2010 United States federal budget

Encyclopedia

The United States Federal Budget for Fiscal Year 2010, titled A New Era of Responsibility: Renewing America's Promise, is a spending request

by President

Barack Obama

to fund government operations for October 2009–September 2010. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 2010, which must be authorized by Congress

.

The subsequent 2010 Financial Report of the United States Government, reporting on the implementation of the 2010 non-Congressionally approved Budget, shows a net operating cost of $2,080 billion, although since this includes accounting provisions

(estimates of future liabilities), the cash

rather than accruals deficit is $1,294 billion. According to the Government Accountability Office

, the 'accrual deficit

provides more information on the longer-term implications of the government's annual operations'. Gross costs rose 20% from $3,736 billion in 2009 to $4,472 billion ($3,552 billion budgeted), while total taxes and other revenues rose 1% from $2,198 billion to $2,217 billion. The Government Accountability Office

was unable to provide an audit opinion on the 2010 financial statements due to 'widespread material internal control weaknesses, significant uncertainties, and other limitations', although it noted that significant progress had been made. The GAO cited as the principal obstacle to its provision of an audit opinion 'serious financial management problems at the Department of Defense

that made its financial statements unauditable'. The GAO identified during its audit

work an estimated $125.4 billion of 'improper payments'. Thirteen of the twenty-four Government Agency Heads either qualified or withheld their assurance statements.

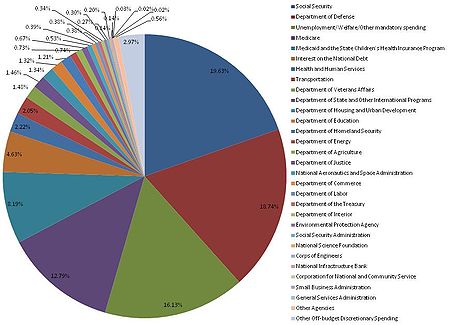

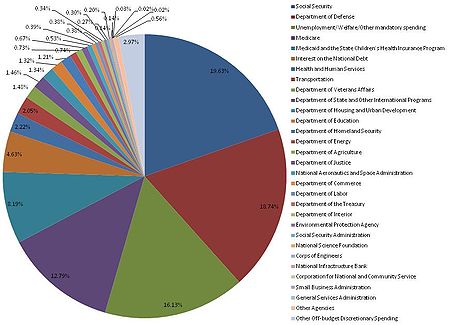

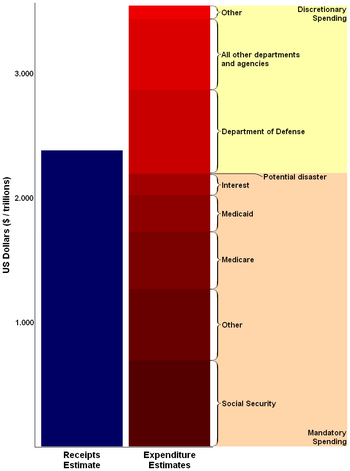

The President's budget request for 2010 totals $3.55 trillion. Percentages in parentheses indicate percentage change compared to 2009. This budget request is broken down by the following expenditures:

The 2009 budget deficit would represent 12.3% of gross domestic product, the largest share since World War II.

projects significant debt increases. A $220 billion increase from the already significant budget shortfall inherited at $1.2 trillion in 2009 from the GW Bush Administration.

The high level of debt and continuing large trade deficits have raised concerns regarding inflation and the value of the dollar relative to other currencies, as well as its place as the primary reserve currency

. The Economist

wrote in May 2009: "Having spent a fortune bailing out their banks, Western governments will have to pay a price in terms of higher taxes to meet the interest on that debt. In the case of countries (like Britain and America) that have trade as well as budget deficits, those higher taxes will be needed to meet the claims of foreign creditors. Given the political implications of such austerity, the temptation will be to default by stealth, by letting their currencies depreciate. Investors are increasingly alive to this danger..."

The U.S. budget situation has deteriorated significantly since 2001, when the Congressional Budget Office

The U.S. budget situation has deteriorated significantly since 2001, when the Congressional Budget Office

(CBO) forecast average annual surpluses of approximately $850 billion from 2009–2012. The average deficit forecast in each of those years is now approximately $1.215 trillion.

CBO data is based only on current law, so policy proposals that have yet to be made law are not included in their analysis.

United States federal budget

The Budget of the United States Government is the President's proposal to the U.S. Congress which recommends funding levels for the next fiscal year, beginning October 1. Congressional decisions are governed by rules and legislation regarding the federal budget process...

by President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

Barack Obama

Barack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

to fund government operations for October 2009–September 2010. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 2010, which must be authorized by Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

.

The subsequent 2010 Financial Report of the United States Government, reporting on the implementation of the 2010 non-Congressionally approved Budget, shows a net operating cost of $2,080 billion, although since this includes accounting provisions

Provision (accounting)

In financial accounting, provision is a word that creates an ambiguous account title. In U.S. GAAP, provision means an expense, while in IFRS, International Financial Reporting Standards, it means a liability. So, in the U.S., Provision for Income Taxes means the same thing as Income Tax Expense,...

(estimates of future liabilities), the cash

Comparison of Cash Method and Accrual Method of accounting

The two primary accounting methods of the cash and the accruals basis are used to calculate US public debt, as well as taxable income for U.S. federal income taxes and other income taxes...

rather than accruals deficit is $1,294 billion. According to the Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

, the 'accrual deficit

United States public debt

The United States public debt is the money borrowed by the federal government of the United States at any one time through the issue of securities by the Treasury and other federal government agencies...

provides more information on the longer-term implications of the government's annual operations'. Gross costs rose 20% from $3,736 billion in 2009 to $4,472 billion ($3,552 billion budgeted), while total taxes and other revenues rose 1% from $2,198 billion to $2,217 billion. The Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

was unable to provide an audit opinion on the 2010 financial statements due to 'widespread material internal control weaknesses, significant uncertainties, and other limitations', although it noted that significant progress had been made. The GAO cited as the principal obstacle to its provision of an audit opinion 'serious financial management problems at the Department of Defense

United States Department of Defense

The United States Department of Defense is the U.S...

that made its financial statements unauditable'. The GAO identified during its audit

Audit

The general definition of an audit is an evaluation of a person, organization, system, process, enterprise, project or product. The term most commonly refers to audits in accounting, but similar concepts also exist in project management, quality management, and energy conservation.- Accounting...

work an estimated $125.4 billion of 'improper payments'. Thirteen of the twenty-four Government Agency Heads either qualified or withheld their assurance statements.

Total spending

The President's budget request for 2010 totals $3.55 trillion. Percentages in parentheses indicate percentage change compared to 2009. This budget request is broken down by the following expenditures:

- Mandatory spending: $2.173 trillion (+14.9%)

- $695 billion (+4.9%) – Social SecuritySocial Security (United States)In the United States, Social Security refers to the federal Old-Age, Survivors, and Disability Insurance program.The original Social Security Act and the current version of the Act, as amended encompass several social welfare and social insurance programs...

- $571 billion (+58.6%) – Unemployment/Welfare/Other mandatory spending

- $453 billion (+6.6%) – MedicareMedicare (United States)Medicare is a social insurance program administered by the United States government, providing health insurance coverage to people who are aged 65 and over; to those who are under 65 and are permanently physically disabled or who have a congenital physical disability; or to those who meet other...

- $290 billion (+12.0%) – MedicaidMedicaidMedicaid is the United States health program for certain people and families with low incomes and resources. It is a means-tested program that is jointly funded by the state and federal governments, and is managed by the states. People served by Medicaid are U.S. citizens or legal permanent...

- $164 billion (+18.0%) – Interest on National Debt

- $695 billion (+4.9%) – Social Security

- Discretionary spending: $1.378 trillion (+13.8%)

- $663.7 billion (+12.7%) – Department of DefenseUnited States Department of DefenseThe United States Department of Defense is the U.S...

(including Overseas Contingency OperationsWar on TerrorThe War on Terror is a term commonly applied to an international military campaign led by the United States and the United Kingdom with the support of other North Atlantic Treaty Organisation as well as non-NATO countries...

) - $78.7 billion (−1.7%) – Department of Health and Human ServicesUnited States Department of Health and Human ServicesThe United States Department of Health and Human Services is a Cabinet department of the United States government with the goal of protecting the health of all Americans and providing essential human services. Its motto is "Improving the health, safety, and well-being of America"...

- $72.5 billion (+2.8%) – Department of TransportationUnited States Department of TransportationThe United States Department of Transportation is a federal Cabinet department of the United States government concerned with transportation. It was established by an act of Congress on October 15, 1966, and began operation on April 1, 1967...

- $52.5 billion (+10.3%) – Department of Veterans AffairsUnited States Department of Veterans AffairsThe United States Department of Veterans Affairs is a government-run military veteran benefit system with Cabinet-level status. It is the United States government’s second largest department, after the United States Department of Defense...

- $51.7 billion (+40.9%) – Department of StateUnited States Department of StateThe United States Department of State , is the United States federal executive department responsible for international relations of the United States, equivalent to the foreign ministries of other countries...

and Other International Programs - $47.5 billion (+18.5%) – Department of Housing and Urban DevelopmentUnited States Department of Housing and Urban DevelopmentThe United States Department of Housing and Urban Development, also known as HUD, is a Cabinet department in the Executive branch of the United States federal government...

- $46.7 billion (+12.8%) – Department of EducationUnited States Department of EducationThe United States Department of Education, also referred to as ED or the ED for Education Department, is a Cabinet-level department of the United States government...

- $42.7 billion (+1.2%) – Department of Homeland SecurityUnited States Department of Homeland SecurityThe United States Department of Homeland Security is a cabinet department of the United States federal government, created in response to the September 11 attacks, and with the primary responsibilities of protecting the territory of the United States and protectorates from and responding to...

- $26.3 billion (−0.4%) – Department of EnergyUnited States Department of EnergyThe United States Department of Energy is a Cabinet-level department of the United States government concerned with the United States' policies regarding energy and safety in handling nuclear material...

- $26.0 billion (+8.8%) – Department of AgricultureUnited States Department of AgricultureThe United States Department of Agriculture is the United States federal executive department responsible for developing and executing U.S. federal government policy on farming, agriculture, and food...

- $23.9 billion (−6.3%) – Department of JusticeUnited States Department of JusticeThe United States Department of Justice , is the United States federal executive department responsible for the enforcement of the law and administration of justice, equivalent to the justice or interior ministries of other countries.The Department is led by the Attorney General, who is nominated...

- $18.7 billion (+5.1%) – National Aeronautics and Space Administration

- $13.8 billion (+48.4%) – Department of CommerceUnited States Department of CommerceThe United States Department of Commerce is the Cabinet department of the United States government concerned with promoting economic growth. It was originally created as the United States Department of Commerce and Labor on February 14, 1903...

- $13.3 billion (+4.7%) – Department of LaborUnited States Department of LaborThe United States Department of Labor is a Cabinet department of the United States government responsible for occupational safety, wage and hour standards, unemployment insurance benefits, re-employment services, and some economic statistics. Many U.S. states also have such departments. The...

- $13.3 billion (+4.7%) – Department of the TreasuryUnited States Department of the TreasuryThe Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

- $12.0 billion (+6.2%) – Department of the InteriorUnited States Department of the InteriorThe United States Department of the Interior is the United States federal executive department of the U.S. government responsible for the management and conservation of most federal land and natural resources, and the administration of programs relating to Native Americans, Alaska Natives, Native...

- $10.5 billion (+34.6%) – Environmental Protection AgencyUnited States Environmental Protection AgencyThe U.S. Environmental Protection Agency is an agency of the federal government of the United States charged with protecting human health and the environment, by writing and enforcing regulations based on laws passed by Congress...

- $9.7 billion (+10.2%) – Social Security AdministrationSocial Security AdministrationThe United States Social Security Administration is an independent agency of the United States federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits...

- $7.0 billion (+1.4%) – National Science Foundation

- $5.1 billion (−3.8%) – Corps of EngineersUnited States Army Corps of EngineersThe United States Army Corps of Engineers is a federal agency and a major Army command made up of some 38,000 civilian and military personnel, making it the world's largest public engineering, design and construction management agency...

- $5.0 billion (+100%-NA) – National Infrastructure BankNational Infrastructure Reinvestment BankThe creation of a National Infrastructure Reinvestment Bank was first proposed by United States Senator Christopher J. Dodd and Senator Chuck Hagel in 2007...

- $1000.1 million (+22.2%) – Corporation for National and Community ServiceCorporation For National and Community ServiceThe Corporation for National and Community Service is a federal agency that engages more than five million Americans in service through Senior Corps, AmeriCorps, and Learn and Serve America, and other national service initiatives...

- $0.7 billion (0.0%) – Small Business Administration

- $0.6 billion (−14.3%) – General Services Administration

- $0 billion (−100%-NA) – Troubled Asset Relief Program (TARP)

- $0 billion (−100%-NA) – Financial stabilization efforts

- $11 billion (+275%-NA) – Potential disaster costs

- $19.8 billion (+3.7%) – Other Agencies

- $105 billion – Other

- $663.7 billion (+12.7%) – Department of Defense

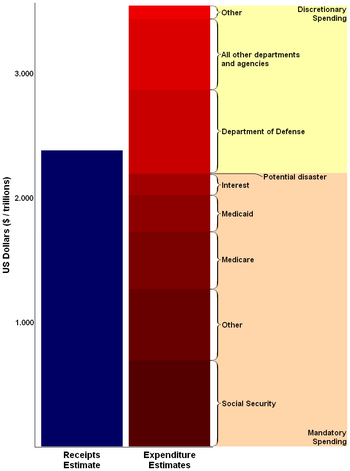

Deficit

The total salary for fiscal year 2010 was $1.17 trillion.The 2009 budget deficit would represent 12.3% of gross domestic product, the largest share since World War II.

Debt increases

The 2010 Budget proposed by President Barack ObamaBarack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

projects significant debt increases. A $220 billion increase from the already significant budget shortfall inherited at $1.2 trillion in 2009 from the GW Bush Administration.

The high level of debt and continuing large trade deficits have raised concerns regarding inflation and the value of the dollar relative to other currencies, as well as its place as the primary reserve currency

Reserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

. The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

wrote in May 2009: "Having spent a fortune bailing out their banks, Western governments will have to pay a price in terms of higher taxes to meet the interest on that debt. In the case of countries (like Britain and America) that have trade as well as budget deficits, those higher taxes will be needed to meet the claims of foreign creditors. Given the political implications of such austerity, the temptation will be to default by stealth, by letting their currencies depreciate. Investors are increasingly alive to this danger..."

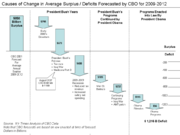

Causes of change in CBO forecasts

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO) forecast average annual surpluses of approximately $850 billion from 2009–2012. The average deficit forecast in each of those years is now approximately $1.215 trillion.

CBO data is based only on current law, so policy proposals that have yet to be made law are not included in their analysis.

External links

- Office of Management and Budget

- Proposed FY 2010 Budget

- Remarks by the President on the Fiscal Year 2010 Budget.

- Gale & Auerbach (Brookings) – Analysis of 2010 Budget

- Budget Proposal and Markups Presidential Proposal and Congressional Documents in convenient form. Senate Version w/ McCain Amendment