Private equity

Encyclopedia

Private equity, in finance, is an asset class consisting of equity

securities in operating companies that are not publicly traded on a stock exchange

.

A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; each however providing working capital to a target company to nurture expansion, new product development, or restructuring of the company’s operations, management, or ownership.

Among the most common investment strategies in private equity are: leveraged buyout

s, venture capital

, growth capital

, distressed investments

and mezzanine capital

. In a typical leveraged buyout transaction, a private equity firm buys majority control of an existing or mature firm. This is distinct from a venture capital or growth capital investment, in which the investors (typically venture capital firms or angel investors) invest in young or emerging companies, and rarely obtain majority control.

Leveraged buyout, LBO or Buyout refers to a strategy of making equity investments as part of a transaction in which a company, business unit or business assets is acquired from the current shareholders typically with the use of financial leverage

Leveraged buyout, LBO or Buyout refers to a strategy of making equity investments as part of a transaction in which a company, business unit or business assets is acquired from the current shareholders typically with the use of financial leverage

. The companies involved in these transactions are typically mature and generate operating cash flows.

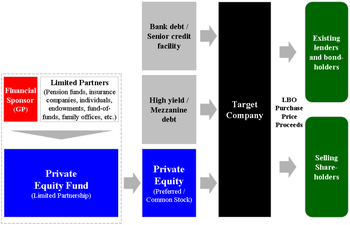

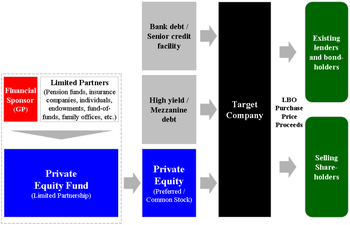

Leveraged buyouts involve a financial sponsor

agreeing to an acquisition without itself committing all the capital required for the acquisition. To do this, the financial sponsor will raise acquisition debt which ultimately looks to the cash flows of the acquisition target to make interest and principal payments. Acquisition debt in an LBO is often non-recourse

to the financial sponsor and has no claim on other investment managed by the financial sponsor. Therefore, an LBO transaction's financial structure is particularly attractive to a fund's limited partners, allowing them the benefits of leverage but greatly limiting the degree of recourse of that leverage. This kind of financing structure leverage benefits an LBO's financial sponsor in two ways: (1) the investor itself only needs to provide a fraction of the capital for the acquisition, and (2) the returns to the investor will be enhanced (as long as the return on assets exceeds the cost of the debt).

As a percentage of the purchase price for a leverage buyout target, the amount of debt used to finance a transaction varies according the financial condition and history of the acquisition target, market conditions, the willingness of lenders

to extend credit (both to the LBO's financial sponsor

s and the company to be acquired) as well as the interest costs and the ability of the company to cover those costs. Historically the debt portion of a LBO will range from 60%–90% of the purchase price, although during certain periods the debt ratio can be higher or lower than the historical averages. Between 2000–2005 debt averaged between 59.4% and 67.9% of total purchase price for LBOs in the United States.

Notes:

refers to equity investments, most often minority investments, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a major acquisition without a change of control of the business.

Companies that seek growth capital will often do so in order to finance a transformational event in their life cycle. These companies are likely to be more mature than venture capital funded companies, able to generate revenue and operating profits but unable to generate sufficient cash to fund major expansions, acquisitions or other investments. Because of this lack of scale these companies generally can find few alternative conduits to secure capital for growth, so access to growth equity can be critical to pursue necessary facility expansion, sales and marketing initiatives, equipment purchases, and new product development. The primary owner of the company may not be willing to take the financial risk alone. By selling part of the company to private equity, the owner can take out some value and share the risk of growth with partners. Capital can also be used to effect a restructuring of a company's balance sheet, particularly to reduce the amount of leverage (or debt)

the company has on its balance sheet

. A Private investment in public equity

, or PIPEs

, refer to a form of growth capital

investment made into a publicly traded company. PIPE investments are typically made in the form of a convertible

or preferred

security that is unregistered for a certain period of time. The Registered Direct, or RD, is another common financing vehicle used for growth capital. A registered direct is similar to a PIPE but is instead sold as a registered security.

refers to subordinated debt

or preferred equity securities that often represent the most junior portion of a company's capital structure

that is senior to the company's common equity

. This form of financing is often used by private equity investors to reduce the amount of equity capital required to finance a leveraged buyout or major expansion. Mezzanine capital, which is often used by smaller companies that are unable to access the high yield market

, allows such companies to borrow additional capital beyond the levels that traditional lenders are willing to provide through bank loans. In compensation for the increased risk, mezzanine debt holders require a higher return for their investment than secured or other more senior lenders.

Venture capital is often sub-divided by the stage of development of the company ranging from early stage capital used for the launch of start-up companies to late stage and growth capital that is often used to fund expansion of existing business that are generating revenue but may not yet be profitable or generating cash flow to fund future growth.

Entrepreneurs often develop products and ideas that require substantial capital during the formative stages of their companies' life cycles. Many entrepreneurs do not have sufficient funds to finance projects themselves, and they must therefore seek outside financing. The venture capitalist's need to deliver high returns to compensate for the risk of these investments makes venture funding an expensive capital source for companies. Being able to secure financing is critical to any business, whether it’s a startup seeking venture capital or a mid-sized firm that needs more cash to grow. Venture capital is most suitable for businesses with large up-front capital requirements which cannot be financed by cheaper alternatives such as debt. Although venture capital is often most closely associated with fast-growing technology and biotechnology

fields, venture funding has been used for other more traditional businesses.

or Special Situations is a broad category referring to investments in equity or debt securities of financially stressed companies. The "distressed" category encompasses two broad sub-strategies including:

In addition to these private equity strategies, hedge funds employ a variety of distressed investment strategies including the active trading of loans and bonds issued by distressed companies.

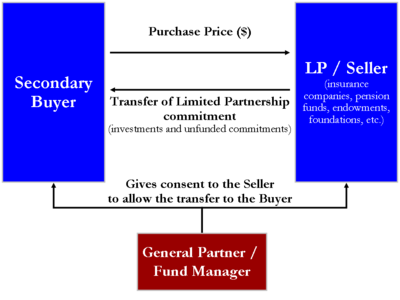

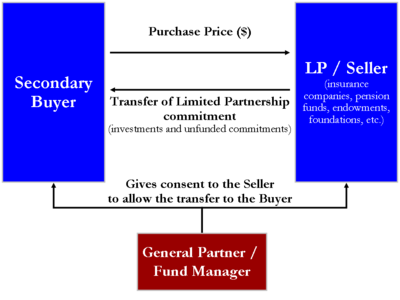

interests or portfolios of direct investments in privately held companies through the purchase of these investments from existing institutional investors. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. Secondary investments provide institutional investors with the ability to improve vintage diversification, particularly for investors that are new to the asset class. Secondaries also typically experience a different cash flow profile, diminishing the j-curve effect of investing in new private equity funds. Often investments in secondaries are made through third party fund vehicle, structured similar to a fund of funds

although many large institutional investors have purchased private equity fund interests through secondary transactions. Sellers of private equity fund investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds.

(ARDC) and J.H. Whitney & Company

. Before World War II, venture capital investments (originally known as "development capital") were primarily the domain of wealthy individuals and families. ARDC was founded by Georges Doriot

, the "father of venture capitalism" and founder of INSEAD

, with capital raised from institutional investors, to encourage private sector investments in businesses run by soldiers who were returning from World War II. ARDC is credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation

(DEC) would be valued at over $355 million after the company's initial public offering in 1968 (representing a return of over 500 times on its investment and an annualized rate of return

of 101%). It is commonly noted that the first venture-backed startup is Fairchild Semiconductor

(which produced the first commercially practicable integrated circuit), funded in 1959 by what would later become Venrock Associates

.

in May 1955 Under the terms of that transaction, McLean borrowed $42 million and raised an additional $7 million through an issue of preferred stock

. When the deal closed, $20 million of Waterman cash and assets were used to retire $20 million of the loan debt. Similar to the approach employed in the McLean transaction, the use of publicly traded holding companies as investment vehicles to acquire portfolios of investments in corporate assets was a relatively new trend in the 1960s popularized by the likes of Warren Buffett

(Berkshire Hathaway

) and Victor Posner

(DWG Corporation) and later adopted by Nelson Peltz

(Triarc), Saul Steinberg

(Reliance Insurance) and Gerry Schwartz

(Onex Corporation). These investment vehicles would utilize a number of the same tactics and target the same type of companies as more traditional leveraged buyouts and in many ways could be considered a forerunner of the later private equity firms. In fact it is Posner who is often credited with coining the term "leveraged buyout

" or "LBO"

The leveraged buyout boom of the 1980s was conceived by a number of corporate financiers, most notably Jerome Kohlberg, Jr.

and later his protégé Henry Kravis

. Working for Bear Stearns

at the time, Kohlberg and Kravis along with Kravis' cousin George Roberts

began a series of what they described as "bootstrap" investments. Many of these companies lacked a viable or attractive exit for their founders as they were too small to be taken public and the founders were reluctant to sell out to competitors and so a sale to a financial buyer could prove attractive. Their acquisition of Orkin Exterminating Company

in 1964 is among the first significant leveraged buyout transactions. In the following years the three Bear Stearns

bankers would complete a series of buyouts including Stern Metals (1965), Incom (a division of Rockwood International, 1971), Cobblers Industries (1971), and Boren Clay (1973) as well as Thompson Wire, Eagle Motors and Barrows through their investment in Stern Metals. By 1976, tensions had built up between Bear Stearns

and Kohlberg, Kravis and Roberts leading to their departure and the formation of Kohlberg Kravis Roberts in that year.

William Simon and a group of investors acquired Gibson Greetings, a producer of greeting cards, for $80 million, of which only $1 million was rumored to have been contributed by the investors. By mid-1983, just sixteen months after the original deal, Gibson completed a $290 million IPO and Simon made approximately $66 million.

The success of the Gibson Greetings investment attracted the attention of the wider media to the nascent boom in leveraged buyouts. Between 1979 and 1989, it was estimated that there were over 2,000 leveraged buyouts valued in excess of $250 million

During the 1980s, constituencies within acquired companies and the media ascribed the "corporate raid

" label to many private equity investments, particularly those that featured a hostile takeover of the company, perceived asset stripping

, major layoffs or other significant corporate restructuring activities. Among the most notable investors to be labeled corporate raiders in the 1980s included Carl Icahn

, Victor Posner

, Nelson Peltz

, Robert M. Bass

, T. Boone Pickens, Harold Clark Simmons

, Kirk Kerkorian

, Sir James Goldsmith, Saul Steinberg

and Asher Edelman

. Carl Icahn

developed a reputation as a ruthless corporate raid

er after his hostile takeover of TWA

in 1985. Many of the corporate raiders were onetime clients of Michael Milken

, whose investment banking firm, Drexel Burnham Lambert

helped raise blind pools of capital with which corporate raiders could make a legitimate attempt to take over a company and provided high-yield debt

("junk bonds") financing of the buyouts.

One of the final major buyouts of the 1980s proved to be its most ambitious and marked both a high water mark and a sign of the beginning of the end of the boom that had begun nearly a decade earlier. In 1989, KKR (Kohlberg Kravis Roberts) closed in on a $31.1 billion takeover of RJR Nabisco

. It was, at that time and for over 17 years, the largest leverage buyout in history. The event was chronicled in the book (and later the movie), Barbarians at the Gate: The Fall of RJR Nabisco. KKR would eventually prevail in acquiring RJR Nabisco at $109 per share, marking a dramatic increase from the original announcement that Shearson Lehman Hutton would take RJR Nabisco private at $75 per share. A fierce series of negotiations and horse-trading ensued which pitted KKR against Shearson and later Forstmann Little & Co. Many of the major banking players of the day, including Morgan Stanley

, Goldman Sachs

, Salomon Brothers

, and Merrill Lynch

were actively involved in advising and financing the parties. After Shearson's original bid, KKR quickly introduced a tender offer to obtain RJR Nabisco for $90 per share—a price that enabled it to proceed without the approval of RJR Nabisco's management. RJR's management team, working with Shearson and Salomon Brothers, submitted a bid of $112, a figure they felt certain would enable them to outflank any response by Kravis's team. KKR's final bid of $109, while a lower dollar

figure, was ultimately accepted by the board of directors of RJR Nabisco. At $31.1 billion of transaction value, RJR Nabisco was by far the largest leveraged buyouts in history. In 2006 and 2007, a number of leveraged buyout transactions were completed that for the first time surpassed the RJR Nabisco leveraged buyout in terms of nominal purchase price. However, adjusted for inflation, none of the leveraged buyouts of the 2006–2007 period would surpass RJR Nabisco. By the end of the 1980s the excesses of the buyout market were beginning to show, with the bankruptcy of several large buyouts including Robert Campeau

's 1988 buyout of Federated Department Stores

, the 1986 buyout of the Revco

drug stores, Walter Industries, FEB Trucking and Eaton Leonard. Additionally, the RJR Nabisco deal was showing signs of strain, leading to a recapitalization in 1990 that involved the contribution of $1.7 billion of new equity from KKR. In the end, KKR lost $700 million on RJR.

Drexel reached an agreement with the government in which it pleaded nolo contendere

(no contest) to six felonies – three counts of stock parking and three counts of stock manipulation. It also agreed to pay a fine of $650 million – at the time, the largest fine ever levied under securities laws. Milken left the firm after his own indictment in March 1989. On 13 February 1990 after being advised by United States Secretary of the Treasury Nicholas F. Brady

, the U.S. Securities and Exchange Commission (SEC), the New York Stock Exchange

and the Federal Reserve, Drexel Burnham Lambert officially filed for Chapter 11 bankruptcy protection.

) would set the stage for the largest boom private equity had seen. Marked by the buyout of Dex Media

in 2002, large multi-billion dollar U.S. buyouts could once again obtain significant high yield debt financing and larger transactions could be completed. By 2004 and 2005, major buyouts were once again becoming common, including the acquisitions of Toys "R" Us, The Hertz Corporation

, Metro-Goldwyn-Mayer

and SunGard

in 2005.

As 2005 ended and 2006 began, new "largest buyout" records were set and surpassed several times with nine of the top ten buyouts at the end of 2007 having been announced in an 18-month window from the beginning of 2006 through the middle of 2007. In 2006, private equity firms bought 654 U.S. companies for $375 billion, representing 18 times the level of transactions closed in 2003. Additionally, U.S. based private equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds Among the mega-buyouts completed during the 2006 to 2007 boom were: Equity Office Properties, HCA

, Alliance Boots

and TXU

.

In July 2007, turmoil that had been affecting the mortgage markets

, spilled over into the leveraged finance and high-yield debt markets. The markets had been highly robust during the first six months of 2007, with highly issuer friendly developments including PIK and PIK Toggle

(interest is "Payable In Kind") and covenant light

debt widely available to finance large leveraged buyouts. July and August saw a notable slowdown in issuance levels in the high yield and leveraged loan markets with few issuers accessing the market. Uncertain market conditions led to a significant widening of yield spreads, which coupled with the typical summer slowdown led many companies and investment banks to put their plans to issue debt on hold until the autumn. However, the expected rebound in the market after 1 May 2007 did not materialize, and the lack of market confidence prevented deals from pricing. By the end of September, the full extent of the credit situation became obvious as major lenders including Citigroup

and UBS AG

announced major writedowns due to credit losses. The leveraged finance markets came to a near standstill. As 2007 ended and 2008 began, it was clear that lending standards had tightened and the era of "mega-buyouts" had come to an end. Nevertheless, private equity continues to be a large and active asset class and the private equity firms, with hundreds of billions of dollars of committed capital from investors are looking to deploy capital in new and different transactions.

Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk adjusted returns that exceed those possible in the public equity markets

Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk adjusted returns that exceed those possible in the public equity markets

. In the 1980s, insurers were major private equity investors. Later, public pension funds and university and other endowments became more significant sources of capital. For most institutional investors, private equity investments are made as part of a broad asset allocation that includes traditional assets (e.g., public equity

and bonds

) and other alternative assets (e.g., hedge funds, real estate, commodities).

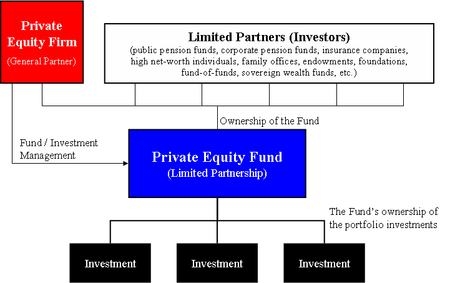

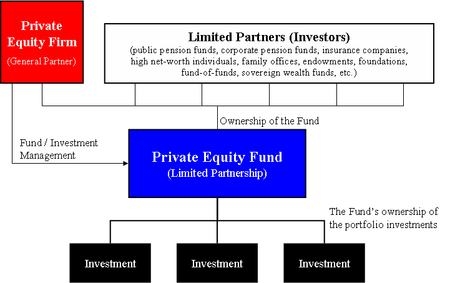

Most institutional investors do not invest directly in privately held companies, lacking the expertise and resources necessary to structure and monitor the investment. Instead, institutional investor

s will invest indirectly through a private equity fund

. Certain institutional investor

s have the scale necessary to develop a diversified portfolio of private equity funds themselves, while others will invest through a fund of funds

to allow a portfolio more diversified than one a single investor could construct.

Returns on private equity investments are created through one or a combination of three factors that include: debt repayment or cash accumulation through cash flows from operations, operational improvements that increase earnings over the life of the investment and multiple expansion, selling the business for a higher multiple of earnings than was originally paid. A key component of private equity as an asset class for institutional investors is that investments are typically realized after some period of time, which will vary depending on the investment strategy. Private equity investments are typically realized through one of the following avenues:

The private equity secondary market (also often called private equity secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.

Increasingly, secondaries

are considered a distinct asset class with a cash flow profile that is not correlated with other private equity investments. As a result, investors are allocating capital to secondary investments to diversify their private equity programs. Driven by strong demand for private equity exposure, a significant amount of capital has been committed to secondary investments from investors looking to increase and diversify their private equity exposure.

Investors seeking access to private equity have been restricted to investments with structural impediments such as long lock-up periods, lack of transparency, unlimited leverage, concentrated holdings of illiquid securities and high investment minimums.

Secondary transactions can be generally split into two basic categories:

called the PEI 300), the largest private equity firm in the world today is TPG, based on the amount of private equity direct-investment capital raised over a five-year window. As ranked by the PEI 300, the 10 largest private equity firms in the world are:

Because private equity firms are continuously in the process of raising, investing and distributing their private equity fund

s, capital raised can often be the easiest to measure. Other metrics can include the total value of companies purchased by a firm or an estimate of the size of a firm's active portfolio plus capital available for new investments. As with any list that focuses on size, the list does not provide any indication as to relative investment performance of these funds or managers.

Additionally, Preqin

(formerly known as Private Equity Intelligence), an independent data provider, ranks the 25 largest private equity investment managers. Among the larger firms in that ranking were AlpInvest Partners

, AXA Private Equity

, AIG Investments

, Goldman Sachs Private Equity Group

and Pantheon Ventures

. The European Private Equity and Venture Capital Association ("EVCA") publishes a yearbook which analyses industry trends derived from data disclosed by over 1, 300 European private equity funds. Finally, websites such as AskIvy.net provide lists of London-based private equity firms.

As fundraising has grown over the past few years, so too has the number of investors in the average fund. In 2004 there were 26 investors in the average private equity fund, this figure has now grown to 42 according to Preqin

ltd. (formerly known as Private Equity Intelligence).

The managers of private equity funds will also invest in their own vehicles, typically providing between 1–5% of the overall capital.

Often private equity fund managers will employ the services of external fundraising teams known as placement agents in order to raise capital for their vehicles. The use of placement agents has grown over the past few years, with 40% of funds closed in 2006 employing their services, according to Preqin

ltd (formerly known as Private Equity Intelligence). Placement agents will approach potential investors on behalf of the fund manager, and will typically take a fee of around 1% of the commitments that they are able to garner.

The amount of time that a private equity firm spends raising capital varies depending on the level of interest among investors, which is defined by current market conditions and also the track record of previous funds raised by the firm in question. Firms can spend as little as one or two months raising capital when they are able to reach the target that they set for their funds relatively easily, often through gaining commitments from existing investors in their previous funds, or where strong past performance leads to strong levels of investor interest. Other managers may find fundraising taking considerably longer, with managers of less popular fund types (such as US and European venture fund managers in the current climate) finding the fundraising process more tough. It is not unheard of for funds to spend as long as two years on the road seeking capital, although the majority of fund managers will complete fundraising within nine months to fifteen months.

Once a fund has reached its fundraising target, it will have a final close. After this point it is not normally possible for new investors to invest in the fund, unless they were to purchase an interest in the fund on the secondary market.

Private equity funds under management totalled $2.4 trillion at the end of 2010. Funds available for investments totalled 40% of overall assets under management

or some $1 trillion, a result of high fund raising volumes between 2006 and 2008. It could take another three years to invest the current volume of uninvested capital targeted for buyouts.

Nearly $180bn of private equity was invested globally in 2010, up 62% from the previous year but still down 55% on the peak in 2007. Activity in the sector is likely to build on this recovery and top $200bn in 2011 as investor sentiment continues to improve. The average cost of debt financing was still well up on pre-crisis levels, while leverage is down and private equity firms are contributing a bigger proportion of equity into their deals.

Exit activity totalled $232bn globally in 2010, a three year high. It continued to increase in 2011, to reach an all-time quarterly record of $120bn in Q2 as fund managers took advantage of relatively robust financial markets to exit investments made in years preceding the credit crisis.

The three years up to 2009 saw an unprecedented amount of fundraising activity, more than $1.4 trillion being raised. However the subsequent economic slowdown took a heavy toll, and the fundraising environment remained depressed afterwards, with only some $150bn in new funds raised in 2010, slightly up on the total raised in the previous year, but around one-third of annual funds raised in the years preceding the credit crisis. New funds raised in 2011 are likely to increase to around $180bn.

The average time taken for funds to achieve a final close fell to 15.5 months in the first half of 2011, down from over 20 months in the previous year.

An oft-cited academic paper by professors at University of Chicago and MIT (Kaplan and Schoar, Journal of Finance, 2005) suggests that the net-of-fees returns to PE funds are roughly comparable to the S&P 500 (or even slightly under). This analysis may actually overstate the returns because it relies on voluntarily reported data and hence suffers from survivorship bias (i.e. funds that fail won't report data). One should also note that these returns are not risk-adjusted. However, it is challenging to compare private equity performance to public equity performance, in particular because private equity fund investments are drawn and returned over time as investments are made and subsequently realized.

Commentators have argued that a standard methodology is needed to present an accurate picture of performance, to make individual private equity funds comparable and so the asset class as a whole can be matched against public markets and other types of investment. It is also claimed that PE fund managers manipulate data to present themselves as strong performers, which makes it even more essential to standardize the industry.

Two other findings in Kaplan and Schoar (2005): First, there is considerable variation in performance across PE funds. Second, unlike the mutual fund industry, there appears to be performance persistence in PE funds. That is, PE funds that perform well over one period, tend to also perform well the next period. Persistence is stronger for VC firms than for LBO firms.

The application of the Freedom of Information Act (FOIA) in certain states in the United States has made certain performance data more readily available. Specifically, FOIA has required certain public agencies to disclose private equity performance data directly on the their websites.

In the United Kingdom, the second largest market for private equity, more data has become available since the 2007 publication of the David Walker Guidelines for Disclosure and Transparency in Private Equity.

(FDI). The difference is blurred on account of private equity not entering the country through the stock market. Private equity generally flows to unlisted firms and to firms where the percentage of shares is relatively smaller than the promoter or investor held shares (also known as free-floating shares).

The main point of contention behind differentiating private equity from FDI is that FDI is used solely for production whereas in the case of private equity the investor can reclaim their money after a revaluation period and make speculative investments in other financial assets.

Presently, most countries report private equity as a part of FDI.

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

securities in operating companies that are not publicly traded on a stock exchange

Stock exchange

A stock exchange is an entity that provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and...

.

A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; each however providing working capital to a target company to nurture expansion, new product development, or restructuring of the company’s operations, management, or ownership.

Among the most common investment strategies in private equity are: leveraged buyout

Leveraged buyout

A leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

s, venture capital

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

, growth capital

Growth capital

Growth capital is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business.Companies...

, distressed investments

Distressed securities

Distressed securities are securities of companies or government entities that are either already in default, under bankruptcy protection, or in distress and heading toward such a condition. The most common distressed securities are bonds and bank debt...

and mezzanine capital

Mezzanine capital

Mezzanine capital, in finance, refers to a subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the common shares...

. In a typical leveraged buyout transaction, a private equity firm buys majority control of an existing or mature firm. This is distinct from a venture capital or growth capital investment, in which the investors (typically venture capital firms or angel investors) invest in young or emerging companies, and rarely obtain majority control.

Leveraged buyout

Leverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

. The companies involved in these transactions are typically mature and generate operating cash flows.

Leveraged buyouts involve a financial sponsor

Financial sponsor

A financial sponsor is a term commonly used to refer to private equity investment firms, particularly those private equity firms that engage in leveraged buyout or LBO transactions....

agreeing to an acquisition without itself committing all the capital required for the acquisition. To do this, the financial sponsor will raise acquisition debt which ultimately looks to the cash flows of the acquisition target to make interest and principal payments. Acquisition debt in an LBO is often non-recourse

Nonrecourse debt

Non-recourse debt or a non-recourse loan is a secured loan that is secured by a pledge of collateral, typically real property, but for which the borrower is not personally liable. If the borrower defaults, the lender/issuer can seize the collateral, but the lender's recovery is limited to the...

to the financial sponsor and has no claim on other investment managed by the financial sponsor. Therefore, an LBO transaction's financial structure is particularly attractive to a fund's limited partners, allowing them the benefits of leverage but greatly limiting the degree of recourse of that leverage. This kind of financing structure leverage benefits an LBO's financial sponsor in two ways: (1) the investor itself only needs to provide a fraction of the capital for the acquisition, and (2) the returns to the investor will be enhanced (as long as the return on assets exceeds the cost of the debt).

As a percentage of the purchase price for a leverage buyout target, the amount of debt used to finance a transaction varies according the financial condition and history of the acquisition target, market conditions, the willingness of lenders

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

to extend credit (both to the LBO's financial sponsor

Financial sponsor

A financial sponsor is a term commonly used to refer to private equity investment firms, particularly those private equity firms that engage in leveraged buyout or LBO transactions....

s and the company to be acquired) as well as the interest costs and the ability of the company to cover those costs. Historically the debt portion of a LBO will range from 60%–90% of the purchase price, although during certain periods the debt ratio can be higher or lower than the historical averages. Between 2000–2005 debt averaged between 59.4% and 67.9% of total purchase price for LBOs in the United States.

Simple example

A private equity fund, ABC Capital II, borrows $9bn from a bank (or other lender). To this it adds $2bn of equity – money from its own partners and from limited partners (pension funds, rich individuals, etc.). With this $11bn it buys all the shares of an underperforming company, XYZ Industrial (after due diligence, i.e. checking the books). It replaces the senior management in XYZ Industrial, and they set out to streamline it. The workforce is reduced, some assets are sold off, etc. The objective is to increase the value of the company for a fast sale. The stockmarket is experiencing a bull market, and XYZ Industrial is sold two years after the buy-out for $13bn, yielding a profit of $2bn. The original loan can now be paid off with interest of say $0.5bn. The remaining profit of $1.5bn is shared among the partners. Taxation of such gains is often minimal. Note that part of that profit results from turning the company round, and part results from the general increase in share prices in a buoyant stockmarket, the latter often being the greater component.Notes:

- The lenders (the people who put up the $11bn in the example) can insure their loans against default, at a cost, by selling credit derivatives, including credit default swaps (CDSs) and collateralised loan obligations (CLOs), to other institutions, such as hedge funds.

- Often the loan/equity ($11bn above) is not paid off after sale but left on the books of the company (XYZ Industrial) for it to pay off over time. This can be advantageous since the interest is typically offsettable against the profits of the company, thus reducing, or even eliminating, tax.

Growth Capital

Growth CapitalGrowth capital

Growth capital is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business.Companies...

refers to equity investments, most often minority investments, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a major acquisition without a change of control of the business.

Companies that seek growth capital will often do so in order to finance a transformational event in their life cycle. These companies are likely to be more mature than venture capital funded companies, able to generate revenue and operating profits but unable to generate sufficient cash to fund major expansions, acquisitions or other investments. Because of this lack of scale these companies generally can find few alternative conduits to secure capital for growth, so access to growth equity can be critical to pursue necessary facility expansion, sales and marketing initiatives, equipment purchases, and new product development. The primary owner of the company may not be willing to take the financial risk alone. By selling part of the company to private equity, the owner can take out some value and share the risk of growth with partners. Capital can also be used to effect a restructuring of a company's balance sheet, particularly to reduce the amount of leverage (or debt)

Leverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

the company has on its balance sheet

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A...

. A Private investment in public equity

Private investment in public equity

A private investment in public equity, often called a PIPE deal, involves the selling of publicly traded common shares or some form of preferred stock or convertible security to private investors. In the U.S...

, or PIPEs

Private investment in public equity

A private investment in public equity, often called a PIPE deal, involves the selling of publicly traded common shares or some form of preferred stock or convertible security to private investors. In the U.S...

, refer to a form of growth capital

Growth capital

Growth capital is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business.Companies...

investment made into a publicly traded company. PIPE investments are typically made in the form of a convertible

Convertible bond

In finance, a convertible note is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. It is a hybrid security with debt- and equity-like features...

or preferred

Preferred stock

Preferred stock, also called preferred shares, preference shares, or simply preferreds, is a special equity security that has properties of both an equity and a debt instrument and is generally considered a hybrid instrument...

security that is unregistered for a certain period of time. The Registered Direct, or RD, is another common financing vehicle used for growth capital. A registered direct is similar to a PIPE but is instead sold as a registered security.

Mezzanine capital

Mezzanine capitalMezzanine capital

Mezzanine capital, in finance, refers to a subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the common shares...

refers to subordinated debt

Subordinated debt

In finance, subordinated debt is debt which ranks after other debts should a company fall into receivership or bankruptcy....

or preferred equity securities that often represent the most junior portion of a company's capital structure

Capital structure

In finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80...

that is senior to the company's common equity

Common equity

-Basel III:Under the new Basel III banking agreement large internationally active banks will be required to hold a minimum of 7% of their assets in common equity.This regulation is to be fully effective as of 1 Jan 2019.-Sources:...

. This form of financing is often used by private equity investors to reduce the amount of equity capital required to finance a leveraged buyout or major expansion. Mezzanine capital, which is often used by smaller companies that are unable to access the high yield market

High-yield debt

In finance, a high-yield bond is a bond that is rated below investment grade...

, allows such companies to borrow additional capital beyond the levels that traditional lenders are willing to provide through bank loans. In compensation for the increased risk, mezzanine debt holders require a higher return for their investment than secured or other more senior lenders.

Venture capital

Venture capital is a broad subcategory of private equity that refers to equity investments made, typically in less mature companies, for the launch, early development, or expansion of a business. Venture investment is most often found in the application of new technology, new marketing concepts and new products that have yet to be proven.Venture capital is often sub-divided by the stage of development of the company ranging from early stage capital used for the launch of start-up companies to late stage and growth capital that is often used to fund expansion of existing business that are generating revenue but may not yet be profitable or generating cash flow to fund future growth.

Entrepreneurs often develop products and ideas that require substantial capital during the formative stages of their companies' life cycles. Many entrepreneurs do not have sufficient funds to finance projects themselves, and they must therefore seek outside financing. The venture capitalist's need to deliver high returns to compensate for the risk of these investments makes venture funding an expensive capital source for companies. Being able to secure financing is critical to any business, whether it’s a startup seeking venture capital or a mid-sized firm that needs more cash to grow. Venture capital is most suitable for businesses with large up-front capital requirements which cannot be financed by cheaper alternatives such as debt. Although venture capital is often most closely associated with fast-growing technology and biotechnology

Biotechnology

Biotechnology is a field of applied biology that involves the use of living organisms and bioprocesses in engineering, technology, medicine and other fields requiring bioproducts. Biotechnology also utilizes these products for manufacturing purpose...

fields, venture funding has been used for other more traditional businesses.

Distressed and Special Situations

DistressedDistressed securities

Distressed securities are securities of companies or government entities that are either already in default, under bankruptcy protection, or in distress and heading toward such a condition. The most common distressed securities are bonds and bank debt...

or Special Situations is a broad category referring to investments in equity or debt securities of financially stressed companies. The "distressed" category encompasses two broad sub-strategies including:

- "Distressed-to-Control" or "Loan-to-Own" strategies where the investor acquires debt securities in the hopes of emerging from a corporate restructuring in control of the company's equity;

- "Special Situations" or "Turnaround" strategies where an investor will provide debt and equity investments, often "rescue financing" to companies undergoing operational or financial challenges.

In addition to these private equity strategies, hedge funds employ a variety of distressed investment strategies including the active trading of loans and bonds issued by distressed companies.

Secondaries

Secondary investments refer to investments made in existing private equity assets. These transactions can involve the sale of private equity fundPrivate equity fund

A private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity....

interests or portfolios of direct investments in privately held companies through the purchase of these investments from existing institutional investors. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. Secondary investments provide institutional investors with the ability to improve vintage diversification, particularly for investors that are new to the asset class. Secondaries also typically experience a different cash flow profile, diminishing the j-curve effect of investing in new private equity funds. Often investments in secondaries are made through third party fund vehicle, structured similar to a fund of funds

Fund of funds

A "fund of funds" is an investment strategy of holding a portfolio of other investment funds rather than investing directly in shares, bonds or other securities. This type of investing is often referred to as multi-manager investment...

although many large institutional investors have purchased private equity fund interests through secondary transactions. Sellers of private equity fund investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds.

Other strategies

Other strategies that can be considered private equity or a close adjacent market include:- Real Estate: in the context of private equity this will typically refer to the riskier end of the investment spectrum including "value added" and opportunity funds where the investments often more closely resemble leveraged buyouts than traditional real estate investments. Certain investors in private equity consider real estate to be a separate asset class.

- InfrastructureInfrastructureInfrastructure is basic physical and organizational structures needed for the operation of a society or enterprise, or the services and facilities necessary for an economy to function...

: investments in various public works (e.g., bridges, tunnels, toll roads, airports, public transportation and other public works) that are made typically as part of a privatization initiative on the part of a government entity.

- EnergyEnergy industryThe energy industry is the totality of all of the industries involved in the production and sale of energy, including fuel extraction, manufacturing, refining and distribution...

and PowerElectrical power industryThe electric power industry provides the production and delivery of electric energy, often known as power, or electricity, in sufficient quantities to areas that need electricity through a grid connection. The grid distributes electrical energy to customers...

: investments in a wide variety of companies (rather than assets) engaged in the production and sale of energy, including fuel extraction, manufacturing, refining and distribution (Energy) or companies engaged in the production or transmission of electrical power (Power).

- Merchant bankingMerchant bankA merchant bank is a financial institution which provides capital to companies in the form of share ownership instead of loans. A merchant bank also provides advisory on corporate matters to the firms they lend to....

: negotiated private equity investment by financial institutions in the unregistered securities of either privately or publicly held companies.

- Fund of FundsFund of fundsA "fund of funds" is an investment strategy of holding a portfolio of other investment funds rather than investing directly in shares, bonds or other securities. This type of investing is often referred to as multi-manager investment...

: investments made in a fund whose primary activity is investing in other private equity funds. The fund of funds model is used by investors looking for: - Diversification but have insufficient capital to diversify their portfolio by themselves

- Access to top performing funds that are otherwise oversubscribed

- Experience in a particular fund type or strategy before investing directly in funds in that niche

- Exposure to difficult-to-reach and/or emerging markets

- Superior fund selection by high-talent fund of fund managers/teams

History and development

Early history and the development of venture capital

The seeds of the US private equity industry were planted in 1946 with the founding of two venture capital firms: American Research and Development CorporationAmerican Research and Development Corporation

American Research and Development Corporation was a venture capital and private equity firm founded in 1946 by Georges Doriot, the "father of venture capitalism" , with Ralph Flanders and Karl Compton .ARDC is credited with the first major venture capital success story when its 1957 investment of...

(ARDC) and J.H. Whitney & Company

J.H. Whitney & Company

J.H. Whitney & Company is a venture capital firm in the U.S., founded in 1946 by John Hay Whitney and his partner Benno Schmidt. Today the firm focuses primarily on leveraged buyouts, turnarounds, acquisitions, and recapitalizations of more mature companies particularly those it considers to be in...

. Before World War II, venture capital investments (originally known as "development capital") were primarily the domain of wealthy individuals and families. ARDC was founded by Georges Doriot

Georges Doriot

Georges F. Doriot was one of the first American venture capitalists. In 1946, he founded American Research and Development Corporation, the first publicly owned venture capital firm...

, the "father of venture capitalism" and founder of INSEAD

INSEAD

INSEAD is an international graduate business school and research institution. It has campuses in Europe , Asia , and the Middle East , as well as a research center in Israel...

, with capital raised from institutional investors, to encourage private sector investments in businesses run by soldiers who were returning from World War II. ARDC is credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation

Digital Equipment Corporation

Digital Equipment Corporation was a major American company in the computer industry and a leading vendor of computer systems, software and peripherals from the 1960s to the 1990s...

(DEC) would be valued at over $355 million after the company's initial public offering in 1968 (representing a return of over 500 times on its investment and an annualized rate of return

Internal rate of return

The internal rate of return is a rate of return used in capital budgeting to measure and compare the profitability of investments. It is also called the discounted cash flow rate of return or the rate of return . In the context of savings and loans the IRR is also called the effective interest rate...

of 101%). It is commonly noted that the first venture-backed startup is Fairchild Semiconductor

Fairchild Semiconductor

Fairchild Semiconductor International, Inc. is an American semiconductor company based in San Jose, California. Founded in 1957, it was a pioneer in transistor and integrated circuit manufacturing...

(which produced the first commercially practicable integrated circuit), funded in 1959 by what would later become Venrock Associates

Venrock Associates

Venrock, a compound of "Venture" and "Rockefeller", is a pioneering venture capital firm formed in 1969 to build upon the successful investing activities of the Rockefeller family that began in the late 1930s. It has offices in Palo Alto, California, New York City, Cambridge, Massachusetts, and...

.

Origins of the leveraged buyout

The first leveraged buyout may have been the purchase by McLean Industries, Inc. of Pan-Atlantic Steamship Company in January 1955 and Waterman Steamship CorporationWaterman Steamship Corporation

Waterman Steamship Corporation is an American deep sea ocean carrier, specializing in liner services and time charter contracts. It is owned by International Shipholding Corporation, based in Mobile, Alabama....

in May 1955 Under the terms of that transaction, McLean borrowed $42 million and raised an additional $7 million through an issue of preferred stock

Preferred stock

Preferred stock, also called preferred shares, preference shares, or simply preferreds, is a special equity security that has properties of both an equity and a debt instrument and is generally considered a hybrid instrument...

. When the deal closed, $20 million of Waterman cash and assets were used to retire $20 million of the loan debt. Similar to the approach employed in the McLean transaction, the use of publicly traded holding companies as investment vehicles to acquire portfolios of investments in corporate assets was a relatively new trend in the 1960s popularized by the likes of Warren Buffett

Warren Buffett

Warren Edward Buffett is an American business magnate, investor, and philanthropist. He is widely regarded as one of the most successful investors in the world. Often introduced as "legendary investor, Warren Buffett", he is the primary shareholder, chairman and CEO of Berkshire Hathaway. He is...

(Berkshire Hathaway

Berkshire Hathaway

Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States, that oversees and manages a number of subsidiary companies. The company averaged an annual growth in book value of 20.3% to its shareholders for the last 44 years,...

) and Victor Posner

Victor Posner

Victor Posner was an American businessman. He was known as one of the highest paid business executives of his generation. He was a pioneer of the leveraged buyout.-Career:...

(DWG Corporation) and later adopted by Nelson Peltz

Nelson Peltz

Nelson Peltz is an American businessman. He is a board director of Wendy's Group, the franchise parent of T.J. Cinnamons, Pasta Connection and Wendy's. Peltz is the former owner of Snapple.- Background :...

(Triarc), Saul Steinberg

Saul Steinberg (business)

Saul Steinberg is a former financier, insurance executive, and corporate raider. He started a computer leasing company , which he used in an audacious and successful takeover of the much larger Reliance Insurance Company in 1968...

(Reliance Insurance) and Gerry Schwartz

Gerry Schwartz

Gerald W. Schwartz, OC born c.1941 in Winnipeg, Manitoba, is a Canadian businessman. In 1977 he co-founded CanWest Global Communications Inc, followed by Onex Corporation in 1983. He has been a director of Scotiabank since 1999...

(Onex Corporation). These investment vehicles would utilize a number of the same tactics and target the same type of companies as more traditional leveraged buyouts and in many ways could be considered a forerunner of the later private equity firms. In fact it is Posner who is often credited with coining the term "leveraged buyout

Leveraged buyout

A leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

" or "LBO"

The leveraged buyout boom of the 1980s was conceived by a number of corporate financiers, most notably Jerome Kohlberg, Jr.

Jerome Kohlberg, Jr.

Jerome Kohlberg, Jr. is an American businessman and early pioneer in the private equity and leveraged buyout industries founding private equity firm Kohlberg Kravis Roberts & Co. and later Kohlberg & Company....

and later his protégé Henry Kravis

Henry Kravis

Henry R. Kravis is an American businessman and private equity investor. He is the co-founder of Kohlberg Kravis Roberts & Co., a private equity firm with over $62 billion in assets as of 2011. He has an estimated net worth of $3.7 billion as of September 2011, ranked by Forbes as the 88th richest...

. Working for Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

at the time, Kohlberg and Kravis along with Kravis' cousin George Roberts

George R. Roberts

George R. Roberts is an American financier and was one of the three original partners of Kohlberg Kravis Roberts & Co. , which he co-founded alongside Jerome Kohlberg and first cousin Henry Kravis in 1976.-Biography:...

began a series of what they described as "bootstrap" investments. Many of these companies lacked a viable or attractive exit for their founders as they were too small to be taken public and the founders were reluctant to sell out to competitors and so a sale to a financial buyer could prove attractive. Their acquisition of Orkin Exterminating Company

Orkin

Orkin is a pest-control company that is a wholly owned subsidiary of Rollins Inc.-The Orkin Uniform:The most recognized Orkin uniform consists of a white collared shirt with the Orkin logo and red epaulets and pressed khaki pants. The uniform varies depending on an employee’s job function for...

in 1964 is among the first significant leveraged buyout transactions. In the following years the three Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

bankers would complete a series of buyouts including Stern Metals (1965), Incom (a division of Rockwood International, 1971), Cobblers Industries (1971), and Boren Clay (1973) as well as Thompson Wire, Eagle Motors and Barrows through their investment in Stern Metals. By 1976, tensions had built up between Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

and Kohlberg, Kravis and Roberts leading to their departure and the formation of Kohlberg Kravis Roberts in that year.

Private equity in the 1980s

In January 1982, former United States Secretary of the TreasuryUnited States Secretary of the Treasury

The Secretary of the Treasury of the United States is the head of the United States Department of the Treasury, which is concerned with financial and monetary matters, and, until 2003, also with some issues of national security and defense. This position in the Federal Government of the United...

William Simon and a group of investors acquired Gibson Greetings, a producer of greeting cards, for $80 million, of which only $1 million was rumored to have been contributed by the investors. By mid-1983, just sixteen months after the original deal, Gibson completed a $290 million IPO and Simon made approximately $66 million.

The success of the Gibson Greetings investment attracted the attention of the wider media to the nascent boom in leveraged buyouts. Between 1979 and 1989, it was estimated that there were over 2,000 leveraged buyouts valued in excess of $250 million

During the 1980s, constituencies within acquired companies and the media ascribed the "corporate raid

Corporate raid

A corporate raid is an American English business term for buying a large interest in a corporation and then using voting rights to enact measures directed at increasing the share value...

" label to many private equity investments, particularly those that featured a hostile takeover of the company, perceived asset stripping

Asset stripping

Asset stripping involves selling the assets of a business individually at a profit. The term is generally used in a pejorative sense as such activity is not considered productive to the economy. Asset stripping is considered to be a problem in economies such as Russia or China that are making a...

, major layoffs or other significant corporate restructuring activities. Among the most notable investors to be labeled corporate raiders in the 1980s included Carl Icahn

Carl Icahn

Carl Celian Icahn is an American business magnate and investor.-Biography:Icahn was raised in Far Rockaway, Queens, New York City, where he attended Far Rockaway High School. His father was a cantor, his mother was a schoolteacher...

, Victor Posner

Victor Posner

Victor Posner was an American businessman. He was known as one of the highest paid business executives of his generation. He was a pioneer of the leveraged buyout.-Career:...

, Nelson Peltz

Nelson Peltz

Nelson Peltz is an American businessman. He is a board director of Wendy's Group, the franchise parent of T.J. Cinnamons, Pasta Connection and Wendy's. Peltz is the former owner of Snapple.- Background :...

, Robert M. Bass

Robert Bass

Robert Muse Bass is an American businessman and philanthropist. He is currently the chairman of Aerion Corporation, an American aerospace firm in Reno, Nevada. Bass is worth approximately $5.5 billion as of 2007, and $4 billion in 2010 on oil and other investments-Life:Bass was born into a wealthy...

, T. Boone Pickens, Harold Clark Simmons

Harold Clark Simmons

Harold Clark Simmons is an American businessman and billionaire whose banking expertise helped him develop the acquisition concept known as the leveraged buyout to acquire various corporations. He is the owner of Contran Corporation and of Valhi, Inc.,...

, Kirk Kerkorian

Kirk Kerkorian

Kerkor "Kirk" Kerkorian is an American businessman who is the president/CEO of Tracinda Corporation, his private holding company based in Beverly Hills, California. Kerkorian is known as one of the important figures in shaping Las Vegas and, with architect Martin Stern, Jr...

, Sir James Goldsmith, Saul Steinberg

Saul Steinberg (business)

Saul Steinberg is a former financier, insurance executive, and corporate raider. He started a computer leasing company , which he used in an audacious and successful takeover of the much larger Reliance Insurance Company in 1968...

and Asher Edelman

Asher Edelman

Asher Edelman began his career on Wall Street in 1961. In 1969 he formed Mack, Bushnell and Edelman where he was CEO. Edelman’s Wall Street businesses included Investment Banking, Money Management, and Derivatives Trading...

. Carl Icahn

Carl Icahn

Carl Celian Icahn is an American business magnate and investor.-Biography:Icahn was raised in Far Rockaway, Queens, New York City, where he attended Far Rockaway High School. His father was a cantor, his mother was a schoolteacher...

developed a reputation as a ruthless corporate raid

Corporate raid

A corporate raid is an American English business term for buying a large interest in a corporation and then using voting rights to enact measures directed at increasing the share value...

er after his hostile takeover of TWA

Trans World Airlines

Trans World Airlines was an American airline that existed from 1925 until it was bought out by and merged with American Airlines in 2001. It was a major domestic airline in the United States and the main U.S.-based competitor of Pan American World Airways on intercontinental routes from 1946...

in 1985. Many of the corporate raiders were onetime clients of Michael Milken

Michael Milken

Michael Robert Milken is an American business magnate, financier, and philanthropist noted for his role in the development of the market for high-yield bonds during the 1970s and 1980s, for his 1990 guilty plea to felony charges for violating US securities laws, and for his funding of medical...

, whose investment banking firm, Drexel Burnham Lambert

Drexel Burnham Lambert

Drexel Burnham Lambert was a major Wall Street investment banking firm, which first rose to prominence and then was forced into bankruptcy in February 1990 by its involvement in illegal activities in the junk bond market, driven by Drexel employee Michael Milken. At its height, it was the...

helped raise blind pools of capital with which corporate raiders could make a legitimate attempt to take over a company and provided high-yield debt

High-yield debt

In finance, a high-yield bond is a bond that is rated below investment grade...

("junk bonds") financing of the buyouts.

One of the final major buyouts of the 1980s proved to be its most ambitious and marked both a high water mark and a sign of the beginning of the end of the boom that had begun nearly a decade earlier. In 1989, KKR (Kohlberg Kravis Roberts) closed in on a $31.1 billion takeover of RJR Nabisco

RJR Nabisco

RJR Nabisco, Inc., was an American conglomerate formed in 1985 by the merger of Nabisco Brands and R.J. Reynolds Tobacco Company. RJR Nabisco was purchased in 1988 by Kohlberg Kravis Roberts & Co...

. It was, at that time and for over 17 years, the largest leverage buyout in history. The event was chronicled in the book (and later the movie), Barbarians at the Gate: The Fall of RJR Nabisco. KKR would eventually prevail in acquiring RJR Nabisco at $109 per share, marking a dramatic increase from the original announcement that Shearson Lehman Hutton would take RJR Nabisco private at $75 per share. A fierce series of negotiations and horse-trading ensued which pitted KKR against Shearson and later Forstmann Little & Co. Many of the major banking players of the day, including Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm headquartered in New York City serving a diversified group of corporations, governments, financial institutions, and individuals. Morgan Stanley also operates in 36 countries around the world, with over 600 offices and a workforce of over 60,000....

, Goldman Sachs

Goldman Sachs

The Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

, Salomon Brothers

Salomon Brothers

Salomon Brothers was a bulge bracket, Wall Street investment bank. Founded in 1910 by three brothers along with a clerk named Ben Levy, it remained a partnership until the early 1980s, when it was acquired by the commodity trading firm Phibro Corporation and then became Salomon Inc. Eventually...

, and Merrill Lynch

Merrill Lynch

Merrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

were actively involved in advising and financing the parties. After Shearson's original bid, KKR quickly introduced a tender offer to obtain RJR Nabisco for $90 per share—a price that enabled it to proceed without the approval of RJR Nabisco's management. RJR's management team, working with Shearson and Salomon Brothers, submitted a bid of $112, a figure they felt certain would enable them to outflank any response by Kravis's team. KKR's final bid of $109, while a lower dollar

figure, was ultimately accepted by the board of directors of RJR Nabisco. At $31.1 billion of transaction value, RJR Nabisco was by far the largest leveraged buyouts in history. In 2006 and 2007, a number of leveraged buyout transactions were completed that for the first time surpassed the RJR Nabisco leveraged buyout in terms of nominal purchase price. However, adjusted for inflation, none of the leveraged buyouts of the 2006–2007 period would surpass RJR Nabisco. By the end of the 1980s the excesses of the buyout market were beginning to show, with the bankruptcy of several large buyouts including Robert Campeau

Robert Campeau

Robert Campeau is a Canadian financier and real estate developer.-Early years:His formal education ended in grade eight, at the age of 14. He talked himself into jobs at Inco as a general labourer, carpenter and machinist. In 1949 he entered the residential end of the construction business...

's 1988 buyout of Federated Department Stores

Federated Department Stores

Macy's, Inc. is a department store holding company and owner of Macy's and Bloomingdale's department stores. Macy's Inc.'s stores specialize mostly in retail clothing, jewelery, watches, dinnerware, and furniture....

, the 1986 buyout of the Revco

Revco

Revco Discount Drug Stores , once based in Twinsburg, Ohio, was a major drug store chain operating through the Ohio Valley, the Mid-Atlantic states, and the Southeastern United States. The chain's stock was traded on the New York Stock Exchange under the ticker RXR...

drug stores, Walter Industries, FEB Trucking and Eaton Leonard. Additionally, the RJR Nabisco deal was showing signs of strain, leading to a recapitalization in 1990 that involved the contribution of $1.7 billion of new equity from KKR. In the end, KKR lost $700 million on RJR.

Drexel reached an agreement with the government in which it pleaded nolo contendere

Nolo contendere

is a legal term that comes from the Latin for "I do not wish to contend." It is also referred to as a plea of no contest.In criminal trials, and in some common law jurisdictions, it is a plea where the defendant neither admits nor disputes a charge, serving as an alternative to a pleading of...

(no contest) to six felonies – three counts of stock parking and three counts of stock manipulation. It also agreed to pay a fine of $650 million – at the time, the largest fine ever levied under securities laws. Milken left the firm after his own indictment in March 1989. On 13 February 1990 after being advised by United States Secretary of the Treasury Nicholas F. Brady

Nicholas F. Brady

Nicholas Frederick Brady was United States Secretary of the Treasury under Presidents Ronald Reagan and George H. W. Bush, and is also known for articulating the Brady Plan in March 1989.-Early life:...

, the U.S. Securities and Exchange Commission (SEC), the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

and the Federal Reserve, Drexel Burnham Lambert officially filed for Chapter 11 bankruptcy protection.

Age of the mega-buyout 2005–2007

The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies (specifically the Sarbanes-Oxley ActSarbanes-Oxley Act

The Sarbanes–Oxley Act of 2002 , also known as the 'Public Company Accounting Reform and Investor Protection Act' and 'Corporate and Auditing Accountability and Responsibility Act' and commonly called Sarbanes–Oxley, Sarbox or SOX, is a United States federal law enacted on July 30, 2002, which...

) would set the stage for the largest boom private equity had seen. Marked by the buyout of Dex Media

Dex Media

Dex Media, Inc. was a print and interactive marketing company. It was acquired by R.H. Donnelley, which became Dex One Corporation in February 2010...

in 2002, large multi-billion dollar U.S. buyouts could once again obtain significant high yield debt financing and larger transactions could be completed. By 2004 and 2005, major buyouts were once again becoming common, including the acquisitions of Toys "R" Us, The Hertz Corporation

The Hertz Corporation

Hertz Global Holdings Inc is an American car rental company with international locations in 145 countries worldwide.-Early years:The company was founded by Walter L. Jacobs in 1918, who started a car rental operation in Chicago with a dozen Model T Ford cars. In 1923, Jacobs sold it to John D...

, Metro-Goldwyn-Mayer

Metro-Goldwyn-Mayer

Metro-Goldwyn-Mayer Inc. is an American media company, involved primarily in the production and distribution of films and television programs. MGM was founded in 1924 when the entertainment entrepreneur Marcus Loew gained control of Metro Pictures, Goldwyn Pictures Corporation and Louis B. Mayer...

and SunGard

SunGard

SunGard is a multinational company based in Wayne, Pennsylvania, which provides software and services to education, financial services, and public sector organizations. It was formed in 1983, as a spin-off of the computer services division of Sun Oil Company, during a period of low crude oil...

in 2005.

As 2005 ended and 2006 began, new "largest buyout" records were set and surpassed several times with nine of the top ten buyouts at the end of 2007 having been announced in an 18-month window from the beginning of 2006 through the middle of 2007. In 2006, private equity firms bought 654 U.S. companies for $375 billion, representing 18 times the level of transactions closed in 2003. Additionally, U.S. based private equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds Among the mega-buyouts completed during the 2006 to 2007 boom were: Equity Office Properties, HCA

Hospital Corporation of America

Hospital Corporation of America is the largest private operator of health care facilities in the world, It is based in Nashville, Tennessee and is widely considered to be the single largest factor in making that city a hotspot for healthcare enterprise.-History:The founders of HCA include Jack C....

, Alliance Boots

Alliance Boots

Alliance Boots GmbH is a leading international, pharmacy-led health and beauty group. It has two core business activities - pharmacy-led health and beauty retailing, and pharmaceutical wholesaling and distribution - and has a presence in more than 25 countries...

and TXU

TXU