International monetary systems

Encyclopedia

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions that facilitate international trade

, cross border investment and generally the reallocation of capital

between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic actors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods

in 1944.

Throughout history, precious metals such as gold

Throughout history, precious metals such as gold

and silver

have been used for trade, termed bullion, and since early history the coins of various issuers – generally kingdoms and empires – have been traded. The earliest known records of pre - coinage use of bullion for monetary exchange are from Mesopotamia and Egypt, dating from the third millennium BC. Its believed that at this time money played a relatively minor role in the ordering of economic life for these regions, compared to barter

and centralised redistribution - a process where the population surrendered their produce to ruling authorities who then redistrubted it as they saw fit. Coinage is believed to have first developed in China in the late 7th century BC, and independently at around the same time in Lydia

, Asia minor

, from where its use spread to nearby Greek cities and later to the rest of the world.

Sometimes formal monetary system

s have been imposed by regional rules. For example scholars have tentatively suggested that the ruler Servius Tullius

created a primitive monetary system in the archaic period of what was to become the Roman Republic

. Tullius reigned in the sixth century BC - several centuries before Rome is believed to have developed a formal coinage system.

As with bullion, early use of coinage is believed to have been generally the preserve of the elite. But by about the 4th century BC they were widely used in Greek cities. Coins were generally supported by the city state authorities, who endeavoured to ensure they retained their values regardless of fluctuations in the availability of whatever base precious metals they were made from. From Greece the use of coins spread slowly westwards throughout Europe, and eastwards to India. Coins were in use in India from about 400BC, initially they played a greater role in religion than trade, but by the 2nd century had become central to commercial transactions. Monetary systems developed in India were so successful they continued to spread through parts of Asia well into the Middle Ages.

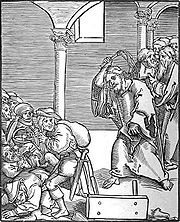

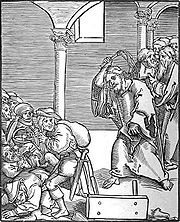

As multiple coins became common within a region, they have been exchanged by moneychangers, which are the predecessors of today's foreign exchange market

. These are famously discussed in the Biblical story of Jesus and the money changers

. In Venice and the Italian city states of the early Middle Ages, money changes would often have to struggle to perform calculations involving six or more currencies. This partly led to Fibonacci

writing his Liber Abaci

where he popularised the use of Arabic numerals which displaced the more difficult roman numerals then in use by western merchants.

When a given nation or empire has achieved regional hegemony

When a given nation or empire has achieved regional hegemony

, its currency has been a basis for international trade, and hence for a de facto monetary system. In the West – Europe and the Middle East – an early such coin was the Persian daric

, of the Persian empire. This was succeeded by Roman currency

of the Roman empire

, such as the denarius

, then the Gold Dinar

of the Muslim empire, and later – from the 16th to 20th centuries, during the Age of Imperialism – by the currency of European colonial powers: the Spanish dollar

, the Dutch Gilder, the French Franc and the British Pound Sterling; at times one currency has been pre-eminent, at times no one dominated. With the growth of American power, the US Dollar became the basis for the international monetary system, formalized in the Bretton Woods agreement that established the post–World War II monetary order, with fixed exchange rates of currencies to the dollar, and convertibility

of the dollar into gold. Since the breakdown of the Bretton Woods system, culminating in the Nixon shock

of 1971, ending convertibility, the US dollar has remained the de facto basis of the world monetary system, though no longer de jure, with various European currencies and the Japanese Yen being used. Since the formation of the Euro, the Euro has gained use as a reserve currency

and a unit of transactions, though the dollar has remained the primary currency.

A dominant currency may be used directly or indirectly by other nations – for example, English kings minted gold mancus

, presumably to function as dinars to exchange with Islamic Spain, and more recently, a number of nations have used the US dollar as their local currency, a custom called dollarization

.

Until the 19th century, the global monetary system was loosely linked at best, with Europe, the Americas, India and China (among others) having largely separate economies, and hence monetary systems were regional. European colonization of the Americas, starting with the Spanish empire, led to the integration of American and European economies and monetary systems, and European colonization of Asia led to the dominance of European currencies, notably the British pound sterling in the 19th century, succeeded by the US dollar in the 20th century. Some, such as Michael Hudson

, foresee the decline of a single basis for the global monetary system, and instead the emergence of regional trade bloc

s, citing the emergence of the Euro as an example of this phenomenon. See also Global financial system

s , world-systems approach and polarity in international relations

. It was in the later half of the 19th century that a monetary system with close to universal global participation emerged, based on the gold standard.

From the 1870s to the outbreak of World War I in 1914, the world benefited from a well integrated financial order, sometimes known as the First age of Globalisation.

From the 1870s to the outbreak of World War I in 1914, the world benefited from a well integrated financial order, sometimes known as the First age of Globalisation.

Money unions were operating which effectively allowed members to accept each others currency as legal tender including the Latin Monetary Union

(Belgium, Italy, Switzerland, France) and Scandinavian monetary union

(Denmark, Norway and Sweden). In the absence of shared membership of a union, transactions were facilitated by widespread participation in the gold standard

, by both independent nations and their colonies. Great Britain was at the time the world's pre-eminent financial, imperial, and industrial power, ruling more of the world and exporting more capital as a percentage of her national income than any other creditor nation has since.

While capital controls comparable to the Bretton Woods System were not in place, damaging capital flows were far less common than they were to be in the post 1971 era. In fact Great Britain's capital exports helped to correct global imbalances as they tended to be counter cyclical, rising when Britain's economy went into recession, thus compensating other states for income lost from export of goods.

Accordingly, this era saw mostly steady growth and a relatively low level of financial crises. In contrast to the Bretton Woods system, the pre–World War I financial order was not created at a single high level conference; rather it evolved organically in a series of discrete steps. The Gilded Age

, a time of especially rapid development in North America, falls into this period.

The years between the world wars have been described as a period of de-globalisation, as both international trade and capital flows shrank compared to the period before World War I. During World War I countries had abandoned the gold standard and, except for the United States, returned to it only briefly. By the early 30's the prevailing order was essentially a fragmented system of floating exchange rates

The years between the world wars have been described as a period of de-globalisation, as both international trade and capital flows shrank compared to the period before World War I. During World War I countries had abandoned the gold standard and, except for the United States, returned to it only briefly. By the early 30's the prevailing order was essentially a fragmented system of floating exchange rates

.

In this era, the experience of Great Britain and others was that the gold standard ran counter to the need to retain domestic policy autonomy. To protect their reserves of gold countries would sometimes need to raise interest rates and generally follow a deflationary policy. The greatest need for this could arise in a downturn, just when leaders would have preferred to lower rates to encourage growth. Economist Nicholas Davenport

had even argued that the wish to return Britain to the gold standard, "sprang from a sadistic desire by the Bankers to inflict pain on the British working class."

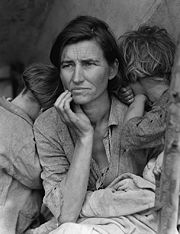

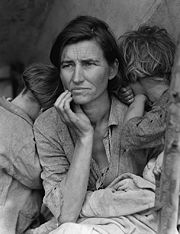

By the end of World War I, Great Britain was heavily indebted to the United States, allowing the USA to largely displace her as the worlds number one financial power. The United States however was reluctant to assume Great Britain's leadership role, partly due to isolationist influences and a focus on domestic concerns. In contrast to Great Britain in the previous era, capital exports from the US were not counter cyclical. They expanded rapidly with the United States's economic growth in the twenties up to 1928, but then almost completely halted as the US economy began slowing in that year. As the Great Depression

intensified in 1930, financial institutions were hit hard along with trade; in 1930 alone 1345 US banks collapsed.

During the 1930s the United States raised trade barriers, refused to act as an international lender of last resort, and refused calls to cancel war debts, all of which further aggravated economic hardship for other countries. According to economist John Maynard Keynes

another factor contributing to the turbulent economic performance of this era was the insistence of French premier Clemenceau

that Germany pay war reparations

at too high a level, which Keynes described in his book The Economic Consequences of the Peace

.

British and American policy makers began to plan the post war international monetary system in the early 1940s. The objective was to create an order that combined the benefits of an integrated and relatively liberal international system with the freedom for governments to pursue domestic policies aimed at promoting full employment and social wellbeing.

British and American policy makers began to plan the post war international monetary system in the early 1940s. The objective was to create an order that combined the benefits of an integrated and relatively liberal international system with the freedom for governments to pursue domestic policies aimed at promoting full employment and social wellbeing.

The principal architects of the new system, John Maynard Keynes and Harry Dexter White

, created a plan which was endorsed by the 42 countries attending the 1944 Bretton Woods conference

. The plan involved nations agreeing to a system of fixed but adjustable exchange rates where the currencies were pegged against the dollar, with the dollar itself convertible into gold. So in effect this was a gold – dollar exchange standard. There were a number of improvements on the old gold standard. Two international institutions, the International Monetary Fund

(IMF) and the World Bank

were created; A key part of their function was to replace private finance as more reliable source of lending for investment projects in developing states. At the time the soon to be defeated powers of Germany and Japan were envisaged as states soon to be in need of such development, and there was a desire from both the US and Britain not to see the defeated powers saddled with punitive sanctions that would inflict lasting pain on future generations. The new exchange rate system allowed countries facing economic hardship to devalue their currencies by up to 10% against the dollar (more if approved by the IMF) – thus they would not be forced to undergo deflation to stay in the gold standard. A system of capital controls was introduced to protect countries from the damaging effects of capital flight and to allow countries to pursue independent macro economic policies

while still welcoming flows intended for productive investment. Keynes had argued against the dollar having such a central role in the monetary system, and suggested an international currency called Bancor

be used instead, but he was overruled by the Americans. Towards the end of the Bretton Woods era, the central role of the dollar became a problem as international demand eventually forced the US to run a persistent trade deficit, which undermined confidence in the dollar. This, together with the emergence of a parallel market for gold where the price soared above the official US mandated price, led to speculators running down the US gold reserves. Even when convertibility was restricted to nations only, some, notably France, continued building up hoards of gold at the expense of the US. Eventually these pressures caused President Nixon to end all convertibility into gold on 15 August 1971. This event marked the effective end of the Bretton Woods systems; attempts were made to find other mechanisms to preserve the fixed exchange rates over the next few years, but they were not successful, resulting in a system of floating exchange rates.

An alternative name for the post Bretton Woods system is the Washington Consensus. While the name was coined in 1989, the associated economic system came into effect years earlier: according to economic historian Lord Skidelsky the Washington Consensus is generally seen as spanning 1980–2009 (the latter half of the 1970s being a transitional period).

An alternative name for the post Bretton Woods system is the Washington Consensus. While the name was coined in 1989, the associated economic system came into effect years earlier: according to economic historian Lord Skidelsky the Washington Consensus is generally seen as spanning 1980–2009 (the latter half of the 1970s being a transitional period).

The transition away from Bretton Woods was marked by a switch

from a state led to a market led system. The Bretton Wood system is considered by economic historians to have broken down in the 1970s: crucial events being Nixon suspending the dollar's convertibility into gold in 1971, the United states abandonment of Capital Controls in 1974, and Great Britain's ending of capital controls in 1979 which was swiftly copied by most other major economies.

In some parts of the developing world, liberalisation brought significant benefits for large sections of the population – most prominently with Deng Xiaoping

's reforms in China since 1978 and the liberalisation of India after her 1991 crisis

.

Generally the industrial nations experienced much slower growth and higher unemployment than in the previous era, and according to Professor Gordon Fletcher in retrospect the 1950s and 60s when the Bretton Woods system was operating came to be seen as a golden age.

Financial crises have been more intense and have increased in frequency by about 300% – with the damaging effects prior to 2008 being chiefly felt in the emerging economies. On the positive side, at least until 2008 investors have frequently achieved very high rates of return, with salaries and bonuses in the financial sector reaching record levels.

From 2003, economists such as Michael P. Dooley, Peter M. Garber, and David Folkerts-Landau began writing papers

describing the emergence of a new international system involving an interdependency between states with generally high savings in Asia lending and exporting to western states with generally high spending. Similar to the original Bretton Woods, this included Asian currencies being pegged to the dollar, though this time by the unilateral intervention of Asian governments in the currency market to stop their currencies appreciating. The developing world as a whole stopped running current account deficits in 1999

– widely seen as a response to unsympathetic treatment following the 1997 Asian Financial Crisis. The most striking example of east-west interdependency is the relationship between China and America, which Niall Ferguson

calls Chimerica

. From 2004, Dooley et al. began using the term Bretton Woods II to describe this de facto state of affairs, and continue to do so as late as 2009.

Others have described this supposed "Bretton Woods II", sometimes called "New Bretton Woods", as a "fiction", and called for the elimination of the structural imbalances that underlie it, viz, the chronic US current account deficit.

However since at least 2007 those authors have also used the term "Bretton Woods II" to call for a new de jure system: for key international financial institutions like the IMF and World Bank to be revamped to meet the demands of the current age,

and between 2008 to mid 2009 the terms Bretton Woods II and New Bretton Woods was increasingly used in the latter sense. By late 2009, with less emphases on structural reform to the international monetary system and more attention being paid to issues such as re-balancing

the world economy, Bretton Woods II is again frequently used to refer to the practice some countries have of unilaterally pegging their currencies to the dollar.

Leading financial journalist Martin Wolf

Leading financial journalist Martin Wolf

has reported that all financial crises since 1971 have been preceded by large capital inflows

into affected regions. While ever since the seventies there have been numerous calls from the global justice movement

for a revamped international system to tackle the problem of unfettered capital flows, it wasn't until late 2008 that this idea began to receive substantial support from leading politicians. On September 26, 2008, French President Nicolas Sarkozy

, then also the President of the European Union

, said, "We must rethink the financial system from scratch, as at Bretton Woods."

On October 13, 2008, British Prime Minister Gordon Brown

said world leaders must meet to agree to a new economic system:

However, Brown's approach was quite different to the original Bretton Woods system

, emphasising the continuation of globalization

and free trade

as opposed to a return to fixed exchange rates.

There were tensions between Brown and Sarkozy, who argued that the "Anglo-Saxon" model of unrestrained markets had failed.

However European leaders were united in calling for a "Bretton Woods II" summit to redesign the world's financial architecture.

President Bush was agreeable to the calls, and the resulting meeting was the 2008 G-20 Washington summit

. International agreement was achieved for the common adoption of Keynesian fiscal stimulus

, an area where the US and China were to emerge as the worlds leading actors.

Yet there was no substantial progress towards reforming the international financial system, and nor was there at the 2009 meeting of the World Economic Forum at Davos

Despite this lack of results leaders continued to campaign for Bretton Woods II. Italian

Economics Minister Giulio Tremonti

said that Italy would use its 2009 G7 chairmanship to push for a "New Bretton Woods." He had been critical of the U.S.'s response to the global financial crisis of 2008, and had suggested that the dollar may be superseded as the base currency of the Bretton Woods system.

Choike, a portal organisation representing southern hemisphere NGOs, called for the establishment of "international permanent and binding mechanisms of control over capital flows" and as of March 2009 had achieved over 550 signatories from civil society organisations.

March 2009 saw Gordon Brown continuing to advocate for reform and the granting of extended powers to international financial institutions like the IMF at the April G20 summit in London,

and was said to have president Obama's support

.

Also during March 2009, in a speech entitled Reform the International Monetary System, Zhou Xiaochuan

, the governor of the People's Bank of China

came out in favour of Keynes's idea of a centrally managed global reserve currency. Dr Zhou argued that it was unfortunate that part of the reason for the Bretton Woods system breaking down was the failure to adopt Keynes's Bancor

. Dr Zhou said that national currencies were unsuitable for use as global reserve currencies as a result of the Triffin dilemma

- the difficulty faced by reserve currency issuers in trying to simultaneously achieve their domestic monetary policy goals and meet other countries' demand for reserve currency. Dr Zhou proposed a gradual move towards increased used of IMF Special Drawing Rights

(SDRs) as a centrally managed global reserve currency

His proposal attracted much international attention. In a November 2009 article published in Foreign Affairs

magazine, economist C. Fred Bergsten

argued that Dr Zhou's suggestion or a similar change to the international monetary system would be in the United States' best interests as well as the rest of the world's.

Leaders meeting in April at the 2009 G-20 London summit

agreed to allow $250 Billion of SDRs to be created by the IMF, to be distributed to all IMF members according to each countries voting rights. In the aftermath of the summit, Gordon Brown declared "the Washington Consensus is over". However in a book

published during September 2009, Professor Robert Skidelsky, an international expert on Keynesianism, argued it was still too early to say whether a new international monetary system was emerging.

On Jan 27, in his opening address to the 2010 World Economic Forum

in Davos, President Sarkozy repeated his call for a new Bretton Woods, and was met by wild applause by a sizeable proportion of the audience.

International trade

International trade is the exchange of capital, goods, and services across international borders or territories. In most countries, such trade represents a significant share of gross domestic product...

, cross border investment and generally the reallocation of capital

Redistribution (economics)

Redistribution of wealth is the transfer of income, wealth or property from some individuals to others caused by a social mechanism such as taxation, monetary policies, welfare, nationalization, charity, divorce or tort law. Most often it refers to progressive redistribution, from the rich to the...

between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic actors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods

United Nations Monetary and Financial Conference

The United Nations Monetary and Financial Conference, commonly known as the Bretton Woods conference, was a gathering of 730 delegates from all 44 Allied nations at the Mount Washington Hotel, situated in Bretton Woods, New Hampshire, to regulate the international monetary and financial order after...

in 1944.

Historical overview

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

and silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

have been used for trade, termed bullion, and since early history the coins of various issuers – generally kingdoms and empires – have been traded. The earliest known records of pre - coinage use of bullion for monetary exchange are from Mesopotamia and Egypt, dating from the third millennium BC. Its believed that at this time money played a relatively minor role in the ordering of economic life for these regions, compared to barter

Barter

Barter is a method of exchange by which goods or services are directly exchanged for other goods or services without using a medium of exchange, such as money. It is usually bilateral, but may be multilateral, and usually exists parallel to monetary systems in most developed countries, though to a...

and centralised redistribution - a process where the population surrendered their produce to ruling authorities who then redistrubted it as they saw fit. Coinage is believed to have first developed in China in the late 7th century BC, and independently at around the same time in Lydia

Lydia

Lydia was an Iron Age kingdom of western Asia Minor located generally east of ancient Ionia in the modern Turkish provinces of Manisa and inland İzmir. Its population spoke an Anatolian language known as Lydian....

, Asia minor

Asia Minor

Asia Minor is a geographical location at the westernmost protrusion of Asia, also called Anatolia, and corresponds to the western two thirds of the Asian part of Turkey...

, from where its use spread to nearby Greek cities and later to the rest of the world.

Sometimes formal monetary system

Monetary system

A monetary system is anything that is accepted as a standard of value and measure of wealth in a particular region.However, the current trend is to use international trade and investment to alter the policy and legislation of individual governments. The best recent example of this policy is the...

s have been imposed by regional rules. For example scholars have tentatively suggested that the ruler Servius Tullius

Servius Tullius

Servius Tullius was the legendary sixth king of ancient Rome, and the second of its Etruscan dynasty. He reigned 578-535 BC. Roman and Greek sources describe his servile origins and later marriage to a daughter of Lucius Tarquinius Priscus, Rome's first Etruscan king, who was assassinated in 579 BC...

created a primitive monetary system in the archaic period of what was to become the Roman Republic

Roman Republic

The Roman Republic was the period of the ancient Roman civilization where the government operated as a republic. It began with the overthrow of the Roman monarchy, traditionally dated around 508 BC, and its replacement by a government headed by two consuls, elected annually by the citizens and...

. Tullius reigned in the sixth century BC - several centuries before Rome is believed to have developed a formal coinage system.

As with bullion, early use of coinage is believed to have been generally the preserve of the elite. But by about the 4th century BC they were widely used in Greek cities. Coins were generally supported by the city state authorities, who endeavoured to ensure they retained their values regardless of fluctuations in the availability of whatever base precious metals they were made from. From Greece the use of coins spread slowly westwards throughout Europe, and eastwards to India. Coins were in use in India from about 400BC, initially they played a greater role in religion than trade, but by the 2nd century had become central to commercial transactions. Monetary systems developed in India were so successful they continued to spread through parts of Asia well into the Middle Ages.

As multiple coins became common within a region, they have been exchanged by moneychangers, which are the predecessors of today's foreign exchange market

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

. These are famously discussed in the Biblical story of Jesus and the money changers

Jesus and the Money Changers

The narrative of Jesus and the money changers, commonly referred to as the cleansing of the Temple, occurs in all four canonical gospels of the New Testament....

. In Venice and the Italian city states of the early Middle Ages, money changes would often have to struggle to perform calculations involving six or more currencies. This partly led to Fibonacci

Fibonacci

Leonardo Pisano Bigollo also known as Leonardo of Pisa, Leonardo Pisano, Leonardo Bonacci, Leonardo Fibonacci, or, most commonly, simply Fibonacci, was an Italian mathematician, considered by some "the most talented western mathematician of the Middle Ages."Fibonacci is best known to the modern...

writing his Liber Abaci

Liber Abaci

Liber Abaci is a historic book on arithmetic by Leonardo of Pisa, known later by his nickname Fibonacci...

where he popularised the use of Arabic numerals which displaced the more difficult roman numerals then in use by western merchants.

Hegemony

Hegemony is an indirect form of imperial dominance in which the hegemon rules sub-ordinate states by the implied means of power rather than direct military force. In Ancient Greece , hegemony denoted the politico–military dominance of a city-state over other city-states...

, its currency has been a basis for international trade, and hence for a de facto monetary system. In the West – Europe and the Middle East – an early such coin was the Persian daric

Persian daric

The daric was a gold coin used within the Persian Empire. It was of very high gold quality, with a purity of 95.83%. Weighing around 8.4 grams, it bore the image of the Persian king or a great warrior armed with a bow and arrow, but who is depicted is not known for sure...

, of the Persian empire. This was succeeded by Roman currency

Roman currency

The Roman currency during most of the Roman Republic and the western half of the Roman Empire consisted of coins including the aureus , the denarius , the sestertius , the dupondius , and the as...

of the Roman empire

Roman Empire

The Roman Empire was the post-Republican period of the ancient Roman civilization, characterised by an autocratic form of government and large territorial holdings in Europe and around the Mediterranean....

, such as the denarius

Denarius

In the Roman currency system, the denarius was a small silver coin first minted in 211 BC. It was the most common coin produced for circulation but was slowly debased until its replacement by the antoninianus...

, then the Gold Dinar

Gold Dinar

The gold dinar is a gold coin first issued in 77 AH by Caliph Abd al-Malik ibn Marwan. The name is derived from denarius, a Roman currency...

of the Muslim empire, and later – from the 16th to 20th centuries, during the Age of Imperialism – by the currency of European colonial powers: the Spanish dollar

Spanish dollar

The Spanish dollar is a silver coin, of approximately 38 mm diameter, worth eight reales, that was minted in the Spanish Empire after a Spanish currency reform in 1497. Its purpose was to correspond to the German thaler...

, the Dutch Gilder, the French Franc and the British Pound Sterling; at times one currency has been pre-eminent, at times no one dominated. With the growth of American power, the US Dollar became the basis for the international monetary system, formalized in the Bretton Woods agreement that established the post–World War II monetary order, with fixed exchange rates of currencies to the dollar, and convertibility

Convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged....

of the dollar into gold. Since the breakdown of the Bretton Woods system, culminating in the Nixon shock

Nixon Shock

The Nixon Shock was a series of economic measures taken by U.S. President Richard Nixon in 1971 including unilaterally cancelling the direct convertibility of the United States dollar to gold that essentially ended the existing Bretton Woods system of international financial exchange.-Background:By...

of 1971, ending convertibility, the US dollar has remained the de facto basis of the world monetary system, though no longer de jure, with various European currencies and the Japanese Yen being used. Since the formation of the Euro, the Euro has gained use as a reserve currency

Reserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

and a unit of transactions, though the dollar has remained the primary currency.

A dominant currency may be used directly or indirectly by other nations – for example, English kings minted gold mancus

Mancus

Mancus was a term used in early medieval Europe to denote either a gold coin, a weight of gold of 4.25g , or a unit of account of thirty silver pence. This made it worth about a months wages for a skilled worker, such as a craftsman or a soldier...

, presumably to function as dinars to exchange with Islamic Spain, and more recently, a number of nations have used the US dollar as their local currency, a custom called dollarization

Dollarization

Dollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency.The biggest economies to have...

.

Until the 19th century, the global monetary system was loosely linked at best, with Europe, the Americas, India and China (among others) having largely separate economies, and hence monetary systems were regional. European colonization of the Americas, starting with the Spanish empire, led to the integration of American and European economies and monetary systems, and European colonization of Asia led to the dominance of European currencies, notably the British pound sterling in the 19th century, succeeded by the US dollar in the 20th century. Some, such as Michael Hudson

Michael Hudson

Admiral Michael Wyndham Hudson AC was a senior officer within the Royal Australian Navy, particularly notable for playing an important role in the introduction of the Collins class submarines, Anzac Class frigates and establishing two-ocean basing for ships of the RAN...

, foresee the decline of a single basis for the global monetary system, and instead the emergence of regional trade bloc

Trade bloc

A trade bloc is a type of intergovernmental agreement, often part of a regional intergovernmental organization, where regional barriers to trade, are reduced or eliminated among the participating states.-Description:...

s, citing the emergence of the Euro as an example of this phenomenon. See also Global financial system

Global financial system

The global financial system is the financial system consisting of institutions and regulators that act on the international level, as opposed to those that act on a national or regional level...

s , world-systems approach and polarity in international relations

Polarity in international relations

Polarity in international relations is any of the various ways in which power is distributed within the international system. It describes the nature of the international system at any given period of time. One generally distinguishes four types of systems: Unipolarity, Bipolarity, Tripolarity, and...

. It was in the later half of the 19th century that a monetary system with close to universal global participation emerged, based on the gold standard.

The pre WWI financial order: 1870–1914

Money unions were operating which effectively allowed members to accept each others currency as legal tender including the Latin Monetary Union

Latin Monetary Union

The Latin Monetary Union was a 19th century attempt to unify several European currencies, at a time when most circulating coins were still made of gold and silver...

(Belgium, Italy, Switzerland, France) and Scandinavian monetary union

Scandinavian Monetary Union

The Scandinavian Monetary Union was a monetary union formed by Sweden and Denmark on May 5, 1873, by fixing their currencies against gold at par to each other...

(Denmark, Norway and Sweden). In the absence of shared membership of a union, transactions were facilitated by widespread participation in the gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

, by both independent nations and their colonies. Great Britain was at the time the world's pre-eminent financial, imperial, and industrial power, ruling more of the world and exporting more capital as a percentage of her national income than any other creditor nation has since.

While capital controls comparable to the Bretton Woods System were not in place, damaging capital flows were far less common than they were to be in the post 1971 era. In fact Great Britain's capital exports helped to correct global imbalances as they tended to be counter cyclical, rising when Britain's economy went into recession, thus compensating other states for income lost from export of goods.

Accordingly, this era saw mostly steady growth and a relatively low level of financial crises. In contrast to the Bretton Woods system, the pre–World War I financial order was not created at a single high level conference; rather it evolved organically in a series of discrete steps. The Gilded Age

Gilded Age

In United States history, the Gilded Age refers to the era of rapid economic and population growth in the United States during the post–Civil War and post-Reconstruction eras of the late 19th century. The term "Gilded Age" was coined by Mark Twain and Charles Dudley Warner in their book The Gilded...

, a time of especially rapid development in North America, falls into this period.

Between the World Wars: 1919–1939

.

In this era, the experience of Great Britain and others was that the gold standard ran counter to the need to retain domestic policy autonomy. To protect their reserves of gold countries would sometimes need to raise interest rates and generally follow a deflationary policy. The greatest need for this could arise in a downturn, just when leaders would have preferred to lower rates to encourage growth. Economist Nicholas Davenport

had even argued that the wish to return Britain to the gold standard, "sprang from a sadistic desire by the Bankers to inflict pain on the British working class."

By the end of World War I, Great Britain was heavily indebted to the United States, allowing the USA to largely displace her as the worlds number one financial power. The United States however was reluctant to assume Great Britain's leadership role, partly due to isolationist influences and a focus on domestic concerns. In contrast to Great Britain in the previous era, capital exports from the US were not counter cyclical. They expanded rapidly with the United States's economic growth in the twenties up to 1928, but then almost completely halted as the US economy began slowing in that year. As the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

intensified in 1930, financial institutions were hit hard along with trade; in 1930 alone 1345 US banks collapsed.

During the 1930s the United States raised trade barriers, refused to act as an international lender of last resort, and refused calls to cancel war debts, all of which further aggravated economic hardship for other countries. According to economist John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

another factor contributing to the turbulent economic performance of this era was the insistence of French premier Clemenceau

Georges Clemenceau

Georges Benjamin Clemenceau was a French statesman, physician and journalist. He served as the Prime Minister of France from 1906 to 1909, and again from 1917 to 1920. For nearly the final year of World War I he led France, and was one of the major voices behind the Treaty of Versailles at the...

that Germany pay war reparations

World War I reparations

World War I reparations refers to the payments and transfers of property and equipment that Germany was forced to make under the Treaty of Versailles following its defeat during World War I...

at too high a level, which Keynes described in his book The Economic Consequences of the Peace

The Economic Consequences of the Peace

The Economic Consequences of the Peace is a book written and published by John Maynard Keynes. Keynes attended the Versailles Conference as a delegate of the British Treasury and argued for a much more generous peace. It was a bestseller throughout the world and was critical in establishing a...

.

The Bretton Woods Era: 1945–1971

The principal architects of the new system, John Maynard Keynes and Harry Dexter White

Harry Dexter White

Harry Dexter White was an American economist, and senior U.S. Treasury department official, participating in the Bretton Woods conference...

, created a plan which was endorsed by the 42 countries attending the 1944 Bretton Woods conference

United Nations Monetary and Financial Conference

The United Nations Monetary and Financial Conference, commonly known as the Bretton Woods conference, was a gathering of 730 delegates from all 44 Allied nations at the Mount Washington Hotel, situated in Bretton Woods, New Hampshire, to regulate the international monetary and financial order after...

. The plan involved nations agreeing to a system of fixed but adjustable exchange rates where the currencies were pegged against the dollar, with the dollar itself convertible into gold. So in effect this was a gold – dollar exchange standard. There were a number of improvements on the old gold standard. Two international institutions, the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF) and the World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

were created; A key part of their function was to replace private finance as more reliable source of lending for investment projects in developing states. At the time the soon to be defeated powers of Germany and Japan were envisaged as states soon to be in need of such development, and there was a desire from both the US and Britain not to see the defeated powers saddled with punitive sanctions that would inflict lasting pain on future generations. The new exchange rate system allowed countries facing economic hardship to devalue their currencies by up to 10% against the dollar (more if approved by the IMF) – thus they would not be forced to undergo deflation to stay in the gold standard. A system of capital controls was introduced to protect countries from the damaging effects of capital flight and to allow countries to pursue independent macro economic policies

while still welcoming flows intended for productive investment. Keynes had argued against the dollar having such a central role in the monetary system, and suggested an international currency called Bancor

Bancor

The Bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher conceptualised in the years 1940-42 and which the United Kingdom proposed to introduce after the Second World War...

be used instead, but he was overruled by the Americans. Towards the end of the Bretton Woods era, the central role of the dollar became a problem as international demand eventually forced the US to run a persistent trade deficit, which undermined confidence in the dollar. This, together with the emergence of a parallel market for gold where the price soared above the official US mandated price, led to speculators running down the US gold reserves. Even when convertibility was restricted to nations only, some, notably France, continued building up hoards of gold at the expense of the US. Eventually these pressures caused President Nixon to end all convertibility into gold on 15 August 1971. This event marked the effective end of the Bretton Woods systems; attempts were made to find other mechanisms to preserve the fixed exchange rates over the next few years, but they were not successful, resulting in a system of floating exchange rates.

The post Bretton Woods system: 1971 – present

The transition away from Bretton Woods was marked by a switch

Post-war displacement of Keynesianism

The Post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world...

from a state led to a market led system. The Bretton Wood system is considered by economic historians to have broken down in the 1970s: crucial events being Nixon suspending the dollar's convertibility into gold in 1971, the United states abandonment of Capital Controls in 1974, and Great Britain's ending of capital controls in 1979 which was swiftly copied by most other major economies.

In some parts of the developing world, liberalisation brought significant benefits for large sections of the population – most prominently with Deng Xiaoping

Deng Xiaoping

Deng Xiaoping was a Chinese politician, statesman, and diplomat. As leader of the Communist Party of China, Deng was a reformer who led China towards a market economy...

's reforms in China since 1978 and the liberalisation of India after her 1991 crisis

1991 India economic crisis

By 1985, India had started having balance of payments problems. By the end of 1990, it was in a serious economic crisis. The government was close to default, its central bank had refused new credit and foreign exchange reserves had reduced to such a point that India could barely finance three...

.

Generally the industrial nations experienced much slower growth and higher unemployment than in the previous era, and according to Professor Gordon Fletcher in retrospect the 1950s and 60s when the Bretton Woods system was operating came to be seen as a golden age.

Financial crises have been more intense and have increased in frequency by about 300% – with the damaging effects prior to 2008 being chiefly felt in the emerging economies. On the positive side, at least until 2008 investors have frequently achieved very high rates of return, with salaries and bonuses in the financial sector reaching record levels.

The "Revived Bretton Woods system" identified in 2003

| Date | System | Reserve assets | Leaders |

|---|---|---|---|

| 1803-1873 | Bimetallism Bimetallism In economics, bimetallism is a monetary standard in which the value of the monetary unit is defined as equivalent both to a certain quantity of gold and to a certain quantity of silver; such a system establishes a fixed rate of exchange between the two metals... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , silver Silver Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal... |

France France The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France... , UK United Kingdom The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages... |

| 1873-1914 | Gold standard Gold standard The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , pound Pound sterling The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence... |

UK United Kingdom The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages... |

| 1914-1924 | Anchored dollar standard United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , UK United Kingdom The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages... , France France The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France... |

| 1924-1933 | Gold standard Gold standard The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , pound Pound sterling The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , UK United Kingdom The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages... , France France The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France... |

| 1933-1971 | Anchored dollar standard United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , G-10 Group of Ten (economic) The Group of Ten or G-10 refers to the group of countries that have agreed to participate in the General Arrangements to Borrow... |

| 1971-1973 | Dollar standard United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... |

| 1973-1985 | Flexible exchange rates Exchange rate regime The exchange-rate regime is the way a country manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , mark, pound Pound sterling The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , Germany Germany Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate... , Japan Japan Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south... |

| 1985-1999 | Managed exchange rates Exchange rate regime The exchange-rate regime is the way a country manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , mark, yen Japanese yen The is the official currency of Japan. It is the third most traded currency in the foreign exchange market after the United States dollar and the euro. It is also widely used as a reserve currency after the U.S. dollar, the euro and the pound sterling... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , G7 G8 The Group of Eight is a forum, created by France in 1975, for the governments of seven major economies: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. In 1997, the group added Russia, thus becoming the G8... , IMF International Monetary Fund The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world... |

| 1999- | Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , euro Euro The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , euro Euro The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,... , yen Japanese yen The is the official currency of Japan. It is the third most traded currency in the foreign exchange market after the United States dollar and the euro. It is also widely used as a reserve currency after the U.S. dollar, the euro and the pound sterling... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , Eurozone Eurozone The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender... , IMF International Monetary Fund The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world... |

From 2003, economists such as Michael P. Dooley, Peter M. Garber, and David Folkerts-Landau began writing papers

describing the emergence of a new international system involving an interdependency between states with generally high savings in Asia lending and exporting to western states with generally high spending. Similar to the original Bretton Woods, this included Asian currencies being pegged to the dollar, though this time by the unilateral intervention of Asian governments in the currency market to stop their currencies appreciating. The developing world as a whole stopped running current account deficits in 1999

– widely seen as a response to unsympathetic treatment following the 1997 Asian Financial Crisis. The most striking example of east-west interdependency is the relationship between China and America, which Niall Ferguson

Niall Ferguson

Niall Campbell Douglas Ferguson is a British historian. His specialty is financial and economic history, particularly hyperinflation and the bond markets, as well as the history of colonialism.....

calls Chimerica

Chimerica

Chimerica is a neologism coined by Niall Ferguson and Moritz Schularick describing the symbiotic relationship between China and the United States, with incidental reference to the legendary chimera....

. From 2004, Dooley et al. began using the term Bretton Woods II to describe this de facto state of affairs, and continue to do so as late as 2009.

Others have described this supposed "Bretton Woods II", sometimes called "New Bretton Woods", as a "fiction", and called for the elimination of the structural imbalances that underlie it, viz, the chronic US current account deficit.

However since at least 2007 those authors have also used the term "Bretton Woods II" to call for a new de jure system: for key international financial institutions like the IMF and World Bank to be revamped to meet the demands of the current age,

and between 2008 to mid 2009 the terms Bretton Woods II and New Bretton Woods was increasingly used in the latter sense. By late 2009, with less emphases on structural reform to the international monetary system and more attention being paid to issues such as re-balancing

Balance of payments

Balance of payments accounts are an accounting record of all monetary transactions between a country and the rest of the world.These transactions include payments for the country's exports and imports of goods, services, financial capital, and financial transfers...

the world economy, Bretton Woods II is again frequently used to refer to the practice some countries have of unilaterally pegging their currencies to the dollar.

Calls for a "New Bretton Woods"

Martin Wolf

Martin Wolf, CBE is a British journalist, widely considered to be one of the world's most influential writers on economics. He is associate editor and chief economics commentator at the Financial Times.-Early life:...

has reported that all financial crises since 1971 have been preceded by large capital inflows

Capital account

The current and capital accounts make up a country's balance of payment . Together these three accounts tell a story about the state of an economy, its economic outlook and its strategies for achieving its desired goals...

into affected regions. While ever since the seventies there have been numerous calls from the global justice movement

Global Justice Movement

The Global Justice Movement is a network or constellation of globalized social movements opposing what is often known as the “corporate globalization” and promoting equal distribution of economic resources.-Movement of movements:...

for a revamped international system to tackle the problem of unfettered capital flows, it wasn't until late 2008 that this idea began to receive substantial support from leading politicians. On September 26, 2008, French President Nicolas Sarkozy

Nicolas Sarkozy

Nicolas Sarkozy is the 23rd and current President of the French Republic and ex officio Co-Prince of Andorra. He assumed the office on 16 May 2007 after defeating the Socialist Party candidate Ségolène Royal 10 days earlier....

, then also the President of the European Union

President of the European Union

President of the European Union could be a reference to any of:* President of the European Council * President of the European Commission...

, said, "We must rethink the financial system from scratch, as at Bretton Woods."

On October 13, 2008, British Prime Minister Gordon Brown

Gordon Brown

James Gordon Brown is a British Labour Party politician who was the Prime Minister of the United Kingdom and Leader of the Labour Party from 2007 until 2010. He previously served as Chancellor of the Exchequer in the Labour Government from 1997 to 2007...

said world leaders must meet to agree to a new economic system:

However, Brown's approach was quite different to the original Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

, emphasising the continuation of globalization

Globalization

Globalization refers to the increasingly global relationships of culture, people and economic activity. Most often, it refers to economics: the global distribution of the production of goods and services, through reduction of barriers to international trade such as tariffs, export fees, and import...

and free trade

Free trade

Under a free trade policy, prices emerge from supply and demand, and are the sole determinant of resource allocation. 'Free' trade differs from other forms of trade policy where the allocation of goods and services among trading countries are determined by price strategies that may differ from...

as opposed to a return to fixed exchange rates.

There were tensions between Brown and Sarkozy, who argued that the "Anglo-Saxon" model of unrestrained markets had failed.

However European leaders were united in calling for a "Bretton Woods II" summit to redesign the world's financial architecture.

President Bush was agreeable to the calls, and the resulting meeting was the 2008 G-20 Washington summit

2008 G-20 Washington summit

The 2008 G-20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G-20 on how to cooperate in key areas so as to strengthen economic growth, deal with the financial...

. International agreement was achieved for the common adoption of Keynesian fiscal stimulus

, an area where the US and China were to emerge as the worlds leading actors.

Yet there was no substantial progress towards reforming the international financial system, and nor was there at the 2009 meeting of the World Economic Forum at Davos

Despite this lack of results leaders continued to campaign for Bretton Woods II. Italian

Italy

Italy , officially the Italian Republic languages]] under the European Charter for Regional or Minority Languages. In each of these, Italy's official name is as follows:;;;;;;;;), is a unitary parliamentary republic in South-Central Europe. To the north it borders France, Switzerland, Austria and...

Economics Minister Giulio Tremonti

Giulio Tremonti

Giulio Tremonti is an Italian politician. He served in the government of Italy as Minister of Economy and Finance under Prime Minister Silvio Berlusconi from 1994 to 1995, from 2001 to 2004, from 2005 to 2006, and from 2008 to 2011....

said that Italy would use its 2009 G7 chairmanship to push for a "New Bretton Woods." He had been critical of the U.S.'s response to the global financial crisis of 2008, and had suggested that the dollar may be superseded as the base currency of the Bretton Woods system.

Choike, a portal organisation representing southern hemisphere NGOs, called for the establishment of "international permanent and binding mechanisms of control over capital flows" and as of March 2009 had achieved over 550 signatories from civil society organisations.

| System | Reserve assets | Leaders |

|---|---|---|

| Flexible exchange rates Exchange rate regime The exchange-rate regime is the way a country manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , euro Euro The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,... , renminbi Renminbi The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , Eurozone Eurozone The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender... , China People's Republic of China China , officially the People's Republic of China , is the most populous country in the world, with over 1.3 billion citizens. Located in East Asia, the country covers approximately 9.6 million square kilometres... |

| Special drawing rights standard Special Drawing Rights Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged... |

SDR Special Drawing Rights Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , G-20 G-20 major economies The Group of Twenty Finance Ministers and Central Bank Governors is a group of finance ministers and central bank governors from 20 major economies: 19 countries plus the European Union, which is represented by the President of the European Council and by the European Central Bank... , IMF International Monetary Fund The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world... |

| Gold standard Gold standard The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard... |

Gold Gold Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a... , dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... |

| Flexible exchange rates Exchange rate regime The exchange-rate regime is the way a country manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.... |

Dollar United States dollar The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies.... , euro Euro The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,... , rupee Indian rupee The Indian rupee is the official currency of the Republic of India. The issuance of the currency is controlled by the Reserve Bank of India.... |

US United States The United States of America is a federal constitutional republic comprising fifty states and a federal district... , Eurozone Eurozone The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender... , India India India , officially the Republic of India , is a country in South Asia. It is the seventh-largest country by geographical area, the second-most populous country with over 1.2 billion people, and the most populous democracy in the world... |

March 2009 saw Gordon Brown continuing to advocate for reform and the granting of extended powers to international financial institutions like the IMF at the April G20 summit in London,

and was said to have president Obama's support

.

Also during March 2009, in a speech entitled Reform the International Monetary System, Zhou Xiaochuan

Zhou Xiaochuan

Zhou Xiaochuan is a Chinese economist, banker, reformist and bureaucrat. As governor of the People's Bank of China since December 2002, he has been in charge of the monetary policy of the People's Republic of China....

, the governor of the People's Bank of China

People's Bank of China

The People's Bank of China is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China...

came out in favour of Keynes's idea of a centrally managed global reserve currency. Dr Zhou argued that it was unfortunate that part of the reason for the Bretton Woods system breaking down was the failure to adopt Keynes's Bancor

Bancor

The Bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher conceptualised in the years 1940-42 and which the United Kingdom proposed to introduce after the Second World War...

. Dr Zhou said that national currencies were unsuitable for use as global reserve currencies as a result of the Triffin dilemma

Triffin dilemma

The Triffin dilemma is a theory that when a national currency also serves as an international reserve currency, there could be conflicts of interest between short-term domestic and long-term international economic objectives...

- the difficulty faced by reserve currency issuers in trying to simultaneously achieve their domestic monetary policy goals and meet other countries' demand for reserve currency. Dr Zhou proposed a gradual move towards increased used of IMF Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(SDRs) as a centrally managed global reserve currency

His proposal attracted much international attention. In a November 2009 article published in Foreign Affairs

Foreign Affairs

Foreign Affairs is an American magazine and website on international relations and U.S. foreign policy published since 1922 by the Council on Foreign Relations six times annually...

magazine, economist C. Fred Bergsten

C. Fred Bergsten

C. Fred Bergsten is an American economist, author, and political adviser. He has served as Assistant Secretary for International Affairs at the U.S. Treasury Department and has been director of the Peterson Institute for International Economics, formerly the Institute for International Economics,...

argued that Dr Zhou's suggestion or a similar change to the international monetary system would be in the United States' best interests as well as the rest of the world's.