, whose principal points of interest are three leisure and recreation facilities...

, to reestablish and regulate the international financial systems. The meeting resulted in the founding of the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF) and the International Bank for Reconstruction and Development

International Bank for Reconstruction and Development

The International Bank for Reconstruction and Development is one of five institutions that compose the World Bank Group. The IBRD is an international organization whose original mission was to finance the reconstruction of nations devastated by World War II. Now, its mission has expanded to fight...

(IBRD), and was followed by other post-war reconstruction efforts, such as establishing the General Agreement on Tariffs and Trade

General Agreement on Tariffs and Trade

The General Agreement on Tariffs and Trade was negotiated during the UN Conference on Trade and Employment and was the outcome of the failure of negotiating governments to create the International Trade Organization . GATT was signed in 1947 and lasted until 1993, when it was replaced by the World...

(GATT). The IMF was charged with the maintenance of a system of international currency exchange rates which became known as the Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

.

Foreign exchange market

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

rates were fixed, but were allowed adjustments when necessary and currencies were required to be convertible

Convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged....

. For this purpose, all currencies had to be backed by either physical gold reserves, or a currency convertible into gold and the United States dollar was recognized as the world's reserve currency

Reserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

, as an anchor currency of the system. The price of one troy ounce

Troy ounce

The troy ounce is a unit of imperial measure. In the present day it is most commonly used to gauge the weight of precious metals. One troy ounce is nowadays defined as exactly 0.0311034768 kg = 31.1034768 g. There are approximately 32.1507466 troy oz in 1 kg...

of gold was pegged to US$35.

This agreement did not affect the independent global or regional markets in which gold was traded as a precious metal

Precious metal

A precious metal is a rare, naturally occurring metallic chemical element of high economic value.Chemically, the precious metals are less reactive than most elements, have high lustre, are softer or more ductile, and have higher melting points than other metals...

commodity

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

. There was still an open gold market. For the Bretton Woods system to remain effective, the fix of the dollar to gold would have to be adjustable, or the free market price of gold would have to be maintained near the $35 official foreign exchange price. The larger the gap, known as the gold window, between free market gold price and the foreign exchange rate, the more tempting it was for nations to deal with internal economic crises by buying gold at the Bretton Woods price and selling it in the gold markets.

The Bretton Woods system was challenged by several crises. As the economic post-war upswing proceeded, international trade and foreign exchange reserves rose, while the gold supply increased only marginally. In the recessions of the 1950s, the US had to convert vast amounts of gold, and the Bretton Woods system suffered increasing break downs due to US payment imbalances.

After oil import quotas and restrictions on trade outflows were insufficient, by 1960, targeted efforts began to maintain the Bretton Woods system and to enforce the US$35 per ounce gold valuation. Late in 1960, amidst of US election debates, panic buying of gold led to a surge in price to over US$40 per oz, causing agreements between the US Federal Reserve

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

and the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

to stabilize the price by allocating for sale substantial gold supplies held by the Bank of England. The United States sought means of ending the drain on its gold reserves.

In November 1961, eight nations agreed on a system of regulating the price of gold and defending the $35/oz price through measures of targeted selling and buying of gold on the world markets. For this purpose each nation provided a contribution of the precious metal into the London Gold Pool, led by the United States pledging to match all other contributions on a one-to-one basis, and thus contributing 50% of the pool.

By 1965 the pool was increasingly unable to balance the outflow of gold reserves with buyback

Buyback

Buyback may refer to:*Buyback, the act of rebuying something that one previously sold, as with a lemon *Share repurchase, also called stock repurchase or share buyback, the repurchase of stock by the company that issued it-See also:...

s. Excessive inflation of the US money supply, in part to fund the Vietnam War, led to the US no longer being able to redeem foreign-held dollars into gold, as the world's gold reserves had not grown in relation, and the payment deficit had grown to US$3 billion. Thus, the London Gold Pool came under increased pressures of failure, causing France to announced in June 1967 a withdrawal from the agreements and moving large amounts of gold from New York to Paris. The 1967 devaluation of the British currency, followed by another run on gold and an attack on the pound sterling

Pound sterling

The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence...

, was one of the final triggers for the collapse of the pooling arrangements. By spring 1968, "the international financial system was moving toward a crisis more dangerous than any since 1931."

West Germany

West Germany is the common English, but not official, name for the Federal Republic of Germany or FRG in the period between its creation in May 1949 to German reunification on 3 October 1990....

was the first to officially abandon the Bretton Woods accords, resulting in a sudden decline of the dollar. The United States, under President Richard Nixon, unilaterally without consultation with international leaders abolished the direct convertibility of the United States dollar into gold resulting in the Nixon Shock

Nixon Shock

The Nixon Shock was a series of economic measures taken by U.S. President Richard Nixon in 1971 including unilaterally cancelling the direct convertibility of the United States dollar to gold that essentially ended the existing Bretton Woods system of international financial exchange.-Background:By...

. The events of 1971 ignited the onset of a gold bull market culminating in a price peak of US$850 in January 1980.

Member contributions

The members of the London Gold Pool and their initial gold contributions in tonnes (and USD equivalents) to the gold pool were:- United States, 50%, 120t ($135 MM)

- Germany, 11%, 27t ($30 MM)

- United Kingdom, 9%, 22t ($25 MM)

- France, 9%, 22t ($25 MM)

- Italy, 9%, 22t ($25 MM)

- Belgium, 4%, 9t ($10 MM)

- Netherlands, 4%, 9t ($10 MM)

- Switzerland, 4%, 9t ($10 MM)

Collapse

Despite policy support and market efforts by the United States, the 1967 attack on the British pound and a run on gold forced the British government to devalueDevaluation

Devaluation is a reduction in the value of a currency with respect to those goods, services or other monetary units with which that currency can be exchanged....

the pound on 18 November 1967 by 14.3%. Further protective

Protectionism

Protectionism is the economic policy of restraining trade between states through methods such as tariffs on imported goods, restrictive quotas, and a variety of other government regulations designed to allow "fair competition" between imports and goods and services produced domestically.This...

measures in the US tried to avert a continued run on gold and attacks on the US dollar. On 14 March 1968, a Thursday evening, the United States requested of the British government that the London gold markets

London bullion market

The London bullion market is a wholesale over-the-counter market for the trading of gold and silver. Trading is conducted amongst members of the London Bullion Market Association , loosely overseen by the Bank of England...

be closed the following day to combat the heavy demand for gold. The ad-hoc declaration of the same Friday (March 15) as a bank holiday in England by the Queen upon petition of the House of Commons, and a conference scheduled for the weekend in Washington, served the consideration of the international monetary situation and to reach a decision with regards to future gold policy. The events of the weekend led the Congress of the United States to repeal the requirement for a gold reserve to back the US currency as of Monday, March 18, 1968. The London gold market stayed closed for two weeks, while markets in other countries continued trading with increasing gold prices. The events ended the London Gold Pool.

As a reaction to the temporary closure of the London gold market in March 1968 and the resulting instability of the gold markets and the financial systems in general, Swiss banks acted immediately to minimize effects on the Swiss banking system and its currency by establishing a gold trading organization, the Zürich Gold Pool, which helped in establishing Zürich as a major trading location for gold.

See also

- Bank for International SettlementsBank for International SettlementsThe Bank for International Settlements is an intergovernmental organization of central banks which "fosters international monetary and financial cooperation and serves as a bank for central banks." It is not accountable to any national government...

- Exchange rates

- Gold as an investmentGold as an investmentOf all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a hedge or harbor against economic, political, or social fiat currency crises...

- Gold standardGold standardThe gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

- Metal as moneyMetal as moneyThroughout history, various metals, some of which are considered precious today, appear to have been used as a form of currency. The Bretton Woods system, under which all major currencies were theoretically exchangeable for gold, was abolished in 1971....

- Price fixingPrice fixingPrice fixing is an agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand...

- United Nations Monetary and Financial ConferenceUnited Nations Monetary and Financial ConferenceThe United Nations Monetary and Financial Conference, commonly known as the Bretton Woods conference, was a gathering of 730 delegates from all 44 Allied nations at the Mount Washington Hotel, situated in Bretton Woods, New Hampshire, to regulate the international monetary and financial order after...

External links

- Federal Reserve System - Monetary Policy

- What is The Gold Standard? University of Iowa Center for International Finance and Development

- The Gold Battles Within the Cold War (PDF) by Francis J. Gavin (2002)

- International Financial Stability (PDF) by Michael Dooley, PhD, David Folkerts-Landau and Peter Garber, Deutsche Bank (October 2005)

- HL Deb 21 November 1967 vol 286 cc904-1036, House of Commons Lords Sitting on the devaluation of the Sterling