United States public debt

Encyclopedia

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

at any one time through the issue of securities

Security (finance)

A security is generally a fungible, negotiable financial instrument representing financial value. Securities are broadly categorized into:* debt securities ,* equity securities, e.g., common stocks; and,...

by the Treasury and other federal government agencies. The US national public debt

Government debt

Government debt is money owed by a central government. In the US, "government debt" may also refer to the debt of a municipal or local government...

consists of two components:

- Debt held by the public comprises securities held by investors outside the federal government, including that held by investors, the Federal Reserve SystemFederal Reserve SystemThe Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

and foreign, state and local governments. - Intragovernment debt comprises Treasury securities held in accounts administered by the federal government, such as the Social Security Trust FundSocial Security Trust FundIn the United States, the Social Security Trust Fund is a fund operated by the Social Security Administration into which are paid contributions from workers and employers under the Social Security system and out of which benefit payments to retirees, survivors, and the disabled, and general...

.

Public debt increases or decreases as a result of the annual unified budget

Unified budget

In the United States a unified budget is a federal government budget in which receipts and outlays from federal funds and the Social Security Trust Fund are consolidated. The change to a unified budget resulted in a single measure of the fiscal status of the government, based on the sum of all...

deficit or surplus. The federal government budget deficit or surplus is the cash difference between government receipts and spending, ignoring intra-governmental transfers. However, there is certain spending (supplemental appropriations) that add to the debt but are excluded from the deficit. The deficit is presented on a cash

Comparison of Cash Method and Accrual Method of accounting

The two primary accounting methods of the cash and the accruals basis are used to calculate US public debt, as well as taxable income for U.S. federal income taxes and other income taxes...

rather than an accruals basis, although the accrual basis may provide more information on the longer-term implications of the government's annual operations.

The public debt has increased by over $500 billion each year since fiscal year (FY) 2003, with increases of $1 trillion in FY2008, $1.9 trillion in FY2009, and $1.7 trillion in FY2010. As of November 17, 2011 the gross debt was $15.03 trillion, of which $10.31 trillion was held by the public and $4.72 trillion was intragovernmental holdings. The annual gross domestic product (GDP) to the end of June 2011 was $15.003 trillion (July 29, 2011 estimate), with total public debt outstanding at a ratio of 100% of GDP, and debt held by the public at 69% of GDP.

In the United States, there continues to be disagreement between Democrats

Democratic Party (United States)

The Democratic Party is one of two major contemporary political parties in the United States, along with the Republican Party. The party's socially liberal and progressive platform is largely considered center-left in the U.S. political spectrum. The party has the lengthiest record of continuous...

and Republicans

Republican Party (United States)

The Republican Party is one of the two major contemporary political parties in the United States, along with the Democratic Party. Founded by anti-slavery expansion activists in 1854, it is often called the GOP . The party's platform generally reflects American conservatism in the U.S...

regarding the United States debt. On August 2, 2011, President Barack Obama

Barack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

signed into law the Budget Control Act of 2011

Budget Control Act of 2011

The Budget Control Act of 2011 was passed by the 112th United States Congress signed into law by President Barack Obama. It brought conclusion to the 2011 United States debt ceiling crisis, which had threatened to lead the United States into sovereign default on or about August 3, 2011.The law...

, averting a possible financial default

Default (finance)

In finance, default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant of the debt contract. A default is the failure to pay back a loan. Default may occur if the debtor is either...

. During June 2011, the Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

called for "...large and rapid policy changes to put the nation on a sustainable

fiscal course."

History

The United States has had a public debt since its founding in 1791. Debts incurred during the American Revolutionary WarAmerican Revolutionary War

The American Revolutionary War , the American War of Independence, or simply the Revolutionary War, began as a war between the Kingdom of Great Britain and thirteen British colonies in North America, and ended in a global war between several European great powers.The war was the result of the...

and under the Articles of Confederation

Articles of Confederation

The Articles of Confederation, formally the Articles of Confederation and Perpetual Union, was an agreement among the 13 founding states that legally established the United States of America as a confederation of sovereign states and served as its first constitution...

amounted to $75,463,476.52 on January 1, 1791. From 1796 to 1811 there were 14 budget surpluses and 2 deficits. There was a sharp increase in the debt as a result of the War of 1812

War of 1812

The War of 1812 was a military conflict fought between the forces of the United States of America and those of the British Empire. The Americans declared war in 1812 for several reasons, including trade restrictions because of Britain's ongoing war with France, impressment of American merchant...

. In the 20 years following that war, there were 18 surpluses and the US paid off 99.97% of its then debt.

Another sharp increase in the debt occurred as a result of the Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

. The debt was just $65 million in 1860, but passed $1 billion in 1863 and reached $2.7 billion by the end of the war. During the following 47 years, there were 36 surpluses and 11 deficits. During this period 55% of the national debt was paid off.

The next period of major increase in the national debt took place during World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, reaching $25.5 billion at its conclusion. It was followed by 11 consecutive surpluses and saw the debt reduced by 36%.

Social programs enacted during the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

and the buildup and involvement in World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

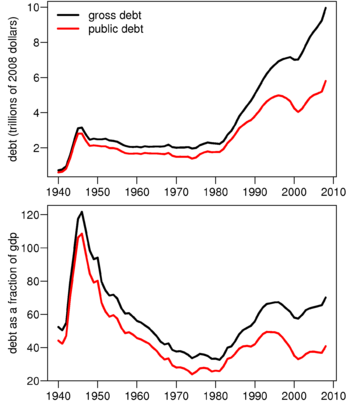

during the F.D. Roosevelt and Truman presidencies in the 1930s and 1940s caused the largest increase — a sixteenfold increase in the gross public debt from $16 billion in 1930 to $260 billion in 1950. When Roosevelt took office in 1933, the national debt was almost $20 billion; a sum equal to 20 percent of the U.S. gross domestic product (GDP). During its first term, the Roosevelt administration ran large annual deficits between 2 and 5 percent of GDP. By 1936, the national debt had increased to $33.7 billion or approximately 40 percent of GDP. Gross debt relative to GDP rose to over 100% to pay for WWII.

After this period, beginning in 1965 and each year afterward, the growth of the U.S. aggregate debt began to increase faster than GDP as GDP growth rates in western countries began to taper off. Gross debt in nominal dollars quadrupled during the Reagan and Bush presidencies from 1980 to 1992. The net public debt quintupled in nominal terms. Gross debt relative to GDP declined after WWII, then rose during the 1980s as part of Reaganomics

Reaganomics

Reaganomics refers to the economic policies promoted by the U.S. President Ronald Reagan during the 1980s, also known as supply-side economics and called trickle-down economics, particularly by critics...

, most of which was Cold War

Cold War

The Cold War was the continuing state from roughly 1946 to 1991 of political conflict, military tension, proxy wars, and economic competition between the Communist World—primarily the Soviet Union and its satellite states and allies—and the powers of the Western world, primarily the United States...

spending to bankrupt the USSR. During the 1970s, debt held by the public declined from 28% of GDP to 26% of GDP. During the 1980s, it rose to 41% of GDP.

In nominal dollars the net public debt rose and then fell between 1992 and 2000 from $3 trillion in 1992 to $3.4 trillion in 2000, in part due to the Dot-com bubble

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

. During the 1990s, debt held by the public rose to 50% and then was reduced to 39% by the end of the decade.

During the presidency of George W. Bush

George W. Bush

George Walker Bush is an American politician who served as the 43rd President of the United States, from 2001 to 2009. Before that, he was the 46th Governor of Texas, having served from 1995 to 2000....

, the gross public debt increased from $5.7 trillion in January 2001 to $10.7 trillion by December 2008. Under President Barack Obama, the debt increased from $10.7 trillion in 2008 to $14.2 trillion by February 2011. Debt relative to GDP rose due to recessions and policy decisions in the early 21st century. From 2000 to 2008 debt held by the public rose from 35% to 40%, and to 62% by the end of fiscal year 2010.

Public and government accounts

The national debt can also be classified into marketable or non-marketable securities. As of February 2011, total marketable securities were $9.0 trillion while the non-marketable securities were $5.2 trillion. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the "government account series" owed to certain government trust funds such as the Social Security Trust Fund

Social Security Trust Fund

In the United States, the Social Security Trust Fund is a fund operated by the Social Security Administration into which are paid contributions from workers and employers under the Social Security system and out of which benefit payments to retirees, survivors, and the disabled, and general...

, which represented $2.5 trillion in 2010. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation's Resolution Fund and the Federal Hospital Insurance Trust Fund (Medicare).

Fannie Mae and Freddie Mac obligations excluded

Although not included in the debt figures reported by the government, the U.S. government has moved to more explicitly support the soundness of obligations of Freddie Mac and Fannie Mae, starting in July 2008 via the Housing and Economic Recovery Act of 2008Housing and Economic Recovery Act of 2008

The Housing and Economic Recovery Act of 2008 designed primarily to address the subprime mortgage crisis. It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders write-down principal loan balances to 90...

, and the September 7, 2008 Federal Housing Finance Agency

Federal Housing Finance Agency

The Federal Housing Finance Agency is an independent federal agency created as the successor regulatory agency resulting from the statutory merger of the Federal Housing Finance Board , the Office of Federal Housing Enterprise Oversight , and the U.S...

(FHFA) conservatorship of both government sponsored enterprises (GSEs). The on- or off-balance sheet obligations of those two independent GSEs was just over $5 trillion at the time the conservatorship was put in place, consisting mainly of mortgage payment guarantees. The extent to which the government will be required to pay these obligations depends on a variety of economic and housing market factors. The federal government provided over $110 billion to Fannie and Freddie by 2010.

Guaranteed obligations excluded

U.S. federal government guarantees are not included in the public debt total, until such time as there is a call on the guarantees. For example, the U.S. federal government in late-2008 guaranteed large amounts of obligations of mutual funds, banks, and corporations under several programs designed to deal with the problems arising from the late-2000s financial crisisLate-2000s financial crisis

The late-2000s financial crisis is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s...

. The funding of direct investments made in response to the crisis, such as those made under the Troubled Assets Relief Program

Troubled Assets Relief Program

The Troubled Asset Relief Program is a program of the United States government to purchase assets and equity from financial institutions to strengthen its financial sector that was signed into law by U.S. President George W. Bush on October 3, 2008...

, are included in the debt.

Unfunded obligations excluded

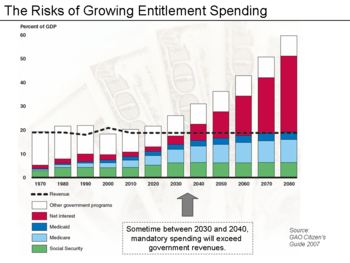

The U.S. government is obligated under current law to mandatory payments for programs such as Medicare, Medicaid and Social Security. The GAO projects that payouts for these programs will significantly exceed tax revenues over the next 75 years. The Medicare Part A (hospital insurance) payouts already exceed program tax revenues, and social security payouts exceeded payroll taxes in fiscal 2010. These deficits require funding from other tax sources or borrowing.The present value of these deficits or unfunded obligations is an estimated $45.8 trillion. This is the amount that would have to be set aside during 2009 so that the principal and interest would pay for the unfunded obligations through 2084. Approximately $7.7 trillion relates to Social Security, while $38.2 trillion relates to Medicare and Medicaid. In other words, health care programs will require nearly five times the level of funding than Social Security. Adding this to the national debt and other federal obligations would bring total obligations to nearly $62 trillion. However, these unfunded obligations are not counted in the national debt.

The Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO) has indicated that: "Future growth in spending per beneficiary for Medicare and Medicaid — the federal government’s major health care programs — will be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costs — which will be difficult, in part because of the complexity of health policy choices — is ultimately the nation’s central long-term challenge in setting federal fiscal policy."

Measuring debt relative to gross domestic product

GDP is a measure of the total size and output of the economy. One measure of the debt burden is its size relative to GDP. In the 2007 fiscal year, U.S. federal debt held by the public was approximately $5 trillion (36.8 percent of GDP) and total debt was $9 trillion (65.5 percent of GDP). Debt held by the public represents money owed to those holding government securities such as Treasury bills and bonds. Total debt includes intra-governmental debt, which includes amounts owed to the Social Security Trust Funds (about $2.2 trillion in FY 2007) and Civil Service Retirement Funds. By August 2008, the total debt was $9.6 trillion.Based on the 2010 U.S. budget, total national debt will nearly double in dollar terms between 2008 and 2015 and will grow to nearly 100% of GDP, versus a level of approximately 80% in early 2009. Multiple government sources including the current and previous presidents, the GAO, Treasury Department, and CBO have said the U.S. is on an unsustainable fiscal path. However, ahead of predictions, total national debt reached 100% by the third quarter of 2011.

As the debt ratio increases, the exchange value of the dollar may fall. Paying back debt with cheaper currency could cause investors (including other governments) to demand higher interest rates if they anticipate further dollar depreciation. Paying higher interest rates could slow domestic U.S. growth.

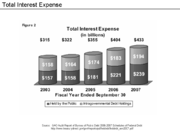

Higher debt increases interest payments on the debt, which already exceed $430 billion annually as discussed below, or about 15 cents of every tax dollar for 2008. According to the CIA Factbook, nine countries have debt to GDP ratios over 100% for 2010, the largest of which is Japan at approximately 197.5%.

Further, a high public debt to GDP ratio may also slow economic growth. Economists Carmen Reinhart

Carmen Reinhart

-External links:*...

and Kenneth Rogoff

Kenneth Rogoff

Kenneth Saul "Ken" Rogoff is currently the Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard University. He is also a chess Grandmaster.-Early life:...

calculated that countries with public debt above 90 percent of GDP grow by an average of 1.3 percentage points per year slower than less indebted countries. The public debt-to-GDP ratio in March 2010 is about 60 percent of GDP; CBO projects it will reach 90 percent around 2020 under policies in place in 2010. If growth slows, all of the economic challenges the U.S. faces will worsen.

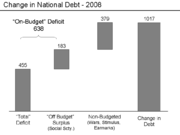

Calculating the annual change in debt

United States Postal Service

The United States Postal Service is an independent agency of the United States government responsible for providing postal service in the United States...

, are considered "off-budget", while most other expenditure and receipt categories are considered "on-budget." The total federal deficit is the sum of the on-budget deficit (or surplus) and the off-budget deficit (or surplus). Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998–FY2001.

In large part because of Social Security surpluses, the total deficit is smaller than the on-budget deficit. The surplus of Social Security payroll taxes over benefit payments is spent by the government for other purposes. However, the government credits the Social Security Trust fund for the surplus amount, adding to the "intragovernmental debt." The total federal debt is divided into "intragovernmental debt" and "debt held by the public." In other words, spending the "off budget" Social Security surplus adds to the total national debt (by increasing the intragovernmental debt) while the surplus reduces the "total" deficit reported in the media.

Certain spending called "supplemental appropriations" is outside the budget process entirely but adds to the national debt. Funding for the Iraq and Afghanistan wars was accounted for this way prior to the Obama administration. Certain stimulus measures and earmark

Earmark (politics)

In United States politics, an earmark is a legislative provision that directs approved funds to be spent on specific projects, or that directs specific exemptions from taxes or mandated fees...

s are also outside the budget process.

For example, in FY2008 an off-budget surplus of $183 billion reduced the on-budget deficit of $642 billion, resulting in a total federal deficit of $459 billion. Media often reported the latter figure. The national debt increased by $1,017 billion between the end of FY2007 and the end of FY2008. The federal government publishes the total debt owed (public and intragovernmental holdings) at the end of each fiscal year and since FY1957 the amount of debt held by the federal government has increased each year.

Debt ceiling

Under Article I Section 8 of the United States Constitution, Congress has the sole power to borrow money on the credit of the United States. From the founding of the United States until 1917 Congress directly authorized each individual debt issuance separately. In order to provide more flexibility to finance the United States' involvement in World War IWorld War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, Congress modified the method by which it authorizes debt in the Second Liberty Bond Act of 1917. Under this act Congress established an aggregate limit, or "ceiling," on the total amount of bonds that could be issued.

The current debt ceiling, in which an aggregate limit is applied to nearly all federal debt, was substantially established by Public Debt Acts

Public Debt Acts

Public Debt Acts are Acts of Congress which attempt to define public spending limits within a fiscal year.- United States :* The United States Public Debt Act of 1939 eliminated separate limits on different types of debt....

passed in 1939 and 1941. The Treasury is authorized to issue debt needed to fund government operations (as authorized by each federal budget) up to a stated debt ceiling, with some small exceptions.

The process of setting the debt ceiling is separate and distinct from the regular process of financing government operations, and raising the debt ceiling does not have any direct impact on the budget deficit. The US government proposes a federal budget every year, which must be approved by Congress. This budget details projected tax collections and outlays and, if there is a budget deficit, the amount of borrowing the government would have to do in that fiscal year. A vote to increase the debt ceiling is, therefore, usually treated as a formality, needed to continue spending that has already been approved previously by the Congress and the President. The Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

explains: "The debt limit does not control or limit the ability of the federal government to run deficits or incur obligations. Rather, it is a limit on the ability to pay obligations already incurred." The apparent redundancy of the debt ceiling has led to suggestions that it should be abolished altogether.

Since 1979, the House of Representatives passed a rule to automatically raise the debt ceiling when passing a budget, without the need for a separate vote on the debt ceiling, except when the House votes to waive or repeal this rule. The exception to the rule was invoked in 1995, which resulted in two government shutdowns.

When the debt ceiling is reached, Treasury can declare a debt issuance suspension period and utilize "extraordinary measures" to acquire funds to meet federal obligations but which do not require the issue of new debt. Treasury first used these measures on December 16, 2009, to remain within the debt ceiling, and avoid a government shutdown, and also used it during the debt-ceiling crisis of 2011

United States debt-ceiling crisis

The United States debt-ceiling crisis was a financial crisis in 2011 that started as a debate in the United States Congress about increasing the debt ceiling. The immediate crisis ended when a complex deal was reached that raised the debt ceiling and reduced future government spending...

. However, there are limits to how much can be raised by these measures.

The debt ceiling was increased on February 12, 2010, to $14.294 trillion. On April 15, 2011, Congress finally passed the 2011 United States federal budget

2011 United States federal budget

The 2011 United States federal budget is the United States federal budget to fund government operations for the fiscal year 2011, which is October 2010–September 2011. The budget is the subject of a spending request by President Barack Obama...

, authorizing federal government spending for the remainder of the 2011 fiscal year, which ends on September 30, 2011, with a deficit of $1.48 trillion, without voting to increase the debt ceiling. The two Houses of Congress were unable to agree on a revision of the debt ceiling in mid-2011, resulting in the United States debt-ceiling crisis

United States debt-ceiling crisis

The United States debt-ceiling crisis was a financial crisis in 2011 that started as a debate in the United States Congress about increasing the debt ceiling. The immediate crisis ended when a complex deal was reached that raised the debt ceiling and reduced future government spending...

. The impasse was resolved with the passing on August 2, 2011, the deadline for a default by the US on its debt, of the Budget Control Act of 2011

Budget Control Act of 2011

The Budget Control Act of 2011 was passed by the 112th United States Congress signed into law by President Barack Obama. It brought conclusion to the 2011 United States debt ceiling crisis, which had threatened to lead the United States into sovereign default on or about August 3, 2011.The law...

, which immediately increased the debt ceiling to $14.694 trillion, required a vote on a Balanced Budget Amendment

Balanced Budget Amendment

A balanced-budget amendment is a constitutional rule requiring that the state cannot spend more than its income. It requires a balance between the projected receipts and expenditures of the government....

, and established several complex mechanisms to further increase the debt ceiling and reduce federal spending.

On September 8, 2011, one of the complex mechanisms to further increase the debt ceiling took place as the Senate defeated a resolution to block a $500 billion automatic increase. The Senate's action allowed the debt ceiling to increase to $15.194 trillion, as agreed upon in the Budget Control Act. This was the third increase in the debt ceiling in 19 months, the fifth increase since President Obama took office, and the twelfth increase in 10 years. The August 2 Act also created the United States Congress Joint Select Committee on Deficit Reduction for the purpose of developing a set of proposals by November 23, 2011, to reduce federal spending by $1.2 trillion. The Act requires both houses of Congress to convene an "up-or-down" vote on the proposals as a whole by December 23, 2011. The Joint Select Committee met for the first time on September 8, 2011.

Credit rating downgrade, 2011

On August 5, 2011, after Congress voted to raise the debt ceiling of the United States federal government, the credit ratingCredit rating

A credit rating evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government. It is an evaluation made by a credit rating agency of the debt issuers likelihood of default. Credit ratings are...

agency Standard & Poor's

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

downgraded the credit rating of the United States federal government from AAA to AA+. It was the first time the US had been downgraded since it was originally given a AAA rating on its debt by Moody's

Moody's

Moody's Corporation is the holding company for Moody's Analytics and Moody's Investors Service, a credit rating agency which performs international financial research and analysis on commercial and government entities. The company also ranks the credit-worthiness of borrowers using a standardized...

in 1917. According to the BBC

BBC

The British Broadcasting Corporation is a British public service broadcaster. Its headquarters is at Broadcasting House in the City of Westminster, London. It is the largest broadcaster in the world, with about 23,000 staff...

, Standard & Poor's had "lost confidence" in the ability of the United States government to make decisions. The United States Treasury, political figures from both parties in the United States including the Obama administration

Presidency of Barack Obama

The Presidency of Barack Obama began at noon EST on January 20, 2009 when he became the 44th President of the United States. Obama was a United States Senator from Illinois at the time of his victory over Arizona Senator John McCain in the 2008 presidential election...

, Mitt Romney

Mitt Romney

Willard Mitt Romney is an American businessman and politician. He was the 70th Governor of Massachusetts from 2003 to 2007 and is a candidate for the 2012 Republican Party presidential nomination.The son of George W...

, Michele Bachmann

Michele Bachmann

Michele Marie Bachmann is a Republican member of the United States House of Representatives, representing , a post she has held since 2007. The district includes several of the northern suburbs of the Twin Cities, such as Woodbury, and Blaine as well as Stillwater and St. Cloud.She is currently a...

and John Kerry

John Kerry

John Forbes Kerry is the senior United States Senator from Massachusetts, the 10th most senior U.S. Senator and chairman of the Senate Foreign Relations Committee. He was the presidential nominee of the Democratic Party in the 2004 presidential election, but lost to former President George W...

, billionaire Warren Buffett

Warren Buffett

Warren Edward Buffett is an American business magnate, investor, and philanthropist. He is widely regarded as one of the most successful investors in the world. Often introduced as "legendary investor, Warren Buffett", he is the primary shareholder, chairman and CEO of Berkshire Hathaway. He is...

and Nobel Memorial Prize winner Paul Krugman

Paul Krugman

Paul Robin Krugman is an American economist, professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor at the London School of Economics, and an op-ed columnist for The New York Times...

criticized the move.

Together with the budget deficit, the political climate at the time was one of the reasons given by Standard & Poor's

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

to revise the outlook on the US sovereign credit rating

Credit rating

A credit rating evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government. It is an evaluation made by a credit rating agency of the debt issuers likelihood of default. Credit ratings are...

down to negative on April 18, 2011. Standard and Poor's downgraded the credit rating by one notch from AAA to AA+ on August 5, 2011, for the first time ever. The long-term outlook is negative and it could lower the rating further to AA within the next 2 years. The downgrade was met with severe criticism from the Obama administration, commentators, and other political figures. The US still has a AAA rating from other ratings agencies.

Ownership of debt

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

.)

As is apparent from the chart, a little less than half of the total national debt is owed to the "Federal Reserve and intragovernmental holdings". The foreign and international holders of the debt are also put together from the notes, bills, and bonds sections. To the right is a chart for the data as of June 2008:

Foreign ownership

As of January 2011, foreigners owned $4.45 trillion of U.S. debt, or approximately 47% of the debt held by the public of $9.49 trillion and 32% of the total debt of $14.1 trillion. The largest holders were the central banks of China, Japan, the United Kingdom and Brazil. The share held by foreign governments has grown over time, rising from 13% of the public debt in 1988 to 25% in 2007.As of May 2011 the largest single holder of U.S. government debt was China, with 26 percent of all foreign-held U.S. Treasury securities (8% of total US public debt). China's holdings of government debt, as a percentage of all foreign-held government debt, have decreased a bit over the last year, but are up significantly since 2000 (when China held just 6 percent of all foreign-held U.S. Treasury securities).

This exposure to potential financial or political risk should foreign banks stop buying Treasury securities or start selling them heavily was addressed in a June 2008 report issued by the Bank of International Settlements, which stated, "Foreign investors in U.S. dollar assets have seen big losses measured in dollars, and still bigger ones measured in their own currency. While unlikely, indeed highly improbable for public sector investors, a sudden rush for the exits cannot be ruled out completely."

On May 20, 2007, Kuwait discontinued pegging its currency exclusively to the dollar, preferring to use the dollar in a basket of currencies. Syria made a similar announcement on June 4, 2007. In September 2009 China, India and Russia said they were interested in buying International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

gold to diversify their dollar-denominated securities. However, in July 2010 China's State Administration of Foreign Exchange "ruled out the option of dumping its vast holdings of US Treasury securities" and said gold "cannot become a main channel for investing our foreign exchange reserves" because the market for gold is too small and prices are too volatile.

Forecasting the debt

Tracking current levels of debt is a cumbersome but fairly straightforward process. Making future projections is much more difficult for a number of reasons. For example, before the September 11 attacks in 2001, the George W. Bush administrationGeorge W. Bush administration

The presidency of George W. Bush began on January 20, 2001, when he was inaugurated as the 43rd President of the United States of America. The oldest son of former president George H. W. Bush, George W...

projected in the 2002 budget that there would be a $1.288 trillion surplus from 2001 through 2004.

In the 2005 Mid-Session Review this had changed to a projected four-year deficit of $851 billion, a swing of $2.138 trillion. The latter document states that 49% of this swing was due to "economic and technical re-estimates", 29% was due to "tax relief" (mainly the Bush Tax Cuts

Bush tax cuts

The Bush tax cuts refers to changes to the United States tax code passed during the presidency of George W. Bush and extended during the presidency of Barack Obama that generally lowered tax rates and revised the code specifying taxation in the United States...

), and the remaining 22% was due to "war, homeland, and other enacted legislation" (mainly expenditures for the War on Terror

War on Terror

The War on Terror is a term commonly applied to an international military campaign led by the United States and the United Kingdom with the support of other North Atlantic Treaty Organisation as well as non-NATO countries...

, Iraq War, and homeland security

Homeland security

Homeland security is an umbrella term for security efforts to protect states against terrorist activity. Specifically, is a concerted national effort to prevent terrorist attacks within the U.S., reduce America’s vulnerability to terrorism, and minimize the damage and recover from attacks that do...

).

Projections between different groups will sometimes differ because they make different assumptions. For example, in August 2003, a Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

report projected a $1.4 trillion deficit from 2004 through 2013.

However, a mid-term and long-term joint analysis a month later by the Center on Budget and Policy Priorities

Center on Budget and Policy Priorities

The Center on Budget and Policy Priorities is a non-profit think tank that describes itself as a "policy organization ... working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals."The Center examines the short- and...

, the Committee for Economic Development

Committee for Economic Development

The Committee for Economic Development is an independent, non-profit, non-partisan think tank based in Washington, DC. Its membership consists of some 200 senior corporate executives and university leaders...

, and the Concord Coalition

Concord Coalition

The Concord Coalition is a political advocacy group in the United States, formed in 1992. A bipartisan organization, it was founded by former U.S. Senator Warren Rudman, former Secretary of Commerce Peter George Peterson, and the late U.S. Senator Paul Tsongas. The Concord Coalition's advocacy...

stated that "In projecting deficits, CBO follows mechanical 'baseline' rules that do not allow it to account for the costs of any prospective tax or entitlement legislation, no matter how likely the enactment of such legislation may be." The analysis added in a proposed tax cut extension and Alternative Minimum Tax

Alternative Minimum Tax

The Alternative Minimum Tax is an income tax imposed by the United States federal government on individuals, corporations, estates, and trusts. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold . This exemption is substantially higher than the...

reform (enacted by a 2005 act

Tax Increase Prevention and Reconciliation Act of 2005

The Tax Increase Prevention and Reconciliation Act of 2005 was enacted on May 17, 2006.This bill prevents several tax provisions from sunseting in the near future. The two most notable pieces of the bill are the extension of the reduced tax rates on capital gains and dividends and extension of the...

), prescription drug plan (Medicare Part D

Medicare Part D

Medicare Part D is a federal program to subsidize the costs of prescription drugs for Medicare beneficiaries in the United States. It was enacted as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 and went into effect on January 1, 2006.- Eligibility and...

, enacted in a 2003 act

Medicare Prescription Drug, Improvement, and Modernization Act

The Medicare Prescription Drug, Improvement, and Modernization Act is a federal law of the United States, enacted in 2003. It produced the largest overhaul of Medicare in the public health program's 38-year history.The MMA was signed by President George W...

), and further increases in defense, homeland security, international, and domestic spending. According to the report, this "adjusts CBO's official ten-year projections for more realistic assumptions about the costs of budget policies", raising the projected deficit from $1.4 trillion to $5 trillion.

The Office of Management and Budget forecasts that, by the end of fiscal year 2012, gross federal debt will total $16.3 trillion. Thus, the projected debt will equal 101% of projected gross domestic product, which represents a milestone in the U.S. economy. Public debt alone, which excludes amounts that the government owes its citizens via various trust funds, will be 67% of GDP by the end of fiscal 2012.

Historical analysis of government spending or debt relative to GDP can be misleading, according to the GAO, CBO and Treasury Department. This is because demographic shifts and per-capita spending are causing Social Security and Medicare/Medicaid expenditures to grow significantly faster than GDP. If this trend continues, government simulations under various assumptions project mandatory spending for these programs will exceed taxes dedicated to these programs by more than $40 trillion over the next 75 years on a present value basis.

According to the GAO, this will double debt-to-GDP ratios by 2040 and double them again by 2060, reaching 600% by 2080. A GAO simulation indicates that Social Security, Medicare, and Medicaid expenditures alone will exceed 20% of GDP by 2080, which is approximately the historical ratio of taxes collected by the federal government. In other words, these mandatory programs alone will take up all government revenues under this simulation.

CBO long-term scenarios

The CBO reported during June 2011 two scenarios for how debt held by the public will change during the 2010–2035 time period. The "extended baseline scenario" assumes that the Bush tax cutsBush tax cuts

The Bush tax cuts refers to changes to the United States tax code passed during the presidency of George W. Bush and extended during the presidency of Barack Obama that generally lowered tax rates and revised the code specifying taxation in the United States...

(extended by Obama) will expire per current law in 2012. It also assumes the alternative minimum tax (AMT) will be allowed to affect more middle-class families, reductions in Medicare reimbursement rates to doctors will occur, and that revenues reach 23% GDP by 2035, much higher than the historical average 18%. Under this scenario, government spending on everything other than the major mandatory health care programs, Social Security, and interest on federal debt (activities such as national defense and a wide variety of domestic programs) would decline to the lowest percentage of GDP since before World War II. Under this scenario, public debt rises from 69% GDP in 2011 to 84% by 2035, with interest payments absorbing 4% of GDP vs. 1% in 2011.

CBO estimated in August 2011 that if laws currently "on the books" were enforced without changes, meaning the "extended baseline scenario" described above is implemented along with deficit reductions from the Budget Control Act of 2011

Budget Control Act of 2011

The Budget Control Act of 2011 was passed by the 112th United States Congress signed into law by President Barack Obama. It brought conclusion to the 2011 United States debt ceiling crisis, which had threatened to lead the United States into sovereign default on or about August 3, 2011.The law...

, the deficit would decline from 8.5% GDP in 2011 to around 1% GDP by 2021.

The "alternative fiscal scenario" more closely assumes the continuation of present trends, such as permanently extending the Bush tax cuts, restricting the reach of the AMT, and keeping Medicare reimbursement rates at the current level (the so-called "Doc Fix" versus declining by one-third as mandated under current law.) Revenues are assumed to remain around the historical average 18% GDP. Under this scenario, public debt rises from 69% GDP in 2011 to 100% by 2021 and approaches 190% by 2035.

The CBO reported: "Many budget analysts believe that the alternative fiscal scenario presents a more realistic picture of the nation’s underlying fiscal policies than the extended-baseline scenario does. The explosive path of federal debt under the alternative fiscal scenario underscores the need for large and rapid policy changes to put the nation on a sustainable fiscal course."

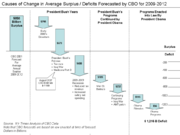

Causes of change in debt

Public debt is the cumulative result of budget deficits; that is, government spending exceeding revenues.2008 vs. 2009

In October 2009, the Congressional Budget OfficeCongressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO) gave the reasons for the higher budget deficit in 2009 ($1,410 billion, i.e. $1.41 trillion) over that of 2008 ($460 billion). The major changes included: declines in tax receipt of $320 billion due to the effects of the recession and another $100 billion due to tax cuts in the stimulus bill (the American Recovery and Reinvestment Act or ARRA); $245 billion for the Troubled Asset Relief Program (TARP) and other bailout efforts; $100 billion in additional spending for ARRA; and another $185 billion due to increases in primary budget categories such as Medicare, Medicaid, unemployment insurance, Social Security, and Defense – including the war effort in Afghanistan and Iraq. This was the highest budget deficit relative to GDP (9.9%) since 1945. The national debt increased by $1.9 trillion during FY2009, versus the $1.0 trillion increase during 2008.

The Obama Administration also made four significant accounting changes to more accurately report the total spending by the federal government. The four changes were:

- accounting for the wars in Iraq and Afghanistan (”overseas military contingencies”) in the budget rather than through the use of supplemental appropriations;

- assuming the Alternative Minimum Tax will be indexed for inflation;

- accounting for the full costs of Medicare reimbursements; and

- anticipating the inevitable expenditures for natural disaster relief.

According to administration officials, these changes will make the debt over ten years look $2.7 trillion larger than it would otherwise appear.

2001 vs. 2009

The 2009 spending level is the highest relative to GDP in 40 years, while the tax receipts are the lowest relative to GDP in 40 years. The next highest spending year was 1985 (22.8%) while the next lowest tax year was 2004 (16.1%).

2001 vs. 2012

The U.S. budget situation has deteriorated significantly since 2001, when the CBO forecast average annual surpluses of approximately $850 billion from 2009–2012. The average deficit forecast in each of those years as of June 2009 was approximately $1,215 billion. The New York Times analyzed this roughly $2 trillion "swing," separating the causes into four major categories along with their share:- Recessions or the business cycle (37%);

- Policies enacted by President Bush (33%);

- Policies enacted by President Bush and supported or extended by President Obama (20%); and

- New policies from President Obama (10%).

CBO data is based only on current law, so policy proposals that have yet to be made law are not included in their analysis. The article states that "President Obama’s agenda ... is responsible for only a sliver of the deficits", but that he "...does not have a realistic plan for reducing the deficit...." Presidents do not, acting alone, have constitutional authority to levy taxes or spend money; all such proposals must originate in Congress, but the President has a veto over new laws, and his priorities influence Congressional action.

Peter Orszag

Peter Ország

Peter Ország is a Slovak ice hockey referee, who referees in the Slovak Extraliga.-Career:He has officiated many international tournaments including the Winter Olympics. He has been named Slovak referee of the year....

, the OMB Director under President Obama, stated in a November 2009 that of the $9 trillion in deficits forecast for the 2010–2019 period, $5 trillion are due to programs from the prior administration, including tax cuts from 2001 and 2003 and the unfunded Medicare Part D. Another $3.5 trillion are due to the financial crisis, including reductions in future tax revenues and additional spending for the social safety net such as unemployment benefits. The remainder are stimulus and bailout programs related to the crisis.

The Pew Center reported in April 2011 the cause of a $12.7 trillion shift in the debt situation, from a 2001 CBO forecast of a cumulative $2.3 trillion surplus by 2011 versus the estimated $10.4 trillion public debt we actually face in 2011. The major drivers were:

- Revenue declines due to the recession, separate from the Bush tax cuts of 2001 and 2003: 28%

- Defense spending increases: 15%

- Bush tax cuts of 2001 and 2003: 13%

- Increases in net interest: 11%

- Other non-defense spending: 10%

- Other tax cuts: 8%

- Obama Stimulus: 6%

- Medicare Part D: 2%

- Other reasons: 7%

Risks to the U.S. dollar and economy

A high debt level may affect inflation, interest rates, and economic growth. A variety of factors are placing increasing pressure on the value of the U.S. dollar, increasing the risk of devaluation or inflation and encouraging challenges to dollar's role as the world's reserve currencyReserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

. If another currency or basket of currencies replaced the dollar as the reserve currency, the U.S. would face higher interest rates to attract capital, reducing economic growth for the long-term. The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

wrote in May 2009:

The Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

(GAO), the federal government's auditor, argues that the U.S. is on a fiscally "unsustainable" path and that politicians and the electorate have been unwilling to change this path. The 2010 U.S. budget prepared by the President indicated annual debt increases of nearly $1 trillion annually through 2019, projecting the total U.S. national debt to grow to $23.3 trillion by 2019. Further, the subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

has significantly increased the financial burden on the U.S. government, with over $10 trillion in commitments or guarantees and $2.6 trillion in investments or expenditures as of May 2009, only some of which are included in the budget document.

Identity (mathematics)

In mathematics, the term identity has several different important meanings:*An identity is a relation which is tautologically true. This means that whatever the number or value may be, the answer stays the same. For example, algebraically, this occurs if an equation is satisfied for all values of...

requires that a country (such as the USA) running a current account

Current account

In economics, the current account is one of the two primary components of the balance of payments, the other being the capital account. The current account is the sum of the balance of trade , net factor income and net transfer payments .The current account balance is one of two major...

deficit also have a capital account

Capital account

The current and capital accounts make up a country's balance of payment . Together these three accounts tell a story about the state of an economy, its economic outlook and its strategies for achieving its desired goals...

(investment) surplus of the same amount. In 2005, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

addressed the implications of the USA's high and rising current account

Current account

In economics, the current account is one of the two primary components of the balance of payments, the other being the capital account. The current account is the sum of the balance of trade , net factor income and net transfer payments .The current account balance is one of two major...

(trade) deficit, resulting from USA imports exceeding its exports. Between 1996 and 2004, the USA current account deficit increased by $650 billion, from 1.5% to 5.8% of GDP.

Debt levels may also affect economic growth rates. Economists Kenneth Rogoff

Kenneth Rogoff

Kenneth Saul "Ken" Rogoff is currently the Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard University. He is also a chess Grandmaster.-Early life:...

and Carmen Reinhart

Carmen Reinhart

-External links:*...

reported in 2010 that among the 20 advanced countries studied, average annual GDP growth was 3–4% when debt was relatively moderate or low (i.e. under 60% of GDP), but it dips to just 1.6% when debt was high (i.e., above 90% of GDP).

The CBO reported several types of risk factors related to rising debt levels in a July 2010 publication:

- A growing portion of savings would go towards purchases of government debt, rather than investments in productive capital goods such as factories and computers, leading to lower output and incomes than would otherwise occur;

- If higher marginal tax rates were used to pay rising interest costs, savings would be reduced and work would be discouraged;

- Rising interest costs would force reductions in important government programs;

- Restrictions to the ability of policymakers to use fiscal policy to respond to economic challenges; and

- An increased risk of a sudden fiscal crisis, in which investors demand higher interest rates.

Rollover and maturity risks

In addition to the debt increase required to fund government spending in excess of tax revenues during a given year, some Treasury securities issued in prior years mature and must be "rolled-over" or replaced with new security issuance. During the financial crisis, the Treasury issued a sizable amount of relatively shorter-term debt, which caused the average maturity on total Treasury debt to reach a 25-year low of just more than 50 months in 2009. As of late 2009, roughly 43% of U.S. public debt needed to be rolled over within 12 months, the highest proportion since the mid-1980s. The relatively short maturity of outstanding Treasury debt, coupled with the increased reliance on foreign creditors, puts the U.S. at greater risk of sharply higher borrowing costs should risk perceptions change abruptly in credit markets.Long-term risks to financial health of federal government

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

(GAO), the Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department. These agencies have reported that the federal government is facing a series of critical long-term financing challenges. This is because expenditures related to entitlement programs such as Social Security

Social Security debate (United States)

This article concerns proposals to change the Social Security system in the United States. Social Security is a social insurance program officially called "Old-Age, Survivors, and Disability Insurance" , in reference to its three components. It is primarily funded through a dedicated payroll tax...

, Medicare

Medicare (United States)

Medicare is a social insurance program administered by the United States government, providing health insurance coverage to people who are aged 65 and over; to those who are under 65 and are permanently physically disabled or who have a congenital physical disability; or to those who meet other...

, and Medicaid

Medicaid

Medicaid is the United States health program for certain people and families with low incomes and resources. It is a means-tested program that is jointly funded by the state and federal governments, and is managed by the states. People served by Medicaid are U.S. citizens or legal permanent...

are growing considerably faster than the economy overall, as the population grows older.

These agencies have indicated that under current law, sometime between 2030 and 2040, mandatory spending (primarily Social Security, Medicare, Medicaid, and interest on the national debt) will exceed tax revenue. In other words, all "discretionary" spending (e.g., defense, homeland security, law enforcement, education, etc.) will require borrowing and related deficit spending. These agencies have used such language as "unsustainable" and "trainwreck" to describe such a future.

While there is significant debate about solutions, the significant long-term risk posed by the increase in entitlement spending is widely recognized, with health care costs (Medicare and Medicaid) the primary risk category. In a June 2010 opinion piece in the Wall Street Journal, former chairman of the Federal Reserve, Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

noted that "Only politically toxic cuts or rationing of medical care, a marked rise in the eligible age for health and retirement benefits, or significant inflation, can close the deficit." If significant reforms are not undertaken, benefits under entitlement programs will exceed government income by over $40 trillion over the next 75 years. According to the GAO, this will cause debt ratios relative to GDP to double by 2040 and double again by 2060, reaching 600 percent by 2080.

In 2006, Professor Laurence Kotlikoff

Laurence Kotlikoff

Laurence Jacob Kotlikoff is a William Warren FairField Professor at Boston University, a Professor of Economics at Boston University, a Fellow of the American Academy of Arts and Sciences, a Research Associate of the National Bureau of Economic Research, a Fellow of the Econometric Society, a...

argued the United States must eventually choose between "bankruptcy", raising taxes, or cutting payouts. He assumes there will be ever-growing payment obligations from Medicare and Medicaid. Others who have attempted to bring this issue to the fore of America's attention range from Ross Perot

Ross Perot

Henry Ross Perot is a U.S. businessman best known for running for President of the United States in 1992 and 1996. Perot founded Electronic Data Systems in 1962, sold the company to General Motors in 1984, and founded Perot Systems in 1988...

in his 1992 Presidential bid, to motivational speaker Robert Kiyosaki

Robert Kiyosaki

Robert Toru Kiyosaki, born April 8, 1947) is an American investor, businessman, self-help author and motivational speaker. Kiyosaki is best known for his Rich Dad Poor Dad series of motivational books and other material published under the Rich Dad brand. He has written 15 books which have combined...

, and David Walker, former head of the Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

.

Thomas Friedman

Thomas Friedman

Thomas Lauren Friedman is an American journalist, columnist and author. He writes a twice-weekly column for The New York Times. He has written extensively on foreign affairs including global trade, the Middle East, and environmental issues and has won the Pulitzer Prize three times.-Personal...

has argued that increasing dependence on foreign sources of funding will render the U.S. less able to act independently.

Moody's Investors Service

Moody's

Moody's Corporation is the holding company for Moody's Analytics and Moody's Investors Service, a credit rating agency which performs international financial research and analysis on commercial and government entities. The company also ranks the credit-worthiness of borrowers using a standardized...

warned in March 2010 that the United States' AAA-rated U.S Treasury bonds, while currently not in danger, could be downgraded in the future if the U.S. government failed to rein in public debt, saying that growing the economy cannot be the only solution.

There is a significant difference between the reported budget deficit and the change in debt. The key differences are: 1) The Social Security surplus, which reduces the "off-budget" deficit often reported in the media; and 2) Non-budgeted spending, such as for the Iraq and Afghanistan wars. The debt increased by approximately $550 billion on average each year during the 2003–2007 period, but then increased over $1 trillion during FY 2008.

The cumulative debt of the United States in the past eight completed fiscal years was approximately $4.3 trillion, or about 43% of the total national debt of ~$10.0 trillion as of September 2008.

Interest expense

During FY2008, the government also accrued a non-cash interest expense of $212 billion for intra-governmental debt, primarily the Social Security Trust Fund, for a total interest expense of $454 billion. This accrued interest is added to the Social Security Trust Fund and therefore the national debt each year and will be paid to Social Security recipients in the future.

Public debt owned by foreigners has increased to approximately 50% of the total or approximately $3.4 trillion. As a result, nearly 50% of the interest payments are now leaving the country, which is different from past years when interest was paid to U.S. citizens holding the public debt. Interest expenses are projected to grow dramatically as the U.S. debt increases and interest rates rise from very low levels in 2009 to more typical historical levels. CBO estimates that nearly half of the debt increases over the 2009–2019 period will be due to interest.

Should interest rates return to historical averages, the interest cost would increase dramatically. Historian Niall Ferguson

Niall Ferguson

Niall Campbell Douglas Ferguson is a British historian. His specialty is financial and economic history, particularly hyperinflation and the bond markets, as well as the history of colonialism.....

described the risk that foreign investors would demand higher interest rates as the U.S. debt levels increase over time in a November 2009 interview.

Monitoring the risks of increasing debt levels

Various financial indicators may provide an early warning that market forces are reacting to an increasing level of debt. Examples include Treasury security interest rates (yields), Treasury auction results, credit default swap spreads, and TIPS spreads.- Treasury note yields: A rising yield for a security of a given maturity could indicate lower demand for Treasury bonds among investors, or nervousness about future rates of inflation. The "yield curve" (a graph that relates the yields of similar securities of different maturities) provides similar information.

- Treasury auctions: The ease with which new securities can be sold reflects the demand for them. For example, a difference between the interest rate that debt trades prior to auction and the yield required to clear the market at auction is called the "tail." A large auction “tail” would be a sign of declining interest from the market. The Treasury also reports the bid-to-cover ratio for each auction, which is the number of market bids received relative to the number of bids accepted and the ratio of international buyers.

- Credit default swapCredit default swapA credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default...

(CDS) spreads: CDS are insurance-like derivative products that offer protection against bond defaults. CDS spreads essentially measure the current market price of insurance against default. When the market perceives a bond is at an increased risk of default, the CDS written on those bonds will increase in price. - TIPS spreads: A key measure of inflation expectations among U.S. bond market investors is the difference between the yield on nominal Treasury bonds and the yield for Treasury inflation-protected securities, or “TIPS.” This difference is a gauge of investors’ beliefs about future U.S. inflation rates. A growing spread between nominal Treasuries and TIPS would indicate that investors are concerned that U.S. fiscal and monetary policy could lead to higher inflation in the future.

In April 2011, rating agency Standard & Poor's (S&P) issued a "negative" outlook on the U.S. "AAA" (highest quality) debt rating for the first time since the rating agency began in 1860, indicating there is a one in three chance of an outright reduction in the rating over the next two years. According to S&P, meaningful progress towards balancing the budget would be required to move the U.S. back to a "stable" outlook. Losing the AAA rating would likely mean higher interest rates and the sale of treasury bonds by entities required to hold AAA securities. The S&P press release stated: "We believe there is a material risk that U.S. policymakers might not reach an agreement on how to address medium- and long-term budgetary challenges by 2013; if an agreement is not reached and meaningful implementation is not begun by then, this would in our view render the U.S. fiscal profile meaningfully weaker than that of peer 'AAA' sovereigns." In June, Moody's

Moody's

Moody's Corporation is the holding company for Moody's Analytics and Moody's Investors Service, a credit rating agency which performs international financial research and analysis on commercial and government entities. The company also ranks the credit-worthiness of borrowers using a standardized...

followed suit, warning that if Congress did not quickly raise the debt ceiling above $14.3 trillion, the agency might reduce the debt rating. Moody's also commented on the political process, warning that the heightened polarization on both sides increased the risk of a default. However, on August 5, 2011, S&P made the decision to give a first-ever downgrade to U.S. sovereign debt, lowering the rating one notch to a "AA+" rating, with a negative outlook. S&P stated that "[w]e lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an

agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process."

Is there a "danger level" of debt?

Economists debate the level of debt relative to GDP that signals a "red line" or dangerous level, or if any such level exists. In January 2010, Economists Kenneth RogoffKenneth Rogoff

Kenneth Saul "Ken" Rogoff is currently the Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard University. He is also a chess Grandmaster.-Early life:...

and Carmen Reinhart

Carmen Reinhart

-External links:*...

stated that 90% of GDP might be an indicative danger level. Reinhart testified to the U.S. Senate in February 2010, stating:

Our main finding is that across both advanced countries and emerging markets, high debt/GDP levels (90 percent and above) are associated with notably lower growth outcomes. Above 90 percent, median growth rates fall one percent, and average growth falls considerably more. In addition, for emerging markets, there appears to be a more stringent threshold for total external debt/GDP; when external debt reaches 60 percent of GDP, annual growth declines by about two percent and for higher levels, growth rates are roughly cut in half. Seldom do countries simply 'grow' their way out of deep debt burdens.

Economist Paul Krugman

Paul Krugman

Paul Robin Krugman is an American economist, professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor at the London School of Economics, and an op-ed columnist for The New York Times...

disputes the existence of a solid debt threshold or danger level, arguing that low growth causes high debt rather than the other way around. He also points out that in Europe, Japan, and the US this has been the case. In the US the only period of debt over 90% of GDP was after World War II "when real GDP was falling."

Fed Chair Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

stated in April 2010:

Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.

Measure of public debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President's Fiscal Reform Commission that gross debt is the appropriate measure. (Gross debt includes government debt held by government institutions, such as the Federal Reserve and the Social Security trust fund.) Certain members of the Commission are focusing on gross debt. The Center on Budget and Policy PrioritiesCenter on Budget and Policy Priorities

The Center on Budget and Policy Priorities is a non-profit think tank that describes itself as a "policy organization ... working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals."The Center examines the short- and...

(CBPP) cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.

Intragovernmental debt

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. A significant portion of the intragovernmental debt is the $2.6 trillion Social Security Trust Fund.For example, the CBPP argues:

Debt held by the public is important because it reflects the extent to which the government goes into private credit markets to borrow. Such borrowing draws on private national saving and international saving, and therefore competes with investment in the nongovernmental sector (for factories and equipment, research and development, housing, and so forth). Large increases in such borrowing can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans’ income. By contrast, intragovernmental debt (the other component of the gross debt) has no such effects because it is simply money the federal government owes (and pays interest on) to itself.

If the U.S. continues to run "on budget" deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds (i.e., debt held by the public) to pay for the projected shortfall in the Social Security program. This will result in "debt held by the public" replacing "intragovernmental debt" to the extent of the Social Security Trust Fund during the period the Trust Fund is liquidated, which is expected to occur between 2015 and the mid-2030s. This replacement of intragovernmental debt with debt held by the public would not occur if: a) The U.S. runs on-budget surpluses sufficient to offset "off-budget" deficits in the Social Security program; or b) Social Security is reformed to maintain an off-budget surplus.

National debt for selected years

| End of Fiscal Year |

Gross Debt in $Billions undeflated Treas. |

Gross Debt in $Billions undeflated OMB |

as % of GDP Low-High est. or a – Treas. audit |

Debt Held By Public ($Billions) |

as % of GDP (Treas/MW, OMB or Treas/BEA) |

GDP $Billions OMB/BEA est.=MW.com |

|---|---|---|---|---|---|---|

| 1910 | 2.653 | 8.0 | 2.653 | 8.0 | est. 32.8 | |

| 1920 | 25.95 | 29.2 | 25.95 | 29.2 | est. 88.6 | |

| 1927 | 18.51 | 19.2 | 18.51 | 19.2 | est. 96.5 | |

| 1930 | 16.19 | 16.6 | 16.19 | 16.6 | est. 97.4 | |

| 1940 | 42.97 | 50.70 | 44.4–52.4 | 42.97 | 42.1 | 96.8/ |

| 1950 | 257.3 | 256.9 | 91.2–94.2 | 219.0 | 80.2 | 273.1/281.7 |

| 1960 | 286.3 | 290.5 | 54.6–56.0 | 236.8 | 45.6 | 518.9/523.9 |

| 1970 | 370.9 | 380.9 | 36.2–37.6 | 283.2 | 28.0 | 1,013/1,026 |

| 1980 | 907.7 | 909.0 | 33.4 | 711.9 | 26.1 | 2,724 |

| 1990 | 3,233 | 3,206 | 56.0–56.4 | 2,412 | 42.1 | 5,735 |

| 2000 | (a1)5,674 | 5,629 | a57.6 | 3,410 | 34.7 | 9,821 |

| 2001 | (a2)5,807 | 5,770 | a56.6 | 3,320 | 32.5 | 10,225 |

| 2002 | (a3)6,228 | 6,198 | a59.0 | 3,540 | 33.6 | 10,544 |

| 2003 | (a)6,783 | 6,760 | a61.8 | 3,913 | 35.6 | 10,980 |

| 2004 | (a)7,379 | 7,355 | a63.2 | 4,296 | 36.8 | 11,686 |

| 2005 | (a4)7,933 | 7,905 | a63.6 | 4,592 | 36.9 | 12,446 |

| 2006 | (a5)8,507 | 8,451 | a64.0 | 4,829 | 36.5 | 13,255 |

| 2007 | (a6)9,008 | 8,951 | a64.8 | 5,035 | 36.2 | 13,896 |

| 2008 | (a7)10,025 | 9,986 | a69.6 | 5,803 | 40.2 | 14,394 |

| 2009 | (a8)11,910 | 11,876 | a~84.4 | 7,552 | 53.6 | ~14,098 |

| 2010 | (a9)13,562 | 13,529 | a~93.4 | 9,023 | 62.2 | ~14,508/14,512 |

Fiscal years 1940–2009 GDP figures are derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 1950–2010 GDP measurements are derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. The two measures in Fiscal Years 1980, 1990 and 2000–2009 diverge only slightly.