United Kingdom national debt

Encyclopedia

The British public debt is the money borrowed by the Government of the United Kingdom

at any one time through the issue of securities

by the British Treasury and other government agencies. The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later Imperial conquests. As of July 2011 the national debt amounted to £940.1 billion, or 61.4% of total GDP. The annual cost of servicing the public debt amounts to around £43bn, or roughly 3% of GDP. This is roughly the same size as the British defence budget. Due to the Government's significant budget deficit, which must be financed by borrowing, the national debt is increasing by approximately £121 billion per annum, or around £2.3 billion each week.

The British Government finances its debt by issuing Gilts

, or Government securities. These securities are the simplest form of government bond

and make up the largest share of British Government debt. A conventional gilt is a bond issued by the British Government which pays the holder a fixed cash payment (or coupon) every six months until maturity, at which point the holder receives their final coupon payment and the return of the principal.

, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough

and later Imperial conquests.

The establishment of the bank was devised by Charles Montagu, 1st Earl of Halifax

, in 1694, to the plan which had been proposed by William Paterson

three years before, but had not been acted upon. He proposed a loan of £1.2m to the government; in return the subscribers would be incorporated as The Governor and Company of the Bank of England with long-term banking privileges including the issue of notes. The Royal Charter

was granted on 27 July through the passage of the Tonnage Act of 1694. Public finances were in so dire a condition at the time that the terms of the loan were that it was to be serviced at a rate of 8% per annum, and there was also a service charge of £4000 per annum for the management of the loan. The first governor was Sir John Houblon

, who is depicted in the £50 note issued in 1994. The charter was renewed in 1742, 1764, and 1781.

In 1815, at the end of the Napoleonic Wars

, British government debt reached a peak of more than 200% of GDP.

At the beginning of the 20th century the national debt stood at around 30 percent of GDP. However, during World War I

At the beginning of the 20th century the national debt stood at around 30 percent of GDP. However, during World War I

the British Government was forced to borrow heavily in order to finance the war effort. The national debt increased from £650m in 1914 to £7.4 billion in 1919.

Britain borrowed heavily from the USA during World War I, and many loans from this period remain in a curious state of limbo. In 1934, during a time of economic crisis, Britain still owed the USA $4.4bn of WWI debt (about £866m at 1934 exchange rates). Adjusted for inflation, that would amount to around £40bn today, and if adjusted by the growth of British GDP, to about £225 billion. During the Great Depression

Britain effectively ceased payments on these loans, which have never been formally written off. In 1931, President Herbert Hoover

announced a one-year moratorium on war loan repayments from all nations.

faced a Sterling crisis during which the value of the pound tumbled and the government found it difficult to raise sufficient funds to maintain its spending commitments. The Prime Minister was forced to apply to the International Monetary Fund

for a £2.3 billion rescue package; the largest-ever call on IMF resources up to that point. In November 1976 the IMF announced its conditions for a loan, including deep cuts in public expenditure, in effect taking control of UK domestic policy. The crisis was seen as a national humiliation, with Callaghan being forced to go "cap in hand" to the IMF.

In the 20 year period from 1986/87 to 2006/07 government spending in the United Kingdom averaged around 40 per cent of GDP. As a result of the 2007-2010 financial crisis and the late-2000s global recession government spending increased to a historically high level of 48 per cent of GDP in 2009-10, partly as a result of the cost of a series of bank bailouts

. In July 2007, Britain had government debt

at 35.5% of GDP

. This figure rose to 56.8% of GDP by July 2009. As of June 2010 there were approximately 6,051,000 public sector employees in Britain (compared to approximately 23,107,000 private sector employees).

, but is now called the public sector net cash requirement (PSNCR). The PSNCR figure for 2010/11 was £143.2 billion, or 11.7% of GDP. Total British GDP in 2010/11 was estimated by the IMF at $2.25 trillion, or around £1.4 trillon.

By historic peacetime standards, the national debt is large and growing rapidly, but it is currently nowhere near its peak after WW2 when it reached over 180% of GDP.

The Institute of Economic Affairs

estimated the current British national debt, once including state & public pensions, as well as other commitments by the government, to be near £5 trillion, compared with the Government's estimate of £845 billion (as of 17/11/2010) Other estimates put the national debt at around £900 billion.

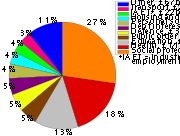

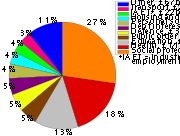

The British Government's debt is owned by a wide variety of investors, most notably pension funds. At present around 35% of the national debt is owed to overseas governments and investors.

In addition to new borrowing, the Government must service the cost of the existing debt. The cost of the British National debt is measured by the interest that the government must pay on the bonds and gilts it sells to investors. The annual cost of servicing the public debt amounts to around £43bn, or roughly 3% of GDP. This is roughly the same size as the British defence budget

In addition to new borrowing, the Government must service the cost of the existing debt. The cost of the British National debt is measured by the interest that the government must pay on the bonds and gilts it sells to investors. The annual cost of servicing the public debt amounts to around £43bn, or roughly 3% of GDP. This is roughly the same size as the British defence budget

.

The British population stands at around 59 million people, and the debt therefore amounts to a little over £15,000 for each individual Briton, or around £33,000 per person in employment.

Every household in Britain pays in taxes around £2,000 per annum to finance the interest.

However, by international standards Britain enjoys very low borrowing costs, perhaps because, like the United States

, the British Government has never failed to repay its creditors.

Britain's volume of debt is ranked 23rd internationally according the CIA World Factbook. Many other countries have larger debt burdens. For example, Japan has a National debt of around 194% of GDP, whilst that of Italy is more than 100%. The US national debt

Britain's volume of debt is ranked 23rd internationally according the CIA World Factbook. Many other countries have larger debt burdens. For example, Japan has a National debt of around 194% of GDP, whilst that of Italy is more than 100%. The US national debt

reached 100% of GDP in November 2011.

The size of the debt can be reduced in several ways:

Unfortunately, large scale cuts in public spending have the potential to significantly dampen consumer demand and, by reducing economic growth, slow the increase in tax revenues.

In Parliament, there continues to be disagreement between the political parties regarding the national debt, with Conservative Party

politicians typically advocating a larger role for cuts to public spending, while the Labour Party

tend to advocate fewer cuts and more emphasis on economic expansion.

Government of the United Kingdom

Her Majesty's Government is the central government of the United Kingdom of Great Britain and Northern Ireland. The Government is led by the Prime Minister, who selects all the remaining Ministers...

at any one time through the issue of securities

Security (finance)

A security is generally a fungible, negotiable financial instrument representing financial value. Securities are broadly categorized into:* debt securities ,* equity securities, e.g., common stocks; and,...

by the British Treasury and other government agencies. The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later Imperial conquests. As of July 2011 the national debt amounted to £940.1 billion, or 61.4% of total GDP. The annual cost of servicing the public debt amounts to around £43bn, or roughly 3% of GDP. This is roughly the same size as the British defence budget. Due to the Government's significant budget deficit, which must be financed by borrowing, the national debt is increasing by approximately £121 billion per annum, or around £2.3 billion each week.

Causes of public debt

The public debt increases or decreases as a result of the annual budget deficit or surplus. The British Government budget deficit or surplus is the cash difference between government receipts and spending, ignoring intra-governmental transfers. The British Government debt is rising due to a gap between revenue and expenditure. Total government revenue in the fiscal year 2011/12 is projected to be £589 billion, whereas total expenditure is estimated at £710 billion. Therefore the total deficit, which must be financed by borrowing, is £121 billion. This represents borrowing of a little over £2 billion per week.The British Government finances its debt by issuing Gilts

Gilts

Gilts are bonds issued by certain national governments. The term is of British origin, and originally referred to the debt securities issued by the Bank of England, which had a gilt edge. Hence, they are called gilt-edged securities, or gilts for short. The term is also sometimes used in Ireland...

, or Government securities. These securities are the simplest form of government bond

Government bond

A government bond is a bond issued by a national government denominated in the country's own currency. Bonds are debt investments whereby an investor loans a certain amount of money, for a certain amount of time, with a certain interest rate, to a company or country...

and make up the largest share of British Government debt. A conventional gilt is a bond issued by the British Government which pays the holder a fixed cash payment (or coupon) every six months until maturity, at which point the holder receives their final coupon payment and the return of the principal.

History

Origins

The origins of the British national debt can be found during the reign of William IIIWilliam III of England

William III & II was a sovereign Prince of Orange of the House of Orange-Nassau by birth. From 1672 he governed as Stadtholder William III of Orange over Holland, Zeeland, Utrecht, Guelders, and Overijssel of the Dutch Republic. From 1689 he reigned as William III over England and Ireland...

, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough

Duke of Marlborough

Duke of Marlborough , is a hereditary title in the Peerage of England. The first holder of the title was John Churchill , the noted English general, and indeed an unqualified reference to the Duke of Marlborough in a historical text will almost certainly refer to him.-History:The dukedom was...

and later Imperial conquests.

The establishment of the bank was devised by Charles Montagu, 1st Earl of Halifax

Charles Montagu, 1st Earl of Halifax

Charles Montagu, 1st Earl of Halifax, KG, PC, FRS was an English poet and statesman.-Early life:Charles Montagu was born in Horton, Northamptonshire, the son of George Montagu, fifth son of 1st Earl of Manchester...

, in 1694, to the plan which had been proposed by William Paterson

William Paterson (banker)

Sir William Paterson was a Scottish trader and banker.- Early life :...

three years before, but had not been acted upon. He proposed a loan of £1.2m to the government; in return the subscribers would be incorporated as The Governor and Company of the Bank of England with long-term banking privileges including the issue of notes. The Royal Charter

Royal Charter

A royal charter is a formal document issued by a monarch as letters patent, granting a right or power to an individual or a body corporate. They were, and are still, used to establish significant organizations such as cities or universities. Charters should be distinguished from warrants and...

was granted on 27 July through the passage of the Tonnage Act of 1694. Public finances were in so dire a condition at the time that the terms of the loan were that it was to be serviced at a rate of 8% per annum, and there was also a service charge of £4000 per annum for the management of the loan. The first governor was Sir John Houblon

John Houblon

Sir John Houblon was the first Governor of the Bank of England from 1694 to 1697.-Biography:Sir John was the third son of James Houblon, a London merchant, and his wife, Mary Du Quesne, daughter of Jean Du Quesne, the younger...

, who is depicted in the £50 note issued in 1994. The charter was renewed in 1742, 1764, and 1781.

In 1815, at the end of the Napoleonic Wars

Napoleonic Wars

The Napoleonic Wars were a series of wars declared against Napoleon's French Empire by opposing coalitions that ran from 1803 to 1815. As a continuation of the wars sparked by the French Revolution of 1789, they revolutionised European armies and played out on an unprecedented scale, mainly due to...

, British government debt reached a peak of more than 200% of GDP.

World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

the British Government was forced to borrow heavily in order to finance the war effort. The national debt increased from £650m in 1914 to £7.4 billion in 1919.

Britain borrowed heavily from the USA during World War I, and many loans from this period remain in a curious state of limbo. In 1934, during a time of economic crisis, Britain still owed the USA $4.4bn of WWI debt (about £866m at 1934 exchange rates). Adjusted for inflation, that would amount to around £40bn today, and if adjusted by the growth of British GDP, to about £225 billion. During the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

Britain effectively ceased payments on these loans, which have never been formally written off. In 1931, President Herbert Hoover

Herbert Hoover

Herbert Clark Hoover was the 31st President of the United States . Hoover was originally a professional mining engineer and author. As the United States Secretary of Commerce in the 1920s under Presidents Warren Harding and Calvin Coolidge, he promoted partnerships between government and business...

announced a one-year moratorium on war loan repayments from all nations.

World War II

During World War II the Government was again forced to borrow heavily in order to finance war with Germany. By the end of the conflict Britain's debt exceeded 200 percent of GDP, as it had done after the end of the Napoleonic Wars. Once again the USA provided the major source of funds, this time via low interest loans and also through the Lend Lease Act. Even at the end of the war Britain needed American financial assistance, and in 1945 Britain took a loan for $586 million (about £145 million at 1945 exchange rates), and in addition a further $3,750 million line of credit (about £930m at 1945 exchange rates). The debt was to be paid off in 50 annual repayments commencing in 1950. Some of these loans have only recently been paid off. On 31 December 2006, Britain made a final payment of about $83m (£45.5m) and thereby discharged the last of its war loans from the USA.1970s

After the war the debt gradually fell as a proportion of GDP, but in 1976 the British Government led by James CallaghanJames Callaghan

Leonard James Callaghan, Baron Callaghan of Cardiff, KG, PC , was a British Labour politician, who was Prime Minister of the United Kingdom from 1976 to 1979 and Leader of the Labour Party from 1976 to 1980...

faced a Sterling crisis during which the value of the pound tumbled and the government found it difficult to raise sufficient funds to maintain its spending commitments. The Prime Minister was forced to apply to the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

for a £2.3 billion rescue package; the largest-ever call on IMF resources up to that point. In November 1976 the IMF announced its conditions for a loan, including deep cuts in public expenditure, in effect taking control of UK domestic policy. The crisis was seen as a national humiliation, with Callaghan being forced to go "cap in hand" to the IMF.

2000s

In the late 1990s and early 2000s the national debt dropped in relative terms, falling to 29% of GDP by 2002. After that it began to increase, despite sustained economic growth, increasing to 37% of GDP in 2007. This was due to extra government borrowing, largely caused by increased spending on health, education, and social security benefits. Since 2008, when the British economy slowed sharply and fell into recession, the national debt has risen dramatically, mainly caused by increased spending on welfare benefits, bank bailouts, and a significant drop in receipts from stamp duty and income tax.In the 20 year period from 1986/87 to 2006/07 government spending in the United Kingdom averaged around 40 per cent of GDP. As a result of the 2007-2010 financial crisis and the late-2000s global recession government spending increased to a historically high level of 48 per cent of GDP in 2009-10, partly as a result of the cost of a series of bank bailouts

2008 United Kingdom bank rescue package

A bank rescue package totalling some £500 billion was announced by the British government on 8 October 2008, as a response to the ongoing global financial crisis. After two unsteady weeks at the end of September, the first week of October had seen major falls in the stock market and severe worries...

. In July 2007, Britain had government debt

Government debt

Government debt is money owed by a central government. In the US, "government debt" may also refer to the debt of a municipal or local government...

at 35.5% of GDP

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

. This figure rose to 56.8% of GDP by July 2009. As of June 2010 there were approximately 6,051,000 public sector employees in Britain (compared to approximately 23,107,000 private sector employees).

Today

Official figures state that as of July 2011 the British national debt amounted to £940.1 billion, or 61.4% of total GDP. The annual amount that the government must borrow to plug the gap in its finances used to be known as the Public sector borrowing requirementPublic sector borrowing requirement

Public sector borrowing requirement is the old name for the budget deficit in the United Kingdom. The budget deficit has been renamed to the public sector net cash requirement to avoid confusion with net borrowing....

, but is now called the public sector net cash requirement (PSNCR). The PSNCR figure for 2010/11 was £143.2 billion, or 11.7% of GDP. Total British GDP in 2010/11 was estimated by the IMF at $2.25 trillion, or around £1.4 trillon.

By historic peacetime standards, the national debt is large and growing rapidly, but it is currently nowhere near its peak after WW2 when it reached over 180% of GDP.

The Institute of Economic Affairs

Institute of Economic Affairs

The Institute of Economic Affairs , founded in 1955, styles itself the UK's pre-eminent free-market think-tank. Its mission is to improve understanding of the fundamental institutions of a free society by analysing and expounding the role of markets in solving economic and social...

estimated the current British national debt, once including state & public pensions, as well as other commitments by the government, to be near £5 trillion, compared with the Government's estimate of £845 billion (as of 17/11/2010) Other estimates put the national debt at around £900 billion.

The British Government's debt is owned by a wide variety of investors, most notably pension funds. At present around 35% of the national debt is owed to overseas governments and investors.

Cost

Ministry of Defence (United Kingdom)

The Ministry of Defence is the United Kingdom government department responsible for implementation of government defence policy and is the headquarters of the British Armed Forces....

.

The British population stands at around 59 million people, and the debt therefore amounts to a little over £15,000 for each individual Briton, or around £33,000 per person in employment.

Every household in Britain pays in taxes around £2,000 per annum to finance the interest.

However, by international standards Britain enjoys very low borrowing costs, perhaps because, like the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, the British Government has never failed to repay its creditors.

International comparisons

United States public debt

The United States public debt is the money borrowed by the federal government of the United States at any one time through the issue of securities by the Treasury and other federal government agencies...

reached 100% of GDP in November 2011.

Remedies

All the main political parties in Britain agree that the debt is too high, but there is disagreement as to the remedy. Forecasts suggest that the national debt could rise towards 100% of GDP by 2012, far above the government’s sustainable investment rule of a national debt no greater than 40% of GDP.The size of the debt can be reduced in several ways:

- economic expansion, which tends to cause tax revenues to grow and also leads to lower spending on welfare benefits;

- an improvement in the banking sector, taking the pressure off of government intervention;

- cuts to public spending;

- tax increases

- inflation, which reduces the total value of the existing debt

Unfortunately, large scale cuts in public spending have the potential to significantly dampen consumer demand and, by reducing economic growth, slow the increase in tax revenues.

In Parliament, there continues to be disagreement between the political parties regarding the national debt, with Conservative Party

Conservative Party (UK)

The Conservative Party, formally the Conservative and Unionist Party, is a centre-right political party in the United Kingdom that adheres to the philosophies of conservatism and British unionism. It is the largest political party in the UK, and is currently the largest single party in the House...

politicians typically advocating a larger role for cuts to public spending, while the Labour Party

Labour Party (UK)

The Labour Party is a centre-left democratic socialist party in the United Kingdom. It surpassed the Liberal Party in general elections during the early 1920s, forming minority governments under Ramsay MacDonald in 1924 and 1929-1931. The party was in a wartime coalition from 1940 to 1945, after...

tend to advocate fewer cuts and more emphasis on economic expansion.

See also

- 2011 United Kingdom Budget2011 United Kingdom budgetThe 2011 United Kingdom budget, officially called 2011 Budget - A strong and stable economy, growth and fairness, was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on 23 March 2011....

- Economic history of the United KingdomEconomic history of the United KingdomThe economic history of the United Kingdom deals with the history of the economy of the United Kingdom from the creation of the Kingdom of Great Britain on May 1st, 1707, with the political union of the Kingdom of England and the Kingdom of Scotland...

- Economy of the United KingdomEconomy of the United KingdomThe economy of the United Kingdom is the sixth-largest national economy in the world measured by nominal GDP and seventh-largest measured by purchasing power parity , and the third-largest in Europe measured by nominal GDP and second-largest measured by PPP...

- European sovereign debt crisis

- GiltsGiltsGilts are bonds issued by certain national governments. The term is of British origin, and originally referred to the debt securities issued by the Bank of England, which had a gilt edge. Hence, they are called gilt-edged securities, or gilts for short. The term is also sometimes used in Ireland...

- Government spending in the United KingdomGovernment spending in the United KingdomCentral government spending in the United Kingdom, also called public expenditure, is the responsibility of the UK government, the Scottish Government, the Welsh Government and the Northern Ireland Executive...

- List of countries by external debt

- List of sovereign states by public debt

- National debt

- Sovereign defaultSovereign defaultA sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full. It may be accompanied by a formal declaration of a government not to pay or only partially pay its debts , or the de facto cessation of due payments...

- United Kingdom budgetUnited Kingdom budgetThe United Kingdom budget deals with HM Treasury budgeting the revenues gathered by Her Majesty's Revenue and Customs and expenditures of public sector departments, in compliance with government policy.Adjustment is achieved with the GDP deflator....

- UK Debt Management OfficeUK Debt Management OfficeThe UK Debt Management Office , was established on 1 April 1998. The DMO is responsible for carrying out the Government's debt management policy of minimising financing costs over the long term, taking account of risk, and managing the aggregate cash needs of the Exchequer in the most...

- United States public debtUnited States public debtThe United States public debt is the money borrowed by the federal government of the United States at any one time through the issue of securities by the Treasury and other federal government agencies...

External links

- Uk National Debt "Bombshell" - webpage discussing the National Debt Retrieved September 2011

- BBC Budget 2009 Overview Retrieved September 2011

- Telegraph.co.uk 2011 Budget coverage Retrieved September 2011

- BBC Budget 2008 Overview Retrieved September 2011

- Budget 2008 UK Budget 2008 from HM treasury Retrieved September 2011

- HM Treasury Whole of Government Accounts development programme Retrieved September 2011

- Government 'hides' billions wasted in public services, Sunday Times, 1 May 2005 Retrieved September 2011

- Better Government Initiative experts say billions wasted on services, Daily Telegraph, 24 November 2007 Retrieved September 2011

- Better Government Initiative Retrieved September 2011

- PricewaterhouseCoopers budget coverage and analysis Retrieved September 2011