Georgism

Encyclopedia

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

and ideology

Ideology

An ideology is a set of ideas that constitutes one's goals, expectations, and actions. An ideology can be thought of as a comprehensive vision, as a way of looking at things , as in common sense and several philosophical tendencies , or a set of ideas proposed by the dominant class of a society to...

that holds that people own what they create, but that things found in nature, most importantly land

Land (economics)

In economics, land comprises all naturally occurring resources whose supply is inherently fixed. Examples are any and all particular geographical locations, mineral deposits, and even geostationary orbit locations and portions of the electromagnetic spectrum. Natural resources are fundamental to...

, belong equally to all. The Georgist philosophy is based on the writings of the economist Henry George

Henry George

Henry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

(1839–1897), and is usually associated with the idea of a single tax on the value of land. Georgists argue that a tax on land value

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

is economically efficient, fair

Justice

Justice is a concept of moral rightness based on ethics, rationality, law, natural law, religion, or equity, along with the punishment of the breach of said ethics; justice is the act of being just and/or fair.-Concept of justice:...

and equitable

Equity (economics)

Equity is the concept or idea of fairness in economics, particularly as to taxation or welfare economics. More specifically it may refer to equal life chances regardless of identity, to provide all citizens with a basic minimum of income/goods/services or to increase funds and commitment for...

; and that it can generate sufficient revenue so that other taxes, which are less fair and efficient (such as taxes on production, sales and income), can be reduced or eliminated. A tax on land value has been described by many as a progressive tax, since it would be paid primarily by the wealthy, and would reduce income inequality.

Main tenets

Henry George is best known for his argument that the economic rentEconomic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

of land should be shared equally by the people of a society rather than being owned privately. George held that people own what they create, but that things found in nature, most importantly land

Land (economics)

In economics, land comprises all naturally occurring resources whose supply is inherently fixed. Examples are any and all particular geographical locations, mineral deposits, and even geostationary orbit locations and portions of the electromagnetic spectrum. Natural resources are fundamental to...

, belongs equally to all. George believed that although scientific experiments could not be carried out in political economy, theories could be tested by comparing different societies with different conditions and through thought experiments about the effects of various factors. Applying this method, George concluded that many of the problems that beset society, such as poverty, inequality, and economic booms and busts, could be attributed to the private ownership of the necessary resource, land.

In his publication Progress and Poverty

Progress and Poverty

Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy was written by Henry George in 1879...

George argued that: "We must make land common property." Although this could be done by nationalizing land and then leasing it to private parties, George preferred taxing unimproved land value

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

. A land value tax would not penalize those had already bought and improved land, and would also be less disruptive and controversial in a country where land titles have already been granted.

It was Adam Smith who first noted the properties of a land value tax in his book, The Wealth of Nations

The Wealth of Nations

An Inquiry into the Nature and Causes of the Wealth of Nations, generally referred to by its shortened title The Wealth of Nations, is the magnum opus of the Scottish economist and moral philosopher Adam Smith...

:

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

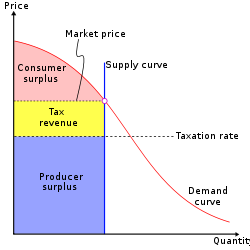

theory suggests that a land value tax

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

would be extremely efficient – unlike other taxes, it does not reduce economic productivity. Nobel laureate Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

agreed that Henry George's land value tax is potentially beneficial for society since, unlike other taxes, it would not impose an excess burden on economic activity (leading to "deadweight loss

Deadweight loss

In economics, a deadweight loss is a loss of economic efficiency that can occur when equilibrium for a good or service is not Pareto optimal...

"). A replacement of other more distortionary taxes with a land value tax would thus improve economic welfare.

Georgists suggest two uses for the revenue from a land value tax. The revenue can be used to fund the state, or it can be redistributed to citizens as a pension or basic income

Basic income

A basic income guarantee is a proposed system of social security, that regularly provides each citizen with a sum of money. In contrast to income redistribution between nations themselves, the phrase basic income defines payments to individuals rather than households, groups, or nations, in order...

(or it can be divided between these two options). If the first option were to be chosen, the state could avoid having to tax any other type of income or economic activity. In practice, the elimination of all other taxes implies a very high land value tax, higher than any currently existing land tax. Introducing a high land value tax would cause the price of land titles to decrease correspondingly, but George did not believe landowners should be compensated, and described the issue as being analogous to compensation for former slave owners. Additionally, a land value tax would be a tax of wealth

Wealth tax

A wealth tax is generally conceived of as a levy based on the aggregate value of all household holdings actually accumulated as purchasing power stock , including owner-occupied housing; cash, bank deposits, money funds, and savings in insurance and pension plans; investment in real estate and...

, and so would be a form of progressive taxation and tend to reduce income inequality. As such, a defining argument for Georgism is that it taxes wealth in a progressive

Progressive

Progressive is an adjectival form of progress and may refer to:-Politics:* Progressivism, a political ideology* Progressive Era, a period of reform in the United States Progressive is an adjectival form of progress and may refer to:-Politics:* Progressivism, a political ideology* Progressive Era, a...

manner, reducing inequality, and yet it also reduces the strain on businesses and productivity.

Georgists also argue that all economic rent

Economic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

(i.e., unearned income

Unearned income

Unearned income is a term in economics that has different meanings and implications depending on the theoretical frame. To classical economists, with their emphasis on dynamic competition, income not subject to competition are “rents” or unearned income, such as incomes attributable to...

) collected from natural resources (land, mineral extraction, the broadcast spectrum, tradable emission permits, fishing quotas, airway corridor use, space orbits, etc.) and extraordinary returns from natural monopolies should accrue to the community rather than a private owner, and that no other taxes or burdensome economic regulations should be levied. Modern environmentalists

Environmentalism

Environmentalism is a broad philosophy, ideology and social movement regarding concerns for environmental conservation and improvement of the health of the environment, particularly as the measure for this health seeks to incorporate the concerns of non-human elements...

find the idea of the earth as the common property of humanity appealing, and some have endorsed the idea of ecological tax reform as a replacement for command and control regulation. This would entail substantial taxes or fees for pollution

Pollution

Pollution is the introduction of contaminants into a natural environment that causes instability, disorder, harm or discomfort to the ecosystem i.e. physical systems or living organisms. Pollution can take the form of chemical substances or energy, such as noise, heat or light...

, waste disposal and resource exploitation, or equivalently a "cap and trade" system where permits are auctioned to the highest bidder, and also include taxes for the use of land and other natural resources.

Synonyms and variants

Most early advocacy groups described themselves as Single Taxers, and George endorsed this as being an accurate description of the philosophy's main political goal – the replacement of all taxes with a land value tax. During the modern era, some groups inspired by Henry George emphasize environmentalismEnvironmentalism

Environmentalism is a broad philosophy, ideology and social movement regarding concerns for environmental conservation and improvement of the health of the environment, particularly as the measure for this health seeks to incorporate the concerns of non-human elements...

more than other aspects, while others emphasize his ideas concerning economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

.

Some devotees are not entirely satisfied with the name Georgist. While Henry George was well-known throughout his life, he has been largely forgotten by the public and the idea of a single tax of land predates him. Some people now use the term "Geoism", with the meaning of "Geo" deliberately ambiguous. "Earth Sharing", "Geoism", "Geonomics", and "Geolibertarianism

Geolibertarianism

Geolibertarianism is a political movement that strives to reconcile libertarianism and Georgism .Geolibertarians are advocates of geoism, which is the position that all natural resources – most importantly land – are common assets to which all individuals have an equal right to access; therefore if...

" (see libertarianism

Libertarianism

Libertarianism, in the strictest sense, is the political philosophy that holds individual liberty as the basic moral principle of society. In the broadest sense, it is any political philosophy which approximates this view...

) are also preferred by some Georgists; "Geoanarchism" is another one. These terms represent a difference of emphasis, and sometimes real differences about how land rent should be spent (citizen's dividend

Citizen's dividend

Citizen's dividend or citizen's income is a proposed state policy based upon the principle that the natural world is the common property of all persons . It is proposed that all citizens receive regular payments from revenue raised by the state through leasing or selling natural resources for...

or just replacing other taxes); but all agree that land rent should be recovered from its private recipients.

Influence

Georgist ideas heavily influenced the politics of the early 1900s, during its heyday. Political parties that were formed based on Georgist ideas include the Commonwealth Land Party, the Justice Party of DenmarkJustice Party of Denmark

Danmarks Retsforbund was founded in 1919. The party's platform is based upon the principles of U.S. economist Henry George who advocated a single tax on all land...

, and the Single Tax League

Single Tax League

The Single Tax League was an Australian political party that flourished throughout the 1920s and 30s.Based upon the ideas of Henry George, who argued that all taxes should be abolished, save for a single tax on unimproved land values, the Single Tax League was founded shortly after World War I, and...

.

In the UK

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

during 1909, the Liberal Government included a land tax as part of several taxes in the People's Budget

People's Budget

The 1909 People's Budget was a product of then British Prime Minister H. H. Asquith's Liberal government, introducing many unprecedented taxes on the wealthy and radical social welfare programmes to Britain's political life...

aimed at redistributing wealth (including a progressively graded income tax and an increase of inheritance tax). This caused a crisis which resulted indirectly in reform of the House of Lords

House of Lords

The House of Lords is the upper house of the Parliament of the United Kingdom. Like the House of Commons, it meets in the Palace of Westminster....

. The budget was passed eventually - but without the land tax. In 1931 the minority Labour Government passed a land value tax as part III of the 1931 Finance act. However this was repealed in 1934 by the National Government before it could be implemented. In Denmark

Denmark

Denmark is a Scandinavian country in Northern Europe. The countries of Denmark and Greenland, as well as the Faroe Islands, constitute the Kingdom of Denmark . It is the southernmost of the Nordic countries, southwest of Sweden and south of Norway, and bordered to the south by Germany. Denmark...

, the Georgist Justice Party

Justice Party of Denmark

Danmarks Retsforbund was founded in 1919. The party's platform is based upon the principles of U.S. economist Henry George who advocated a single tax on all land...

has previously been represented in Folketinget. It formed part of a centre-left government 1957-60 and was also represented in the European Parliament

European Parliament

The European Parliament is the directly elected parliamentary institution of the European Union . Together with the Council of the European Union and the Commission, it exercises the legislative function of the EU and it has been described as one of the most powerful legislatures in the world...

1978-79. The influence of Henry George has waned over time, but Georgist ideas still occasionally emerge in politics. In the 2004 Presidential campaign, Ralph Nader

Ralph Nader

Ralph Nader is an American political activist, as well as an author, lecturer, and attorney. Areas of particular concern to Nader include consumer protection, humanitarianism, environmentalism, and democratic government....

mentioned Henry George in his policy statements.

Communities

Several communities were also initiated with Georgist principles during the height of the philosophy's popularity. Two such communities that still exist are Arden, DelawareArden, Delaware

Arden is a village and art colony in New Castle County, Delaware, in the United States, founded in 1900 as a radical Georgist single-tax community by sculptor Frank Stephens and architect Will Price. The village occupies about 160 acres, with half kept as open land. According to the 2010 Census,...

, which was founded during 1900 by Frank Stephens

George Francis Stephens

George Francis Stephens , known as Frank Stephens, was an American sculptor, political activist and co-founder of a utopian single-tax community in Arden, Delaware.-Early life, education and family:...

and Will Price

Will Price

William Lightfoot Price was an influential American architect, a pioneer in the use of reinforced concrete, and a founder of the utopian communities of Arden, Delaware and Rose Valley, Pennsylvania.-Career:...

, and Fairhope, Alabama

Fairhope, Alabama

Fairhope is a city in Baldwin County, Alabama, on a sloping plateau, along the cliffs and shoreline of Mobile Bay. The 2010 census lists the population of the city as 16,176....

, which was founded during 1894 by the auspices of the Fairhope Single Tax Corporation.

The German protectorate of Jiaozhou Bay

Jiaozhou Bay

The Jiaozhou Bay is a sea gulf located in Qingdao Prefecture of Shandong Province. It was a German colonial concession from 1898 until 1914....

(also known as Kiaochow) in China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

fully implemented Georgist policy. Its sole source of government revenue was the land value tax of six percent which it levied on its territory. The German government had previously had economic problems with its African colonies caused by land speculation. One of the main aims in using the land value tax in Jiaozhou Bay was to eliminate such speculation, an aim which was entirely achieved. The colony existed as a German protectorate from 1898 until 1914 when it was seized by Japan. In 1922 it was returned to China.

Georgist ideas were also adopted to some degree in Australia

Australia

Australia , officially the Commonwealth of Australia, is a country in the Southern Hemisphere comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands in the Indian and Pacific Oceans. It is the world's sixth-largest country by total area...

, Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

, Singapore

Singapore

Singapore , officially the Republic of Singapore, is a Southeast Asian city-state off the southern tip of the Malay Peninsula, north of the equator. An island country made up of 63 islands, it is separated from Malaysia by the Straits of Johor to its north and from Indonesia's Riau Islands by the...

, South Africa

South Africa

The Republic of South Africa is a country in southern Africa. Located at the southern tip of Africa, it is divided into nine provinces, with of coastline on the Atlantic and Indian oceans...

, South Korea

South Korea

The Republic of Korea , , is a sovereign state in East Asia, located on the southern portion of the Korean Peninsula. It is neighbored by the People's Republic of China to the west, Japan to the east, North Korea to the north, and the East China Sea and Republic of China to the south...

, and Taiwan

Republic of China

The Republic of China , commonly known as Taiwan , is a unitary sovereign state located in East Asia. Originally based in mainland China, the Republic of China currently governs the island of Taiwan , which forms over 99% of its current territory, as well as Penghu, Kinmen, Matsu and other minor...

. In these countries, governments still levy some type of land value tax

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

, albeit with exemptions. Many municipal governments of the USA depend on real property tax as their main source of revenue, although such taxes are not "Georgist" as they generally include the value of buildings and other improvements, one exception being the town of Altoona, Pennsylvania

Altoona, Pennsylvania

-History:A major railroad town, Altoona was founded by the Pennsylvania Railroad in 1849 as the site for a shop complex. Altoona was incorporated as a borough on February 6, 1854, and as a city under legislation approved on April 3, 1867, and February 8, 1868...

, which only taxes land value.

Institutes and organizations

Various organizations still exist that continue to promote the ideas of Henry George. According to the The American Journal of Economics and SociologyThe American Journal of Economics and Sociology

The American Journal of Economics and Sociology is a peer-reviewed academic journal established in 1941 by Will Lissner with support from the Robert Schalkenbach Foundation. The purpose of the journal was to create a forum for a continuing discussion of the issues raised by Henry George, a...

, the periodical Land&Liberty

Land&Liberty

Land&Liberty is a quarterly magazine of popular political economics: its focus is the relationship between land and natural resource rights and 21st century economic policy...

, established in 1894, is "the longest-lived Georgist project in history". Also in the U.S., the Lincoln Institute of Land Policy was established in 1974 founded based on the writings of Henry George, and "seeks to improve the dialogue about urban development, the built environment, and tax policy in the United States and abroad". The Henry George Foundation continues to promote the ideas of Henry George in the UK. The IU

The IU

The IUThe IU is the popular name of the International Union for Land Value Taxation and Free Trade, officially also known as the International Union for Land Value Taxation, and the International Georgist Union; and colloquially as The International Union. is an international umbrella organisation...

, is an international umbrella organisation that brings together organizations worldwide that seek land value tax reform.

Criticisms

Although both advocated workers' rights, Henry George and Karl MarxKarl Marx

Karl Heinrich Marx was a German philosopher, economist, sociologist, historian, journalist, and revolutionary socialist. His ideas played a significant role in the development of social science and the socialist political movement...

were antagonists. Marx saw the Single Tax platform as a step backwards from the transition to communism

Communism

Communism is a social, political and economic ideology that aims at the establishment of a classless, moneyless, revolutionary and stateless socialist society structured upon common ownership of the means of production...

. He argued that, "The whole thing is... simply an attempt, decked out with socialism

Socialism

Socialism is an economic system characterized by social ownership of the means of production and cooperative management of the economy; or a political philosophy advocating such a system. "Social ownership" may refer to any one of, or a combination of, the following: cooperative enterprises,...

, to save capitalist domination and indeed to establish it afresh on an even wider basis than its present one."

Marx also criticized the way land value tax theory emphasizes the value of land, arguing that, "His fundamental dogma is that everything would be all right if ground rent were paid to the state."

On his part, Henry George predicted that if Marx's ideas were tried the likely result would be a dictatorship. Fred Harrison

Fred Harrison (author)

Fred Harrison is a British author, economic commentator and corporate policy advisor, notable for his stances on land reform and belief that an over reliance on land, property and mortgage weakens economic structures and makes companies vulnerable to economic collapse...

provides a full treatment of Marxist objections to land value taxation and Henry George in "Gronlund and other Marxists - Part III: nineteenth-century Americas critics", American Journal of Economics and Sociology, (Nov 2003).

George has also been accused of exaggerating the importance of his "all-devouring rent thesis" in claiming that it is the primary cause of poverty and injustice in society. More recent critics have claimed that increasing government spending has rendered a land tax insufficient to fund government. Georgists have responded by citing a multitude of sources showing that the total land value of nations like the US is enormous, and more than sufficient to fund government.

Notable people influenced by Georgism

- Matthew BellamyMatthew BellamyMatthew James Bellamy is an English musician, singer-songwriter and multi-instrumentalist, best known as the lead vocalist, lead guitarist, pianist, and main songwriter of the alternative rock band Muse.-Early life:...

- member of the alternative rock band, MuseMuseThe Muses in Greek mythology, poetry, and literature, are the goddesses who inspire the creation of literature and the arts. They were considered the source of the knowledge, related orally for centuries in the ancient culture, that was contained in poetic lyrics and myths... - Ralph BorsodiRalph BorsodiRalph Borsodi was an agrarian theorist and practical experimenter interested in ways of living useful to the modern family desiring greater self-reliance...

- William F. Buckley, Jr.William F. Buckley, Jr.William Frank Buckley, Jr. was an American conservative author and commentator. He founded the political magazine National Review in 1955, hosted 1,429 episodes of the television show Firing Line from 1966 until 1999, and was a nationally syndicated newspaper columnist. His writing was noted for...

- Vince Cable - UK Secretary of State for Business, Innovation and Skills, Liberal DemocratsLiberal DemocratsThe Liberal Democrats are a social liberal political party in the United Kingdom which supports constitutional and electoral reform, progressive taxation, wealth taxation, human rights laws, cultural liberalism, banking reform and civil liberties .The party was formed in 1988 by a merger of the...

Deputy Leader and Shadow Chancellor. - Winston ChurchillWinston ChurchillSir Winston Leonard Spencer-Churchill, was a predominantly Conservative British politician and statesman known for his leadership of the United Kingdom during the Second World War. He is widely regarded as one of the greatest wartime leaders of the century and served as Prime Minister twice...

- Nick CleggNick CleggNicholas William Peter "Nick" Clegg is a British Liberal Democrat politician who is currently the Deputy Prime Minister, Lord President of the Council and Minister for Constitutional and Political Reform in the coalition government of which David Cameron is the Prime Minister...

- Deputy Prime Minister of the United KingdomDeputy Prime Minister of the United KingdomThe Deputy Prime Minister of the United Kingdom of Great Britain and Northern Ireland is a senior member of the Cabinet of the United Kingdom. The office of the Deputy Prime Minister is not a permanent position, existing only at the discretion of the Prime Minister, who may appoint to other offices...

, leader of the Liberal DemocratsLiberal DemocratsThe Liberal Democrats are a social liberal political party in the United Kingdom which supports constitutional and electoral reform, progressive taxation, wealth taxation, human rights laws, cultural liberalism, banking reform and civil liberties .The party was formed in 1988 by a merger of the... - Clarence DarrowClarence DarrowClarence Seward Darrow was an American lawyer and leading member of the American Civil Liberties Union, best known for defending teenage thrill killers Leopold and Loeb in their trial for murdering 14-year-old Robert "Bobby" Franks and defending John T...

- Michael DavittMichael DavittMichael Davitt was an Irish republican and nationalist agrarian agitator, a social campaigner, labour leader, journalist, Home Rule constitutional politician and Member of Parliament , who founded the Irish National Land League.- Early years :Michael Davitt was born in Straide, County Mayo,...

- Albert EinsteinAlbert EinsteinAlbert Einstein was a German-born theoretical physicist who developed the theory of general relativity, effecting a revolution in physics. For this achievement, Einstein is often regarded as the father of modern physics and one of the most prolific intellects in human history...

- Fred Foldvary, PhD - Lecturer in Economics, Santa Clara UniversitySanta Clara UniversitySanta Clara University is a private, not-for-profit, Jesuit-affiliated university located in Santa Clara, California, United States. Chartered by the state of California and accredited by the Western Association of Schools and Colleges, it operates in collaboration with the Society of Jesus , whose...

- Henry FordHenry FordHenry Ford was an American industrialist, the founder of the Ford Motor Company, and sponsor of the development of the assembly line technique of mass production. His introduction of the Model T automobile revolutionized transportation and American industry...

- M. Mason Gaffney, PhDMason GaffneyMason Gaffney is an American economist and a major critic of Neoclassical economics from a Georgist point of view. He earned his B.A. in 1948 from Reed College in Portland, Oregon. Gaffney first read Henry George's masterwork Progress and Poverty as a high school junior...

- Economics professor at the University of California at Riverside - David Lloyd GeorgeDavid Lloyd GeorgeDavid Lloyd George, 1st Earl Lloyd-George of Dwyfor OM, PC was a British Liberal politician and statesman...

- George GreyGeorge Edward GreySir George Grey, KCB was a soldier, explorer, Governor of South Australia, twice Governor of New Zealand, Governor of Cape Colony , the 11th Premier of New Zealand and a writer.-Early life and exploration:...

- Walter Burley GriffinWalter Burley GriffinWalter Burley Griffin was an American architect and landscape architect, who is best known for his role in designing Canberra, Australia's capital city...

- Bolton HallBolton Hall (activist)Bolton Hall was an American lawyer, author and activist who worked on behalf of the poor and was the originator of the back-to-the-land movement in the United States at the beginning of the 20th century.-Activism:...

, New York City activist - Fred HarrisonFred Harrison (author)Fred Harrison is a British author, economic commentator and corporate policy advisor, notable for his stances on land reform and belief that an over reliance on land, property and mortgage weakens economic structures and makes companies vulnerable to economic collapse...

- Research Director of the London-based Land Research Trust - William Morris Hughes - seventh Prime Minister of Australia (1915–1923)

- Bill MoyersBill MoyersBill Moyers is an American journalist and public commentator. He served as White House Press Secretary in the United States President Lyndon B. Johnson Administration from 1965 to 1967. He worked as a news commentator on television for ten years. Moyers has had an extensive involvement with public...

- Aldous HuxleyAldous HuxleyAldous Leonard Huxley was an English writer and one of the most prominent members of the famous Huxley family. Best known for his novels including Brave New World and a wide-ranging output of essays, Huxley also edited the magazine Oxford Poetry, and published short stories, poetry, travel...

- Blas InfanteBlas InfanteBlas Infante Pérez de Vargas . Blas Infante was an andalusist politician, writer, historian and musicologist, known as the "Father" of Andalusian fatherland ....

- Mumia Abu-JamalMumia Abu-JamalMumia Abu-Jamal was convicted of the 1981 murder of Philadelphia police officer Daniel Faulkner and sentenced to death. He has been described as "perhaps the world's best known death-row inmate", and his sentence is one of the most debated today...

- Tom L. JohnsonTom L. JohnsonThomas Loftin Johnson , better known as Tom L. Johnson, was an American politician of the Democratic Party from the late 19th and early 20th centuries. He headed relief efforts after the Johnstown, Pennsylvania floods of 1889, was a U.S. Representative from 1891–1895 and the 35th mayor of...

- Samuel M. JonesSamuel M. JonesSamuel Milton Jones, a.k.a. "Golden Rule Jones", lived from August 3, 1846 to 1904 and served as a Progressive Era Mayor of Toledo, Ohio from 1897 to 1904 . Born in Denbighshire, Wales, Jones emigrated to the United States in 1849. Jones had little education because he had to work in order to help...

- Mayor of Toledo, OhioToledo, OhioToledo is the fourth most populous city in the U.S. state of Ohio and is the county seat of Lucas County. Toledo is in northwest Ohio, on the western end of Lake Erie, and borders the State of Michigan...

(1897 to 1904) - Wolf LadejinskyWolf LadejinskyWolf Isaac Ladejinsky was an influential American agricultural economist and researcher, serving first in the United States Department of Agriculture, then the Ford Foundation and later the World Bank...

- Suzanne La FolletteSuzanne La FolletteSuzanne Clara La Follette was an American journalist and author who advocated for libertarian feminism in the first half of the 20th century. As an editor she helped found several magazines. She was an early and ardent feminist and a vocal anti communist.-Family:She was born in Washington state...

- American journalist & libertarian feminist - Elizabeth MagieElizabeth MagieElizabeth "Lizzie" J. Phillips née Magie was an American game designer. She invented The Landlord's Game, the precursor to Monopoly.-Early life:...

,. - Ralph NaderRalph NaderRalph Nader is an American political activist, as well as an author, lecturer, and attorney. Areas of particular concern to Nader include consumer protection, humanitarianism, environmentalism, and democratic government....

- Francis NeilsonFrancis NeilsonFrancis Neilson , was an accomplished actor, playwright, stage director, political figure avid lecturer, and author of more than 60 books, plays and opera librettos and a leader in the Georgist movement.-Early:Born as Francis Butters, the eldest of nine siblings, in the Claugton Road,...

- Actor, playwright, stage director, Member of the British House of CommonsBritish House of CommonsThe House of Commons is the lower house of the Parliament of the United Kingdom, which also comprises the Sovereign and the House of Lords . Both Commons and Lords meet in the Palace of Westminster. The Commons is a democratically elected body, consisting of 650 members , who are known as Members...

, avid lecturer, and author - Albert Jay NockAlbert Jay NockAlbert Jay Nock was an influential United States libertarian author, educational theorist, and social critic of the early and middle 20th century.- Life and work :...

- Herbert SimonHerbert SimonHerbert Alexander Simon was an American political scientist, economist, sociologist, and psychologist, and professor—most notably at Carnegie Mellon University—whose research ranged across the fields of cognitive psychology, cognitive science, computer science, public administration, economics,...

- Winner of the Nobel Memorial Prize in Economics (1978) - Raymond A. SpruanceRaymond A. SpruanceRaymond Ames Spruance was a United States Navy admiral in World War II.Spruance commanded US naval forces during two of the most significant naval battles in the Pacific theater, the Battle of Midway and the Battle of the Philippine Sea...

- Joseph Stiglitz - Winner of the Nobel Memorial Prize in Economics (2001)

- Leo TolstoyLeo TolstoyLev Nikolayevich Tolstoy was a Russian writer who primarily wrote novels and short stories. Later in life, he also wrote plays and essays. His two most famous works, the novels War and Peace and Anna Karenina, are acknowledged as two of the greatest novels of all time and a pinnacle of realist...

- William Simon U'Ren

- William VickreyWilliam VickreyWilliam Spencer Vickrey was a Canadian professor of economics and Nobel Laureate. Vickrey was awarded the Nobel Memorial Prize in Economics with James Mirrlees for their research into the economic theory of incentives under asymmetric information...

- Winner of the Nobel Memorial Prize in Economics (1996) - Frank Lloyd WrightFrank Lloyd WrightFrank Lloyd Wright was an American architect, interior designer, writer and educator, who designed more than 1,000 structures and completed 500 works. Wright believed in designing structures which were in harmony with humanity and its environment, a philosophy he called organic architecture...

- Sun Yat-senSun Yat-senSun Yat-sen was a Chinese doctor, revolutionary and political leader. As the foremost pioneer of Nationalist China, Sun is frequently referred to as the "Father of the Nation" , a view agreed upon by both the People's Republic of China and the Republic of China...

See also

- Excess burden of taxationExcess burden of taxationIn economics, the excess burden of taxation, also known as the distortionary cost or deadweight loss of taxation, is one of the economic losses that society suffers as the result of a tax. Economic theory posits that distortions changes the amount and type of economic behavior from that which...

- MutualismMutualism (economic theory)Mutualism is an anarchist school of thought that originates in the writings of Pierre-Joseph Proudhon, who envisioned a society where each person might possess a means of production, either individually or collectively, with trade representing equivalent amounts of labor in the free market...

- Economic democracyEconomic democracyEconomic democracy is a socioeconomic philosophy that suggests a shift in decision-making power from a small minority of corporate shareholders to a larger majority of public stakeholders...

- GeolibertarianismGeolibertarianismGeolibertarianism is a political movement that strives to reconcile libertarianism and Georgism .Geolibertarians are advocates of geoism, which is the position that all natural resources – most importantly land – are common assets to which all individuals have an equal right to access; therefore if...

- Bolton Hall (activist)Bolton Hall (activist)Bolton Hall was an American lawyer, author and activist who worked on behalf of the poor and was the originator of the back-to-the-land movement in the United States at the beginning of the 20th century.-Activism:...

, a proponent of the theory - Progress and PovertyProgress and PovertyProgress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy was written by Henry George in 1879...

- Protection or Free TradeProtection or Free TradeProtection or Free Trade: An Examination of the Tariff Question with Especial Regard to the Interests of Labor was a book written by 19th century economist and social philosopher, Henry George ....

- Tragedy of the anticommonsTragedy of the anticommonsThe tragedy of the anticommons is a neologism coined by Michael Heller to describe a coordination breakdown where the existence of numerous rightsholders frustrates achieving a socially desirable outcome. The term mirrors the older term tragedy of the commons used to describe coordination...

External links

- Center for the Study of Economics

- Henry George Biography

- Henry George Foundation of America

- The Henry George Institute

- Henry George Papers, New York Public Library

- The Henry George School, founded 1932

- Prosper Australia (formerly the Henry George LeagueProsper AustraliaProsper Australia is a non-profit, privately funded Georgist association incorporated in the State of Victoria, Australia. Founded in 1890 as the Single Tax League of Victoria, it was later known as the Henry George League of Victoria, then as Tax Reform Australia, before adopting its present name...

) - Robert Schalkenbach Foundation

- Understanding Economics

- Georgist Education Association

- Henry George Foundation, founded 1929

- Some mildly critical private comment