Model (economics)

Encyclopedia

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, a model is a theoretical

Theory

The English word theory was derived from a technical term in Ancient Greek philosophy. The word theoria, , meant "a looking at, viewing, beholding", and referring to contemplation or speculation, as opposed to action...

construct that represents economic processes by a set of variables

Variable (mathematics)

In mathematics, a variable is a value that may change within the scope of a given problem or set of operations. In contrast, a constant is a value that remains unchanged, though often unknown or undetermined. The concepts of constants and variables are fundamental to many areas of mathematics and...

and a set of logic

Logic

In philosophy, Logic is the formal systematic study of the principles of valid inference and correct reasoning. Logic is used in most intellectual activities, but is studied primarily in the disciplines of philosophy, mathematics, semantics, and computer science...

al and/or quantitative relationships between them. The economic model is a simplified framework designed to illustrate complex processes, often but not always using mathematical techniques

Mathematical model

A mathematical model is a description of a system using mathematical concepts and language. The process of developing a mathematical model is termed mathematical modeling. Mathematical models are used not only in the natural sciences and engineering disciplines A mathematical model is a...

. Frequently, economic models use structural parameters. Structural parameters are underlying parameters in a model or class of models. A model may have various parameters and those parameters may change to create various properties.

Overview

In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigmParadigm

The word paradigm has been used in science to describe distinct concepts. It comes from Greek "παράδειγμα" , "pattern, example, sample" from the verb "παραδείκνυμι" , "exhibit, represent, expose" and that from "παρά" , "beside, beyond" + "δείκνυμι" , "to show, to point out".The original Greek...

of econometric study.

Simplification is particularly important for economics given the enormous complexity

Complexity

In general usage, complexity tends to be used to characterize something with many parts in intricate arrangement. The study of these complex linkages is the main goal of complex systems theory. In science there are at this time a number of approaches to characterizing complexity, many of which are...

of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; these factors include: individual and cooperative decision processes, resource

Natural resource

Natural resources occur naturally within environments that exist relatively undisturbed by mankind, in a natural form. A natural resource is often characterized by amounts of biodiversity and geodiversity existent in various ecosystems....

limitations, environment

Natural environment

The natural environment encompasses all living and non-living things occurring naturally on Earth or some region thereof. It is an environment that encompasses the interaction of all living species....

al and geographical

Geography

Geography is the science that studies the lands, features, inhabitants, and phenomena of Earth. A literal translation would be "to describe or write about the Earth". The first person to use the word "geography" was Eratosthenes...

constraints, institution

Institution

An institution is any structure or mechanism of social order and cooperation governing the behavior of a set of individuals within a given human community...

al and legal

Law

Law is a system of rules and guidelines which are enforced through social institutions to govern behavior, wherever possible. It shapes politics, economics and society in numerous ways and serves as a social mediator of relations between people. Contract law regulates everything from buying a bus...

requirements and purely random fluctuations. Economists therefore must make a reasoned choice of which variables and which relationships between these variables are relevant and which ways of analyzing and presenting this information are useful.

Selection is important because the nature of an economic model will often determine what facts will be looked at, and how they will be compiled. For example inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

is a general economic concept, but to measure inflation requires a model of behavior, so that an economist can differentiate between real changes in price, and changes in price which are to be attributed to inflation.

In addition to their professional academic

Academia

Academia is the community of students and scholars engaged in higher education and research.-Etymology:The word comes from the akademeia in ancient Greece. Outside the city walls of Athens, the gymnasium was made famous by Plato as a center of learning...

interest, the use of models include:

- ForecastingForecastingForecasting is the process of making statements about events whose actual outcomes have not yet been observed. A commonplace example might be estimation for some variable of interest at some specified future date. Prediction is a similar, but more general term...

economic activity in a way in which conclusions are logically related to assumptions; - Proposing economic policyEconomic policyEconomic policy refers to the actions that governments take in the economic field. It covers the systems for setting interest rates and government budget as well as the labor market, national ownership, and many other areas of government interventions into the economy.Such policies are often...

to modify future economic activity; - Presenting reasoned arguments to politically justify economic policy at the national level, to explain and influence companyCorporationA corporation is created under the laws of a state as a separate legal entity that has privileges and liabilities that are distinct from those of its members. There are many different forms of corporations, most of which are used to conduct business. Early corporations were established by charter...

strategy at the level of the firm, or to provide intelligent advice for household economic decisions at the level of households. - PlanPlanA plan is typically any diagram or list of steps with timing and resources, used to achieve an objective. See also strategy. It is commonly understood as a temporal set of intended actions, through which one expects to achieve a goal...

ning and allocationAllocationAllocation may refer to:* Computers** Delayed allocation** Block allocation map** FAT** IP address allocation** Memory allocation** C++ allocators** No-write allocation ** Register allocation* Economics** Economic system** Asset allocation...

, in the case of centrally plannedPlanned economyA planned economy is an economic system in which decisions regarding production and investment are embodied in a plan formulated by a central authority, usually by a government agency...

economies, and on a smaller scale in logisticsLogisticsLogistics is the management of the flow of goods between the point of origin and the point of destination in order to meet the requirements of customers or corporations. Logistics involves the integration of information, transportation, inventory, warehousing, material handling, and packaging, and...

and managementManagementManagement in all business and organizational activities is the act of getting people together to accomplish desired goals and objectives using available resources efficiently and effectively...

of businessBusinessA business is an organization engaged in the trade of goods, services, or both to consumers. Businesses are predominant in capitalist economies, where most of them are privately owned and administered to earn profit to increase the wealth of their owners. Businesses may also be not-for-profit...

es. - In financeFinance"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

predictive models have been used since the 1980s for tradingTradeTrade is the transfer of ownership of goods and services from one person or entity to another. Trade is sometimes loosely called commerce or financial transaction or barter. A network that allows trade is called a market. The original form of trade was barter, the direct exchange of goods and...

(investmentInvestmentInvestment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

, and speculationSpeculationIn finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

), for example emerging market bondsBond (finance)In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

were often traded based on economic models predicting the growth of the developing nation issuing them. Since the 1990s many long-term risk managementRisk managementRisk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities...

models have incorporated economic relationships between simulated variables in an attempt to detect high-exposure future scenarios (often through a Monte Carlo methodMonte Carlo methodMonte Carlo methods are a class of computational algorithms that rely on repeated random sampling to compute their results. Monte Carlo methods are often used in computer simulations of physical and mathematical systems...

).

Obviously any kind of reasoning about anything uses representations by variables and logical relationships. A model however establishes an argumentative framework for applying logic and mathematics

Mathematics

Mathematics is the study of quantity, space, structure, and change. Mathematicians seek out patterns and formulate new conjectures. Mathematicians resolve the truth or falsity of conjectures by mathematical proofs, which are arguments sufficient to convince other mathematicians of their validity...

that can be independently discussed and tested and that can be applied in various instances. Policies and arguments that rely on economic models have a clear basis for soundness, namely the validity of the supporting model.

Economic models in current use do not pretend to be theories of everything economic; any such pretensions would immediately be thwarted by computation

Computation

Computation is defined as any type of calculation. Also defined as use of computer technology in Information processing.Computation is a process following a well-defined model understood and expressed in an algorithm, protocol, network topology, etc...

al infeasibility and the paucity of theories for most types of economic behavior. Therefore conclusions drawn from models will be approximate representations of economic facts. However, properly constructed models can remove extraneous information and isolate useful approximation

Approximation

An approximation is a representation of something that is not exact, but still close enough to be useful. Although approximation is most often applied to numbers, it is also frequently applied to such things as mathematical functions, shapes, and physical laws.Approximations may be used because...

s of key relationships. In this way more can be understood about the relationships in question than by trying to understand the entire economic process.

The details of model construction vary with type of model and its application, but a generic process can be identified. Generally any modelling process has two steps: generating a model, then checking the model for accuracy (sometimes called diagnostics). The diagnostic step is important because a model is only useful to the extent that it accurately mirrors the relationships that it purports to describe. Creating and diagnosing a model is frequently an iterative process in which the model is modified (and hopefully improved) with each iteration of diagnosis and respecification. Once a satisfactory model is found, it should be double checked by applying it to a different data set.

Types of models

According to whether all the model variables are deterministic, economic models can be classified as stochasticStochastic process

In probability theory, a stochastic process , or sometimes random process, is the counterpart to a deterministic process...

or non-stochastic models; according to whether all the variables are quantitative, economic models are classified as discrete or continuous choice model; according to the model's intended purpose/function, it can be classified as

quantitative or qualitative; according to the model's ambit, it can be classified as a general equilibrium model, a partial equilibrium model, or even a non-equilibrium model; according to the economic agent's characteristics, models can be classified as rational agent models, representative agent models etc.

- Stochastic models are formulated using stochastic processStochastic processIn probability theory, a stochastic process , or sometimes random process, is the counterpart to a deterministic process...

es. They model economically observable values over time. Most of econometricsEconometricsEconometrics has been defined as "the application of mathematics and statistical methods to economic data" and described as the branch of economics "that aims to give empirical content to economic relations." More precisely, it is "the quantitative analysis of actual economic phenomena based on...

is based on statisticsStatisticsStatistics is the study of the collection, organization, analysis, and interpretation of data. It deals with all aspects of this, including the planning of data collection in terms of the design of surveys and experiments....

to formulate and test hypotheses about these processes or estimate parameters for them. A widely used class of econometric models popularized by TinbergenJan TinbergenJan Tinbergen , was a Dutch economist. He was awarded the first Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel in 1969, which he shared with Ragnar Frisch for having developed and applied dynamic models for the analysis of economic processes...

and later WoldWoldWold may refer to :Geography*The Wolds, a term used in England to describe a range of hills consisting of open country overlying limestone or chalk *The former name of the village of Old, Northamptonshire, EnglandPeople...

are autoregressive models, in which the stochastic process satisfies some relation between current and past values. Examples of these are autoregressive moving average modelAutoregressive moving average modelIn statistics and signal processing, autoregressive–moving-average models, sometimes called Box–Jenkins models after the iterative Box–Jenkins methodology usually used to estimate them, are typically applied to autocorrelated time series data.Given a time series of data Xt, the ARMA model is a...

s and related ones such as autoregressive conditional heteroskedasticityAutoregressive conditional heteroskedasticityIn econometrics, AutoRegressive Conditional Heteroskedasticity models are used to characterize and model observed time series. They are used whenever there is reason to believe that, at any point in a series, the terms will have a characteristic size, or variance...

(ARCH) and GARCH models for the modelling of heteroskedasticityHeteroskedasticityIn statistics, a collection of random variables is heteroscedastic, or heteroskedastic, if there are sub-populations that have different variabilities than others. Here "variability" could be quantified by the variance or any other measure of statistical dispersion...

.

- Non-stochastic mathematical models may be purely qualitative (for example, models involved in some aspect of social choice theory) or quantitative (involving rationalization of financial variables, for example with hyperbolic coordinates, and/or specific forms of functional relationshipsFunction (mathematics)In mathematics, a function associates one quantity, the argument of the function, also known as the input, with another quantity, the value of the function, also known as the output. A function assigns exactly one output to each input. The argument and the value may be real numbers, but they can...

between variables). In some cases economic predictions of a model merely assert the direction of movement of economic variables, and so the functional relationships are used only in a qualitative sense: for example, if the pricePrice-Definition:In ordinary usage, price is the quantity of payment or compensation given by one party to another in return for goods or services.In modern economies, prices are generally expressed in units of some form of currency...

of an item increases, then the demandDemand (economics)In economics, demand is the desire to own anything, the ability to pay for it, and the willingness to pay . The term demand signifies the ability or the willingness to buy a particular commodity at a given point of time....

for that item will decrease. For such models, economists often use two-dimensional graphs instead of functions.

- Qualitative models – Although almost all economic models involve some form of mathematical or quantitative analysis, qualitative models are occasionally used. One example is qualitative scenario planningScenario planningScenario planning, also called scenario thinking or scenario analysis, is a strategic planning method that some organizations use to make flexible long-term plans. It is in large part an adaptation and generalization of classic methods used by military intelligence.The original method was that a...

in which possible future events are played out. Another example is non-numerical decision tree analysis. Qualitative models often suffer from lack of precision.

At a more practical level, quantitative modelling is applied to many areas of economics and several methodologies have evolved more or less independently of each other. As a result, no overall model taxonomy

Taxonomy

Taxonomy is the science of identifying and naming species, and arranging them into a classification. The field of taxonomy, sometimes referred to as "biological taxonomy", revolves around the description and use of taxonomic units, known as taxa...

is naturally available. We can nonetheless provide a few examples which illustrate some particularly relevant points of model construction.

- An accounting model is one based on the premise that for every creditCredit (finance)Credit is the trust which allows one party to provide resources to another party where that second party does not reimburse the first party immediately , but instead arranges either to repay or return those resources at a later date. The resources provided may be financial Credit is the trust...

there is a debitDebitDebit and credit are the two aspects of every financial transaction. Their use and implication is the fundamental concept in the double-entry bookkeeping system, in which every debit transaction must have a corresponding credit transaction and vice versa.Debits and credits are a system of notation...

. More symbolically, an accounting model expresses some principle of conservation in the form

-

- algebraic sum of inflows = sinks − sources

- This principle is certainly true for moneyMoneyMoney is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

and it is the basis for national income accounting. Accounting models are true by conventionConvention (norm)A convention is a set of agreed, stipulated or generally accepted standards, norms, social norms or criteria, often taking the form of a custom....

, that is any experimentExperimentAn experiment is a methodical procedure carried out with the goal of verifying, falsifying, or establishing the validity of a hypothesis. Experiments vary greatly in their goal and scale, but always rely on repeatable procedure and logical analysis of the results...

al failure to confirm them, would be attributed to fraudFraudIn criminal law, a fraud is an intentional deception made for personal gain or to damage another individual; the related adjective is fraudulent. The specific legal definition varies by legal jurisdiction. Fraud is a crime, and also a civil law violation...

, arithmetic error or an extraneous injection (or destruction) of cash which we would interpret as showing the experiment was conducted improperly.

- Optimality and constrained optimization models – Other examples of quantitative models are based on principles such as profitProfit (economics)In economics, the term profit has two related but distinct meanings. Normal profit represents the total opportunity costs of a venture to an entrepreneur or investor, whilst economic profit In economics, the term profit has two related but distinct meanings. Normal profit represents the total...

or utilityUtilityIn economics, utility is a measure of customer satisfaction, referring to the total satisfaction received by a consumer from consuming a good or service....

maximization. An example of such a model is given by the comparative staticsComparative staticsIn economics, comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous parameter....

of taxTaxTo tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

ation on the profit-maximizing firm. The profit of a firm is given by

- where

is the price that a product commands in the market if it is supplied at the rate

is the price that a product commands in the market if it is supplied at the rate  ,

,  is the revenue obtained from selling the product,

is the revenue obtained from selling the product,  is the cost of bringing the product to marketMarketA market is one of many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers...

is the cost of bringing the product to marketMarketA market is one of many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers...

at the rate , and

, and  is the tax that the firm must pay per unit of the product sold.

is the tax that the firm must pay per unit of the product sold.

- The profit maximization assumption states that a firm will produce at the output rate x if that rate maximizes the firm's profit. Using differential calculusDifferential calculusIn mathematics, differential calculus is a subfield of calculus concerned with the study of the rates at which quantities change. It is one of the two traditional divisions of calculus, the other being integral calculus....

we can obtain conditions on x under which this holds. The first order maximization condition for x is

- Regarding x is an implicitly defined function of t by this equation (see implicit function theoremImplicit function theoremIn multivariable calculus, the implicit function theorem is a tool which allows relations to be converted to functions. It does this by representing the relation as the graph of a function. There may not be a single function whose graph is the entire relation, but there may be such a function on...

), one concludes that the derivativeDerivativeIn calculus, a branch of mathematics, the derivative is a measure of how a function changes as its input changes. Loosely speaking, a derivative can be thought of as how much one quantity is changing in response to changes in some other quantity; for example, the derivative of the position of a...

of x with respect to t has the same sign as

- which is negative if the second order conditionSecond derivative testIn calculus, the second derivative test is a criterion often useful for determining whether a given stationary point of a function is a local maximum or a local minimum using the value of the second derivative at the point....

s for a local maximum are satisfied.

- Thus the profit maximization model predicts something about the effect of taxation on output, namely that output decreases with increased taxation. If the predictions of the model fail, we conclude that the profit maximization hypothesis was false; this should lead to alternate theories of the firm, for example based on bounded rationalityBounded rationalityBounded rationality is the idea that in decision making, rationality of individuals is limited by the information they have, the cognitive limitations of their minds, and the finite amount of time they have to make a decision...

.

- Borrowing a notion apparently first used in economics by Paul SamuelsonPaul SamuelsonPaul Anthony Samuelson was an American economist, and the first American to win the Nobel Memorial Prize in Economic Sciences. The Swedish Royal Academies stated, when awarding the prize, that he "has done more than any other contemporary economist to raise the level of scientific analysis in...

, this model of taxation and the predicted dependency of output on the tax rate, illustrates an operationally meaningful theorem; that is one which requires some economically meaningful assumption which is falsifiableFalsifiabilityFalsifiability or refutability of an assertion, hypothesis or theory is the logical possibility that it can be contradicted by an observation or the outcome of a physical experiment...

under certain conditions.

- Aggregate models. MacroeconomicsMacroeconomicsMacroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of the whole economy. This includes a national, regional, or global economy...

needs to deal with aggregate quantities such as outputOutput (economics)Output in economics is the "quantity of goods or services produced in a given time period, by a firm, industry, or country," whether consumed or used for further production.The concept of national output is absolutely essential in the field of macroeconomics...

, the price levelPrice levelA price level is a hypothetical measure of overall prices for some set of goods and services, in a given region during a given interval, normalized relative to some base set...

, the interest rateInterest rateAn interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

and so on. Now real output is actually a vector of goods and services, such as cars, passenger airplanes, computerComputerA computer is a programmable machine designed to sequentially and automatically carry out a sequence of arithmetic or logical operations. The particular sequence of operations can be changed readily, allowing the computer to solve more than one kind of problem...

s, food items, secretarial services, home repair services etc. Similarly pricePrice-Definition:In ordinary usage, price is the quantity of payment or compensation given by one party to another in return for goods or services.In modern economies, prices are generally expressed in units of some form of currency...

is the vector of individual prices of goods and services. Models in which the vector nature of the quantities is maintained are used in practice, for example LeontiefWassily LeontiefWassily Wassilyovich Leontief , was a Russian-American economist notable for his research on how changes in one economic sector may have an effect on other sectors. Leontief won the Nobel Committee's Nobel Memorial Prize in Economic Sciences in 1973, and three of his doctoral students have also...

input-output modelInput-output modelIn economics, an input-output model is a quantitative economic technique that represents the interdependencies between different branches of national economy or between branches of different, even competing economies. Wassily Leontief developed this type of analysis and took the Nobel Memorial...

s are of this kind. However, for the most part, these models are computationally much harder to deal with and harder to use as tools for qualitative analysis. For this reason, macroeconomic models usually lump together different variables into a single quantity such as output or price. Moreover, quantitative relationships between these aggregate variables are often parts of important macroeconomic theories. This process of aggregation and functional dependency between various aggregates usually is interpreted statistically and validated by econometricsEconometricsEconometrics has been defined as "the application of mathematics and statistical methods to economic data" and described as the branch of economics "that aims to give empirical content to economic relations." More precisely, it is "the quantitative analysis of actual economic phenomena based on...

. For instance, one ingredient of the Keynesian modelKeynesian economicsKeynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

is a functional relationship between consumption and national income: C = C(Y). This relationship plays an important role in Keynesian analysis.elow

Quantitative vs. Qualitative models

A quantitative model is designed to produce accurate predictions, without elucidating the underlying dynamics. On the other hand, a qualitative model aims to explain these dynamics without necessarily fitting empirical data or informing accurate predictions.Interest rate parity

Interest rate parity

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors will be indifferent to interest rates available on bank deposits in two countries. Two assumptions central to interest rate parity are capital mobility and perfect substitutability of domestic...

can be deemed a qualitative model in this sense: though it generally fails to fit exchange rate data as well as higher-powered statistical forecasting models, it offers an intuitive interpretation of the exchange rate and its relation to foreign and domestic interest and inflation rates. Views on the relative merits of qualitative and quantitative models vary across the profession: Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

can be viewed as having advocated a qualitative approach, while Ronald Coase

Ronald Coase

Ronald Harry Coase is a British-born, American-based economist and the Clifton R. Musser Professor Emeritus of Economics at the University of Chicago Law School. After studying with the University of London External Programme in 1927–29, Coase entered the London School of Economics, where he took...

worried that "if you torture the data long enough, it will confess;" Prospect theory

Prospect theory

Prospect theory is a theory that describes decisions between alternatives that involve risk i.e. where the probabilities of outcomes are known. The model is descriptive: it tries to model real-life choices, rather than optimal decisions.-Model:...

as proposed by Daniel Kahneman

Daniel Kahneman

Daniel Kahneman is an Israeli-American psychologist and Nobel laureate. He is notable for his work on the psychology of judgment and decision-making, behavioral economics and hedonic psychology....

(a Nobel prize winner) is more quantiative, while rational agent models are more qualitative.

Restrictive, unrealistic assumptions

Provably-unrealistic assumptions are pervasive in neoclassical economictheory (also called the "standard theory" or "neoclassical paradigm"),

and those assumptions are inherited by simplified models for that theory.

(Any model based on a flawed theory, cannot transcend the limitations

of that theory.)

Joseph Stiglitz' 2001 Nobel Prize lecture

reviews his work on Information Asymmetries

Information asymmetry

In economics and contract theory, information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other. This creates an imbalance of power in transactions which can sometimes cause the transactions to go awry, a kind of market failure...

, which contrasts with the

assumption, in standard models, of "Perfect Information". Stiglitz surveys many

aspects of these faulty standard models, and the faulty policy implications

and recommendations that arise from their unrealistic assumptions.

Stiglitz writes: (p. 519–520)

"I only varied one assumption – the assumption concerning perfect information

– and in ways which seemed highly plausible. ...

We succeeded in showing not only that the standard theory was not robust –

changing only one assumption in ways which were totally plausible

had drastic consequences, but also that an alternative robust

paradigm with great explanatory power could be constructed.

There were other deficiencies in the theory, some of which were closely

connected. The standard theory assumed that technology and preferences

were fixed. But changes in technology, R & D, are at the heart of capitalism.

... I similarly became increasingly convinced of the inappropriateness

of the assumption of fixed preferences.

(Footnote: In addition, much of recent economic theory has assumed that

beliefs are, in some sense, rational. As noted earlier, there are many aspects

of economic behavior that seem hard to reconcile with this hypothesis.)"

Economic models can be such powerful tools in understanding some economic relationships, that it is easy to ignore their limitations.

One tangible example where the limits of Economic Models collided with

reality, but were nevertheless accepted as "evidence" in public policy debates,

involved models to simulate the effects of NAFTA, the North American Free Trade

Agreement. James Stanford published his examination of 10 of these models.

The fundamental issue is circularity: embedding one's assumptions as

foundational "input" axioms in a model, then proceeding to "prove" that,

indeed, the model's "output" supports the validity of those assumptions.

Such a model is consistent with similar models that have adopted those same assumptions.

But is it consistent with reality?

As with any scientific theory, empirical validation is needed,

if we are to have any confidence in its predictive ability.

If those assumptions are, in fact, fundamental aspects of empirical reality,

then the model's output will correctly describe reality (if it is properly

"tuned", and if it is not missing any crucial assumptions). But if those

assumptions are not valid for the particular aspect of reality one

attempts to simulate, then it becomes a case of "GIGO" –

Garbage In, Garbage Out".

James Stanford outlines this issue for the specific

Computable General Equilibrium

Computable general equilibrium

Computable general equilibrium models are a class of economic models that use actual economic data to estimate how an economy might react to changes in policy, technology or other external factors...

("CGE") models that were introduced as evidence

into the public policy debate, by advocates for NAFTA:

"..CGE models are circular: if trade theory holds that free trade is mutually

beneficial, then a quantitative simulation model based on that theoretical

structure will automatically show that free trade is mutually beneficial...if

the economy actually behaves in the manner supposed by the modeler, and the

model itself sheds no light on this question, then a properly calibrated model

may provide a rough empirical estimate of the effects of a policy change. But

the validity of the model hangs entirely on the prior, nontested specification

of its structural relationships ...

[Hence, the apparent consensus of pro-NAFTA modelers]

reflects more a consensus of prior theoretical views than a consensus of

quantitative evidence."

Commenting on Stanford's analysis, one computer scientist wrote,

"When simulating the impact of a trade agreement on labor, it

seems absurd to assume a priori that capital is immobile, that full

employment will prevail, that unit labor costs are identical in the

U.S. and Mexico, that American consumers will prefer products made

in America (even if they are more expensive), and that trade flows

between the U.S. and Mexico will exactly balance. Yet a recent

examination of ten prominent CGE models showed that nine of them

include at least one of those unrealistic assumptions, and two of

the CGE models included all the above assumptions.

This situation bears a disturbing resemblance to computer-assisted

intellectual dishonesty. Human beings have always been masters of

self-deception, and hiding the essential basis of one's deception by

embedding it in a computer program surely helps reduce what might

otherwise become an intolerable burden of cognitive dissonance."

In commenting on the general phenomenon of embedding unrealistic "GIGO"

assumptions in neoclassical economic models, Nobel prizewinner Joseph Stiglitz

is only slightly more diplomatic: (p. 507-8)

"But the ... model, by construction, ruled out the information asymmetries which

are at the heart of macro-economic problems. Only if an individual has a severe

case of schizophrenia is it possible for such problems to arise. If one begins

with a model that assumes that markets clear, it is hard to see how one can get

much insight into unemployment (the failure of the labor market to clear)."

Despite the prominence of Stiglitz' 2001 Nobel prize lecture,

the use of (perhaps intentionally-) misleading neoclassical models

persisted in 2007, according to these authors:

" ... projected welfare

gains from trade liberalization are derived from global computable

general equilibrium (CGE) models, which are based on highly

unrealistic assumptions. CGE models have become the main

tool for economic analysis of the benefits of multilateral trade

liberalization; therefore, it is essential that these models be

scrutinized for their realism and relevance. ...

we analyze the foundation of CGE models and argue

that their predictions are often misleading.

...

We appeal for more honest simulation strategies that produce

a variety of plausible outcomes."

The working paper,

"Debunking the Myths of Computable General Equilibrium Models",

provides both a history, and a readable theoretical analysis

of what CGE models are, and are not. In particular, despite their name,

CGE models use neither the Walrass general equilibrium,

nor the Arrow-Debreus General Equilibrium frameworks.

Thus, CGE models are highly-distorted simplifications of theoretical frameworks—collectively called "the neoclassical economic paradigm" –

which—themselves—were largely discredited by Joseph Stiglitz.

In the "Concluding Remarks" (p. 524) of his 2001 Nobel Prize lecture,

Stiglitz examined why the neoclassical paradigm—and models based on it—persists, despite his publication,

over a decade earlier, of some of his seminal results showing that

Information Asymmetries invalidated core Assumptions of that paradigm

and its models:

"One might ask, how can we explain the persistence of the paradigm for

so long? Partly, it must be because, in spite of its deficiencies, it

did provide insights into many economic phenomena. ...

But one cannot ignore the possibility that the survival of the [neoclassical]

paradigm was partly because the belief in that paradigm,

and the policy prescriptions, has served certain interests."

In the aftermath of the 2007–2009 global economic meltdown,

the profession's attachment to unrealistic models is increasingly

being questioned and criticized. After a weeklong workshop,

one group of economists released a paper highly critical of

their own profession's unethical use of unrealistic models.

Their Abstract offers an indictment of fundamental practices:

"The economics profession appears to have been unaware

of the long build-up to the current worldwide financial crisis

and to have significantly underestimated its dimensions

once it started to unfold. In our view, this lack of understanding

is due to a misallocation of research efforts in economics.

We trace the deeper roots of this failure to the profession’s

focus on models that, by design, disregard key elements

driving outcomes in real-world markets.

The economics profession has failed in communicating the limitations,

weaknesses, and even dangers of its preferred models to the public.

This state of affairs makes clear the need for a major reorientation

of focus in the research economists undertake, as well as

for the establishment of an ethical code that would

ask economists to understand and communicate

the limitations and potential misuses of their models."

Omitted details

A great danger inherent in the simplification required to fit the entire economy into a model is omitting critical elements. Some economists believe that making the model as simple as possible is an art formArt

Art is the product or process of deliberately arranging items in a way that influences and affects one or more of the senses, emotions, and intellect....

, but the details left out are often contentious. For instance:

- Market models often exclude externalitiesExternalityIn economics, an externality is a cost or benefit, not transmitted through prices, incurred by a party who did not agree to the action causing the cost or benefit...

such as unpunished pollutionPollutionPollution is the introduction of contaminants into a natural environment that causes instability, disorder, harm or discomfort to the ecosystem i.e. physical systems or living organisms. Pollution can take the form of chemical substances or energy, such as noise, heat or light...

. Such models are the basis for many environmentalistEnvironmentalistAn environmentalist broadly supports the goals of the environmental movement, "a political and ethical movement that seeks to improve and protect the quality of the natural environment through changes to environmentally harmful human activities"...

attacks on mainstream economistEconomistAn economist is a professional in the social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy...

s. It is said that if the social costs of externalities were included in the models their conclusions would be very different, and models are often accused of leaving out these terms because of economist's pro-free marketFree marketA free market is a competitive market where prices are determined by supply and demand. However, the term is also commonly used for markets in which economic intervention and regulation by the state is limited to tax collection, and enforcement of private ownership and contracts...

bias. - In turn, environmental economicsEnvironmental economicsEnvironmental economics is a subfield of economics concerned with environmental issues. Quoting from the National Bureau of Economic Research Environmental Economics program:...

has been accused of omitting key financial considerations from its models. For example the returns to solar powerSolar powerSolar energy, radiant light and heat from the sun, has been harnessed by humans since ancient times using a range of ever-evolving technologies. Solar radiation, along with secondary solar-powered resources such as wind and wave power, hydroelectricity and biomass, account for most of the available...

investments are sometimes modelled without a discount factor, so that the present utilityUtilityIn economics, utility is a measure of customer satisfaction, referring to the total satisfaction received by a consumer from consuming a good or service....

of solar energy delivered in a century's time is precisely equal to gas-power station energy today. - Financial models can be oversimplified by relying on historically unprecedented arbitrageArbitrageIn economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

-free markets, probably underestimating the chance of crisesKurtosisIn probability theory and statistics, kurtosis is any measure of the "peakedness" of the probability distribution of a real-valued random variable...

, and under-pricing or under-planning for riskRiskRisk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

. - Models of consumptionConsumption (economics)Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

either assume that humans are immortalImmortalityImmortality is the ability to live forever. It is unknown whether human physical immortality is an achievable condition. Biological forms have inherent limitations which may or may not be able to be overcome through medical interventions or engineering...

or that teenagers plan their life around an optimal retirement supported by the next generationOverlapping generations modelAn overlapping generations model, abbreviated to OLG model, is a type of economic model in which agents live a finite length of time and live long enough to endure into at least one period of the next generation's lives....

. (These conclusions are probably harmless, except possibly to the credibility of the modelling profession.) - All Models share the same problem of the butterfly effectButterfly effectIn chaos theory, the butterfly effect is the sensitive dependence on initial conditions; where a small change at one place in a nonlinear system can result in large differences to a later state...

. Because they represent large complex nonlinear systems, it is possible that any missing variable as well as errors in value of included variables can lead to erroneous results.

Are economic models falsifiable?

The sharp distinction between falsifiableFalsifiability

Falsifiability or refutability of an assertion, hypothesis or theory is the logical possibility that it can be contradicted by an observation or the outcome of a physical experiment...

economic models and those that are not is by no means a universally accepted one. Indeed one can argue that the ceteris paribus (all else being equal) qualification that accompanies any claim in economics is nothing more than an all-purpose escape clause (See N. de Marchi and M. Blaug.) The all else being equal claim allows holding all variables constant except the few that the model is attempting to reason about. This allows the separation and clarification of the specific relationship. However, in reality all else is never equal, so economic models are guaranteed to not be perfect. The goal of the model is that the isolated and simplified relationship has some predictive power

Predictive power

The predictive power of a scientific theory refers to its ability to generate testable predictions. Theories with strong predictive power are highly valued, because the predictions can often encourage the falsification of the theory...

that can be tested, mainly that it is a theory capable of being applied to reality. To qualify as a theory, a model should arguably answer three questions: Theory of what?, Why should we care?, What merit is in your explanation? If the model fails to do so, it is probably too detached from reality and meaningful societal issues to qualify as theory. Research conducted according to this three-question test finds that in the 2004 edition of the Journal of Economic Theory, only 12% of the articles satisfy the three requirements.” Ignoring the fact that the ceteris paribus assumption is being made is another big failure often made when a model is applied. At the minimum an attempt must be made to look at the various factors that may not be equal and take those into account.

History

One of the major problems addressed by economic models has been understanding economic growth. An early attempt to provide a technique to approach this came from the French physiocratic school in the Eighteenth century. Among these economists, François QuesnayFrançois Quesnay

François Quesnay was a French economist of the Physiocratic school. He is known for publishing the "Tableau économique" in 1758, which provided the foundations of the ideas of the Physiocrats...

should be noted, particularly for his development and use of tables he called Tableaux économiques

Tableau économique

The Tableau économique or Economic Table is an economic model first described in François Quesnay in 1759, which lay the foundation of the Physiocrats’ economic theories....

. These tables have in fact been interpreted in more modern terminology as a Leontiev model, see the Phillips reference below.

All through the 18th century (that is, well before the founding of modern political economy, conventionally marked by Adam Smith's 1776 Wealth of Nations) simple probabilistic models were used to understand the economics of insurance

Insurance

In law and economics, insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. An insurer is a company selling the...

. This was a natural extrapolation of the theory of gambling

Gambling

Gambling is the wagering of money or something of material value on an event with an uncertain outcome with the primary intent of winning additional money and/or material goods...

, and played an important role both in the development of probability theory

Probability theory

Probability theory is the branch of mathematics concerned with analysis of random phenomena. The central objects of probability theory are random variables, stochastic processes, and events: mathematical abstractions of non-deterministic events or measured quantities that may either be single...

itself and in the development of actuarial science

Actuarial science

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in the insurance and finance industries. Actuaries are professionals who are qualified in this field through education and experience...

. Many of the giants of 18th century mathematics

Mathematics

Mathematics is the study of quantity, space, structure, and change. Mathematicians seek out patterns and formulate new conjectures. Mathematicians resolve the truth or falsity of conjectures by mathematical proofs, which are arguments sufficient to convince other mathematicians of their validity...

contributed to this field. Around 1730, De Moivre addressed some of these problems in the 3rd edition of the Doctrine of Chances

Doctrine of chances

In law, the doctrine of chances is a rule of evidence that allows evidence to show that it is unlikely a defendant would be repeatedly, innocently involved in similar, suspicious circumstances....

. Even earlier (1709), Nicolas Bernoulli studies problems related to savings and interest in the Ars Conjectandi

Ars Conjectandi

Ars Conjectandi is a combinatorial mathematical paper written by Jakob Bernoulli and published in 1713, eight years after his death, by his nephew, Niklaus Bernoulli. The seminal work consolidated, most notably among other combinatorial topics, probability theory: indeed, it is widely regarded as...

. In 1730, Daniel Bernoulli

Daniel Bernoulli

Daniel Bernoulli was a Dutch-Swiss mathematician and was one of the many prominent mathematicians in the Bernoulli family. He is particularly remembered for his applications of mathematics to mechanics, especially fluid mechanics, and for his pioneering work in probability and statistics...

studied "moral probability" in his book Mensura Sortis, where he introduced what would today be called "logarithmic utility of money" and applied it to gambling and insurance problems, including a solution of the paradoxical Saint Petersburg problem

St. Petersburg paradox

In economics, the St. Petersburg paradox is a paradox related to probability theory and decision theory. It is based on a particular lottery game that leads to a random variable with infinite expected value, i.e., infinite expected payoff, but would nevertheless be considered to be worth only a...

. All of these developments were summarized by Laplace in his Analytical Theory of Probabilities (1812). Clearly, by the time David Ricardo

David Ricardo

David Ricardo was an English political economist, often credited with systematising economics, and was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and John Stuart Mill. He was also a member of Parliament, businessman, financier and speculator,...

came along he had a lot of well-established math to draw from.

Tests of macroeconomic predictions

This paragraph seems to conflate 3 different references. This needs to be sorted out.In the late 1980s a research institute compared the twelve top macroeconomic models

Model (macroeconomics)

A macroeconomic model is an analytical tool designed to describe the operation of the economy of a country or a region. These models are usually designed to examine the dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of...

available at the time. They asked the designers of these models what would happen to the economy under a variety of quantitatively specified shocks, and compared the diversity in the answers (allowing the models to control for all the variability in the real world; this was a test of model vs. model, not a test against the actual outcome). Although the designers were allowed to simplify the world and start from a stable, known baseline (e.g. NAIRU

NAIRU

In monetarist economics, particularly the work of Milton Friedman, on which also worked Lucas Papademos and Franco Modigliani in 1975,NAIRU is an acronym for Non-Accelerating Inflation Rate of Unemployment, and refers to a level of unemployment below which inflation rises.It is widely used in...

unemployment) the various models gave dramatically different answers. For instance, in calculating the impact of a monetary loosening on output some models estimated a 3% change in GDP after one year, and one gave almost no change, with the rest spread between.

Here are the references that seem to apply

1. 1988, Brookings Institute - "Examining Alternative Macroeconomi Theories"

2. 1998, Brookings Institute - "Foundations of the Goldilocks Economy: Supply Shocks and the Time-Varying NAIRU".

3. 2006, Journal of Policy Modeling - "A comparison of twelve macroeconomic models of the Canadian economy". Quoting from the abstract, "Deterministic shocks considered in this report reveal significant differences in the dynamic properties of the participating models. A comparison of the models’ impulse-response functions with those of a vector autoregression suggests that some models do better than others in reflecting the typical response of the Canadian economy to certain shocks."

Partly as a result of such experiments, modern central bankers no longer have as much confidence that it is possible to 'fine-tune' the economy as they had in the 1960s and early 1970s. Modern policy makers tend to use a less activist approach, explicitly because they lack confidence that their models will actually predict where the economy is going, or the effect of any shock upon it. The new, more humble, approach sees danger in dramatic policy changes based on model predictions, because of several practical and theoretical limitations in current macroeconomic models; in addition to the theoretical pitfalls, (listed above) some problems specific to aggregate modelling are:

- Limitations in model construction caused by difficulties in understanding the underlying mechanisms of the real economy. (Hence the profusion of separate models.)

- The law of Unintended consequenceUnintended consequenceIn the social sciences, unintended consequences are outcomes that are not the outcomes intended by a purposeful action. The concept has long existed but was named and popularised in the 20th century by American sociologist Robert K. Merton...

s, on elements of the real economy not yet included in the model. - The time lag in both receiving data and the reaction of economic variables to policy makers attempts to 'steer' them (mostly through monetary policy) in the direction that central bankers want them to move. Milton FriedmanMilton FriedmanMilton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

has vigorously argued that these lags are so long and unpredictably variable that effective management of the macroeconomy is impossible. - The difficulty in correctly specifying all of the parameters (through econometric measurements) even if the structural model and data were perfect.

- The fact that all the model's relationships and coefficients are stochastic, so that the error term becomes very large quickly, and the available snapshot of the input parameters is already out of date.

- Modern economic models incorporate the reaction of the public & market to the policy maker's actions (through game theoryGame theoryGame theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

), and this feedback is included in modern models (following the rational expectationsRational expectationsRational expectations is a hypothesis in economics which states that agents' predictions of the future value of economically relevant variables are not systematically wrong in that all errors are random. An alternative formulation is that rational expectations are model-consistent expectations, in...

revolution and Robert Lucas, Jr.Robert Lucas, Jr.Robert Emerson Lucas, Jr. is an American economist at the University of Chicago. He received the Nobel Prize in Economics in 1995 and is consistently indexed among the top 10 economists in the Research Papers in Economics rankings. He is married to economist Nancy Stokey.He received his B.A. in...

's critique of the optimal controlOptimal controlOptimal control theory, an extension of the calculus of variations, is a mathematical optimization method for deriving control policies. The method is largely due to the work of Lev Pontryagin and his collaborators in the Soviet Union and Richard Bellman in the United States.-General method:Optimal...

concept of precise macroeconomic management). If the response to the decision maker's actions (and their credibility) must be included in the model then it becomes much harder to influence some of the variables simulated.

Comparison with models in other sciences

Complex systemsComplex systems

Complex systems present problems in mathematical modelling.The equations from which complex system models are developed generally derive from statistical physics, information theory and non-linear dynamics, and represent organized but unpredictable behaviors of systems of nature that are considered...

specialist and mathematician David Orrell

David Orrell

David John Orrell is a Canadian mathematician and author who is living in Oxford, England. He received his doctorate in mathematics from the University of Oxford. His work in the prediction of complex systems such as the weather, genetics and the economy has been featured in New Scientist,...

wrote on this issue and explained that the weather, human health and economics use similar methods of prediction (mathematical models). Their systems – the atmosphere, the human body and the economy – also have similar levels of complexity. He found that forecasts fail because the models suffer from two problems : i- they cannot capture the full detail of the underlying system, so rely on approximate equations; ii- they are sensitive to small changes in the exact form of these equations. This is because complex systems like the economy or the climate consist of a delicate balance of opposing forces, so a slight imbalance in their representation has big effects. Thus, predictions of things like economic recessions are still highly inaccurate, despite the use of enormous models running on fast computers. http://www.postpythagorean.com/FAQ.html

The effects of deterministic chaos on economic models

Economic and meteorological simulations may share a fundamental limit to their predictive powers: chaosChaos theory

Chaos theory is a field of study in mathematics, with applications in several disciplines including physics, economics, biology, and philosophy. Chaos theory studies the behavior of dynamical systems that are highly sensitive to initial conditions, an effect which is popularly referred to as the...

. Although the modern mathematical work on chaotic systems began in the 1970s the danger of chaos had been identified and defined in Econometrica

Econometrica

Econometrica is a peer-reviewed academic journal of economics, publishing articles not only in econometrics but in many areas of economics. It is published by the Econometric Society and distributed by Wiley-Blackwell. Econometrica is one of the most highly ranked economics journals in the world...

as early as 1958:

- "Good theorising consists to a large extent in avoiding assumptions....(with the property that)....a small change in what is posited will seriously affect the conclusions.".

It is straightforward to design economic models susceptible to butterfly effect

Butterfly effect

In chaos theory, the butterfly effect is the sensitive dependence on initial conditions; where a small change at one place in a nonlinear system can result in large differences to a later state...

s of initial-condition sensitivity.

However, the econometric research program to identify which variables are chaotic (if any) has largely concluded that aggregate macroeconomic variables probably do not behave chaotically. This would mean that refinements to the models could ultimately produce reliable long-term forecasts. However the validity of this conclusion has generated two challenges:

- In 2004 Philip MirowskiPhilip MirowskiPhilip Mirowski is a historian and philosopher of economic thought at the University of Notre Dame. He received a PhD in Economics from the University of Michigan in 1979.-Career:...

challenged this view and those who hold it, saying that chaos in economics is suffering from a biased "crusade" against it by neo-classical economics in order to preserve their mathematical models. - The variables in financeFinance"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

may well be subject to chaos. Also in 2004, the University of CanterburyUniversity of CanterburyThe University of Canterbury , New Zealand's second-oldest university, operates its main campus in the suburb of Ilam in the city of Christchurch, New Zealand...

study Economics on the Edge of Chaos concludes that after noise is removed from S&P 500S&P 500The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

returns, evidence of deterministicDeterminismDeterminism is the general philosophical thesis that states that for everything that happens there are conditions such that, given them, nothing else could happen. There are many versions of this thesis. Each of them rests upon various alleged connections, and interdependencies of things and...

chaos is found.

More recently, chaos (or the butterfly effect) has been identified as less significant than previously thought to explain prediction errors. Rather, the predictive power of economics and meteorology would mostly be limited by the models themselves and the nature of their underlying systems (see Comparison with models in other sciences above).

The critique of hubris in planning

A key strand of free marketFree market

A free market is a competitive market where prices are determined by supply and demand. However, the term is also commonly used for markets in which economic intervention and regulation by the state is limited to tax collection, and enforcement of private ownership and contracts...

economic thinking is that the market's "invisible hand" guides an economy to prosperity more efficiently than central planning using an economic model. One reason, emphasized by Friedrich Hayek

Friedrich Hayek

Friedrich August Hayek CH , born in Austria-Hungary as Friedrich August von Hayek, was an economist and philosopher best known for his defense of classical liberalism and free-market capitalism against socialist and collectivist thought...

, is the claim that many of the true forces shaping the economy can never be captured in a single plan. This is an argument which cannot be made through a conventional (mathematical) economic model, because it says that there are critical systemic-elements that will always be omitted from any top-down analysis of the economy.

Examples of economic models

- Black–Scholes option pricing model

- Heckscher-Ohlin modelHeckscher-Ohlin modelThe Heckscher–Ohlin model is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo's theory of comparative advantage by predicting patterns of commerce and production based...

- International FuturesInternational FuturesInternational Futures is a global integrated assessment model designed to help in thinking strategically and systematically about economic, social, political and environmental systems. Initially created by Barry B...

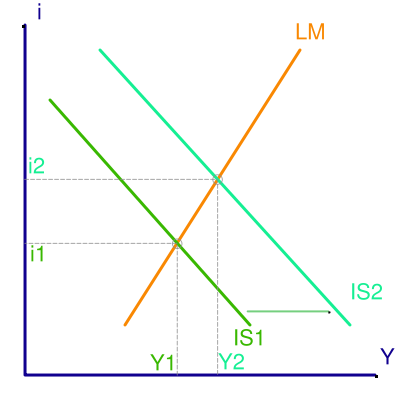

- IS/LM modelIS/LM modelThe IS/LM model is a macroeconomic tool that demonstrates the relationship between interest rates and real output in the goods and services market and the money market...

- Participatory EconomicsParticipatory economicsParticipatory economics, often abbreviated parecon, is an economic system proposed primarily by activist and political theorist Michael Albert and radical economist Robin Hahnel, among others. It uses participatory decision making as an economic mechanism to guide the production, consumption and...

- KeynesianKeynesian economicsKeynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

cross - LeontiefWassily LeontiefWassily Wassilyovich Leontief , was a Russian-American economist notable for his research on how changes in one economic sector may have an effect on other sectors. Leontief won the Nobel Committee's Nobel Memorial Prize in Economic Sciences in 1973, and three of his doctoral students have also...

's input-output modelInput-output modelIn economics, an input-output model is a quantitative economic technique that represents the interdependencies between different branches of national economy or between branches of different, even competing economies. Wassily Leontief developed this type of analysis and took the Nobel Memorial... - World3World3The World3 model was a computer simulation of interactions between population, industrial growth, food production and limits in the ecosystems of the Earth. It was originally produced and used by a Club of Rome study that produced the model and the book The Limits to Growth...

- WonderlandWonderland model- Governing equations :Denote the four state variables as: x , y , z and p...

See also

- Economic methodologyEconomic methodologyEconomic methodology is the study of methods, especially the scientific method, in relation to economics, including principles underlying economic reasoning...

- Computational EconomicsComputational economicsComputational economics is a research discipline at the interface between computer science and economic and management science. Areas encompassed include agent-based computational modeling, computational modeling of dynamic macroeconomic systems and transaction costs, other applications in...

- Agent-based computational economicsAgent-Based Computational EconomicsAgent-based computational economics is the major aspect of computational economics that studies economic processes, including whole economies, as dynamic systems of interacting agents. As such, it falls in paradigm of complex adaptive systems...

- Macroeconomic model

- Financial modelingFinancial modelingFinancial modeling is the task of building an abstract representation of a financial decision making situation. This is a mathematical model designed to represent the performance of a financial asset or a portfolio, of a business, a project, or any other investment...

External links

- R. Frigg and S. Hartmann, Models in Science. Entry in the Stanford Encyclopedia of Philosophy.

- H. Varian How to build a model in your spare time The author makes several unexpected suggestions: Look for a model in the real world, not in journals. Look at the literature later, not sooner.

- Elmer G. Wiens: Classical & Keynesian AD-AS Model – An on-line, interactive model of the Canadian Economy.

- IFs Economic Sub-Model http://www.ifs.du.edu/ifs: Online Global Model