Ontario Bank

Encyclopedia

|

| Canada Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean... |

| |

| |

| Bank of Montreal The Bank of Montreal , , or BMO Financial Group, is the fourth largest bank in Canada by deposits. The Bank of Montreal was founded on June 23, 1817 by John Richardson and eight merchants in a rented house in Montreal, Quebec. On May 19, 1817 the Articles of Association were adopted, making it... |

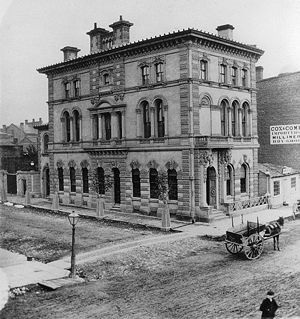

Ontario Bank was an early bank operating in Toronto

Toronto

Toronto is the provincial capital of Ontario and the largest city in Canada. It is located in Southern Ontario on the northwestern shore of Lake Ontario. A relatively modern city, Toronto's history dates back to the late-18th century, when its land was first purchased by the British monarchy from...

, Ontario

Ontario

Ontario is a province of Canada, located in east-central Canada. It is Canada's most populous province and second largest in total area. It is home to the nation's most populous city, Toronto, and the nation's capital, Ottawa....

in 1860. It was last listed as a member of the Canadian Bankers Association

Canadian Bankers Association

The Canadian Bankers Association is a financial lobbying group that works on behalf of 52 domestic banks, foreign bank subsidiaries and foreign bank branches operating in Canada and their 267,000 employees. The CBA was organized in Montreal in 1891, making it one of Canada’s oldest interest...

in 1901. The bank and its 30 branches across the province were absorbed into the Bank of Montreal

Bank of Montreal

The Bank of Montreal , , or BMO Financial Group, is the fourth largest bank in Canada by deposits. The Bank of Montreal was founded on June 23, 1817 by John Richardson and eight merchants in a rented house in Montreal, Quebec. On May 19, 1817 the Articles of Association were adopted, making it...

in the fall of 1906, after its general manager Charles McGill was found to have been speculating in the U.S. stock markets with bank funds and sustained an estimated $1.25 million in losses from ill-timed short sales. McGill was convicted of filing false tax returns and sentenced to a five year prison term early in 1907.