Reserve currency

Encyclopedia

A reserve currency, or anchor currency, is a currency

that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves

. It also tends to be the international pricing currency for products traded on a global market, and commodities such as oil

, gold

, etc.

This permits the issuing country to purchase the commodities at a marginally lower rate than other nations, which must exchange their currencies with each purchase and pay a transaction cost

. For major currencies, this transaction cost is negligible with respect to the price of the commodity. It also permits the government issuing the currency to borrow money at a better rate, as there will always be a larger market for that currency than others.

reserve currencies come and go. "International currencies in the past have included the Chinese Liang

and Greek drachma, coined in the fifth century B.C., the silver punch-marked coins of fourth century India, the Roman denari

, the Byzantine solidus

and Islamic dinar

of the middle-ages, the Venetian ducato of the Renaissance, the seventeenth century Dutch guilder and of course, more recently, sterling and the dollar.”

Before 1944, the world reference currency was the Pound Sterling. After World War II

, the international financial system was governed by a formal agreement, the Bretton Woods System

. Under this system the United States dollar

was placed deliberately as the anchor of the system, with the US government guaranteeing other central banks that they could sell their US dollar reserves at a fixed rate for gold. European countries and Japan deliberately devalued their currencies against the dollar in order to boost exports and development.

In the late 1960s and early 1970s the system suffered setbacks due to problems pointed out by the Triffin dilemma

, a general problem with any fiat currency under a fixed exchange regimen, as the dollar was in the Bretton Woods system.

Thus the following table is only a limited view about the global currency reserves because it only deals with Allocated Reserves:

However, some economists, such as Barry Eichengreen

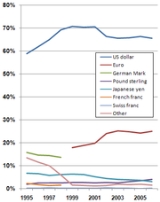

argue that this is not as true when it comes to the denomination of official reserves because the network externalities are not strong. As long as the currency's market is sufficiently liquid, the benefits of reserve diversification are strong, as it insures against large capital losses. The implication is that the world may well soon begin to move away from a financial system dominated uniquely by the US dollar. In the first half of the 20th century multiple currencies did share the status as primary reserve currencies. Although the British Sterling was the largest currency, both the French franc and the German mark shared large portions of the market until the First World War, after which the mark was replaced by the dollar. Since the Second World War, the dollar has dominated official reserves, but this is likely a reflection of the unusual domination of the American economy during this period, as well as official discouragement of reserve status from the potential rivals, Germany and Japan.

The top reserve currency is generally selected by the banking community for the strength and stability of the economy in which it is used. Thus, as a currency becomes less stable, or its economy becomes less dominant, bankers may over time abandon it for a currency issued by a larger or more stable economy. This can take a relatively long time, as recognition is important in determining a reserve currency. For example, it took many years after the United States overtook the United Kingdom as the world's largest economy before the dollar overtook Sterling as the dominant global reserve currency. Schenk has shown in her 2009 study that in 1944 (Bretton Woods) the US dollar was chosen as the world reference currency whereas it was only the second currency in global reserves.

The G8

also frequently issues public statements as to exchange rates. In the past due to the Plaza Accord

, its predecessor bodies could directly manipulate rates to reverse large trade deficits.

is the most widely held currency in the Allocated Reserves today. Throughout the last decade, an average of two thirds of the total Allocated foreign exchange reserves of countries have been in US dollars. For this reason, the US dollar is said to have "reserve-currency status," making it somewhat easier for the United States to run higher trade deficits with greatly postponed economic impact or even postponing a currency crisis

. Central bank reserves held in dollar-denominated debt, however, are small compared to private holdings of such debt. In the event that non-United States holders of dollar-denominated assets decided to shift holdings to assets denominated in other currencies, there could be serious consequences for the US economy. Changes of this kind are rare, and typically change takes place gradually over time; the markets involved adjust accordingly.

However, the dollar remains until recently the favorite reserve currency because it has stability along with assets such as United States Treasury security that have both scale and liquidity.

US dollar dominant position in global reserves is very much challenged currently, because of the growing share of Unallocated Reserves, and because of the doubt regarding dollar stability in the long term.

is currently the second most commonly held reserve currency, comprising approximately a quarter of allocated holdings. After World War II and the rebuilding

of the German

economy, the German Deutsche Mark gained the status of the second most important reserve currency after the US dollar. When the euro was launched

on 1 January 1999, replacing the Mark, French Franc

and ten other European currencies, it inherited the status of a major reserve currency from the Mark. Since then, its contribution to official reserves has risen continually as banks seek to diversify their reserves and trade in the eurozone

continues to expand.

Former US Federal Reserve Chairman Alan Greenspan

said in September 2007 that the euro could replace the U.S. dollar as the world's primary reserve currency. It is "absolutely conceivable that the euro will replace the US dollar as reserve currency, or will be traded as an equally important reserve currency." Econometric analysis by Jeffery Frankel and Menzie Chinn in 2006 suggests the euro may replace the U.S. dollar as the major reserve currency by 2020 if: (1) the remaining EU members, including the UK and Denmark, adopt the euro by 2020 or (2) the recent depreciation trend of the dollar persists into the future. In recent years, the euro's increase in the share of the worldwide currency reserve basket has continued to increase—albeit at a slower rate than prior to the beginning of the worldwide credit crunch

related recession and sovereign debt crisis

was the primary reserve currency of much of the world in the 19th century. U.S. and German economic dominance from the second half of the 20th century onward, the emergence of the USA as an economic superpower (and, importantly, the establishment of the U.S. Federal Reserve System

in 1913) as well as economic weakness in the UK at various intervals during the second half of the 20th century resulted in Sterling losing its status as the world's most reserved currency.

Since mid-2006 it is the third most widely held reserve currency, having seen a resurgence in popularity in recent years, but growing from about 2.5% to just around 4% of all currency reserves. Analysts say this resurgence is caused by carry-trade investors considering the pound as a stable high-yield proxy to the euro, as well as the position of London in world financial affairs.

's (IMF) Special Drawing Rights

(SDR) valuation. The SDR currency value is determined daily by the IMF, based on the exchange rates of the currencies making up the basket, as quoted at noon at the London market. The valuation basket is reviewed and adjusted every five years.

The SDR Values and yen conversion for government procurement are used by the Japan External Trade Organization for Japan's official procurement in international trade

.

(AUD) in the Asia-Pacific

region. The Canadian dollar (as a regional reserve currency for banking) has been an important part of the British, French and Dutch Caribbean states' economies and finance systems since the 1950s. The Canadian dollar is also held by many central banks in Central America and South America. The Canadian dollar is held in Latin America because of remittances and international trade in each nation.

Canadian economists primarily define and value the Canadian dollar in terms of the United States dollar, and thus by observing how the Canadian dollar floats in terms of the US dollar, foreign-exchange economists can indirectly observe internal behaviours and patterns in the US economy that could not be seen by direct observation (Canada’s primary foreign-trade relationship is with the United States). Also, considered a petrodollar

, the Canadian dollar has only fully evolved into a global reserve currency since the 1970s when it was floated against all other world currencies. Some economists have attributed the rise of importance of the Canadian dollar to the long term effects of the Nixon Shock

that effectively ended the Bretton Woods system

of global finance.

The Canadian dollar is used as a reserve currency around the world and is currently ranked 6th in value held as reserves.

is often considered a reserve currency, because of the perceived stability of the currency and the Swiss banking system. However, the share of all foreign exchange reserves held in Swiss francs has historically been well below 0.5%. The daily trading market turnover of the franc however, ranked fifth, or about 3.4%, among all currencies in a 2007 survey by the Bank for International Settlements

.

in 2010, called for abandoning the U.S. dollar as the single major reserve currency. The report states that the new reserve system should not be based on a single currency or even multiple national currencies but instead permit the emission of international liquidity to create a more stable global financial system.

Countries such as Russia

and the People's Republic of China

, central banks, and economic analysts and groups, such as the Gulf Cooperation Council, have expressed a desire to see an independent new currency replace the dollar as the reserve currency.

On 10 July 2009, Russian President Medvedev proposed a new 'world currency' at the G8 meeting in London as an alternative reserve currency to replace the dollar.

According to economist Michael Hudson

, China has said, "we don't want to make any more foreign exchange reserve of any paper currency, because all the paper currencies are government debt currencies." China, Russia, India, Turkey, Brazil, Venezuela and oil-producing countries have recently agreed "to transact all of their mutual trade and investment in their own currencies" effectively minimizing the need, at least in the short term, for a global reserve currency. And yet oil is still priced in dollars, which has brought complaints about OPEC's policies of managing oil quotas to maintain dollar price stability.

's (IMF) Special Drawing Rights

(SDRs) as a reserve.

China has proposed using SDRs, calculated daily from a basket of U.S. dollar, euro, Japanese yen and British pound, for international payments.

On 3 September 2009, the United Nations Conference on Trade and Development

(UNCTAD) issued a report calling for a new reserve currency based on the SDR, managed by a new global reserve bank. The IMF released a report in February 2011, stating that using SDRs could help stabilize the world economy.

or renminbi

(RMB) cannot be used as a reserve currency as long as the Chinese government maintains capital controls on the conversion of its currency. The currency would not be attractive to central banks for holding unless China developed a strong open bond market.

Chinese President Hu Jintao has said that it would be a long process before the yuan was accepted as a global currency.

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves

Foreign exchange reserves

Foreign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

. It also tends to be the international pricing currency for products traded on a global market, and commodities such as oil

Petroleum

Petroleum or crude oil is a naturally occurring, flammable liquid consisting of a complex mixture of hydrocarbons of various molecular weights and other liquid organic compounds, that are found in geologic formations beneath the Earth's surface. Petroleum is recovered mostly through oil drilling...

, gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

, etc.

This permits the issuing country to purchase the commodities at a marginally lower rate than other nations, which must exchange their currencies with each purchase and pay a transaction cost

Transaction cost

In economics and related disciplines, a transaction cost is a cost incurred in making an economic exchange . For example, most people, when buying or selling a stock, must pay a commission to their broker; that commission is a transaction cost of doing the stock deal...

. For major currencies, this transaction cost is negligible with respect to the price of the commodity. It also permits the government issuing the currency to borrow money at a better rate, as there will always be a larger market for that currency than others.

History

As emphasised by the economist Avinash PersaudAvinash Persaud

Avinash D. Persaud is Chairman of Intelligence Capital Ltd, a company specializing in analyzing, managing and creating financial liquidity in investment projects and portfolios. He is also the non-Executive Chairman of the London-based Elara Capital, a leading investment bank...

reserve currencies come and go. "International currencies in the past have included the Chinese Liang

Tael

Tael can refer to any one of several weight measures of the Far East. Most commonly, it refers to the Chinese tael, a part of the Chinese system of weights and currency....

and Greek drachma, coined in the fifth century B.C., the silver punch-marked coins of fourth century India, the Roman denari

Denarius

In the Roman currency system, the denarius was a small silver coin first minted in 211 BC. It was the most common coin produced for circulation but was slowly debased until its replacement by the antoninianus...

, the Byzantine solidus

Solidus (coin)

The solidus was originally a gold coin issued by the Romans, and a weight measure for gold more generally, corresponding to 4.5 grams.-Roman and Byzantine coinage:...

and Islamic dinar

Gold Dinar

The gold dinar is a gold coin first issued in 77 AH by Caliph Abd al-Malik ibn Marwan. The name is derived from denarius, a Roman currency...

of the middle-ages, the Venetian ducato of the Renaissance, the seventeenth century Dutch guilder and of course, more recently, sterling and the dollar.”

Before 1944, the world reference currency was the Pound Sterling. After World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

, the international financial system was governed by a formal agreement, the Bretton Woods System

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

. Under this system the United States dollar

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

was placed deliberately as the anchor of the system, with the US government guaranteeing other central banks that they could sell their US dollar reserves at a fixed rate for gold. European countries and Japan deliberately devalued their currencies against the dollar in order to boost exports and development.

In the late 1960s and early 1970s the system suffered setbacks due to problems pointed out by the Triffin dilemma

Triffin dilemma

The Triffin dilemma is a theory that when a national currency also serves as an international reserve currency, there could be conflicts of interest between short-term domestic and long-term international economic objectives...

, a general problem with any fiat currency under a fixed exchange regimen, as the dollar was in the Bretton Woods system.

Global currency reserves

A 2011 study about the current dominant reserve currency in central banks shows that dollar may not be the obvious dominant currency, because of the major part of Unallocated Reserves increasingly reported by central banks since 2001.Thus the following table is only a limited view about the global currency reserves because it only deals with Allocated Reserves:

Theory

Economists debate whether a single reserve currency will always dominate the global economy. Many have recently argued that one currency will almost always dominate due to network externalities, especially in the field of invoicing trade and denominating foreign debt securities, meaning that there are strong incentives to conform to the choice that dominates the marketplace. The argument is that, in the absence of sufficiently large shocks, a currency that dominates the marketplace will not lose much ground to challengers.However, some economists, such as Barry Eichengreen

Barry Eichengreen

Barry Eichengreen is an American economist who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987...

argue that this is not as true when it comes to the denomination of official reserves because the network externalities are not strong. As long as the currency's market is sufficiently liquid, the benefits of reserve diversification are strong, as it insures against large capital losses. The implication is that the world may well soon begin to move away from a financial system dominated uniquely by the US dollar. In the first half of the 20th century multiple currencies did share the status as primary reserve currencies. Although the British Sterling was the largest currency, both the French franc and the German mark shared large portions of the market until the First World War, after which the mark was replaced by the dollar. Since the Second World War, the dollar has dominated official reserves, but this is likely a reflection of the unusual domination of the American economy during this period, as well as official discouragement of reserve status from the potential rivals, Germany and Japan.

The top reserve currency is generally selected by the banking community for the strength and stability of the economy in which it is used. Thus, as a currency becomes less stable, or its economy becomes less dominant, bankers may over time abandon it for a currency issued by a larger or more stable economy. This can take a relatively long time, as recognition is important in determining a reserve currency. For example, it took many years after the United States overtook the United Kingdom as the world's largest economy before the dollar overtook Sterling as the dominant global reserve currency. Schenk has shown in her 2009 study that in 1944 (Bretton Woods) the US dollar was chosen as the world reference currency whereas it was only the second currency in global reserves.

The G8

G8

The Group of Eight is a forum, created by France in 1975, for the governments of seven major economies: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. In 1997, the group added Russia, thus becoming the G8...

also frequently issues public statements as to exchange rates. In the past due to the Plaza Accord

Plaza Accord

The Plaza Accord or Plaza Agreement was an agreement between the governments of France, West Germany, Japan, the United States, and the United Kingdom, to depreciate the U.S. dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets...

, its predecessor bodies could directly manipulate rates to reverse large trade deficits.

United States dollar

The United States dollarUnited States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

is the most widely held currency in the Allocated Reserves today. Throughout the last decade, an average of two thirds of the total Allocated foreign exchange reserves of countries have been in US dollars. For this reason, the US dollar is said to have "reserve-currency status," making it somewhat easier for the United States to run higher trade deficits with greatly postponed economic impact or even postponing a currency crisis

Currency crisis

A currency crisis, which is also called a balance-of-payments crisis, is a sudden devaluation of a currency caused by chronic balance-of-payments deficits which usually ends in a speculative attack in the foreign exchange market. It occurs when the value of a currency changes quickly, undermining...

. Central bank reserves held in dollar-denominated debt, however, are small compared to private holdings of such debt. In the event that non-United States holders of dollar-denominated assets decided to shift holdings to assets denominated in other currencies, there could be serious consequences for the US economy. Changes of this kind are rare, and typically change takes place gradually over time; the markets involved adjust accordingly.

However, the dollar remains until recently the favorite reserve currency because it has stability along with assets such as United States Treasury security that have both scale and liquidity.

US dollar dominant position in global reserves is very much challenged currently, because of the growing share of Unallocated Reserves, and because of the doubt regarding dollar stability in the long term.

Euro

The euroEuro

The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,...

is currently the second most commonly held reserve currency, comprising approximately a quarter of allocated holdings. After World War II and the rebuilding

Wirtschaftswunder

The term describes the rapid reconstruction and development of the economies of West Germany and Austria after World War II . The expression was used by The Times in 1950...

of the German

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

economy, the German Deutsche Mark gained the status of the second most important reserve currency after the US dollar. When the euro was launched

Introduction of the euro

The euro came into existence on 1 January 1999, although it has been a goal of the European Union and its predecessors since the 1960s. After tough negotiations, particularly due to opposition from the United Kingdom, the Maastricht Treaty entered into force in 1993 with the goal of creating...

on 1 January 1999, replacing the Mark, French Franc

French franc

The franc was a currency of France. Along with the Spanish peseta, it was also a de facto currency used in Andorra . Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money...

and ten other European currencies, it inherited the status of a major reserve currency from the Mark. Since then, its contribution to official reserves has risen continually as banks seek to diversify their reserves and trade in the eurozone

Eurozone

The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender...

continues to expand.

Former US Federal Reserve Chairman Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

said in September 2007 that the euro could replace the U.S. dollar as the world's primary reserve currency. It is "absolutely conceivable that the euro will replace the US dollar as reserve currency, or will be traded as an equally important reserve currency." Econometric analysis by Jeffery Frankel and Menzie Chinn in 2006 suggests the euro may replace the U.S. dollar as the major reserve currency by 2020 if: (1) the remaining EU members, including the UK and Denmark, adopt the euro by 2020 or (2) the recent depreciation trend of the dollar persists into the future. In recent years, the euro's increase in the share of the worldwide currency reserve basket has continued to increase—albeit at a slower rate than prior to the beginning of the worldwide credit crunch

Credit crunch

A credit crunch is a reduction in the general availability of loans or a sudden tightening of the conditions required to obtain a loan from the banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates...

related recession and sovereign debt crisis

2010 European sovereign debt crisis

From late 2009, fears of a sovereign debt crisis developed among investors concerning some European states, intensifying in early 2010 and thereafter.....

Pound sterling

The United Kingdom's pound sterlingPound sterling

The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence...

was the primary reserve currency of much of the world in the 19th century. U.S. and German economic dominance from the second half of the 20th century onward, the emergence of the USA as an economic superpower (and, importantly, the establishment of the U.S. Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

in 1913) as well as economic weakness in the UK at various intervals during the second half of the 20th century resulted in Sterling losing its status as the world's most reserved currency.

Since mid-2006 it is the third most widely held reserve currency, having seen a resurgence in popularity in recent years, but growing from about 2.5% to just around 4% of all currency reserves. Analysts say this resurgence is caused by carry-trade investors considering the pound as a stable high-yield proxy to the euro, as well as the position of London in world financial affairs.

Japanese yen

Japan's yen is part of the International Monetary FundInternational Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

's (IMF) Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(SDR) valuation. The SDR currency value is determined daily by the IMF, based on the exchange rates of the currencies making up the basket, as quoted at noon at the London market. The valuation basket is reviewed and adjusted every five years.

The SDR Values and yen conversion for government procurement are used by the Japan External Trade Organization for Japan's official procurement in international trade

International trade

International trade is the exchange of capital, goods, and services across international borders or territories. In most countries, such trade represents a significant share of gross domestic product...

.

Canadian dollar

A number of central banks (and commercial banks) keep Canadian dollars as a reserve currency. In the economy of the Americas, the Canadian dollar plays a similar role to that played by the Australian dollarAustralian dollar

The Australian dollar is the currency of the Commonwealth of Australia, including Christmas Island, Cocos Islands, and Norfolk Island, as well as the independent Pacific Island states of Kiribati, Nauru and Tuvalu...

(AUD) in the Asia-Pacific

Asia-Pacific

Asia-Pacific or Asia Pacific is the part of the world in or near the Western Pacific Ocean...

region. The Canadian dollar (as a regional reserve currency for banking) has been an important part of the British, French and Dutch Caribbean states' economies and finance systems since the 1950s. The Canadian dollar is also held by many central banks in Central America and South America. The Canadian dollar is held in Latin America because of remittances and international trade in each nation.

Canadian economists primarily define and value the Canadian dollar in terms of the United States dollar, and thus by observing how the Canadian dollar floats in terms of the US dollar, foreign-exchange economists can indirectly observe internal behaviours and patterns in the US economy that could not be seen by direct observation (Canada’s primary foreign-trade relationship is with the United States). Also, considered a petrodollar

Petrocurrency

Petrocurrency is a portmanteau neologism used with three distinct meanings, though often confused:#Trading surpluses of oil producing nations, originally called petrodollars...

, the Canadian dollar has only fully evolved into a global reserve currency since the 1970s when it was floated against all other world currencies. Some economists have attributed the rise of importance of the Canadian dollar to the long term effects of the Nixon Shock

Nixon Shock

The Nixon Shock was a series of economic measures taken by U.S. President Richard Nixon in 1971 including unilaterally cancelling the direct convertibility of the United States dollar to gold that essentially ended the existing Bretton Woods system of international financial exchange.-Background:By...

that effectively ended the Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

of global finance.

The Canadian dollar is used as a reserve currency around the world and is currently ranked 6th in value held as reserves.

Swiss franc

The Swiss francSwiss franc

The franc is the currency and legal tender of Switzerland and Liechtenstein; it is also legal tender in the Italian exclave Campione d'Italia. Although not formally legal tender in the German exclave Büsingen , it is in wide daily use there...

is often considered a reserve currency, because of the perceived stability of the currency and the Swiss banking system. However, the share of all foreign exchange reserves held in Swiss francs has historically been well below 0.5%. The daily trading market turnover of the franc however, ranked fifth, or about 3.4%, among all currencies in a 2007 survey by the Bank for International Settlements

Bank for International Settlements

The Bank for International Settlements is an intergovernmental organization of central banks which "fosters international monetary and financial cooperation and serves as a bank for central banks." It is not accountable to any national government...

.

Call for new major reserve currency

In a report released by the United NationsUnited Nations

The United Nations is an international organization whose stated aims are facilitating cooperation in international law, international security, economic development, social progress, human rights, and achievement of world peace...

in 2010, called for abandoning the U.S. dollar as the single major reserve currency. The report states that the new reserve system should not be based on a single currency or even multiple national currencies but instead permit the emission of international liquidity to create a more stable global financial system.

Countries such as Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

and the People's Republic of China

People's Republic of China

China , officially the People's Republic of China , is the most populous country in the world, with over 1.3 billion citizens. Located in East Asia, the country covers approximately 9.6 million square kilometres...

, central banks, and economic analysts and groups, such as the Gulf Cooperation Council, have expressed a desire to see an independent new currency replace the dollar as the reserve currency.

On 10 July 2009, Russian President Medvedev proposed a new 'world currency' at the G8 meeting in London as an alternative reserve currency to replace the dollar.

According to economist Michael Hudson

Michael Hudson (economist)

Michael Hudson is research professor of economics at University of Missouri, Kansas City and a research associate at the Levy Economics Institute of Bard College...

, China has said, "we don't want to make any more foreign exchange reserve of any paper currency, because all the paper currencies are government debt currencies." China, Russia, India, Turkey, Brazil, Venezuela and oil-producing countries have recently agreed "to transact all of their mutual trade and investment in their own currencies" effectively minimizing the need, at least in the short term, for a global reserve currency. And yet oil is still priced in dollars, which has brought complaints about OPEC's policies of managing oil quotas to maintain dollar price stability.

Special Drawing Rights

Some have proposed the use of the International Monetary FundInternational Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

's (IMF) Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(SDRs) as a reserve.

China has proposed using SDRs, calculated daily from a basket of U.S. dollar, euro, Japanese yen and British pound, for international payments.

On 3 September 2009, the United Nations Conference on Trade and Development

United Nations Conference on Trade and Development

The United Nations Conference on Trade and Development was established in 1964 as a permanent intergovernmental body. It is the principal organ of the United Nations General Assembly dealing with trade, investment, and development issues....

(UNCTAD) issued a report calling for a new reserve currency based on the SDR, managed by a new global reserve bank. The IMF released a report in February 2011, stating that using SDRs could help stabilize the world economy.

Chinese yuan

The Chinese yuanChinese yuan

The yuan is the base unit of a number of modern Chinese currencies. The yuan is the primary unit of account of the Renminbi.A yuán is also known colloquially as a kuài . One yuán is divided into 10 jiǎo or colloquially máo...

or renminbi

Renminbi

The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC...

(RMB) cannot be used as a reserve currency as long as the Chinese government maintains capital controls on the conversion of its currency. The currency would not be attractive to central banks for holding unless China developed a strong open bond market.

Chinese President Hu Jintao has said that it would be a long process before the yuan was accepted as a global currency.

See also

- Commodity currencyCommodity currencyA commodity currency is a name given to currencies of countries which depend heavily on the export of certain raw materials for income. These countries are typically developing countries, eg...

- Exorbitant privilegeExorbitant privilegeThe exorbitant privilege is a term coined in the 1960s by Valéry Giscard d'Estaing, then the French Minister of Finance.This quote is generally misattributed to Charles de Gaulle, who is said to have had somewhat similar views....

- Floating currency

- Foreign exchange reservesForeign exchange reservesForeign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

- Fiat currency

- Hard currencyHard currencyHard currency , in economics, refers to a globally traded currency that is expected to serve as a reliable and stable store of value...

- Special Drawing RightsSpecial Drawing RightsSpecial Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

- Triffin dilemmaTriffin dilemmaThe Triffin dilemma is a theory that when a national currency also serves as an international reserve currency, there could be conflicts of interest between short-term domestic and long-term international economic objectives...

- World currencyWorld currencyIn the foreign exchange market and international finance, a world currency, supranational currency, or global currency refers to a currency in which the vast majority of international transactions take place and which serves as the world's primary reserve currency...