History of the United States dollar

Encyclopedia

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

covers more than 200 years.

Early history

The history of the dollarDollar

The dollar is the name of the official currency of many countries, including Australia, Belize, Canada, Ecuador, El Salvador, Hong Kong, New Zealand, Singapore, Taiwan, and the United States.-Etymology:...

in North America pre-dates US independence. It began with the issuance of Early American currency called the colonial script, whereby the issuance of currency was equal to the goods and services in the economy. Even before the Declaration of Independence, the Continental Congress had authorized the issuance of dollar denominated coins and currency, since the term 'dollar' was in common usage referring to Spanish colonial eight-real coin or Spanish dollar

Spanish dollar

The Spanish dollar is a silver coin, of approximately 38 mm diameter, worth eight reales, that was minted in the Spanish Empire after a Spanish currency reform in 1497. Its purpose was to correspond to the German thaler...

. Though several monetary systems were proposed for the early republic, the dollar was approved by Congress in a largely symbolic resolution on August 8, 1786. After passage of the Constitution was secured, the government turned its attention to monetary issues again in the early 1790s under the leadership of Alexander Hamilton

Alexander Hamilton

Alexander Hamilton was a Founding Father, soldier, economist, political philosopher, one of America's first constitutional lawyers and the first United States Secretary of the Treasury...

, the secretary of the treasury at the time. Congress acted on Hamilton's recommendations in the Coinage Act of 1792, which established the dollar as the basic unit of account for the United States. The word "dollar" is derived from Low Saxon

Low German

Low German or Low Saxon is an Ingvaeonic West Germanic language spoken mainly in northern Germany and the eastern part of the Netherlands...

"thaler", an abbreviation of "Joachimsthaler" – (coin) from Joachimsthal (St. Joachim's Valley, now Jáchymov, Bohemia

Bohemia

Bohemia is a historical region in central Europe, occupying the western two-thirds of the traditional Czech Lands. It is located in the contemporary Czech Republic with its capital in Prague...

, then part of the Holy Roman Empire

Holy Roman Empire

The Holy Roman Empire was a realm that existed from 962 to 1806 in Central Europe.It was ruled by the Holy Roman Emperor. Its character changed during the Middle Ages and the Early Modern period, when the power of the emperor gradually weakened in favour of the princes...

, now part of the Czech Republic

Czech Republic

The Czech Republic is a landlocked country in Central Europe. The country is bordered by Poland to the northeast, Slovakia to the east, Austria to the south, and Germany to the west and northwest....

; for further history of the name, see dollar

Dollar

The dollar is the name of the official currency of many countries, including Australia, Belize, Canada, Ecuador, El Salvador, Hong Kong, New Zealand, Singapore, Taiwan, and the United States.-Etymology:...

.) – so called because it was minted from 1519 onwards using silver extracted from a mine which had opened in 1516 near Joachimstal, a town in the Ore Mountains of northwestern Bohemia

Bohemia

Bohemia is a historical region in central Europe, occupying the western two-thirds of the traditional Czech Lands. It is located in the contemporary Czech Republic with its capital in Prague...

.

Because gold and silver in the open marketplace vary independently, the production of coins of full intrinsic worth under any ratio will nearly always result in the melting of either all silver coins or all gold coins. In the early 19th century, gold rose in relation to silver, resulting in the removal from commerce of nearly all gold coins, and their subsequent melting. Therefore, in 1834

Coinage Act of 1834

The Coinage Act of 1834 was passed by the United States Congress on June 27, 1834. It raised the silver-to-gold weight ratio from its 1792 level of 15:1 to 16:1 thus setting the mint price for silver at a level below its international market price...

, the 15:1 ratio of silver to gold was changed to a 16:1 ratio by reducing the weight of the nation's gold coinage. This created a new U.S. dollar that was backed by 1.50 g (23.22 grains) of gold. However, the previous dollar had been represented by 1.60 g (24.75 grains) of gold. The result of this revaluation, which was the first-ever devaluation of the U.S. dollar, was that the value in gold of the dollar was reduced by 6%. Moreover, for a time, both gold and silver coins were useful in commerce.

In 1853, the weights of US silver coins (except, interestingly, the dollar itself, which was rarely used) were reduced. This had the effect of placing the nation effectively (although not officially) on the gold standard. The retained weight in the dollar coin was a nod to bimetallism, although it had the effect of further driving the silver dollar coin from commerce. Foreign coins, including the Spanish dollar, were also widely used as legal tender until 1857

Coinage Act of 1857

The Coinage Act of 1857 was an act of the United States Congress which forbade the use of foreign coins as legal tender, repealing all acts "authorizing the currency of foreign gold or silver coins". Specific coins would be exchanged at the Treasury and recoined...

.

With the enactment (1863) of the National Banking Act

National Banking Act

The National Banking Acts of 1863 and 1864 were two United States federal laws that established a system of national charters for banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S...

during the American Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

and its later versions that taxed states' bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

and currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

out of existence, the dollar became the sole currency of the United States and remains so today.

In 1878, the Bland-Allison Act

Bland-Allison Act

The Bland–Allison Act was an 1878 act of Congress requiring the U.S. Treasury to buy a certain amount of silver and put it into circulation as silver dollars. Though the bill was vetoed by President Rutherford B...

was enacted to provide for freer coinage of silver. This act required the government to purchase between $2 million and $4 million worth of silver bullion each month at market prices and to coin it into silver dollars. This was, in effect, a subsidy for politically influential silver producers.

The discovery of large silver deposits in the Western United States in the late 19th century created a political controversy. Due to the large influx of silver, the value of silver in the nation's coinage dropped precipitously. On one side were agrarian interests such as the United States Greenback Party

United States Greenback Party

The Greenback Party was an American political party with an anti-monopoly ideology that was active between 1874 and 1884. Its name referred to paper money, or "greenbacks," that had been issued during the American Civil War and afterward...

that wanted to retain the bimetallic standard in order to inflate the dollar, which would allow farmers to more easily repay their debts. On the other side were Eastern banking and commercial interests, who advocated sound money and a switch to the gold standard. This issue split the Democratic Party in 1896. It led to the famous "cross of gold" speech

Cross of Gold speech

The Cross of Gold speech was delivered by William Jennings Bryan at the 1896 Democratic National Convention in Chicago on July 8, 1896. The speech advocated bimetallism. Following the Coinage Act , the United States abandoned its policy of bimetallism and began to operate a de facto gold...

given by William Jennings Bryan

William Jennings Bryan

William Jennings Bryan was an American politician in the late-19th and early-20th centuries. He was a dominant force in the liberal wing of the Democratic Party, standing three times as its candidate for President of the United States...

, and may have inspired many of the themes in The Wizard of Oz

Political interpretations of The Wonderful Wizard of Oz

Political interpretations of The Wonderful Wizard of Oz include treatments of the modern fairy tale as an allegory or metaphor for the political, economic and social events of America in the 1890s...

. Despite the controversy, the status of silver was slowly diminished through a series of legislative changes from 1873 to 1900, when a gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

was formally adopted. The gold standard survived, with several modifications, until 1971.

Gold standard

Bimetallism persisted until March 14, 1900, with the passage of the Gold Standard ActGold Standard Act

The Gold Standard Act of the United States was passed in 1900 and established gold as the only standard for redeeming paper money, stopping bimetallism...

, which provided that:

- "...the dollar consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard..."

Thus the United States moved to a gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

, made gold the sole legal-tender coinage of the United States, and set the value of the dollar at $20.67 per ounce (66.46 ¢/g) of gold. This made the dollar convertible to 1.5 g (23.22 grains)—the same convertibility into gold that was possible on the bimetallic standard.

The gold standard was suspended twice during World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, once fully and then for foreign exchange. At the onset of the war, US corporations had large debts payable to European entities, who began liquidating their debts in gold. With debts looming to Europe, the dollar to British pound exchange rate reached as high as $6.75, far above the (gold) parity of $4.8665. This caused large gold outflows until July 31, 1914 when the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

closed and the gold standard was temporarily suspended. In order to defend the exchange value of the dollar, the US Treasury Department authorized state and nationally-charted banks to issue emergency currency under the Aldrich-Vreeland Act

Aldrich-Vreeland Act

The Aldrich–Vreeland Act was passed in response to the Panic of 1907 and established the National Monetary Commission, which recommended the Federal Reserve Act of 1913....

, and the newly-created Federal Reserve organized a fund to assure debts to foreign creditors. These efforts were largely successful, and the Aldrich-Vreeland notes were retired starting in November and the gold standard was restored when the New York Stock Exchange re-opened in December 1914.

As the United States remained neutral in the war, it remained the only country to maintain its gold standard, doing so without restriction on import or export of gold from 1915-1917. During the participation of the US as a belligerent, President Wilson

Woodrow Wilson

Thomas Woodrow Wilson was the 28th President of the United States, from 1913 to 1921. A leader of the Progressive Movement, he served as President of Princeton University from 1902 to 1910, and then as the Governor of New Jersey from 1911 to 1913...

banned gold export, thereby suspending the gold standard for foreign exchange. After the war, European countries slowly returned to their gold standards, though in somewhat altered form.

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

, every major currency abandoned the gold standard. Among the earliest, the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

abandoned the gold standard in 1931 as speculators demanded gold in exchange for currency, threatening the solvency of the British monetary system. This pattern repeated throughout Europe and North America. In the United States, the Federal Reserve was forced to raise interest rates in order to protect the gold standard for the US dollar, worsening already severe domestic economic pressures. After bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

s became more pronounced in early 1933, people began to hoard gold coins as distrust for banks led to distrust for paper money

Paper Money

Paper Money is the second album by the band Montrose. It was released in 1974 and was the band's last album to feature Sammy Hagar as lead vocalist.-History:...

, worsening deflation and depleting gold reserves.

The Gold Reserve Act

In early 1933, in order to fightReflation

Reflation is the act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy back up to the long-term trend, following a dip in the business cycle...

severe deflation Congress and President Roosevelt implemented a series of Acts of Congress

Act of Congress

An Act of Congress is a statute enacted by government with a legislature named "Congress," such as the United States Congress or the Congress of the Philippines....

and Executive Orders which suspended the gold standard except for foreign exchange, revoked gold as universal legal tender

Legal tender

Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Paper currency is a common form of legal tender in many countries....

for debts, and banned private ownership of significant amounts of gold coin. These acts included Executive Order 6073, the Emergency Banking Act

Emergency Banking Act

The Emergency Banking Act was an act of the United States Congress spearheaded by President Franklin D. Roosevelt during the Great Depression. It was passed on March 9, 1933...

, Executive Order 6102

Executive Order 6102

Executive Order 6102 is an Executive Order signed on April 5, 1933, by U.S. President Franklin D. Roosevelt "forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States"...

, Executive Order 6111, the Agricultural Adjustment Act

Agricultural Adjustment Act

The Agricultural Adjustment Act was a United States federal law of the New Deal era which restricted agricultural production by paying farmers subsidies not to plant part of their land and to kill off excess livestock...

, 1933 Banking Act, House Joint Resolution 192, and later the Gold Reserve Act

Gold Reserve Act

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury....

. These actions were upheld by the US Supreme Court in the "Gold Clause Cases

Gold Clause Cases

The Gold Clause Cases were a series of actions brought before the Supreme Court of the United States, in which the court narrowly upheld restrictions on the ownership of gold implemented by the administration of U.S. President Franklin D. Roosevelt in order to fight the Great Depression. The cases...

" in 1935.

For foreign exchange purposes, the set $20.67 per ounce value of the dollar was lifted, allowing the dollar to float freely in foreign exchange markets with no set value in gold. This was terminated after one year. Roosevelt attempted first to restabilize falling prices with the Agricultural Adjustment Act

Agricultural Adjustment Act

The Agricultural Adjustment Act was a United States federal law of the New Deal era which restricted agricultural production by paying farmers subsidies not to plant part of their land and to kill off excess livestock...

; however, this did not prove popular, so instead the next politically popular option was to devalue the dollar on foreign exchange markets. Under the Gold Reserve Act

Gold Reserve Act

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury....

the value of the dollar was fixed at $35 per ounce, making the dollar more attractive for foreign buyers (and making foreign currencies more expensive for those holding dollars). This change led to more conversion of gold into dollars, allowing the U.S. to effectively corner the world gold market.

The suspension of the gold standard was considered temporary by many in markets and in the government at the time, but restoring the standard was considered a low priority to dealing with other issues.

Under the post-World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

, all other currencies were valued in terms of U.S. dollars and were thus indirectly linked to the gold standard. The need for the U.S. government to maintain both a $35 per troy ounce (112.53 ¢/g) market price of gold and also the conversion to foreign currencies caused economic and trade pressures. By the early 1960s, compensation for these pressures started to become too complicated to manage.

In March 1968, the effort to control the private market price of gold was abandoned. A two-tier system began. In this system all central-bank transactions in gold were insulated from the free market price. Central banks would trade gold among themselves at $35 per troy ounce (112.53 ¢/g) but would not trade with the private market. The private market could trade at the equilibrium market price and there would be no official intervention. The price immediately jumped to $43 per troy ounce (138.25 ¢/g). The price of gold touched briefly back at $35 (112.53 ¢/g) near the end of 1969 before beginning a steady price increase. This gold price increase turned steep through 1972 and hit a high that year of over $70 (2.25 $/g). By that time floating exchange rates had also begun to emerge, which indicated the de facto dissolution of the Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

. The two-tier system was abandoned in November 1973. By then the price of gold had reached $100 per troy ounce (3.22 $/g).

In the early 1970s, inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

caused by rising prices for imported commodities, especially oil

Oil

An oil is any substance that is liquid at ambient temperatures and does not mix with water but may mix with other oils and organic solvents. This general definition includes vegetable oils, volatile essential oils, petrochemical oils, and synthetic oils....

, and spending on the Vietnam War

Vietnam War

The Vietnam War was a Cold War-era military conflict that occurred in Vietnam, Laos, and Cambodia from 1 November 1955 to the fall of Saigon on 30 April 1975. This war followed the First Indochina War and was fought between North Vietnam, supported by its communist allies, and the government of...

, which was not counteracted by cuts in other government expenditures, combined with a trade deficit to create a situation in which the dollar was worth less than the gold used to back it.

In 1971, President Richard Nixon

Richard Nixon

Richard Milhous Nixon was the 37th President of the United States, serving from 1969 to 1974. The only president to resign the office, Nixon had previously served as a US representative and senator from California and as the 36th Vice President of the United States from 1953 to 1961 under...

unilaterally ordered the cancellation of the direct convertibility of the United States dollar to gold. This act was known as the Nixon Shock

Nixon Shock

The Nixon Shock was a series of economic measures taken by U.S. President Richard Nixon in 1971 including unilaterally cancelling the direct convertibility of the United States dollar to gold that essentially ended the existing Bretton Woods system of international financial exchange.-Background:By...

.

US dollar value vs. gold value

The sudden jump in the price of gold after the demise of the Bretton Woods accords was a result of the significant prior debasement of the US dollar due to excessive inflation of the monetary supply via central bank (Federal Reserve) coordinated fractional reserve banking under the Bretton Woods partial gold standard. In the absence of an international mechanism tying the dollar to gold via fixed exchange rates, the dollar became a pure fiat currency and as such fell to its free market exchange price versus gold. Consequently, the price of gold rose from $35 per troy ounce (1.125 $/g) in 1969 to almost $500 (29 $/g) in 1980. |

Shortly after the gold price started its ascent in the early 1970s, the price of other commodities such as oil also began to rise. While commodity prices became more volatile, the average exchange rate between oil and gold remained much the same in the 1990s as it had been in the 1960s, 1970s and 1980s.

Fearing the emergence of a specie

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

gold-based economy separate from central banking, and with the corresponding threat of the collapse of the U.S. dollar, the U.S. government approved several changes to the trading on the COMEX

New York Mercantile Exchange

The New York Mercantile Exchange is the world's largest physical commodity futures exchange. It is located at One North End Avenue in the World Financial Center in the Battery Park City section of Manhattan, New York City...

. These changes resulted in a steep decline in the traded value of precious metals from the early 1980s onward.

In September 1987 under the Reagan

Ronald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

administration the U.S. Secretary of the Treasury James Baker

James Baker

James Addison Baker, III is an American attorney, politician and political advisor.Baker served as the Chief of Staff in President Ronald Reagan's first administration and in the final year of the administration of President George H. W. Bush...

made a proposal through the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

to use a commodity basket (which included gold).

Silver standard

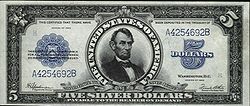

Representative money

The term representative money has been used variously to mean:*a claim on a commodity, for example gold certificates or silver certificates. In this sense it may be called 'commodity-backed money'....

printed from 1878 to 1964 in the United States as part of its circulation of paper currency. They were produced in response to silver agitation

Free Silver

Free Silver was an important United States political policy issue in the late 19th century and early 20th century. Its advocates were in favor of an inflationary monetary policy using the "free coinage of silver" as opposed to the less inflationary Gold Standard; its supporters were called...

by citizens who were angered by the Fourth Coinage Act

Fourth Coinage Act

The Fourth Coinage Act was enacted by the United States Congress in 1873 and embraced the gold standard and demonetized silver. Western mining interests and others who wanted silver in circulation years later labeled this measure the "Crime of '73"...

, and were used alongside the gold-based dollar notes. The silver certificates were initially redeemable in the same face value of silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

dollar coins

United States dollar coin

Dollar coins have been minted in the United States in gold, silver, and base metal versions. The term silver dollar is often used for any large white metal coin issued by the United States with a face value of one dollar, although purists insist that a dollar is not silver unless it contains some...

, and later in raw silver bullion.

Since the early 1920s, silver certificates were issued in $1, $5, and $10 notes. In the 1928 series, only $1 silver certificates were produced. Fives and tens of this time were mainly Federal Reserve notes, which were backed by and redeemable in gold. In 1933, the Agricultural Adjustment Act

Agricultural Adjustment Act

The Agricultural Adjustment Act was a United States federal law of the New Deal era which restricted agricultural production by paying farmers subsidies not to plant part of their land and to kill off excess livestock...

was passed, which included a clause allowing for the pumping of silver into the market to replace the gold. A new 1933 series of $10 silver certificate was printed and released, but not many were released into circulation.

In 1934, a law was passed in Congress that changed the obligation on Silver Certificates so as to denote the current location of the silver.

The last government regulation regarding the silver standard was in 1963, when President John F. Kennedy

John F. Kennedy

John Fitzgerald "Jack" Kennedy , often referred to by his initials JFK, was the 35th President of the United States, serving from 1961 until his assassination in 1963....

issued Executive Order 11110

Executive Order 11110

Executive Order 11110 was issued by U.S. President John F. Kennedy on June 4, 1963.This executive order delegated to the Secretary of the Treasury the president's authority to issue silver certificates under the Thomas Amendment of the Agricultural Adjustment Act.-Background:On November 28, 1961,...

, authorizing the US Department of Treasury to issue silver certificates for any silver held by the U.S. Government in excess of that not already backing issued certificates. These redeemable silver certificates were issued for a short period in notes of $5, but they were eventually discontinued.

United States Notes

Greenback (money)

The term greenback refers to paper currency that was issued by the United States during the American Civil War.There are at least two types of notes that were called greenback:*United States Note*Demand Note...

" in their day, a name inherited from the Demand Notes

Demand Note

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 US$...

that they replaced in 1862.

While issuance of United States Notes ended in January 1971, existing United States Notes are still valid currency in the United States today, though rarely seen in circulation.

Both United States Notes and Federal Reserve Notes are parts of the national currency of the United States, and both have been legal tender

Legal tender

Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Paper currency is a common form of legal tender in many countries....

since the gold recall

Executive Order 6102

Executive Order 6102 is an Executive Order signed on April 5, 1933, by U.S. President Franklin D. Roosevelt "forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States"...

of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes. United States Notes were created as fiat currency, in that the government has never categorically guaranteed to redeem them for precious metal - even though at times, such as after the specie resumption of 1879, federal officials were authorized to do so if requested.

The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and was inserted by the Treasury directly into circulation free of interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

. Federal Reserve Notes are backed by debt

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

purchased by the Federal Reserve, and thus generate seigniorage

Seigniorage

Seigniorage can have the following two meanings:* Seigniorage derived from specie—metal coins, is a tax, added to the total price of a coin , that a customer of the mint had to pay to the mint, and that was sent to the sovereign of the political area.* Seigniorage derived from notes is more...

for the Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

, which serves as a lending intermediary between the Treasury and the public.

Fiat standard

Today, like the currency of most nations, the dollar is fiat moneyFiat money

Fiat money is money that has value only because of government regulation or law. The term derives from the Latin fiat, meaning "let it be done", as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used.Fiat money originated in 11th...

, unbacked by any physical asset. A holder of a federal reserve note has no right to demand an asset such as gold or silver from the government in exchange for a note. Consequently, some proponents of the intrinsic theory of value

Intrinsic theory of value

An intrinsic theory of value is any theory of value in economics which holds that the value of an object, good or service, is intrinsic or contained in the item itself...

believe that the near-zero marginal cost of production of the current fiat dollar detracts from its attractiveness as a medium of exchange and store of value because a fiat currency without a marginal cost of production is easier to debase via overproduction and the subsequent inflation of the money supply.

In 1963, the words "PAYABLE TO THE BEARER ON DEMAND" were removed from all newly issued Federal Reserve note

Federal Reserve Note

A Federal Reserve Note is a type of banknote used in the United States of America. Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. They are the only type of U.S...

s. Then, in 1968, redemption of pre-1963 Federal Reserve notes for gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

or silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

officially ended. The Coinage Act of 1965 removed all silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

from quarters and dimes, which were 90% silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

prior to the act. However, there was a provision in the act allowing some coins to contain a 40% silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

consistency, such as the Kennedy

John F. Kennedy

John Fitzgerald "Jack" Kennedy , often referred to by his initials JFK, was the 35th President of the United States, serving from 1961 until his assassination in 1963....

Half Dollar. Later, even this provision was removed, and all coins minted for general circulation are now mostly clad

Cladding (metalworking)

Cladding is the bonding together of dissimilar metals. It is distinct from welding or gluing as a method to fasten the metals together. Cladding is often achieved by extruding two metals through a die as well as pressing or rolling sheets together under high pressure.The United States Mint uses...

. The content of the nickel has not changed since 1946.

All circulating notes, issued from 1861 to present, will be honored by the government at face value as legal tender

Legal tender

Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Paper currency is a common form of legal tender in many countries....

. This means only that the government will give the holder of the notes new federal reserve notes in exchange for the note (or will accept the old notes as payments for debts owed to the federal government). The government is not obligated to redeem the notes for gold or silver, even if the note itself states that it is so redeemable. Some bills may have a premium to collectors.

The only exception to this rule is the $10,000 gold certificate of Series 1900, a number of which were inadvertently released to the public because of a fire in 1935. A box of them was literally thrown out of a window. This set is not considered to be "in circulation" and, in fact, is stolen property. However, the government canceled these banknotes and removed them from official records. Their value, relevant only to collectors, is approximately one thousand US dollars.

According to the Federal Reserve Bank of New York, there was $829 billion in total US currency in worldwide circulation as of December 2007.

In September 2004, it was estimated that if all the gold held by the U.S. government (287.13 million ounces

Troy ounce

The troy ounce is a unit of imperial measure. In the present day it is most commonly used to gauge the weight of precious metals. One troy ounce is nowadays defined as exactly 0.0311034768 kg = 31.1034768 g. There are approximately 32.1507466 troy oz in 1 kg...

= 8.14 million kilogram

Kilogram

The kilogram or kilogramme , also known as the kilo, is the base unit of mass in the International System of Units and is defined as being equal to the mass of the International Prototype Kilogram , which is almost exactly equal to the mass of one liter of water...

s = 8,140 metric tonnes) were again required to back the circulating U.S. currency ($733,170,953,704), gold would need to be valued at $2,800/ounce ($90/gram).

Color and design

The federal government began issuing currency that was backed by Spanish dollarSpanish dollar

The Spanish dollar is a silver coin, of approximately 38 mm diameter, worth eight reales, that was minted in the Spanish Empire after a Spanish currency reform in 1497. Its purpose was to correspond to the German thaler...

s during the American Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

. As photographic technology of the day could not reproduce color, it was decided the back of the bills would be printed in a color other than black. Because the color green

Green

Green is a color, the perception of which is evoked by light having a spectrum dominated by energy with a wavelength of roughly 520–570 nanometres. In the subtractive color system, it is not a primary color, but is created out of a mixture of yellow and blue, or yellow and cyan; it is considered...

was seen as a symbol of stability, it was selected. These bills were known as "greenbacks" for their color and started a tradition of the United States' printing the back of its money in green. In contrast to the currency notes of many other countries, Federal Reserve notes of varying denominations are the same colors: predominantly black ink with green highlights on the front, and predominantly green ink on the back. Federal Reserve notes were printed in the same colors for most of the 20th century, although older bills called "silver certificates" had blue highlights on the front, and "United States notes" had red highlights on the front.

In 1929, sizing of the bills was standardized (involving a 25% reduction in their current sizes, compared to the older, larger notes nicknamed "horse blankets"). Modern U.S. currency, regardless of denomination, is 2.61 inches (66.3 mm) wide, 6.14 inches (156 mm) long, and 0.0043 inches (0.109 mm) thick. A single bill weighs about one gram and costs approximately 4.2 cents for the Bureau of Engraving and Printing

Bureau of Engraving and Printing

The Bureau of Engraving and Printing is a government agency within the United States Department of the Treasury that designs and produces a variety of security products for the United States government, most notable of which is paper currency for the Federal Reserve. The Federal Reserve itself is...

to produce.

Microprinting

Microprinting

Microprinting is one of many anti-counterfeiting techniques used most often on currency and bank checks, as well as various other items of value. Microprinting involves printing very small text, usually too small to read with the naked eye, onto the note or item. Microprint is frequently hidden in...

and security thread

Security thread

A security thread is a security feature of many bank notes to protect against counterfeiting, consisting of a thin ribbon that is threaded through the note's paper....

s were introduced in the 1991 currency series.

Another series started in 1996 with the $100 note, adding the following changes:

- A larger portraitPortraitthumb|250px|right|Portrait of [[Thomas Jefferson]] by [[Rembrandt Peale]], 1805. [[New-York Historical Society]].A portrait is a painting, photograph, sculpture, or other artistic representation of a person, in which the face and its expression is predominant. The intent is to display the likeness,...

, moved off-center to create more space to incorporate a watermarkWatermarkA watermark is a recognizable image or pattern in paper that appears as various shades of lightness/darkness when viewed by transmitted light , caused by thickness or density variations in the paper...

. - The watermark to the right of the portrait depicting the same historical figure as the portrait. The watermark can be seen only when held up to the light (and had long been a standard feature of all other major currencies).

- A security thread that will glow red when exposed to ultravioletUltravioletUltraviolet light is electromagnetic radiation with a wavelength shorter than that of visible light, but longer than X-rays, in the range 10 nm to 400 nm, and energies from 3 eV to 124 eV...

light in a dark environment. The thread is in a unique position on each denomination. - Color-shifting ink that changes from green to black when viewed from different angles. This feature appears in the numeral on the lower right-hand corner of the bill front.

- Microprinting in the numeral in the note's lower left-hand corner and on Benjamin Franklin's coat.

- Concentric fine-line printing in the background of the portrait and on the back of the note. This type of printing is difficult to copy well.

- The value of the currency written in 14pt Arial font on the back for those with sight disabilities.

- Other features for machine authentication and processing of the currency.

Annual releases of the 1996 series followed. The $50 note on June 12, 1997, introduced a large dark numeral with a light background on the back of the note to make it easier for people to identify the denomination. The $20 note in 1998 introduced a new machine-readable capability to assist scanning devices. The security thread glows green under ultraviolet light, and "USA TWENTY" and a flag are printed on the thread, while the numeral "20" is printed within the star field of the flag. The microprinting is in the lower left ornamentation of the portrait and in the lower left corner of the note front. , the $20 note was the most frequently counterfeited note in the United States.

On May 13, 2003, the Treasury announced that it would introduce new colors into the $20 bill, the first U.S. currency since 1905 (not counting the 1934 gold certificates) to have colors other than green or black. The move was intended primarily to reduce counterfeit

Counterfeit

To counterfeit means to illegally imitate something. Counterfeit products are often produced with the intent to take advantage of the superior value of the imitated product...

ing, rather than to increase visual differentiation between denominations. The main colors of all denominations, including the new $20 and $50, remain green and black; the other colors are present only in subtle shades in secondary design elements. This contrasts with the euro

Euro

The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,...

and other currencies, in which the main banknote colors contrast strongly with one another.

The new $20 bills entered circulation on October 9, 2003, the new $50 bills on September 28, 2004. The new $10 notes were introduced in 2006. The new $5 bills on March 13, 2008. Each will have subtle elements of different colors, though will continue to be primarily green and black. The Treasury said it will update Federal Reserve notes every 7 to 10 years to keep up with counterfeiting technology. In addition, there have been rumors that future banknotes will use embedded RFID microchips as another anti-counterfeiting tool.

The 2008 $5 bill contains significant new security updates. The obverse side of the bill includes patterned yellow printing that will cue digital image-processing software to prevent digital copying, watermarks, digital security thread, and extensive microprinting. The reverse side includes an oversized purple number 5 to provide easy differentiation from other denominations.

On April 21, 2010, the US Government announced a heavily redesigned $100 bill that featured bolder colors, color shifting ink, microlenses, and other features. It was scheduled to start circulating February 10, 2011. It will cost 11.8 cents to produce each bill.

"The soundness of a nation's currency is essential to the soundness of its economy. And to uphold our currency's soundness, it must be recognized and honored as legal tender and counterfeiting must be effectively thwarted," Federal Reserve Chairman Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

said at a ceremony unveiling the $20 bill's new design. Prior to the current design, the most recent redesign of the U.S. dollar bill was in 1996.

|

|

See also

- Continental currency

- Coinage Act of 1792

- Coinage Act of 1849

- National Banking ActNational Banking ActThe National Banking Acts of 1863 and 1864 were two United States federal laws that established a system of national charters for banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S...

(1863) - Coinage Act of 1864

- Coinage Act of 1873

- History of central banking in the United StatesHistory of central banking in the United StatesThis article is about the history of central banking in the United States, from the 1790s to the present.-Bank of North America:Some Founding Fathers were strongly opposed to the formation of a central banking system; the fact that England tried to place the colonies under the monetary control of...

External links

- Joint Economic Committee Study, November 1998 - http://www.house.gov/jec/fed/fed/dollar.htm