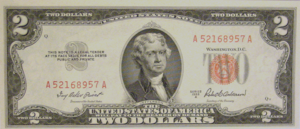

United States Note

Encyclopedia

Paper Money

Paper Money is the second album by the band Montrose. It was released in 1974 and was the band's last album to feature Sammy Hagar as lead vocalist.-History:...

that was issued from 1862 to 1971 in the U.S. Having been current for over 100 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as "greenbacks

Greenback (money)

The term greenback refers to paper currency that was issued by the United States during the American Civil War.There are at least two types of notes that were called greenback:*United States Note*Demand Note...

" in their heyday, a name inherited from the Demand Note

Demand Note

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 US$...

s that they replaced in 1862. Often called Legal Tender Notes, they were called United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. On the back, they give notice that:

This Note is Legal Tender for All Debts Public and Private Except Duties On Imports And Interest On The Public Debt; And Is Redeemable In Payment Of All Loans Made To The United States.

They were originally issued directly into circulation by the U.S. Treasury

United States Department of the Treasury

The Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

to pay expenses incurred by the Union

Union (American Civil War)

During the American Civil War, the Union was a name used to refer to the federal government of the United States, which was supported by the twenty free states and five border slave states. It was opposed by 11 southern slave states that had declared a secession to join together to form the...

during the American Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

. Over the next century, the legislation governing these notes was modified many times and numerous versions have been issued by the Treasury.

United States Notes that were issued in the large-size

Large-sized note

A large-sized note is a bill of any denomination of U.S. currency printed between 1863 and 1929. This is in contrast with small-sized notes, which were printed starting in 1928. Large-sized notes exist in denominations of $1 through $10,000. The most common large-sized notes are the Federal Reserve...

format, before 1929, differ dramatically in appearance when compared to modern American currency, but those issued in the small-size format, starting in 1929, are very similar to contemporary Federal Reserve Notes with the highly visible distinction of having red U.S. Treasury Seals

Seal of the United States Department of the Treasury

The United States Treasury Seal is the official symbol of the United States Department of the Treasury. It actually predates the department, having originated with the Board of Treasury during the period of the Articles of Confederation. It is used on all U.S...

and serial numbers

Serial number

A serial number is a unique number assigned for identification which varies from its successor or predecessor by a fixed discrete integer value...

in place of green ones.

Existing United States Notes remain valid currency in the United States. However, since no United States Notes have been issued since January 1971, they are vanishingly rare in circulation.

Demand Notes

Salmon P. Chase

Salmon Portland Chase was an American politician and jurist who served as U.S. Senator from Ohio and the 23rd Governor of Ohio; as U.S. Treasury Secretary under President Abraham Lincoln; and as the sixth Chief Justice of the United States Supreme Court.Chase was one of the most prominent members...

to raise money via the issuance of $50,000,000 in Treasury Notes payable on demand. These Demand Note

Demand Note

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 US$...

s were paid out to creditors directly and used to meet the payroll of soldiers in the field. While issued within the legal framework of Treasury Note Debt, the Demand Notes were intended to circulate as currency and were of the same size as and, in appearance, closely resembled banknotes. In December 1861, economic conditions deteriorated and a suspension of specie payment led the government to cease redeeming the Demand Notes in coin. Also, in 1861, at General Grant's Headquarters, Edmund Dick Taylor mentioned his idea for greenbacks.

The Legal Tender Acts

The beginning of 1862 found the Union's expenses mounting, and the government was having trouble funding the escalating war. U.S. Demand Notes—which were used, among other things, to pay Union soldiers—were unredeemable, and the value of the notes began to deteriorate. On January 16, 1862, in a private meeting with President Lincoln, Edmund D. Taylor advised him to issue greenbacks. Congressman and Buffalo banker Elbridge G. SpauldingElbridge G. Spaulding

Elbridge Gerry Spaulding Elbridge Gerry Spaulding Elbridge Gerry Spaulding (February 24, 1809 - May 5, 1897 was an American lawyer, banker, and politician. He supported the idea for the first U.S...

prepared a bill, based on the Free Banking Law of New York, that eventually became the National Banking Act of 1863.

Recognizing, however, that his proposal would take many months to pass Congress, in early February Spaulding introduced another bill to permit the U.S. Treasury to issue $150 million in notes as legal tender. This caused tremendous controversy in Congress, as hitherto the Constitution had been interpreted as not granting the government the power to issue a paper currency. "The bill before us is a war measure, a measure of necessity, and not of choice," Spaulding argued before the House, adding, "These are extraordinary times, and extraordinary measures must be resorted to in order to save our Government, and preserve our nationality." Spaulding justified the action as a "necessary means of carrying into execution the powers granted in the Constitution 'to raise and support armies,' and 'to provide and maintain a navy.'” Despite strong opposition, on February 25, 1862, President Lincoln signed the First Legal Tender Act into law, authorizing the issuance of United States Notes as a legal tender

Legal tender

Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Paper currency is a common form of legal tender in many countries....

—the paper currency soon to be known as "greenback

Greenback

Greenback may refer to:In currency:* Greenback , a fiat currency issued during the American Civil War**United States Note**Demand Note, issued in 1861–62* A modern United States Federal Reserve Note...

s." In his correspondence, Lincoln credited Edmund Dick Taylor for his suggestion of the greenback currency, and named him "Father of the Greenback."

Initially, the emission was limited to $150,000,000 total face value between the new Legal Tender Notes and the existing Demand Notes. The Act also called for the new notes to be used to replace the Demand Notes as soon as practical. The Demand Notes had been issued in denominations of $5

United States five-dollar bill

The United States five-dollar bill or fiver is a denomination of United States currency. The $5 bill currently features U.S. President Abraham Lincoln's portrait on the front and the Lincoln Memorial on the back. All $5 bills issued today are Federal Reserve Notes...

, $10

United States ten-dollar bill

The United States ten-dollar bill is a denomination of United States currency. The first U.S. Secretary of the Treasury, Alexander Hamilton, is currently featured on the obverse of the bill, while the U.S. Treasury is featured on the reverse. The United States ten-dollar bill ($10) is a...

, and $20

United States twenty-dollar bill

The United States twenty-dollar bill is a denomination of United States currency. U.S. President Andrew Jackson is currently featured on the front side of the bill, which is why the twenty-dollar bill is often called a "Jackson," while the White House is featured on the reverse side.The...

, and these were replaced by United States Notes nearly identical in appearance on the obverse. In addition, notes of entirely new design were introduced in denominations of $50

United States fifty-dollar bill

The United States fifty-dollar bill is a denomination of United States currency. Ulysses S. Grant is currently featured on the obverse, while the U.S. Capitol is featured on the reverse. All current-issue $50 bills are Federal Reserve Notes....

, $100

United States one hundred-dollar bill

The United States one hundred-dollar bill is a denomination of United States currency. U.S. statesman, inventor and diplomat Benjamin Franklin is currently featured on the obverse of the bill. On the reverse of the banknote is an image of Independence Hall. The time on the clock according to the...

, $500 and $1000

Large denominations of United States currency

The base currency of the United States is the U.S. dollar, and is printed on bills in denominations of $1, $2, $5, $10, $20, $50, and $100.At one time, however, it also included five larger denominations. High-denomination currency was prevalent from the very beginning of U.S. Government issue...

. The Demand Notes' printed promise of payment "On Demand" was removed and the statement "This Note is a Legal Tender" was added.

Thaddeus Stevens

Thaddeus Stevens , of Pennsylvania, was a Republican leader and one of the most powerful members of the United States House of Representatives...

, the Chairman of the House of Representatives Committee of Ways and Means, which had authored an earlier version of the Legal Tender Act that would have made United States Notes a legal tender for all debts, denounced the exceptions, calling the new bill "mischievous" because it made United States Notes an intentionally depreciated currency for the masses, while the banks who loaned to the government got "sound money" in gold. This controversy would continue until the removal of the exceptions in 1933.

In the First Legal Tender Act, Congress limited the Treasury's emission of United States Notes to $150,000,000; however, by 1863, the Second Legal Tender Act, a Joint Resolution of Congress, and the Third Legal Tender Act had expanded the limit to $450,000,000, the option to exchange the notes for United States bonds at par had been revoked, and notes of $1

United States one-dollar bill

The United States one-dollar bill is the most common denomination of US currency. The first president, George Washington, painted by Gilbert Stuart, is currently featured on the obverse, while the Great Seal of the United States is featured on the reverse. The one-dollar bill has the oldest...

and $2

United States two-dollar bill

The United States two-dollar bill is a current denomination of US currency. President Thomas Jefferson is featured on the obverse of the note...

denominations had been introduced as the appearance of fiat currency had driven

Gresham's Law

Gresham's law is an economic principle that states: "When a government compulsorily overvalues one type of money and undervalues another, the undervalued money will leave the country or disappear from circulation into hoards, while the overvalued money will flood into circulation." It is commonly...

even silver coinage out of circulation. As a result of this inflation

Monetary inflation

Monetary inflation is a sustained increase in the money supply of a country. It usually results in price inflation, which is a rise in the general level of prices of goods and services . Originally the term "inflation" was used to refer only to monetary inflation, whereas in present usage it...

, the greenback went on to trade at a substantial discount from gold, which prompted Congress to pass the short-lived Anti-gold futures act of 1864

Anti-Gold Futures Act of 1864

The Anti-Gold Futures Act of 1864 was the first instance of United States Federal regulation of derivatives. More formally titled "An Act to Prohibit Certain Sales of Gold and Foreign Exchange," the Act was passed by Congress on June 17, 1864....

, which was soon repealed after it seemed to accelerate the decline of the greenback.

The largest amount of greenbacks outstanding at any one time was calculated as $447,300,203.10. The Union's reliance on expanding the circulation of greenbacks eventually ended with the emission of Interest Bearing

Interest Bearing Note

Interest Bearing Note refers to a grouping of Civil War era paper money-related emissions of the Treasury. The grouping includes the one and two year notes authorized by the Act of March 3, 1863, which bore interest at 5 percent, were a legal tender at face value, and were issued in denominations...

and Compound Interest Treasury Note

Compound Interest Treasury Note

Compound Interest Treasury Notes were emissions of the United States Treasury Department authorized in 1863 and 1864 with aspects of both paper money and debt. They were issued in denominations of $10, $20, $50, $100, $500 and $1000. They matured for three years until they could be redeemed and...

s, and the passage of the National Banking Act

National Banking Act

The National Banking Acts of 1863 and 1864 were two United States federal laws that established a system of national charters for banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S...

. However, the end of the war found the greenbacks trading for only roughly half of their nominal value in gold.

Post Civil War

Henry Charles Carey

Henry Charles Carey , a leading 19th century economist of the American School of capitalism. He is now best known for the book The Harmony of Interests, to compare and contrast what he called the "British System" of laissez faire free trade capitalism with the "American System" of developmental...

, argued for building on the precedent of non-debt-based fiat money and making the greenback system permanent. However, Secretary of the Treasury McCulloch

Hugh McCulloch

Hugh McCulloch was an American statesman who served two non-consecutive terms as U.S. Treasury Secretary, serving under three presidents.-Biography:...

argued that the Legal Tender Acts had been war measures, and that the United States should soon reverse them and return to the gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

. The House of Representatives

United States House of Representatives

The United States House of Representatives is one of the two Houses of the United States Congress, the bicameral legislature which also includes the Senate.The composition and powers of the House are established in Article One of the Constitution...

voted overwhelmingly to endorse the Secretary's view. With an eventual return to gold convertibility in mind, the Funding Act of April 12, 1866 was passed, authorizing McCulloch to retire $10 million of the Greenbacks within six months and up to $4 million per month thereafter. This he proceeded to do until only $356,000,000 were outstanding in February 1868. By this point, the wartime economic boom was over, the crop harvest was poor, and a panic in Great Britain caused a recession and a sharp drop in prices in the United States. The contraction of the money supply was blamed for the deflationary effects, and led debtors to successfully agitate for a halt to the notes' retirement.

In the early 1870s, Treasury Secretaries George S. Boutwell

George S. Boutwell

George Sewall Boutwell was an American statesman who served as Secretary of the Treasury under President Ulysses S...

and William Adams Richardson

William Adams Richardson

William Adams Richardson was an American judge and politician.Born in Tyngsborough, Massachusetts, he graduated from Pinkerton Academy, Lawrence Academy at Groton, and attended Harvard University, graduating in 1843....

maintained that, though Congress had mandated $356,000,000 as the minimum Greenback circulation, the old Civil War statutes still authorized a maximum of $400,000,000 - and thus they had at their discretion a "reserve" of $44,000,000. While the Senate Finance Committee under John Sherman

John Sherman (politician)

John Sherman, nicknamed "The Ohio Icicle" , was a U.S. Representative and U.S. Senator from Ohio during the Civil War and into the late nineteenth century. He served as both Secretary of the Treasury and Secretary of State and was the principal author of the Sherman Antitrust Act...

disagreed, being of the opinion that the $356,000,000 was a maximum as well as a minimum, no legislation was passed to assert the Committee's opinion. Starting in 1872, Boutwell and Richardson used the "reserve" to counteract seasonal demands for currency, and eventually expanded the circulation of the Greenbacks to $382,000,000 in response to the Panic of 1873

Panic of 1873

The Panic of 1873 triggered a severe international economic depression in both Europe and the United States that lasted until 1879, and even longer in some countries. The depression was known as the Great Depression until the 1930s, but is now known as the Long Depression...

.

In June 1874, Congress officially capped the Greenback circulation at $382,000,000, and in January 1875, passed the Specie Payment Resumption Act

Specie Payment Resumption Act

Late in 1861, the United States federal government suspended specie payments, seeking to raise revenue for the American Civil War effort without exhausting its reserves of gold and silver. Early in 1862, the United States issued legal-tender notes, called greenbacks...

, which authorized a contraction in the circulation of Greenbacks towards a revised limit of $300,000,000, and required the government to redeem them for gold, on demand, after the first of January 1879. As a result, the currency strengthened and by April 1876, the notes were on par with silver coins which then began to re-emerge into circulation. On May 31, 1878, the contraction in the circulation was halted at $346,681,016 - a level which would be maintained for almost 100 years afterwards. While $346,681,016 was a significant figure at the time, it is now a very small fraction of the total currency in circulation in the United States. The year 1879 found Sherman

John Sherman (politician)

John Sherman, nicknamed "The Ohio Icicle" , was a U.S. Representative and U.S. Senator from Ohio during the Civil War and into the late nineteenth century. He served as both Secretary of the Treasury and Secretary of State and was the principal author of the Sherman Antitrust Act...

, now Secretary of the Treasury, in possession of sufficient specie to redeem notes as requested, but as this brought the value of the greenbacks into parity with gold for the first time since the Specie Suspension of December 1861, the public voluntarily accepted the greenbacks as part of the circulating medium.

While the United States Notes had been used as a form of debt issuance during the Civil War, afterwards they were used as a way of moderately influencing the money supply by the federal government - such as through the actions of Boutwell and Richardson. During the Panic of 1907

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on...

, President Theodore Roosevelt

Theodore Roosevelt

Theodore "Teddy" Roosevelt was the 26th President of the United States . He is noted for his exuberant personality, range of interests and achievements, and his leadership of the Progressive Movement, as well as his "cowboy" persona and robust masculinity...

attempted to increase liquidity in the markets by authorizing the Treasury to issue more Greenbacks, but the Aldrich-Vreeland Act

Aldrich-Vreeland Act

The Aldrich–Vreeland Act was passed in response to the Panic of 1907 and established the National Monetary Commission, which recommended the Federal Reserve Act of 1913....

provided for the needed flexibility in the National Bank Note

National Bank Note

National Bank Notes were United States currency banknotes issued by National banks chartered by the United States Government. The notes were usually backed by United States bonds the bank deposited with the United States Treasury.- Background :...

supply instead. Eventually, the "need" for an elastic currency was addressed with the Federal Reserve Notes authorized by the Federal Reserve Act

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

, and pressure to alter the circulating quantity of United States Notes subsided.

Soon after private ownership of gold was banned

Executive Order 6102

Executive Order 6102 is an Executive Order signed on April 5, 1933, by U.S. President Franklin D. Roosevelt "forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States"...

in 1933, all of the remaining types of circulating currency, silver certificate

Silver Certificate

Silver Certificates are a type of representative money printed from 1878 to 1964 in the United States as part of its circulation of paper currency. They were produced in response to silver agitation by citizens who were angered by the Fourth Coinage Act, which had effectively placed the United...

s, Federal Reserve Note

Federal Reserve Note

A Federal Reserve Note is a type of banknote used in the United States of America. Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. They are the only type of U.S...

s, and United States Notes, were redeemable by individuals only for silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

. Eventually, even silver redemption stopped in 1965-68, during a time in which all U.S. currency (both coins and paper currency) was changed to fiat currency

Fiat money

Fiat money is money that has value only because of government regulation or law. The term derives from the Latin fiat, meaning "let it be done", as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used.Fiat money originated in 11th...

. At this point for the general public, there was little to distinguish United States Notes from Federal Reserve Notes. As a result, the public circulation of United States Notes, which was then mainly in the form of $5 bills, was replaced with $5 Federal Reserve Notes, and the stock of United States Notes was mostly converted into $100 bills, which spent most of their time in bank vaults. No more United States Notes were put into circulation after January 21, 1971. In September 1994 the Riegle Improvement Act released the Treasury from its long-standing obligation to keep the notes in circulation and finally, in 1996, the Treasury announced that its stock of $100 United States Notes had been destroyed.

Comparison to Federal Reserve Notes

Both United States Notes and Federal Reserve Notes are parts of the national currency of the United States, and both have been legal tender since the gold recallExecutive Order 6102

Executive Order 6102 is an Executive Order signed on April 5, 1933, by U.S. President Franklin D. Roosevelt "forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States"...

of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes. United States Notes were created as fiat currency, in that the government has never categorically guaranteed to redeem them for precious metal - even though at times, such as after the specie resumption of 1879, federal officials were authorized to do so if requested. The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and was inserted by the Treasury directly into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate seigniorage

Seigniorage

Seigniorage can have the following two meanings:* Seigniorage derived from specie—metal coins, is a tax, added to the total price of a coin , that a customer of the mint had to pay to the mint, and that was sent to the sovereign of the political area.* Seigniorage derived from notes is more...

, or interest, for the Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

, which serves as a lending intermediary between the Treasury and the public.

Characteristics

Like all U.S. currency, United States Notes were produced in a large sizedLarge-sized note

A large-sized note is a bill of any denomination of U.S. currency printed between 1863 and 1929. This is in contrast with small-sized notes, which were printed starting in 1928. Large-sized notes exist in denominations of $1 through $10,000. The most common large-sized notes are the Federal Reserve...

format until 1929, at which point the notes' sizes were reduced to the small-size format of the present day.

The original large-sized Civil War issues were dated 1862 and 1863, and issued in denominations of $1, $2, $5, $10, $20, $50, $100, $500 and $1000. The United States Notes were dramatically redesigned for the Series of 1869, the so-called Rainbow Notes. The notes were again redesigned in the Series of 1874, 1875 and 1878. The Series of 1878 included, for the first and last time, notes of $5,000 and $10,000 denominations. The final across-the-board redesign of the large-sized notes was the Series of 1880. Individual denominations were redesigned in 1901, 1907, 1917 and 1923.

On small-sized United States Notes, the U.S. Treasury Seal

Seal of the United States Department of the Treasury

The United States Treasury Seal is the official symbol of the United States Department of the Treasury. It actually predates the department, having originated with the Board of Treasury during the period of the Articles of Confederation. It is used on all U.S...

and the serial number

Serial number

A serial number is a unique number assigned for identification which varies from its successor or predecessor by a fixed discrete integer value...

s are printed in red (contrasting with Federal Reserve Notes, where they usually appear in green). By the time the small-size format was adopted, the Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

was already in place and there was limited need for United States Notes. They were mainly issued in $2 and $5 denominations in the Series years of 1928, 1953, and 1963. There was a limited issue of $1 notes in the Series of 1928, and an issue of $100 notes in the Series year of 1966, mainly to satisfy legacy legal requirements of maintaining the mandated quantity in circulation.

Section 5119(b)(2) of Title 31, United States Code, was amended by the Riegle Community Development and Regulatory Improvement Act of 1994 (Public Law 103-325) to read as follows: "The Secretary shall not be required to reissue United States currency notes upon redemption." This does not change the legal tender status of United States Notes nor does it require a recall of those notes already in circulation. This provision means that United States Notes are to be cancelled and destroyed but not reissued. This will eventually result in a decrease in the amount of these notes outstanding.

Public Debt of the United States

, the U.S. Treasury calculates that $230 million in United States notes are in circulation, and excludes this amount from the statutory debt limit of the United States. This amount excludes $25 million in United States Notes issued prior to July 1, 1929, determined pursuant to Act of June 30, 1961, 31 U.S.C. 5119, to have been destroyed or irretrievably lost.Politics and controversy

The concept of replacing precious metals with fiat paper as the medium of exchange was contentious and attracted attention.The United States Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

had enacted the Legal Tender Acts during the U.S. Civil War when southern Democrats were absent from the Congress, and thus their Jacksonian

Jacksonian democracy

Jacksonian democracy is the political movement toward greater democracy for the common man typified by American politician Andrew Jackson and his supporters. Jackson's policies followed the era of Jeffersonian democracy which dominated the previous political era. The Democratic-Republican Party of...

hard money

Hard money (policy)

Hard money policies are those which are opposed to fiat currency and thus in support of a specie standard, usually gold or silver, typically implemented with representative money....

views were underrepresented. After the war, the Supreme Court

Supreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

ruled on the Legal Tender Cases

Legal Tender Cases

The Legal Tender Cases were a series of United States Supreme Court cases in the latter part of the nineteenth century that affirmed the constitutionality of paper money. In the 1870 case of Hepburn v. Griswold, the Court had held that paper money violated the United States Constitution. The...

to determine the constitutionality of the use of greenbacks

Greenback (money)

The term greenback refers to paper currency that was issued by the United States during the American Civil War.There are at least two types of notes that were called greenback:*United States Note*Demand Note...

. The 1870 case Hepburn v. Griswold

Hepburn v. Griswold

Hepburn v. Griswold, 75 U.S. 603 , was a Supreme Court of the United States case in which the Chief Justice, Salmon P. Chase, speaking for the Court, declared certain parts of the legal tender acts to be unconstitutional...

found unconstitutional the use of greenbacks when applied to debts established prior to the First Legal Tender Act as the five Democrats

Democratic Party (United States)

The Democratic Party is one of two major contemporary political parties in the United States, along with the Republican Party. The party's socially liberal and progressive platform is largely considered center-left in the U.S. political spectrum. The party has the lengthiest record of continuous...

on the Court, Nelson

Samuel Nelson

Samuel Nelson was an American attorney and an Justice of the Supreme Court of the United States....

, Grier

Robert Cooper Grier

Robert Cooper Grier , was an American jurist who served on the Supreme Court of the United States.-Early life, education, and career:...

, Clifford

Nathan Clifford

Nathan Clifford was an American statesman, diplomat and jurist.Clifford was born of old Yankee stock in Rumney, New Hampshire, to farmers, the only son of seven children He attended the public schools of that town, then the Haverhill Academy in New...

, Field

Stephen Johnson Field

Stephen Johnson Field was an American jurist. He was an Associate Justice of the United States Supreme Court of the United States Supreme Court from May 20, 1863, to December 1, 1897...

, and Chase

Salmon P. Chase

Salmon Portland Chase was an American politician and jurist who served as U.S. Senator from Ohio and the 23rd Governor of Ohio; as U.S. Treasury Secretary under President Abraham Lincoln; and as the sixth Chief Justice of the United States Supreme Court.Chase was one of the most prominent members...

, ruled against the Civil War legislation in a 5-3 decision. Secretary Chase had become Chief Justice of the United States

Chief Justice of the United States

The Chief Justice of the United States is the head of the United States federal court system and the chief judge of the Supreme Court of the United States. The Chief Justice is one of nine Supreme Court justices; the other eight are the Associate Justices of the Supreme Court of the United States...

and a Democrat, and spearheaded the decision invalidating his own actions during the war. However, Grier retired from the Court, and President Grant

Ulysses S. Grant

Ulysses S. Grant was the 18th President of the United States as well as military commander during the Civil War and post-war Reconstruction periods. Under Grant's command, the Union Army defeated the Confederate military and ended the Confederate States of America...

appointed two new Republicans

Republican Party (United States)

The Republican Party is one of the two major contemporary political parties in the United States, along with the Democratic Party. Founded by anti-slavery expansion activists in 1854, it is often called the GOP . The party's platform generally reflects American conservatism in the U.S...

, Strong

William Strong (judge)

William Strong was an American jurist and politician. He was a justice on the Supreme Court of Pennsylvania and an Associate Justice on the Supreme Court of the United States.-Early life:...

and Bradley, who joined the three sitting Republicans, Swayne

Noah Haynes Swayne

Noah Haynes Swayne was an American jurist and politician. He was the first Republican appointed as a justice to the United States Supreme Court.-Birth and early life:...

, Miller

Samuel Freeman Miller

Samuel Freeman Miller was an associate justice of the United States Supreme Court from 1862–1890. He was a physician and lawyer.-Early life and education:...

, and Davis

David Davis (Supreme Court justice)

David Davis was a United States Senator from Illinois and associate justice of the United States Supreme Court. He also served as Abraham Lincoln's campaign manager at the 1860 Republican National Convention....

, to reverse Hepburn, 5-4, in the cases Knox v. Lee

Knox v. Lee

Knox v. Lee, 79 U.S. 457 , was an important case for its time where the Supreme Court of the United States reversed Hepburn v. Griswold . The Court held that making paper money legal tender through the Legal Tender Act did not conflict with Article One of the United States Constitution.Mrs...

and Parker v. Davis. In 1884, the Court, controlled 8-1 by Republicans, granted the federal government very broad power to issue Legal Tender paper through the case Juilliard v. Greenman

Juilliard v. Greenman

Juilliard v. Greenman, 110 U.S. 421 , was a Supreme Court of the United States case in which issuance of greenbacks as legal tender was challenged in peacetime.The Legal Tender Acts of 1862 and 1863 were upheld....

, with only the lone remaining Democrat, Field, dissenting.

The states in the far west stayed loyal to the Union, but also had hard money sympathies. During the specie suspension from 1862 to 1878 western states used the gold dollar as a unit of account whenever possible and accepted greenbacks at a discount wherever they could. The preferred forms of paper money were gold certificates and National Gold Bank Note

National Gold Bank Note

-History:National Gold Bank Notes were banknotes that were redeemable for gold in the 1870s. National gold bank notes came in $5, $10, $20, $50, $100, $500, $1,000, and $5,000. Today, all are very rare and in the higher grades and denominations many are unknown to even exist now. Most notes show...

s, the latter having been created specifically to address the desire for hard money in California

California

California is a state located on the West Coast of the United States. It is by far the most populous U.S. state, and the third-largest by land area...

.

During the 1870s and 1880s, the Greenback Party existed for the primary purpose of advocating an increased circulation of United States Notes as a way of creating inflation according to the quantity theory of money

Quantity theory of money

In monetary economics, the quantity theory of money is the theory that money supply has a direct, proportional relationship with the price level....

. However, as the 1870s unfolded, the market price of silver fell with respect to gold, and inflationists found a new cause in the Free Silver movement

Free Silver

Free Silver was an important United States political policy issue in the late 19th century and early 20th century. Its advocates were in favor of an inflationary monetary policy using the "free coinage of silver" as opposed to the less inflationary Gold Standard; its supporters were called...

. Opposition to the resumption of specie convertibility of the Greenbacks in 1879 was accordingly muted.

Further reading

- On Greenbacks, Free Silver, and Free Banking by Henry GeorgeHenry GeorgeHenry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

; appeared in The Standard on December 14, 1889