2008–2009 Russian financial crisis

Encyclopedia

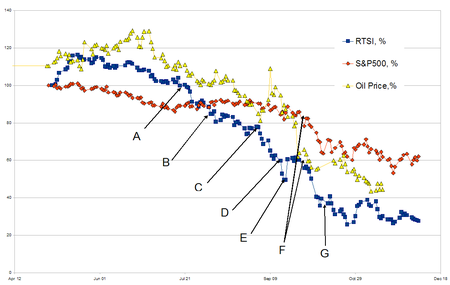

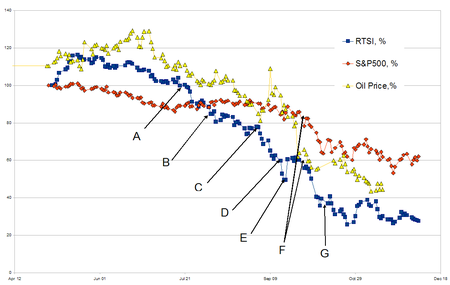

The 2008–2009 Russian financial crisis, part of the world Economic crisis of 2008, was a crisis in the Russia

n financial markets as well as an economic recession that was compounded by political fears after the war with Georgia and by the plummeting price of Urals heavy crude oil

, which lost more than 70% of its value since its record peak of US$147 on 4 July 2008 before rebounding moderately in 2009. According to the World Bank

, Russia’s strong short-term macroeconomic fundamentals made it better prepared than many emerging economies to deal with the crisis, but its underlying structural weaknesses and high dependence on the price of a single commodity made its impact more pronounced than would otherwise be the case.

In late 2008 during the onset of the crisis, Russian markets plummeted and more than $1 trillion had been wiped off the value of Russia's shares, although Russian stocks rebounded in 2009 becoming the world’s best performers, with the Micex index having more than doubled in value and regaining half its 2008 losses.

As the crisis progressed, Reuters

and the Financial Times

speculated that the crisis would be used to increase the Kremlin's control over key strategic assets in a reverse of the "loans for shares" sales of the 1990s, when the state sold off major assets to the oligarch

s in return for loans. In contrast to this earlier speculation, in September 2009 the Russian government announced plans to sell state energy and transport holdings in order to help plug the budget deficit and to help improve the nation's aging infrastructure. The state earmarked

about 5,500 enterprises for divestment

and plans to sell shares in companies that are already publicly traded, including Rosneft

, the country’s biggest oil producer.

From July 2008 – January 2009, Russia's foreign exchange reserves

(FXR) fell by $210 billion from their peak to $386 billion as the central bank adopted a policy of gradual devaluation to combat the sharp devaluation of the ruble

. The ruble weakened 35% against the dollar from the onset of the crisis in August to January 2009. As the ruble stabilized in January the reserves began to steadily grow again throughout 2009, reaching a year-long high of $452 billion by year's-end.

Russia's economy emerged from recession in the third quarter of 2009 after two quarters of record negative growth. GDP contracted by 7.9% for the whole of 2009, slightly less than the economic ministry's prediction of 8.5%. Experts expect Russia's economy will grow modestly in 2010, with estimates ranging from 3.1% by the Russian economic ministry to 2.5%, 3.6% and 4.9% by the World Bank

, International Monetary Fund

(IMF), and Organisation for Economic Cooperation and Development (OECD) respectively.

's criticism of steel company Mechel

collapsing the company's stock. By September 2008, the RTS stock index plunged almost 54%, making it one of the worst performing markets in the world. Russian involvement in the US subprime mortgage crisis

contributed to the volatility in Russia's financial system. The Russian Central Bank owned US$100 Billion of mortgage-backed securities

of the two American mortgage giants Fannie Mae and Freddie Mac that were taken over by the US government

. This investment most likely will have to be written off.

Many analysts, including Andrei Illarionov, former economic policy adviser to then-President Vladimir Putin, claim that in Russia the crisis in the stock market was deepened dramatically by internal factors, including concerns over state interference in the economy fueled in June by Putin's criticism of Mechel

and the conflict over TNK-BP

, lack of transparency in banking and political risks associated with escalating geopolitical tensions following the 2008 South Ossetia war

in August. Swedish Foreign minister

Carl Bildt

said on 17 September that the current Russian financial crisis is "obviously more worrying" than the ongoing subprime mortgage crisis

in view of the political development in Russia. Furthermore, Russia's overt reliance on the oil and natural gas sector made it particularly vulnerable

According to the Wall Street Journal and Gazeta.ru, as the Russian market declined in September, conspiracy theories circulated in Russia among the leadership that the U.S. government allegedly incited American investors to withdraw their capitals from Russia, punishing Moscow for the recent war in Georgia.

's stock plunged by almost 38 percent after Russia's Prime Minister Vladimir Putin

criticized its CEO Igor Zyuzin

, and accused the company of selling resources to Russia at higher prices than those charged to foreign countries. The comments, which raised fears of another attack similar to that made on Yukos

in 2004, contrasted sharply with previous efforts by President Dmitry Medvedev

to improve Russia's reputation as an investor-friendly country. On the following day, Mechel issued a contrite statement promising full cooperation with federal authorities, while share values rebounded by nearly 15 percent. 28 July presidential aide Arkady Dvorkovich

then sought to restore calm, declaring that all parties would "act in a civilized way," and confirming that Mechel was cooperating with antitrust authorities. Just hours later, however, Putin announced that Mechel had been avoiding taxes, by using foreign subsidiaries to sell its products internationally. His renewed attack caused share prices to tumble once more—this time by almost 33 percent.

On 16 September Russia's most liquid stock exchange MICEX and the dollar-denominated RTS

were suspended trade for one hour after the worst one-day fall in 10 years as Finance Minister Alexei Kudrin

reassured markets there was no "systemic" crisis. Next day, trading was suspended for the second day in succession on Russia's two main stock exchanges (MICEX and RTS) after shares fell dramatically, forcing the Federal Financial Markets Service

to intervene. The simultaneous collapse of money markets prompted reaction from the government and the Central Bank, while Finance Minister Alexey Kudrin sought assurances from U.S. Treasury Secretary Henry Paulson

that the U.S. did not play politics with Russia in the crisis.

The crisis continued on 18 September, as trading was suspended for the third day in succession on Russia's two main stock exchanges amidst fear of financial collapse. News agencies are quoting Russia's finance minister Alexei Kudrin

as saying trading on Russian exchanges will not resume until 19 September 2008. Officials at MICEX stock exchange describe conditions in the Russian markets as "extraordinary" Deputy Finance Minister

Pyotr Kazakevich asserted that "Russia is facing its worst stock market decline in a decade mainly because of a confidence crisis rather than liquidity problems".

6 October the MICEX and RTS

crashed by 18.6% and 19.1% respectively. The losses forced the Federal Financial Markets Service

to suspend the stocks three times. The decreases in other world markets on that day were considerable, but less dramatic than in Russia. Trading on both exchanges was suspended on the next day; Russian companies have augmented in price at London LSE

. On 8 October the MICEX and RTS plunged 14.4% and 11.3% respectively, trading on the markets was halted until 10 October, respectively. However, on 9 October MICEX trading resumed ahead of schedule, and the stock market rose 14.7%. On the next day the regulator, wary of crises in American and Asian markets, decided not to open trading at all.

s was imminent since spring, when Central Bank of Russia warned the public of a gradual contraction in bank lending due to unfolding world liquidity crisis. However, the regulator preferred to combat inflation, raising the refinancing rate and bank reserve contributions

. 1 September hike in reserve rate alone withdrew nearly 100 billion roubles from the money market. The raise coincided with a seasonal peak in tax payments and left the banking system in a worse state of liquidity than that of August 1998. A subsequent drop in rouble-to-dollar exchange rate and dollar-denominated prices of Russian corporate securities forced investors to crowd out

, worsening the positive feedback

loop. The interbank money market

that traditionally relied on Russian corporate stock as a colllateral

for the repurchase agreement

s, immediately imploded in what was called "a crisis of trust" or even "elimination of trust": when the borrowers defaulted on loans, leaving lenders with impaired collateral, other banks stopped lending as a precaution.

Money market crunch passed its first lowest mark 15–17 September. 17 September the government lent the country's three biggest banks, Sberbank

, VTB Bank and Gazprombank

, 1.13 trillion rubles

(US$44 billion) for at least three months to boost liquidity

; the Central Bank lowered the reserve requirement

. This was followed 24 September by Central Bank loans to keep the current accounts afloat and prevent a bank run

. The regulators also raised the cap for deposit insurance

from 400 to 700 thousand roubles (equivalent to 25 thousand dollars). These actions served their short-term purpose but failed to revitalize the money market: no bank was willing to lend for longer than overnight.

17 November MosPrime interbank interest rate on rouble loans reached a record high of 22.67%, indicating another shortage of liquid funds as the bank clients transferred funds overseas or paid taxes due. Rates on six-month US dollar forward contract

s fluctuated at 40–60%, short-term currency swap

s averaged around 80% as the banks anticipated further drop in exchange rates.

and Alrosa

agreed to acquire a 90% stake in KIT Finance.

In the beginning of October Sergei Ignatyev, chairman of the Central Bank, announced imminent bankruptcy of 50 to 70 banks. Actually, in late August – late November the regulator has shut down only nine banks. More smaller banks showing signs of distress are allowed to operate, like the Moscow Mortgage Bank that defaulted on returning individual deposits in November. Regional banks, heavily dependent on individual deposits, were in particular hit. A bank run

registered in Bashkortostan

in November caused local crises. Three of the four worst affected banks were promised rescue by their shareholders or third-party buyers; fate of the fourth one is yet to be decided.

On 18 September, Russian President Dmitry Medvedev

On 18 September, Russian President Dmitry Medvedev

ordered ministers to inject 500 billion roubles of funds from the state budget into the markets and pledged that the financial system would receive "all necessary support". On 7 October, Medvedev announced an additional $36 billion for banks on top of the $150 billion approved in September.

On 29 September, Vladimir Putin

announced a government policy aimed at refinancing Russian corporations that previously relied on foreign loans. Government authorized Vnesheconombank as its principal agent in distributing state loans to these corporations, amounting initially up to 50 billion US dollars, or 8% of Russia's foreign currency assets. At the same time Putin recommended the Central Bank to extend unsecured stabilization loans to Russian banks, which was duly implemented. The policy was immediately dubbed "soft re-nationalisation" and criticized for selective picking of "eligible" borrowers. The 50 billion installment covers only the current portion of 477 billion US dollars owed by Russian corporations to foreign lenders; total assets of the government and the Central Bank combined are estimated at 550 billion US dollars.

On 23 October, Standard & Poor's

changed the long-term outlook on the sovereign credit ratings of Russia from stable to negative, warning of the costs of bailing out troubled banks and a rising risk of a budget deficit in 2009. It also lowered Russia's Transfer and Convertibility (T&C) assessment to BBB+

from A-

. At the same time, the 'BBB+' long-term foreign currency, the 'A-' long-term local currency ratings and the short-term ratings of A-2

were affirmed.

By 13 November, Russian government spending to quench the recession reached 222 billion US dollars, or 13.9% of its GDP; in November the state was spending its reserves at an average 22 billion dollars a week.

On 8 December 2008, Standard & Poor's

additionally lowered Russia's foreign currency credit ratings to BBB

(long term) and A-3

. It also lowered Russia's Transfer and Convertibility (T&C) assessment to BBB

and the long-term local currency assessment to BBB+

. On the other hand, the short-term credit rating in local currency was left intact as A-2. The lowering of credit ratings was caused by the sharp decline of reserves and investment flow. Standard & Poor's also launched a downward revision of Russian municipal and corporate bond ratings.

announced government package of tax reforms. Corporate profit tax rate (24% in 2008) is to be reduced to 20%. Profit tax base will decrease for companies investing in capital assets as the immediately recoverable depreciation allowance is raised from 10% to 30% of the asset cost. There will be no change in value added tax

rates (maximum 18%) in 2009, but the government considered changing VAT accrual rules in favor of the taxpayers. Minister of finance Alexey Kudrin, who resisted tax breaks until September, concurred with Putin's proposal, estimating that they will save the businesses around 500 billion roubles annually.

Earlier in November, Kudrin announced that the state has accepted the fact of a long-term drop in oil prices and that the existing state budget plans will hold unchanged if the oil prices stabilize on 50 dollars per barrel mark. Even with tax breaks effective, Kudrin estimated that the 2009 state budget will break even or, in worst case, bear no more than 1% deficit. The deficit will be covered by Stabilisation Fund, without resorting to borrowing.

In December the government lifted import tariffs on industrial equipment imported by metallurgy, construction, forestry and textile industry, at the same time enforcing increased tariffs on imported cars.

On 15 April 2009, Finance Minister Alexei Kudrin

said the federal budget will show a deficit of 7.4% of GDP in 2009. In comparison, the US expects a budget deficit of 13.5% of GDP, Britain 9.3%, and France 6.6%. According to Kudrin forecast for the 2010 deficit is 5%. Kudrin warned, that Russia must cut down its budget deficit before 2011. "Our vulnerability to the crisis is higher than that of the countries with more diversified economies. This is why 2009 should be a unique year. We must not have a comparable budget deficit in subsequent years. We must work to reduce it to 3% in 2011," he said.

On 25 May 2009, President Dmitry Medvedev said the budget deficit in 2009 will be "at least 7%" of GDP.

, pressed the corporations to reveal their true owners and signed an agreement with the government of Cyprus

(20 November) that may enable inter-government dislosure of ownership records. Cyprus is, nominally, the number one investor in Russia; 99% of RTS

stock trades are arranged between foreign shareholders.

emergency loans to other states, initially contributing one billion US dollar. Earlier, in October, Russian ambassador to Iceland

announces that Iceland will receive a €4 billion loan from Russia to mitigate the 2008–2011 Icelandic financial crisis. The loan will be given across three or four years, and the interest rates will be 30 to 50 points above LIBOR

. Prime minister Geir Haarde

had been investigating the possibility of a loan provided by Russia since the mid-summer. Iceland's Central bank Governor Davíð Oddsson

later clarified that the loan was still being negotiated.

report projected 3% growth for 2009, However, a revised projection issued 30 March 2009 by the World Bank projects a 4.5% decrease for 2009 with unemployment projected to rise to 12% by the end of 2009. The World Bank report expressed concern about the condition of the poor and recommended increases in social support payments such as unemployment payments and child support payments. The report projected a slight rise in the average price of oil during 2010, up to $53 a barrel from the projected average of $45 for 2009.

In the middle of December 2008 Russian officials confirmed that possibility of a recession was inevitable. "Russia is headed for a recession", the country's deputy economy minister, Andrei Klepach

, has said. Asked whether Russia would have a recession, he said: "It's started already. I'm afraid it will not be over in the next two quarters. ... A major drop began in October and there will also be drops in November–December," he said, according to official reports. Recessions are normally declared after two quarters of negative growth. He also said that full-year economic growth for 2008 would be lower than the 6.8% previously forecast.

laid off 3,000 workers (10% of its Urals staff) and reduced output by 15% on 7 October, another layoff of 1,300 was announced in early November. Severstal

reduced domestic production by 25%; its US and Italian production dropped by 30%. Evraz Group

, employer of 40 thousands workers in Kemerovo Oblast

, was reported negotiating layoffs with the unions and regional government since 30 October. The company, specializing in construction-grade rolled steel, was inherently in worse position than other Russian steel mills. 13 November Evraz announced that, instead of layoffs, it will decrease workers' wages by a third. Some of Evraz facilities were converted to a four-day working week; the company reduced output to an estimated 50–60% of its capacity.

On 18 November Goskomstat

insider reported an unprecedented drop in industrial prices – minus 6.6% monthly, following a 0.8% drop in September (the agency itself delayed its regular monthly report). Most of the losses concentrate in raw material industries; automobile and tool-making industries dropped only 0.4%. In two months, gasoline and diesel oil wholesale prices dropped by 12.8% and 16.5%. The worst price fall hit the steel industry: pig iron an ferric alloys dropped 21.7% in October after a 8.9% drop in September. Prices on aluminum and nickel are down to break-even

point. The decline is sufficient to indicate a recession

.

In November the industry relied on government funds distributed through Vneshtorgbank

loans. VTB issued a 10 billion roubles emergency loan to Evraz to finance its current tax payments; a similar 5 billion loan was issued to OAO TMK

. Magnitka

was reported "in the line" for VTB financing. The industry continued to implode, and on 14 and 18 November Novolipetsk Steel

shut down two of its five blast furnace

s, reducing its pig iron

capacity by 2.5 million metric tons, or 27%. On the same day Novolipetsk Steel denied steel shipments to GAZ

due to automobile maker's default on payments.

described "Russia's booming car market" as a place where "you just need someone to count the money". In November the market slowed to its lowest since January 2007. AC Nielsen linked the market drop to a collapse in auto loan programs and general uncertainty among consumers, and predicted that unless auto loans recover, the market will slide back into 1990s. The government supported domestic auto makers by an increase in tariff

s on imports, leading to an expected 7.5–8% price increase for imported cars.

GAZ

and KAMAZ

were the first auto makers to declare production cuts in September–October 2008. GAZ

truck production has decreased by 23.4% in September 2008; in October the company announced week-long shutdowns of the main assembly line to meet decrease in demand for its most successful line, the GAZelle

truck. KAMAZ

, the target of acquisition by Daimler AG since July, has been reporting financial difficulties since September. In October KAMAZ reduced working hours by a third, from six-day to four-day working week. KAMAZ requested a 15 billion rouble state-backed loan and took a private loan from Citigroup

at 9% over prime rate

; in December Daimler AG acquired the first 10% in KAMAZ stock, citing "perfect storm" as a good time acquisition.

AvtoVAZ

disclosed emergency measures on 16 October, when Igor Sechin

held an industry-wide anti-crisis brainstorming session in Togliatti

. AvtoVAZ

reported a stockpile of 100 thousands unsold cars (two months' output). The company requested government assistance of 1 billion US Dollars arranged through a Vneshtorgbank

loan. Unlike other major borrowers who used VTB loans to substitute foreign capital, AvtoVAZ loan was intended solely to pay current expenses.

AvtoFramos, Moscow-based manufacturer of Renault Logan, has confirmed that instead of a planned weekly New Year holiday, the plant will stop for a month, 12 December 2008 to 12 January 2009. Trade unions asserted that AvroFramos has practiced short-time stoppages in November; plant administration refuted these statements. According to the unions, unsold stock reached 8 thousand cars, a month's output of the plant.

Amtel-Vredestein

has closed two of its tire

plants due to cash flow problems. On 2 December media announced closure of Bor Glass Works, the principal supplier of auto glass, but the news was soon refuted as false by the plant administration.

construction executive described regional business prospects as "very bad", notably the fact that "there is no single bank for today which grants mortgage loan

s... Construction industry will not survive under such terms."

27 October Vladimir Putin urged the government agencies to increase state purchases of road and housing construction services, arguing that the state must capitalize on the decrease in prices of raw materials. The state allocated 50 billion roubles to buy ready-to-occupy urban housing from cash-strapped developers. Putin emphasized that the new contracts must be struck on new, decreased, price terms – estimated to be 20–30% cheaper than in spring. Strabag

executive estimated that in 2009 construction costs will decrease a further 30%. In November Moscow city government has been successfully pressing local developers for a 25% discount against October auction

prices; the only developer who attempted to sue the city for a breach of contract withdrew their lawsuit and accepted the government terms. City government also pulled out of the 118-floor Russia Tower

project, which was immediately suspended by its developer, citing "credit crunch".

and the City of Moscow), declared a ten day shutdown on 24 November. UPM-Kymmene Oyj

anticipates at least a 30–40% decrease in output compared to 2008. In June 2010, President Dmitry Medvedev visited Silicon Valley in San Jose, California in order to cultivate ideas of how to develop Russia as a major research center. Skolkovo, a mid-sized city near Moscow, is the proposed location for this Russian Silicon Valley, and will have its own tax structure. Yet, Medvedev has been criticized by opposition politicians for deflecting attention away from the struggling economy and corruption.

, a Krasnoyarsk

-based airline with a controlling state interest, was grounded by the fuel suppliers' refusal to extend credit to the company that defaulted on payments. Other members of AiRUnion

consortium, notably Dalavia, also folded in August. Thousands of passengers were stranded in airports; flight delays and cancellations became a national agenda. Government action focused on setting the cap on jet fuel

prices and restructuring its assets into a new company managed by Rostechnologii, a newly-formed state conglomerate

. Ministry of Transportation distributed the licenses to fly former KrasAir routes to other companies. KrasAir also defaulted on payments to its staff, and on 27 October a strike action

, coupled with fuel suppliers' denial of service, finally ruined the airline. Dalavia lost its license earlier in October. The collapse of KrasAir also threatened Sky Express

, Russia's first low cost carrier co-owned by the EBRD and former manager of KrasAir. 22 October the assets of bankrupt KrasAir

, Domodedovo Airlines

, Samara Airlines

and Atlant-Soyuz Airlines

were consolidated in a new company, Rosavia, co-financed by the City of Moscow and Rostekhnologii. Rossiya

, Orenair, Kavminvodyavia

, Vladivostok Air, Dalavia and Saravia

were originally planned to join this proposed airline holding company, too, which would have made Rosavia the largest Russian airline by fleet size. Following a 20 percent drop of domestic passenger numbers in Russia per month, the federal government scrapped all plans concerning the new airline on 5 March 2009

authorized a state export subsidy of 40 US dollars per metric ton. This, according to the minister of agriculture, is sufficient to maintain exports at 20–25 million metric tons. The food industry is, however, locked between high costs of farm produce and tight price and credit terms dictated by retail chains. Food industry executives anticipate that the chains will eventually lose part of their clients to street markets, as the suppliers are forced to develop this independent sales channel.

Domestic retail chains, heavily leveraged

, were experiencing liquidity crisis

at least since April 2008. The first chain to go bankrupt in May 2008, Grossmart (190 stores in Moscow region), had a particularly high debt-to-EBITDA

ratio of 6 to 1. Arbat Prestige, subject to government attacks since 2007, defaulted on its bonds in June. In November 2008 nine leading food retail chains (out of nearly 300) received access to government-backed financing. Nevertheless, retailers are pressing food suppliers for longer credit terms or bigger cash discounts, demanding up to 50% price cut for cash payment. Suppliers, in a mirror move, raised "regular" credit prices by 20–60%. Rather than submit to the chains' demands, they simply refuse to sell; visible depletion of stocks has affected only a few affected chains.

survey of 113 clients that leaked into Russian press in November summarized their losses at 8% of managerial and 6% of low-level jobs by end of October. All companies in the survey practiced some sort of reducing labor costs. One company in four practiced unpaid "vacations"; 8% of clients settled for reduced working hours. Federal Migratory Service announced in November that 1123 Russian companies reported upcoming layoffs of 45 thousand.

Most layoffs were reported in metallurgy and financial services: 20% in Uralsib

, 1000 in Vneshtorgbank

's VTB24 retail division. 1 December Vedomosti

reported upcoming 40% cuts in MDM Bank

and 80% in IFD Kapital. Sberbank

endorsed a long-term program to reduce headcount by 25% in 2014. In telecommunications, Sitronics

laid off up to 10% in all business units; in audit services, Deloitte Touche Tohmatsu

reduced number of partners in its Russian division by 17 out of 180. Vedomosti

has set up a private "layoff newsreel" syndicating independent reports of job cuts, yet as at 7 December 2008, there are no reliable nation-wide statistics on white-collar unemployment, which usually escapes official unemployment record.

By late November, Kremlin First Deputy Chief of Staff, Vladislav Surkov

, was warning that the middle classes should be defended from poverty during the crisis. He called for swift measures to protect the middle class from layoffs and to support consumption. "If the 1980s were the times of the intellectuals and the 1990s were the times of the oligarchs then the 00s can be seen as the epoch of the middle classes,' Surkov said in a speech published on the Web site of the ruling United Russia party ... The main task of the state during the slump must become the preservation of the middle class, the defence of the middle class from the waves of poverty and confusion that are coming from the West," he said.

According to official statements released 9 December, rate of unemployment growth peaked in the middle of November and slowed down in subsequent weeks. In the week ending 3 December overall unemployment grew by 1.6% to 1.315 million people, following a 2.3% increase in the preceding week. The state also reported an increase in unpaid vacations and reduced working week employees to 149.3 thousands. The number increased by 84% in a single week ending 3 December. The trade unions anticipate that official unemployment will peak at around 2 million people in 2009, when hidden forms of unemployment become visible to statisticians. Yet on 12 December Putin announced completely different unemployment numbers – 4.6 million in October.

In February 2009 the unemployment rate peaked at a seven-year high of 9.4%, then began to steadily decline, falling to 7.7% as of October.

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

n financial markets as well as an economic recession that was compounded by political fears after the war with Georgia and by the plummeting price of Urals heavy crude oil

Price of petroleum

The price of petroleum as quoted in news generally refers to the spot price per barrel of either WTI/light crude as traded on the New York Mercantile Exchange for delivery at Cushing, Oklahoma, or of Brent as traded on the Intercontinental Exchange for delivery at Sullom Voe.The price...

, which lost more than 70% of its value since its record peak of US$147 on 4 July 2008 before rebounding moderately in 2009. According to the World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

, Russia’s strong short-term macroeconomic fundamentals made it better prepared than many emerging economies to deal with the crisis, but its underlying structural weaknesses and high dependence on the price of a single commodity made its impact more pronounced than would otherwise be the case.

In late 2008 during the onset of the crisis, Russian markets plummeted and more than $1 trillion had been wiped off the value of Russia's shares, although Russian stocks rebounded in 2009 becoming the world’s best performers, with the Micex index having more than doubled in value and regaining half its 2008 losses.

As the crisis progressed, Reuters

Reuters

Reuters is a news agency headquartered in New York City. Until 2008 the Reuters news agency formed part of a British independent company, Reuters Group plc, which was also a provider of financial market data...

and the Financial Times

Financial Times

The Financial Times is an international business newspaper. It is a morning daily newspaper published in London and printed in 24 cities around the world. Its primary rival is the Wall Street Journal, published in New York City....

speculated that the crisis would be used to increase the Kremlin's control over key strategic assets in a reverse of the "loans for shares" sales of the 1990s, when the state sold off major assets to the oligarch

Business oligarch

Business oligarch is a near-synonym of the term "business magnate", borrowed by the English speaking and western media from post-Soviet parlance to describe the huge, fast-acquired wealth of some businessmen of the former Soviet republics during the privatization in Russia and other post-Soviet...

s in return for loans. In contrast to this earlier speculation, in September 2009 the Russian government announced plans to sell state energy and transport holdings in order to help plug the budget deficit and to help improve the nation's aging infrastructure. The state earmarked

Earmark (politics)

In United States politics, an earmark is a legislative provision that directs approved funds to be spent on specific projects, or that directs specific exemptions from taxes or mandated fees...

about 5,500 enterprises for divestment

Divestment

In finance and economics, divestment or divestiture is the reduction of some kind of asset for either financial or ethical objectives or sale of an existing business by a firm...

and plans to sell shares in companies that are already publicly traded, including Rosneft

Rosneft

Rosneft is an integrated oil company majority owned by the Government of Russia. Rosneft is headquartered in Moscow’s Balchug district near the Kremlin, across the Moskva river...

, the country’s biggest oil producer.

From July 2008 – January 2009, Russia's foreign exchange reserves

Foreign exchange reserves

Foreign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

(FXR) fell by $210 billion from their peak to $386 billion as the central bank adopted a policy of gradual devaluation to combat the sharp devaluation of the ruble

Russian ruble

The ruble or rouble is the currency of the Russian Federation and the two partially recognized republics of Abkhazia and South Ossetia. Formerly, the ruble was also the currency of the Russian Empire and the Soviet Union prior to their breakups. Belarus and Transnistria also use currencies with...

. The ruble weakened 35% against the dollar from the onset of the crisis in August to January 2009. As the ruble stabilized in January the reserves began to steadily grow again throughout 2009, reaching a year-long high of $452 billion by year's-end.

Russia's economy emerged from recession in the third quarter of 2009 after two quarters of record negative growth. GDP contracted by 7.9% for the whole of 2009, slightly less than the economic ministry's prediction of 8.5%. Experts expect Russia's economy will grow modestly in 2010, with estimates ranging from 3.1% by the Russian economic ministry to 2.5%, 3.6% and 4.9% by the World Bank

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

, International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF), and Organisation for Economic Cooperation and Development (OECD) respectively.

Background

Russia is a major exporter of commodities such as oil and metals, so its economy has been hit hard by the decline in the price of many commodities. Russian stock market declined significantly. Foreign investors have pulled billions of dollars out of Russia on concerns over escalating geopolitical tensions with the West following the military conflict between Georgia and Russia, as well as concerns about state interference in the economy. Those concerns were underscored in July by Prime Minister Vladimir PutinVladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

's criticism of steel company Mechel

Mechel

Mechel is one of Russia’s leading mining and metallurgical companies, producing coal, iron ore, nickel steel, rolled steel products, hardware, heat and electric power. Headquartered in Moscow, the company operates facilities in Russia, Romania, Lithuania, Kazakhstan, Bulgaria, and the United...

collapsing the company's stock. By September 2008, the RTS stock index plunged almost 54%, making it one of the worst performing markets in the world. Russian involvement in the US subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

contributed to the volatility in Russia's financial system. The Russian Central Bank owned US$100 Billion of mortgage-backed securities

Mortgage-backed security

A mortgage-backed security is an asset-backed security that represents a claim on the cash flows from mortgage loans through a process known as securitization.-Securitization:...

of the two American mortgage giants Fannie Mae and Freddie Mac that were taken over by the US government

Federal takeover of Fannie Mae and Freddie Mac

The federal takeover of Fannie Mae and Freddie Mac refers to the placing into conservatorship of government sponsored enterprises Fannie Mae and Freddie Mac by the U.S. Treasury in September 2008. It was one financial event among many in the ongoing subprime mortgage crisis.On September 6, 2008,...

. This investment most likely will have to be written off.

Many analysts, including Andrei Illarionov, former economic policy adviser to then-President Vladimir Putin, claim that in Russia the crisis in the stock market was deepened dramatically by internal factors, including concerns over state interference in the economy fueled in June by Putin's criticism of Mechel

Mechel

Mechel is one of Russia’s leading mining and metallurgical companies, producing coal, iron ore, nickel steel, rolled steel products, hardware, heat and electric power. Headquartered in Moscow, the company operates facilities in Russia, Romania, Lithuania, Kazakhstan, Bulgaria, and the United...

and the conflict over TNK-BP

TNK-BP

TNK-BP is a major vertically integrated Russian oil company. It is Russia's third largest oil producer and among the ten largest private oil companies in the world. TNK-BP is Russia's third largest oil company in terms of reserves and crude oil production...

, lack of transparency in banking and political risks associated with escalating geopolitical tensions following the 2008 South Ossetia war

2008 South Ossetia war

The 2008 South Ossetia War or Russo-Georgian War was an armed conflict in August 2008 between Georgia on one side, and Russia and separatist governments of South Ossetia and Abkhazia on the other....

in August. Swedish Foreign minister

Minister for Foreign Affairs (Sweden)

The Minister for Foreign Affairs is the foreign minister of Sweden and the head of the Ministry for Foreign Affairs.The office was instituted in 1809 as a result of the constitutional Instrument of Government promulgated in the same year. Until 1876 the office was called Prime Minister for Foreign...

Carl Bildt

Carl Bildt

, Honorary KCMG is a Swedish politician, diplomat and nobleman. Formerly Prime Minister of Sweden from 1991 to 1994 and leader of the liberal conservative Moderate Party from 1986 to 1999, Bildt has served as Swedish Minister for Foreign Affairs since 6 October 2006...

said on 17 September that the current Russian financial crisis is "obviously more worrying" than the ongoing subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

in view of the political development in Russia. Furthermore, Russia's overt reliance on the oil and natural gas sector made it particularly vulnerable

According to the Wall Street Journal and Gazeta.ru, as the Russian market declined in September, conspiracy theories circulated in Russia among the leadership that the U.S. government allegedly incited American investors to withdraw their capitals from Russia, punishing Moscow for the recent war in Georgia.

Financial markets

Stock markets

24 July 2008, MechelMechel

Mechel is one of Russia’s leading mining and metallurgical companies, producing coal, iron ore, nickel steel, rolled steel products, hardware, heat and electric power. Headquartered in Moscow, the company operates facilities in Russia, Romania, Lithuania, Kazakhstan, Bulgaria, and the United...

's stock plunged by almost 38 percent after Russia's Prime Minister Vladimir Putin

Vladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

criticized its CEO Igor Zyuzin

Igor Zyuzin

Zyuzin, Igor Vladimirovich is a major Russian businessman, Managing Director and a major shareholder of mining and metallurgical holding company "Mechel". According to Forbes magazine on March 8, 2008 his personal fortune estimated at $ 13.1 billion. According to Forbes magazine on March 11, 2009...

, and accused the company of selling resources to Russia at higher prices than those charged to foreign countries. The comments, which raised fears of another attack similar to that made on Yukos

YUKOS

OJSC "Yukos Oil Company" was a petroleum company in Russia which, until 2003, was controlled by Russian oligarch Mikhail Khodorkovsky and a number of other prominent Russian businessmen. After Yukos was bankrupted, Khodorkovsky was convicted and sent to prison.Yukos headquarters was located in...

in 2004, contrasted sharply with previous efforts by President Dmitry Medvedev

Dmitry Medvedev

Dmitry Anatolyevich Medvedev is the third President of the Russian Federation.Born to a family of academics, Medvedev graduated from the Law Department of Leningrad State University in 1987. He defended his dissertation in 1990 and worked as a docent at his alma mater, now renamed to Saint...

to improve Russia's reputation as an investor-friendly country. On the following day, Mechel issued a contrite statement promising full cooperation with federal authorities, while share values rebounded by nearly 15 percent. 28 July presidential aide Arkady Dvorkovich

Arkady Dvorkovich

Arkady Vladimirovich Dvorkovich is an official of the Russian Chess Federation. Dvorkovich favors his opponent, Kirsan Ilyumzhinov, who is running for re-election of FIDE....

then sought to restore calm, declaring that all parties would "act in a civilized way," and confirming that Mechel was cooperating with antitrust authorities. Just hours later, however, Putin announced that Mechel had been avoiding taxes, by using foreign subsidiaries to sell its products internationally. His renewed attack caused share prices to tumble once more—this time by almost 33 percent.

On 16 September Russia's most liquid stock exchange MICEX and the dollar-denominated RTS

Russian Trading System

The Russian Trading System is a stock market established in 1995 in Moscow, consolidating various regional trading floors into one exchange. Originally RTS was modelled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system...

were suspended trade for one hour after the worst one-day fall in 10 years as Finance Minister Alexei Kudrin

Alexei Kudrin

Alexei Leonidovich Kudrin was the Minister of Finance and Deputy Prime Minister of Russia from 18 May 2000 to 26 September 2011. After graduating with degrees in finance and economics, Kudrin worked in the administration of Saint Petersburg's liberal Mayor Anatoly Sobchak. In 1996 he started...

reassured markets there was no "systemic" crisis. Next day, trading was suspended for the second day in succession on Russia's two main stock exchanges (MICEX and RTS) after shares fell dramatically, forcing the Federal Financial Markets Service

Federal Financial Markets Service

The Federal Financial Markets Service is a Russian federal executive body which regulates Russian financial markets including securities issuance and trading and supervision of exchanges, issuers, professional market participants and their Self-Regulatory Organisations; the Russian Federation...

to intervene. The simultaneous collapse of money markets prompted reaction from the government and the Central Bank, while Finance Minister Alexey Kudrin sought assurances from U.S. Treasury Secretary Henry Paulson

Henry Paulson

Henry Merritt "Hank" Paulson, Jr. is an American banker who served as the 74th United States Secretary of the Treasury. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.-Early life and family:...

that the U.S. did not play politics with Russia in the crisis.

The crisis continued on 18 September, as trading was suspended for the third day in succession on Russia's two main stock exchanges amidst fear of financial collapse. News agencies are quoting Russia's finance minister Alexei Kudrin

Alexei Kudrin

Alexei Leonidovich Kudrin was the Minister of Finance and Deputy Prime Minister of Russia from 18 May 2000 to 26 September 2011. After graduating with degrees in finance and economics, Kudrin worked in the administration of Saint Petersburg's liberal Mayor Anatoly Sobchak. In 1996 he started...

as saying trading on Russian exchanges will not resume until 19 September 2008. Officials at MICEX stock exchange describe conditions in the Russian markets as "extraordinary" Deputy Finance Minister

Finance minister

The finance minister is a cabinet position in a government.A minister of finance has many different jobs in a government. He or she helps form the government budget, stimulate the economy, and control finances...

Pyotr Kazakevich asserted that "Russia is facing its worst stock market decline in a decade mainly because of a confidence crisis rather than liquidity problems".

6 October the MICEX and RTS

Russian Trading System

The Russian Trading System is a stock market established in 1995 in Moscow, consolidating various regional trading floors into one exchange. Originally RTS was modelled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system...

crashed by 18.6% and 19.1% respectively. The losses forced the Federal Financial Markets Service

Federal Financial Markets Service

The Federal Financial Markets Service is a Russian federal executive body which regulates Russian financial markets including securities issuance and trading and supervision of exchanges, issuers, professional market participants and their Self-Regulatory Organisations; the Russian Federation...

to suspend the stocks three times. The decreases in other world markets on that day were considerable, but less dramatic than in Russia. Trading on both exchanges was suspended on the next day; Russian companies have augmented in price at London LSE

London Stock Exchange

The London Stock Exchange is a stock exchange located in the City of London within the United Kingdom. , the Exchange had a market capitalisation of US$3.7495 trillion, making it the fourth-largest stock exchange in the world by this measurement...

. On 8 October the MICEX and RTS plunged 14.4% and 11.3% respectively, trading on the markets was halted until 10 October, respectively. However, on 9 October MICEX trading resumed ahead of schedule, and the stock market rose 14.7%. On the next day the regulator, wary of crises in American and Asian markets, decided not to open trading at all.

Money markets

The crisis in money marketMoney market

The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

s was imminent since spring, when Central Bank of Russia warned the public of a gradual contraction in bank lending due to unfolding world liquidity crisis. However, the regulator preferred to combat inflation, raising the refinancing rate and bank reserve contributions

Bank reserves

Bank reserves are banks' holdings of deposits in accounts with their central bank , plus currency that is physically held in the bank's vault . The central banks of some nations set minimum reserve requirements...

. 1 September hike in reserve rate alone withdrew nearly 100 billion roubles from the money market. The raise coincided with a seasonal peak in tax payments and left the banking system in a worse state of liquidity than that of August 1998. A subsequent drop in rouble-to-dollar exchange rate and dollar-denominated prices of Russian corporate securities forced investors to crowd out

Crowding out (economics)

In economics, crowding out occurs when Expansionary Fiscal Policy causes interest rates to rise, thereby reducing private spending. That means increase in government spending crowds out investment spending....

, worsening the positive feedback

Positive feedback

Positive feedback is a process in which the effects of a small disturbance on a system include an increase in the magnitude of the perturbation. That is, A produces more of B which in turn produces more of A. In contrast, a system that responds to a perturbation in a way that reduces its effect is...

loop. The interbank money market

Money market

The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

that traditionally relied on Russian corporate stock as a colllateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

for the repurchase agreement

Repurchase agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is the sale of securities together with an agreement for the seller to buy back the securities at a later date. The repurchase price should be greater than the original sale price, the difference effectively...

s, immediately imploded in what was called "a crisis of trust" or even "elimination of trust": when the borrowers defaulted on loans, leaving lenders with impaired collateral, other banks stopped lending as a precaution.

Money market crunch passed its first lowest mark 15–17 September. 17 September the government lent the country's three biggest banks, Sberbank

Sberbank

Sberbank Rossii is the largest bank in Russia and Eastern Europe. The company's headquarters are in Moscow and its history goes back to Cancrin's financial reform of 1841...

, VTB Bank and Gazprombank

Gazprombank

Gazprombank is the largest Russian non-state owned bank, which is among the three largest banks in Russia. It is a joint stock bank founded in 1990. The bank is owned by the Russian gas company Gazprom, which controls 62.59% of shares directly and also retains shares through its subsidiaries...

, 1.13 trillion rubles

Russian ruble

The ruble or rouble is the currency of the Russian Federation and the two partially recognized republics of Abkhazia and South Ossetia. Formerly, the ruble was also the currency of the Russian Empire and the Soviet Union prior to their breakups. Belarus and Transnistria also use currencies with...

(US$44 billion) for at least three months to boost liquidity

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

; the Central Bank lowered the reserve requirement

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

. This was followed 24 September by Central Bank loans to keep the current accounts afloat and prevent a bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

. The regulators also raised the cap for deposit insurance

Deposit insurance

Explicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due...

from 400 to 700 thousand roubles (equivalent to 25 thousand dollars). These actions served their short-term purpose but failed to revitalize the money market: no bank was willing to lend for longer than overnight.

17 November MosPrime interbank interest rate on rouble loans reached a record high of 22.67%, indicating another shortage of liquid funds as the bank clients transferred funds overseas or paid taxes due. Rates on six-month US dollar forward contract

Forward contract

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed today. This is in contrast to a spot contract, which is an agreement to buy or sell an asset today. It costs nothing to enter a...

s fluctuated at 40–60%, short-term currency swap

Currency swap

A currency swap is a foreign-exchange agreement between two parties to exchange aspects of a loan in one currency for equivalent aspects of an equal in net present value loan in another currency; see foreign exchange derivative. Currency swaps are motivated by comparative advantage...

s averaged around 80% as the banks anticipated further drop in exchange rates.

Bank failures

On 15 September the KIT Finance brokerage failed to pay off its debt, signalling problems in Russia's financial sector. On 8 October the Russian RailwaysRussian Railways

The Russian Railways , is the government owned national rail carrier of the Russian Federation, headquartered in Moscow. The Russian Railways operate over of common carrier routes as well as a few hundred kilometers of industrial routes, making it the second largest network in the world exceeded...

and Alrosa

Alrosa

ZAO ALROSA , is Russia's largest diamond company. Alrosa is engaged in the exploration, mining, manufacture and sale of diamonds. The company's operations are located primarily in the Sakha Republic/Yakutsk region. Alrosa accounts for approximately 25% of the world's rough diamond supply and 97%...

agreed to acquire a 90% stake in KIT Finance.

In the beginning of October Sergei Ignatyev, chairman of the Central Bank, announced imminent bankruptcy of 50 to 70 banks. Actually, in late August – late November the regulator has shut down only nine banks. More smaller banks showing signs of distress are allowed to operate, like the Moscow Mortgage Bank that defaulted on returning individual deposits in November. Regional banks, heavily dependent on individual deposits, were in particular hit. A bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

registered in Bashkortostan

Bashkortostan

The Republic of Bashkortostan , also known as Bashkiria is a federal subject of Russia . It is located between the Volga River and the Ural Mountains. Its capital is the city of Ufa...

in November caused local crises. Three of the four worst affected banks were promised rescue by their shareholders or third-party buyers; fate of the fourth one is yet to be decided.

Refinancing foreign capital

Dmitry Medvedev

Dmitry Anatolyevich Medvedev is the third President of the Russian Federation.Born to a family of academics, Medvedev graduated from the Law Department of Leningrad State University in 1987. He defended his dissertation in 1990 and worked as a docent at his alma mater, now renamed to Saint...

ordered ministers to inject 500 billion roubles of funds from the state budget into the markets and pledged that the financial system would receive "all necessary support". On 7 October, Medvedev announced an additional $36 billion for banks on top of the $150 billion approved in September.

On 29 September, Vladimir Putin

Vladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

announced a government policy aimed at refinancing Russian corporations that previously relied on foreign loans. Government authorized Vnesheconombank as its principal agent in distributing state loans to these corporations, amounting initially up to 50 billion US dollars, or 8% of Russia's foreign currency assets. At the same time Putin recommended the Central Bank to extend unsecured stabilization loans to Russian banks, which was duly implemented. The policy was immediately dubbed "soft re-nationalisation" and criticized for selective picking of "eligible" borrowers. The 50 billion installment covers only the current portion of 477 billion US dollars owed by Russian corporations to foreign lenders; total assets of the government and the Central Bank combined are estimated at 550 billion US dollars.

On 23 October, Standard & Poor's

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

changed the long-term outlook on the sovereign credit ratings of Russia from stable to negative, warning of the costs of bailing out troubled banks and a rising risk of a budget deficit in 2009. It also lowered Russia's Transfer and Convertibility (T&C) assessment to BBB+

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

from A-

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

. At the same time, the 'BBB+' long-term foreign currency, the 'A-' long-term local currency ratings and the short-term ratings of A-2

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

were affirmed.

By 13 November, Russian government spending to quench the recession reached 222 billion US dollars, or 13.9% of its GDP; in November the state was spending its reserves at an average 22 billion dollars a week.

On 8 December 2008, Standard & Poor's

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

additionally lowered Russia's foreign currency credit ratings to BBB

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

(long term) and A-3

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

. It also lowered Russia's Transfer and Convertibility (T&C) assessment to BBB

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

and the long-term local currency assessment to BBB+

Bond credit rating

In investment, the bond credit rating assesses the credit worthiness of a corporation's or government debt issues. It is analogous to credit ratings for individuals.-Table:...

. On the other hand, the short-term credit rating in local currency was left intact as A-2. The lowering of credit ratings was caused by the sharp decline of reserves and investment flow. Standard & Poor's also launched a downward revision of Russian municipal and corporate bond ratings.

Tax and state budget policy

20 November Vladimir PutinVladimir Putin

Vladimir Vladimirovich Putin served as the second President of the Russian Federation and is the current Prime Minister of Russia, as well as chairman of United Russia and Chairman of the Council of Ministers of the Union of Russia and Belarus. He became acting President on 31 December 1999, when...

announced government package of tax reforms. Corporate profit tax rate (24% in 2008) is to be reduced to 20%. Profit tax base will decrease for companies investing in capital assets as the immediately recoverable depreciation allowance is raised from 10% to 30% of the asset cost. There will be no change in value added tax

Value added tax

A value added tax or value-added tax is a form of consumption tax. From the perspective of the buyer, it is a tax on the purchase price. From that of the seller, it is a tax only on the "value added" to a product, material or service, from an accounting point of view, by this stage of its...

rates (maximum 18%) in 2009, but the government considered changing VAT accrual rules in favor of the taxpayers. Minister of finance Alexey Kudrin, who resisted tax breaks until September, concurred with Putin's proposal, estimating that they will save the businesses around 500 billion roubles annually.

Earlier in November, Kudrin announced that the state has accepted the fact of a long-term drop in oil prices and that the existing state budget plans will hold unchanged if the oil prices stabilize on 50 dollars per barrel mark. Even with tax breaks effective, Kudrin estimated that the 2009 state budget will break even or, in worst case, bear no more than 1% deficit. The deficit will be covered by Stabilisation Fund, without resorting to borrowing.

In December the government lifted import tariffs on industrial equipment imported by metallurgy, construction, forestry and textile industry, at the same time enforcing increased tariffs on imported cars.

On 15 April 2009, Finance Minister Alexei Kudrin

Alexei Kudrin

Alexei Leonidovich Kudrin was the Minister of Finance and Deputy Prime Minister of Russia from 18 May 2000 to 26 September 2011. After graduating with degrees in finance and economics, Kudrin worked in the administration of Saint Petersburg's liberal Mayor Anatoly Sobchak. In 1996 he started...

said the federal budget will show a deficit of 7.4% of GDP in 2009. In comparison, the US expects a budget deficit of 13.5% of GDP, Britain 9.3%, and France 6.6%. According to Kudrin forecast for the 2010 deficit is 5%. Kudrin warned, that Russia must cut down its budget deficit before 2011. "Our vulnerability to the crisis is higher than that of the countries with more diversified economies. This is why 2009 should be a unique year. We must not have a comparable budget deficit in subsequent years. We must work to reduce it to 3% in 2011," he said.

On 25 May 2009, President Dmitry Medvedev said the budget deficit in 2009 will be "at least 7%" of GDP.

Corporate governance

Federal Financial Monitoring Service of Russia, the agency in charge of domestic stock markets and corporate governanceCorporate governance

Corporate governance is a number of processes, customs, policies, laws, and institutions which have impact on the way a company is controlled...

, pressed the corporations to reveal their true owners and signed an agreement with the government of Cyprus

Cyprus

Cyprus , officially the Republic of Cyprus , is a Eurasian island country, member of the European Union, in the Eastern Mediterranean, east of Greece, south of Turkey, west of Syria and north of Egypt. It is the third largest island in the Mediterranean Sea.The earliest known human activity on the...

(20 November) that may enable inter-government dislosure of ownership records. Cyprus is, nominally, the number one investor in Russia; 99% of RTS

Russian Trading System

The Russian Trading System is a stock market established in 1995 in Moscow, consolidating various regional trading floors into one exchange. Originally RTS was modelled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system...

stock trades are arranged between foreign shareholders.

International cooperation

Russia has agreed to co-finance International Monetary FundInternational Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

emergency loans to other states, initially contributing one billion US dollar. Earlier, in October, Russian ambassador to Iceland

Iceland

Iceland , described as the Republic of Iceland, is a Nordic and European island country in the North Atlantic Ocean, on the Mid-Atlantic Ridge. Iceland also refers to the main island of the country, which contains almost all the population and almost all the land area. The country has a population...

announces that Iceland will receive a €4 billion loan from Russia to mitigate the 2008–2011 Icelandic financial crisis. The loan will be given across three or four years, and the interest rates will be 30 to 50 points above LIBOR

London Interbank Offered Rate

The LIBOR rate is the average interest rate that leading banks in London charge when lending to other banks. It is an acronym for London Interbank Offered Rate Banks borrow money for one day, one month, two months, six months, one year etc. and they pay interest to their lenders based on...

. Prime minister Geir Haarde

Geir Haarde

Geir Hilmar Haarde was Prime Minister of Iceland from 15 June 2006 to 1 February 2009 and Chairman of the Icelandic Independence Party from 2005 to 2009. Geir initially led a coalition between his party and the Progressive Party...

had been investigating the possibility of a loan provided by Russia since the mid-summer. Iceland's Central bank Governor Davíð Oddsson

Davíð Oddsson

Davíð Oddsson is an Icelandic politician and the longest-serving Prime Minister of Iceland, holding office from 1991 to 2004. He also served as Foreign Minister from 2004 to 2005. Previously, he was Mayor of Reykjavík from 1982 to 1991, and he chaired the board of governors of the Central Bank of...

later clarified that the loan was still being negotiated.

Crisis in real economy

At the end of November 2008, The Russian economy as a whole was not in a state of recession. The government forecast for 2009 stood at a 6.7% annual growth rate while a November 2008 World BankWorld Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

report projected 3% growth for 2009, However, a revised projection issued 30 March 2009 by the World Bank projects a 4.5% decrease for 2009 with unemployment projected to rise to 12% by the end of 2009. The World Bank report expressed concern about the condition of the poor and recommended increases in social support payments such as unemployment payments and child support payments. The report projected a slight rise in the average price of oil during 2010, up to $53 a barrel from the projected average of $45 for 2009.

In the middle of December 2008 Russian officials confirmed that possibility of a recession was inevitable. "Russia is headed for a recession", the country's deputy economy minister, Andrei Klepach

Andrei Klepach

Andrei Nikolayevich Klepach is a deputy economics minister of Russia, and since 2004 the director of macroeconomic forecasting department of the Ministry of Economic Development and Trade of the Russian Federation...

, has said. Asked whether Russia would have a recession, he said: "It's started already. I'm afraid it will not be over in the next two quarters. ... A major drop began in October and there will also be drops in November–December," he said, according to official reports. Recessions are normally declared after two quarters of negative growth. He also said that full-year economic growth for 2008 would be lower than the 6.8% previously forecast.

Steel industry

Russian steel industry is dependent on foreign markets and domestic construction and automobile industries. Crisis in the industry was first publicly reported in the end of September – early October. Magnitogorsk Iron and Steel WorksMagnitogorsk Iron and Steel Works

Magnitogorsk Iron and Steel Works , abbreviated as MMK, is the third largest steel company in Russia. It is located in the city of Magnitogorsk, in Chelyabinsk Oblast....

laid off 3,000 workers (10% of its Urals staff) and reduced output by 15% on 7 October, another layoff of 1,300 was announced in early November. Severstal

Severstal

OAO Severstal Russian: Северсталь, "Northern Steel") is a Russian company mainly operating in the steel and mining industry, centred in the northern city of Cherepovets. Severstal is listed on the RTS and LSE. As of 2009, it is the largest steel company in Russia according to The Metal Bulletin....

reduced domestic production by 25%; its US and Italian production dropped by 30%. Evraz Group

Evraz Group

Evraz Group is one of the world's biggest vertically integrated steel production and mining businesses, with operations mainly in Russia. In 2008, Evraz Group produced 17.7 million tonnes of crude steel.-Overview:...

, employer of 40 thousands workers in Kemerovo Oblast

Kemerovo Oblast

Kemerovo Oblast , also known as Kuzbass after the Kuznetsk Basin, is a federal subject of Russia , located in southwestern Siberia, where the West Siberian Plain meets the South Siberian mountains...

, was reported negotiating layoffs with the unions and regional government since 30 October. The company, specializing in construction-grade rolled steel, was inherently in worse position than other Russian steel mills. 13 November Evraz announced that, instead of layoffs, it will decrease workers' wages by a third. Some of Evraz facilities were converted to a four-day working week; the company reduced output to an estimated 50–60% of its capacity.

On 18 November Goskomstat

Goskomstat

Goskomstat was the centralised agency dealing with statistics in the Soviet Union. Goskomstat was created in 1987 to replace the Central Statistical Administration. While maintaining the same basic functions in the collection, analysis, and publicationand distribution of state statistics,...

insider reported an unprecedented drop in industrial prices – minus 6.6% monthly, following a 0.8% drop in September (the agency itself delayed its regular monthly report). Most of the losses concentrate in raw material industries; automobile and tool-making industries dropped only 0.4%. In two months, gasoline and diesel oil wholesale prices dropped by 12.8% and 16.5%. The worst price fall hit the steel industry: pig iron an ferric alloys dropped 21.7% in October after a 8.9% drop in September. Prices on aluminum and nickel are down to break-even

Break-even

Break-even is a point where any difference between plus or minus or equivalent changes side.-In economics:A technique for which identifying the point where the total revenue is just sufficient to cover the total cost...

point. The decline is sufficient to indicate a recession

Recession

In economics, a recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way...

.

In November the industry relied on government funds distributed through Vneshtorgbank

Vneshtorgbank

Bank VTB , former Vneshtorgbank, is one of the leading universal banks of Russia and the largest in terms of authorized capital....

loans. VTB issued a 10 billion roubles emergency loan to Evraz to finance its current tax payments; a similar 5 billion loan was issued to OAO TMK

OAO TMK

OAO "TMK" is one of the world's leading producers of steel pipes for the oil and gas sector...

. Magnitka

Magnitogorsk Iron and Steel Works

Magnitogorsk Iron and Steel Works , abbreviated as MMK, is the third largest steel company in Russia. It is located in the city of Magnitogorsk, in Chelyabinsk Oblast....

was reported "in the line" for VTB financing. The industry continued to implode, and on 14 and 18 November Novolipetsk Steel

Novolipetsk Steel

Novolipetsk Steel , or NLMK, is one of the four largest steel companies in Russia with sales of more than US$11.7 billion in 2008 and 9.2 million tonnes of steel output. NLMK's share of domestic crude steel production was about 13% in 2007. It primary produces flat steel products, semi-finished...

shut down two of its five blast furnace

Blast furnace

A blast furnace is a type of metallurgical furnace used for smelting to produce industrial metals, generally iron.In a blast furnace, fuel and ore and flux are continuously supplied through the top of the furnace, while air is blown into the bottom of the chamber, so that the chemical reactions...

s, reducing its pig iron

Pig iron

Pig iron is the intermediate product of smelting iron ore with a high-carbon fuel such as coke, usually with limestone as a flux. Charcoal and anthracite have also been used as fuel...

capacity by 2.5 million metric tons, or 27%. On the same day Novolipetsk Steel denied steel shipments to GAZ

GAZ

GAZ or Gorkovsky Avtomobilny Zavod , translated as Gorky Automobile Plant , started in 1932 as NAZ, a cooperation between Ford and the Soviet Union. It is one of the largest companies in the Russian automotive industry....

due to automobile maker's default on payments.

Automotive industry

In June 2008 The EconomistThe Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

described "Russia's booming car market" as a place where "you just need someone to count the money". In November the market slowed to its lowest since January 2007. AC Nielsen linked the market drop to a collapse in auto loan programs and general uncertainty among consumers, and predicted that unless auto loans recover, the market will slide back into 1990s. The government supported domestic auto makers by an increase in tariff

Tariff

A tariff may be either tax on imports or exports , or a list or schedule of prices for such things as rail service, bus routes, and electrical usage ....

s on imports, leading to an expected 7.5–8% price increase for imported cars.

GAZ

GAZ

GAZ or Gorkovsky Avtomobilny Zavod , translated as Gorky Automobile Plant , started in 1932 as NAZ, a cooperation between Ford and the Soviet Union. It is one of the largest companies in the Russian automotive industry....

and KAMAZ

Kamaz

KAMAZ is a Russian truck manufacturer located in Naberezhnye Chelny, Tatarstan, Russian Federation. KAMAZ opened their doors in 1976...

were the first auto makers to declare production cuts in September–October 2008. GAZ

GAZ

GAZ or Gorkovsky Avtomobilny Zavod , translated as Gorky Automobile Plant , started in 1932 as NAZ, a cooperation between Ford and the Soviet Union. It is one of the largest companies in the Russian automotive industry....

truck production has decreased by 23.4% in September 2008; in October the company announced week-long shutdowns of the main assembly line to meet decrease in demand for its most successful line, the GAZelle

GAZelle

The GAZelle is a series of mid-sized trucks, vans and buses made by Russian car manufacturer GAZ. GAZelles are similar to the later launched GAZ-2215/GAZ-2752 Sobol and GAZ-3310 Valdai line of vans and light trucks...

truck. KAMAZ

Kamaz

KAMAZ is a Russian truck manufacturer located in Naberezhnye Chelny, Tatarstan, Russian Federation. KAMAZ opened their doors in 1976...

, the target of acquisition by Daimler AG since July, has been reporting financial difficulties since September. In October KAMAZ reduced working hours by a third, from six-day to four-day working week. KAMAZ requested a 15 billion rouble state-backed loan and took a private loan from Citigroup

Citigroup